Key Insights

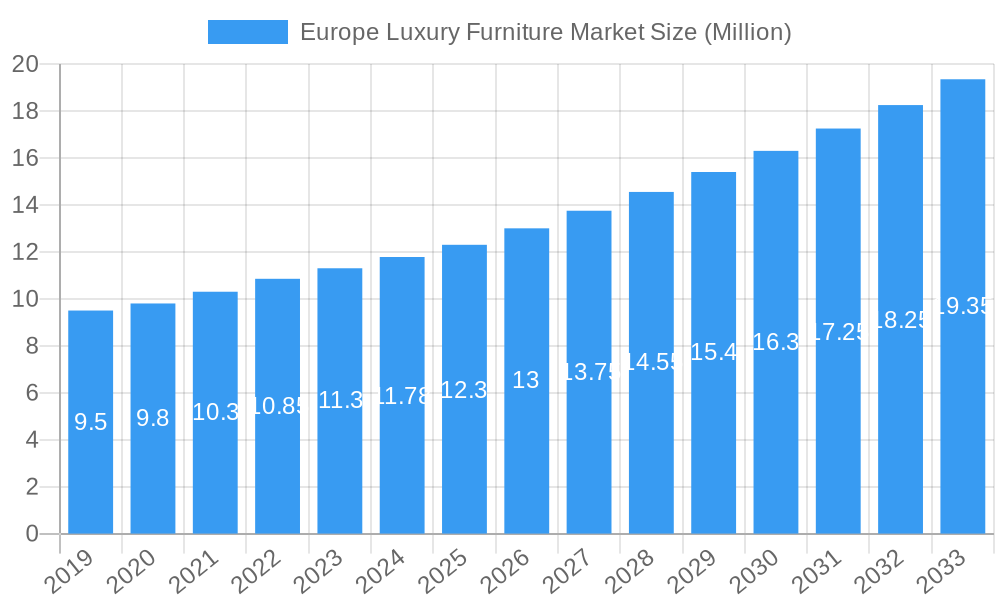

The European luxury furniture market is poised for significant expansion, projected to reach a substantial valuation by 2033. With an estimated current market size of approximately 11.78 billion Euros, the sector is on track to grow at a Compound Annual Growth Rate (CAGR) of 6.24% over the forecast period from 2025 to 2033. This robust growth is underpinned by a confluence of factors, including an increasing disposable income among affluent consumers, a growing appreciation for high-quality craftsmanship and bespoke designs, and a rising demand for sophisticated home décor that reflects personal status and lifestyle. The residential segment, in particular, is a key driver, fueled by a growing trend of home renovation and the desire to create more personalized and luxurious living spaces. Furthermore, the commercial sector, encompassing hotels, high-end restaurants, and corporate offices, is also contributing to this upward trajectory as businesses invest in premium furnishings to enhance their brand image and customer experience.

Europe Luxury Furniture Market Market Size (In Million)

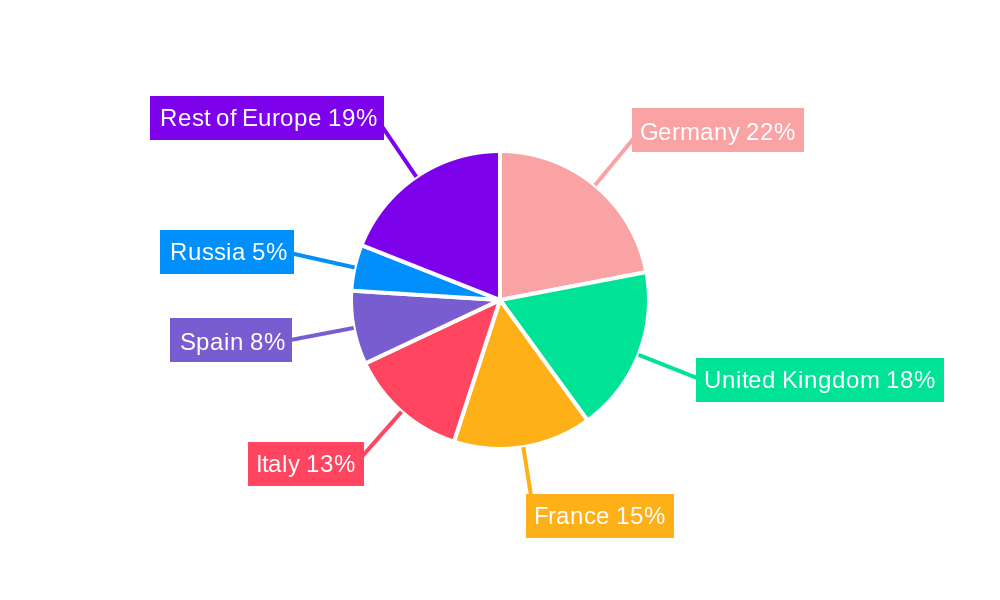

Key product segments expected to witness substantial demand include lighting, chairs and sofas, and bedroom sets, reflecting a consumer focus on statement pieces and comfort. The online distribution channel is rapidly gaining prominence, offering unparalleled convenience and access to a wider array of luxury brands, while traditional channels like flagship stores and specialty stores continue to cater to consumers seeking an immersive brand experience. Despite strong growth, the market faces certain restraints, such as the high cost of raw materials and production, and the potential for economic downturns to impact discretionary spending. However, emerging trends like sustainability, smart furniture integration, and the increasing influence of interior designers are shaping the market landscape and creating new opportunities for innovation and growth across European nations like Germany, the United Kingdom, France, and Italy, which are anticipated to lead the market.

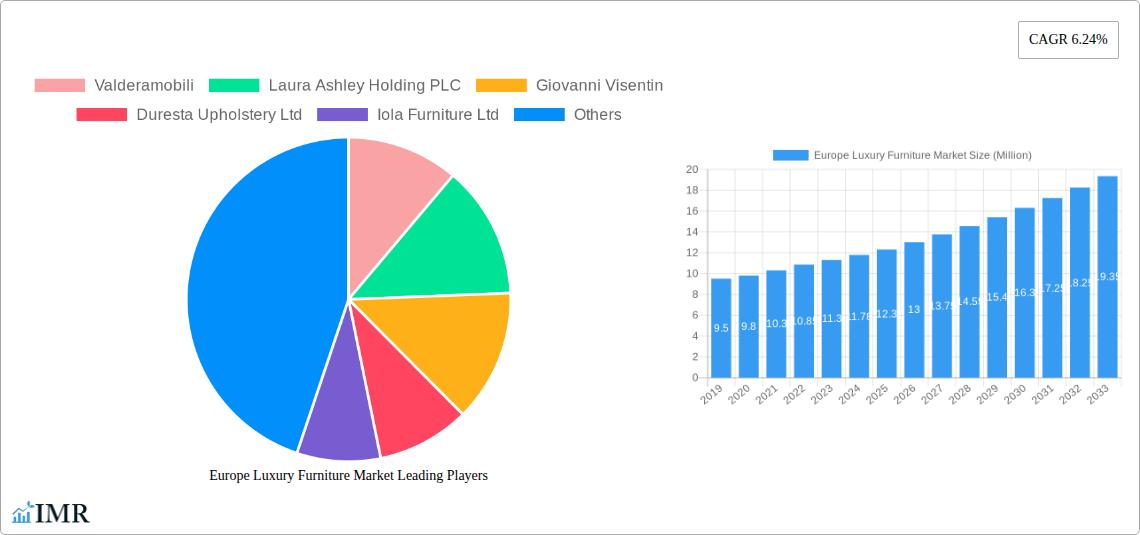

Europe Luxury Furniture Market Company Market Share

Unlock critical insights into the thriving European luxury furniture market. This in-depth report delves into market dynamics, growth trends, regional dominance, product innovations, and key players shaping the industry from 2019 to 2033. Essential for manufacturers, designers, distributors, and investors seeking to capitalize on high-value segments, sustainable practices, and evolving consumer demands for premium home and commercial furnishings.

Europe Luxury Furniture Market Market Dynamics & Structure

The Europe Luxury Furniture Market is characterized by a moderate to high concentration, with established brands and new entrants vying for market share. Technological innovation is a key driver, with increasing adoption of sustainable materials, smart furniture integration, and advanced manufacturing techniques to meet evolving consumer preferences. Regulatory frameworks in Europe, particularly concerning environmental standards and material sourcing, play a significant role in shaping product development and market entry strategies. Competitive product substitutes, while present in the broader furniture market, are less of a concern in the luxury segment due to distinct brand positioning and perceived value. End-user demographics are shifting, with a growing affluent millennial population seeking unique, personalized, and ethically sourced luxury furniture. Mergers and acquisitions (M&A) are a notable trend, as larger players consolidate their market position and smaller, innovative companies are acquired for their intellectual property and market niche. For instance, between 2019 and 2024, there were an estimated xx M&A deals in the European luxury furniture sector, reflecting industry consolidation.

- Market Concentration: Moderate to high, with a mix of well-established global brands and emerging artisanal designers.

- Technological Innovation: Focus on sustainable materials (e.g., recycled plastics, organic textiles), smart furniture features, and advanced design software.

- Regulatory Frameworks: Stringent EU regulations on material safety, emissions, and eco-labeling influence product development.

- Competitive Landscape: Differentiated by brand heritage, design exclusivity, material quality, and customer service, rather than direct price competition.

- End-User Demographics: Increasing demand from High Net Worth Individuals (HNWIs), particularly younger demographics valuing design, sustainability, and personalization.

- M&A Trends: Strategic acquisitions of niche brands and technology providers to expand product portfolios and market reach. An estimated XX% of market share has changed hands through M&A in the past five years.

Europe Luxury Furniture Market Growth Trends & Insights

The European luxury furniture market is poised for robust growth driven by increasing disposable incomes, a heightened appreciation for craftsmanship and design, and the growing trend of home personalization. The market size evolution from a base of approximately €XX billion in 2019 is projected to reach over €XX billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates for high-end furniture are steadily increasing, fueled by a desire for statement pieces that reflect individual style and a commitment to quality over quantity. Technological disruptions, while less radical than in other sectors, are manifesting in the integration of smart features and advanced material science, enhancing functionality and aesthetic appeal. Consumer behavior shifts are profoundly impacting the market, with a growing emphasis on sustainability, ethical sourcing, and bespoke designs. The "experience economy" is also influencing purchasing decisions, with consumers seeking not just furniture but a curated lifestyle. Market penetration of luxury furniture, particularly within emerging affluent segments, is expected to rise by XX% by 2033. The online distribution channel is experiencing significant growth, with dedicated luxury e-commerce platforms and direct-to-consumer (DTC) models gaining traction.

Dominant Regions, Countries, or Segments in Europe Luxury Furniture Market

The United Kingdom consistently emerges as a dominant country within the European luxury furniture market, driven by a sophisticated consumer base with a strong appetite for high-end design and quality craftsmanship. London, in particular, serves as a global hub for luxury retail and interior design, attracting affluent buyers and renowned designers alike. This dominance is further bolstered by robust economic policies supporting luxury goods and a well-developed infrastructure that facilitates the import and distribution of premium furniture. The UK's strong heritage in furniture making, combined with a forward-looking approach to contemporary design, attracts both domestic and international brands.

Within Product Types, Chairs and Sofas represent a leading segment, accounting for approximately XX% of the total market value. This is attributed to their central role in interior design and the significant investment consumers are willing to make in statement seating pieces that offer both comfort and aesthetic appeal. Brands like Duresta Upholstery Ltd and Valderamobili have consistently innovated within this category, offering bespoke options and utilizing premium materials like velvet, leather, and wool.

In terms of End-Users, the Residential segment is the primary growth engine, holding an estimated XX% market share. The increasing trend of remote working, coupled with a rising global emphasis on home comfort and interior aesthetics, has significantly boosted demand for luxury residential furnishings. Homeowners are increasingly investing in creating personalized and functional living spaces that reflect their status and lifestyle.

The Specialty Stores distribution channel also plays a crucial role, commanding a significant market share of approximately XX%. These stores offer a curated selection, personalized customer service, and an immersive brand experience, which are highly valued by luxury consumers. However, the Online distribution channel is experiencing the most rapid growth, projected to increase its market share by XX% by 2033, driven by convenience, wider selection, and increasingly sophisticated e-commerce platforms catering to the luxury segment.

- Dominant Country: United Kingdom, driven by affluent consumer base and design leadership.

- Leading Product Segment: Chairs and Sofas, valued for their aesthetic and functional importance in living spaces.

- Primary End-User: Residential sector, amplified by the work-from-home trend and focus on home enhancement.

- Key Distribution Channel: Specialty Stores, offering curated experiences, with Online channels exhibiting the fastest growth.

Europe Luxury Furniture Market Product Landscape

The Europe Luxury Furniture Market is defined by an unwavering commitment to exquisite craftsmanship, premium materials, and innovative design. Product innovations are centered around enhancing both aesthetic appeal and functionality. For instance, Lighting solutions are moving beyond mere illumination to become sculptural art pieces, integrating smart technologies for adjustable ambiance and energy efficiency. Tables are being crafted from exotic hardwoods, rare marbles, and sustainable composites, often featuring intricate inlay work or unique geometric designs. Chairs and Sofas are at the forefront of material innovation, utilizing ethically sourced leathers, hand-woven silks, and advanced performance fabrics that offer durability and luxurious feel. Bedroom sets emphasize serene aesthetics and ergonomic comfort, with bespoke cabinetry offering seamless storage solutions. The focus remains on creating heirloom-quality pieces that offer exceptional performance and stand the test of time, with a growing integration of sustainable practices and materials to appeal to the eco-conscious luxury consumer.

Key Drivers, Barriers & Challenges in Europe Luxury Furniture Market

Key Drivers:

- Rising Disposable Incomes: Increasing wealth among affluent consumers in Europe fuels demand for high-end furniture.

- Growing Appreciation for Craftsmanship & Design: Consumers are prioritizing quality, uniqueness, and aesthetic appeal over mass-produced items.

- Home Personalization Trends: The desire for unique, statement pieces that reflect individual style and status is a significant driver.

- Sustainability & Ethical Sourcing: Growing consumer awareness drives demand for eco-friendly materials and responsible production practices.

- Technological Integration: Smart furniture features and advanced materials enhance functionality and desirability.

Barriers & Challenges:

- High Production Costs: The use of premium materials and artisanal techniques leads to higher manufacturing expenses.

- Supply Chain Volatility: Geopolitical issues, raw material availability, and logistics disruptions can impact production and delivery timelines.

- Economic Downturns: Luxury spending is often discretionary and can be affected by broader economic slowdowns.

- Counterfeit Products: The prevalence of imitation luxury goods poses a threat to brand reputation and revenue.

- Intense Competition: While the market is specialized, competition among established and emerging luxury brands remains fierce. The cost of raw materials, such as premium wood and leather, has increased by an estimated XX% in the past two years, impacting profitability.

Emerging Opportunities in Europe Luxury Furniture Market

Emerging opportunities in the Europe Luxury Furniture Market lie in the continued expansion of the online luxury retail experience, offering personalized virtual consultations and immersive digital showrooms. There is also a significant opportunity in developing sustainable and eco-friendly luxury furniture lines, utilizing recycled materials, responsibly sourced wood, and bio-based fabrics to cater to the growing segment of environmentally conscious affluent consumers. The demand for customizable and modular furniture solutions is also on the rise, allowing consumers to tailor pieces to their specific space and aesthetic preferences. Furthermore, strategic partnerships with luxury interior designers and high-end real estate developers can open new avenues for market penetration and brand exposure. The integration of smart home technology within luxury furniture, offering enhanced comfort and convenience, presents another significant growth area.

Growth Accelerators in the Europe Luxury Furniture Market Industry

Several key growth accelerators are propelling the Europe Luxury Furniture Market forward. The increasing adoption of direct-to-consumer (DTC) models allows brands to build stronger relationships with customers, control brand narrative, and improve profit margins. Technological advancements in manufacturing, such as 3D printing and advanced robotics, are enabling greater design flexibility and efficiency in producing complex luxury pieces. Strategic collaborations with influential interior designers and architects create desirability and drive demand for specific collections. Furthermore, market expansion into emerging affluent economies within Europe and beyond offers substantial untapped potential. The focus on bespoke and artisanal craftsmanship, appealing to the desire for unique and exclusive products, continues to be a significant growth catalyst.

Key Players Shaping the Europe Luxury Furniture Market Market

- Valderamobili

- Laura Ashley Holding PLC

- Giovanni Visentin

- Duresta Upholstery Ltd

- Iola Furniture Ltd

- Giemme Stile SpA

- Vimercati

- Nella Vetrina

- Scavolini

- Muebles Pico

Notable Milestones in Europe Luxury Furniture Market Sector

- February 2023: Muebles Pico launched a new collection of luxury sofas and chairs named "Atlas." The collection features contemporary designs with clean lines and soft curves and incorporates high-quality materials such as leather and velvet. This launch highlights the company's commitment to modern design and premium materials, catering to a discerning clientele.

- September 2022: Duresta Upholstery Ltd launched a new collection of luxury sofas and chairs named "Westwood." The collection features classic designs with a contemporary twist and incorporates high-quality materials such as velvet, leather, and wool. This initiative signifies the brand's ability to blend timeless aesthetics with modern sensibilities, reinforcing its position in the classic luxury segment.

In-Depth Europe Luxury Furniture Market Market Outlook

The future of the Europe Luxury Furniture Market is exceptionally promising, driven by a confluence of evolving consumer demands and strategic industry advancements. Continued investment in sustainable practices and materials will not only meet regulatory requirements but also appeal to a growing segment of ethically conscious luxury buyers. The digital transformation of the retail experience, encompassing immersive online platforms and virtual design consultations, will be crucial for engaging a global clientele. Furthermore, the persistent desire for unique, handcrafted, and personalized furniture will ensure the enduring relevance of artisanal craftsmanship. Brands that successfully integrate smart technology to enhance functionality and user experience while maintaining sophisticated aesthetics will likely lead the market. Strategic market penetration into tier-2 cities and regions with growing affluent populations presents a significant opportunity for sustained growth and market diversification.

Europe Luxury Furniture Market Segmentation

-

1. Product Type

- 1.1. Lighting

- 1.2. Tables

- 1.3. Chairs and Sofas

- 1.4. Accessories

- 1.5. Bedroom

- 1.6. Cabinets

- 1.7. Other Product Types

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Home Centers

- 3.2. Flagship Stores

- 3.3. Specialty Stores

- 3.4. Online

- 3.5. Other Distribution Channels

Europe Luxury Furniture Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Spain

- 5. Russia

- 6. Italy

- 7. Rest of Europe

Europe Luxury Furniture Market Regional Market Share

Geographic Coverage of Europe Luxury Furniture Market

Europe Luxury Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The higher demand for space-saving and modular furniture solutions; Increasing demand for luxurious home furniture

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Second-hand furniture; High labor costs

- 3.4. Market Trends

- 3.4.1. E-commerce Transforming Europe's Luxury Furniture Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lighting

- 5.1.2. Tables

- 5.1.3. Chairs and Sofas

- 5.1.4. Accessories

- 5.1.5. Bedroom

- 5.1.6. Cabinets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Home Centers

- 5.3.2. Flagship Stores

- 5.3.3. Specialty Stores

- 5.3.4. Online

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Spain

- 5.4.5. Russia

- 5.4.6. Italy

- 5.4.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Lighting

- 6.1.2. Tables

- 6.1.3. Chairs and Sofas

- 6.1.4. Accessories

- 6.1.5. Bedroom

- 6.1.6. Cabinets

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Home Centers

- 6.3.2. Flagship Stores

- 6.3.3. Specialty Stores

- 6.3.4. Online

- 6.3.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Lighting

- 7.1.2. Tables

- 7.1.3. Chairs and Sofas

- 7.1.4. Accessories

- 7.1.5. Bedroom

- 7.1.6. Cabinets

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Home Centers

- 7.3.2. Flagship Stores

- 7.3.3. Specialty Stores

- 7.3.4. Online

- 7.3.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. France Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Lighting

- 8.1.2. Tables

- 8.1.3. Chairs and Sofas

- 8.1.4. Accessories

- 8.1.5. Bedroom

- 8.1.6. Cabinets

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Home Centers

- 8.3.2. Flagship Stores

- 8.3.3. Specialty Stores

- 8.3.4. Online

- 8.3.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Lighting

- 9.1.2. Tables

- 9.1.3. Chairs and Sofas

- 9.1.4. Accessories

- 9.1.5. Bedroom

- 9.1.6. Cabinets

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Home Centers

- 9.3.2. Flagship Stores

- 9.3.3. Specialty Stores

- 9.3.4. Online

- 9.3.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Lighting

- 10.1.2. Tables

- 10.1.3. Chairs and Sofas

- 10.1.4. Accessories

- 10.1.5. Bedroom

- 10.1.6. Cabinets

- 10.1.7. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Residential

- 10.2.2. Commercial

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Home Centers

- 10.3.2. Flagship Stores

- 10.3.3. Specialty Stores

- 10.3.4. Online

- 10.3.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Italy Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Lighting

- 11.1.2. Tables

- 11.1.3. Chairs and Sofas

- 11.1.4. Accessories

- 11.1.5. Bedroom

- 11.1.6. Cabinets

- 11.1.7. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by End-User

- 11.2.1. Residential

- 11.2.2. Commercial

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Home Centers

- 11.3.2. Flagship Stores

- 11.3.3. Specialty Stores

- 11.3.4. Online

- 11.3.5. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe Luxury Furniture Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Lighting

- 12.1.2. Tables

- 12.1.3. Chairs and Sofas

- 12.1.4. Accessories

- 12.1.5. Bedroom

- 12.1.6. Cabinets

- 12.1.7. Other Product Types

- 12.2. Market Analysis, Insights and Forecast - by End-User

- 12.2.1. Residential

- 12.2.2. Commercial

- 12.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 12.3.1. Home Centers

- 12.3.2. Flagship Stores

- 12.3.3. Specialty Stores

- 12.3.4. Online

- 12.3.5. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Valderamobili

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Laura Ashley Holding PLC

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Giovanni Visentin

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Duresta Upholstery Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Iola Furniture Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Giemme Stile SpA

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Vimercati

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nella Vetrina

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Scavolini

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Muebles Pico

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Valderamobili

List of Figures

- Figure 1: Europe Luxury Furniture Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Luxury Furniture Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 5: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Luxury Furniture Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe Luxury Furniture Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 13: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Luxury Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 19: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 21: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Europe Luxury Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 26: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 28: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 29: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Europe Luxury Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 35: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 36: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 37: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Europe Luxury Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 42: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 43: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 44: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 45: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Europe Luxury Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 51: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 52: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 53: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 54: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 55: Europe Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Europe Luxury Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 57: Europe Luxury Furniture Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 58: Europe Luxury Furniture Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 59: Europe Luxury Furniture Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 60: Europe Luxury Furniture Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 61: Europe Luxury Furniture Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 62: Europe Luxury Furniture Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 63: Europe Luxury Furniture Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Europe Luxury Furniture Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Luxury Furniture Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Europe Luxury Furniture Market?

Key companies in the market include Valderamobili, Laura Ashley Holding PLC, Giovanni Visentin, Duresta Upholstery Ltd, Iola Furniture Ltd, Giemme Stile SpA, Vimercati, Nella Vetrina, Scavolini, Muebles Pico.

3. What are the main segments of the Europe Luxury Furniture Market?

The market segments include Product Type, End-User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.78 Million as of 2022.

5. What are some drivers contributing to market growth?

The higher demand for space-saving and modular furniture solutions; Increasing demand for luxurious home furniture.

6. What are the notable trends driving market growth?

E-commerce Transforming Europe's Luxury Furniture Market.

7. Are there any restraints impacting market growth?

Growing Demand for Second-hand furniture; High labor costs.

8. Can you provide examples of recent developments in the market?

February 2023: Muebles Pico launched a new collection of luxury sofas and chairs named "Atlas." The collection features contemporary designs with clean lines and soft curves and incorporates high-quality materials such as leather and velvet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Luxury Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Luxury Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Luxury Furniture Market?

To stay informed about further developments, trends, and reports in the Europe Luxury Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence