Key Insights

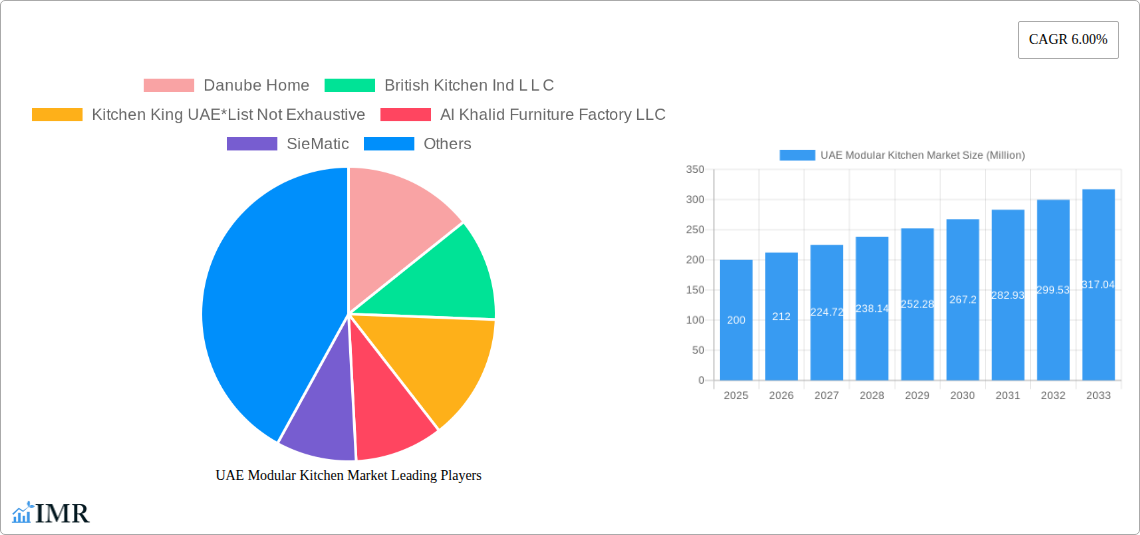

The UAE modular kitchen market is projected to reach $1676 million by 2024, exhibiting a Compound Annual Growth Rate (CAGR) of 2.7% from 2024 to 2033. This growth is driven by increasing urbanization and population in the UAE, leading to higher demand for contemporary, space-efficient housing solutions like modular kitchens. Rising disposable incomes and a preference for customized, aesthetically pleasing kitchens also contribute to market expansion. The convenience and efficiency of modular kitchens, featuring pre-fabricated units and streamlined installation, appeal to busy consumers seeking hassle-free renovations. While offline channels dominate, online sales are emerging as a crucial distribution route, enhancing accessibility. The residential sector leads the market, though the commercial sector, particularly hospitality and restaurants, is expected to grow due to the adoption of modern kitchen setups. Intense competition exists among local and international players, including Danube Home, British Kitchen Ind L L C, and SieMatic. Challenges include fluctuating material costs and the need for skilled labor, but the overall market outlook remains positive.

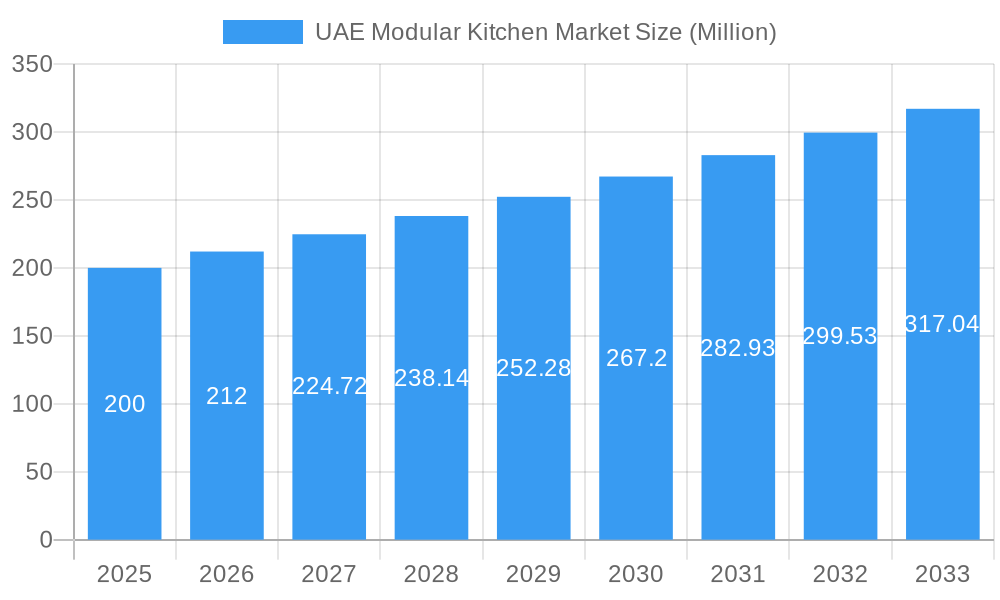

UAE Modular Kitchen Market Market Size (In Billion)

Floor and wall cabinets continue to lead product categories, serving as essential components of modular kitchen designs. Tall storage cabinets are gaining traction, indicating a growing demand for optimized storage solutions. The offline distribution channel, primarily through contractors and builders, remains dominant, reflecting their integral role in construction and renovation. However, the online channel offers significant future growth potential as e-commerce platforms improve consumer engagement and accessibility. The residential sector is the largest end-user segment, consistent with broader housing market expansion in the UAE.

UAE Modular Kitchen Market Company Market Share

UAE Modular Kitchen Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE modular kitchen market, encompassing market dynamics, growth trends, key players, and future outlook. With a focus on the parent market (Home Improvement) and child market (Modular Kitchens), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The total market size is projected to reach XX Million units by 2033.

UAE Modular Kitchen Market Dynamics & Structure

This section analyzes the UAE modular kitchen market's structure, highlighting market concentration, technological advancements, regulatory influences, competitive landscape, and end-user demographics. We delve into the impact of mergers and acquisitions (M&A) activities on market consolidation.

- Market Concentration: The UAE modular kitchen market exhibits a moderately concentrated structure, with a few large players like Inter IKEA Group and SieMatic holding significant market share, alongside numerous smaller regional players like Al Khalid Furniture Factory LLC. The market share of top 5 players is estimated at xx%.

- Technological Innovation: Technological advancements, such as smart kitchen integration and sustainable material usage, are significant growth drivers. However, high initial investment costs and a lack of skilled workforce present innovation barriers.

- Regulatory Framework: Building codes and safety regulations influence design and material choices within the UAE.

- Competitive Landscape: Intense competition exists amongst both domestic and international players, driving innovation and price competitiveness. Product differentiation through design and customization is key.

- End-User Demographics: The growing population and rising disposable incomes, coupled with a preference for modern, space-saving kitchens, fuel demand. Commercial projects contribute significantly to market growth.

- M&A Activity: The number of M&A deals in the UAE modular kitchen sector during the historical period (2019-2024) totalled approximately xx deals, largely driven by expansion strategies.

UAE Modular Kitchen Market Growth Trends & Insights

This section examines the evolution of the UAE modular kitchen market size, adoption rates, technological disruptions, and shifts in consumer behavior from 2019 to 2033. The market is expected to exhibit a CAGR of xx% during the forecast period.

[Insert 600-word analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts including specific metrics (e.g., CAGR, market penetration) for deeper insights].

Dominant Regions, Countries, or Segments in UAE Modular Kitchen Market

This section identifies the leading regions, countries, or segments within the UAE modular kitchen market, analyzing the key drivers of growth across different product categories (Floor Cabinet & Wall Cabinets, Tall Storage Cabinets, Other Products), distribution channels (Offline, Online), and end-users (Residential, Commercial).

- By Product: Floor Cabinet & Wall Cabinets constitute the largest segment, holding approximately xx% market share in 2025, driven by high demand in residential projects. Tall Storage Cabinets show strong growth potential due to increased storage needs in modern homes.

- By Distribution Channel: Offline channels (contractors, builders) currently dominate the market, but online sales are expected to increase rapidly driven by e-commerce expansion and improved logistics.

- By End-User: Residential end-users represent the largest market segment, closely followed by the commercial sector. Growth in tourism and hospitality fuels demand for commercial kitchens.

[Insert 600-word analysis of dominance factors including market share and growth potential for each segment. Include bullet points to highlight key drivers (e.g., economic policies, infrastructure) and paragraphs to analyze dominance factors].

UAE Modular Kitchen Market Product Landscape

The UAE modular kitchen market showcases a wide range of products, incorporating innovative designs and materials. Smart kitchen features like integrated appliances and automated systems are gaining traction. Customizable options and eco-friendly materials are significant selling points. Performance is assessed through durability, functionality, and aesthetic appeal.

Key Drivers, Barriers & Challenges in UAE Modular Kitchen Market

Key Drivers:

- Rising disposable incomes and improved living standards drive demand for high-quality, modern kitchens.

- Growing urbanization and new construction projects contribute to market expansion.

- Government initiatives promoting sustainable construction practices positively impact the market.

Key Challenges:

- Intense competition from both local and international players creates pricing pressure.

- Fluctuations in raw material prices can impact profitability.

- Supply chain disruptions can lead to delays in project completion.

Emerging Opportunities in UAE Modular Kitchen Market

- Growing adoption of smart home technologies presents opportunities for integrating smart appliances and automation systems into modular kitchens.

- Increased focus on sustainable and eco-friendly materials opens avenues for innovative product development.

- Demand for customized and personalized kitchens offers opportunities for bespoke design and manufacturing services.

Growth Accelerators in the UAE Modular Kitchen Market Industry

Technological advancements in kitchen design and manufacturing processes, strategic partnerships between manufacturers and retailers, and expansion into untapped market segments are key catalysts accelerating growth in the UAE modular kitchen market.

Key Players Shaping the UAE Modular Kitchen Market

- Danube Home

- British Kitchen Ind L L C

- Kitchen King UAE

- Al Khalid Furniture Factory LLC

- SieMatic

- Space 3 LLC

- Scavolini

- Arabian Falcon Metal Kitchens LLC

- Al Marri Metal Kitchen Factory LLC

- Hacker

- Inter IKEA Group

Notable Milestones in UAE Modular Kitchen Market Sector

- December 2022: OC Home announced a 100,000 sq ft retail space expansion in the UAE, signifying increased investment in the home improvement sector.

- February 2022: Casa Milano's collaboration with Arredo3 broadened the availability of high-end modular kitchen designs in Dubai.

In-Depth UAE Modular Kitchen Market Outlook

The UAE modular kitchen market is poised for robust growth driven by sustained economic expansion, rising consumer spending, and the ongoing trend towards modern home designs. Strategic collaborations, product innovation, and a focus on sustainable practices will be crucial for success in this dynamic market. Expansion into emerging segments, like smart kitchens and customized solutions, will offer significant opportunities for growth.

UAE Modular Kitchen Market Segmentation

-

1. Product

- 1.1. Floor Cabinet & Wall Cabinets

- 1.2. Tall Storage Cabinets

- 1.3. Other Products

-

2. Distribution Channel

- 2.1. Offline (Contractors, Builders, etc.)

- 2.2. Online

-

3. End-User

- 3.1. Residential

- 3.2. Commercial

UAE Modular Kitchen Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Modular Kitchen Market Regional Market Share

Geographic Coverage of UAE Modular Kitchen Market

UAE Modular Kitchen Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Offline Distribution Channel is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Reduced Consumer Spending is Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Development in the Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Floor Cabinet & Wall Cabinets

- 5.1.2. Tall Storage Cabinets

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline (Contractors, Builders, etc.)

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Floor Cabinet & Wall Cabinets

- 6.1.2. Tall Storage Cabinets

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline (Contractors, Builders, etc.)

- 6.2.2. Online

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Floor Cabinet & Wall Cabinets

- 7.1.2. Tall Storage Cabinets

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline (Contractors, Builders, etc.)

- 7.2.2. Online

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Floor Cabinet & Wall Cabinets

- 8.1.2. Tall Storage Cabinets

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline (Contractors, Builders, etc.)

- 8.2.2. Online

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Floor Cabinet & Wall Cabinets

- 9.1.2. Tall Storage Cabinets

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline (Contractors, Builders, etc.)

- 9.2.2. Online

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific UAE Modular Kitchen Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Floor Cabinet & Wall Cabinets

- 10.1.2. Tall Storage Cabinets

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline (Contractors, Builders, etc.)

- 10.2.2. Online

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Danube Home

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 British Kitchen Ind L L C

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kitchen King UAE*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Al Khalid Furniture Factory LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SieMatic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Space 3 LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Scavolini

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arabian Falcon Metal Kitchens LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Marri Metal Kitchen Factory LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hacker

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inter IKEA Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Danube Home

List of Figures

- Figure 1: Global UAE Modular Kitchen Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 3: North America UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 7: North America UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 11: South America UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: South America UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 13: South America UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 15: South America UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 17: South America UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 19: Europe UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Europe UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 21: Europe UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 23: Europe UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Europe UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 27: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 31: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific UAE Modular Kitchen Market Revenue (million), by Product 2025 & 2033

- Figure 35: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: Asia Pacific UAE Modular Kitchen Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific UAE Modular Kitchen Market Revenue (million), by End-User 2025 & 2033

- Figure 39: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Asia Pacific UAE Modular Kitchen Market Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific UAE Modular Kitchen Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 4: Global UAE Modular Kitchen Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 13: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 15: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 20: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 22: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 33: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 35: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global UAE Modular Kitchen Market Revenue million Forecast, by Product 2020 & 2033

- Table 43: Global UAE Modular Kitchen Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global UAE Modular Kitchen Market Revenue million Forecast, by End-User 2020 & 2033

- Table 45: Global UAE Modular Kitchen Market Revenue million Forecast, by Country 2020 & 2033

- Table 46: China UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific UAE Modular Kitchen Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Modular Kitchen Market?

The projected CAGR is approximately 2.7%.

2. Which companies are prominent players in the UAE Modular Kitchen Market?

Key companies in the market include Danube Home, British Kitchen Ind L L C, Kitchen King UAE*List Not Exhaustive, Al Khalid Furniture Factory LLC, SieMatic, Space 3 LLC, Scavolini, Arabian Falcon Metal Kitchens LLC, Al Marri Metal Kitchen Factory LLC, Hacker, Inter IKEA Group.

3. What are the main segments of the UAE Modular Kitchen Market?

The market segments include Product, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1676 million as of 2022.

5. What are some drivers contributing to market growth?

Offline Distribution Channel is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Development in the Construction Sector.

7. Are there any restraints impacting market growth?

Reduced Consumer Spending is Restraining the Market.

8. Can you provide examples of recent developments in the market?

December 2022: OC Home, a provider of modern home improvement needs, announced 100,000 sq ft of retail space expansion plans with a new store launch in Muscat and three new stores in the UAE.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Modular Kitchen Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Modular Kitchen Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Modular Kitchen Market?

To stay informed about further developments, trends, and reports in the UAE Modular Kitchen Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence