Key Insights

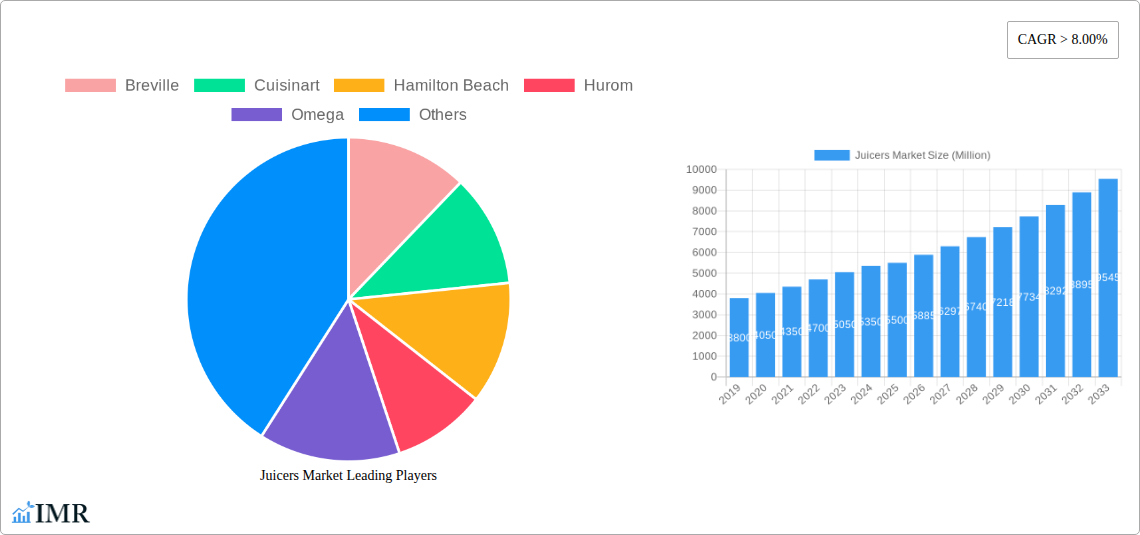

The global juicers market is poised for significant expansion, projected to reach a market size of USD 3.17 billion by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 8.7%. This growth is primarily attributed to escalating consumer health consciousness and the increasing demand for fresh, nutrient-dense beverages. The rising trend of home juicing and heightened awareness of its health benefits are key market catalysts. Innovations in juicer technology, resulting in more efficient, user-friendly, and aesthetically appealing designs, particularly within the electric juicer segment, are broadening consumer appeal. The residential sector significantly contributes to market expansion, driven by the convenience and economic advantages of at-home juice preparation.

Juicers Market Market Size (In Billion)

Emerging trends, including the incorporation of smart functionalities for personalized juicing and recipe recommendations, are anticipated to further stimulate market growth. The expanding variety of juicer types available, from high-performance centrifugal and masticating models to compact manual options, effectively addresses diverse consumer preferences and price points. Evolving distribution strategies, with online channels increasingly facilitating global reach alongside traditional retail outlets, are also shaping the market. While electric juicers dominate, manual juicers serve a niche market seeking affordability and portability. Leading industry players are strategically investing in innovation and product portfolio expansion to secure market share in this dynamic and expanding industry.

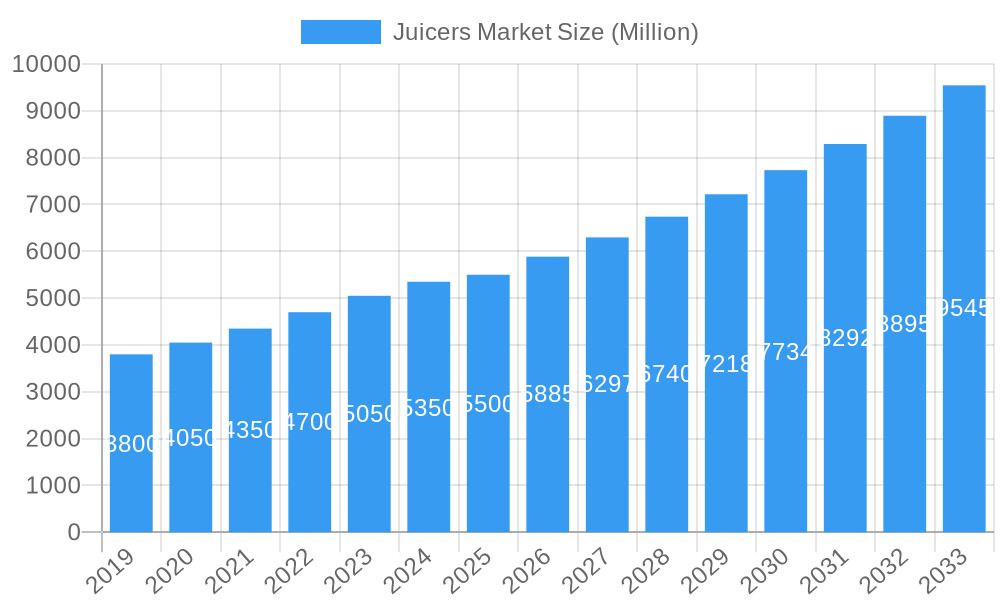

Juicers Market Company Market Share

Juicers Market: Comprehensive Industry Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global Juicers Market, exploring its dynamics, growth trends, competitive landscape, and future projections. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report offers critical insights for manufacturers, suppliers, distributors, and investors navigating the evolving juicer industry. We examine parent and child market segments to provide a holistic view of market opportunities.

Juicers Market Market Dynamics & Structure

The global juicers market exhibits a moderate to high concentration, driven by the presence of established brands and the increasing demand for health-conscious appliances. Technological innovation is a primary driver, with manufacturers continuously introducing features such as improved motor efficiency, quieter operation, and advanced juicing mechanisms like cold-press technology. Regulatory frameworks, primarily concerning product safety and energy efficiency, influence product development and market entry. Competitive product substitutes include blenders and other kitchen appliances that can perform similar functions, necessitating continuous innovation and product differentiation in the juicers market. End-user demographics are shifting, with a growing segment of health-conscious consumers, fitness enthusiasts, and individuals seeking convenient ways to incorporate fresh produce into their diets. Mergers and acquisitions (M&A) trends are present, as larger companies seek to expand their product portfolios and market reach, while smaller innovators might be acquired to gain access to cutting-edge technology.

- Market Concentration: Dominated by a few key players, but with significant room for niche brands.

- Technological Innovation: Focus on efficiency, ease of use, and health benefits.

- Regulatory Impact: Safety standards and energy efficiency labels influence product design.

- Competitive Substitutes: Blenders and other kitchen gadgets offer alternative solutions.

- End-User Demographics: Increasing demand from health-conscious consumers and families.

- M&A Activity: Strategic acquisitions to enhance product offerings and market share.

Juicers Market Growth Trends & Insights

The global juicers market has witnessed robust growth, fueled by an escalating global focus on health and wellness. This trend has significantly boosted the adoption rates of various juicer types, particularly masticating and centrifugal juicers, as consumers actively seek to integrate nutrient-rich juices into their daily routines. The market size has expanded considerably over the historical period (2019-2024), demonstrating a consistent upward trajectory. Technological disruptions have played a pivotal role, with advancements in motor technology leading to more powerful, energy-efficient, and quieter juicers. Innovations such as cold-press juicing have gained traction, appealing to consumers who prioritize preserving maximum nutrients and enzymes in their juices. Consumer behavior shifts are evident, with a growing preference for appliance durability, ease of cleaning, and versatility. The base year of 2025 is projected to reflect these evolving preferences, with electric juicers continuing to dominate due to their convenience and speed. The forecast period (2025-2033) is anticipated to see sustained growth, driven by further product innovations, expanding distribution channels, and increasing consumer awareness of the health benefits associated with fresh juice consumption. The market penetration of juicers is expected to rise, especially in emerging economies where health and wellness trends are gaining momentum.

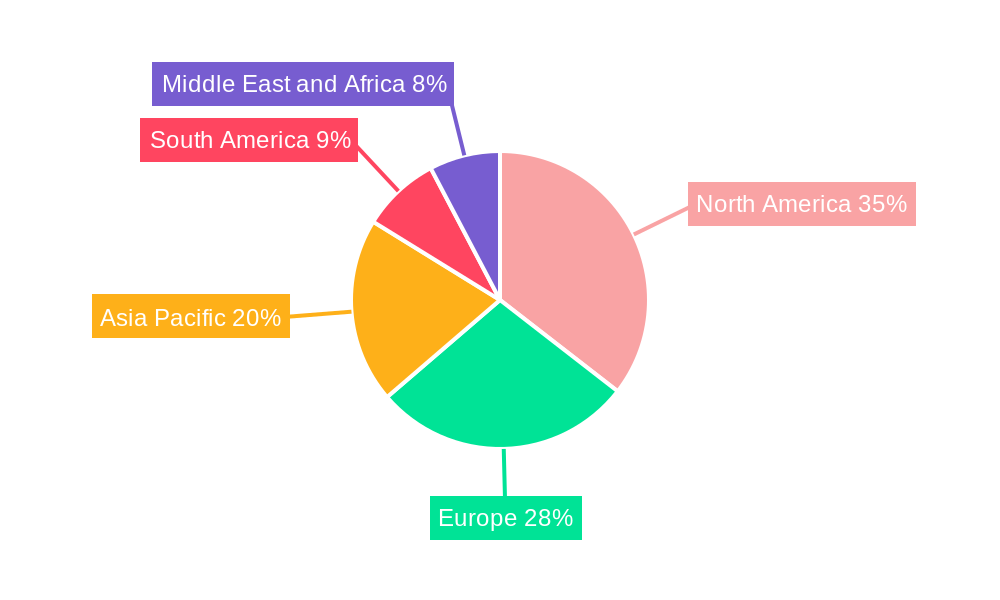

Dominant Regions, Countries, or Segments in Juicers Market

The North America region is a dominant force in the global juicers market, driven by a confluence of factors including a high disposable income, a well-established health and wellness culture, and a strong preference for organic and fresh produce. Within this region, the United States leads in terms of market share and consumption, owing to widespread consumer awareness regarding the health benefits of juicing and the presence of major juicer brands. Electric juicers, particularly centrifugal and masticating juicers, are the leading segments within the category type, catering to the demand for convenience and efficiency in residential settings. The commercial end-user segment also contributes significantly, with juice bars, cafes, and restaurants incorporating juicers into their operations to offer fresh juice options.

- Regional Dominance: North America, led by the United States, holds a significant market share due to high consumer spending and health consciousness.

- Leading Country: The United States accounts for the largest portion of the juicers market due to strong demand and brand presence.

- Dominant Type: Masticating juicers are gaining significant traction due to their ability to extract more juice and preserve nutrients. Centrifugal juicers remain popular for their speed and affordability.

- Leading Category Type: Electric juicers are paramount, offering convenience and efficiency for both commercial and residential users. Manual juicers cater to a niche market seeking portability and simplicity.

- End-User Dominance: The Residential end-user segment is the primary driver of market growth, with increasing adoption in households focused on healthy living. Commercial use in juice bars and cafes also contributes substantially.

- Distribution Channel Strength: Online sales channels are experiencing rapid growth, driven by convenience and wider product availability. Supermarkets and hypermarkets remain strong channels for mass market penetration.

- Economic Policies and Infrastructure: Favorable economic conditions and robust retail infrastructure in North America facilitate market expansion.

- Consumer Behavior: A proactive approach to health and fitness, coupled with a willingness to invest in kitchen appliances that support these lifestyles, fuels demand.

Juicers Market Product Landscape

The juicers market is characterized by a dynamic product landscape, with continuous innovation focused on enhancing user experience and juice quality. Key product innovations include the development of ultra-quiet masticating juicers, high-speed centrifugal juicers with improved pulp separation, and compact designs for space-saving kitchens. Applications range from daily health-boosting juices and smoothies to more specialized uses in professional culinary settings. Performance metrics such as juice yield, speed of operation, ease of cleaning, and durability are critical selling points. Unique selling propositions often revolve around cold-press technology for maximum nutrient retention, smart features like pre-programmed settings, and robust build quality for commercial-grade performance. Technological advancements are also seen in materials science, leading to more durable and food-safe components.

Key Drivers, Barriers & Challenges in Juicers Market

Key Drivers:

- Rising Health Consciousness: Growing awareness of the benefits of fresh juice consumption for overall well-being and disease prevention is a primary driver.

- Product Innovation: Continuous development of more efficient, user-friendly, and feature-rich juicers by leading manufacturers.

- Increasing Disposable Income: Higher purchasing power in developed and developing economies allows consumers to invest in premium kitchen appliances.

- Demand for Convenience: Electric juicers, in particular, appeal to busy consumers seeking quick and easy ways to prepare healthy beverages.

Barriers & Challenges:

- High Initial Cost: Some advanced juicer models, especially high-end masticating and twin-gear juicers, can be expensive, limiting affordability for some consumers.

- Cleaning and Maintenance: The perceived effort in cleaning juicers can deter potential buyers, although manufacturers are increasingly focusing on easy-to-clean designs.

- Availability of Substitutes: Blenders and other kitchen appliances that can perform similar functions pose a competitive challenge.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials and components, affecting production and pricing.

- Regulatory Hurdles: Adhering to various product safety and electrical standards across different regions can add complexity for manufacturers.

- Intense Competition: A saturated market with numerous players necessitates strong branding and differentiation strategies.

Emerging Opportunities in Juicers Market

Emerging opportunities in the juicers market lie in the growing demand for portable and personal juicers, catering to on-the-go lifestyles and single-person households. The expansion of subscription-based juicing services and recipe platforms presents a significant avenue for growth, creating a recurring revenue model and fostering customer loyalty. Furthermore, the integration of smart technology, such as app connectivity for recipe suggestions and maintenance reminders, offers a niche for product differentiation and enhanced user engagement. There's also an untapped market potential in developing countries where awareness of health benefits is rising but affordability remains a key consideration, suggesting a need for cost-effective yet functional juicer models.

Growth Accelerators in the Juicers Market Industry

Long-term growth in the juicers market industry is significantly propelled by ongoing technological breakthroughs that enhance efficiency, reduce noise levels, and improve the nutrient extraction capabilities of juicers. Strategic partnerships between juicer manufacturers and health and wellness influencers, as well as collaborations with organic food brands, are crucial for market expansion and consumer education. Market expansion strategies focused on emerging economies, where health and wellness trends are gaining traction, represent a substantial growth accelerator. The increasing consumer preference for sustainable and eco-friendly products also presents an opportunity for manufacturers to innovate with sustainable materials and energy-efficient designs.

Key Players Shaping the Juicers Market Market

- Breville

- Cuisinart

- Hamilton Beach

- Hurom

- Omega

- Panasonic

- Philips

- Proctor Silex

- Sage Appliances

- Vitamix

Notable Milestones in Juicers Market Sector

- February 2023: Angela Juicers announced the launch of their new website, a comprehensive online store offering a wide selection of juicers, accessories, and recipes, ranging from masticating to centrifugal models.

- January 2023: Prestige launched the Prestige Plus Atlas 750 W Juicer Mixer Grinder, featuring a locking system and a 1.5-liter liquidizing jar.

In-Depth Juicers Market Market Outlook

The future outlook for the juicers market is exceptionally promising, fueled by the persistent global emphasis on health, wellness, and preventative healthcare. Growth accelerators such as continuous technological innovation, particularly in cold-press technology and smart appliance integration, will continue to drive consumer adoption. Strategic partnerships with health and wellness platforms and a focus on expanding into emerging markets with tailored product offerings will be pivotal. The increasing consumer demand for convenient, nutritious, and easy-to-maintain kitchen appliances positions the juicers market for sustained and significant expansion in the coming years.

Juicers Market Segmentation

-

1. Type

- 1.1. Centrifugal Juicer

- 1.2. Masticating Juicer

- 1.3. Triturating Juicer

- 1.4. Others

-

2. Category Type

- 2.1. Manual Juicers

- 2.2. Electric Juicers

-

3. End- User

- 3.1. Commercial

- 3.2. Residential

-

4. Distribution Channel

- 4.1. Supermarkets/Hypermarkets

- 4.2. Specialty Stores

- 4.3. Online

- 4.4. Other Distribution Channels

Juicers Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Juicers Market Regional Market Share

Geographic Coverage of Juicers Market

Juicers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The trend towards home cooking and DIY health solutions has led to increased interest in juicers. Consumers are looking for ways to make their own juices and health drinks at home

- 3.2.2 which drives demand for juicing appliances.

- 3.3. Market Restrains

- 3.3.1 High-quality juicers

- 3.3.2 especially masticating or cold-press models

- 3.3.3 can be expensive. The high initial cost may deter some consumers

- 3.3.4 particularly in price-sensitive markets.

- 3.4. Market Trends

- 3.4.1 The integration of smart technology is a growing trend in the juicers market. Smart juicers offer features such as programmable settings

- 3.4.2 connectivity with mobile apps

- 3.4.3 and remote control capabilities

- 3.4.4 enhancing user convenience and experience.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Juicers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Centrifugal Juicer

- 5.1.2. Masticating Juicer

- 5.1.3. Triturating Juicer

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Category Type

- 5.2.1. Manual Juicers

- 5.2.2. Electric Juicers

- 5.3. Market Analysis, Insights and Forecast - by End- User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Supermarkets/Hypermarkets

- 5.4.2. Specialty Stores

- 5.4.3. Online

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. South America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Juicers Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Centrifugal Juicer

- 6.1.2. Masticating Juicer

- 6.1.3. Triturating Juicer

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Category Type

- 6.2.1. Manual Juicers

- 6.2.2. Electric Juicers

- 6.3. Market Analysis, Insights and Forecast - by End- User

- 6.3.1. Commercial

- 6.3.2. Residential

- 6.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.4.1. Supermarkets/Hypermarkets

- 6.4.2. Specialty Stores

- 6.4.3. Online

- 6.4.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Juicers Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Centrifugal Juicer

- 7.1.2. Masticating Juicer

- 7.1.3. Triturating Juicer

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Category Type

- 7.2.1. Manual Juicers

- 7.2.2. Electric Juicers

- 7.3. Market Analysis, Insights and Forecast - by End- User

- 7.3.1. Commercial

- 7.3.2. Residential

- 7.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.4.1. Supermarkets/Hypermarkets

- 7.4.2. Specialty Stores

- 7.4.3. Online

- 7.4.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Juicers Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Centrifugal Juicer

- 8.1.2. Masticating Juicer

- 8.1.3. Triturating Juicer

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Category Type

- 8.2.1. Manual Juicers

- 8.2.2. Electric Juicers

- 8.3. Market Analysis, Insights and Forecast - by End- User

- 8.3.1. Commercial

- 8.3.2. Residential

- 8.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.4.1. Supermarkets/Hypermarkets

- 8.4.2. Specialty Stores

- 8.4.3. Online

- 8.4.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Juicers Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Centrifugal Juicer

- 9.1.2. Masticating Juicer

- 9.1.3. Triturating Juicer

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Category Type

- 9.2.1. Manual Juicers

- 9.2.2. Electric Juicers

- 9.3. Market Analysis, Insights and Forecast - by End- User

- 9.3.1. Commercial

- 9.3.2. Residential

- 9.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.4.1. Supermarkets/Hypermarkets

- 9.4.2. Specialty Stores

- 9.4.3. Online

- 9.4.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Juicers Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Centrifugal Juicer

- 10.1.2. Masticating Juicer

- 10.1.3. Triturating Juicer

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Category Type

- 10.2.1. Manual Juicers

- 10.2.2. Electric Juicers

- 10.3. Market Analysis, Insights and Forecast - by End- User

- 10.3.1. Commercial

- 10.3.2. Residential

- 10.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.4.1. Supermarkets/Hypermarkets

- 10.4.2. Specialty Stores

- 10.4.3. Online

- 10.4.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Breville

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cuisinart

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hamilton Beach

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hurom

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Omega

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Philips

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Proctor Silex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sage Appliances

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vitamix

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Breville

List of Figures

- Figure 1: Global Juicers Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 5: North America Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 6: North America Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 7: North America Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 8: North America Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 9: North America Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 15: Europe Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 16: Europe Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 17: Europe Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 18: Europe Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 19: Europe Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Europe Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 23: Asia Pacific Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 25: Asia Pacific Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 26: Asia Pacific Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 27: Asia Pacific Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 28: Asia Pacific Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: South America Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 33: South America Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: South America Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 35: South America Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 36: South America Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 37: South America Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 38: South America Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: South America Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Juicers Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Juicers Market Revenue (billion), by Type 2025 & 2033

- Figure 43: Middle East and Africa Juicers Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: Middle East and Africa Juicers Market Revenue (billion), by Category Type 2025 & 2033

- Figure 45: Middle East and Africa Juicers Market Revenue Share (%), by Category Type 2025 & 2033

- Figure 46: Middle East and Africa Juicers Market Revenue (billion), by End- User 2025 & 2033

- Figure 47: Middle East and Africa Juicers Market Revenue Share (%), by End- User 2025 & 2033

- Figure 48: Middle East and Africa Juicers Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 49: Middle East and Africa Juicers Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 50: Middle East and Africa Juicers Market Revenue (billion), by Country 2025 & 2033

- Figure 51: Middle East and Africa Juicers Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 3: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 4: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Juicers Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 8: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 9: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 13: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 14: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 18: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 19: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 23: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 24: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Global Juicers Market Revenue billion Forecast, by Type 2020 & 2033

- Table 27: Global Juicers Market Revenue billion Forecast, by Category Type 2020 & 2033

- Table 28: Global Juicers Market Revenue billion Forecast, by End- User 2020 & 2033

- Table 29: Global Juicers Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Juicers Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Juicers Market?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Juicers Market?

Key companies in the market include Breville, Cuisinart, Hamilton Beach, Hurom, Omega, Panasonic, Philips, Proctor Silex, Sage Appliances, Vitamix.

3. What are the main segments of the Juicers Market?

The market segments include Type, Category Type, End- User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.17 billion as of 2022.

5. What are some drivers contributing to market growth?

The trend towards home cooking and DIY health solutions has led to increased interest in juicers. Consumers are looking for ways to make their own juices and health drinks at home. which drives demand for juicing appliances..

6. What are the notable trends driving market growth?

The integration of smart technology is a growing trend in the juicers market. Smart juicers offer features such as programmable settings. connectivity with mobile apps. and remote control capabilities. enhancing user convenience and experience..

7. Are there any restraints impacting market growth?

High-quality juicers. especially masticating or cold-press models. can be expensive. The high initial cost may deter some consumers. particularly in price-sensitive markets..

8. Can you provide examples of recent developments in the market?

On 5th February 2023, Angela Juicers announced the launch of their new website. Angela Juicers is an online store that offers juicers, accessories, and recipes. Angela Juicers offers a wide selection of juicers, from masticating to centrifugal, as well as a variety of accessories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Juicers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Juicers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Juicers Market?

To stay informed about further developments, trends, and reports in the Juicers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence