Key Insights

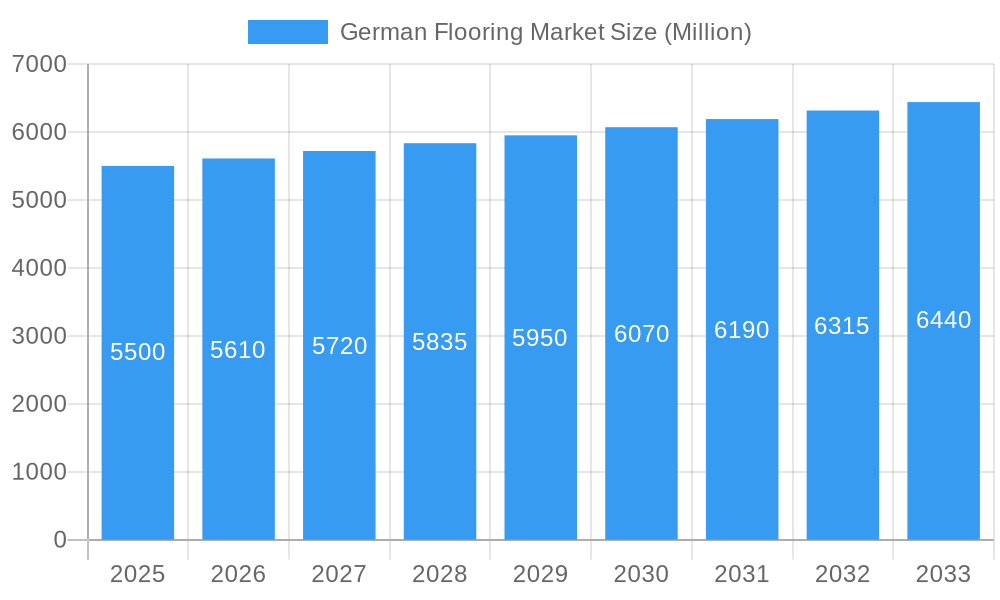

The German flooring market is poised for steady expansion, projected to grow at a Compound Annual Growth Rate (CAGR) exceeding 1.90% over the forecast period of 2025-2033. This sustained growth is driven by a confluence of factors, including a robust renovation and remodeling sector, increasing demand for sustainable and eco-friendly flooring solutions, and ongoing advancements in material technology leading to more durable and aesthetically pleasing products. The residential replacement segment is anticipated to be a significant contributor, fueled by an aging housing stock and a growing consumer preference for enhanced home aesthetics and comfort. Furthermore, the commercial sector, encompassing retail spaces, offices, and hospitality, is also expected to see consistent demand, particularly for high-performance and visually appealing flooring that aligns with brand identities and operational needs. Investments in new construction projects, though potentially sensitive to economic fluctuations, will also play a role in market development.

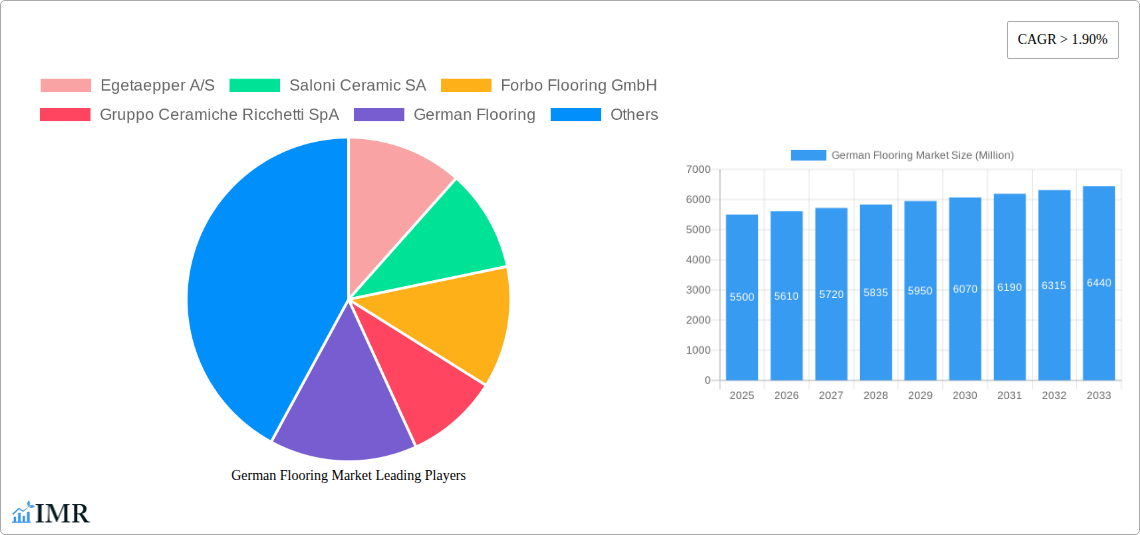

German Flooring Market Market Size (In Billion)

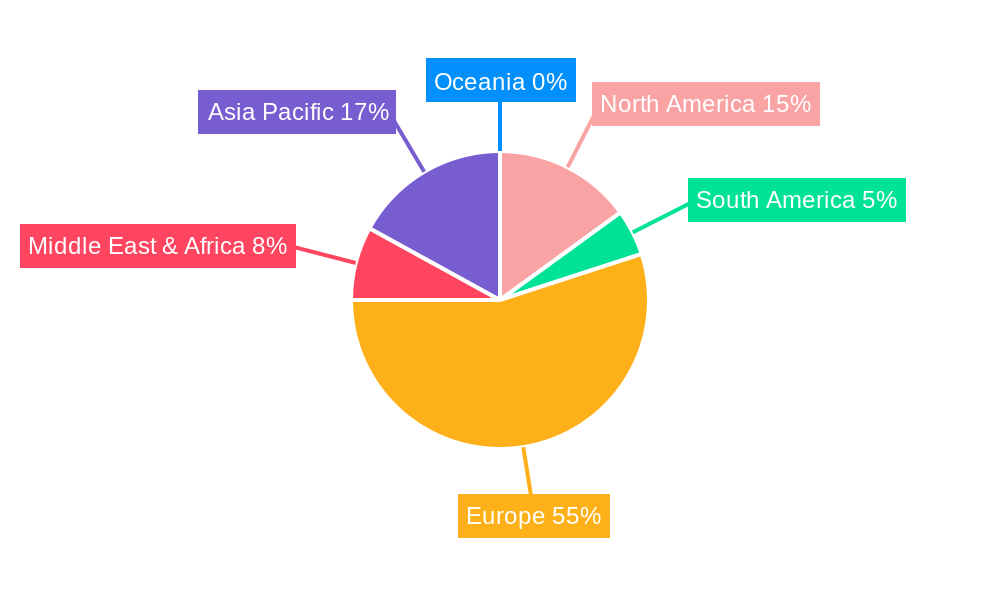

Several key trends are shaping the German flooring landscape. The rise of resilient flooring, particularly vinyl, is a prominent theme, attributed to its water resistance, durability, and wide range of design options that mimic natural materials like wood and stone. Wood flooring continues to hold its appeal, with a focus on sustainable sourcing and engineered wood solutions offering enhanced stability. Ceramic and stone flooring remain popular for their longevity and premium feel, especially in high-traffic areas and luxury segments. The distribution channel is also evolving, with contractors and specialty stores retaining their importance for expert installation and advice, while home centers cater to the DIY segment. Geographically, Europe, as the primary region for the German market, is expected to continue its dominance, with Germany itself being a major consumer. However, emerging markets within the Asia Pacific and other regions are showing increasing potential, influenced by urbanization and rising disposable incomes. Restraints such as rising raw material costs and supply chain disruptions could pose challenges, but the inherent demand for quality flooring in Germany is expected to largely counterbalance these issues.

German Flooring Market Company Market Share

This comprehensive German Flooring Market Report offers an in-depth analysis of the flooring industry in Germany, meticulously segmented by material, distribution channel, and end-user. Covering the historical period of 2019–2024, base year 2025, and extending to a detailed forecast period of 2025–2033, this report provides crucial insights into market dynamics, growth trends, and key player strategies. Utilizing high-traffic keywords like "German flooring market," "vinyl flooring Germany," "wood flooring market share," "carpet sales Germany," and "laminate flooring demand," this SEO-optimized report is designed to maximize search engine visibility and attract industry professionals, including manufacturers, distributors, contractors, and investors.

The report breaks down the parent market of the German flooring industry and delves into the performance of child markets within key segments. Values are presented in Million units for clarity and comparability, with xx used for unavailable data and predicted values where necessary.

German Flooring Market Market Dynamics & Structure

The German flooring market is characterized by a moderate level of concentration, with established players like Forbo Flooring GmbH, Parador, and Nora Systems GmbH holding significant market share. Technological innovation is a key driver, particularly in the development of sustainable and high-performance materials like advanced vinyl and eco-friendly wood finishes. Regulatory frameworks, such as stringent environmental standards and building codes, influence product development and material choices, favoring sustainable and low-emission options. Competitive product substitutes are abundant, with constant innovation pushing the boundaries between different material categories, for instance, the increasing sophistication of luxury vinyl tiles mimicking natural stone and wood. End-user demographics are shifting, with an aging population in residential sectors demanding comfort and ease of maintenance, while the commercial sector emphasizes durability, aesthetics, and sustainability. Mergers and acquisitions (M&A) activity, while not overly aggressive, plays a role in market consolidation and the acquisition of innovative technologies or market access.

- Market Concentration: Moderate, with a few key players and a significant number of smaller specialized companies.

- Technological Innovation: Driven by sustainability, durability, aesthetics, and ease of installation.

- Regulatory Frameworks: Environmental certifications (e.g., Blue Angel) and building regulations impact material selection and manufacturing processes.

- Competitive Product Substitutes: High degree of substitution across material types, driven by price, performance, and aesthetics.

- End-User Demographics: Influence of aging population on residential demand for comfort and low maintenance, and commercial demand for high traffic durability and eco-friendliness.

- M&A Trends: Strategic acquisitions for technology or market expansion, ongoing but not defining the market.

German Flooring Market Growth Trends & Insights

The German flooring market is poised for steady growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 3.5% from 2025 to 2033. This growth is underpinned by consistent demand from both residential and commercial sectors, with the residential replacement market demonstrating resilience and steady adoption rates. Technological disruptions are continuously reshaping the market, with innovations in resilient flooring, particularly luxury vinyl tiles (LVT) and engineered wood, gaining significant traction due to their durability, aesthetic versatility, and ease of maintenance. Consumer behavior is shifting towards a greater emphasis on sustainable, eco-friendly, and health-conscious flooring solutions, driving demand for products with low VOC emissions and recycled content. The commercial segment, encompassing offices, retail spaces, healthcare facilities, and hospitality, is a major growth driver, fueled by new construction projects and extensive renovation activities aimed at modernizing workspaces and public areas. The adoption rate of advanced resilient flooring materials is particularly high in these settings due to their performance benefits. Furthermore, the increasing interest in interior design and home improvement, amplified by digital media and online platforms, encourages consumers to invest in higher-quality and more aesthetically pleasing flooring options. This sustained demand, coupled with ongoing product development and a growing awareness of the importance of healthy indoor environments, paints a positive outlook for the German flooring market. The market penetration of innovative flooring solutions is expected to rise as consumers become more informed about their benefits.

Dominant Regions, Countries, or Segments in German Flooring Market

Within the German Flooring Market, Resilient Flooring, specifically Vinyl Flooring, emerges as the dominant segment driving market growth. This dominance is attributed to a confluence of factors, including its versatility, cost-effectiveness, and superior performance characteristics, making it a preferred choice across various applications. The Commercial end-user segment is another significant growth engine, propelled by ongoing investments in office renovations, retail space upgrades, and the expansion of healthcare and hospitality infrastructure. Economic policies promoting construction and urban development, coupled with infrastructure investments, further bolster demand for flooring solutions.

In terms of distribution channels, Contractors play a pivotal role, leveraging their expertise to install and recommend flooring solutions to both residential and commercial clients. Their influence is particularly strong in project-based sales.

- Dominant Material Segment: Resilient Flooring, with Vinyl Flooring (including LVT) leading due to its durability, water resistance, and wide range of aesthetic options.

- Dominant End User Segment: Commercial sector, driven by new construction, renovation projects in offices, retail, healthcare, and hospitality, and the need for durable, low-maintenance, and aesthetically pleasing surfaces.

- Key Distribution Channel: Contractors, who act as crucial intermediaries in specifying and installing flooring, particularly in large-scale commercial projects and custom residential installations.

- Geographical Influence: While the report focuses on Germany as a whole, within Germany, economic hubs and densely populated urban areas tend to exhibit higher flooring market activity due to greater construction and renovation investments.

- Growth Drivers within Segments:

- Vinyl Flooring: Technological advancements leading to realistic wood and stone looks, enhanced durability, and improved sustainability features.

- Commercial End User: Demand for high-traffic wear resistance, ease of cleaning, aesthetic appeal, and compliance with safety and hygiene standards.

- Contractors: Influence on material selection based on ease of installation, cost-effectiveness, and client satisfaction.

German Flooring Market Product Landscape

The German flooring market is witnessing a surge in product innovation, with a strong emphasis on enhanced performance and sustainability. Luxury Vinyl Tiles (LVT) and engineered wood flooring are at the forefront, offering realistic aesthetics, superior durability, and improved water resistance. Forbo Flooring GmbH, for example, is known for its sustainable linoleum and vinyl products. Parador is innovating in wood and laminate flooring with enhanced scratch resistance and moisture protection. Companies are also focusing on acoustic properties and ease of installation, making products more attractive for both residential and commercial applications. The unique selling proposition often lies in the combination of eco-friendly manufacturing processes, visually striking designs, and long-term performance metrics that meet stringent European standards.

Key Drivers, Barriers & Challenges in German Flooring Market

Key Drivers:

- Technological Advancements: Innovations in materials science leading to more durable, aesthetically pleasing, and sustainable flooring options like advanced vinyl and engineered wood.

- Growing Construction & Renovation Activity: Increased investment in residential and commercial building projects, coupled with a strong renovation market, fuels demand for flooring.

- Sustainability Focus: Rising consumer and regulatory demand for eco-friendly, low-VOC, and recyclable flooring products.

- Aesthetic Appeal & Home Improvement Trends: A continuous desire for visually appealing interiors drives upgrades and the adoption of premium flooring solutions.

Barriers & Challenges:

- Supply Chain Volatility: Global disruptions can impact raw material availability and lead to price fluctuations, affecting production costs and lead times.

- Intense Competition: A crowded market with numerous players leads to price pressures and necessitates continuous innovation to differentiate products.

- Skilled Labor Shortages: A lack of qualified installers can hinder project completion and impact customer satisfaction.

- Economic Slowdowns: Potential recessions or economic downturns can reduce consumer spending on discretionary home improvement and new construction.

- Regulatory Compliance Costs: Adhering to evolving environmental and safety regulations can increase manufacturing costs.

Emerging Opportunities in German Flooring Market

Emerging opportunities in the German flooring market lie in the expanding demand for smart flooring solutions that integrate technology, such as self-heating or sensor-equipped options. The continued growth of the sustainable and bio-based flooring sector presents a significant avenue, with increasing consumer preference for products made from renewable resources. Furthermore, the renovation and retrofitting of older commercial and residential buildings offer a substantial untapped market for high-performance, easy-to-install flooring systems. The digitalization of the distribution channel, including enhanced e-commerce platforms and virtual showroom experiences, also presents opportunities for reaching a wider customer base and streamlining the purchasing process.

Growth Accelerators in the German Flooring Market Industry

Several key catalysts are accelerating growth in the German flooring market. The ongoing push towards sustainable construction and renovation, driven by both government policies and consumer awareness, is a major accelerator, favoring manufacturers of eco-friendly flooring solutions. Technological breakthroughs in material science, leading to enhanced product performance, durability, and design flexibility, are further boosting market adoption. Strategic partnerships between material suppliers and flooring manufacturers, as well as collaborations with architects and designers, are crucial for driving innovation and market penetration. Market expansion strategies, including entering niche segments or developing specialized product lines for specific applications (e.g., healthcare, education), are also contributing to sustained growth.

Key Players Shaping the German Flooring Market Market

- Egetaepper A/S

- Saloni Ceramic SA

- Forbo Flooring GmbH

- Gruppo Ceramiche Ricchetti SpA

- German Flooring

- Porcelanosa Group

- PolyFlor

- Parador

- Milliken Flooring

- Nora Systems GmbH

Notable Milestones in German Flooring Market Sector

- 2019: Increased focus on sustainable material sourcing and production in response to growing environmental concerns.

- 2020: Rise in home improvement and renovation projects during the pandemic, boosting demand for residential flooring.

- 2021: Introduction of advanced LVT products mimicking natural materials with enhanced durability and water resistance.

- 2022: Greater emphasis on digital sales channels and virtual showroom experiences for flooring products.

- 2023: Growing investment in R&D for bio-based and recycled content flooring materials.

- 2024: Stringent regulations regarding VOC emissions and indoor air quality drive innovation in low-emission flooring solutions.

In-Depth German Flooring Market Market Outlook

The future outlook for the German flooring market remains robust, driven by ongoing residential and commercial construction and renovation activities. The persistent demand for sustainable and eco-friendly solutions will continue to shape product development and consumer preferences. Technological advancements in resilient and wood flooring will further enhance their market appeal, offering greater durability and aesthetic diversity. Strategic partnerships and market expansion initiatives will be key for players aiming to capture a larger share. The integration of digital technologies in sales and customer engagement will also play an increasingly important role. Opportunities in niche applications and the growing demand for healthy indoor environments present significant avenues for future growth and innovation, ensuring a dynamic and expanding market.

German Flooring Market Segmentation

-

1. Material

- 1.1. Carpet and Area Rugs

-

1.2. Resilent Flooring

- 1.2.1. Vinyl Flooring

- 1.2.2. Other Resilient Flooring

-

1.3. Non-resilent Flooring

- 1.3.1. Wood Flooring

- 1.3.2. Ceramic Flooring

- 1.3.3. Laminate Flooring

- 1.3.4. Stone Flooring

-

2. Distribution Channel

- 2.1. Contractors

- 2.2. Specialty Stores

- 2.3. Home Centers

- 2.4. Other Distribution Channels

-

3. End User

- 3.1. Residential Replacement

- 3.2. Commercial

- 3.3. Builder

German Flooring Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

German Flooring Market Regional Market Share

Geographic Coverage of German Flooring Market

German Flooring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 1.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Urbanization and the Expansion of Ultramodern Workspaces; Rising Consumer Awareness About Eco-Friendly and Sustainable Flooring Options

- 3.3. Market Restrains

- 3.3.1. Volatility in Raw Material Prices to Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Construction Industry in Germany is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global German Flooring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Resilent Flooring

- 5.1.2.1. Vinyl Flooring

- 5.1.2.2. Other Resilient Flooring

- 5.1.3. Non-resilent Flooring

- 5.1.3.1. Wood Flooring

- 5.1.3.2. Ceramic Flooring

- 5.1.3.3. Laminate Flooring

- 5.1.3.4. Stone Flooring

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Contractors

- 5.2.2. Specialty Stores

- 5.2.3. Home Centers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.3.3. Builder

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America German Flooring Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Carpet and Area Rugs

- 6.1.2. Resilent Flooring

- 6.1.2.1. Vinyl Flooring

- 6.1.2.2. Other Resilient Flooring

- 6.1.3. Non-resilent Flooring

- 6.1.3.1. Wood Flooring

- 6.1.3.2. Ceramic Flooring

- 6.1.3.3. Laminate Flooring

- 6.1.3.4. Stone Flooring

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Contractors

- 6.2.2. Specialty Stores

- 6.2.3. Home Centers

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Residential Replacement

- 6.3.2. Commercial

- 6.3.3. Builder

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America German Flooring Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Carpet and Area Rugs

- 7.1.2. Resilent Flooring

- 7.1.2.1. Vinyl Flooring

- 7.1.2.2. Other Resilient Flooring

- 7.1.3. Non-resilent Flooring

- 7.1.3.1. Wood Flooring

- 7.1.3.2. Ceramic Flooring

- 7.1.3.3. Laminate Flooring

- 7.1.3.4. Stone Flooring

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Contractors

- 7.2.2. Specialty Stores

- 7.2.3. Home Centers

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Residential Replacement

- 7.3.2. Commercial

- 7.3.3. Builder

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe German Flooring Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Carpet and Area Rugs

- 8.1.2. Resilent Flooring

- 8.1.2.1. Vinyl Flooring

- 8.1.2.2. Other Resilient Flooring

- 8.1.3. Non-resilent Flooring

- 8.1.3.1. Wood Flooring

- 8.1.3.2. Ceramic Flooring

- 8.1.3.3. Laminate Flooring

- 8.1.3.4. Stone Flooring

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Contractors

- 8.2.2. Specialty Stores

- 8.2.3. Home Centers

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Residential Replacement

- 8.3.2. Commercial

- 8.3.3. Builder

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa German Flooring Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Carpet and Area Rugs

- 9.1.2. Resilent Flooring

- 9.1.2.1. Vinyl Flooring

- 9.1.2.2. Other Resilient Flooring

- 9.1.3. Non-resilent Flooring

- 9.1.3.1. Wood Flooring

- 9.1.3.2. Ceramic Flooring

- 9.1.3.3. Laminate Flooring

- 9.1.3.4. Stone Flooring

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Contractors

- 9.2.2. Specialty Stores

- 9.2.3. Home Centers

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Residential Replacement

- 9.3.2. Commercial

- 9.3.3. Builder

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific German Flooring Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Carpet and Area Rugs

- 10.1.2. Resilent Flooring

- 10.1.2.1. Vinyl Flooring

- 10.1.2.2. Other Resilient Flooring

- 10.1.3. Non-resilent Flooring

- 10.1.3.1. Wood Flooring

- 10.1.3.2. Ceramic Flooring

- 10.1.3.3. Laminate Flooring

- 10.1.3.4. Stone Flooring

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Contractors

- 10.2.2. Specialty Stores

- 10.2.3. Home Centers

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Residential Replacement

- 10.3.2. Commercial

- 10.3.3. Builder

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Egetaepper A/S

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saloni Ceramic SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Forbo Flooring GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Gruppo Ceramiche Ricchetti SpA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 German Flooring

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Porcelanosa Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PolyFlor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Parador

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Milliken Flooring

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nora Systems GmbH**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Egetaepper A/S

List of Figures

- Figure 1: Global German Flooring Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America German Flooring Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America German Flooring Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America German Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America German Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America German Flooring Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America German Flooring Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America German Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America German Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America German Flooring Market Revenue (Million), by Material 2025 & 2033

- Figure 11: South America German Flooring Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America German Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 13: South America German Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America German Flooring Market Revenue (Million), by End User 2025 & 2033

- Figure 15: South America German Flooring Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: South America German Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America German Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe German Flooring Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe German Flooring Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe German Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: Europe German Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe German Flooring Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Europe German Flooring Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Europe German Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe German Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa German Flooring Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa German Flooring Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa German Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa German Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa German Flooring Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East & Africa German Flooring Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East & Africa German Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa German Flooring Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific German Flooring Market Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific German Flooring Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific German Flooring Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific German Flooring Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific German Flooring Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Asia Pacific German Flooring Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Asia Pacific German Flooring Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific German Flooring Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global German Flooring Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global German Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global German Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global German Flooring Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global German Flooring Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global German Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global German Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global German Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global German Flooring Market Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global German Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global German Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global German Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global German Flooring Market Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global German Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global German Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 22: Global German Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global German Flooring Market Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global German Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global German Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global German Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global German Flooring Market Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global German Flooring Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global German Flooring Market Revenue Million Forecast, by End User 2020 & 2033

- Table 45: Global German Flooring Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific German Flooring Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the German Flooring Market?

The projected CAGR is approximately > 1.90%.

2. Which companies are prominent players in the German Flooring Market?

Key companies in the market include Egetaepper A/S, Saloni Ceramic SA, Forbo Flooring GmbH, Gruppo Ceramiche Ricchetti SpA, German Flooring, Porcelanosa Group, PolyFlor, Parador, Milliken Flooring, Nora Systems GmbH**List Not Exhaustive.

3. What are the main segments of the German Flooring Market?

The market segments include Material, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Urbanization and the Expansion of Ultramodern Workspaces; Rising Consumer Awareness About Eco-Friendly and Sustainable Flooring Options.

6. What are the notable trends driving market growth?

Growing Construction Industry in Germany is Driving the Market.

7. Are there any restraints impacting market growth?

Volatility in Raw Material Prices to Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "German Flooring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the German Flooring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the German Flooring Market?

To stay informed about further developments, trends, and reports in the German Flooring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence