Key Insights

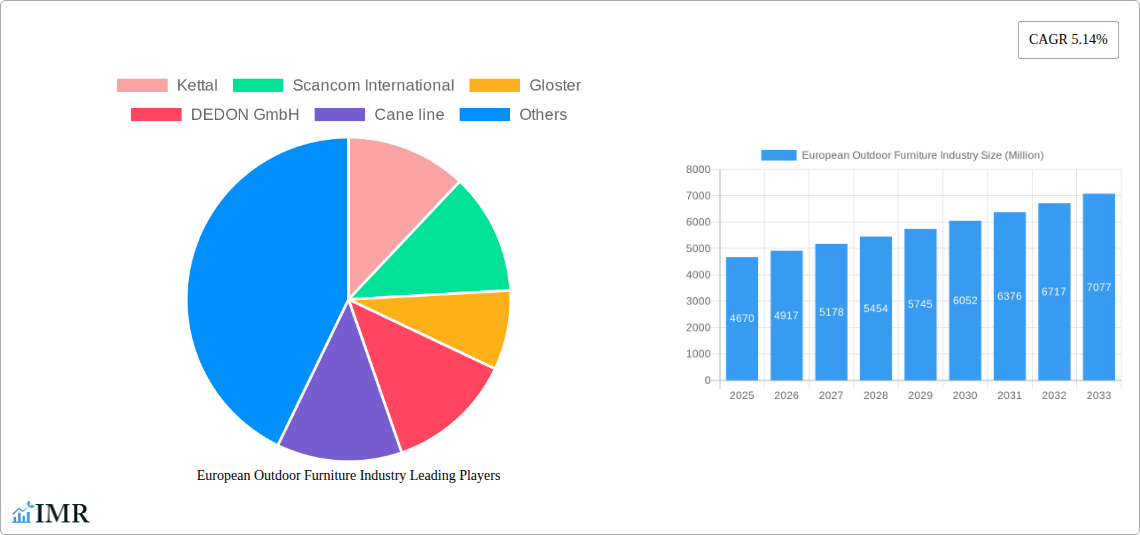

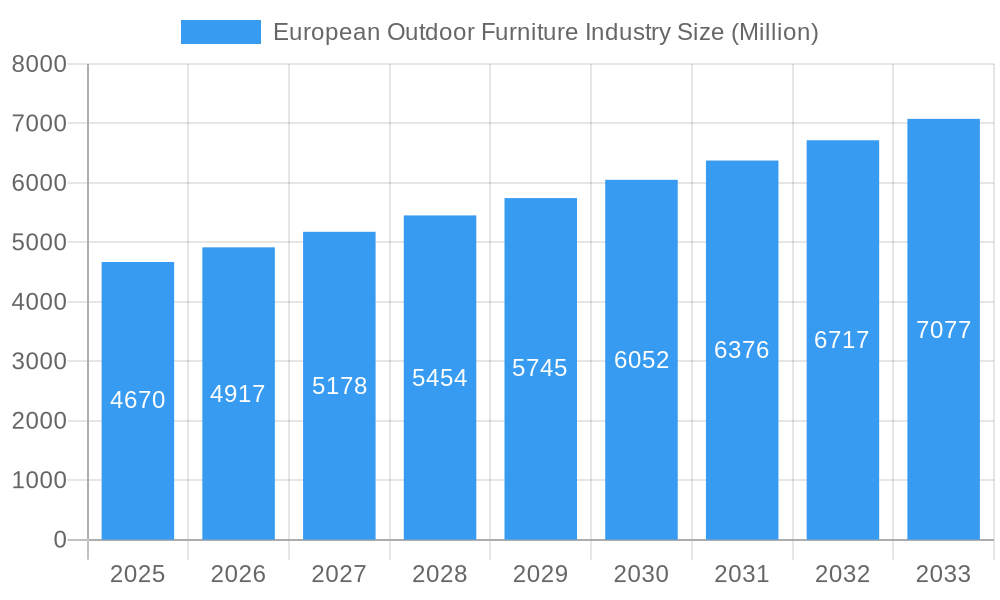

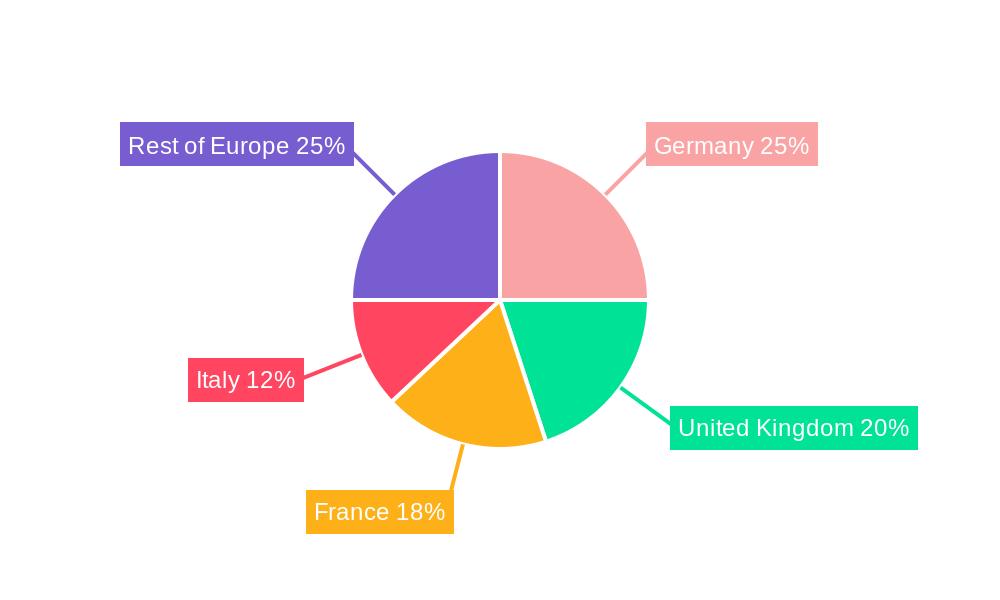

The European outdoor furniture market, valued at €4.67 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.14% from 2025 to 2033. This expansion is driven by several key factors. Increasing disposable incomes across Europe, coupled with a growing preference for outdoor living and entertaining, are fueling demand for high-quality, stylish outdoor furniture. Furthermore, the rise of eco-conscious consumers is driving demand for sustainable materials like recycled wood and aluminum, influencing manufacturers to adapt their production processes. The popularity of minimalist designs and multifunctional pieces caters to space-conscious urban dwellers and vacation homeowners alike. Strong growth is anticipated in the residential segment, fueled by renovation projects and new home construction, while the commercial sector benefits from the resurgence of hospitality and tourism post-pandemic. Germany, the United Kingdom, and France represent the largest national markets, though significant growth potential exists in other European countries, particularly those experiencing sustained economic growth and increased tourism. The online distribution channel is exhibiting rapid expansion, driven by improved e-commerce infrastructure and consumer convenience.

European Outdoor Furniture Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of established global players and regional manufacturers. Established brands like Kettal and Dedon cater to the premium segment, emphasizing design and durability, while companies like IKEA offer more affordable options, catering to a broader consumer base. Competition is intensifying, with brands increasingly focusing on innovation in materials, design, and sustainability to gain a competitive edge. The market is segmented by product type (chairs, tables, seating sets, loungers, dining sets, etc.), end-user (commercial and residential), distribution channel (online, multi-brand stores, specialty stores), and material (wood, metal, plastic). The ongoing trend toward customization and personalization is expected to drive further market segmentation and product differentiation. Challenges include fluctuating raw material prices and potential supply chain disruptions, but the overall outlook for the European outdoor furniture market remains optimistic, with significant growth potential over the forecast period.

European Outdoor Furniture Industry Company Market Share

European Outdoor Furniture Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European outdoor furniture market, encompassing market dynamics, growth trends, regional performance, product landscapes, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report leverages extensive data analysis to deliver actionable insights and forecasts across various segments, including product type, end-user, distribution channel, and country.

European Outdoor Furniture Industry Market Dynamics & Structure

The European outdoor furniture market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. Technological innovation, particularly in materials science and design, is a key driver of growth, while evolving regulatory frameworks concerning sustainability and material sourcing are shaping industry practices. Competitive pressure from substitute products, including indoor furniture adapted for outdoor use, remains a factor. End-user demographics, particularly the rising disposable incomes and preference for outdoor living among younger generations, are fueling demand. M&A activity has been moderate, with a focus on consolidating market share and expanding product portfolios.

- Market Concentration: The top 5 players hold approximately xx% of the market share (2024).

- Technological Innovation: Focus on sustainable materials (recycled plastic, sustainably sourced wood), smart furniture integration, and ergonomic designs.

- Regulatory Frameworks: Growing emphasis on eco-friendly manufacturing processes and waste reduction.

- Competitive Substitutes: Increasing competition from indoor furniture adapted for outdoor use.

- End-User Demographics: Rising disposable incomes and increased preference for outdoor living spaces drive demand.

- M&A Activity: xx major M&A deals completed between 2019 and 2024, primarily focused on expanding geographic reach.

European Outdoor Furniture Industry Growth Trends & Insights

The European outdoor furniture market experienced consistent growth during the historical period (2019-2024), driven by favorable economic conditions and increasing consumer spending on home improvement and outdoor living. The market size is estimated at xx Million units in 2025 and is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of smart outdoor furniture and the adoption of sustainable materials, are reshaping the market landscape. Consumer behavior is evolving towards a preference for durable, stylish, and eco-friendly products. The increasing adoption of online sales channels is also impacting market dynamics, impacting both B2C and B2B models. This shift necessitates manufacturers to adapt to modern commerce models to reach their customer base. Analysis reveals that the residential sector accounts for a significantly larger segment of the market compared to the commercial sector, representing xx% of the total market in 2024.

Dominant Regions, Countries, or Segments in European Outdoor Furniture Industry

Germany, the United Kingdom, and France represent the largest national markets within Europe, collectively accounting for approximately xx% of the total market value in 2024. Within product segments, seating sets and dining sets represent the largest portions of the market, together making up xx% of the overall market volume in 2024. The residential end-user segment dominates the market, driven by increasing homeowner investments in outdoor spaces. Multi-brand stores and specialty stores remain the primary distribution channels, although online sales are growing rapidly. Wood and metal remain the dominant materials, although plastic and other materials (e.g., resin, wicker) are gaining traction due to their cost-effectiveness and durability.

- Key Drivers:

- Strong economic growth: particularly in Western European countries.

- Increased disposable incomes: fueling consumer spending on home improvement.

- Growing popularity of outdoor living: driving demand for high-quality outdoor furniture.

- Dominance Factors:

- Established infrastructure: particularly in Germany, the UK, and France.

- Strong consumer demand: for durable and stylish outdoor furniture.

- Presence of major manufacturers: in key European countries.

European Outdoor Furniture Industry Product Landscape

The European outdoor furniture market offers a wide range of products, including chairs, tables, seating sets, loungers and daybeds, dining sets, and other accessories. Innovation is focused on improving comfort, durability, and weather resistance. Technological advancements include the use of lightweight yet strong materials, ergonomic designs, and smart features such as integrated lighting or sound systems. Unique selling propositions emphasize sustainable materials, customizable designs, and long-term warranties.

Key Drivers, Barriers & Challenges in European Outdoor Furniture Industry

Key Drivers:

- Increasing disposable incomes and a rising focus on outdoor living.

- Technological advancements in materials and design.

- Government initiatives promoting sustainable manufacturing.

Key Challenges:

- Fluctuating raw material prices, especially for wood and metal.

- Intense competition from low-cost manufacturers in Asia.

- Supply chain disruptions impacting production and delivery timelines.

Emerging Opportunities in European Outdoor Furniture Industry

- Growing demand for sustainable and eco-friendly products.

- Increasing popularity of modular and customizable furniture.

- Expansion into untapped markets in Eastern Europe.

Growth Accelerators in the European Outdoor Furniture Industry

Technological innovation in materials and manufacturing processes, strategic partnerships to expand distribution networks, and targeted marketing campaigns focused on specific consumer segments are key growth accelerators for the European outdoor furniture industry. Furthermore, expansion into new markets and product diversification will further propel long-term growth.

Key Players Shaping the European Outdoor Furniture Industry Market

- Kettal

- Scancom International

- Gloster

- DEDON GmbH

- Cane line

- Hartman

- Alexander Rose

- IKEA

- Sieger

- Fermob

- Royal Botania

- Grosfillex

- EMU Group SpA

- Fischer Mobel GmbH

Notable Milestones in European Outdoor Furniture Industry Sector

- February 2022: IKEA's £1 billion investment in London signals a significant commitment to the UK market and expansion into urban retail spaces. This move could significantly impact the market share of outdoor furniture within the city.

- June 2022: Poltrona Frau's launch of the Boundless Living Collection highlights the growing demand for durable and versatile outdoor furniture suitable for various settings. This signals a wider trend of product diversification within the industry, particularly focusing on all-weather capabilities.

In-Depth European Outdoor Furniture Industry Market Outlook

The European outdoor furniture market is poised for continued growth, driven by favorable demographic trends, increasing consumer spending, and ongoing technological advancements. Strategic opportunities exist in developing sustainable and innovative products, expanding distribution channels, and tapping into emerging markets within the European region. Further growth is expected through acquisitions of smaller companies in order to improve market share and geographic reach.

European Outdoor Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Product

- 2.1. Chairs

- 2.2. Tables

- 2.3. Seating Sets

- 2.4. Loungers and Daybeds

- 2.5. Dining Sets

- 2.6. Other Products

-

3. End User

- 3.1. Commercial

- 3.2. Residential

-

4. Distribution Channel

- 4.1. Multi-brand Stores

- 4.2. Specialty Stores

- 4.3. Online Platforms

- 4.4. Other Distribution Channels

European Outdoor Furniture Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Outdoor Furniture Industry Regional Market Share

Geographic Coverage of European Outdoor Furniture Industry

European Outdoor Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Safety and Security of Documents Drives the Market Growth; Facility Of Large Storage Space Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Complex Registration Restrictions; Poor Resistance To Water And Chemical Damage

- 3.4. Market Trends

- 3.4.1. Italy Held the Largest Share in the Production of Outdoor Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Outdoor Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chairs

- 5.2.2. Tables

- 5.2.3. Seating Sets

- 5.2.4. Loungers and Daybeds

- 5.2.5. Dining Sets

- 5.2.6. Other Products

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.4. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.4.1. Multi-brand Stores

- 5.4.2. Specialty Stores

- 5.4.3. Online Platforms

- 5.4.4. Other Distribution Channels

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kettal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Scancom International

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gloster

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DEDON GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cane line

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hartman

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alexander Rose

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 IKEA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sieger

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fermob

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Royal Botania

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Grosfillex

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 EMU Group SpA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Fischer Mobel GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Kettal

List of Figures

- Figure 1: European Outdoor Furniture Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Outdoor Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: European Outdoor Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: European Outdoor Furniture Industry Volume K Unit Forecast, by Material 2020 & 2033

- Table 3: European Outdoor Furniture Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 4: European Outdoor Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 5: European Outdoor Furniture Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: European Outdoor Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: European Outdoor Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: European Outdoor Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 9: European Outdoor Furniture Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: European Outdoor Furniture Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: European Outdoor Furniture Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 12: European Outdoor Furniture Industry Volume K Unit Forecast, by Material 2020 & 2033

- Table 13: European Outdoor Furniture Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: European Outdoor Furniture Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 15: European Outdoor Furniture Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: European Outdoor Furniture Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: European Outdoor Furniture Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: European Outdoor Furniture Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 19: European Outdoor Furniture Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: European Outdoor Furniture Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United Kingdom European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Germany European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: France European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Italy European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Spain European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Netherlands European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Netherlands European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Belgium European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Belgium European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Sweden European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Sweden European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Norway European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Norway European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Poland European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Poland European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Denmark European Outdoor Furniture Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Denmark European Outdoor Furniture Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Outdoor Furniture Industry?

The projected CAGR is approximately 5.14%.

2. Which companies are prominent players in the European Outdoor Furniture Industry?

Key companies in the market include Kettal, Scancom International, Gloster, DEDON GmbH, Cane line, Hartman, Alexander Rose, IKEA, Sieger, Fermob, Royal Botania, Grosfillex, EMU Group SpA, Fischer Mobel GmbH.

3. What are the main segments of the European Outdoor Furniture Industry?

The market segments include Material, Product, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Safety and Security of Documents Drives the Market Growth; Facility Of Large Storage Space Drives the Market Growth.

6. What are the notable trends driving market growth?

Italy Held the Largest Share in the Production of Outdoor Furniture.

7. Are there any restraints impacting market growth?

Complex Registration Restrictions; Poor Resistance To Water And Chemical Damage.

8. Can you provide examples of recent developments in the market?

February, 2022: IKEA announced it would invest £1 billion in London over three years as it opened the doors to its first high street IKEA store in Britain, anchoring its first-ever inner-city mall in the capital's Hammersmith district.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Outdoor Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Outdoor Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Outdoor Furniture Industry?

To stay informed about further developments, trends, and reports in the European Outdoor Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence