Key Insights

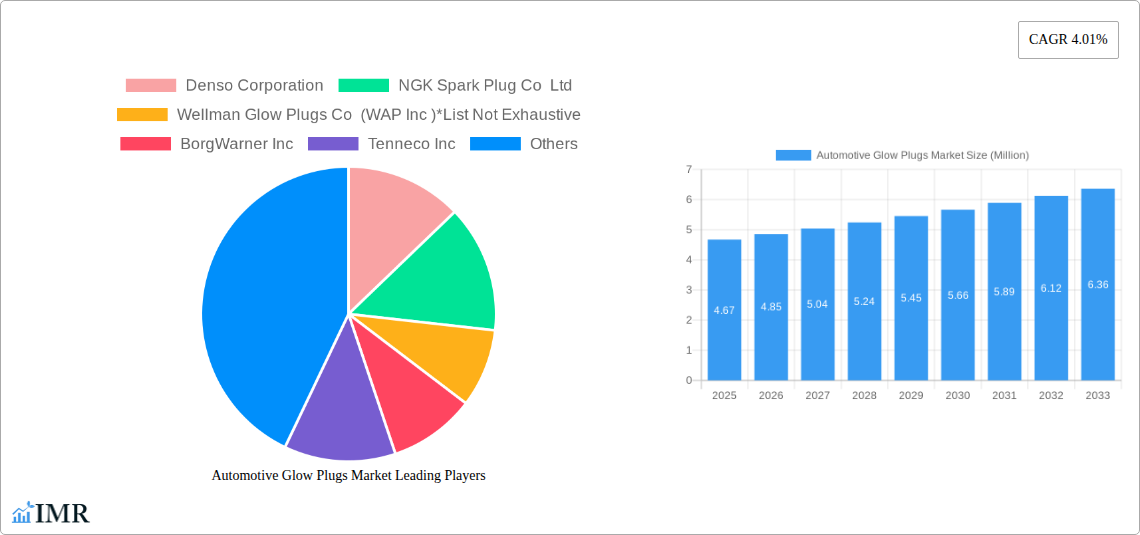

The global Automotive Glow Plugs Market is poised for steady expansion, projected to reach a valuation of approximately USD 4.67 million with a Compound Annual Growth Rate (CAGR) of 4.01% from 2025 to 2033. This growth is underpinned by several key drivers, primarily the increasing production of diesel vehicles worldwide and the evolving regulatory landscape that favors cleaner emissions, thereby necessitating advanced glow plug technologies. As environmental consciousness rises and governments implement stricter emission standards, the demand for efficient and reliable glow plugs that facilitate smoother cold starts and reduce pollutant output is expected to surge. The market is segmented into Metal Glow Plugs and Ceramic Glow Plugs, with ceramic variants gaining traction due to their superior performance characteristics, including faster heat-up times and longer lifespans. Passenger cars currently dominate the vehicle type segment, but a significant growth trajectory is anticipated for commercial vehicles as fleet operators increasingly adopt diesel powertrains for their fuel efficiency and durability. The sales channel bifurcates into Original Equipment Manufacturer (OEM) and Aftermarket. The OEM segment benefits from new vehicle production, while the aftermarket is driven by the replacement needs of the existing vehicle parc, both contributing to sustained market demand.

Automotive Glow Plugs Market Market Size (In Million)

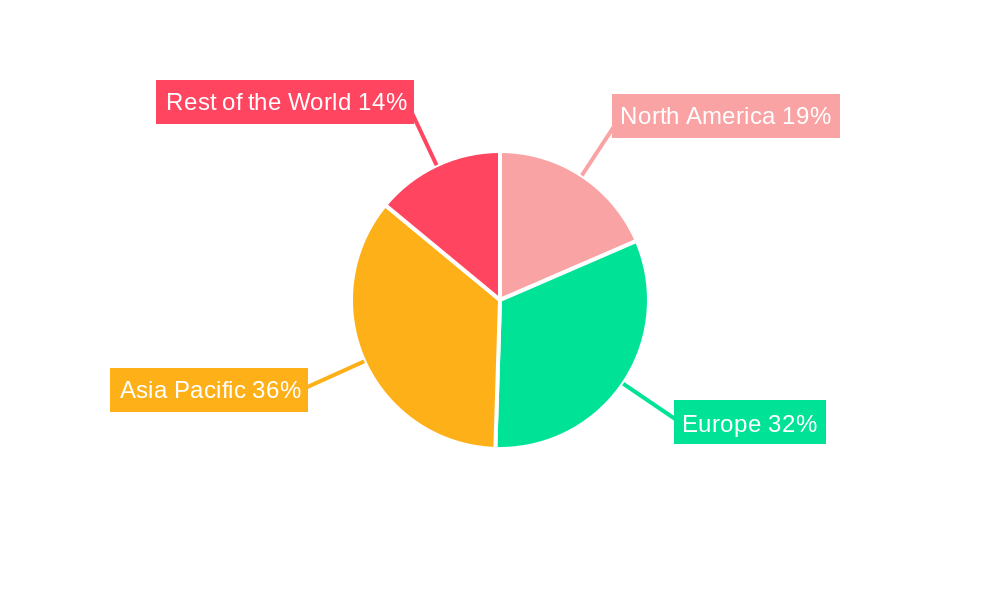

Geographically, the Asia Pacific region is emerging as a significant growth engine for the automotive glow plugs market, fueled by a burgeoning automotive industry in countries like China, India, and South Korea, coupled with a substantial diesel vehicle population. Europe, with its stringent emission norms and a mature automotive market, also represents a substantial share, driven by a large installed base of diesel vehicles and a strong aftermarket demand. North America is also a key market, though the adoption of diesel in passenger cars has seen fluctuations. Rest of the World markets, including Brazil and the UAE, are showing promising growth potential. Key players such as Denso Corporation, NGK Spark Plug Co. Ltd., BorgWarner Inc., and Robert Bosch GmbH are at the forefront, continually innovating to develop more advanced, durable, and efficient glow plug solutions to meet the evolving demands of the automotive industry and address the global push towards sustainable mobility.

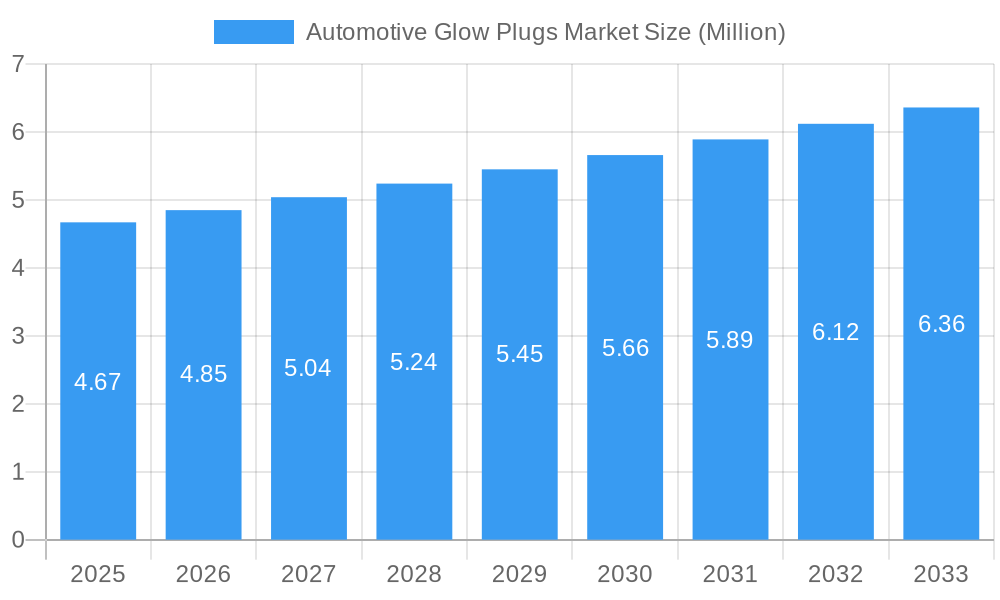

Automotive Glow Plugs Market Company Market Share

Automotive Glow Plugs Market: Comprehensive Industry Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global Automotive Glow Plugs Market, a critical component in diesel engine ignition systems. We offer an exhaustive examination of market dynamics, growth trajectories, regional dominance, product innovations, and the competitive landscape. This report is essential for stakeholders seeking to understand current trends and capitalize on future opportunities within the automotive aftermarket and OEM segments.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Automotive Glow Plugs Market Dynamics & Structure

The Automotive Glow Plugs Market exhibits a moderately concentrated structure, characterized by the presence of both established global players and regional specialists. Technological innovation is a primary driver, with continuous advancements in ceramic glow plugs offering faster heat-up times and improved durability compared to traditional metal glow plugs. Regulatory frameworks, particularly stringent emission standards in developed economies, are increasingly influencing engine design and component performance, indirectly boosting demand for advanced glow plug technologies. Competitive product substitutes, while limited for direct ignition function, include advancements in alternative starting systems for certain diesel applications. End-user demographics are shifting, with an increasing demand for reliable and efficient diesel engines in both passenger cars and commercial vehicles, particularly in emerging markets. Mergers and acquisitions (M&A) trends are present, with larger Tier-1 suppliers acquiring smaller, innovative component manufacturers to enhance their product portfolios and market reach. For instance, the M&A deal volume in the past five years (2019-2024) is estimated to be around $250 Million units, signifying strategic consolidation. Barriers to innovation include the high cost of R&D for advanced materials and the lengthy certification processes for new automotive components.

- Market Concentration: Moderately concentrated with key global manufacturers.

- Technological Innovation: Driven by advancements in ceramic glow plugs and enhanced materials.

- Regulatory Frameworks: Emission standards are a significant influence on product development.

- Competitive Landscape: Limited direct substitutes, but alternative starting technologies pose indirect competition.

- End-User Demographics: Growing demand for efficient diesel engines in passenger cars and commercial vehicles.

- M&A Trends: Strategic acquisitions to strengthen market position and product offerings.

- Innovation Barriers: High R&D costs and stringent certification requirements.

Automotive Glow Plugs Market Growth Trends & Insights

The Automotive Glow Plugs Market is poised for substantial growth, driven by the persistent demand for diesel engines and the evolution of their technology. The global market size for automotive glow plugs is projected to grow from an estimated $1,500 Million units in 2025 to $2,200 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period (2025-2033). This growth is underpinned by several key factors. Firstly, the ongoing adoption of diesel powertrains, especially in commercial vehicles and for heavy-duty applications, continues to fuel demand. Despite the rise of electric vehicles, diesel engines remain the preferred choice for many commercial and industrial uses due to their torque, fuel efficiency, and range capabilities. Secondly, technological disruptions are playing a crucial role. The transition from metal glow plugs to more advanced ceramic glow plugs is a significant trend. Ceramic glow plugs offer superior performance characteristics, including faster pre-heating times, higher operating temperatures, and extended lifespan. These improvements are critical for meeting increasingly stringent emission regulations and enhancing cold-start performance, especially in colder climates.

Consumer behavior shifts are also contributing to market expansion. While environmental concerns are pushing some consumers towards gasoline and electric alternatives, the economic advantages of diesel, particularly for long-haul transportation and heavy-duty applications, remain compelling. This is driving demand for fuel-efficient and reliable diesel engines, which in turn necessitates high-quality glow plugs. The automotive aftermarket segment is a significant contributor to growth, as regular replacement of glow plugs is essential for maintaining engine performance and compliance with emission standards. Furthermore, advancements in diagnostic tools and a growing awareness among vehicle owners about the importance of regular maintenance are boosting aftermarket sales. The penetration of advanced glow plug technologies is expected to increase as manufacturers integrate them as standard equipment in new diesel vehicles, driving up the overall market value. The historical period (2019-2024) saw a steady increase in market value, with an estimated CAGR of 3.8%, demonstrating the resilience of the diesel engine market.

Dominant Regions, Countries, or Segments in Automotive Glow Plugs Market

The Automotive Glow Plugs Market is experiencing robust growth across various regions and segments, with distinct drivers influencing their dominance.

Regionally, Europe stands as a leading market for automotive glow plugs. This dominance is attributed to several interconnected factors:

- Strict Emission Standards: Europe has some of the world's most stringent emission regulations (e.g., Euro 6, Euro 7), which necessitate advanced diesel engine technologies. This directly translates to a higher demand for high-performance glow plugs, particularly ceramic glow plugs, to ensure efficient combustion and reduced emissions during cold starts.

- Prevalence of Diesel Vehicles: Historically, diesel vehicles have held a significant market share in Europe, especially in the commercial vehicles segment, including trucks, buses, and vans. This strong existing fleet, coupled with continued preference for diesel in certain applications, creates a substantial aftermarket for glow plugs.

- Technological Adoption: European automakers are at the forefront of adopting new technologies, making them early adopters of advanced ceramic glow plugs and other ignition innovations.

- Economic Policies: Favorable economic policies and tax incentives for fuel-efficient vehicles have historically supported the diesel market in Europe.

Within product types, ceramic glow plugs are rapidly gaining dominance over traditional metal glow plugs.

- Superior Performance: Ceramic glow plugs offer significantly faster heat-up times (often under 5 seconds), higher operating temperatures, and longer lifespans compared to their metal counterparts. This leads to improved cold-start reliability and reduced emissions.

- Regulatory Compliance: The enhanced performance of ceramic glow plugs is crucial for manufacturers to meet increasingly stringent global emission standards.

- Technological Advancement: Continuous R&D in ceramic materials and manufacturing processes is making these plugs more cost-effective and widely available.

- Market Share: While precise figures are proprietary, the market share of ceramic glow plugs is estimated to be growing by over 6% annually, projected to capture over 60% of the total glow plug market by 2028.

In terms of vehicle type, commercial vehicles are a significant driver of market growth.

- Heavy-Duty Applications: Diesel engines are the backbone of the logistics and transportation industries. Trucks, buses, and other heavy-duty vehicles rely on diesel powertrains for their power, torque, and fuel efficiency over long distances.

- Operational Demands: The demanding operational environment for commercial vehicles, including frequent starts and stops and operation in varying weather conditions, necessitates reliable engine starting, making glow plugs indispensable.

- Fleet Replacement and Maintenance: The large existing fleet of commercial vehicles creates a continuous demand for replacement glow plugs in the aftermarket.

Regarding sales channels, the OEM (Original Equipment Manufacturer) segment holds a dominant position due to new vehicle production.

- New Vehicle Integration: As new diesel vehicles are manufactured, the OEM channel is the primary conduit for new glow plug installations.

- Technological Advancements: OEMs are increasingly integrating advanced ceramic glow plugs as standard equipment in new vehicle models to meet performance and emission targets.

- Volume Sales: The sheer volume of new vehicle production contributes significantly to the overall market size through the OEM channel.

However, the aftermarket segment is experiencing robust growth and is crucial for sustained market health.

- Replacement Demand: As diesel vehicles age, the need for replacement glow plugs increases, driving aftermarket sales.

- Independent Repair Shops and Dealerships: A well-established network of independent repair shops and authorized dealerships ensures accessibility and service for vehicle owners.

- Growing Awareness: Increased awareness among consumers about the importance of regular vehicle maintenance and the impact of worn-out glow plugs on engine performance and fuel efficiency is boosting aftermarket purchases.

Automotive Glow Plugs Market Product Landscape

The Automotive Glow Plugs Market is characterized by continuous product innovation focused on enhancing performance and durability. Metal glow plugs, primarily constructed from steel alloys, have been the traditional standard, offering reliable ignition. However, the market is witnessing a strong shift towards ceramic glow plugs. These advanced components utilize specialized ceramic materials, such as silicon nitride or aluminum nitride, which enable them to reach higher operating temperatures faster and maintain them for longer durations. This translates to significantly improved cold-start performance, reduced combustion noise, and lower exhaust emissions, aligning with increasingly stringent environmental regulations. Innovations also include the development of glow plugs with integrated sensors for real-time engine monitoring and diagnostic capabilities, further enhancing their value proposition. The unique selling propositions of modern glow plugs lie in their rapid heating times, superior heat retention, and extended lifespan, contributing to overall engine efficiency and reliability.

Key Drivers, Barriers & Challenges in Automotive Glow Plugs Market

Key Drivers:

- Persistent Demand for Diesel Engines: Despite the rise of EVs, diesel engines remain critical for heavy-duty applications, long-haul trucking, and specific passenger car segments due to their torque and fuel efficiency.

- Stringent Emission Regulations: Global environmental mandates (e.g., Euro 7) compel manufacturers to improve diesel engine performance, directly increasing the need for advanced glow plug technologies that ensure efficient combustion during cold starts.

- Technological Advancements in Ceramic Glow Plugs: The superior performance of ceramic glow plugs, including faster heat-up times and longer lifespans, drives their adoption over traditional metal variants.

- Growth of the Automotive Aftermarket: As the global fleet of diesel vehicles ages, the demand for replacement glow plugs for maintenance and repairs continues to rise significantly.

Barriers & Challenges:

- Electrification of Vehicles: The growing global shift towards electric vehicles (EVs) poses a long-term threat to the overall diesel engine market, consequently impacting the demand for glow plugs.

- High R&D Costs: Developing and manufacturing advanced glow plug technologies, especially high-performance ceramic variants, requires substantial investment in research and development.

- Supply Chain Disruptions: Geopolitical factors, raw material price volatility (e.g., for specialized alloys and ceramics), and global logistics challenges can impact the availability and cost of glow plug components.

- Price Sensitivity in Certain Markets: In some price-sensitive markets, the adoption of more expensive, advanced glow plugs might be slower compared to their lower-cost metal counterparts.

- Competition from Alternative Starting Technologies: While not direct substitutes, advancements in engine management systems and alternative starting aids for diesel engines can present indirect competitive pressures.

Emerging Opportunities in Automotive Glow Plugs Market

Emerging opportunities in the Automotive Glow Plugs Market are intrinsically linked to the evolving landscape of diesel technology and aftermarket services. The increasing demand for fuel-efficient and emission-compliant diesel engines in developing economies presents a significant untapped market. Furthermore, the integration of smart diagnostics into glow plugs, allowing for predictive maintenance and remote monitoring, offers a pathway for value-added services and brand differentiation. Innovations in advanced ceramic materials, potentially leading to even faster heating and greater durability, could open up new application areas or enhance existing ones. The growing emphasis on remanufacturing and the circular economy also presents an opportunity for specialized companies to focus on remanufactured glow plugs, offering cost-effective solutions for the aftermarket.

Growth Accelerators in the Automotive Glow Plugs Market Industry

Several key accelerators are propelling long-term growth within the Automotive Glow Plugs Market. Continuous technological breakthroughs, particularly in the development of next-generation ceramic glow plugs with even faster activation times and enhanced thermal management, are crucial. Strategic partnerships between glow plug manufacturers and leading automotive OEMs are vital for ensuring the integration of these advanced components into new vehicle models. Market expansion strategies, focusing on emerging economies where diesel engines remain a dominant powertrain, are also critical for sustained growth. Investments in robust R&D to address evolving emission standards and improve cold-start performance in extreme weather conditions will further accelerate market adoption. The development of more efficient manufacturing processes for ceramic materials will also contribute to cost reduction and wider accessibility.

Key Players Shaping the Automotive Glow Plugs Market Market

- Denso Corporation

- NGK Spark Plug Co Ltd

- Wellman Glow Plugs Co (WAP Inc)

- BorgWarner Inc

- Tenneco Inc

- Robert Bosch GmbH

- ACDelco Corporation

- KLG Spark Plugs

- Autolite (Fram Group LLC)

Notable Milestones in Automotive Glow Plugs Market Sector

- 2019-2021: Increased focus on R&D for advanced ceramic glow plug materials to meet evolving emission standards.

- 2020: Several key players announce strategic partnerships with automotive OEMs for the supply of next-generation glow plugs for new diesel engine platforms.

- 2021: Launch of new ceramic glow plugs offering significantly reduced pre-heating times (under 4 seconds) by major manufacturers.

- 2022: Growing demand in emerging markets, particularly Asia-Pacific and Latin America, for reliable diesel engine components.

- 2023: Introduction of glow plugs with integrated diagnostic capabilities, enabling better engine performance monitoring.

- 2024: Increased M&A activity as larger companies seek to consolidate their position in the glow plug market and acquire innovative technologies.

In-Depth Automotive Glow Plugs Market Market Outlook

The future outlook for the Automotive Glow Plugs Market remains robust, driven by the enduring necessity of diesel engines in critical sectors like transportation and logistics. Growth accelerators will center on the continued innovation and widespread adoption of advanced ceramic glow plugs, which are indispensable for meeting stringent emission targets and ensuring optimal engine performance in diverse climatic conditions. Strategic collaborations between manufacturers and OEMs will be paramount in embedding these cutting-edge technologies into new vehicle architectures. Furthermore, expansion into burgeoning markets with a strong reliance on diesel powertrains will unlock significant growth potential. The market will also benefit from increased emphasis on aftermarket services and the integration of smart diagnostics, offering enhanced value and reliability to end-users.

Automotive Glow Plugs Market Segmentation

-

1. Product Type

- 1.1. Metal Glow Plug

- 1.2. Ceramic Glow Plug

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Sales Channel

- 3.1. OEM

- 3.2. Aftermarket

Automotive Glow Plugs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. South Korea

- 3.4. India

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Argentina

- 4.3. United Arab Emirates

- 4.4. Other Countries

Automotive Glow Plugs Market Regional Market Share

Geographic Coverage of Automotive Glow Plugs Market

Automotive Glow Plugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for ADAS Integration

- 3.3. Market Restrains

- 3.3.1. High Upfront Cost

- 3.4. Market Trends

- 3.4.1. High Demand for Commercial Vehicles Across the World

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Glow Plugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Metal Glow Plug

- 5.1.2. Ceramic Glow Plug

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Automotive Glow Plugs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Metal Glow Plug

- 6.1.2. Ceramic Glow Plug

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. OEM

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Automotive Glow Plugs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Metal Glow Plug

- 7.1.2. Ceramic Glow Plug

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. OEM

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Automotive Glow Plugs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Metal Glow Plug

- 8.1.2. Ceramic Glow Plug

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. OEM

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Automotive Glow Plugs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Metal Glow Plug

- 9.1.2. Ceramic Glow Plug

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. OEM

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NGK Spark Plug Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Wellman Glow Plugs Co (WAP Inc )*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 BorgWarner Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tenneco Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Robert Bosch GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 ACDelco Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 KLG Spark Plugs

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Autolite (Fram Group LLC)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Automotive Glow Plugs Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Glow Plugs Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Automotive Glow Plugs Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Automotive Glow Plugs Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Glow Plugs Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Glow Plugs Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 7: North America Automotive Glow Plugs Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 8: North America Automotive Glow Plugs Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Glow Plugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Glow Plugs Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Automotive Glow Plugs Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Automotive Glow Plugs Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Glow Plugs Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Glow Plugs Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 15: Europe Automotive Glow Plugs Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 16: Europe Automotive Glow Plugs Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Glow Plugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Glow Plugs Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Glow Plugs Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Glow Plugs Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Glow Plugs Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Glow Plugs Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 23: Asia Pacific Automotive Glow Plugs Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 24: Asia Pacific Automotive Glow Plugs Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Glow Plugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Glow Plugs Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Rest of the World Automotive Glow Plugs Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the World Automotive Glow Plugs Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Automotive Glow Plugs Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Automotive Glow Plugs Market Revenue (Million), by Sales Channel 2025 & 2033

- Figure 31: Rest of the World Automotive Glow Plugs Market Revenue Share (%), by Sales Channel 2025 & 2033

- Figure 32: Rest of the World Automotive Glow Plugs Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Glow Plugs Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Glow Plugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Automotive Glow Plugs Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Glow Plugs Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 4: Global Automotive Glow Plugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Glow Plugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Automotive Glow Plugs Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Glow Plugs Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 8: Global Automotive Glow Plugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Glow Plugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Automotive Glow Plugs Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Glow Plugs Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 15: Global Automotive Glow Plugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Automotive Glow Plugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Automotive Glow Plugs Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Glow Plugs Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 25: Global Automotive Glow Plugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: India Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Global Automotive Glow Plugs Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Global Automotive Glow Plugs Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Glow Plugs Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 34: Global Automotive Glow Plugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Brazil Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: United Arab Emirates Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Other Countries Automotive Glow Plugs Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Glow Plugs Market?

The projected CAGR is approximately 4.01%.

2. Which companies are prominent players in the Automotive Glow Plugs Market?

Key companies in the market include Denso Corporation, NGK Spark Plug Co Ltd, Wellman Glow Plugs Co (WAP Inc )*List Not Exhaustive, BorgWarner Inc, Tenneco Inc, Robert Bosch GmbH, ACDelco Corporation, KLG Spark Plugs, Autolite (Fram Group LLC).

3. What are the main segments of the Automotive Glow Plugs Market?

The market segments include Product Type, Vehicle Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for ADAS Integration.

6. What are the notable trends driving market growth?

High Demand for Commercial Vehicles Across the World.

7. Are there any restraints impacting market growth?

High Upfront Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Glow Plugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Glow Plugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Glow Plugs Market?

To stay informed about further developments, trends, and reports in the Automotive Glow Plugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence