Key Insights

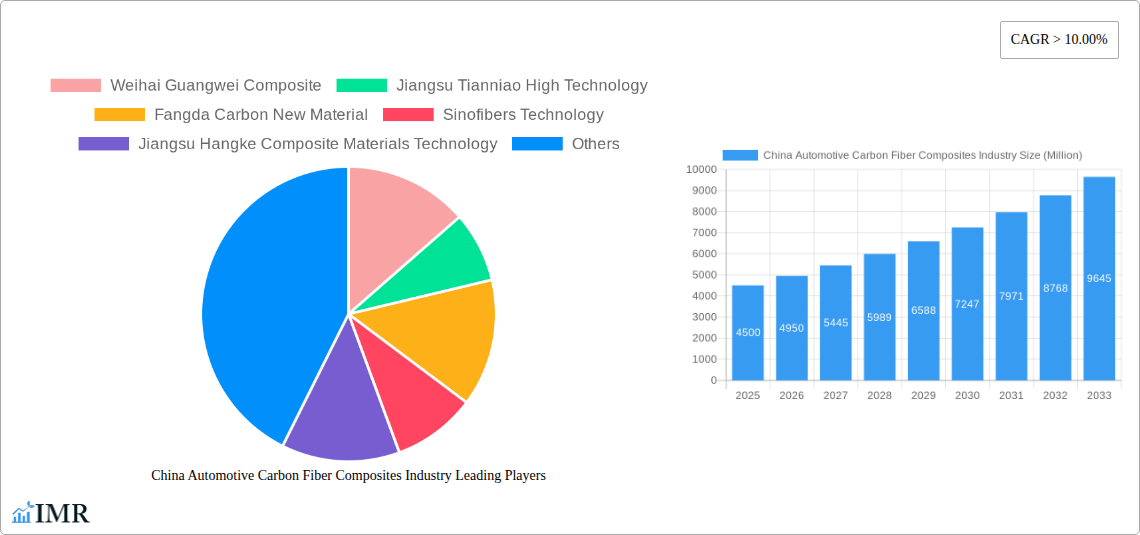

The China Automotive Carbon Fiber Composites Market is projected for substantial growth, with a current market size of $4.5 billion. This sector is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 14.5% from a base year of 2025 through 2033. Key growth drivers include the automotive industry's escalating demand for lightweight materials to improve fuel efficiency and performance, alongside increasingly stringent environmental regulations mandating lower emissions. Advancements in manufacturing techniques such as Resin Transfer Molding and Vacuum Infusion Processing are enhancing the cost-effectiveness and scalability of carbon fiber composites for mass production, accelerating their adoption. The exceptional strength-to-weight ratio of carbon fiber composites positions them as ideal for critical automotive components, including structural assemblies and powertrain elements, where weight reduction directly benefits vehicle dynamics and environmental sustainability.

China Automotive Carbon Fiber Composites Industry Market Size (In Billion)

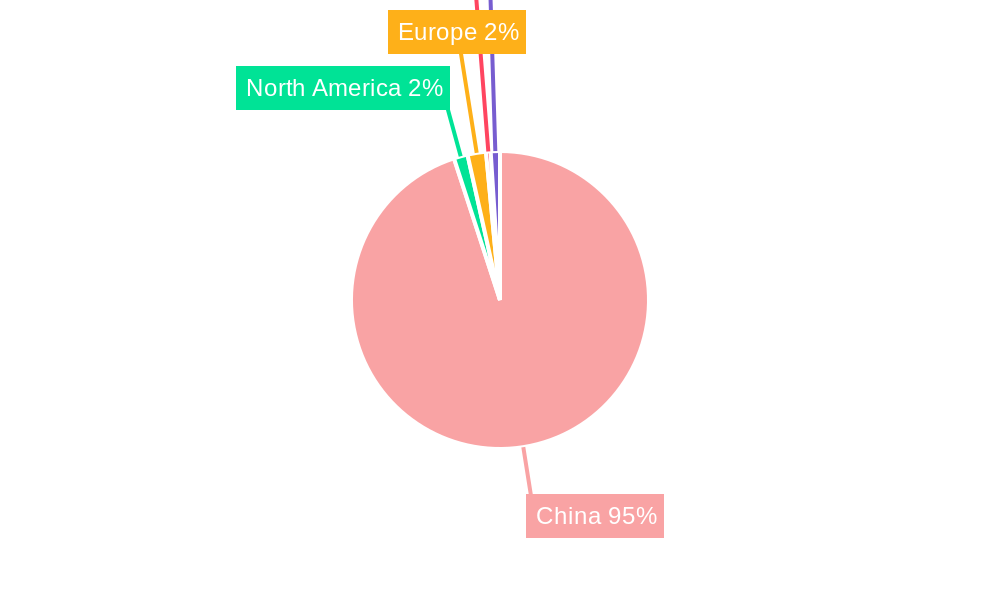

Emerging trends highlight an increased adoption of carbon fiber composites in both interior and exterior automotive applications, expanding beyond their traditional structural roles. This includes components like body panels, chassis elements, and interior trims, contributing to both aesthetic appeal and overall vehicle lightweighting. However, the market faces challenges, primarily the high initial costs associated with raw materials and manufacturing processes when compared to conventional metals. Continuous innovation in material science and production efficiency is vital to address these cost barriers. Despite these hurdles, the strategic imperative of lightweighting to meet future automotive standards and ongoing investments from key industry players are expected to propel the China Automotive Carbon Fiber Composites Market to significant new levels. The market is primarily concentrated in China, with domestic enterprises leading production and consumption.

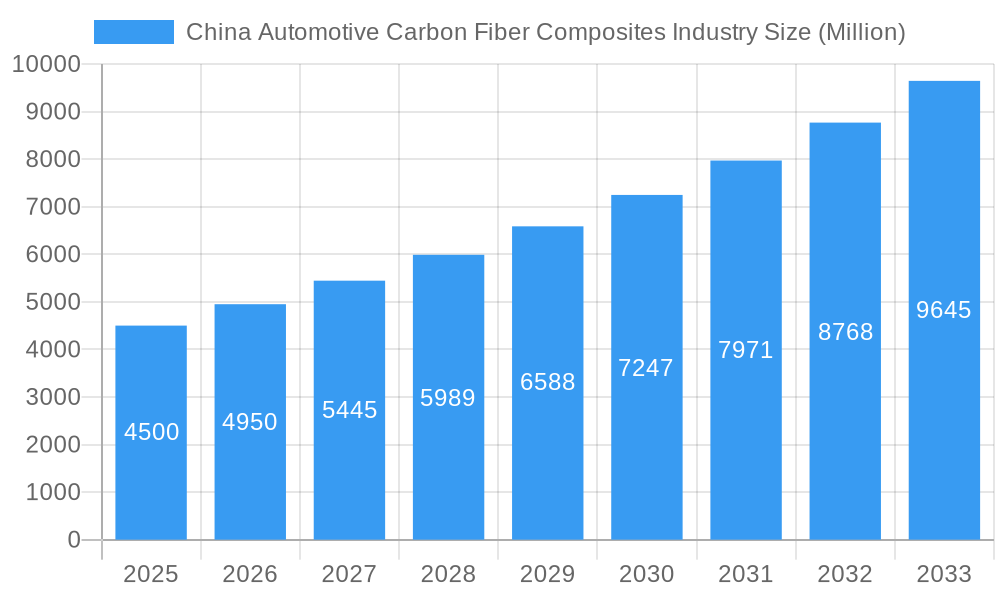

China Automotive Carbon Fiber Composites Industry Company Market Share

China Automotive Carbon Fiber Composites Industry: Forecast to 2033 | Market Size, Growth, Key Players & Trends

This comprehensive report provides an in-depth analysis of the China Automotive Carbon Fiber Composites Industry, offering critical insights into market dynamics, growth trajectories, and future opportunities. Covering the Study Period: 2019–2033, with Base Year: 2025, Estimated Year: 2025, and Forecast Period: 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the burgeoning demand for advanced composite materials in the Chinese automotive sector. Delve into parent and child market analyses, production types, and application segments to gain a granular understanding of this rapidly evolving industry. All quantitative values are presented in Million units.

China Automotive Carbon Fiber Composites Industry Market Dynamics & Structure

The China automotive carbon fiber composites market exhibits a XX% market concentration, driven by significant technological innovation and evolving regulatory frameworks aimed at promoting lightweight vehicles for enhanced fuel efficiency and reduced emissions. Key drivers of technological innovation include advancements in carbon fiber manufacturing processes, leading to cost reductions and improved material properties, and sophisticated composite manufacturing techniques such as Resin Transfer Molding (RTM) and Vacuum Infusion Processing. While the industry is experiencing robust growth, innovation barriers persist, including the high initial capital investment for advanced manufacturing facilities and the need for skilled labor.

Competitive product substitutes, primarily traditional materials like steel and aluminum alloys, are increasingly challenged by the superior strength-to-weight ratio of carbon fiber composites, particularly for structural applications. End-user demographics are shifting towards a greater demand for premium, performance-oriented vehicles, where lightweighting and advanced materials are highly valued. The M&A trend in this sector is characterized by strategic acquisitions aimed at consolidating market share and acquiring specialized technological capabilities. In the Historical Period (2019-2024), there were approximately XX M&A deal volumes in the Chinese automotive carbon fiber composites industry.

- Technological Innovation: Focus on cost reduction in carbon fiber production and development of faster, more efficient composite manufacturing methods.

- Regulatory Frameworks: Government incentives for electric vehicles and lightweighting initiatives, boosting demand for advanced materials.

- Competitive Landscape: Increasing substitution of traditional metals by carbon fiber composites in high-performance vehicles.

- End-User Demographics: Growing consumer preference for lightweight, fuel-efficient, and performance-driven vehicles.

- M&A Activity: Strategic consolidation to gain market share and access to advanced technologies.

China Automotive Carbon Fiber Composites Industry Growth Trends & Insights

The China automotive carbon fiber composites industry is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fundamentally driven by an escalating adoption rate of lightweight materials across various vehicle segments, propelled by stringent government regulations on fuel economy and emissions. The market size is expected to grow from an estimated XX Million units in 2025 to XX Million units by 2033. Technological disruptions, such as advancements in automated composite manufacturing and the development of novel resin systems, are further accelerating this growth by improving production efficiency and reducing costs.

Consumer behavior shifts are also playing a pivotal role, with an increasing demand for electric vehicles (EVs) and hybrid vehicles, where lightweighting is crucial for extending battery range and improving overall performance. The market penetration of carbon fiber composites in mainstream automotive applications is anticipated to rise significantly, moving beyond niche high-performance vehicles. The ability of carbon fiber composites to offer superior structural integrity, enhanced safety features, and improved aesthetics provides a compelling value proposition for both automakers and consumers. The industry is also witnessing a trend towards the development of integrated structural components, reducing assembly complexity and overall vehicle weight.

The increasing focus on sustainability and circular economy principles within the automotive sector is also fostering innovation in recyclable and bio-based composite materials, further broadening the appeal and applicability of carbon fiber composites. The synergy between advancements in carbon fiber production, composite processing, and the evolving demands of the automotive industry creates a fertile ground for sustained market expansion.

Dominant Regions, Countries, or Segments in China Automotive Carbon Fiber Composites Industry

The Structural Assembly segment, within the Application Type classification, is a dominant force driving growth in the China Automotive Carbon Fiber Composites Industry. This segment is projected to account for XX% of the total market share by 2033, driven by the critical need for lightweighting in chassis, body-in-white components, and battery enclosures for electric vehicles. Regions with robust automotive manufacturing hubs and strong governmental support for new energy vehicles, such as East China (e.g., Jiangsu, Shanghai), are leading in the adoption and production of these advanced materials.

The dominance of Structural Assembly is underpinned by its direct impact on vehicle performance, safety, and energy efficiency. The inherent strength and stiffness of carbon fiber composites make them ideal for replacing heavier metal components, leading to significant weight reductions. This is particularly crucial for extending the range of electric vehicles and improving the fuel efficiency of internal combustion engine vehicles. Economic policies promoting lightweight vehicle development and significant infrastructure investments in advanced manufacturing facilities within these key regions further bolster this segment’s growth.

Within the Production Type segment, Resin Transfer Molding (RTM) and Vacuum Infusion Processing are emerging as key technologies for the mass production of complex structural components, offering a balance of cost-effectiveness and high-quality output for automotive applications. These methods enable the precise placement of carbon fiber reinforcements and efficient resin infusion, leading to consistent part quality and reduced manufacturing waste.

- Dominant Application Segment: Structural Assembly (e.g., chassis, body panels, battery enclosures).

- Key Regional Hubs: East China (Jiangsu, Shanghai), South China.

- Dominance Factors: Critical role in vehicle lightweighting, direct impact on safety and energy efficiency, government mandates for fuel economy.

- Leading Production Types: Resin Transfer Molding (RTM) and Vacuum Infusion Processing for efficient mass production.

- Market Share Projection: Structural Assembly expected to hold XX% market share by 2033.

- Growth Potential: High due to the accelerating EV market and stringent emission regulations.

China Automotive Carbon Fiber Composites Industry Product Landscape

The product landscape within the China automotive carbon fiber composites industry is characterized by continuous innovation, focusing on enhancing performance metrics and expanding application possibilities. Key product developments include high-strength, high-stiffness carbon fiber prepregs tailored for complex automotive structures, and advanced resin systems offering improved toughness and durability. Innovations are also centered on developing integrated composite solutions, where multiple components are consolidated into single parts, reducing assembly time and weight. The unique selling proposition of these products lies in their ability to deliver superior strength-to-weight ratios, corrosion resistance, and design flexibility.

Key Drivers, Barriers & Challenges in China Automotive Carbon Fiber Composites Industry

The China automotive carbon fiber composites industry is propelled by several key drivers, including stringent government regulations promoting vehicle lightweighting for improved fuel efficiency and reduced emissions, coupled with the escalating demand for electric vehicles where range extension is paramount. Technological advancements in carbon fiber production and composite manufacturing are also crucial drivers, leading to cost reductions and improved material properties.

However, the industry faces significant barriers. The high cost of raw materials, particularly carbon fiber precursors, remains a primary restraint, impacting the overall affordability of composite components. Supply chain issues, including the availability of high-quality carbon fiber and specialized resins, can also pose challenges. Furthermore, the need for specialized manufacturing equipment and skilled labor presents a substantial capital investment barrier for new entrants and existing players looking to scale up. Regulatory hurdles related to recycling and end-of-life management of composite materials are also emerging concerns.

Emerging Opportunities in China Automotive Carbon Fiber Composites Industry

Emerging opportunities in the China automotive carbon fiber composites industry are abundant, driven by the relentless pursuit of vehicle performance and sustainability. The growing EV market presents a significant opportunity for lightweight battery enclosures and structural components that enhance range and safety. The increasing adoption of advanced driver-assistance systems (ADAS) also creates opportunities for novel composite designs that integrate sensors and antennas seamlessly. Furthermore, the development of more sustainable and recyclable composite materials, including bio-based composites, is an untapped market with growing consumer and regulatory appeal. The integration of composite materials into smaller, urban mobility solutions and specialized commercial vehicles also represents a promising avenue for market expansion.

Growth Accelerators in the China Automotive Carbon Fiber Composites Industry Industry

Catalysts driving long-term growth in the China automotive carbon fiber composites industry include significant technological breakthroughs in carbon fiber production, aiming to dramatically reduce costs and improve efficiency. Strategic partnerships between carbon fiber manufacturers, composite processors, and automotive OEMs are crucial for developing tailored material solutions and accelerating adoption. Market expansion strategies focusing on the increasing demand for lightweighting in commercial vehicles, beyond passenger cars, will also serve as a major growth accelerator. Furthermore, continued government support through incentives for advanced material research and development will foster innovation and drive down costs, making carbon fiber composites more accessible for a wider range of automotive applications.

Key Players Shaping the China Automotive Carbon Fiber Composites Industry Market

- Weihai Guangwei Composite

- Jiangsu Tianniao High Technology

- Fangda Carbon New Material

- Sinofibers Technology

- Jiangsu Hangke Composite Materials Technology

- Jiyan High-tech Fibers

- Jiangsu Kangde Xin Composite Material

- Beijing Kangde Xin Composite Material

- Jilin Tangu Carbon

- Jiangsu Hengshen

- Jilin Carbon

Notable Milestones in China Automotive Carbon Fiber Composites Industry Sector

- 2020: Increased government focus on EV incentives, spurring demand for lightweight materials.

- 2021: Several Chinese companies announce significant investments in expanding carbon fiber production capacity.

- 2022: Launch of new, cost-effective composite manufacturing techniques for mass production of automotive parts.

- 2023: Growing adoption of carbon fiber reinforced polymer (CFRP) in battery enclosures for new EV models.

- 2024: Emerging trend of strategic collaborations between domestic material suppliers and international automakers.

In-Depth China Automotive Carbon Fiber Composites Industry Market Outlook

The future outlook for the China automotive carbon fiber composites industry is exceptionally bright, fueled by persistent technological advancements and an unwavering commitment to sustainable mobility. Growth accelerators, including breakthroughs in cost-effective carbon fiber production and the development of advanced, recyclable composite materials, will continue to drive market expansion. Strategic partnerships between upstream material suppliers and downstream automotive manufacturers will be pivotal in optimizing material application and accelerating the adoption of carbon fiber composites across diverse vehicle segments. The increasing emphasis on lightweighting for both electric and conventional vehicles, coupled with evolving consumer preferences for performance and efficiency, positions the industry for sustained and robust growth, presenting significant strategic opportunities for stakeholders.

China Automotive Carbon Fiber Composites Industry Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Others

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Powertrain Components

- 2.3. Interiors

- 2.4. Exteriors

China Automotive Carbon Fiber Composites Industry Segmentation By Geography

- 1. China

China Automotive Carbon Fiber Composites Industry Regional Market Share

Geographic Coverage of China Automotive Carbon Fiber Composites Industry

China Automotive Carbon Fiber Composites Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ease of Steering

- 3.3. Market Restrains

- 3.3.1. Cost and Price Sensitivity

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Carbon Fiber for Greater Fuel Efficiency

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Carbon Fiber Composites Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Components

- 5.2.3. Interiors

- 5.2.4. Exteriors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Weihai Guangwei Composite

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jiangsu Tianniao High Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fangda Carbon New Material

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinofibers Technology

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jiangsu Hangke Composite Materials Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jiyan High-tech Fibers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangsu Kangde Xin Composite Material

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beijing Kangde Xin Composite Material

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jilin Tangu Carbon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jiangsu Hengshen

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jilin Carbon

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Weihai Guangwei Composite

List of Figures

- Figure 1: China Automotive Carbon Fiber Composites Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Automotive Carbon Fiber Composites Industry Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 5: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Carbon Fiber Composites Industry?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the China Automotive Carbon Fiber Composites Industry?

Key companies in the market include Weihai Guangwei Composite, Jiangsu Tianniao High Technology, Fangda Carbon New Material, Sinofibers Technology, Jiangsu Hangke Composite Materials Technology, Jiyan High-tech Fibers, Jiangsu Kangde Xin Composite Material, Beijing Kangde Xin Composite Material, Jilin Tangu Carbon, Jiangsu Hengshen, Jilin Carbon.

3. What are the main segments of the China Automotive Carbon Fiber Composites Industry?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Ease of Steering.

6. What are the notable trends driving market growth?

Increasing Adoption of Carbon Fiber for Greater Fuel Efficiency.

7. Are there any restraints impacting market growth?

Cost and Price Sensitivity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Carbon Fiber Composites Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Carbon Fiber Composites Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Carbon Fiber Composites Industry?

To stay informed about further developments, trends, and reports in the China Automotive Carbon Fiber Composites Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence