Key Insights

The North American motorhome market is projected for significant expansion, with an estimated market size of $37.9 billion by 2025. The industry is expected to experience a compound annual growth rate (CAGR) of 9.4% from 2025 to 2033. This growth is driven by increasing consumer demand for experiential travel, the rising popularity of recreational vehicle (RV) ownership for leisure and remote work, and a growing preference for diverse motorhome types, from Class A to Class C models. The rise of digital nomads and the appeal of flexible accommodation solutions are key factors, especially among younger demographics. Additionally, an aging population seeking comfortable travel options continues to be a substantial market driver. Technological advancements in motorhomes, focusing on enhanced comfort, connectivity, and fuel efficiency, are further broadening their appeal.

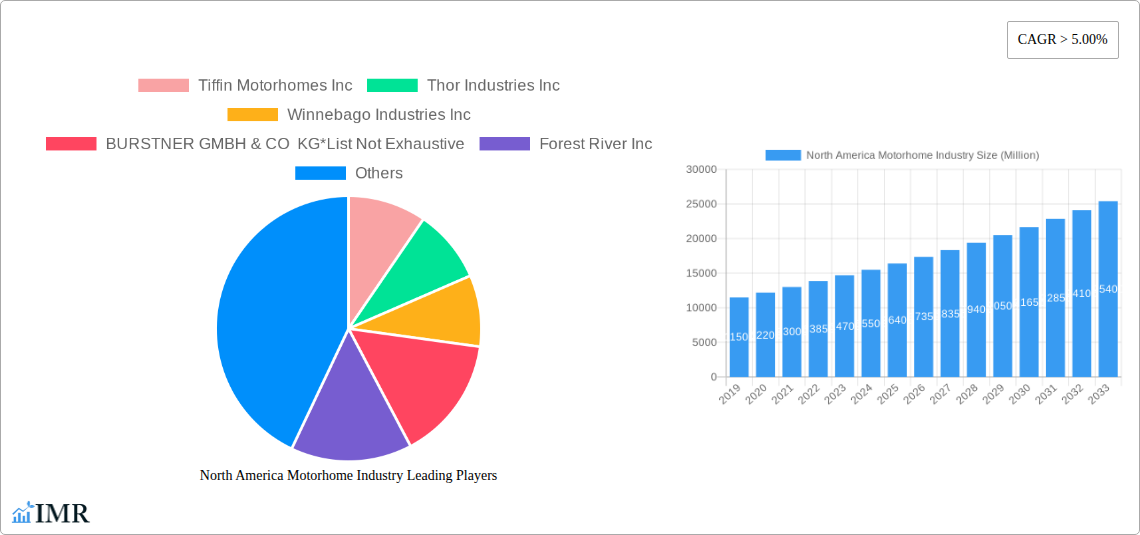

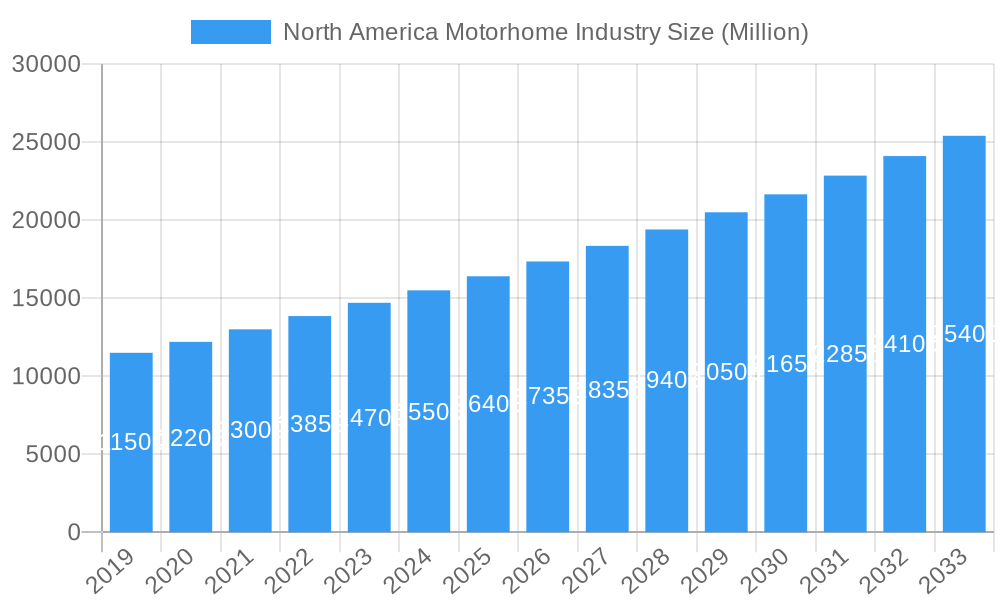

North America Motorhome Industry Market Size (In Billion)

Key industry trends include the growing adoption of sustainable manufacturing and the development of eco-friendly motorhome models. Innovations in smart technology, such as advanced navigation and integrated entertainment systems, are enhancing the user experience. However, the market faces restraints including fluctuating fuel prices, challenges with campground availability, and initial investment costs. Despite these obstacles, leading manufacturers like Thor Industries, Inc., Winnebago Industries, Inc., and Forest River, Inc. are strategically focused on product innovation and market expansion, demonstrating strong confidence in the sector's future. The North American region, including the United States and Canada, is anticipated to maintain its dominance due to its established RV culture and favorable demographics.

North America Motorhome Industry Company Market Share

North America Motorhome Industry: Comprehensive Market Analysis & Forecast (2019-2033)

This report offers an in-depth analysis of the North America motorhome industry, providing critical insights into market dynamics, growth trends, and future outlook. Covering parent and child markets, this study is essential for industry professionals seeking to understand the evolving landscape of recreational vehicles in the United States, Canada, and the broader North American region. Values are presented in Million units.

North America Motorhome Industry Market Dynamics & Structure

The North America motorhome industry is characterized by a moderate market concentration, with key players like Thor Industries Inc., Winnebago Industries Inc., and Forest River Inc. holding significant market shares. Technological innovation remains a key driver, with advancements in lightweight materials, energy efficiency, and smart vehicle technology shaping product development. Regulatory frameworks, particularly concerning emissions and safety standards, influence manufacturing processes and product designs. Competitive product substitutes, such as travel trailers and campervans, present a constant challenge, necessitating differentiation through features and user experience. End-user demographics are shifting, with a growing interest from younger generations and a sustained demand from retirees. Merger and acquisition trends are indicative of strategic consolidation, aimed at expanding product portfolios and market reach.

- Market Concentration: Dominated by a few major manufacturers, but with increasing fragmentation in specialized segments.

- Technological Innovation Drivers: Focus on fuel efficiency, sustainable materials, smart home integration, and enhanced connectivity.

- Regulatory Frameworks: Stringent emission standards (e.g., EPA regulations) and safety certifications (e.g., RVIA standards) impacting manufacturing.

- Competitive Product Substitutes: Travel trailers, fifth wheels, and truck campers offering alternative recreational vehicle experiences.

- End-User Demographics: Growing appeal to millennials and Gen Z seeking experiential travel, alongside the traditional retiree market.

- M&A Trends: Strategic acquisitions to broaden product offerings, enhance distribution networks, and achieve economies of scale. Expected M&A deal volumes in the historical period: 5-8 deals per year.

North America Motorhome Industry Growth Trends & Insights

The North America motorhome industry is poised for robust growth, fueled by a confluence of factors including an expanding economy, a renewed interest in outdoor recreation, and evolving consumer lifestyles. The market size is projected to witness a significant upward trajectory, with adoption rates of motorhomes steadily increasing across various age demographics. Technological disruptions are not only enhancing the functionality and comfort of motorhomes but also contributing to their appeal as sophisticated, mobile living spaces. Consumer behavior shifts, such as the rise of remote work and the desire for flexible travel options, are profoundly impacting demand. The industry's ability to adapt to these changing preferences will be crucial for sustained growth.

The forecast period, from 2025 to 2033, anticipates a Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5%, indicating a healthy expansion of the market. This growth is further supported by increasing market penetration, especially within the younger demographic who are embracing the freedom and affordability associated with motorhome travel compared to traditional accommodations. The pandemic era significantly accelerated this trend, creating a lasting impact on leisure travel preferences. Furthermore, the development of more fuel-efficient and environmentally friendly motorhome models is addressing concerns about sustainability and opening up new market segments. The shift towards experiential travel, where consumers prioritize unique and immersive experiences, directly benefits the motorhome sector. The average motorhome lifespan, often exceeding 15-20 years with proper maintenance, also contributes to a steady replacement market, though the primary growth will stem from new acquisitions. The integration of advanced infotainment systems, connectivity features, and smart home technologies is transforming the motorhome into a connected living environment, attracting a tech-savvy consumer base. This ongoing evolution in product offerings and consumer preferences is a critical growth accelerator, ensuring the industry remains dynamic and appealing.

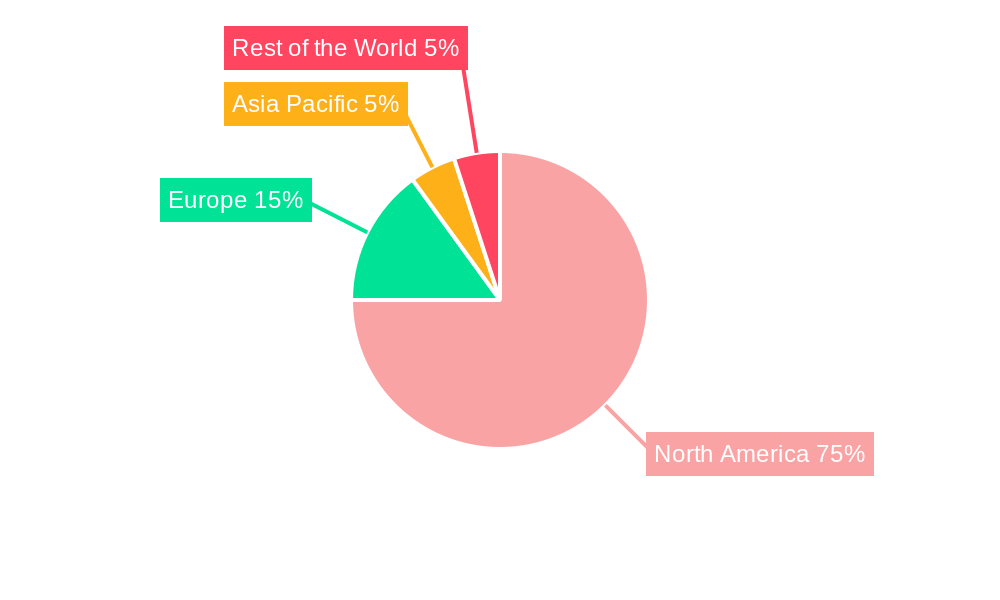

Dominant Regions, Countries, or Segments in North America Motorhome Industry

The United States unequivocally stands as the dominant region within the North America motorhome industry, driven by a confluence of economic prosperity, extensive road networks, and a deeply ingrained culture of outdoor recreation. Its vast geographical expanse, diverse landscapes, and a well-established network of campgrounds and recreational facilities provide an ideal ecosystem for motorhome ownership and usage. Within the US, states with a higher propensity for outdoor tourism and a larger retiree population, such as Florida, California, Arizona, and Texas, consistently exhibit higher sales volumes.

Key Dominance Factors in the United States:

- Market Share: The United States accounts for approximately 85-90% of the total North America motorhome market.

- Economic Policies: Favorable economic conditions, including disposable income and consumer confidence, directly correlate with increased motorhome sales.

- Infrastructure: An extensive highway system and a robust network of state and national parks, along with private campgrounds, facilitate widespread motorhome travel.

- Consumer Preferences: A strong cultural inclination towards road trips, camping, and a desire for self-contained travel solutions fuels demand.

- Demographics: A significant retired population with the time and financial resources for extended travel, alongside an emerging younger demographic seeking adventure and flexibility.

While Canada represents a significant, albeit smaller, market within North America, its growth is influenced by similar factors. However, the colder climate in many parts of Canada during several months of the year can lead to seasonal demand fluctuations. The "Rest of North America," primarily encompassing Mexico and smaller island nations, currently represents a nascent but growing market for motorhomes, with potential for future expansion as infrastructure and leisure travel habits evolve.

In terms of segments, Class C motorhomes have historically held a strong position due to their balance of affordability, maneuverability, and living space, making them popular among families and first-time buyers. However, there is a noticeable and growing trend towards Class B motorhomes, often referred to as campervans. Their compact size, fuel efficiency, and ease of driving in urban environments are appealing to a younger, more adventurous demographic and those seeking a more agile travel experience. Class A motorhomes, representing the pinnacle of luxury and space, continue to cater to the high-end market and those undertaking extensive, long-term travel.

The Direct Buyers end-user segment remains the largest driver of the North America motorhome industry, comprising individuals and families purchasing for personal recreational use. Fleet Owners, including rental companies and tour operators, represent a significant and growing segment, driven by the increasing demand for rental motorhomes as a flexible and accessible way to experience RV travel without the commitment of ownership. The "Other End Users" category encompasses niche applications such as mobile businesses, temporary housing, and specialized research units, which contribute to market diversity.

North America Motorhome Industry Product Landscape

The North America motorhome industry is witnessing a surge in product innovation, focusing on enhanced user experience and sustainability. Manufacturers are integrating advanced technologies such as smart home control systems, integrated Wi-Fi, and solar power solutions to offer greater convenience and reduce environmental impact. Lightweight construction materials and fuel-efficient engine options are becoming standard, addressing consumer demand for better mileage and reduced operating costs. Applications range from family vacations and adventure travel to mobile workspaces and extended living solutions. Performance metrics are increasingly defined by fuel economy, interior comfort, safety features, and the integration of digital technologies, creating a more connected and luxurious mobile living experience.

Key Drivers, Barriers & Challenges in North America Motorhome Industry

Key Drivers:

- Growing interest in outdoor recreation and travel: A fundamental driver, amplified by a desire for experiences and escape.

- Increased disposable income and consumer confidence: Enabling discretionary spending on leisure assets.

- Rise of remote work and flexible lifestyles: Creating demand for mobile living solutions.

- Technological advancements: Enhancing comfort, efficiency, and connectivity in motorhomes.

- Aging population and retirement travel: A consistent and significant demographic driver.

Barriers & Challenges:

- Supply chain disruptions: Affecting the availability of components and manufacturing timelines, leading to increased lead times and costs. For instance, semiconductor shortages have impacted the integration of advanced electronics.

- High initial cost of purchase: Remains a significant barrier for some potential buyers, especially in economic downturns.

- Fuel prices and efficiency concerns: Volatile fuel costs can impact the affordability of long-distance travel.

- Complex regulations and licensing: Varying state and provincial regulations can create administrative hurdles for owners.

- Perceived maintenance and repair costs: Can deter some consumers from investing in a motorhome.

- Competition from alternative leisure options: Including vacation rentals, cruises, and traditional hotels.

Emerging Opportunities in North America Motorhome Industry

Emerging opportunities in the North America motorhome industry lie in the development of more compact and affordable "entry-level" motorhomes, catering to younger demographics and first-time buyers. The growth of the electric and hybrid motorhome segment presents a significant untapped market, driven by environmental consciousness and government incentives. Furthermore, the expansion of integrated rental and ownership models, facilitated by digital platforms, offers accessible entry points for consumers. Innovative financing solutions and subscription-based services could also unlock new customer segments. The increasing popularity of glamping and curated outdoor experiences presents opportunities for specialized, luxury motorhome offerings with unique amenities.

Growth Accelerators in the North America Motorhome Industry Industry

Technological breakthroughs in battery technology and charging infrastructure are poised to accelerate the adoption of electric motorhomes. Strategic partnerships between motorhome manufacturers and technology companies will foster the integration of cutting-edge smart features and connectivity solutions, enhancing the overall user experience. Market expansion strategies, including the development of more accessible financing options and robust rental programs, will drive growth by lowering the barriers to entry for a wider consumer base. Furthermore, the continuous innovation in lightweight materials and aerodynamic designs will improve fuel efficiency, making motorhomes more appealing in the face of rising energy costs.

Key Players Shaping the North America Motorhome Industry Market

- Tiffin Motorhomes Inc.

- Thor Industries Inc.

- Winnebago Industries Inc.

- BURSTNER GMBH & CO KG

- Forest River Inc.

- REV Group

- Triple E Recreational Vehicles

- Newmar Corporation

- Fleetwood RV

- Jayco, Inc.

Notable Milestones in North America Motorhome Industry Sector

- 2019: Thor Industries Inc. completes acquisition of Erwin Hymer Group, expanding its global footprint.

- 2020: Significant surge in demand for RVs driven by the COVID-19 pandemic and increased interest in domestic travel.

- 2021: Winnebago Industries Inc. launches its first all-electric concept vehicle, showcasing a commitment to sustainable mobility.

- 2022: Forest River Inc. introduces new models with advanced smart home technology integration, enhancing connectivity for users.

- 2023: Industry-wide focus on addressing supply chain challenges to meet robust demand.

- 2024 (Estimated): Continued innovation in lightweight materials and fuel-efficient powertrains across major manufacturers.

In-Depth North America Motorhome Industry Market Outlook

The North America motorhome industry is positioned for sustained growth, driven by the enduring appeal of the freedom and flexibility that motorhome travel offers. Key accelerators include the ongoing technological revolution, with electric and hybrid powertrains becoming more viable, and the increasing integration of smart technologies that enhance convenience and connectivity. Strategic partnerships between manufacturers, technology providers, and rental platforms will further democratize access and cater to diverse consumer needs. As consumer preferences continue to evolve towards experiential and sustainable travel, the motorhome industry is well-equipped to adapt and thrive, promising a dynamic and expanding future market.

North America Motorhome Industry Segmentation

-

1. Type

- 1.1. Class A

- 1.2. Class B

- 1.3. Class C

-

2. End-User

- 2.1. Fleet Owners

- 2.2. Direct Buyers

- 2.3. Other End Users

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Rest of North America

-

3.1. North America

North America Motorhome Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

North America Motorhome Industry Regional Market Share

Geographic Coverage of North America Motorhome Industry

North America Motorhome Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. Recreational Vehicle Rental to Affect The Market Over the Long Term

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Class C Motorhome

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Motorhome Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Class A

- 5.1.2. Class B

- 5.1.3. Class C

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Fleet Owners

- 5.2.2. Direct Buyers

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tiffin Motorhomes Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thor Industries Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Winnebago Industries Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BURSTNER GMBH & CO KG*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Forest River Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Tiffin Motorhomes Inc

List of Figures

- Figure 1: North America Motorhome Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Motorhome Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Motorhome Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Motorhome Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: North America Motorhome Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Motorhome Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Motorhome Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: North America Motorhome Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 7: North America Motorhome Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Motorhome Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Motorhome Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Motorhome Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America North America Motorhome Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Motorhome Industry?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the North America Motorhome Industry?

Key companies in the market include Tiffin Motorhomes Inc, Thor Industries Inc, Winnebago Industries Inc, BURSTNER GMBH & CO KG*List Not Exhaustive, Forest River Inc.

3. What are the main segments of the North America Motorhome Industry?

The market segments include Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Increasing Demand for Class C Motorhome.

7. Are there any restraints impacting market growth?

Recreational Vehicle Rental to Affect The Market Over the Long Term.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Motorhome Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Motorhome Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Motorhome Industry?

To stay informed about further developments, trends, and reports in the North America Motorhome Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence