Key Insights

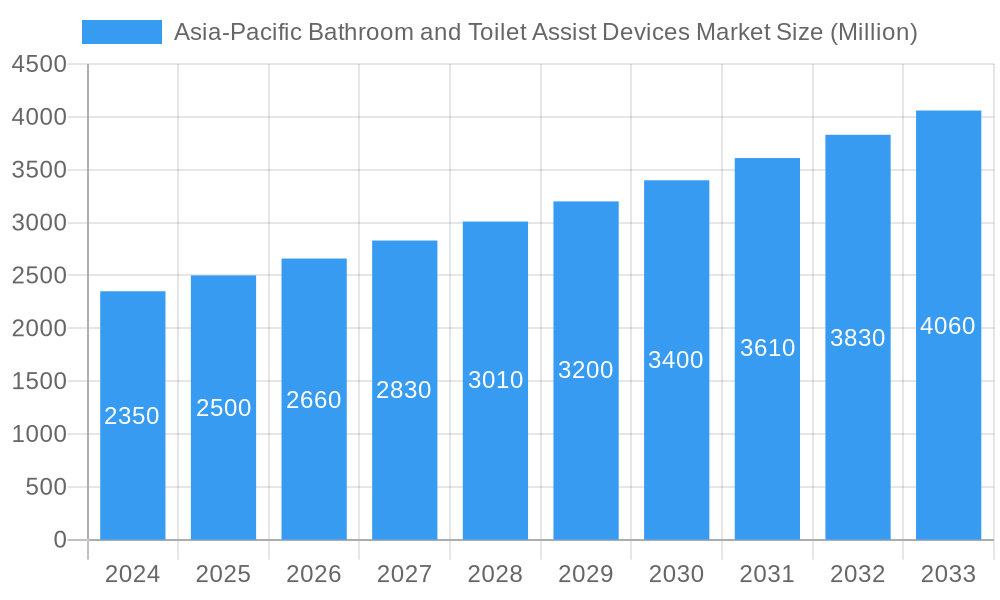

The Asia-Pacific Bathroom and Toilet Assist Devices Market is poised for robust expansion, projected to reach an estimated USD 2,500 million by 2025 and experience a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This significant growth is fueled by a confluence of factors, primarily driven by the rapidly aging population across key Asian economies and a heightened awareness of the importance of independent living for individuals with mobility challenges. The increasing prevalence of chronic diseases and a greater emphasis on home healthcare solutions further bolster demand for assistive devices that enhance safety and dignity in personal hygiene routines. Government initiatives promoting healthcare accessibility and a growing disposable income among the middle class also contribute to market penetration, enabling consumers to invest in these essential products. The market is characterized by a diverse product landscape, with Shower Chairs and Stools, including shower stools, bathtub seats, and transfer benches, leading the segment due to their widespread utility and affordability. Bath lifts, offering enhanced bathing experiences for those with severe mobility limitations, are also gaining traction. Toilet Seat Raisers and Commodes, crucial for maintaining independence in the restroom, along with Handgrips and Grab Bars, are fundamental safety features driving consistent demand.

Asia-Pacific Bathroom and Toilet Assist Devices Market Market Size (In Billion)

The market's trajectory is further shaped by prevailing trends such as the integration of advanced materials for enhanced durability and user comfort, and the development of aesthetically pleasing designs that blend seamlessly with modern bathroom interiors. Innovations in smart technology, offering features like adjustable heights and enhanced stability, are also emerging. However, the market faces certain restraints, including the relatively high cost of sophisticated assistive devices for a segment of the population and a potential lack of awareness regarding the availability and benefits of these products in certain developing regions. Despite these challenges, the strategic importance of the Asia-Pacific region, encompassing significant markets like China, Japan, India, and South Korea, coupled with the presence of major global and regional players such as Arjo, Toto Asia, and Huida Group, underscores the immense potential for growth. The continuous innovation and increasing adoption rates are expected to overcome these hurdles, solidifying the market's upward trajectory.

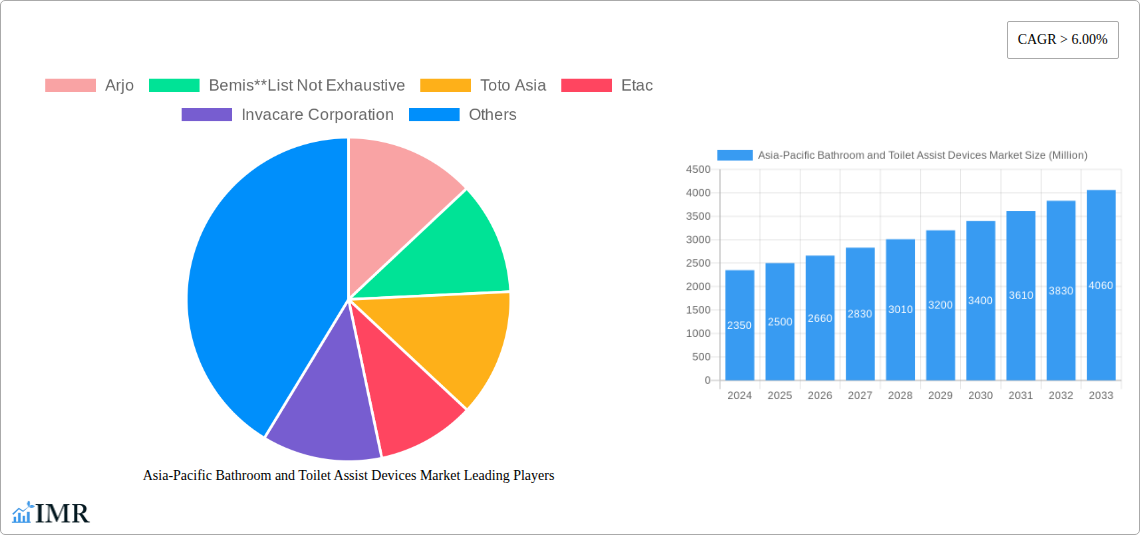

Asia-Pacific Bathroom and Toilet Assist Devices Market Company Market Share

This in-depth report provides a comprehensive analysis of the Asia-Pacific Bathroom and Toilet Assist Devices Market, examining parent and child market dynamics, growth trends, and future projections. With a focus on shower chairs, bath lifts, toilet seat raisers, commodes, handgrips, grab bars, and bath aids, this report offers crucial insights for manufacturers, suppliers, distributors, and stakeholders. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research details market evolution, technological advancements, and strategic opportunities. Values are presented in Million units.

Asia-Pacific Bathroom and Toilet Assist Devices Market Market Dynamics & Structure

The Asia-Pacific Bathroom and Toilet Assist Devices Market is characterized by a moderately concentrated landscape with key players like Arjo, Bemis, Toto Asia, Etac, Invacare Corporation, E-Z Lock, Huida Group, Roca, Aidacare, ProBasics, Lixil Group Corporation, and Tall-Ette, among others. Technological innovation is a primary driver, fueled by the increasing demand for elderly care assistive devices and disability aids in homes and healthcare facilities. Regulatory frameworks are evolving to support the adoption of safer and more accessible bathroom solutions, though regional variations exist. Competitive product substitutes, ranging from simple grab bars to advanced automated bath lifts, influence market segmentation and pricing strategies. End-user demographics, particularly the aging population in countries like Japan and China, significantly shape demand for bathroom accessibility solutions. Mergers and acquisitions (M&A) trends, while not as pronounced as in other sectors, are observed as companies seek to expand their product portfolios and market reach. Innovation barriers include high manufacturing costs for specialized equipment and the need for extensive user testing to ensure safety and efficacy. Market concentration is estimated at XX% by key players, with a significant number of smaller regional manufacturers catering to specific needs. The volume of M&A deals has been approximately XX in the historical period.

Asia-Pacific Bathroom and Toilet Assist Devices Market Growth Trends & Insights

The Asia-Pacific Bathroom and Toilet Assist Devices Market is projected for robust growth, driven by a confluence of demographic shifts, technological advancements, and increasing awareness of aging in place and accessibility needs. The market is expected to experience a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is underpinned by the rapidly aging population across the region, particularly in China and Japan, which are actively seeking solutions to enhance the safety and independence of their elderly citizens. The increasing prevalence of chronic conditions and disabilities further accentuates the demand for specialized bathing and toileting aids.

Technological disruptions are playing a pivotal role, with manufacturers innovating to create more user-friendly, ergonomic, and aesthetically pleasing bathroom assistive devices. This includes the development of lighter materials, improved safety features, and smart technologies integrated into products like smart commodes and automatic bath lifts. Consumer behavior is shifting towards proactive investment in home modifications that support long-term independent living. This trend is further amplified by growing disposable incomes in many Asia-Pacific nations, enabling households to afford these essential accessibility products.

The adoption rates for various bathroom safety equipment are steadily rising, propelled by government initiatives promoting accessible infrastructure and healthcare support for the elderly and disabled. Market penetration is currently estimated at XX% but is projected to grow significantly as awareness and affordability increase. The shift towards home healthcare solutions and a greater emphasis on preventing falls and injuries in bathrooms are key factors influencing this growth trajectory. The market size, valued at approximately USD XX Million in the base year 2025, is anticipated to reach USD XX Million by 2033.

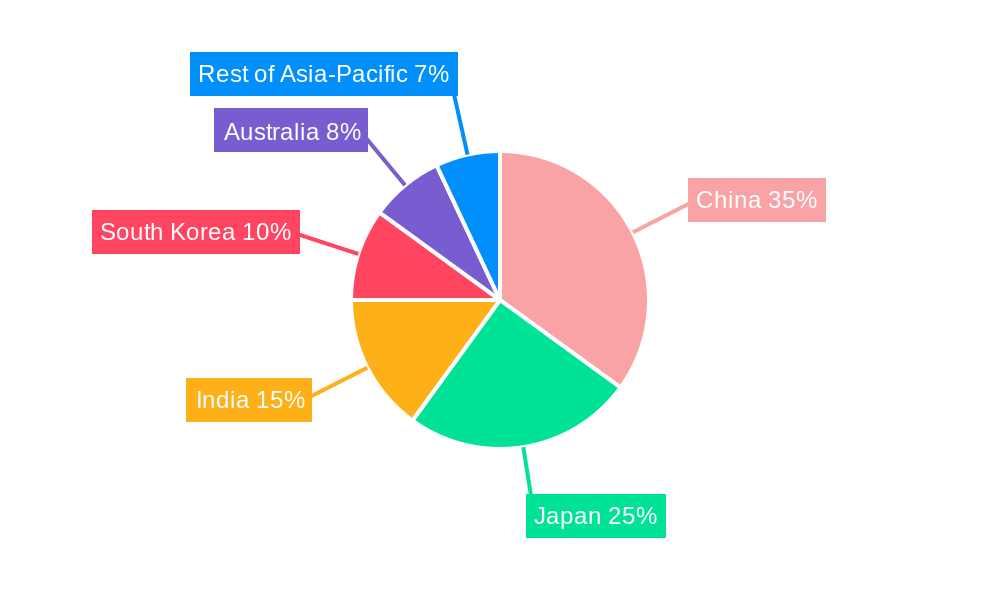

Dominant Regions, Countries, or Segments in Asia-Pacific Bathroom and Toilet Assist Devices Market

The Asia-Pacific Bathroom and Toilet Assist Devices Market is significantly influenced by regional demographics, economic development, and healthcare policies. China stands out as the dominant region, driven by its massive aging population and substantial government investment in healthcare and eldercare infrastructure. The sheer volume of potential end-users in China, coupled with a growing middle class increasingly able to afford these home accessibility aids, positions it as a key growth engine.

China: Accounts for an estimated XX% of the total Asia-Pacific market share. Its dominance is fueled by:

- A rapidly aging population, with over XX million individuals aged 65 and above.

- Government initiatives promoting elderly care facilities and home-based support systems.

- Rapid urbanization and increasing disposable incomes, allowing for greater adoption of bathroom safety products.

- A burgeoning domestic manufacturing base for assistive technology for bathrooms.

Japan: A mature market with a high penetration rate of bathroom assistive devices, driven by an even older population and a strong cultural emphasis on independent living for seniors. Japan is a significant adopter of advanced mobility aids for the bathroom.

India: Presents a high-growth potential market due to its large young population but with a rapidly increasing elderly demographic. Government focus on accessible infrastructure and rising healthcare awareness are key drivers. The demand for affordable bathroom aids is particularly high.

South Korea: Similar to Japan, South Korea has an aging population and a strong demand for sophisticated bathroom accessibility solutions.

Among the product segments, Handgrips and Grab Bars represent the largest segment due to their universal applicability and affordability, accounting for approximately XX% of the market volume. However, Bath Lifts (including Fixed Bath Lifts, Reclining Bath Lifts, and Lying Bath Lifts) are experiencing the fastest growth, driven by technological advancements and increasing demand for enhanced bathing comfort and safety for individuals with severe mobility limitations. The Shower Chairs and Stools segment, encompassing Shower Stools, Bathtub Seats, and Transfer Benches, also holds a substantial market share, estimated at XX%, due to their versatility and widespread use in both home and institutional settings. The Toilet Seat Raisers and Commodes (Shower and Toilet Commodes) are crucial sub-segments catering to specific toileting needs, with a steady growth rate.

Asia-Pacific Bathroom and Toilet Assist Devices Market Product Landscape

The Asia-Pacific Bathroom and Toilet Assist Devices Market is witnessing continuous innovation across its product categories. Key developments include the introduction of lightweight and corrosion-resistant materials for shower chairs and stools, enhancing durability and ease of use. Bath lifts are evolving with improved motor technology for smoother operation and enhanced safety features. Toilet seat raisers are becoming more integrated and aesthetically pleasing, often featuring adjustable heights and ergonomic designs. Commodes are diversified into sleek, multi-functional units that serve both showering and toileting needs. Handgrips and grab bars are incorporating advanced mounting systems for secure installation and stylish finishes to match bathroom decor. Bath aids, such as bath boards and transfer aids, are focusing on simplifying transfers and improving user independence with intuitive designs. These innovations aim to enhance user comfort, safety, and dignity, addressing the growing needs of an aging population and individuals with disabilities.

Key Drivers, Barriers & Challenges in Asia-Pacific Bathroom and Toilet Assist Devices Market

Key Drivers:

- Aging Population: The most significant driver is the rapidly increasing elderly population across Asia-Pacific, necessitating accessible bathroom solutions for independent living.

- Rising Healthcare Awareness: Growing awareness of health, safety, and the benefits of assistive devices for independent living is boosting demand.

- Government Initiatives: Supportive government policies and funding for elderly care and disability support services encourage market growth.

- Technological Advancements: Innovations in design, materials, and functionality are leading to more effective and user-friendly products.

- Increasing Disposable Income: Rising economic prosperity in many Asia-Pacific countries allows consumers to invest in home modifications and bathroom safety equipment.

Barriers & Challenges:

- High Product Costs: Advanced mobility aids and specialized bathroom equipment can be expensive, limiting affordability for some segments of the population.

- Lack of Awareness and Education: In some regions, there is a lack of awareness regarding the availability and benefits of bathroom assistive devices.

- Supply Chain Disruptions: Global and regional supply chain vulnerabilities can impact the availability and cost of raw materials and finished products.

- Regulatory Hurdles: Varying product safety standards and registration processes across different countries can pose challenges for market entry.

- Competitive Pressure: Intense competition among both global and local manufacturers can lead to price wars and pressure on profit margins. The estimated market share of the top 5 players is XX%.

Emerging Opportunities in Asia-Pacific Bathroom and Toilet Assist Devices Market

Emerging opportunities in the Asia-Pacific Bathroom and Toilet Assist Devices Market lie in the increasing demand for smart bathroom technologies that integrate with smart homes, offering features like remote monitoring and automated assistance. The growing trend of "aging in place" presents a significant opportunity for customized home modification solutions and integrated bathroom accessibility packages. Furthermore, the untapped potential in developing nations like India and Vietnam, with their rapidly growing elderly populations and increasing urbanization, offers substantial room for market expansion. The development of more aesthetically pleasing and discreet bathroom aids that blend seamlessly with modern interior designs is also an evolving consumer preference creating a niche for premium products. The focus on preventative healthcare and fall prevention is driving demand for innovative bathroom safety devices that can be easily installed and used by individuals of all ages.

Growth Accelerators in the Asia-Pacific Bathroom and Toilet Assist Devices Market Industry

The Asia-Pacific Bathroom and Toilet Assist Devices Market is propelled by several key growth accelerators. Technological breakthroughs in materials science are leading to lighter, stronger, and more durable products, enhancing portability and longevity. The increasing adoption of digital platforms for product information and sales is expanding market reach and customer engagement. Strategic partnerships between healthcare providers, assistive technology manufacturers, and government bodies are crucial for driving adoption and ensuring the availability of these essential devices. Furthermore, market expansion strategies focused on emerging economies, coupled with product localization to cater to specific cultural and economic needs, are significant catalysts for long-term growth. The growing emphasis on user-centric design and personalization is also accelerating innovation and market penetration.

Key Players Shaping the Asia-Pacific Bathroom and Toilet Assist Devices Market Market

- Arjo

- Bemis Manufacturing Company

- Toto Asia

- Etac

- Invacare Corporation

- E-Z Lock

- Huida Group

- Roca

- Aidacare

- ProBasics

- Lixil Group Corporation

- Tall-Ette

Notable Milestones in Asia-Pacific Bathroom and Toilet Assist Devices Market Sector

- August 2022: Bemis Manufacturing Company launched a non-electric Personal Wash Bidet attachment, enhancing user independence and privacy with its Clean Shield raised toilet seat.

- May 2022: Etac introduced a new model of Clean mobile shower commode chairs featuring a front seat opening, improving accessibility and caregiver routines, particularly in regions preferring hand showers.

In-Depth Asia-Pacific Bathroom and Toilet Assist Devices Market Market Outlook

The Asia-Pacific Bathroom and Toilet Assist Devices Market is poised for substantial future growth, driven by persistent demographic trends and a growing emphasis on independent living. The market's outlook is shaped by continuous innovation in bathroom accessibility solutions, with a focus on smart technologies and user-centric designs that enhance both safety and dignity. Strategic initiatives by key players to expand their presence in developing Asian economies, coupled with evolving consumer preferences for aesthetically pleasing and discreet assistive devices, will be critical growth accelerators. The increasing integration of these devices into broader home healthcare ecosystems presents significant future market potential, further solidifying the region's commitment to supporting its aging population and individuals with disabilities.

Asia-Pacific Bathroom and Toilet Assist Devices Market Segmentation

-

1. Product

-

1.1. Shower Chairs and Stools

- 1.1.1. Shower Stools

- 1.1.2. Bathtub Seats

- 1.1.3. Transfer Benches

-

1.2. Bath Lifts

- 1.2.1. Fixed Bath Lifts

- 1.2.2. Reclining Bath Lifts

- 1.2.3. Lying Bath Lifts

- 1.2.4. Other Bath Lifts

- 1.3. Toilet Seat Raisers

-

1.4. Commodes

- 1.4.1. Shower and Toilet Commodes

- 1.5. Handgrips and Grab Bars

-

1.6. Bath Aids

- 1.6.1. Bath Boards

- 1.6.2. Transfer Aids

-

1.1. Shower Chairs and Stools

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. Australia

- 2.4. India

- 2.5. South Korea

- 2.6. Rest of Asia-Pacific

Asia-Pacific Bathroom and Toilet Assist Devices Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. Australia

- 4. India

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Bathroom and Toilet Assist Devices Market Regional Market Share

Geographic Coverage of Asia-Pacific Bathroom and Toilet Assist Devices Market

Asia-Pacific Bathroom and Toilet Assist Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Residential Construction; Increased Penetration of Smart Appliances

- 3.3. Market Restrains

- 3.3.1. Saturation in Adoption of Major Appliances

- 3.4. Market Trends

- 3.4.1. Increasing Geriatric Population and Number of Individuals with Physical Disabilities Boosting the Adoption of Bathroom and Toilet Assist Devices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Bathroom and Toilet Assist Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Shower Chairs and Stools

- 5.1.1.1. Shower Stools

- 5.1.1.2. Bathtub Seats

- 5.1.1.3. Transfer Benches

- 5.1.2. Bath Lifts

- 5.1.2.1. Fixed Bath Lifts

- 5.1.2.2. Reclining Bath Lifts

- 5.1.2.3. Lying Bath Lifts

- 5.1.2.4. Other Bath Lifts

- 5.1.3. Toilet Seat Raisers

- 5.1.4. Commodes

- 5.1.4.1. Shower and Toilet Commodes

- 5.1.5. Handgrips and Grab Bars

- 5.1.6. Bath Aids

- 5.1.6.1. Bath Boards

- 5.1.6.2. Transfer Aids

- 5.1.1. Shower Chairs and Stools

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. Australia

- 5.2.4. India

- 5.2.5. South Korea

- 5.2.6. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. Australia

- 5.3.4. India

- 5.3.5. South Korea

- 5.3.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. China Asia-Pacific Bathroom and Toilet Assist Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Shower Chairs and Stools

- 6.1.1.1. Shower Stools

- 6.1.1.2. Bathtub Seats

- 6.1.1.3. Transfer Benches

- 6.1.2. Bath Lifts

- 6.1.2.1. Fixed Bath Lifts

- 6.1.2.2. Reclining Bath Lifts

- 6.1.2.3. Lying Bath Lifts

- 6.1.2.4. Other Bath Lifts

- 6.1.3. Toilet Seat Raisers

- 6.1.4. Commodes

- 6.1.4.1. Shower and Toilet Commodes

- 6.1.5. Handgrips and Grab Bars

- 6.1.6. Bath Aids

- 6.1.6.1. Bath Boards

- 6.1.6.2. Transfer Aids

- 6.1.1. Shower Chairs and Stools

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. Australia

- 6.2.4. India

- 6.2.5. South Korea

- 6.2.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Japan Asia-Pacific Bathroom and Toilet Assist Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Shower Chairs and Stools

- 7.1.1.1. Shower Stools

- 7.1.1.2. Bathtub Seats

- 7.1.1.3. Transfer Benches

- 7.1.2. Bath Lifts

- 7.1.2.1. Fixed Bath Lifts

- 7.1.2.2. Reclining Bath Lifts

- 7.1.2.3. Lying Bath Lifts

- 7.1.2.4. Other Bath Lifts

- 7.1.3. Toilet Seat Raisers

- 7.1.4. Commodes

- 7.1.4.1. Shower and Toilet Commodes

- 7.1.5. Handgrips and Grab Bars

- 7.1.6. Bath Aids

- 7.1.6.1. Bath Boards

- 7.1.6.2. Transfer Aids

- 7.1.1. Shower Chairs and Stools

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. Australia

- 7.2.4. India

- 7.2.5. South Korea

- 7.2.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Australia Asia-Pacific Bathroom and Toilet Assist Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Shower Chairs and Stools

- 8.1.1.1. Shower Stools

- 8.1.1.2. Bathtub Seats

- 8.1.1.3. Transfer Benches

- 8.1.2. Bath Lifts

- 8.1.2.1. Fixed Bath Lifts

- 8.1.2.2. Reclining Bath Lifts

- 8.1.2.3. Lying Bath Lifts

- 8.1.2.4. Other Bath Lifts

- 8.1.3. Toilet Seat Raisers

- 8.1.4. Commodes

- 8.1.4.1. Shower and Toilet Commodes

- 8.1.5. Handgrips and Grab Bars

- 8.1.6. Bath Aids

- 8.1.6.1. Bath Boards

- 8.1.6.2. Transfer Aids

- 8.1.1. Shower Chairs and Stools

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. Australia

- 8.2.4. India

- 8.2.5. South Korea

- 8.2.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. India Asia-Pacific Bathroom and Toilet Assist Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Shower Chairs and Stools

- 9.1.1.1. Shower Stools

- 9.1.1.2. Bathtub Seats

- 9.1.1.3. Transfer Benches

- 9.1.2. Bath Lifts

- 9.1.2.1. Fixed Bath Lifts

- 9.1.2.2. Reclining Bath Lifts

- 9.1.2.3. Lying Bath Lifts

- 9.1.2.4. Other Bath Lifts

- 9.1.3. Toilet Seat Raisers

- 9.1.4. Commodes

- 9.1.4.1. Shower and Toilet Commodes

- 9.1.5. Handgrips and Grab Bars

- 9.1.6. Bath Aids

- 9.1.6.1. Bath Boards

- 9.1.6.2. Transfer Aids

- 9.1.1. Shower Chairs and Stools

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. Australia

- 9.2.4. India

- 9.2.5. South Korea

- 9.2.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South Korea Asia-Pacific Bathroom and Toilet Assist Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Shower Chairs and Stools

- 10.1.1.1. Shower Stools

- 10.1.1.2. Bathtub Seats

- 10.1.1.3. Transfer Benches

- 10.1.2. Bath Lifts

- 10.1.2.1. Fixed Bath Lifts

- 10.1.2.2. Reclining Bath Lifts

- 10.1.2.3. Lying Bath Lifts

- 10.1.2.4. Other Bath Lifts

- 10.1.3. Toilet Seat Raisers

- 10.1.4. Commodes

- 10.1.4.1. Shower and Toilet Commodes

- 10.1.5. Handgrips and Grab Bars

- 10.1.6. Bath Aids

- 10.1.6.1. Bath Boards

- 10.1.6.2. Transfer Aids

- 10.1.1. Shower Chairs and Stools

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. Australia

- 10.2.4. India

- 10.2.5. South Korea

- 10.2.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Rest of Asia Pacific Asia-Pacific Bathroom and Toilet Assist Devices Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Shower Chairs and Stools

- 11.1.1.1. Shower Stools

- 11.1.1.2. Bathtub Seats

- 11.1.1.3. Transfer Benches

- 11.1.2. Bath Lifts

- 11.1.2.1. Fixed Bath Lifts

- 11.1.2.2. Reclining Bath Lifts

- 11.1.2.3. Lying Bath Lifts

- 11.1.2.4. Other Bath Lifts

- 11.1.3. Toilet Seat Raisers

- 11.1.4. Commodes

- 11.1.4.1. Shower and Toilet Commodes

- 11.1.5. Handgrips and Grab Bars

- 11.1.6. Bath Aids

- 11.1.6.1. Bath Boards

- 11.1.6.2. Transfer Aids

- 11.1.1. Shower Chairs and Stools

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. China

- 11.2.2. Japan

- 11.2.3. Australia

- 11.2.4. India

- 11.2.5. South Korea

- 11.2.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Arjo

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bemis**List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Toto Asia

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Etac

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Invacare Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 E-Z Lock

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huida Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Roca

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Aidacare

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ProBasics

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Lixil Group Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Tall-Ette

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Arjo

List of Figures

- Figure 1: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Bathroom and Toilet Assist Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 14: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Asia-Pacific Bathroom and Toilet Assist Devices Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Bathroom and Toilet Assist Devices Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Asia-Pacific Bathroom and Toilet Assist Devices Market?

Key companies in the market include Arjo, Bemis**List Not Exhaustive, Toto Asia, Etac, Invacare Corporation, E-Z Lock, Huida Group, Roca, Aidacare, ProBasics, Lixil Group Corporation, Tall-Ette.

3. What are the main segments of the Asia-Pacific Bathroom and Toilet Assist Devices Market?

The market segments include Product, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Residential Construction; Increased Penetration of Smart Appliances.

6. What are the notable trends driving market growth?

Increasing Geriatric Population and Number of Individuals with Physical Disabilities Boosting the Adoption of Bathroom and Toilet Assist Devices.

7. Are there any restraints impacting market growth?

Saturation in Adoption of Major Appliances.

8. Can you provide examples of recent developments in the market?

On August 03, 2022, Bemis Manufacturing Company, a leading manufacturer of toilet and bidet seats, launched a Personal Wash Bidet attachment available exclusively for use with the Clean Shield raised toilet seat. The non-electric Personal Wash Bidet operates simply, allowing users to cleanse themselves independently and maintain their privacy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Bathroom and Toilet Assist Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Bathroom and Toilet Assist Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Bathroom and Toilet Assist Devices Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Bathroom and Toilet Assist Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence