Key Insights

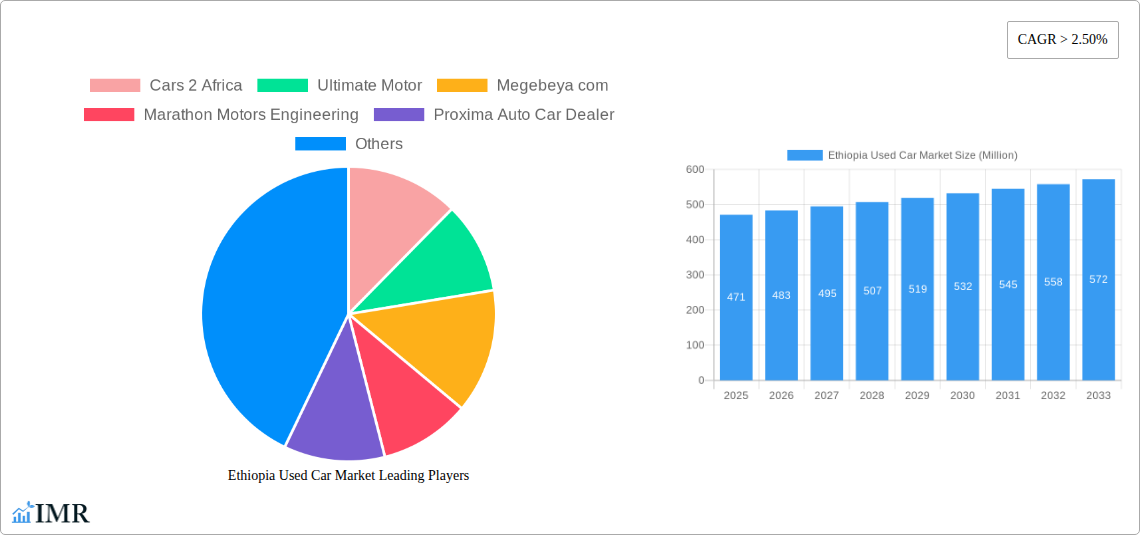

The Ethiopian used car market is poised for significant growth, projected to reach a substantial value of USD 471 million by 2025. This expansion is driven by a confluence of factors, including an increasing demand for affordable and reliable transportation solutions as the country's economy develops. A healthy CAGR exceeding 2.50% underscores the market's robust upward trajectory. Key segments contributing to this growth include Sedans and Sport Utility Vehicles (SUVs), reflecting evolving consumer preferences for both practicality and comfort. The organized vendor segment is expected to gain prominence, driven by enhanced trust, transparent pricing, and standardized quality assurance, attracting a larger customer base seeking dependable pre-owned vehicles. This shift towards organized channels will likely influence the competitive landscape, favoring dealerships that offer comprehensive services and robust warranties.

Ethiopia Used Car Market Market Size (In Million)

Further analysis reveals that the market is being shaped by burgeoning demand for fuel-efficient options, with Gasoline-powered vehicles continuing to dominate due to established infrastructure and lower initial costs. However, there's a discernible upward trend in interest towards Electric and Alternative Fuel Vehicles, albeit from a smaller base, indicating a nascent but growing awareness of sustainable mobility solutions. While the market presents ample opportunities, certain restraints such as fluctuating import duties, potential quality control challenges in the unorganized sector, and the need for improved financing options could moderate the pace of growth. Despite these challenges, the overall outlook for the Ethiopian used car market remains highly positive, supported by a growing middle class, increasing urbanization, and a persistent need for accessible personal mobility.

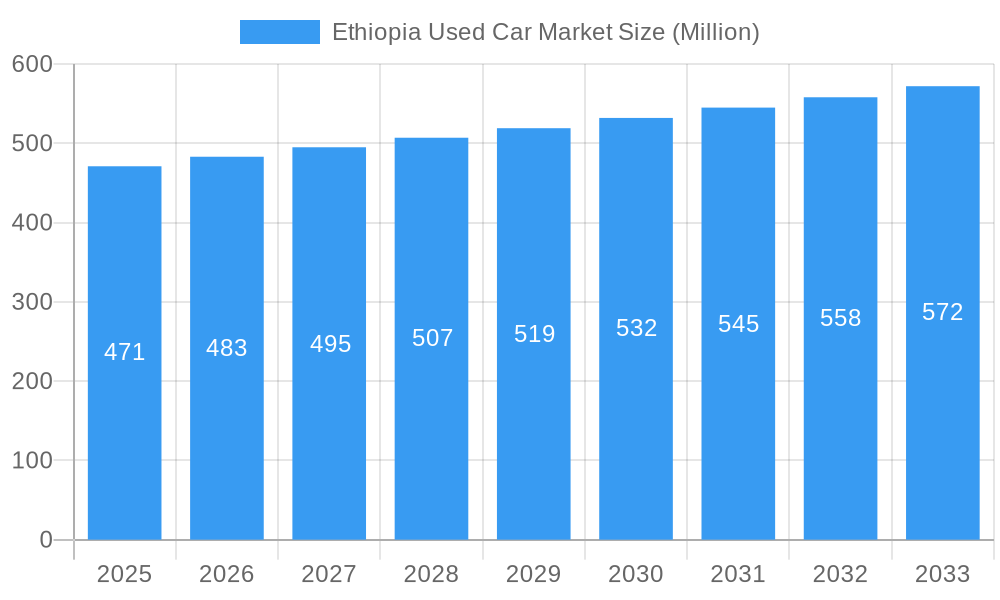

Ethiopia Used Car Market Company Market Share

This in-depth report offers a definitive analysis of the Ethiopia Used Car Market, meticulously dissecting its current landscape and forecasting its trajectory through 2033. With a focus on key market dynamics, growth trends, regional dominance, and a comprehensive product and player landscape, this study is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on this rapidly evolving sector. The report leverages high-traffic keywords such as "Ethiopia used cars," "second-hand vehicles Ethiopia," "Ethiopian automotive market," "car import Ethiopia," and "pre-owned vehicles Ethiopia" to ensure maximum search engine visibility. We delve into the parent and child market structures, providing granular insights into vehicle types, vendor categories, and fuel preferences, all presented in millions of units for clarity.

Ethiopia Used Car Market Market Dynamics & Structure

The Ethiopia Used Car Market exhibits a dynamic interplay of market concentration and fragmented vendor presence. While organized dealerships, such as Cars 2 Africa and Marathon Motors Engineering, are carving out significant niches, the unorganized sector, comprising numerous independent traders and individual sellers, still holds a substantial share. Technological innovation is emerging as a crucial driver, with online platforms like Megebeya.com facilitating wider reach and improved transaction transparency. Regulatory frameworks, particularly concerning vehicle importation and taxation, are continuously evolving, influencing market accessibility and pricing. Competitive product substitutes are primarily other used vehicles of similar age and condition, with new vehicle affordability remaining a significant barrier for a large segment of the population. End-user demographics are diverse, ranging from first-time buyers seeking economical transportation to businesses requiring fleet replacements. Merger and acquisition (M&A) activity is nascent but holds potential for consolidation, particularly among organized players aiming for economies of scale.

- Market Concentration: Moderate, with a growing influence of organized players and online platforms.

- Technological Innovation Drivers: Online marketplaces, digital payment solutions, vehicle history reporting platforms.

- Regulatory Frameworks: Evolving import duties, environmental standards, and taxation policies.

- Competitive Product Substitutes: Other used vehicles, public transportation, emerging ride-sharing services.

- End-User Demographics: Broad spectrum from budget-conscious individuals to small businesses and fleet operators.

- M&A Trends: Limited current activity, but potential for future consolidation among organized players.

Ethiopia Used Car Market Growth Trends & Insights

The Ethiopia Used Car Market is poised for substantial expansion, fueled by a confluence of economic, demographic, and policy-driven factors. The market size evolution is projected to see a steady upward trajectory as disposable incomes gradually rise and urbanization intensifies the demand for personal mobility. Adoption rates of used vehicles are expected to remain high, as affordability continues to be a primary concern for a vast majority of Ethiopian consumers. Technological disruptions, primarily in the form of online sales platforms and enhanced digital marketing strategies, are democratizing access to the market and improving buyer confidence. Consumer behavior shifts are marked by an increasing preference for reliable, well-maintained pre-owned vehicles, with a growing awareness of the total cost of ownership. The base year for this analysis is 2025, with projections extending to 2033. Historically, from 2019 to 2024, the market has demonstrated resilience, adapting to economic fluctuations. The forecast period (2025–2033) anticipates a compound annual growth rate (CAGR) of approximately 7.5%, driven by an increasing import of vehicles from international markets and a growing domestic re-sale market. Market penetration for organized used car sales is projected to increase from an estimated 30% in 2025 to over 45% by 2033. The report quantifies this growth by analyzing the net import of used cars, domestic de-registration rates, and the average resale value of vehicles across different segments.

Dominant Regions, Countries, or Segments in Ethiopia Used Car Market

Within the Ethiopia Used Car Market, the Sport Utility Vehicles (SUVs) segment is emerging as a dominant force, driven by a combination of evolving consumer preferences, improved road infrastructure in urban centers, and their perceived versatility for both personal and commercial use. Organized vendors are increasingly focusing on stocking and marketing SUVs, catering to a growing demand for vehicles that offer higher ground clearance and more passenger space. While Hatchbacks and Sedans still hold significant market share due to their affordability and fuel efficiency, the aspirational appeal and practical utility of SUVs are propelling their growth.

Dominant Vehicle Type: Sport Utility Vehicles (SUVs):

- Key Drivers: Increased urbanization, improved road conditions in major cities, perceived safety and utility, aspirational purchasing power.

- Market Share Potential: Projected to capture over 35% of the used car market by 2033.

- Growth Potential: High, driven by a burgeoning middle class seeking multi-purpose vehicles.

Vendor Type: Organized Vendors:

- Key Drivers: Growing trust in professional sales processes, availability of financing options, warranties, and certified pre-owned programs.

- Market Share Potential: Expected to increase their share from 30% in 2025 to 45% by 2033.

- Growth Potential: Significant, as they professionalize the used car buying experience. Companies like Marathon Motors Engineering are leading this shift.

Fuel Type: Gasoline:

- Key Drivers: Availability and cost of gasoline, established refueling infrastructure, lower upfront cost compared to some diesel models.

- Market Share Potential: Will likely remain dominant, accounting for an estimated 70% of the market.

- Growth Potential: Stable, with a gradual increase as more fuel-efficient gasoline models become available in the used market.

The dominance of SUVs is further amplified by the growth of organized vendors who can offer a wider selection and better assurances for these vehicles. While Addis Ababa remains the primary hub for used car transactions, secondary cities are also witnessing increased activity, driven by regional economic development and improved transportation networks. The increasing availability of financing options, often facilitated by institutions partnering with dealerships like Cars 2 Africa, also contributes to the growing accessibility of mid-to-high-end used vehicles, including SUVs.

Ethiopia Used Car Market Product Landscape

The Ethiopia Used Car Market product landscape is characterized by a wide array of vehicles catering to diverse budget constraints and functional needs. Hatchbacks and Sedans, often older models, form the backbone of the affordable transportation segment, prioritizing fuel economy and maneuverability for urban commutes. Sport Utility Vehicles (SUVs) are increasingly sought after for their blend of passenger capacity, cargo space, and perceived ruggedness, with popular models from Japanese and European manufacturers dominating. Multi-Purpose Vehicles (MUVs) serve families and commercial operators requiring maximum seating and utility. The market primarily consists of gasoline-powered vehicles, reflecting global supply trends, though diesel options remain relevant for their torque and efficiency in certain applications. Emerging alternative fuel vehicles, including nascent electric vehicle (EV) imports, are currently niche but represent a future growth frontier. While specific performance metrics are highly dependent on individual vehicle condition, the overall trend indicates a growing demand for well-maintained, reliable pre-owned vehicles with documented service histories. Unique selling propositions in this market revolve around affordability, immediate availability, and the potential for significant cost savings compared to new vehicle purchases.

Key Drivers, Barriers & Challenges in Ethiopia Used Car Market

Key Drivers: The Ethiopia Used Car Market is propelled by a fundamental driver: affordability. For a substantial portion of the Ethiopian population, purchasing a new vehicle is financially prohibitive, making used cars the primary mode of personal transportation. The growing urbanization and increasing need for mobility in cities like Addis Ababa further fuel demand. Government incentives, such as the duty-free import of vehicles announced in May 2023, play a crucial role in moderating import costs, thereby influencing the availability and pricing of used cars. The expansion of financing options by companies and financial institutions is also a significant catalyst, enabling more individuals to access pre-owned vehicles.

Barriers & Challenges: One of the most significant barriers is limited access to quality pre-owned vehicles. The supply chain can be inconsistent, and a lack of stringent inspection standards can lead to the sale of vehicles with underlying mechanical issues. Regulatory hurdles related to vehicle import procedures, inspections, and licensing can be complex and time-consuming. Lack of robust financing infrastructure for the used car market, although improving, still presents a challenge for many potential buyers. Trust and transparency remain concerns, with a prevalence of informal sales channels where vehicle history and condition might not be accurately disclosed. Supply chain disruptions, both domestic and international, can also impact the availability and pricing of desirable used car models.

Emerging Opportunities in Ethiopia Used Car Market

Emerging opportunities within the Ethiopia Used Car Market lie in the professionalization of the used car sales process. The growing demand for transparency and reliability presents a significant opportunity for organized players like Proxima Auto Car Dealer and Ultimate Motor to expand their footprint. Developing specialized online platforms that offer comprehensive vehicle history reports, secure payment gateways, and virtual showrooms can attract a wider customer base. Furthermore, the nascent interest in alternative fuel vehicles, particularly electric and hybrid used cars, offers a future growth avenue as infrastructure and consumer awareness gradually increase. The importation of specific vehicle categories that are in high demand, such as fuel-efficient sedans and reliable SUVs, from markets with surplus supply also presents a lucrative opportunity for import-focused businesses.

Growth Accelerators in the Ethiopia Used Car Market Industry

Several catalysts are accelerating growth in the Ethiopia Used Car Market Industry. The ongoing expansion of financial services, including partnerships between dealerships and loan providers, is making vehicle ownership more accessible. Government initiatives, such as the investment incentives for duty-free vehicle imports, directly reduce the cost of acquiring vehicles for resale, thereby boosting the market. The increasing adoption of digital technologies by dealerships for marketing, sales, and customer service is enhancing efficiency and reach. Furthermore, the growing preference for SUVs and multi-purpose vehicles reflects evolving lifestyle needs and a rising aspirational consumer base, creating sustained demand for these segments in the used car market.

Key Players Shaping the Ethiopia Used Car Market Market

- Cars 2 Africa

- Ultimate Motor

- Megebeya.com

- Marathon Motors Engineering

- Proxima Auto Car Dealer

- Nyala Motors

- ALEM INTERNATIONAL PL

Notable Milestones in Ethiopia Used Car Market Sector

- July 2023: Volkswagen AG announced the expansion of its operations in Ethiopia, seeking financial partners to offer loan and finance options for both new and used vehicles, indicating a strategic interest in the broader Ethiopian automotive ecosystem.

- May 2023: The Ministry of Finance of Ethiopia announced the adoption of new investment incentives for the duty-free import of vehicles, a move aimed at making vehicle acquisition more affordable and potentially boosting the supply of used cars available for sale.

In-Depth Ethiopia Used Car Market Market Outlook

The Ethiopia Used Car Market is projected for sustained growth, with future market potential significantly augmented by ongoing economic development and evolving consumer needs. The strategic investments and policy reforms highlighted, such as duty-free import incentives and the potential for expanded financing options by major automotive players, are set to act as powerful growth accelerators. Opportunities for market players lie in professionalizing the sales experience, leveraging digital platforms for wider reach and transparency, and catering to the increasing demand for versatile vehicles like SUVs. The industry is moving towards a more structured and trustworthy environment, creating a fertile ground for both local and international stakeholders to capitalize on the burgeoning demand for pre-owned vehicles in Ethiopia.

Ethiopia Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Alternative Fuel Vehicles

Ethiopia Used Car Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Used Car Market Regional Market Share

Geographic Coverage of Ethiopia Used Car Market

Ethiopia Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand For Used Cars Compared To New Cars

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Online Infrastructure witnessing major growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Alternative Fuel Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cars 2 Africa

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ultimate Motor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Megebeya com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marathon Motors Engineering

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Proxima Auto Car Dealer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nyala Motors

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALEM INTERNATIONAL PL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Cars 2 Africa

List of Figures

- Figure 1: Ethiopia Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Ethiopia Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Ethiopia Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Ethiopia Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Ethiopia Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Ethiopia Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Ethiopia Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Ethiopia Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Ethiopia Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Ethiopia Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Used Car Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Ethiopia Used Car Market?

Key companies in the market include Cars 2 Africa, Ultimate Motor, Megebeya com, Marathon Motors Engineering, Proxima Auto Car Dealer, Nyala Motors, ALEM INTERNATIONAL PL.

3. What are the main segments of the Ethiopia Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 471 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand For Used Cars Compared To New Cars.

6. What are the notable trends driving market growth?

Online Infrastructure witnessing major growth.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

July 2023: Volkswagen AG announced the expansion of its operations in Ethiopia. The company is looking for a financial partner that provides loan and finance options to buy new and used vehicles in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Used Car Market?

To stay informed about further developments, trends, and reports in the Ethiopia Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence