Key Insights

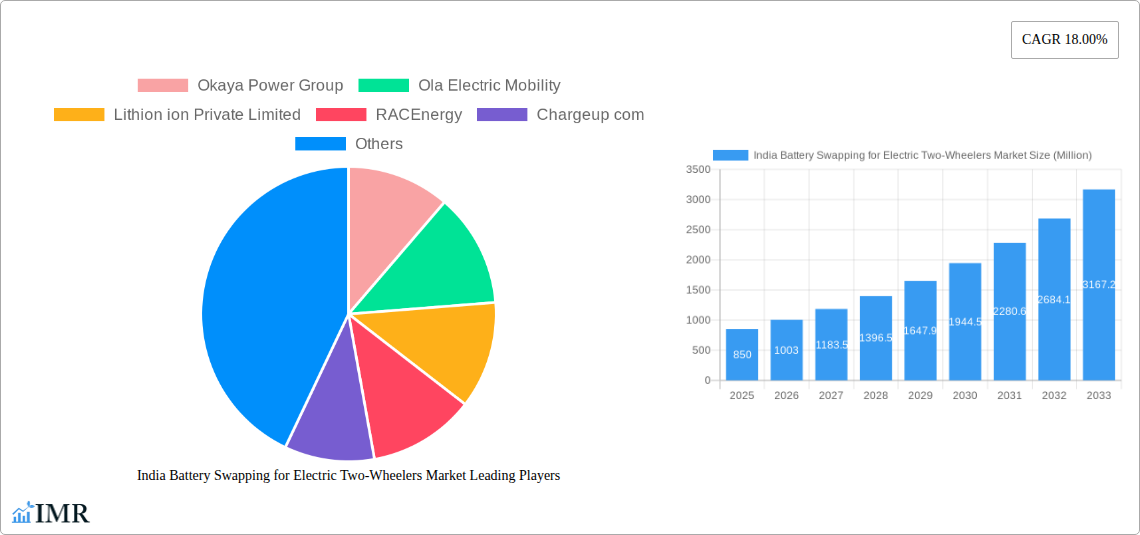

The Indian market for battery swapping in electric two-wheelers is poised for exceptional growth, projected to reach a substantial market size within the forecast period, driven by an impressive CAGR of 18.00%. This rapid expansion is fueled by several critical factors, including government initiatives promoting electric vehicle adoption, such as subsidies and favorable policies aimed at accelerating EV deployment. The increasing cost of petrol, coupled with growing environmental consciousness among consumers, is also significantly boosting the demand for electric two-wheelers, consequently driving the need for efficient and convenient battery swapping solutions. Furthermore, the growing network of battery swapping stations, supported by key players like Okaya Power Group, Ola Electric Mobility, and Sun Mobility, is enhancing the accessibility and practicality of electric mobility, addressing range anxiety and reducing charging downtime. The prevalence of the Pay-Per-Use Model and the Subscription Model are catering to diverse consumer needs and affordability, making electric two-wheelers a more attractive proposition.

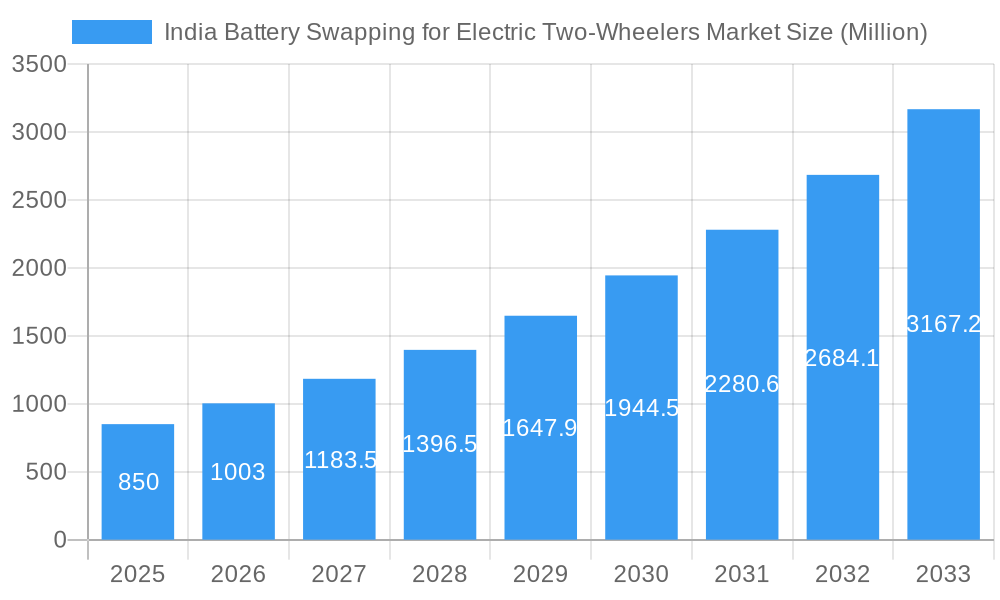

India Battery Swapping for Electric Two-Wheelers Market Market Size (In Million)

The market is primarily segmented by battery type, with Lead-Acid batteries still holding a presence due to their cost-effectiveness, but the rapid advancement and adoption of Lithium-ion batteries are clearly defining the future trajectory of this market due to their superior energy density, longer lifespan, and faster charging capabilities. Major players are heavily investing in research and development to enhance battery technology and expand their infrastructure. While the market enjoys robust growth, potential restraints include the initial capital investment required for setting up swapping infrastructure and the need for standardization in battery technology and charging protocols to ensure interoperability. However, with the strong underlying demand, supportive government policies, and continuous innovation from established and emerging companies like Lithion ion Private Limited and RACEnergy, the India battery swapping for electric two-wheelers market is expected to witness sustained high growth and widespread adoption, transforming the urban mobility landscape.

India Battery Swapping for Electric Two-Wheelers Market Company Market Share

India Battery Swapping for Electric Two-Wheelers Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock the burgeoning potential of India's electric two-wheeler revolution with our in-depth report on the India Battery Swapping for Electric Two-Wheelers Market. This comprehensive study offers critical insights into market dynamics, growth trends, key players, and future projections, making it an indispensable resource for stakeholders seeking to capitalize on this rapidly expanding sector. Our analysis covers the period from 2019 to 2033, with a base year of 2025, providing a granular understanding of historical performance, current market scenarios, and future growth trajectories. We meticulously examine market concentration, technological innovation drivers, the influence of regulatory frameworks, the competitive landscape of product substitutes, evolving end-user demographics, and crucial Mergers & Acquisitions (M&A) trends.

India Battery Swapping for Electric Two-Wheelers Market Market Dynamics & Structure

The India Battery Swapping for Electric Two-Wheelers Market is characterized by a dynamic and evolving structure, influenced by intense competition and rapid technological advancements. Market concentration is gradually shifting as new entrants and established players vie for market dominance. Key drivers of technological innovation include the constant pursuit of enhanced battery efficiency, faster swapping times, and the development of robust and scalable infrastructure. The regulatory framework, while still maturing, plays a pivotal role in shaping market growth through government incentives and policy support for electric mobility. Competitive product substitutes, primarily traditional internal combustion engine (ICE) vehicles and standalone charging solutions, present a continuous challenge, necessitating a focus on the cost-effectiveness and convenience of battery swapping. End-user demographics are predominantly urban and semi-urban, comprising individuals and businesses seeking cost-efficient and time-saving mobility solutions. M&A trends indicate a consolidation phase, with larger players acquiring smaller, innovative startups to expand their network and technological capabilities.

- Market Concentration: Fragmented with increasing consolidation, leading players are investing heavily in network expansion.

- Technological Innovation Drivers: Focus on faster charging, longer battery life, AI-powered station management, and interoperability standards.

- Regulatory Frameworks: Government incentives like FAME-II, PLI schemes, and state-level EV policies are boosting adoption and infrastructure development.

- Competitive Product Substitutes: While ICE vehicles remain a threat, the superior convenience of battery swapping is a key differentiator against traditional EV charging.

- End-User Demographics: Growing adoption by delivery fleets, ride-sharing services, and individual commuters in Tier 1 and Tier 2 cities.

- M&A Trends: Strategic partnerships and acquisitions by established energy companies and EV manufacturers to gain market share and technological prowess.

India Battery Swapping for Electric Two-Wheelers Market Growth Trends & Insights

The India Battery Swapping for Electric Two-Wheelers Market is poised for exponential growth, driven by a confluence of favorable market trends and increasing consumer adoption. The market size is projected to witness a significant CAGR during the forecast period, fueled by the escalating demand for sustainable and cost-effective transportation solutions. Adoption rates are accelerating, particularly among last-mile delivery services and daily commuters, who benefit immensely from the reduced downtime and enhanced convenience offered by battery swapping. Technological disruptions are continually redefining the market landscape, with advancements in battery technology, smart grid integration, and IoT-enabled management systems enhancing efficiency and user experience. Consumer behavior is shifting towards electric mobility, with a growing awareness of environmental benefits and the long-term cost savings associated with EVs. The convenience of swapping batteries in minutes, eliminating lengthy charging waits, is a primary catalyst for this behavioral shift, positioning battery swapping as a critical enabler for mass EV adoption.

- Market Size Evolution: Projected to grow from approximately 0.5 Million units in 2024 to over 15 Million units by 2033.

- Adoption Rates: Driven by increasing electric two-wheeler sales and the demand for uninterrupted operations, especially for commercial fleets.

- Technological Disruptions: Introduction of swappable battery standards, advanced battery management systems (BMS), and integrated payment solutions.

- Consumer Behavior Shifts: Growing preference for convenience, lower operating costs, and reduced range anxiety, making battery swapping a preferred option.

- CAGR Projection: Estimated to be in the range of 45-55% during the forecast period (2025-2033).

- Market Penetration: Expected to reach over 30% of the electric two-wheeler market by 2033.

Dominant Regions, Countries, or Segments in India Battery Swapping for Electric Two-Wheelers Market

The dominance in the India Battery Swapping for Electric Two-Wheelers Market is primarily observed in specific segments and regions, driven by a combination of economic policies, infrastructure development, and user demand. The Pay-Per-Use Model for service type is currently the dominant segment, offering flexibility and affordability to a wide range of users, especially commercial riders. This model's accessibility significantly contributes to wider adoption. In terms of battery type, Lithium-ion batteries are overwhelmingly leading the market due to their higher energy density, longer lifespan, and faster charging capabilities compared to Lead Acid batteries.

Geographically, Southern and Western India, particularly states like Maharashtra, Karnataka, and Tamil Nadu, are emerging as the dominant regions. This dominance is attributable to several factors:

- Strong EV Adoption: These regions have witnessed higher adoption rates of electric two-wheelers, fueled by proactive state government policies and incentives.

- Developed Infrastructure: Existing urban infrastructure and a higher density of commercial EV users, such as delivery personnel, create a robust demand for battery swapping stations.

- Economic Policies: Favorable industrial policies and investment promotion schemes encourage the establishment of manufacturing and service hubs for EVs and their components, including batteries.

- Market Share: These regions account for an estimated 60-70% of the current battery swapping infrastructure and service utilization.

- Growth Potential: With a growing number of EV manufacturers and fleet operators expanding their presence, these regions are expected to maintain their leadership position.

India Battery Swapping for Electric Two-Wheelers Market Product Landscape

The product landscape of the India Battery Swapping for Electric Two-Wheelers Market is characterized by innovative solutions focused on user convenience and operational efficiency. Companies are developing standardized, modular battery packs that can be quickly and safely swapped at dedicated stations. These battery packs are designed with advanced Battery Management Systems (BMS) that monitor health, optimize performance, and ensure safety. The swapping stations themselves are becoming increasingly sophisticated, incorporating automated mechanisms for battery exchange and robust software for network management, billing, and user authentication. Unique selling propositions revolve around achieving near-instantaneous refueling, effectively eliminating range anxiety and downtime for riders, particularly those in commercial operations. Technological advancements are also focused on interoperability between different battery providers and EV models, aiming to create a seamless ecosystem for users.

Key Drivers, Barriers & Challenges in India Battery Swapping for Electric Two-Wheelers Market

Key Drivers:

The India Battery Swapping for Electric Two-Wheelers Market is propelled by several significant drivers. Government initiatives, including subsidies and favorable policies under schemes like FAME-II, are crucial in reducing the upfront cost of electric two-wheelers and encouraging the development of battery swapping infrastructure. The increasing operational efficiency and cost savings for commercial fleets, such as delivery services, is a major adoption driver. Furthermore, the growing environmental consciousness among consumers and the rising fuel prices for internal combustion engine vehicles are contributing to the shift towards electric mobility and battery swapping solutions. The convenience of rapid battery exchange, significantly reducing downtime compared to traditional charging, is a key attraction for users.

Barriers & Challenges:

Despite the positive momentum, the market faces several barriers and challenges. The high initial cost of setting up a widespread battery swapping network, including the manufacturing and deployment of battery packs and stations, remains a significant hurdle. Standardization of battery pack designs and swapping mechanisms across different manufacturers is crucial for interoperability but is still an evolving aspect. Regulatory clarity and consistency across different states are essential for sustained growth. Supply chain disruptions and the availability of critical raw materials for battery manufacturing can impact production volumes and costs. Moreover, consumer perception and trust in the reliability and safety of battery swapping technology need to be continuously built and reinforced.

Emerging Opportunities in India Battery Swapping for Electric Two-Wheelers Market

Emerging opportunities in the India Battery Swapping for Electric Two-Wheelers Market are abundant, driven by innovative business models and expanding applications. The integration of IoT and AI for predictive maintenance of batteries and optimization of station placement presents significant opportunities for enhanced efficiency. Expansion into unexplored Tier 2 and Tier 3 cities, where electric mobility infrastructure is less developed, offers a vast untapped market. Partnerships with e-commerce and logistics companies to electrify their last-mile delivery fleets are a key growth avenue. Furthermore, exploring battery-as-a-service models that bundle battery usage, swapping, and maintenance into a single subscription can attract a broader user base and provide recurring revenue streams. The development of smart battery swapping stations integrated with renewable energy sources and grid management systems also presents a promising avenue for sustainable growth.

Growth Accelerators in the India Battery Swapping for Electric Two-Wheelers Market Industry

Several key growth accelerators are set to propel the India Battery Swapping for Electric Two-Wheelers Market forward. Strategic partnerships between battery swapping providers, EV manufacturers, and fleet operators are crucial for rapid network expansion and customer acquisition. Technological breakthroughs in battery chemistry, leading to higher energy density and longer battery life, will further enhance the appeal of electric two-wheelers and battery swapping services. Government support in the form of extended incentives and clear policy guidelines for battery swapping infrastructure will play a vital role in accelerating deployment. Market expansion into untapped rural and semi-urban areas, coupled with localized solutions tailored to specific user needs, will unlock significant growth potential. The increasing focus on circular economy principles, including battery recycling and second-life applications, will also contribute to sustainable market development.

Key Players Shaping the India Battery Swapping for Electric Two-Wheelers Market Market

- Okaya Power Group

- Ola Electric Mobility

- Lithion ion Private Limited

- RACEnergy

- Chargeup com

- Voltup in

- Sun Mobility Private Limited

- Numocity Technologies

- Upgrid solutions Private Limited (Battery Smart)

- Twenty Two Motors Private Limited (Bounce Infinity)

- Esmito Solutions Pvt Ltd

- Gogoro

Notable Milestones in India Battery Swapping for Electric Two-Wheelers Market Sector

- November 2022: Taiwan-based battery-swapping ecosystem leader, Gogoro, announced a B2B partnership with India's EV-as-a-Service platform Zypp Electric to begin its battery-swapping pilot service in the country. Both companies plan to accelerate the shift of last-mile deliveries to electric using battery swapping.

- September 2022: Battery-swapping startup VoltUp announced a partnership on Wednesday with Adani Electricity, Hero Electric, and Zomato to open 500 electric mobility stations across Mumbai by 2024, catering to over 30,000 riders daily. This is the first smart mobility partnership in India between a battery-swapping startup and infrastructure, original equipment manufacturers, and last-mile partners.

- June 2022: New Delhi-based EV solutions provider SUN Mobility announced the expansion of its battery-swapping network to Maharashtra as part of its partnership with Amazon India. The first set of battery-swapping stations in the state was set up at Amazon facilities in Mumbai and Pune, respectively. The company aims to locate over 2,000 battery-swapping units across Maharashtra by 2025.

In-Depth India Battery Swapping for Electric Two-Wheelers Market Market Outlook

The India Battery Swapping for Electric Two-Wheelers Market is on a robust growth trajectory, presenting significant future potential and strategic opportunities. Growth accelerators such as increasing government support, technological advancements in battery performance, and strategic collaborations between key industry players will continue to fuel market expansion. The expanding ecosystem of EV manufacturers and service providers adopting battery swapping solutions, coupled with evolving consumer preferences for convenient and cost-effective mobility, will further solidify its position. Untapped markets in Tier 2 and Tier 3 cities, along with the integration of renewable energy sources for charging battery banks, offer substantial avenues for innovation and market penetration. The sustained focus on creating a seamless and interoperable battery swapping network will be critical in realizing the full potential of electric two-wheeler adoption in India.

India Battery Swapping for Electric Two-Wheelers Market Segmentation

-

1. Service Type

- 1.1. Pay-Per-Use Model

- 1.2. Subscription Model

-

2. Battery Type

- 2.1. Lead Acid

- 2.2. Lithium-ion

India Battery Swapping for Electric Two-Wheelers Market Segmentation By Geography

- 1. India

India Battery Swapping for Electric Two-Wheelers Market Regional Market Share

Geographic Coverage of India Battery Swapping for Electric Two-Wheelers Market

India Battery Swapping for Electric Two-Wheelers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Rising Focus of Manufacturers on Improving Lithium Ion Batteries Expect to Enhance Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Battery Swapping for Electric Two-Wheelers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pay-Per-Use Model

- 5.1.2. Subscription Model

- 5.2. Market Analysis, Insights and Forecast - by Battery Type

- 5.2.1. Lead Acid

- 5.2.2. Lithium-ion

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Okaya Power Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ola Electric Mobility

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lithion ion Private Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 RACEnergy

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chargeup com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Voltup in

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sun Mobility Private Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Numocity Technologies

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Upgrid solutions Private Limited (Battery Smart)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Twenty Two Motors Private Limited (Bounce Infinity

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Esmito Solutions Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Okaya Power Group

List of Figures

- Figure 1: India Battery Swapping for Electric Two-Wheelers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Battery Swapping for Electric Two-Wheelers Market Share (%) by Company 2025

List of Tables

- Table 1: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 2: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 3: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Service Type 2020 & 2033

- Table 5: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 6: India Battery Swapping for Electric Two-Wheelers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Battery Swapping for Electric Two-Wheelers Market?

The projected CAGR is approximately 22.7%.

2. Which companies are prominent players in the India Battery Swapping for Electric Two-Wheelers Market?

Key companies in the market include Okaya Power Group, Ola Electric Mobility, Lithion ion Private Limited, RACEnergy, Chargeup com, Voltup in, Sun Mobility Private Limited, Numocity Technologies, Upgrid solutions Private Limited (Battery Smart), Twenty Two Motors Private Limited (Bounce Infinity, Esmito Solutions Pvt Ltd.

3. What are the main segments of the India Battery Swapping for Electric Two-Wheelers Market?

The market segments include Service Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Rising Focus of Manufacturers on Improving Lithium Ion Batteries Expect to Enhance Demand.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

November 2022: Taiwan-based battery-swapping ecosystem leader, Gogoro, announced a B2B partnership with India's EV-as-a-Service platform Zypp Electric to begin its battery-swapping pilot service in the country. Both companies plan to accelerate the shift of last-mile deliveries to electric using battery swapping.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Battery Swapping for Electric Two-Wheelers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Battery Swapping for Electric Two-Wheelers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Battery Swapping for Electric Two-Wheelers Market?

To stay informed about further developments, trends, and reports in the India Battery Swapping for Electric Two-Wheelers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence