Key Insights

The Asia-Pacific (APAC) luxury car market is projected for significant expansion, with a Compound Annual Growth Rate (CAGR) of 4.1%. The market is estimated to reach $170.4 billion by 2024. This growth is propelled by rising disposable incomes, an expanding affluent demographic, and a strong consumer preference for premium, technologically advanced vehicles. Key growth drivers include high demand for SUVs and sedans, reflecting consumer desires for comfort, performance, and status. The growing middle class in China, India, and Southeast Asia actively aspires to luxury vehicle ownership, supported by aspirational marketing and accessible financing. The increasing adoption of electric vehicles (EVs) in the luxury segment, driven by consumer interest in sustainable high-performance mobility, is also prompting significant manufacturer investment in EV technology and infrastructure.

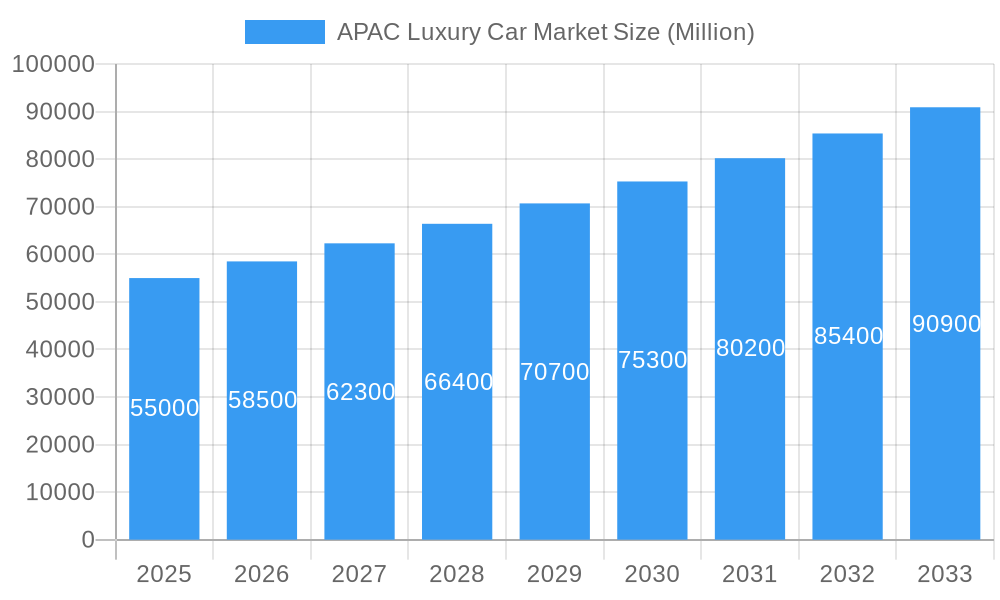

APAC Luxury Car Market Market Size (In Billion)

Potential restraints to market growth include high import duties and stringent regulations in select APAC countries, which can increase vehicle costs and limit accessibility. Fluctuating economic conditions and currency volatilities in some developing APAC economies may also affect consumer spending on discretionary items. The competitive landscape is robust, featuring established global brands like Mercedes-Benz, BMW, Audi, and Porsche, alongside emerging players and growing domestic manufacturers in China and India. Despite these challenges, the persistent demand for brand prestige, advanced features, and superior ownership experiences positions the APAC region as a vital market for luxury automotive manufacturers. Continued innovation in advanced safety features, personalized in-car experiences, and seamless connectivity will be crucial for market share acquisition and retention in this dynamic sector.

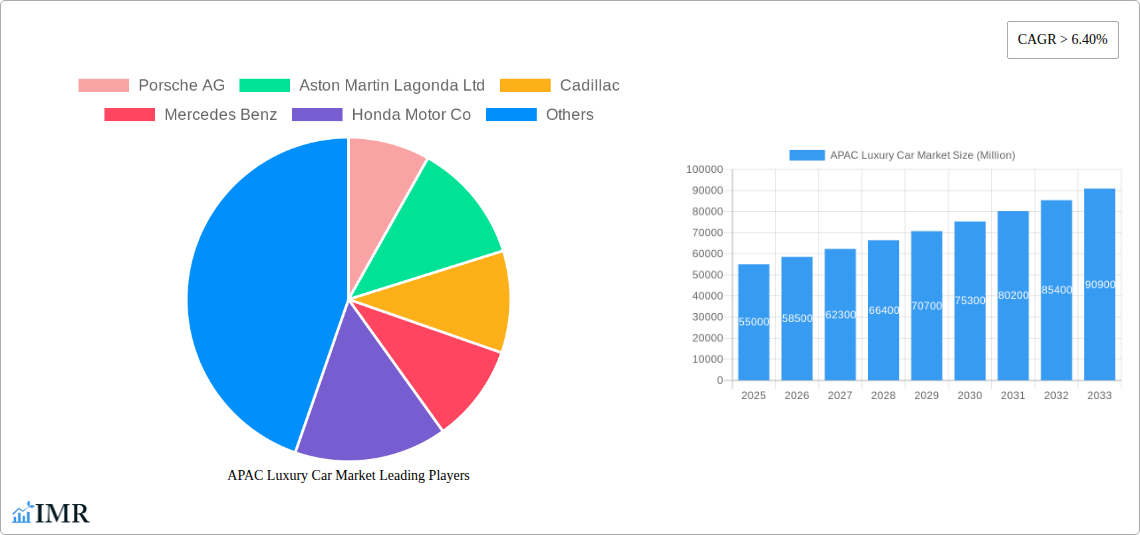

APAC Luxury Car Market Company Market Share

This report offers a comprehensive analysis of the APAC Luxury Car Market, detailing market size, growth forecasts, and key trends.

APAC Luxury Car Market: Comprehensive Market Research Report 2024-2033

Unlock deep insights into the dynamic APAC Luxury Car Market with our definitive research report. Spanning from 2019 to 2033, this report provides an in-depth analysis of market dynamics, growth trends, regional dominance, product landscape, key players, and emerging opportunities. Essential for automotive manufacturers, suppliers, investors, and industry stakeholders seeking to capitalize on the burgeoning demand for premium vehicles in Asia-Pacific.

APAC Luxury Car Market Market Dynamics & Structure

The APAC luxury car market is characterized by a moderately consolidated structure, with established global players and a growing presence of domestic premium brands. Technological innovation is a primary driver, fueled by significant R&D investments in electrification, autonomous driving, and advanced connectivity features. Regulatory frameworks, particularly concerning emissions standards and vehicle safety, are increasingly stringent, influencing product development and market entry strategies. Competitive product substitutes are emerging from performance-oriented mainstream brands and the rapid advancement of electric vehicle (EV) technology, blurring traditional luxury segment lines. End-user demographics are shifting towards a younger, tech-savvy demographic with higher disposable incomes and a preference for sustainability and personalization. Mergers and acquisitions (M&A) are observed as companies seek to expand their market reach, acquire new technologies, and enhance their competitive positioning.

- Market Concentration: Dominated by a few key global players, with increasing competition from emerging Chinese luxury brands.

- Technological Innovation Drivers: Focus on EV powertrain advancements, AI-driven infotainment, and semi-autonomous driving capabilities.

- Regulatory Frameworks: Stringent emission norms (e.g., Euro 7) and safety mandates are shaping vehicle design and manufacturing.

- Competitive Product Substitutes: High-performance EVs and feature-rich mainstream vehicles are challenging traditional luxury offerings.

- End-User Demographics: Growing demand from affluent millennials and Gen Z consumers in urban centers.

- M&A Trends: Strategic alliances and acquisitions to secure market share and access technological expertise.

APAC Luxury Car Market Growth Trends & Insights

The APAC luxury car market is poised for substantial growth, driven by robust economic expansion and a rapidly increasing affluent consumer base across key Asian economies. This growth is further accelerated by a paradigm shift in consumer preferences, with a growing inclination towards electric and hybrid luxury vehicles, reflecting a heightened awareness of environmental sustainability and technological innovation. The market size evolution is expected to witness a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period (2025-2033), reaching an estimated 4.8 million units in 2025 and projected to expand significantly by the end of the forecast period. Adoption rates for new technologies, particularly in the EV segment, are rapidly increasing, surpassing initial expectations as charging infrastructure expands and battery technology improves. Technological disruptions, including the integration of sophisticated AI-powered features, augmented reality displays, and advanced driver-assistance systems (ADAS), are redefining the luxury driving experience. Consumer behavior shifts are evident, with a greater emphasis on personalized ownership experiences, digital connectivity, and brand values that align with social and environmental consciousness. The penetration of luxury electric SUVs is particularly noteworthy, catering to the demand for both prestige and practicality.

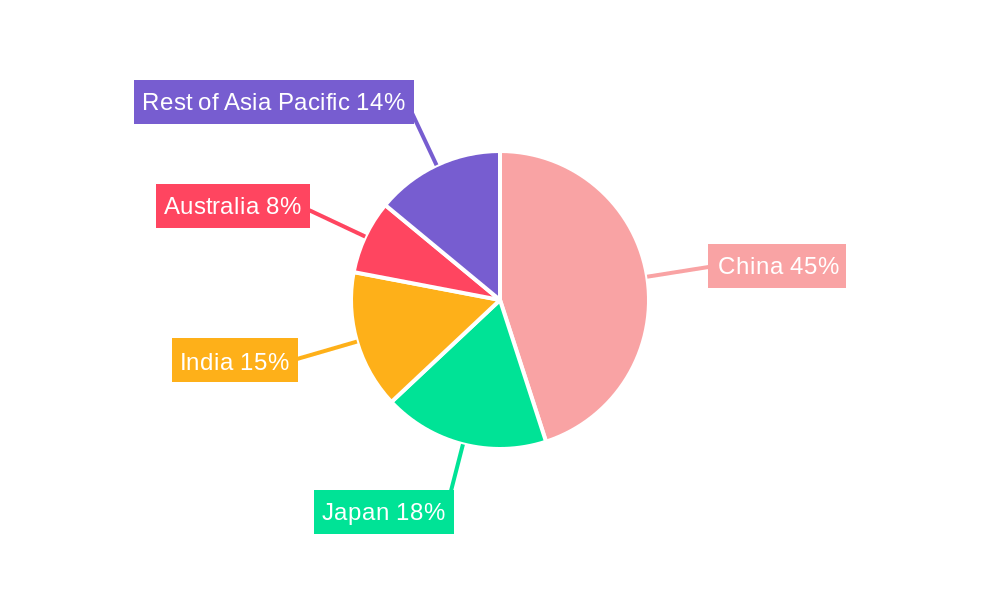

Dominant Regions, Countries, or Segments in APAC Luxury Car Market

China stands as the undisputed leader in the APAC luxury car market, driven by its colossal economy, rapidly expanding middle and upper classes, and a government actively promoting new energy vehicles. The SUV segment within China's luxury car market is particularly dominant, accounting for over 60% of luxury vehicle sales, reflecting a strong consumer preference for spacious, versatile, and technologically advanced vehicles. This dominance is further propelled by favorable government policies, including tax incentives for EVs and continued investment in charging infrastructure. The Electric drive type is experiencing exponential growth, not just in China but also across South Korea and Japan, indicating a significant shift away from traditional IC engines for luxury consumers. South Korea, with its strong domestic automotive players like Hyundai's Genesis brand and a growing appetite for premium offerings, and Japan, with its established luxury marques and a high per capita income, are also crucial growth engines. India's luxury car market, though smaller, presents significant untapped potential, with a growing affluent segment and increasing interest in premium SUVs and sedans.

- Dominant Region: China, leading in both volume and technological adoption.

- Dominant Country: China, accounting for the largest share of the APAC luxury car market.

- Dominant Vehicle Type: SUV, favored for its practicality and premium appeal.

- Dominant Drive Type: Electric, driven by environmental consciousness and government incentives.

- Key Drivers in China: Economic prosperity, expanding affluent population, strong government support for EVs, and a sophisticated consumer palate for luxury and technology.

- Growth Potential in India: Significant untapped market with a burgeoning affluent demographic.

- Market Share Analysis: China's luxury car market is estimated to hold over 65% of the total APAC market share, with SUVs contributing approximately 2.8 million units in 2025. Electric luxury vehicles in China are projected to reach 1.2 million units in 2025.

APAC Luxury Car Market Product Landscape

The product landscape of the APAC luxury car market is characterized by an intense focus on electrification, cutting-edge technology, and bespoke customization. Manufacturers are rolling out a plethora of electric luxury SUVs, sedans, and even performance-oriented hatchbacks, boasting impressive ranges, rapid charging capabilities, and advanced driver-assistance systems (ADAS). Unique selling propositions often revolve around sustainable materials, intuitive infotainment systems powered by artificial intelligence, and sophisticated connectivity solutions. Performance metrics are constantly being pushed, with acceleration times rivaling hypercars and sophisticated suspension systems offering unparalleled comfort. The integration of augmented reality (AR) navigation and personalized interior ambiances are becoming standard.

Key Drivers, Barriers & Challenges in APAC Luxury Car Market

Key Drivers:

- Economic Growth & Rising Disposable Incomes: A burgeoning affluent class in countries like China, India, and Southeast Asia is fueling demand for premium vehicles.

- Technological Advancements: Innovations in EV technology, autonomous driving, and in-car connectivity are attracting tech-savvy luxury consumers.

- Government Incentives for EVs: Favorable policies and subsidies in many APAC nations are accelerating the adoption of electric luxury cars.

- Brand Prestige & Status Symbolism: Luxury cars remain a strong indicator of success and aspiration in many APAC cultures.

- Expansion of Charging Infrastructure: Growing availability of charging stations is alleviating range anxiety for EV buyers.

Barriers & Challenges:

- High Import Duties & Taxes: In some countries, these can significantly inflate the price of luxury vehicles.

- Supply Chain Disruptions: Global chip shortages and geopolitical tensions continue to impact production volumes and delivery timelines.

- Intense Competition: A crowded market with both established global players and emerging domestic brands creates significant pressure.

- Evolving Regulatory Landscape: Adapting to diverse and often changing emission and safety standards across different APAC nations.

- Consumer Price Sensitivity: While demand is high, a segment of consumers remains price-sensitive, especially for non-essential premium purchases.

Emerging Opportunities in APAC Luxury Car Market

Emerging opportunities lie in the growing demand for ultra-luxury electric vehicles (EVs) and performance-oriented EVs in rapidly developing markets like Vietnam and Indonesia. The development of personalized in-car digital services and subscription models presents a significant revenue stream. Furthermore, the burgeoning second-hand luxury car market offers a gateway for aspirational buyers. Tailoring vehicle offerings to specific cultural preferences and investing in localized digital sales and service platforms are crucial for capturing new market segments. The demand for sustainable and ethically sourced materials in vehicle interiors also represents a growing niche.

Growth Accelerators in the APAC Luxury Car Market Industry

Several catalysts are accelerating long-term growth in the APAC luxury car market. The rapid development and widespread adoption of advanced battery technology, leading to longer ranges and faster charging for EVs, is a primary accelerator. Strategic partnerships between luxury automakers and technology firms for developing cutting-edge AI and autonomous driving systems are creating differentiated product offerings. Market expansion strategies focused on emerging economies within Southeast Asia and untapped segments in India are crucial. Furthermore, the continuous innovation in vehicle connectivity and the integration of smart mobility solutions are enhancing the ownership experience and driving brand loyalty.

Key Players Shaping the APAC Luxury Car Market Market

- Porsche AG

- Aston Martin Lagonda Ltd

- Cadillac

- Mercedes Benz

- Honda Motor Co

- Bayerische Motoren Werke AG (BMW)

- Volvo Group

- Hongqi (FAW Group)

- Jaguar Land Rover

- Tesla Inc

- The Lincoln Motor Company

- Rolls-Royce Motor Cars Limited

- Audi AG

- Nissan

- Bentley Motors

Notable Milestones in APAC Luxury Car Market Sector

- 2019: Mercedes-Benz launches the EQC, its first all-electric SUV, signaling a strong commitment to electrification in the region.

- 2020: Tesla's Shanghai Gigafactory significantly ramps up production of Model 3, impacting the luxury EV market.

- 2021: BMW introduces its iX electric SUV, expanding its premium EV portfolio in key APAC markets.

- 2022: BYD's entry into the premium EV segment with models like the Han and Tang challenges established luxury brands in China.

- 2023: Aston Martin announces plans to electrify its entire lineup by 2030, aligning with global sustainability trends.

- Early 2024: Porsche unveils the new Panamera, featuring advanced hybrid powertrains and digital innovations.

- Mid-2024: Rolls-Royce begins accepting pre-orders for its highly anticipated Spectre EV, targeting the ultra-luxury segment.

- Late 2024: Audi expands its e-tron luxury EV range with new sedan and SUV variants in response to growing demand.

In-Depth APAC Luxury Car Market Market Outlook

The APAC luxury car market is set for a sustained period of robust growth, driven by ongoing economic prosperity, a rapidly expanding affluent consumer base, and a pronounced shift towards electric and technologically advanced vehicles. The ongoing advancements in EV battery technology and charging infrastructure will continue to fuel adoption, making sustainable luxury mobility increasingly accessible. Strategic market expansion into emerging economies and a focus on personalized digital ownership experiences will be key to unlocking future potential. Companies that prioritize innovation, sustainability, and localized consumer engagement are best positioned to capitalize on the dynamic evolution of this lucrative market.

APAC Luxury Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. SUV

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric

APAC Luxury Car Market Segmentation By Geography

-

1. By Country

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Rest of Asia Pacific

APAC Luxury Car Market Regional Market Share

Geographic Coverage of APAC Luxury Car Market

APAC Luxury Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Automotive Vehicle Sales Anticipated to Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Cost Acting as Barrier for the Market

- 3.4. Market Trends

- 3.4.1. High Net Worth Individuals Expected to Be the Prominent Customers for Luxury Car

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. APAC Luxury Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. SUV

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. By Country

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Porsche AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aston Martin Lagonda Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cadillac

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mercedes Benz

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honda Motor Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bayerische Motoren Werke AG (BMW)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hongqi (FAW Group)*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jaguar Land Rover

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tesla Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Lincoln Motor Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rolls-Royce Motor Cars Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Audi AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Nissan

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Bentley Motors

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Porsche AG

List of Figures

- Figure 1: APAC Luxury Car Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: APAC Luxury Car Market Share (%) by Company 2025

List of Tables

- Table 1: APAC Luxury Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: APAC Luxury Car Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: APAC Luxury Car Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: APAC Luxury Car Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: APAC Luxury Car Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: APAC Luxury Car Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China APAC Luxury Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan APAC Luxury Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: India APAC Luxury Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Australia APAC Luxury Car Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific APAC Luxury Car Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Luxury Car Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the APAC Luxury Car Market?

Key companies in the market include Porsche AG, Aston Martin Lagonda Ltd, Cadillac, Mercedes Benz, Honda Motor Co, Bayerische Motoren Werke AG (BMW), Volvo Group, Hongqi (FAW Group)*List Not Exhaustive, Jaguar Land Rover, Tesla Inc, The Lincoln Motor Company, Rolls-Royce Motor Cars Limited, Audi AG, Nissan, Bentley Motors.

3. What are the main segments of the APAC Luxury Car Market?

The market segments include Vehicle Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 170.4 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Automotive Vehicle Sales Anticipated to Drive the Market.

6. What are the notable trends driving market growth?

High Net Worth Individuals Expected to Be the Prominent Customers for Luxury Car.

7. Are there any restraints impacting market growth?

High Initial Cost Acting as Barrier for the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Luxury Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Luxury Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Luxury Car Market?

To stay informed about further developments, trends, and reports in the APAC Luxury Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence