Key Insights

The United States pharmaceutical transportation market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 6% through 2033. With a current estimated market size of 107.6 billion in the 2025 base year, this sector is driven by increasing pharmaceutical demand, stringent regulatory mandates for specialized logistics (e.g., cold chain for biologics and vaccines), and the burgeoning e-commerce of prescription medications. Technological advancements in track-and-trace systems and real-time monitoring, alongside a rise in outsourced logistics solutions, further accelerate market growth.

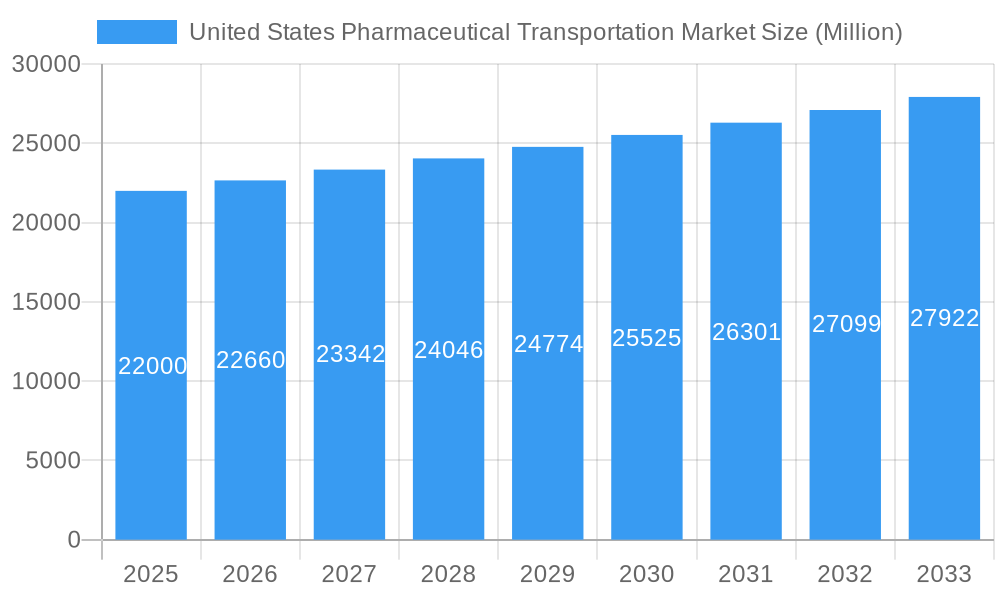

United States Pharmaceutical Transportation Market Market Size (In Billion)

Despite robust growth, the market faces challenges including the high costs associated with cold chain logistics, complex regulatory compliance with severe penalty risks, and significant security concerns regarding drug theft and counterfeiting. The market is segmented by product type (generics, branded drugs), operational mode (cold chain, non-cold chain), and service offerings (transportation, warehousing, value-added services). Leading players like FedEx, UPS, and DHL, alongside specialized pharmaceutical logistics providers, are actively investing in infrastructure and technology to enhance services and ensure compliance. Continued growth in the US pharmaceutical industry and ongoing logistical innovations present substantial opportunities, provided companies effectively manage regulatory complexities and operational hurdles.

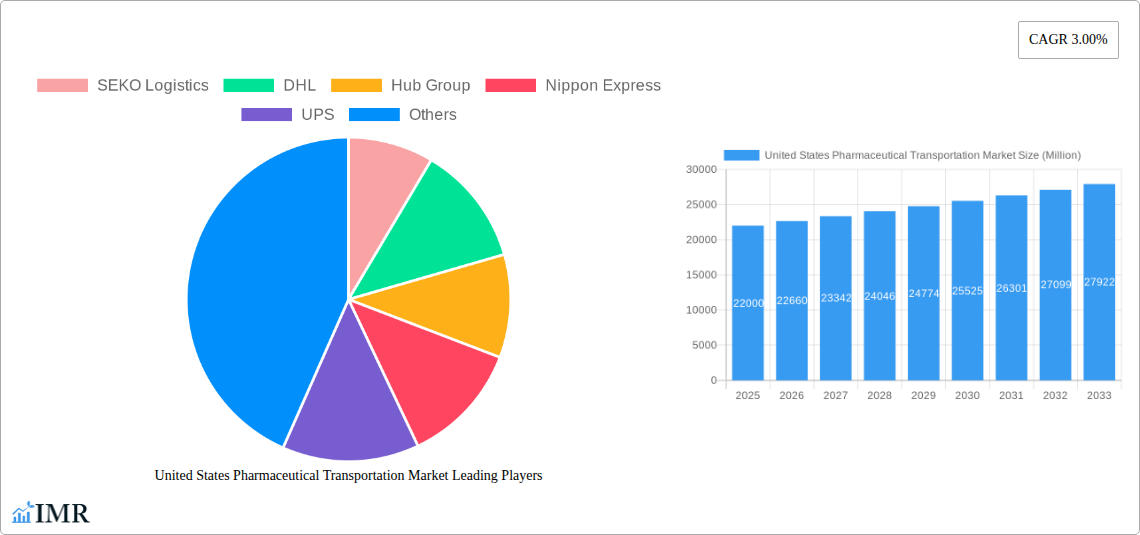

United States Pharmaceutical Transportation Market Company Market Share

United States Pharmaceutical Transportation Market: Forecast to 2033

This report offers a comprehensive analysis of the United States Pharmaceutical Transportation Market, detailing dynamics, growth trends, regional segmentation, product landscape, key players, and future projections. The forecast period extends to 2033, with 2025 identified as the base year. Market values are presented in billion units.

United States Pharmaceutical Transportation Market Dynamics & Structure

The US pharmaceutical transportation market is characterized by a moderately concentrated landscape with a few dominant players and numerous smaller specialized firms. Technological innovation, particularly in cold chain logistics and data analytics, is a key driver. Stringent regulatory frameworks, including FDA guidelines on temperature-sensitive drug handling, significantly impact operations. Competitive pressures exist from substitute transportation modes and warehousing solutions. The end-user demographic comprises pharmaceutical manufacturers, distributors, wholesalers, and hospitals. M&A activity is moderate, driven by consolidation and expansion into specialized services.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Focus on automation, IoT-enabled tracking, and AI-driven route optimization.

- Regulatory Framework: Strict adherence to GDP (Good Distribution Practices) and temperature control regulations.

- Competitive Substitutes: Alternative transportation modes and third-party logistics providers (3PLs).

- M&A Trends: xx M&A deals recorded in the past five years, primarily focused on cold chain logistics acquisitions.

United States Pharmaceutical Transportation Market Growth Trends & Insights

The US pharmaceutical transportation market is experiencing robust growth, driven by increasing pharmaceutical sales, the rise of biologics and specialized drugs requiring stringent temperature control, and the growing adoption of advanced logistics technologies. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for cold chain transportation, expansion of e-pharmacy, and the implementation of sophisticated supply chain management systems. Technological disruptions, such as the integration of blockchain technology for enhanced traceability and the use of autonomous vehicles for last-mile delivery, are further accelerating market expansion. Consumer behavior shifts towards personalized medicine and home delivery of pharmaceuticals are also impacting market dynamics.

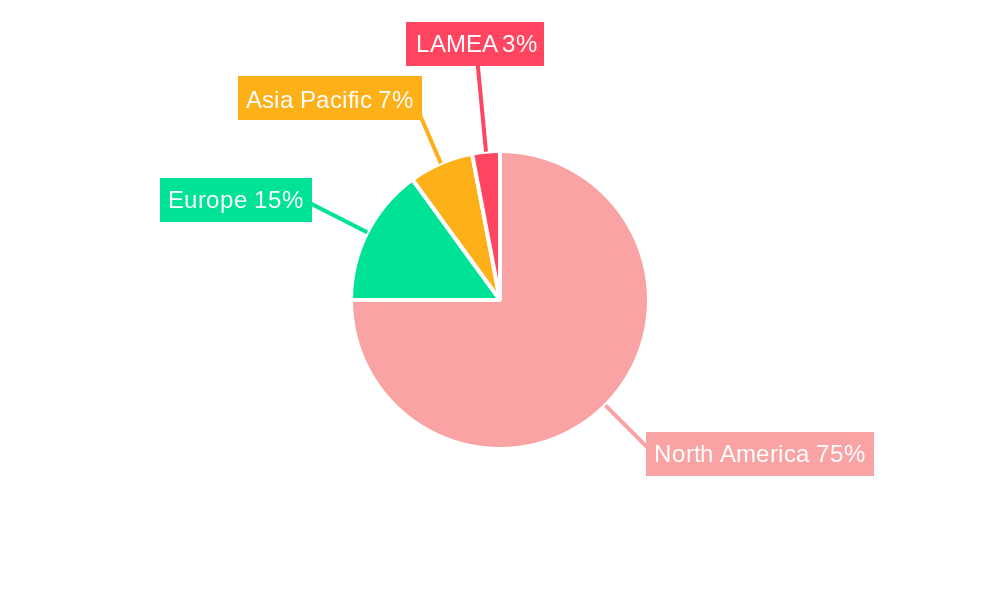

Dominant Regions, Countries, or Segments in United States Pharmaceutical Transportation Market

The Northeast and West Coast regions dominate the US pharmaceutical transportation market due to high concentrations of pharmaceutical manufacturers and distribution centers. Within segments, cold chain transportation holds the largest market share (xx%) followed by warehousing services (xx%). The Branded Drugs segment accounts for a larger share than Generic Drugs (xx% vs xx%).

- Key Drivers:

- Robust pharmaceutical manufacturing activity in key states.

- Developed cold chain infrastructure in major cities.

- Government support for pharmaceutical innovation and distribution.

- Dominance Factors:

- High concentration of pharmaceutical companies.

- Extensive warehousing and transportation networks.

- Favorable regulatory environment.

United States Pharmaceutical Transportation Market Product Landscape

The pharmaceutical transportation market offers a diverse range of services, including temperature-controlled transportation, warehousing, value-added services (e.g., labeling, repackaging), and specialized handling for high-value drugs. Recent innovations focus on real-time temperature monitoring, predictive maintenance of vehicles, and integrated logistics platforms offering end-to-end visibility. Unique selling propositions revolve around reliability, compliance, and cost-effectiveness. Technological advancements, such as the deployment of IoT sensors and AI-powered route optimization systems, are enhancing efficiency and security.

Key Drivers, Barriers & Challenges in United States Pharmaceutical Transportation Market

Key Drivers:

- Increasing demand for temperature-sensitive pharmaceuticals.

- Stringent regulatory requirements driving investment in advanced technologies.

- Rising adoption of e-commerce for pharmaceutical distribution.

Key Challenges & Restraints:

- High cost of cold chain transportation and specialized equipment.

- Potential for supply chain disruptions due to extreme weather events or geopolitical instability.

- Regulatory complexities and compliance requirements.

- xx% increase in fuel costs projected to impact profitability.

Emerging Opportunities in United States Pharmaceutical Transportation Market

- Expansion into niche markets, such as personalized medicine and gene therapy.

- Development of sustainable and eco-friendly transportation solutions.

- Increased adoption of automation and AI-powered systems.

- Growing demand for integrated logistics solutions that combine transportation, warehousing, and value-added services.

Growth Accelerators in the United States Pharmaceutical Transportation Market Industry

Technological advancements in cold chain technology, such as the development of more efficient and cost-effective temperature-controlled containers, are key growth accelerators. Strategic partnerships between pharmaceutical companies and logistics providers are also creating synergies and driving market expansion. Government initiatives promoting pharmaceutical innovation and supply chain security are further contributing to market growth.

Key Players Shaping the United States Pharmaceutical Transportation Market Market

- SEKO Logistics

- DHL

- Hub Group

- Nippon Express

- UPS

- Penske Logistics

- XPO Logistics

- FedEx

- Expeditors International

- DB Schenker

- 63 Other Companies

Notable Milestones in United States Pharmaceutical Transportation Market Sector

- August 2022: Wabash expands its North American dealer network, enhancing its service reach for pharmaceutical transportation equipment.

- May 2022: Vertical Cold Storage acquires three public refrigerated warehouses, increasing cold chain storage capacity.

In-Depth United States Pharmaceutical Transportation Market Market Outlook

The US pharmaceutical transportation market is poised for continued growth, driven by technological innovation, regulatory changes, and increasing demand for specialized transportation services. Strategic partnerships and investments in advanced technologies will be crucial for companies to maintain competitiveness and capitalize on emerging opportunities. The market's future potential is significant, with expansion into new therapeutic areas and growth in emerging markets expected to fuel continued market expansion.

United States Pharmaceutical Transportation Market Segmentation

-

1. Product

- 1.1. Generic Drugs

- 1.2. Branded Drugs

-

2. Mode of Operation

- 2.1. Cold Chain Transport

- 2.2. Non-cold Chain Transport

-

3. Services

-

3.1. Transport

- 3.1.1. Road

- 3.1.2. Air

- 3.1.3. Rail

- 3.1.4. Sea

- 3.2. Warehousing Services

- 3.3. Value-added Services and Other Services

-

3.1. Transport

United States Pharmaceutical Transportation Market Segmentation By Geography

- 1. United States

United States Pharmaceutical Transportation Market Regional Market Share

Geographic Coverage of United States Pharmaceutical Transportation Market

United States Pharmaceutical Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Boom; Same-day and Next-day Delivery

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Infrastructure Limitations

- 3.4. Market Trends

- 3.4.1. Growing Pharmaceutical Industry in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Pharmaceutical Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Generic Drugs

- 5.1.2. Branded Drugs

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operation

- 5.2.1. Cold Chain Transport

- 5.2.2. Non-cold Chain Transport

- 5.3. Market Analysis, Insights and Forecast - by Services

- 5.3.1. Transport

- 5.3.1.1. Road

- 5.3.1.2. Air

- 5.3.1.3. Rail

- 5.3.1.4. Sea

- 5.3.2. Warehousing Services

- 5.3.3. Value-added Services and Other Services

- 5.3.1. Transport

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SEKO Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hub Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Penske Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Expeditors International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DB Schenker*List Not Exhaustive 6 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SEKO Logistics

List of Figures

- Figure 1: United States Pharmaceutical Transportation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Pharmaceutical Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 3: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Services 2020 & 2033

- Table 4: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Mode of Operation 2020 & 2033

- Table 7: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Services 2020 & 2033

- Table 8: United States Pharmaceutical Transportation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Pharmaceutical Transportation Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the United States Pharmaceutical Transportation Market?

Key companies in the market include SEKO Logistics, DHL, Hub Group, Nippon Express, UPS, Penske Logistics, XPO Logistics, FedEx, Expeditors International, DB Schenker*List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the United States Pharmaceutical Transportation Market?

The market segments include Product, Mode of Operation, Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 107.6 billion as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Boom; Same-day and Next-day Delivery.

6. What are the notable trends driving market growth?

Growing Pharmaceutical Industry in the Country.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Infrastructure Limitations.

8. Can you provide examples of recent developments in the market?

August 2022: Wabash, a provider of transportation, logistics, and distribution solutions, announced the addition of two dealers to its industry-leading North American dealer network. Bergey's Truck Centers and Allegiance Trucks, two of the largest dealers in the Northeast, will be full-line dealers of Wabash parts, services, and equipment, including dry and refrigerated van trailers, dry and refrigerated truck bodies, and platform trailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Pharmaceutical Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Pharmaceutical Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Pharmaceutical Transportation Market?

To stay informed about further developments, trends, and reports in the United States Pharmaceutical Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence