Key Insights

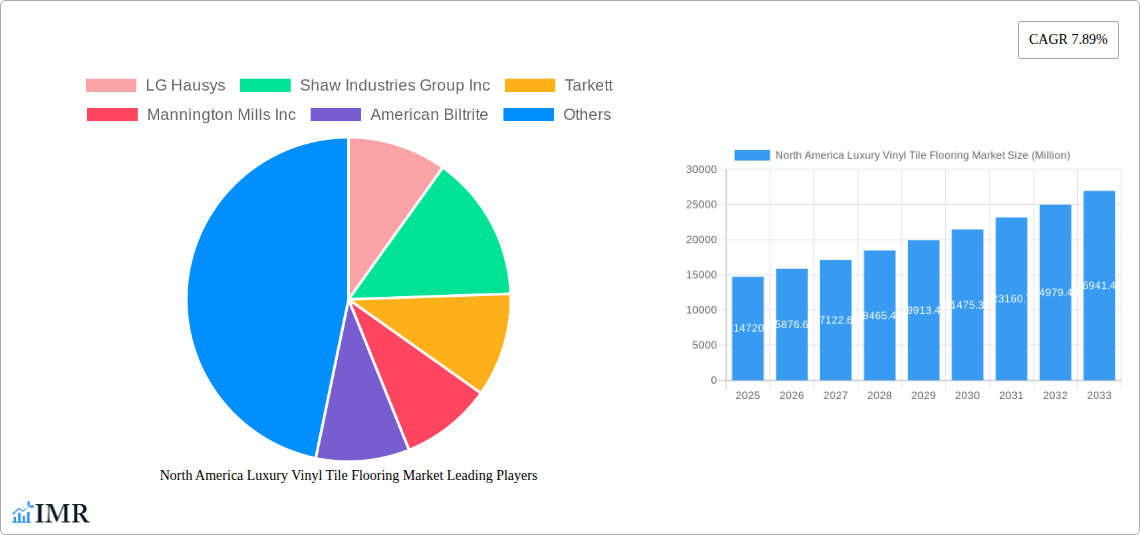

The North American luxury vinyl tile (LVT) flooring market, valued at $14.72 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.89% from 2025 to 2033. This expansion is driven by several key factors. The increasing preference for durable, water-resistant, and aesthetically pleasing flooring solutions in both residential and commercial settings fuels market demand. Furthermore, advancements in LVT technology, offering improved designs mimicking natural materials like wood and stone, contribute significantly to its popularity. The rising construction activity across North America, particularly in the residential sector, further boosts market growth. While pricing pressures and competition from alternative flooring materials pose some challenges, the inherent advantages of LVT – affordability, easy installation, and low maintenance – are expected to offset these constraints. The market is segmented by product type (rigid and flexible), end-user (residential and commercial), distribution channel (home centers, flagship stores, specialty stores, online stores, and other channels), and country (United States, Canada, and Rest of North America). The United States holds the largest market share within North America due to its substantial construction industry and high consumer spending. Major players like LG Hausys, Shaw Industries Group Inc., Tarkett, and Mohawk Industries are driving innovation and market competition.

North America Luxury Vinyl Tile Flooring Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continuous expansion, propelled by sustained growth in new residential construction and renovation projects. The increasing adoption of LVT in commercial spaces, such as offices, retail stores, and hospitality settings, will also significantly contribute to market growth. However, potential fluctuations in raw material prices and economic conditions could influence the market trajectory. Nonetheless, the LVT segment's inherent advantages and ongoing technological improvements suggest a positive outlook for the North American market throughout the forecast period, indicating sustained growth and increased market penetration.

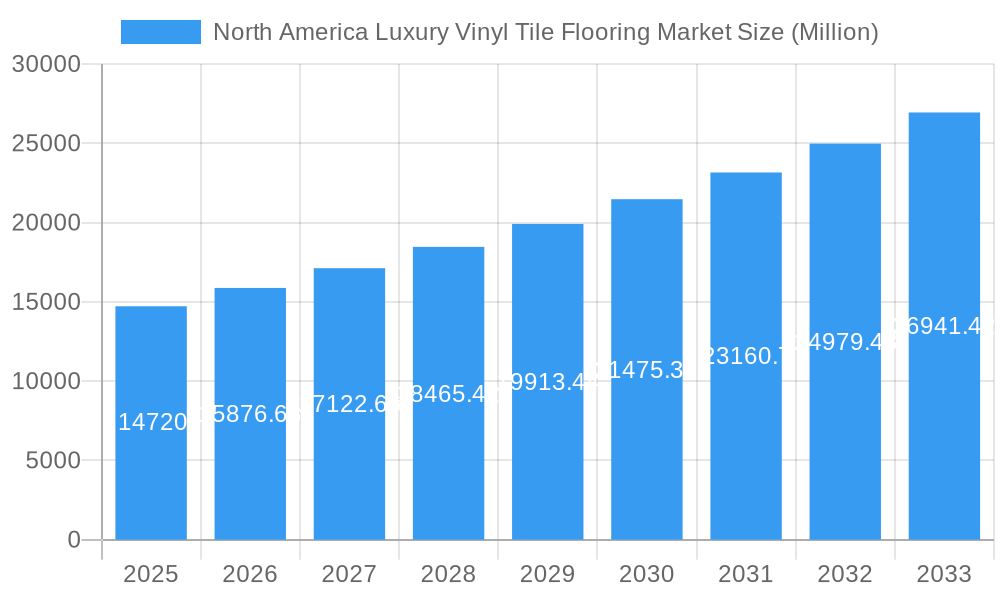

North America Luxury Vinyl Tile Flooring Market Company Market Share

North America Luxury Vinyl Tile Flooring Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Luxury Vinyl Tile (LVT) flooring market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period spans 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is crucial for industry professionals, investors, and businesses seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is segmented by product type (rigid, flexible), end-user (residential, commercial), distribution channel (home centers, flagship stores, specialty stores, online stores, other), and country (United States, Canada, Rest of North America). Market values are presented in million units.

North America Luxury Vinyl Tile Flooring Market Dynamics & Structure

This section analyzes the competitive landscape of the North American LVT market, examining market concentration, technological innovation, regulatory frameworks, and market trends. The analysis incorporates quantitative data such as market share percentages and M&A deal volumes, as well as qualitative factors influencing market dynamics. The report explores the impact of factors like technological advancements, consumer preferences, and economic conditions on the overall market structure.

Market Concentration: The North American LVT market exhibits a moderately concentrated structure, with key players holding significant market share. The report provides detailed analysis of market share distribution among leading companies, such as LG Hausys, Shaw Industries Group Inc, Tarkett, Mannington Mills Inc, American Biltrite, Armstrong Flooring, Gerflor, Mohawk Industries, Adore Floors Inc, Interface, and others. The xx% market share held by the top 5 players indicates a relatively consolidated yet competitive landscape.

Technological Innovation: Continuous innovation in LVT manufacturing, particularly in areas like realistic wood and stone visuals and improved durability, drives market growth. The report explores the role of R&D investments in shaping product differentiation and consumer appeal.

Regulatory Frameworks: Government regulations concerning building materials and environmental standards impact the LVT market. The report analyzes relevant regulations and their influence on product development and manufacturing practices.

Competitive Product Substitutes: The LVT market faces competition from other flooring materials such as hardwood, ceramic tile, and laminate. The report assesses the competitive pressures from these substitutes and their impact on market share.

End-User Demographics: The report profiles the changing demographics of residential and commercial end-users, identifying key preferences and purchasing behaviors impacting LVT demand.

M&A Trends: The report analyzes recent mergers and acquisitions (M&A) activity in the LVT industry, such as the December 2023 acquisition of Galleher by Transom Capital, and their impact on market consolidation and competitive dynamics. The estimated number of M&A deals in the past five years is xx.

North America Luxury Vinyl Tile Flooring Market Growth Trends & Insights

This section presents a comprehensive analysis of the North American LVT market's growth trajectory, exploring market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. The analysis utilizes detailed data to provide a nuanced understanding of market dynamics.

The North American LVT market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors, including increasing consumer preference for durable, stylish, and cost-effective flooring solutions, particularly in the residential segment. Technological advancements in LVT manufacturing, such as the introduction of rigid core LVT, further enhanced the product's appeal and market penetration. The estimated market size in 2025 is xx million units, and the forecast period (2025-2033) projects continued growth, driven by factors such as rising disposable incomes, new construction activity, and the growing preference for LVT in commercial spaces. The projected CAGR for the forecast period is xx%. Consumer preference shifts toward environmentally friendly and sustainable flooring options are also shaping market dynamics.

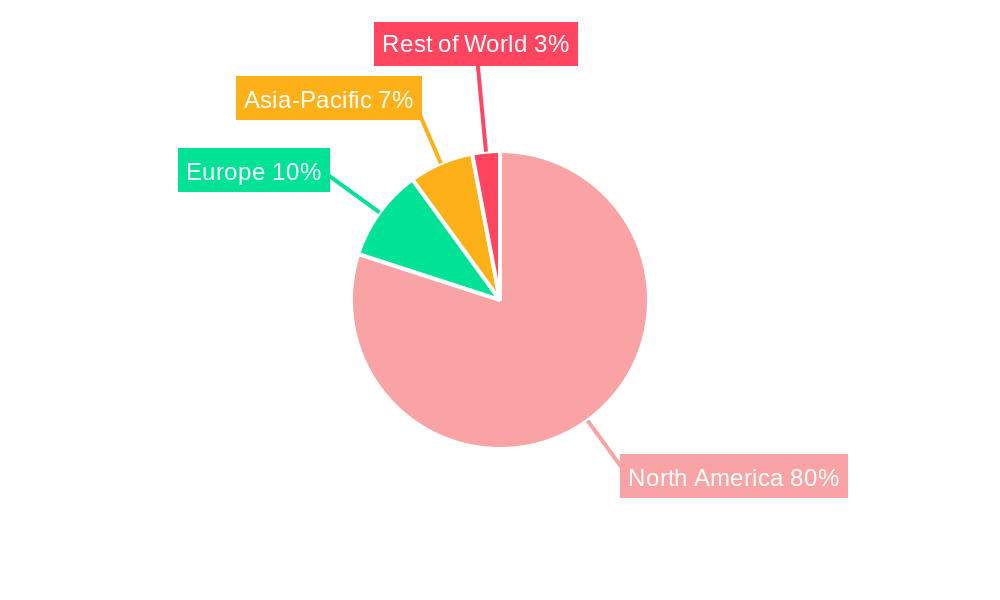

Dominant Regions, Countries, or Segments in North America Luxury Vinyl Tile Flooring Market

This section identifies the leading regions, countries, and segments within the North American LVT market, analyzing the factors driving their dominance.

By Product Type: The rigid core LVT segment is the dominant product type, commanding a xx% market share in 2025, driven by its superior durability, water resistance, and dimensional stability. Flexible LVT maintains a significant market presence, but its growth is projected to be slower than that of rigid core LVT.

By End-User: The residential segment holds a larger market share compared to the commercial segment, representing xx% of the total market in 2025. However, the commercial segment is expected to witness faster growth driven by increasing adoption in various commercial settings, such as offices, retail spaces, and healthcare facilities.

By Distribution Channel: Home centers are the leading distribution channel, accounting for xx% of the market in 2025. However, online stores are experiencing rapid growth, offering consumers greater convenience and choice.

By Country: The United States represents the largest market for LVT in North America, holding a market share of xx% in 2025, followed by Canada. The rest of North America shows potential for future growth.

North America Luxury Vinyl Tile Flooring Market Product Landscape

LVT products are characterized by diverse designs, textures, and functionalities. Recent innovations focus on improved durability, water resistance, and realistic aesthetics. Key product differentiators include the use of advanced materials, improved click-lock systems for easy installation, and enhanced surface technologies to mimic natural materials like wood and stone. The industry is witnessing the introduction of thicker, more resilient LVT options catering to high-traffic areas. The introduction of antimicrobial technologies is also a growing trend.

Key Drivers, Barriers & Challenges in North America Luxury Vinyl Tile Flooring Market

Key Drivers: The increasing preference for durable, waterproof, and aesthetically pleasing flooring solutions drives market growth. Economic factors such as rising disposable incomes and new housing construction further stimulate demand. Government initiatives promoting energy-efficient building materials indirectly benefit LVT adoption.

Key Barriers & Challenges: Fluctuations in raw material prices and supply chain disruptions pose significant challenges. Competition from established flooring materials and the emergence of new technologies create competitive pressure. Stringent environmental regulations and concerns about product sustainability also impact the market. For example, xx% of manufacturers reported supply chain disruptions in 2024, leading to xx% increase in production costs.

Emerging Opportunities in North America Luxury Vinyl Tile Flooring Market

Emerging opportunities include tapping into the growing demand for sustainable and eco-friendly LVT products. Expanding into niche markets, like luxury residential projects and specialized commercial applications (e.g., healthcare), presents significant growth potential. The incorporation of smart home technologies into LVT products, such as integrated heating systems, opens new avenues for innovation.

Growth Accelerators in the North America Luxury Vinyl Tile Flooring Market Industry

Technological advancements in LVT manufacturing, particularly in terms of improved durability and realistic aesthetics, are crucial growth drivers. Strategic partnerships between manufacturers and distributors enhance market reach and distribution efficiency. Expanding into new geographical markets and targeting underserved segments fuels long-term growth. The increasing awareness of LVT's advantages over traditional flooring options further contributes to its market expansion.

Key Players Shaping the North America Luxury Vinyl Tile Flooring Market Market

- LG Hausys

- Shaw Industries Group Inc

- Tarkett

- Mannington Mills Inc

- American Biltrite

- Armstrong Flooring

- Gerflor

- Mohawk Industries

- Adore Floors Inc

- Interface

Notable Milestones in North America Luxury Vinyl Tile Flooring Market Sector

- December 2023: Galleher, a major flooring distributor, was acquired by Transom Capital, signifying entry into the premium flooring market.

- September 2023: AHF Products and Spartan Surfaces signed a distribution agreement for Parterre flooring, expanding market reach.

In-Depth North America Luxury Vinyl Tile Flooring Market Market Outlook

The North American LVT market is poised for continued growth, driven by sustained demand from both residential and commercial sectors. Opportunities abound in product innovation, sustainable materials, and expanding market reach. Strategic partnerships, targeted marketing, and effective supply chain management will be key factors determining long-term success in this competitive landscape. The market's future growth potential is substantial, with ongoing technological advancements and evolving consumer preferences promising further expansion in the coming years.

North America Luxury Vinyl Tile Flooring Market Segmentation

-

1. Product Type

- 1.1. Rigid

- 1.2. Flexible

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online Stores

- 3.5. Other Distribution Channels

North America Luxury Vinyl Tile Flooring Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Luxury Vinyl Tile Flooring Market Regional Market Share

Geographic Coverage of North America Luxury Vinyl Tile Flooring Market

North America Luxury Vinyl Tile Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Real Estate Market is Driving the Market; Increasing Construction Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Competition from Other Flooring Options; Rise in Raw Material Costs

- 3.4. Market Trends

- 3.4.1. The Residential Segment Leads the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Luxury Vinyl Tile Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rigid

- 5.1.2. Flexible

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG Hausys

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shaw Industries Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Tarkett

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mannington Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Biltrite

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Armstrong Flooring

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gerflor

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mohawk Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adore Floors Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Interface

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 LG Hausys

List of Figures

- Figure 1: North America Luxury Vinyl Tile Flooring Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Luxury Vinyl Tile Flooring Market Share (%) by Company 2025

List of Tables

- Table 1: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: North America Luxury Vinyl Tile Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Luxury Vinyl Tile Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Luxury Vinyl Tile Flooring Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the North America Luxury Vinyl Tile Flooring Market?

Key companies in the market include LG Hausys, Shaw Industries Group Inc, Tarkett, Mannington Mills Inc, American Biltrite, Armstrong Flooring, Gerflor, Mohawk Industries, Adore Floors Inc **List Not Exhaustive, Interface.

3. What are the main segments of the North America Luxury Vinyl Tile Flooring Market?

The market segments include Product Type, End User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Real Estate Market is Driving the Market; Increasing Construction Industry is Driving the Market.

6. What are the notable trends driving market growth?

The Residential Segment Leads the Market.

7. Are there any restraints impacting market growth?

Competition from Other Flooring Options; Rise in Raw Material Costs.

8. Can you provide examples of recent developments in the market?

In December 2023, Galleher, the third-biggest flooring distributor and the largest in the western United States was acquired by operations-focused middle market private equity company transom capital, allowing it to enter the premium flooring industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Luxury Vinyl Tile Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Luxury Vinyl Tile Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Luxury Vinyl Tile Flooring Market?

To stay informed about further developments, trends, and reports in the North America Luxury Vinyl Tile Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence