Key Insights

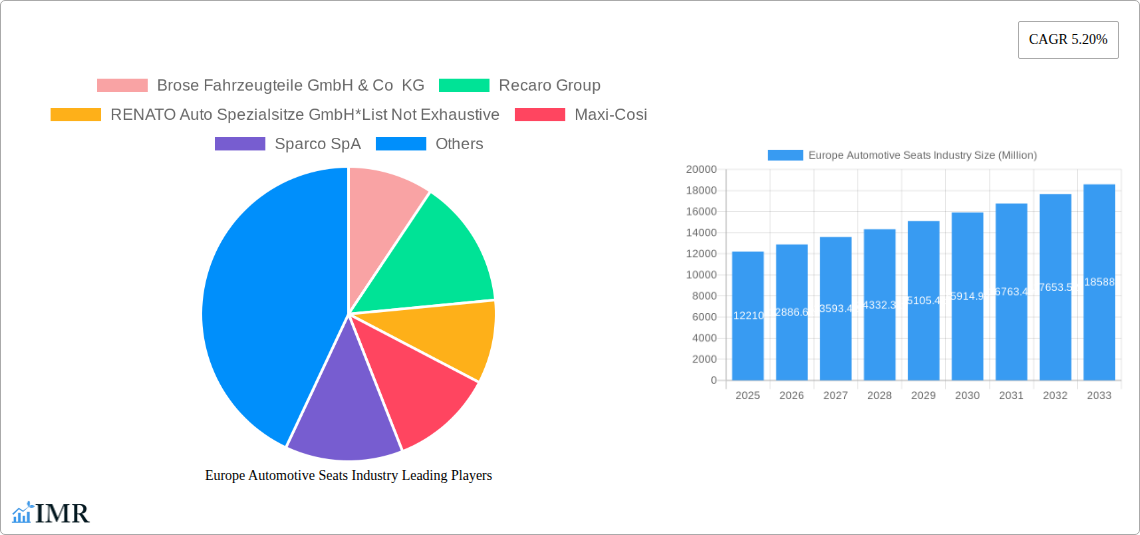

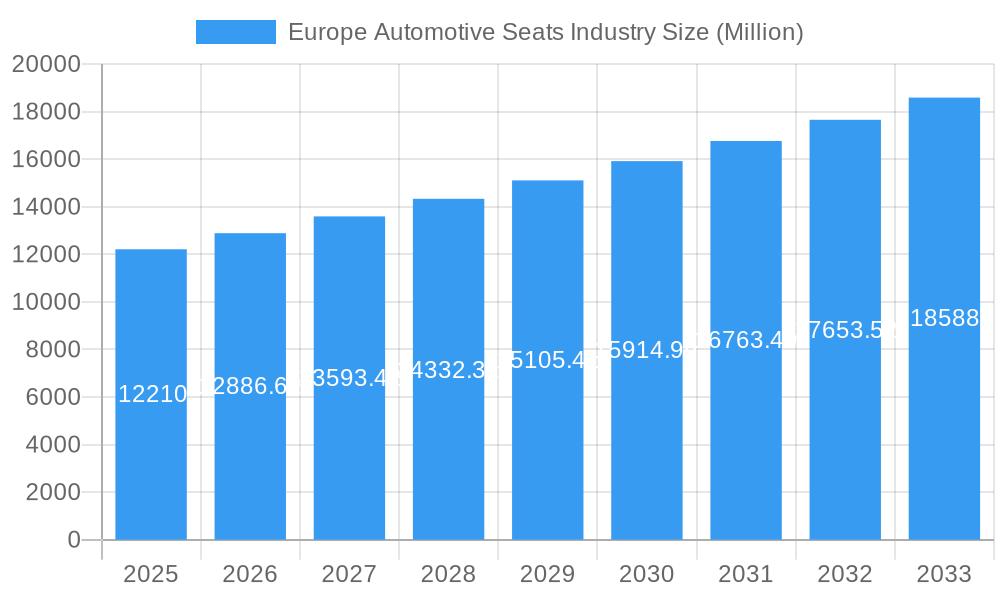

The European automotive seats market, valued at €12.21 billion in 2025, is projected to experience robust growth, driven by several key factors. The rising demand for passenger vehicles, particularly in the premium segment, fuels the need for advanced and comfortable seating solutions. Technological advancements, such as the integration of powered, ventilated, and massaging seats, are significantly enhancing consumer preference and driving market expansion. Furthermore, increasing consumer awareness of safety features, particularly for child safety seats, is bolstering the market. The shift toward electric and autonomous vehicles also presents opportunities, as manufacturers incorporate innovative seating designs to optimize passenger experience within these evolving vehicle types. While the aftermarket segment provides a significant revenue stream, the Original Equipment Manufacturer (OEM) segment remains dominant, closely tied to overall vehicle production. Competitive pressures among established players like Lear Corporation, Adient PLC, and Faurecia, alongside the emergence of specialized companies like Recaro and Sparco, maintain a dynamic and innovative market landscape.

Europe Automotive Seats Industry Market Size (In Billion)

Regional variations within Europe exist, with Germany, France, and the UK representing significant markets due to their established automotive industries and higher purchasing power. However, growth is anticipated across the region, driven by improving living standards and increased vehicle ownership in several European countries. While material costs and supply chain disruptions pose potential restraints, the long-term outlook for the European automotive seats market remains positive, with a projected Compound Annual Growth Rate (CAGR) of 5.20% from 2025 to 2033. This growth trajectory is supported by continuous innovation in seat design, materials, and technology, catering to evolving consumer preferences and safety regulations. The market’s segmentation by material (leather, fabric, others), technology (powered, ventilated, child safety seats), and vehicle type (passenger car, commercial vehicle) provides a comprehensive understanding of specific market dynamics and future growth opportunities.

Europe Automotive Seats Industry Company Market Share

Europe Automotive Seats Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European automotive seats market, covering market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report utilizes data from 2019-2024 (historical period), with a base year of 2025 and a forecast period extending to 2033. This detailed analysis is crucial for industry professionals seeking to understand market trends and opportunities within the parent market (Automotive Components) and child markets (Passenger Car Seats, Commercial Vehicle Seats, Child Safety Seats). The total market size is predicted to reach xx Million units by 2033.

Europe Automotive Seats Industry Market Dynamics & Structure

The European automotive seats market is characterized by a moderately concentrated landscape with several major players and a multitude of smaller specialized firms. Technological innovation, driven by advancements in materials science, ergonomics, and safety features, significantly shapes market dynamics. Stringent regulatory frameworks concerning safety and environmental regulations influence product design and manufacturing processes. Competitive pressures arise from the availability of substitute materials and continuous innovation in seat design. The market also observes a growing focus on lightweighting and sustainability initiatives. Consumer preferences, influenced by factors like vehicle type and personal comfort expectations, are pivotal. Finally, M&A activity has been relatively consistent, with xx deals recorded in the last five years, driving consolidation and technological integration.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on lightweight materials (e.g., carbon fiber composites), advanced adjustability (powered and ventilated seats), and enhanced safety features (child safety seats).

- Regulatory Framework: Strict Euro NCAP safety standards and increasing environmental regulations drive innovation towards sustainable materials and manufacturing processes.

- Competitive Product Substitutes: Alternative materials and design concepts exert pressure on traditional seat technologies.

- End-User Demographics: Shifting consumer preferences towards luxury and comfort features, especially in premium vehicles.

- M&A Trends: Consistent M&A activity resulting in consolidation and increased technological capabilities within leading players.

Europe Automotive Seats Industry Growth Trends & Insights

The European automotive seats market experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is primarily driven by increasing vehicle production, particularly in the passenger car segment. The adoption rate of advanced features, such as powered and ventilated seats, is increasing steadily, reflecting the consumer preference for enhanced comfort and convenience. Technological disruptions, such as the rise of electric vehicles (EVs) requiring lighter seats and the integration of smart technologies, are reshaping the market. Furthermore, changing consumer behavior, favoring premium features and personalized seating options, drives market expansion.

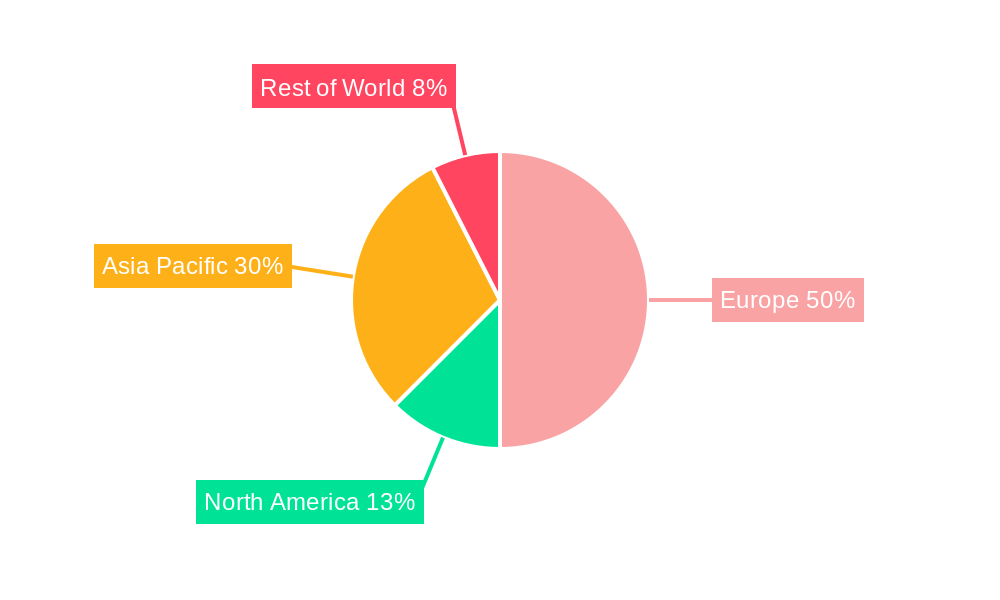

Dominant Regions, Countries, or Segments in Europe Automotive Seats Industry

Germany, France, and the UK are the dominant regions for automotive seats in Europe, driven by established automotive manufacturing bases and high vehicle ownership rates. Within the segments, the passenger car segment dominates, accounting for xx million units in 2025. Fabric remains the most prevalent material, capturing approximately xx% market share, followed by leather at xx%. However, the adoption rate of other materials, including sustainable options, is increasing. Powered and ventilated seats are witnessing high growth, while the child safety seats segment shows robust expansion due to strict safety regulations.

- Key Drivers:

- High vehicle production in key European markets.

- Growing demand for premium vehicles and advanced seating features.

- Stringent safety and environmental regulations.

- Dominance Factors: Established automotive manufacturing infrastructure, high disposable incomes, strong consumer preference for advanced features.

Europe Automotive Seats Industry Product Landscape

The product landscape is characterized by a wide range of seats categorized by material (leather, fabric, other), technology (standard, powered, ventilated, child safety, other), and vehicle type (passenger car, commercial vehicle). Recent innovations include lightweight designs, improved ergonomics, integrated heating/cooling systems, massage functionality, and advanced safety features. These advancements cater to rising consumer demand for comfort, safety, and sustainability. Unique selling propositions often center on comfort, adjustability, premium materials, and innovative safety mechanisms.

Key Drivers, Barriers & Challenges in Europe Automotive Seats Industry

Key Drivers:

- Rising vehicle production.

- Increasing demand for advanced seating features.

- Stringent safety regulations.

- Technological advancements in materials and design.

Key Challenges:

- Supply chain disruptions impacting material availability and cost.

- Fluctuating raw material prices affecting profitability.

- Intense competition among existing players.

- Meeting stringent environmental regulations.

Emerging Opportunities in Europe Automotive Seats Industry

Emerging opportunities include the increasing demand for sustainable and lightweight seat materials, integration of advanced technologies such as haptic feedback and connectivity, and the growth of the aftermarket segment. Further, the expansion of the EV market presents significant opportunities for manufacturers to develop specialized seats tailored for electric vehicles, and the growing emphasis on personalized comfort settings can drive demand for bespoke seat options.

Growth Accelerators in the Europe Automotive Seats Industry Industry

Technological advancements in materials science, lightweighting technologies, and smart seating systems are key growth accelerators. Strategic partnerships between seat manufacturers and automotive OEMs are driving innovation and streamlining supply chains. The expansion of manufacturing capabilities in emerging economies, while maintaining quality standards, offers another strategic direction. These factors collectively contribute to significant market growth.

Key Players Shaping the Europe Automotive Seats Industry Market

- Brose Fahrzeugteile GmbH & Co KG

- Recaro Group

- RENATO Auto Spezialsitze GmbH

- Maxi-Cosi

- Sparco SpA

- Britax

- Groclin SA

- Lear Corporation

- Faurecia

- Adient PLC

Notable Milestones in Europe Automotive Seats Industry Sector

- November 2022: Daewon Precision's new facility for Hyundai Genesis EV seats signals significant investment in EV seat production.

- October 2022: Lear Corporation's new Meknes facility signifies expansion in the European market and increased job creation.

- April 2022: INEOS Automotive's Grenadier launch offers versatile seating options, expanding the commercial vehicle market segment.

In-Depth Europe Automotive Seats Industry Market Outlook

The European automotive seats market is poised for continued growth, driven by the factors outlined above. The increasing adoption of advanced technologies, a focus on sustainability, and strategic partnerships will play a key role in shaping the future of this dynamic sector. Significant growth potential exists in the areas of electric vehicle seating, personalized comfort options, and aftermarket modifications. Companies that effectively leverage innovation and adapt to evolving consumer preferences are expected to thrive in the coming years.

Europe Automotive Seats Industry Segmentation

-

1. Material

- 1.1. Leather

- 1.2. Fabric

- 1.3. Other Materials

-

2. Technology

- 2.1. Standard Seats

- 2.2. Powered Seats

- 2.3. Ventilated Seats

- 2.4. Child Safety Seats

- 2.5. Other Seats

-

3. Vehicle Type

- 3.1. Passenger Car

- 3.2. Commercial Vehicle

-

4. Sales Channel

- 4.1. OEM

- 4.2. Aftermarket

Europe Automotive Seats Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Netherlands

- 6. Spain

- 7. Rest of Europe

Europe Automotive Seats Industry Regional Market Share

Geographic Coverage of Europe Automotive Seats Industry

Europe Automotive Seats Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Leather

- 5.1.2. Fabric

- 5.1.3. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Standard Seats

- 5.2.2. Powered Seats

- 5.2.3. Ventilated Seats

- 5.2.4. Child Safety Seats

- 5.2.5. Other Seats

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Car

- 5.3.2. Commercial Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Sales Channel

- 5.4.1. OEM

- 5.4.2. Aftermarket

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.5.2. United Kingdom

- 5.5.3. Italy

- 5.5.4. France

- 5.5.5. Netherlands

- 5.5.6. Spain

- 5.5.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Germany Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Leather

- 6.1.2. Fabric

- 6.1.3. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Standard Seats

- 6.2.2. Powered Seats

- 6.2.3. Ventilated Seats

- 6.2.4. Child Safety Seats

- 6.2.5. Other Seats

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Car

- 6.3.2. Commercial Vehicle

- 6.4. Market Analysis, Insights and Forecast - by Sales Channel

- 6.4.1. OEM

- 6.4.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. United Kingdom Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Leather

- 7.1.2. Fabric

- 7.1.3. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Standard Seats

- 7.2.2. Powered Seats

- 7.2.3. Ventilated Seats

- 7.2.4. Child Safety Seats

- 7.2.5. Other Seats

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Car

- 7.3.2. Commercial Vehicle

- 7.4. Market Analysis, Insights and Forecast - by Sales Channel

- 7.4.1. OEM

- 7.4.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Italy Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Leather

- 8.1.2. Fabric

- 8.1.3. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Standard Seats

- 8.2.2. Powered Seats

- 8.2.3. Ventilated Seats

- 8.2.4. Child Safety Seats

- 8.2.5. Other Seats

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Car

- 8.3.2. Commercial Vehicle

- 8.4. Market Analysis, Insights and Forecast - by Sales Channel

- 8.4.1. OEM

- 8.4.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. France Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Leather

- 9.1.2. Fabric

- 9.1.3. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Standard Seats

- 9.2.2. Powered Seats

- 9.2.3. Ventilated Seats

- 9.2.4. Child Safety Seats

- 9.2.5. Other Seats

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Car

- 9.3.2. Commercial Vehicle

- 9.4. Market Analysis, Insights and Forecast - by Sales Channel

- 9.4.1. OEM

- 9.4.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Netherlands Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Leather

- 10.1.2. Fabric

- 10.1.3. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Standard Seats

- 10.2.2. Powered Seats

- 10.2.3. Ventilated Seats

- 10.2.4. Child Safety Seats

- 10.2.5. Other Seats

- 10.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.3.1. Passenger Car

- 10.3.2. Commercial Vehicle

- 10.4. Market Analysis, Insights and Forecast - by Sales Channel

- 10.4.1. OEM

- 10.4.2. Aftermarket

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Spain Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Material

- 11.1.1. Leather

- 11.1.2. Fabric

- 11.1.3. Other Materials

- 11.2. Market Analysis, Insights and Forecast - by Technology

- 11.2.1. Standard Seats

- 11.2.2. Powered Seats

- 11.2.3. Ventilated Seats

- 11.2.4. Child Safety Seats

- 11.2.5. Other Seats

- 11.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 11.3.1. Passenger Car

- 11.3.2. Commercial Vehicle

- 11.4. Market Analysis, Insights and Forecast - by Sales Channel

- 11.4.1. OEM

- 11.4.2. Aftermarket

- 11.1. Market Analysis, Insights and Forecast - by Material

- 12. Rest of Europe Europe Automotive Seats Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Material

- 12.1.1. Leather

- 12.1.2. Fabric

- 12.1.3. Other Materials

- 12.2. Market Analysis, Insights and Forecast - by Technology

- 12.2.1. Standard Seats

- 12.2.2. Powered Seats

- 12.2.3. Ventilated Seats

- 12.2.4. Child Safety Seats

- 12.2.5. Other Seats

- 12.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 12.3.1. Passenger Car

- 12.3.2. Commercial Vehicle

- 12.4. Market Analysis, Insights and Forecast - by Sales Channel

- 12.4.1. OEM

- 12.4.2. Aftermarket

- 12.1. Market Analysis, Insights and Forecast - by Material

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Brose Fahrzeugteile GmbH & Co KG

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Recaro Group

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 RENATO Auto Spezialsitze GmbH*List Not Exhaustive

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Maxi-Cosi

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Sparco SpA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Britax

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Groclin SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Lear Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Faurecia

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Adient PLC

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Brose Fahrzeugteile GmbH & Co KG

List of Figures

- Figure 1: Europe Automotive Seats Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Seats Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: Europe Automotive Seats Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 7: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 10: Europe Automotive Seats Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 15: Europe Automotive Seats Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 17: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 19: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 20: Europe Automotive Seats Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 22: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 23: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 24: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 25: Europe Automotive Seats Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 27: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 28: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 29: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 30: Europe Automotive Seats Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 32: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 33: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 34: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 35: Europe Automotive Seats Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Europe Automotive Seats Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 37: Europe Automotive Seats Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 38: Europe Automotive Seats Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 39: Europe Automotive Seats Industry Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 40: Europe Automotive Seats Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Seats Industry?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Europe Automotive Seats Industry?

Key companies in the market include Brose Fahrzeugteile GmbH & Co KG, Recaro Group, RENATO Auto Spezialsitze GmbH*List Not Exhaustive, Maxi-Cosi, Sparco SpA, Britax, Groclin SA, Lear Corporation, Faurecia, Adient PLC.

3. What are the main segments of the Europe Automotive Seats Industry?

The market segments include Material , Technology , Vehicle Type, Sales Channel .

4. Can you provide details about the market size?

The market size is estimated to be USD 12.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

November 2022: Daewon Precision Ind. Co., Ltd. (Daewon Precision) proudly announced the successful completion of its state-of-the-art manufacturing facility dedicated to producing car seats for the prestigious Hyundai Genesis brand. This cutting-edge plant, situated at the brand-new Daewon Premium Mechanism (DPM) facility, is set to play a pivotal role in supplying seat components for the upcoming Genesis brand electric vehicles (EVs), scheduled for mass production in 2025 or later.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Seats Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Seats Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Seats Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Seats Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence