Key Insights

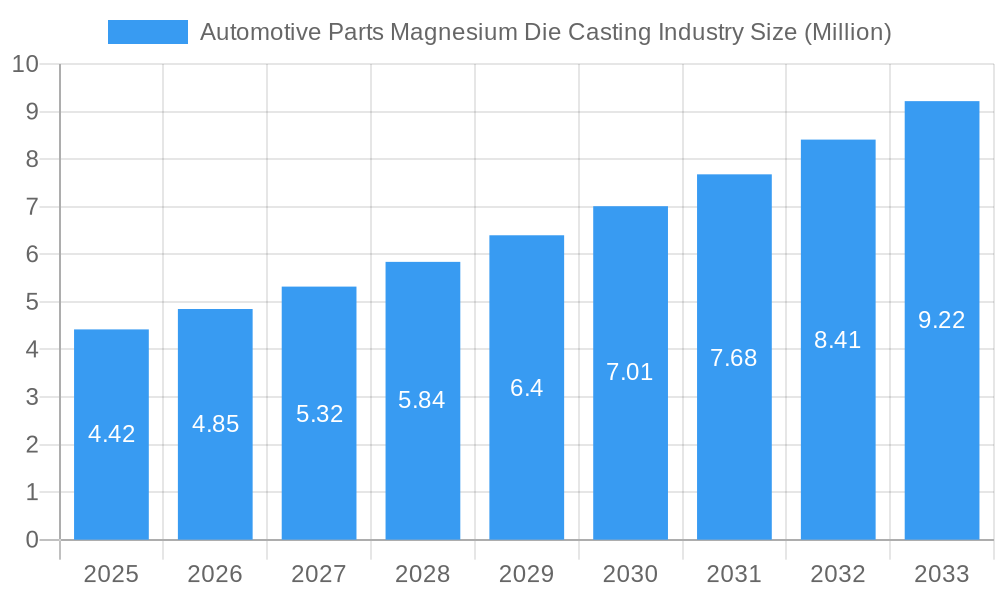

The global Automotive Parts Magnesium Die Casting market is poised for significant expansion, projected to reach a substantial USD 4.42 million by the base year 2025. This robust growth is fueled by a compelling Compound Annual Growth Rate (CAGR) of 9.65%, indicating a dynamic and expanding industry landscape. Key drivers propelling this market include the escalating demand for lightweight automotive components to enhance fuel efficiency and reduce emissions, stringent government regulations promoting sustainable automotive practices, and the inherent advantages of magnesium in terms of its high strength-to-weight ratio and excellent recyclability. Emerging trends such as the increasing adoption of electric vehicles (EVs), which necessitate lighter materials for battery casings and structural components, and advancements in die casting technologies leading to improved precision and cost-effectiveness, are further accelerating market penetration. The industry is witnessing a surge in innovation, with manufacturers focusing on developing advanced magnesium alloys and sophisticated casting techniques to meet the evolving needs of the automotive sector.

Automotive Parts Magnesium Die Casting Industry Market Size (In Million)

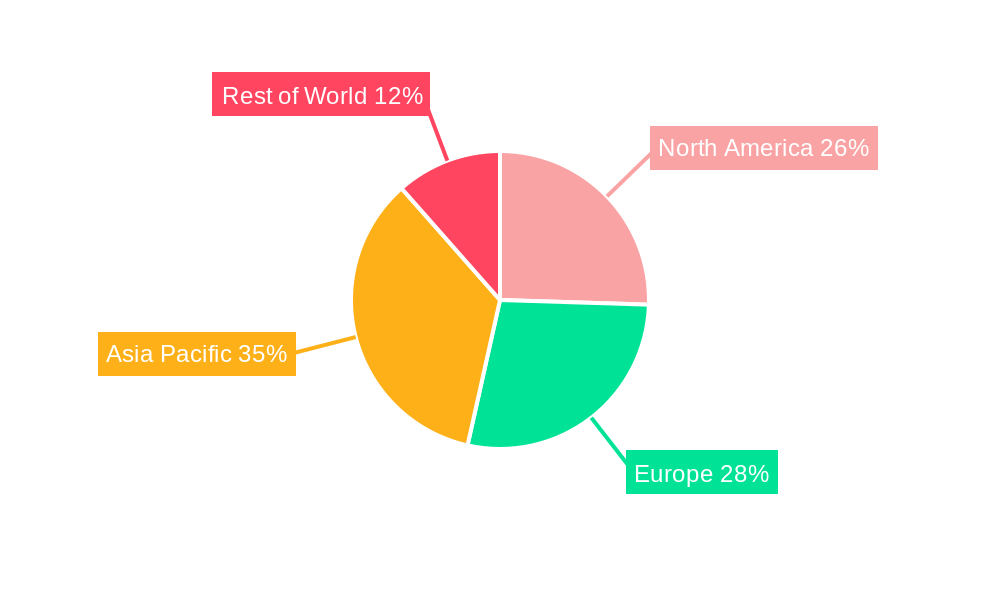

The market segmentation reveals a diverse range of applications and production processes, highlighting the versatility of magnesium die casting in automotive manufacturing. Key segments include Pressure Die Casting, Vacuum Die Casting, Gravity Die Casting, and Squeeze Die Casting, each offering specific advantages for different component requirements. Applications span across critical areas such as Body Parts, Engine Parts, Transmission Parts, and Other Applications, underscoring the integral role of magnesium die castings in modern vehicle construction. Geographically, the Asia Pacific region, particularly China and India, is expected to emerge as a dominant force due to its expanding automotive production base and growing adoption of advanced manufacturing technologies. North America and Europe are also significant contributors, driven by the presence of leading automotive manufacturers and a strong focus on lightweighting initiatives. Restraints such as the fluctuating raw material prices of magnesium and the initial capital investment required for specialized die casting machinery are present, but the overwhelming benefits of magnesium in terms of performance and sustainability are expected to outweigh these challenges, ensuring sustained market growth throughout the forecast period of 2025-2033.

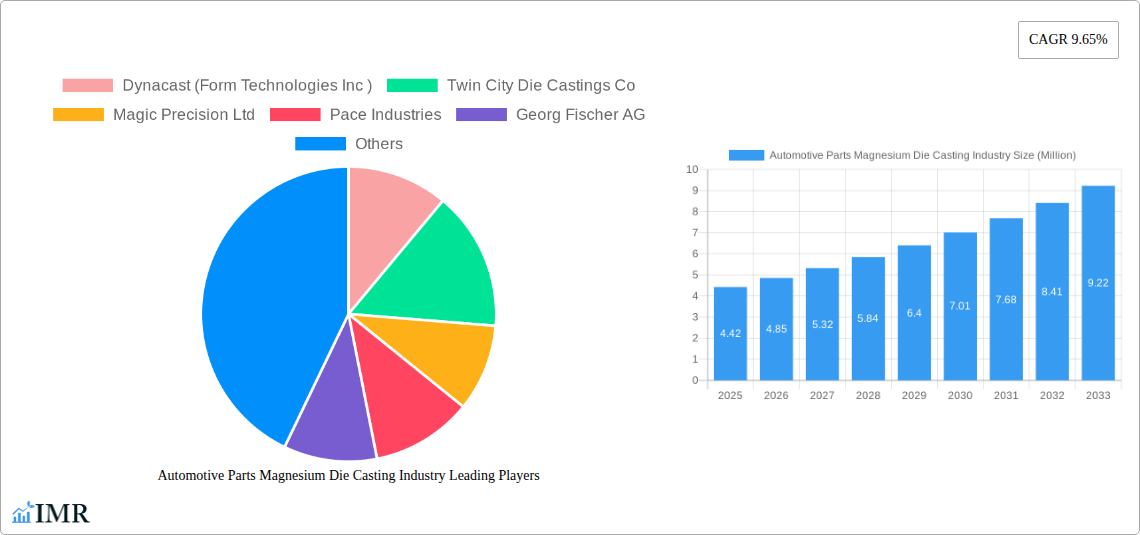

Automotive Parts Magnesium Die Casting Industry Company Market Share

Here's a compelling, SEO-optimized report description for the Automotive Parts Magnesium Die Casting Industry:

Report Title: Automotive Parts Magnesium Die Casting Industry: Market Dynamics, Growth Trends, Regional Dominance, and Key Player Analysis (2019-2033)

Report Description:

Dive deep into the evolving Automotive Parts Magnesium Die Casting Industry with our comprehensive market research report. This analysis provides an in-depth exploration of market dynamics, growth trends, regional insights, and key player strategies, covering the period from 2019 to 2033, with a base and estimated year of 2025. We meticulously examine the magnesium die casting automotive applications, including body parts, engine parts, and transmission parts, analyzing production processes such as pressure die casting, vacuum die casting, gravity die casting, and squeeze die casting. Uncover critical market intelligence for stakeholders in the global automotive components sector, focusing on the strategic advantages of lightweight magnesium alloys in modern vehicle manufacturing.

This report is essential for automotive manufacturers, die casting companies, raw material suppliers, investors, and technology providers seeking to understand the current landscape and future trajectory of the automotive magnesium die casting market. Gain actionable insights into market concentration, technological innovation drivers, regulatory frameworks, and M&A trends, along with an understanding of parent and child market influences. We present all values in Million units for clear quantitative analysis.

Automotive Parts Magnesium Die Casting Industry Market Dynamics & Structure

The Automotive Parts Magnesium Die Casting Industry is characterized by a moderate to high market concentration, with leading players investing heavily in technological advancements to gain a competitive edge. Innovation is primarily driven by the relentless pursuit of lightweighting solutions to meet stringent fuel efficiency and emissions standards, coupled with the growing demand for electric vehicles (EVs) that benefit significantly from reduced vehicle weight. Regulatory frameworks, particularly those focusing on environmental impact and vehicle safety, play a crucial role in shaping product development and manufacturing processes. The increasing integration of advanced materials and sophisticated die casting techniques, such as vacuum-assisted processes, addresses performance requirements and enhances the durability of automotive magnesium components. Competitive substitutes, including aluminum alloys and advanced plastics, present ongoing challenges, necessitating continuous innovation in magnesium alloy properties and casting technologies. End-user demographics are shifting towards a greater demand for sustainable and high-performance automotive parts. Mergers and acquisitions (M&A) trends are evident as companies seek to consolidate market share, expand their technological capabilities, and broaden their product portfolios within the automotive die casting sector.

- Technological Innovation Drivers: Lightweighting for fuel efficiency, EV battery enclosures, enhanced NVH (Noise, Vibration, and Harshness) damping, complex part geometries, and improved crashworthiness.

- Regulatory Frameworks: Stringent emission standards (e.g., Euro 7, EPA regulations), safety mandates, and evolving recycling directives for automotive components.

- Competitive Product Substitutes: High-strength aluminum alloys, advanced composites, and engineered plastics for specific automotive applications.

- M&A Trends: Strategic acquisitions to enhance production capacity, acquire specialized casting technologies, and expand geographic reach in the automotive supply chain.

- End-User Demographics: Growing demand for premium, lightweight vehicles, increased adoption of EVs, and a preference for durable and sustainable automotive parts.

Automotive Parts Magnesium Die Casting Industry Growth Trends & Insights

The Automotive Parts Magnesium Die Casting Industry is poised for robust growth, driven by a confluence of factors compelling automotive manufacturers to embrace lightweighting solutions. The increasing global emphasis on reducing vehicle emissions and improving fuel economy directly translates into a higher demand for magnesium die-cast parts, which offer a superior strength-to-weight ratio compared to traditional materials. The burgeoning electric vehicle (EV) market, in particular, represents a significant growth accelerator, as manufacturers seek to maximize battery range through substantial weight reduction. This trend is further amplified by advancements in magnesium die casting processes, enabling the production of larger, more intricate components with improved structural integrity and cost-effectiveness. The study period, from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, anticipates a substantial Compound Annual Growth Rate (CAGR). This growth trajectory is supported by increasing adoption rates of magnesium alloys in critical automotive applications like engine blocks, transmission housings, and structural components. Technological disruptions, such as the development of novel magnesium alloys with enhanced corrosion resistance and thermal management properties, are broadening the application spectrum within the automotive industry. Consumer behavior is also evolving, with a growing appreciation for the performance benefits and sustainability aspects associated with lightweight vehicles. The industry's capacity to adapt to these shifts, while addressing supply chain complexities and ensuring cost competitiveness, will be paramount in realizing its full market potential within the automotive parts market. The parent market, encompassing the broader automotive industry, continues to expand, directly influencing the child market of automotive magnesium die casting.

Dominant Regions, Countries, or Segments in Automotive Parts Magnesium Die Casting Industry

The Automotive Parts Magnesium Die Casting Industry witnesses significant dominance driven by key regions and specific production processes, notably Pressure Die Casting (PDC). Asia-Pacific, particularly China, emerges as a dominant force due to its expansive automotive manufacturing base, supportive government policies promoting electric vehicle adoption, and a well-established supply chain for raw materials and manufacturing. North America and Europe also hold substantial market share, driven by the presence of major automotive OEMs, stringent emission regulations pushing for lightweighting, and advanced technological adoption. Among the production processes, Pressure Die Casting accounts for the lion's share of the market. Its ability to produce complex geometries with high precision, excellent surface finish, and at high production rates makes it the preferred method for a wide array of automotive parts, including structural components, engine blocks, and housings. The demand for PDC is intrinsically linked to the application segments of body parts and engine parts, where lightweighting and intricate designs are paramount.

- Dominant Region: Asia-Pacific, driven by China's manufacturing prowess and strong EV market growth.

- Key Drivers: Favorable government incentives for EVs, robust automotive production volumes, and competitive manufacturing costs.

- Market Share Potential: Significant contribution due to large-scale production and increasing adoption of lightweight materials.

- Dominant Country: China, leading in both production volume and demand for automotive magnesium die-cast components.

- Economic Policies: Subsidies for EV production, investment in advanced manufacturing technologies.

- Infrastructure: Extensive industrial parks and efficient logistics networks supporting automotive supply chains.

- Dominant Production Process: Pressure Die Casting (PDC).

- Advantages: High precision, complex geometries, excellent surface finish, high production rates.

- Application Linkage: Crucial for manufacturing of body parts, engine parts, and transmission parts requiring intricate designs and structural integrity.

- Dominant Application Segment: Engine Parts and Body Parts, driven by the imperative for weight reduction and improved performance in both internal combustion engine (ICE) vehicles and EVs.

- Growth Potential: Continued innovation in alloy development and casting techniques will expand applications within these segments.

Automotive Parts Magnesium Die Casting Industry Product Landscape

The Automotive Parts Magnesium Die Casting Industry is defined by an increasing array of sophisticated components and innovative material applications. Manufacturers are focusing on developing magnesium alloy parts that offer superior strength-to-weight ratios, enhancing fuel efficiency and electric vehicle range. Innovations span across the production of lightweight structural components, complex engine housings, advanced chassis parts, and even interior trim elements, showcasing the versatility of magnesium die casting. Key product innovations include the development of advanced magnesium alloys with improved corrosion resistance and higher tensile strength, alongside advancements in die casting techniques that allow for thinner walls and more intricate designs. These technological advancements enable the production of parts that not only reduce vehicle weight but also contribute to improved NVH characteristics and overall vehicle performance. Unique selling propositions often revolve around the ability to produce large, integrated components, thereby reducing assembly complexity and overall part count.

Key Drivers, Barriers & Challenges in Automotive Parts Magnesium Die Casting Industry

Key Drivers:

- Lightweighting Mandates: Increasing global pressure for fuel efficiency and reduced emissions drives the demand for lightweight materials like magnesium.

- Electric Vehicle Growth: The expanding EV market significantly benefits from magnesium's weight-saving properties to enhance battery range.

- Technological Advancements: Improvements in die casting processes and alloy development enable more complex and cost-effective magnesium parts.

- Performance Enhancement: Magnesium offers excellent NVH damping and thermal conductivity, improving vehicle comfort and performance.

Key Barriers & Challenges:

- Cost Competitiveness: Magnesium alloys can be more expensive than traditional materials like aluminum, impacting cost-sensitive applications.

- Corrosion Susceptibility: Certain magnesium alloys require protective coatings, adding to manufacturing costs and complexity.

- Supply Chain Volatility: Fluctuations in raw material prices and availability can impact production costs and lead times.

- Recycling Infrastructure: The development of robust and widespread recycling processes for magnesium die-cast parts is still evolving.

- Skilled Labor Shortage: The specialized nature of die casting requires skilled labor, which can be a limiting factor in some regions.

- High Initial Investment: Setting up advanced magnesium die casting facilities requires significant capital expenditure.

Emerging Opportunities in Automotive Parts Magnesium Die Casting Industry

Emerging opportunities within the Automotive Parts Magnesium Die Casting Industry are largely centered around the escalating adoption of electric vehicles and the ongoing push for sustainable manufacturing. The demand for lightweight battery enclosures, thermal management systems, and structural components for EVs presents a significant growth avenue. Furthermore, the development of advanced magnesium alloys with enhanced properties, such as higher strength at elevated temperatures and improved corrosion resistance, will unlock new applications in areas like powertrain components and chassis structures for both conventional and alternative fuel vehicles. The increasing focus on circular economy principles also opens opportunities for enhanced recycling technologies and the development of design for recyclability strategies for magnesium die-cast parts, aligning with global sustainability goals.

Growth Accelerators in the Automotive Parts Magnesium Die Casting Industry Industry

Several catalysts are accelerating the growth of the Automotive Parts Magnesium Die Casting Industry. Technological breakthroughs in high-pressure die casting (HPDC) and the development of new magnesium alloys with superior performance characteristics are key growth accelerators. Strategic partnerships between die casting manufacturers and automotive OEMs are fostering collaborative innovation and ensuring the integration of magnesium components early in vehicle design phases. Market expansion strategies, particularly into emerging automotive markets and the rapidly growing EV sector, are also crucial. The increasing emphasis on smart manufacturing and Industry 4.0 principles within die casting facilities is improving efficiency, reducing costs, and enhancing the overall quality and consistency of magnesium parts, further driving adoption.

Key Players Shaping the Automotive Parts Magnesium Die Casting Industry Market

- Dynacast (Form Technologies Inc.)

- Twin City Die Castings Co

- Magic Precision Ltd

- Pace Industries

- Georg Fischer AG

- Ryobi Limited

- Sundaram-Clayton Ltd

- Shiloh Industries Inc

- Meridian Lightweight Technologies Inc

- Gibbs Die Casting Group

- Tadir-Gan Group (Ortal Ltd)

- Sandhar Group

- Morimura Bros Ltd

- Chicago White Metal Casting Inc

Notable Milestones in Automotive Parts Magnesium Die Casting Industry Sector

- February 2022: GF is joining the MassChallenge initiative, gaining access to top start-ups in Switzerland to develop innovative business models, products and services.

- [Undated, assumed recent]: GF Linamar announced that the company is expanding its Mills River building extension 1B. The new extension of the building will expand its machining and assembly capabilities of magnesium HPDC components at the site.

In-Depth Automotive Parts Magnesium Die Casting Industry Market Outlook

The Automotive Parts Magnesium Die Casting Industry is set for sustained expansion, fueled by an unyielding demand for lightweight solutions in the automotive sector. Future market potential is intrinsically linked to the trajectory of electric vehicle adoption, where magnesium's inherent weight-saving advantages offer a critical pathway to enhanced battery range and performance. Strategic opportunities lie in the continuous innovation of high-performance magnesium alloys and the refinement of die casting processes to achieve greater design complexity and cost-efficiency. Furthermore, the industry can capitalize on the growing global focus on sustainability by investing in advanced recycling technologies and eco-friendly manufacturing practices, thereby solidifying magnesium's position as a material of choice for the next generation of vehicles.

Automotive Parts Magnesium Die Casting Industry Segmentation

-

1. Production Process

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Gravity Die Casting

- 1.4. Squeeze Die Casting

-

2. Application

- 2.1. Body Parts

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Applications

Automotive Parts Magnesium Die Casting Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Parts Magnesium Die Casting Industry Regional Market Share

Geographic Coverage of Automotive Parts Magnesium Die Casting Industry

Automotive Parts Magnesium Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and the Growing Emphasis on Safety is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Adoption of Steer-By-Wire System Hindering the Market Growth

- 3.4. Market Trends

- 3.4.1. Pressure Die Casting dominating the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Parts Magnesium Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Gravity Die Casting

- 5.1.4. Squeeze Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Body Parts

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of World

- 5.1. Market Analysis, Insights and Forecast - by Production Process

- 6. North America Automotive Parts Magnesium Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Process

- 6.1.1. Pressure Die Casting

- 6.1.2. Vacuum Die Casting

- 6.1.3. Gravity Die Casting

- 6.1.4. Squeeze Die Casting

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Body Parts

- 6.2.2. Engine Parts

- 6.2.3. Transmission Parts

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Production Process

- 7. Europe Automotive Parts Magnesium Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Process

- 7.1.1. Pressure Die Casting

- 7.1.2. Vacuum Die Casting

- 7.1.3. Gravity Die Casting

- 7.1.4. Squeeze Die Casting

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Body Parts

- 7.2.2. Engine Parts

- 7.2.3. Transmission Parts

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Production Process

- 8. Asia Pacific Automotive Parts Magnesium Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Process

- 8.1.1. Pressure Die Casting

- 8.1.2. Vacuum Die Casting

- 8.1.3. Gravity Die Casting

- 8.1.4. Squeeze Die Casting

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Body Parts

- 8.2.2. Engine Parts

- 8.2.3. Transmission Parts

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Production Process

- 9. Rest of World Automotive Parts Magnesium Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Process

- 9.1.1. Pressure Die Casting

- 9.1.2. Vacuum Die Casting

- 9.1.3. Gravity Die Casting

- 9.1.4. Squeeze Die Casting

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Body Parts

- 9.2.2. Engine Parts

- 9.2.3. Transmission Parts

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Production Process

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Dynacast (Form Technologies Inc )

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Twin City Die Castings Co

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Magic Precision Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Pace Industries

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Georg Fischer AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ryobi Limite

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Sundaram-Clayton Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Shiloh Industries Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Meridian Lightweight Technologies Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Gibbs Die Casting Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Tadir-Gan Group (Ortal Ltd)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Sandhar Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Morimura Bros Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Chicago White Metal Casting Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Dynacast (Form Technologies Inc )

List of Figures

- Figure 1: Global Automotive Parts Magnesium Die Casting Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 3: North America Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 4: North America Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 9: Europe Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 10: Europe Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 15: Asia Pacific Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 16: Asia Pacific Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of World Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Production Process 2025 & 2033

- Figure 21: Rest of World Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Production Process 2025 & 2033

- Figure 22: Rest of World Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of World Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of World Automotive Parts Magnesium Die Casting Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of World Automotive Parts Magnesium Die Casting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 2: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 5: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 11: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of the Europe Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 19: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Production Process 2020 & 2033

- Table 27: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Automotive Parts Magnesium Die Casting Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South America Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Automotive Parts Magnesium Die Casting Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Parts Magnesium Die Casting Industry?

The projected CAGR is approximately 9.65%.

2. Which companies are prominent players in the Automotive Parts Magnesium Die Casting Industry?

Key companies in the market include Dynacast (Form Technologies Inc ), Twin City Die Castings Co, Magic Precision Ltd, Pace Industries, Georg Fischer AG, Ryobi Limite, Sundaram-Clayton Ltd, Shiloh Industries Inc, Meridian Lightweight Technologies Inc, Gibbs Die Casting Group, Tadir-Gan Group (Ortal Ltd), Sandhar Group, Morimura Bros Ltd, Chicago White Metal Casting Inc.

3. What are the main segments of the Automotive Parts Magnesium Die Casting Industry?

The market segments include Production Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.42 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and the Growing Emphasis on Safety is Driving the Market.

6. What are the notable trends driving market growth?

Pressure Die Casting dominating the market.

7. Are there any restraints impacting market growth?

Adoption of Steer-By-Wire System Hindering the Market Growth.

8. Can you provide examples of recent developments in the market?

In February 2022, GF is joining the MassChallenge initiative, gaining access to top start-ups in Switzerland to develop innovative business models, products and services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Parts Magnesium Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Parts Magnesium Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Parts Magnesium Die Casting Industry?

To stay informed about further developments, trends, and reports in the Automotive Parts Magnesium Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence