Key Insights

The Europe Automotive Pneumatic Actuators Market is projected for significant growth, expected to reach over $24 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 5.44% from a 2025 base year. This expansion is driven by the increasing demand for advanced vehicle systems that enhance safety, performance, and fuel efficiency. Pneumatic actuators, valued for their precision, reliability, and cost-effectiveness, are essential in numerous automotive applications, including throttle control for optimized engine performance and emissions, and brake actuators for advanced safety systems.

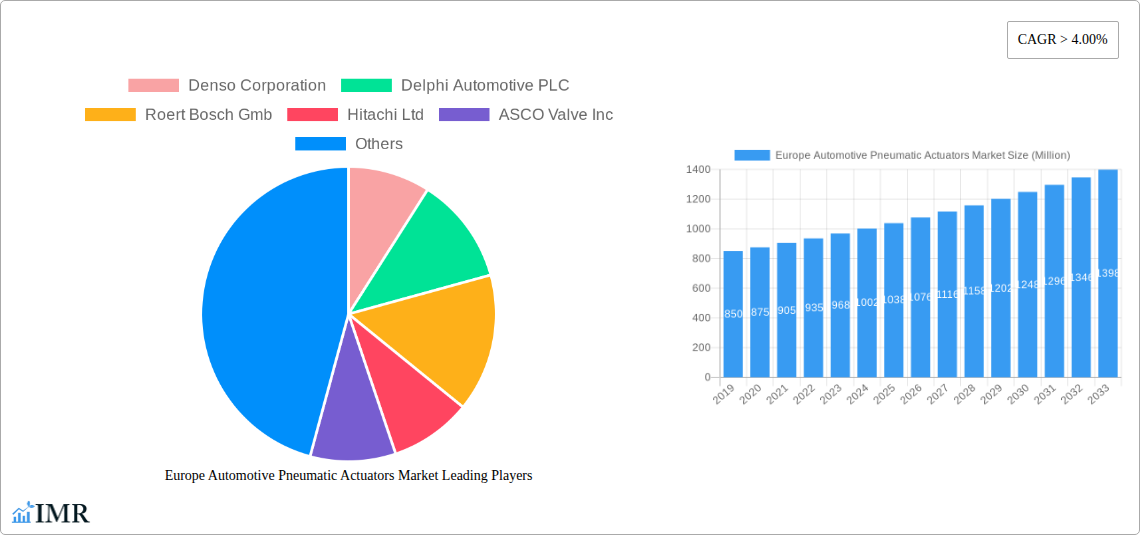

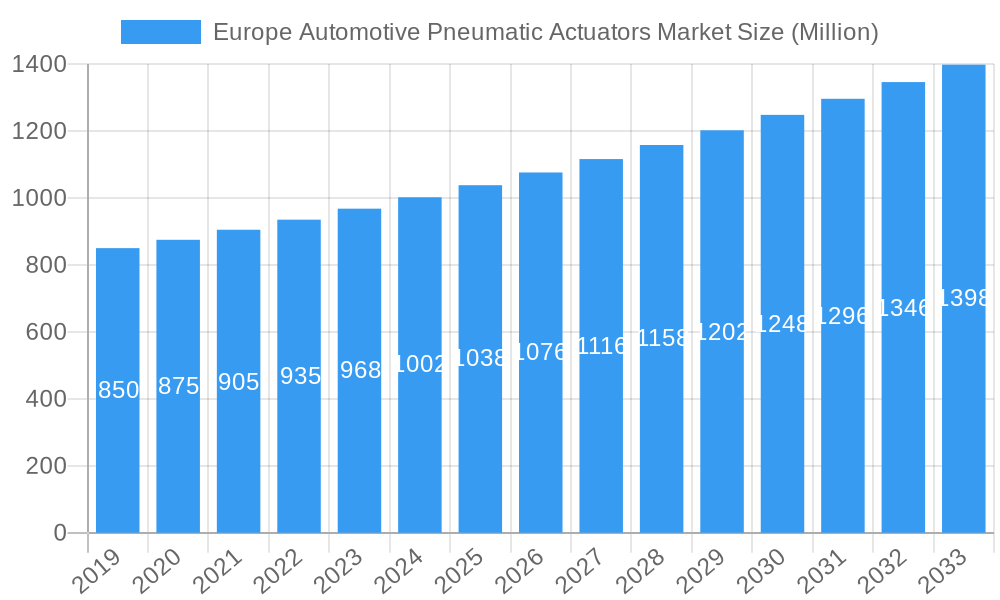

Europe Automotive Pneumatic Actuators Market Market Size (In Billion)

Europe's robust automotive sector, characterized by technological innovation and strict emission standards, fuels the adoption of these pneumatic components. The evolving landscape of electric and hybrid vehicles also presents new opportunities for innovative pneumatic solutions that improve overall system efficiency and driver experience.

Europe Automotive Pneumatic Actuators Market Company Market Share

Market segmentation indicates strong demand for throttle, fuel injection, and brake actuators, crucial for modern engines, cleaner powertrains, and advanced driver-assistance systems (ADAS). Passenger cars will likely remain the dominant segment, supported by consumer demand for advanced features and safety. The commercial vehicle segment is also growing, driven by automation and efficiency demands in logistics. Leading companies like Denso Corporation, Robert Bosch GmbH, and Continental AG are investing in R&D, fostering innovation and market growth.

Europe Automotive Pneumatic Actuators Market: Comprehensive Analysis & Future Outlook (2019-2033)

Report Description:

This in-depth market research report provides a definitive analysis of the Europe Automotive Pneumatic Actuators Market. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report delves into critical market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, and emerging opportunities. We offer a granular examination of the market by application type, including Throttle Actuators, Fuel Injection Actuators, Brake Actuators, and Others, and by vehicle type, encompassing Passenger Cars and Commercial Vehicles. With a keen focus on automotive components, vehicle automation, and pneumatic systems in vehicles, this report is an essential resource for industry professionals seeking strategic insights into this evolving sector. Quantifiable data and actionable intelligence are presented throughout, with all values expressed in Million units.

Europe Automotive Pneumatic Actuators Market Dynamics & Structure

The Europe Automotive Pneumatic Actuators Market is characterized by a moderately consolidated structure, with key players like Denso Corporation, Delphi Automotive PLC, Robert Bosch GmbH, and Continental AG holding significant market shares. Technological innovation remains a primary driver, fueled by the increasing demand for enhanced fuel efficiency, stricter emission regulations, and the growing complexity of vehicle systems. Regulatory frameworks, particularly stringent Euro emission standards, are compelling manufacturers to adopt advanced pneumatic actuator technologies for precise control of engine and exhaust systems. While direct pneumatic actuators face competition from their electric and electro-mechanical counterparts, their cost-effectiveness and reliability in specific applications, especially in heavy-duty commercial vehicles, ensure their continued relevance. End-user demographics are shifting towards a greater demand for sophisticated vehicle functionalities and improved performance, indirectly influencing actuator development. Mergers and acquisitions (M&A) are a notable trend, with companies strategically acquiring smaller, innovative firms to bolster their product portfolios and expand market reach. For instance, the acquisition of specialized pneumatic component manufacturers by larger automotive suppliers aims to integrate advanced solutions into existing supply chains. Approximately 25% of market consolidation is driven by such strategic M&A activities, while innovation barriers include the high cost of R&D for novel materials and complex manufacturing processes.

Europe Automotive Pneumatic Actuators Market Growth Trends & Insights

The Europe Automotive Pneumatic Actuators Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. This growth is underpinned by a confluence of factors including the relentless pursuit of improved vehicle performance and the ongoing electrification of the automotive industry, which, while introducing electric actuators, also necessitates advanced control systems where pneumatic elements can play a supporting role. The market size is estimated to reach XX Million units by 2033, a significant increase from XX Million units in the base year of 2025. Adoption rates for advanced pneumatic actuators are accelerating, particularly in the commercial vehicle segment, where durability and robustness are paramount. Technological disruptions are characterized by the integration of smart sensors and advanced control algorithms within pneumatic actuator systems, enabling real-time diagnostics and predictive maintenance. Consumer behavior shifts towards a demand for greater vehicle automation and enhanced safety features are indirectly driving the need for highly responsive and precise actuation systems. For example, the increasing adoption of advanced driver-assistance systems (ADAS) indirectly influences the demand for sophisticated control mechanisms within vehicle powertrains and braking systems. The penetration of pneumatic actuators in new vehicle platforms is steadily increasing, driven by their proven reliability and cost-effectiveness in specific applications, especially within the commercial vehicle segment for applications like braking and exhaust gas recirculation.

Dominant Regions, Countries, or Segments in Europe Automotive Pneumatic Actuators Market

The Europe Automotive Pneumatic Actuators Market is experiencing robust growth, with Commercial Vehicles emerging as the dominant vehicle type segment. This dominance is driven by the inherent need for high-durability, reliable, and cost-effective actuation solutions in the demanding operational environments of trucks, buses, and other heavy-duty vehicles. The Brake Actuators application type within the commercial vehicle segment holds a particularly strong position, accounting for an estimated 35% of the total market share. This is directly attributable to stringent safety regulations and the critical role of effective braking systems in preventing accidents. Key drivers for this segment's growth include economic policies that promote trade and logistics, necessitating a larger and more efficient commercial vehicle fleet. Infrastructure development across Europe further supports the increased utilization of commercial vehicles, thereby boosting the demand for related pneumatic actuator components. Market share within this segment is significantly influenced by the presence of major automotive manufacturers and tier-1 suppliers with strong R&D capabilities and established manufacturing footprints. Germany, as a leading automotive manufacturing hub, is a significant contributor to this dominance, followed by France and the UK. The growth potential in the commercial vehicle segment is further amplified by the ongoing fleet renewal programs and the increasing adoption of intelligent transportation systems, which require sophisticated control mechanisms for braking and other critical functions. The market share of Brake Actuators in commercial vehicles is projected to reach XX Million units by 2033.

Europe Automotive Pneumatic Actuators Market Product Landscape

The Europe Automotive Pneumatic Actuators Market product landscape is characterized by continuous innovation focused on enhancing performance, durability, and integration capabilities. Manufacturers are developing lighter, more compact pneumatic actuators with improved sealing technologies to withstand harsh under-hood environments. Throttle Actuators are seeing advancements in responsiveness and precision control, enabling finer management of engine performance and emissions. Fuel Injection Actuators are evolving to support higher injection pressures and more sophisticated spray patterns, crucial for optimizing fuel combustion and reducing particulate matter. Innovations also extend to improved material science, leading to actuators with enhanced resistance to thermal expansion and chemical degradation. Unique selling propositions include the inherent fail-safe nature of some pneumatic systems and their ability to deliver high force outputs with relatively simple designs. Technological advancements are enabling tighter integration with electronic control units (ECUs), leading to more sophisticated feedback loops for actuator operation.

Key Drivers, Barriers & Challenges in Europe Automotive Pneumatic Actuators Market

Key Drivers:

- Stricter Emission Standards: Regulations like Euro 7 mandate more precise engine control, driving the need for advanced pneumatic actuators in throttle and fuel injection systems.

- Commercial Vehicle Demand: The growing logistics sector and fleet renewals in Europe boost the demand for robust pneumatic actuators, particularly for braking and exhaust gas recirculation.

- Cost-Effectiveness: In many heavy-duty applications, pneumatic actuators offer a more economical solution compared to their electric or electro-hydraulic counterparts.

- Technological Advancements: Integration of smart sensors and improved control algorithms enhance the precision and diagnostic capabilities of pneumatic actuators.

Barriers & Challenges:

- Competition from Electric Actuators: The broader trend towards vehicle electrification presents a significant challenge as electric actuators offer greater precision and integration with electric powertrains.

- Complexity of Pneumatic Systems: While the actuators themselves can be simple, the overall pneumatic system, including compressors and air lines, can add complexity and weight.

- Maintenance Requirements: Pneumatic systems can require regular maintenance, including air filter replacement and leak checks, which may be less desirable for some end-users.

- Supply Chain Volatility: Global supply chain disruptions can impact the availability of raw materials and components, affecting production schedules and costs.

Emerging Opportunities in Europe Automotive Pneumatic Actuators Market

Emerging opportunities in the Europe Automotive Pneumatic Actuators Market lie in the development of hybrid actuation systems that combine the strengths of pneumatic and electric technologies. This approach could lead to optimized performance and efficiency in specific applications within both passenger and commercial vehicles. The increasing focus on sustainable manufacturing practices presents an opportunity for companies that can offer pneumatic actuators made from recycled or bio-based materials. Furthermore, the growing demand for autonomous driving features, particularly in commercial logistics, could create new niche applications for highly responsive and reliable pneumatic actuators in areas such as steering assist or advanced braking systems. Untapped markets within specific industrial automation sectors that interface with automotive supply chains also represent potential growth avenues.

Growth Accelerators in the Europe Automotive Pneumatic Actuators Market Industry

Long-term growth in the Europe Automotive Pneumatic Actuators Market is being accelerated by significant technological breakthroughs, particularly in the realm of micro-pneumatics and advanced materials science. Strategic partnerships between pneumatic actuator manufacturers and leading automotive OEMs are crucial for co-developing next-generation solutions tailored to evolving vehicle architectures. Furthermore, market expansion strategies focusing on emerging economies within Europe that are experiencing rapid automotive sector growth will be key. The continuous innovation in developing actuators with integrated diagnostic capabilities and predictive maintenance features also acts as a significant growth accelerator, enhancing product lifecycle value and customer satisfaction.

Key Players Shaping the Europe Automotive Pneumatic Actuators Market Market

- Denso Corporation

- Delphi Automotive PLC

- Robert Bosch GmbH

- Hitachi Ltd

- ASCO Valve Inc

- Continental AG

- Sahrader Ducan Limited

- Numatics Inc

- CTS Corporation

Notable Milestones in Europe Automotive Pneumatic Actuators Market Sector

- 2019: Introduction of next-generation compact pneumatic throttle actuators offering improved fuel efficiency.

- 2020: Major automotive supplier announces strategic acquisition of a specialized pneumatic valve manufacturer to enhance its braking system portfolio.

- 2021: Development of advanced pneumatic brake actuators with integrated electronic control for enhanced ABS performance.

- 2022: Launch of pneumatic actuators designed for heavy-duty commercial vehicles, featuring extended durability and reduced maintenance requirements.

- 2023: Increased investment in R&D for pneumatic systems capable of supporting advanced driver-assistance features.

- 2024: Focus on sustainable manufacturing processes and the use of recycled materials in pneumatic actuator production.

In-Depth Europe Automotive Pneumatic Actuators Market Market Outlook

The future outlook for the Europe Automotive Pneumatic Actuators Market remains positive, driven by continuous innovation and evolving industry demands. Growth accelerators, including advancements in hybrid actuation technologies and strategic collaborations with automotive giants, are set to propel the market forward. The increasing emphasis on vehicle safety and emissions reduction will continue to fuel the demand for reliable pneumatic solutions, especially within the robust Commercial Vehicle segment. Strategic opportunities lie in the integration of smart technologies and the development of sustainable manufacturing practices. The market is expected to demonstrate sustained growth, offering significant potential for stakeholders adept at adapting to technological shifts and regulatory landscapes.

Europe Automotive Pneumatic Actuators Market Segmentation

-

1. Application Type

- 1.1. Throttle Actuators

- 1.2. Fuel Injection Actuators

- 1.3. Brake Actuators

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicle

Europe Automotive Pneumatic Actuators Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

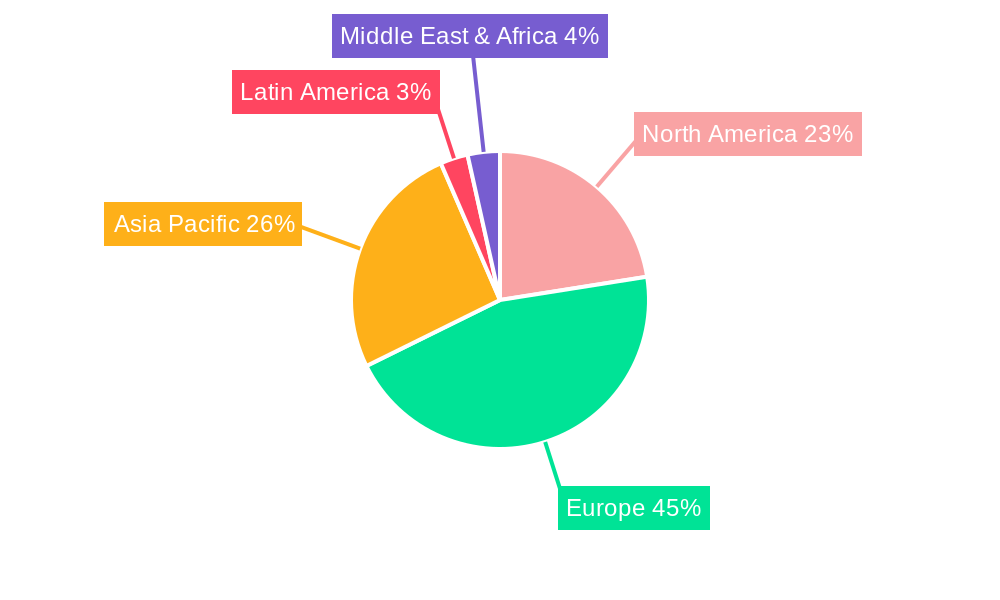

Europe Automotive Pneumatic Actuators Market Regional Market Share

Geographic Coverage of Europe Automotive Pneumatic Actuators Market

Europe Automotive Pneumatic Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Luxury Vehicle Sale Across the Country

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With the Component

- 3.4. Market Trends

- 3.4.1. Growing Demand for Throttle Actuators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Pneumatic Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Throttle Actuators

- 5.1.2. Fuel Injection Actuators

- 5.1.3. Brake Actuators

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delphi Automotive PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Roert Bosch Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ASCO Valve Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sahrader Ducan Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Numatics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CTS Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Europe Automotive Pneumatic Actuators Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Pneumatic Actuators Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Pneumatic Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 2: Europe Automotive Pneumatic Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Europe Automotive Pneumatic Actuators Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Automotive Pneumatic Actuators Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 5: Europe Automotive Pneumatic Actuators Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Pneumatic Actuators Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Automotive Pneumatic Actuators Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Pneumatic Actuators Market?

The projected CAGR is approximately 5.44%.

2. Which companies are prominent players in the Europe Automotive Pneumatic Actuators Market?

Key companies in the market include Denso Corporation, Delphi Automotive PLC, Roert Bosch Gmb, Hitachi Ltd, ASCO Valve Inc, Continental AG, Sahrader Ducan Limited, Numatics Inc, CTS Corporation.

3. What are the main segments of the Europe Automotive Pneumatic Actuators Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Luxury Vehicle Sale Across the Country.

6. What are the notable trends driving market growth?

Growing Demand for Throttle Actuators.

7. Are there any restraints impacting market growth?

High Costs Associated With the Component.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Pneumatic Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Pneumatic Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Pneumatic Actuators Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Pneumatic Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence