Key Insights

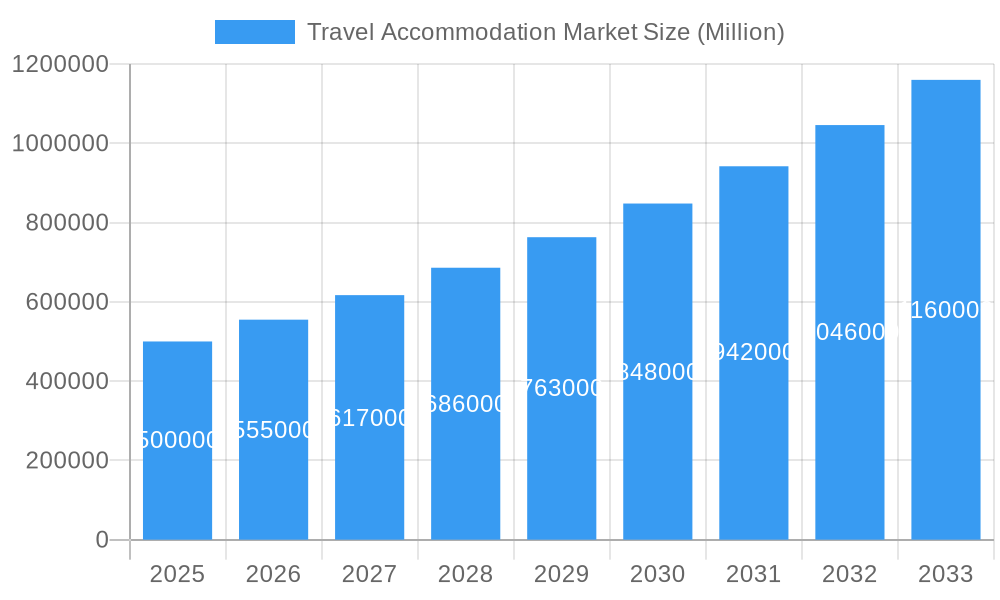

The global travel accommodation market, valued at approximately $961.6 billion in 2025, is projected for significant expansion. With a Compound Annual Growth Rate (CAGR) of 9.56%, the market is expected to grow substantially from 2025 to 2033. This upward trajectory is propelled by key factors including the proliferation and user-friendliness of Online Travel Agencies (OTAs) such as Booking.com, Expedia, and TripAdvisor, which offer competitive pricing and streamlined booking processes. The increasing accessibility of air travel, coupled with a growing global middle class possessing higher disposable incomes, is stimulating demand for both leisure and business travel, thereby positively influencing the accommodation sector. The rising popularity of alternative lodging options like Airbnb, catering to a spectrum of traveler preferences, further energizes this market growth. Moreover, technological advancements, particularly in mobile booking applications and personalized travel recommendations, are enhancing the customer journey and driving increased booking volumes. While economic uncertainties and geopolitical events present potential headwinds, the long-term outlook for the travel accommodation market remains highly positive. Market segmentation highlights robust growth in mobile application bookings and increased reliance on third-party online portals, underscoring the pivotal role of digital platforms in influencing travel decisions.

Travel Accommodation Market Market Size (In Billion)

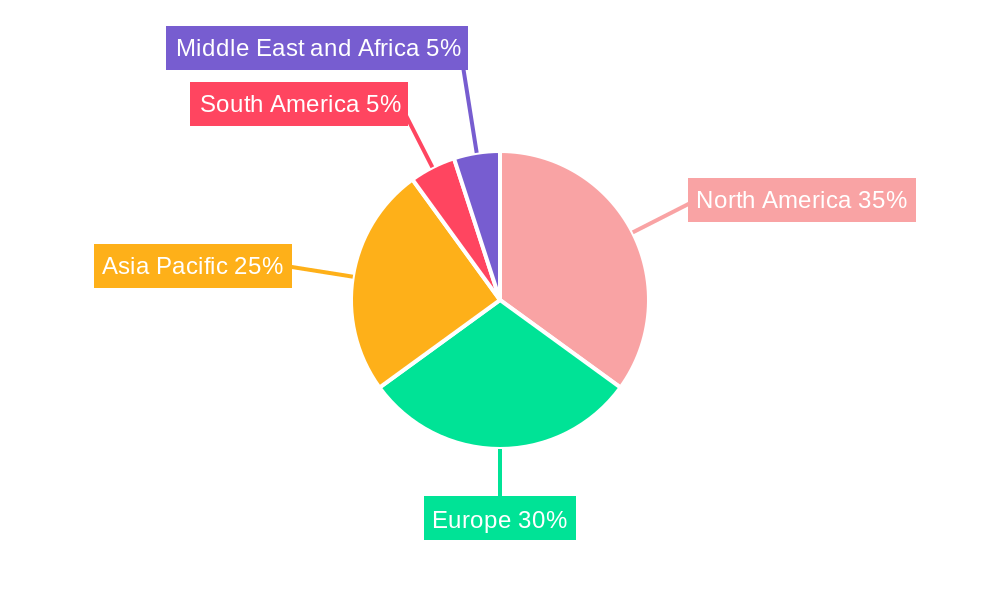

Regional market dynamics are anticipated to show variations, with North America and Europe retaining significant market shares due to well-established tourism infrastructures and high consumer spending power. Concurrently, the Asia-Pacific region is on track for accelerated growth, fueled by rapid economic development and an expanding middle-class demographic in emerging economies such as India and China. The competitive environment is characterized by a high degree of fragmentation, featuring established global brands like AccorHotels and Expedia, alongside innovative disrupters like Airbnb, all competing for market leadership. Strategic alliances, mergers, acquisitions, and continuous technological innovation will be imperative for sustained success in this dynamic and evolving industry. The market is likely to witness further consolidation as major entities acquire smaller businesses and broaden their service portfolios, intensifying competitive pressures. To thrive in this landscape, businesses must prioritize the development of distinctive value propositions and cultivate strong brand loyalty.

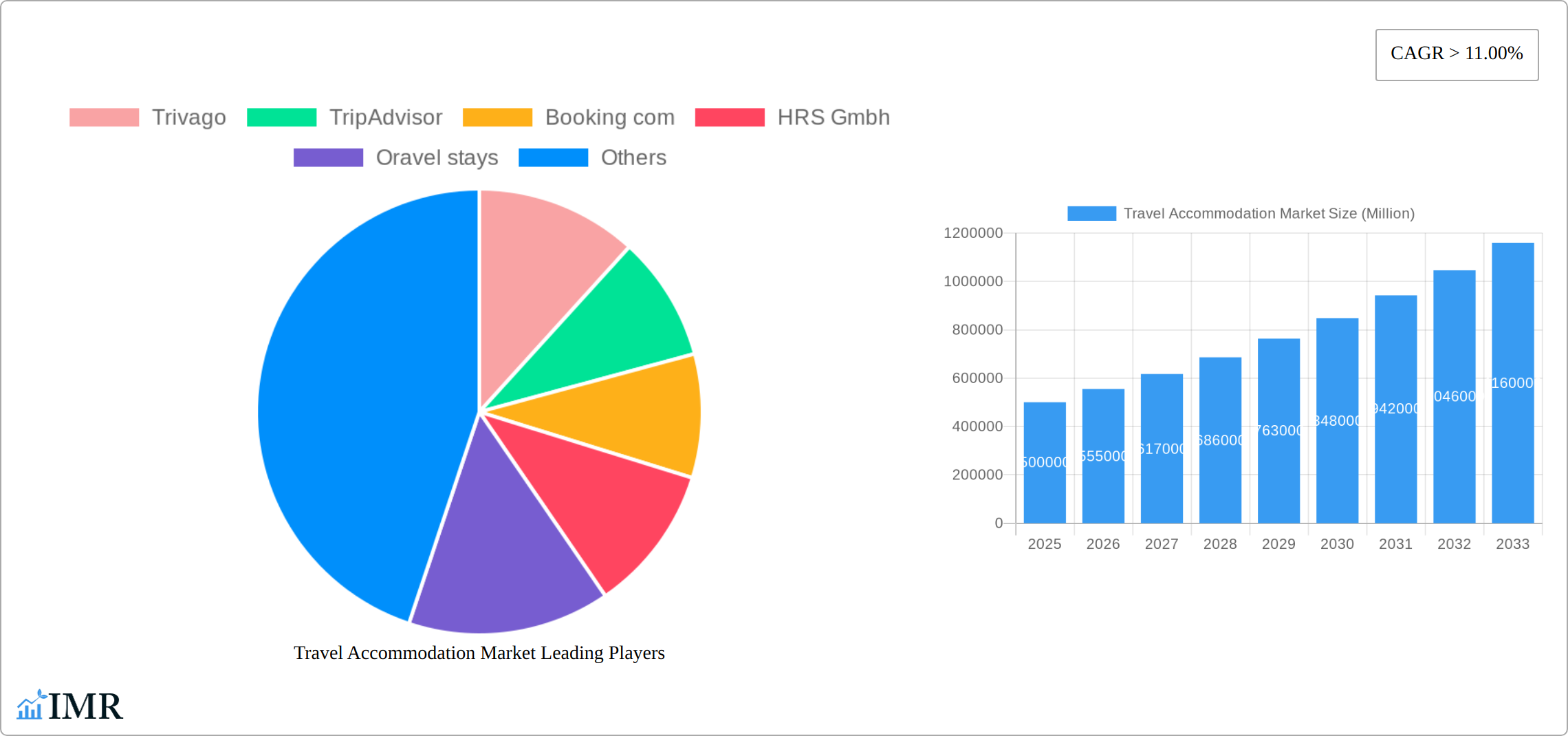

Travel Accommodation Market Company Market Share

Travel Accommodation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Travel Accommodation Market, covering the period 2019-2033, with a focus on 2025. We dissect market dynamics, growth trends, regional dominance, and key players to offer actionable insights for industry professionals. The report delves into both parent and child markets, specifically examining the segments of online travel agencies (OTAs) and direct bookings across various platforms (mobile apps and websites). The analysis encompasses key players like Booking.com, Expedia, Airbnb, and more, providing a detailed competitive landscape. The market value is estimated in million units.

Value Proposition: This report is invaluable for investors, businesses, and strategic decision-makers seeking to understand the current state and future trajectory of the travel accommodation sector. It delivers data-driven insights on market size, growth, trends, and competitive dynamics, enabling informed strategies for success.

Travel Accommodation Market Dynamics & Structure

The travel accommodation market is characterized by intense competition, rapid technological innovation, and evolving regulatory landscapes. Market concentration is moderate, with a few dominant players like Booking.com and Expedia holding significant market share, while numerous smaller players and niche providers also compete. The market is witnessing a continuous shift towards online booking platforms, driven by increased internet penetration and smartphone adoption.

Market Structure Highlights:

- High fragmentation: A diverse range of players exists, from large global OTAs to small independent hotels and vacation rentals.

- Technological disruption: The rise of mobile booking apps, personalized recommendations, and AI-powered services are reshaping customer experience.

- Regulatory changes: Data privacy regulations (GDPR, CCPA), taxation policies, and licensing requirements impact market operations.

- Competitive substitutes: Alternative accommodation options like homestays and unique lodging experiences are increasing competition.

- End-user demographics: Millennial and Gen Z travelers are driving demand for budget-friendly, experiential, and tech-savvy accommodation options.

- M&A Activity: The past five years have seen xx M&A deals, primarily driven by larger players seeking to expand their market share and service offerings. These deals have resulted in a xx% increase in market concentration from 2019 to 2024. The average deal size was approximately xx million.

Travel Accommodation Market Growth Trends & Insights

The travel accommodation market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to factors such as rising disposable incomes, increased leisure travel, and the proliferation of online booking platforms. The adoption rate of online booking platforms is rapidly increasing, with a projected xx% penetration by 2033. Technological disruptions, such as the rise of mobile-first booking and AI-driven personalization, are further accelerating market growth. Consumer behavior is shifting towards greater price transparency, personalized experiences, and seamless booking processes. The estimated market size in 2025 is xx million, projected to reach xx million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Dominant Regions, Countries, or Segments in Travel Accommodation Market

North America and Europe currently dominate the travel accommodation market, accounting for a combined xx% of the global market share in 2025. However, the Asia-Pacific region is projected to experience the fastest growth over the forecast period, driven by rising disposable incomes, burgeoning tourism, and increasing internet penetration.

Key Drivers by Segment:

By Platform:

- Mobile Applications: The ease of use and convenience of mobile apps are driving rapid growth, particularly in emerging markets. Mobile bookings are projected to represent xx% of the total market by 2033.

- Websites: Websites still retain a significant market share, particularly among older demographics and those booking complex itineraries.

By Mode of Booking:

- Third-party online portals: These platforms dominate the market, offering a wide range of options and competitive pricing. They will continue to hold a significant market share in the coming years.

- Direct/captive portals: Direct bookings through hotel websites are growing, as hotels seek to reduce reliance on third-party platforms and enhance customer loyalty programs.

Key Factors Driving Regional Dominance:

- Strong tourism infrastructure: Well-developed tourist attractions, transportation networks, and accommodation options are key enablers.

- Favorable economic policies: Government incentives and support for tourism boost market growth.

- High internet and smartphone penetration: This facilitates online booking and accelerates market adoption.

Travel Accommodation Market Product Landscape

The travel accommodation market is a dynamic and diverse sector, encompassing a wide range of offerings, from budget-friendly hostels and boutique hotels to luxury resorts and unique vacation rentals like glamping sites and farm stays. Innovation is central to the market's evolution, with a strong focus on enhancing the customer experience through personalized services, flexible booking options, and innovative pricing models. Technology plays a crucial role, with AI-powered chatbots streamlining the booking process, virtual reality tours providing immersive previews, and sophisticated revenue management systems optimizing occupancy and profitability for providers. Key differentiators for providers include robust loyalty programs, personalized recommendations tailored to individual traveler profiles, and bundled services that create seamless travel packages, often incorporating tours, transportation, and other related activities.

Key Drivers, Barriers & Challenges in Travel Accommodation Market

Key Drivers:

- Rising disposable incomes and increased leisure travel: This is fueling demand for diverse accommodation options.

- Technological advancements: Online booking platforms, mobile apps, and AI-powered tools enhance convenience and accessibility.

- Government initiatives to promote tourism: This boosts investment and infrastructure development.

Key Challenges and Restraints:

- Increased competition: The market is highly competitive, with both established players and new entrants vying for market share. This leads to pressure on pricing and profitability.

- Economic downturns: Recessions or economic uncertainty can significantly impact travel spending and accommodation demand.

- Regulatory uncertainties: Changing regulations related to data privacy, taxation, and environmental concerns create uncertainty for businesses. The impact of fluctuating regulations is estimated to be a xx% reduction in profitability for some market players.

Emerging Opportunities in Travel Accommodation Market

- Sustainable and Eco-Friendly Accommodations: The growing awareness of environmental issues is driving significant demand for sustainable and eco-friendly travel options. This includes accommodations utilizing renewable energy, implementing waste reduction strategies, and supporting local communities.

- Experiential Travel: Travelers increasingly prioritize authentic experiences and local immersion. This trend fuels the growth of boutique hotels, unique accommodations offering local cultural interactions, and opportunities for personalized adventure.

- Expansion in Underserved Markets: Emerging markets in Asia, Africa, and Latin America offer substantial growth potential as tourism infrastructure develops and disposable incomes rise.

- Blockchain Technology Integration: The adoption of blockchain technology offers the potential for more secure and transparent transactions, fostering greater trust and efficiency in the booking process and enhancing data security.

- The Rise of the "Bleisure" Traveler: The blending of business and leisure travel creates opportunities for accommodations that cater to both needs, offering flexible workspaces and convenient access to business amenities alongside leisure facilities.

Growth Accelerators in the Travel Accommodation Market Industry

Several factors are driving robust growth in the travel accommodation market. Technological advancements, such as AI-driven personalization, VR/AR experiences that enhance pre-booking engagement, and the seamless integration of blockchain technology for secure payments, are key catalysts. Strategic partnerships between Online Travel Agencies (OTAs), airlines, car rental companies, and activity providers are enhancing the overall customer journey by offering bundled services and a more cohesive travel experience. The expansion into emerging economies with rapidly growing tourism sectors presents another significant growth driver. Furthermore, the increasing adoption of mobile booking platforms and the influence of social media marketing contribute to market expansion.

Key Players Shaping the Travel Accommodation Market Market

- Trivago

- TripAdvisor

- Booking.com

- HRS Gmbh

- OYO Rooms (Oravel Stays)

- Airbnb

- AccorHotels

- Agoda

- Hotels.com

- Expedia

- OUI sncf

Notable Milestones in Travel Accommodation Market Sector

- 2020: Airbnb goes public, reshaping the competitive landscape.

- 2021: Increased adoption of contactless check-in and mobile key technologies due to the pandemic.

- 2022: Significant investment in sustainable tourism initiatives by several major players.

- 2023: Launch of several new AI-powered travel booking platforms.

In-Depth Travel Accommodation Market Market Outlook

The travel accommodation market exhibits strong potential for continued growth, fueled by several key factors. Technological innovation is transforming the customer experience and operational efficiency, while evolving consumer preferences towards personalized and sustainable travel options are shaping demand. The expansion of tourism in emerging markets presents significant opportunities for growth. Companies that prioritize personalized experiences, sustainable practices, and innovative technology solutions are well-positioned to capitalize on these trends. The long-term outlook for the market remains positive, with considerable scope for expansion and increased profitability for businesses that adapt to the dynamic and ever-changing landscape of the travel industry.

Travel Accommodation Market Segmentation

-

1. Platform

- 1.1. Mobile application

- 1.2. Website

-

2. Mode of booking

- 2.1. Third party online portals

- 2.2. Direct/captive portals

Travel Accommodation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Travel Accommodation Market Regional Market Share

Geographic Coverage of Travel Accommodation Market

Travel Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Rising Internet Usage Pushing Customers Towards Online Accommodation in France.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Mobile application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of booking

- 5.2.1. Third party online portals

- 5.2.2. Direct/captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Mobile application

- 6.1.2. Website

- 6.2. Market Analysis, Insights and Forecast - by Mode of booking

- 6.2.1. Third party online portals

- 6.2.2. Direct/captive portals

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. South America Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Mobile application

- 7.1.2. Website

- 7.2. Market Analysis, Insights and Forecast - by Mode of booking

- 7.2.1. Third party online portals

- 7.2.2. Direct/captive portals

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Mobile application

- 8.1.2. Website

- 8.2. Market Analysis, Insights and Forecast - by Mode of booking

- 8.2.1. Third party online portals

- 8.2.2. Direct/captive portals

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Middle East & Africa Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Mobile application

- 9.1.2. Website

- 9.2. Market Analysis, Insights and Forecast - by Mode of booking

- 9.2.1. Third party online portals

- 9.2.2. Direct/captive portals

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Asia Pacific Travel Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Mobile application

- 10.1.2. Website

- 10.2. Market Analysis, Insights and Forecast - by Mode of booking

- 10.2.1. Third party online portals

- 10.2.2. Direct/captive portals

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trivago

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TripAdvisor

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Booking com

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HRS Gmbh

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oravel stays

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AirBnb

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AccorHotels

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Agoda**List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hotels com

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Expedia

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OUI sncf

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Trivago

List of Figures

- Figure 1: Global Travel Accommodation Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 3: North America Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 5: North America Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 6: North America Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 9: South America Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 10: South America Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 11: South America Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 12: South America Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 15: Europe Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Europe Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 17: Europe Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 18: Europe Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 21: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Middle East & Africa Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 23: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 24: Middle East & Africa Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Travel Accommodation Market Revenue (billion), by Platform 2025 & 2033

- Figure 27: Asia Pacific Travel Accommodation Market Revenue Share (%), by Platform 2025 & 2033

- Figure 28: Asia Pacific Travel Accommodation Market Revenue (billion), by Mode of booking 2025 & 2033

- Figure 29: Asia Pacific Travel Accommodation Market Revenue Share (%), by Mode of booking 2025 & 2033

- Figure 30: Asia Pacific Travel Accommodation Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Travel Accommodation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 2: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 3: Global Travel Accommodation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 5: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 6: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 11: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 12: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 17: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 18: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 29: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 30: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Travel Accommodation Market Revenue billion Forecast, by Platform 2020 & 2033

- Table 38: Global Travel Accommodation Market Revenue billion Forecast, by Mode of booking 2020 & 2033

- Table 39: Global Travel Accommodation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Travel Accommodation Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Travel Accommodation Market?

The projected CAGR is approximately 9.56%.

2. Which companies are prominent players in the Travel Accommodation Market?

Key companies in the market include Trivago, TripAdvisor, Booking com, HRS Gmbh, Oravel stays, AirBnb, AccorHotels, Agoda**List Not Exhaustive, Hotels com, Expedia, OUI sncf.

3. What are the main segments of the Travel Accommodation Market?

The market segments include Platform, Mode of booking.

4. Can you provide details about the market size?

The market size is estimated to be USD 961.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Rising Internet Usage Pushing Customers Towards Online Accommodation in France..

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Travel Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Travel Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Travel Accommodation Market?

To stay informed about further developments, trends, and reports in the Travel Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence