Key Insights

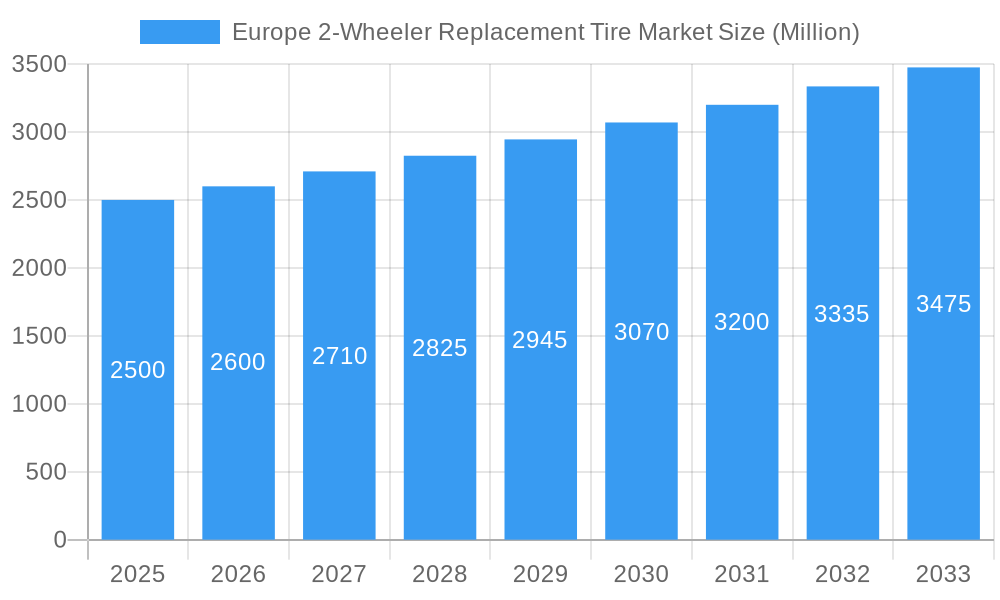

The Europe 2-Wheeler Replacement Tire Market is projected for significant expansion, expected to reach a market size of 460.76 million by 2033, with a Compound Annual Growth Rate (CAGR) of 2.6% from the base year 2025. This growth is fueled by increasing urbanization, demand for cost-effective personal transport, and a rising recreational riding culture across key European nations. Manufacturers are prioritizing safety, performance, and durability, investing in innovative tire technologies for enhanced grip, fuel efficiency, and longevity. The rise of electric scooters and motorcycles presents new opportunities, requiring specialized tire solutions.

Europe 2-Wheeler Replacement Tire Market Market Size (In Million)

Key market trends include a strong emphasis on sustainability through eco-friendly materials and manufacturing. The aftermarket segment, driven by demand for premium replacement tires, is particularly robust. While Original Equipment Manufacturer (OEM) demand remains a steady contributor, the replacement market offers substantial growth potential. Strategic pricing and product differentiation are crucial to navigate fluctuating raw material costs and intense competition. Europe, with its established two-wheeler culture, particularly Germany, France, the United Kingdom, and Italy, leads market adoption and replacement cycles, influenced by evolving vehicle technology and safety regulations.

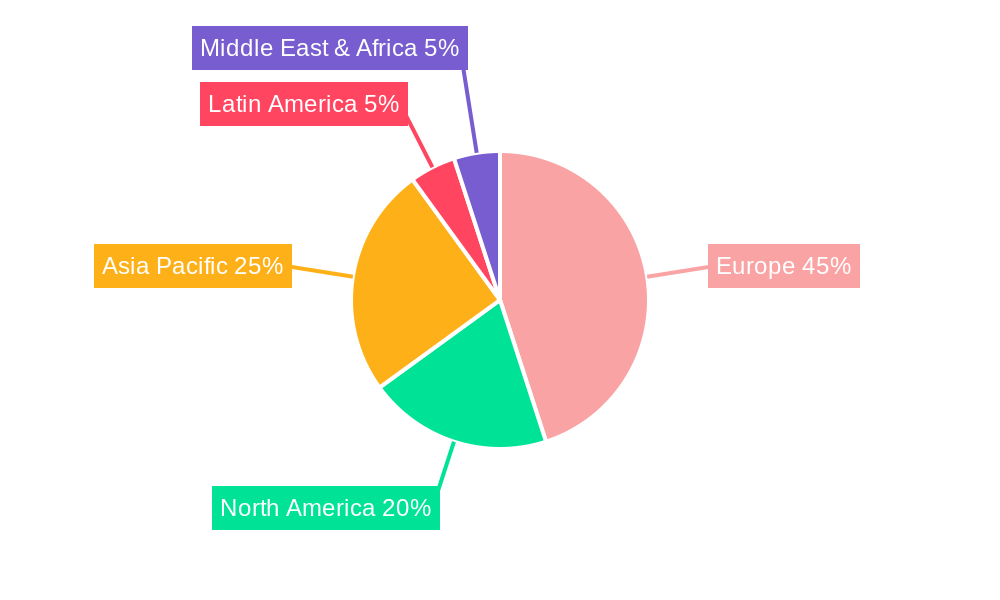

Europe 2-Wheeler Replacement Tire Market Company Market Share

This report offers a strategic analysis of the Europe 2-Wheeler Replacement Tire Market, covering dynamic shifts driven by evolving mobility trends, technological advancements, and growing demand for sustainable solutions. From 2019 to 2033, with a base year of 2025, this analysis provides actionable insights into market size, growth drivers, segmentation, competitive landscape, and future opportunities for motorcycle tires, scooter tires, moped tires, and electric scooter tires. Understand the nuances of both the OEM tire market and the replacement tire market to inform your business strategy.

Europe 2-Wheeler Replacement Tire Market Market Dynamics & Structure

The Europe 2-Wheeler Replacement Tire Market exhibits a moderately concentrated structure, with key global players like Michelin, Goodyear, and Dunlop holding significant market share. Technological innovation remains a primary driver, with manufacturers investing heavily in developing tires with enhanced grip, durability, fuel efficiency, and sustainability. Regulatory frameworks, particularly concerning emissions and road safety standards, are increasingly influencing product development and market entry. Competitive product substitutes, such as advancements in tire repair technologies and the growing adoption of larger wheeled vehicles, pose challenges. End-user demographics are shifting, with an aging population in some regions and a younger, urban demographic embracing 2-wheelers for their convenience and environmental benefits. Merger and acquisition (M&A) trends are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities within the 2-wheeler tire industry.

- Market Concentration: Dominated by a few key global manufacturers, but with a growing presence of specialized and regional players.

- Technological Innovation: Focus on eco-friendly materials, puncture resistance, and smart tire technology for enhanced safety and performance.

- Regulatory Impact: Stricter emission standards and safety regulations are influencing material choices and tire design.

- Competitive Substitutes: Advancements in tire sealants and the rise of e-bikes with higher performance characteristics.

- End-User Demographics: Growing urban population, younger riders, and increased adoption of 2-wheelers for last-mile connectivity.

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand product offerings.

Europe 2-Wheeler Replacement Tire Market Growth Trends & Insights

The Europe 2-Wheeler Replacement Tire Market is poised for significant growth, projected to reach xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This expansion is fueled by a confluence of factors, including the escalating adoption of electric scooters and motorcycles, driven by environmental consciousness and favorable government incentives across the continent. The burgeoning urban population further propels demand for agile and cost-effective personal transportation, directly benefiting the scooter tire and moped tire segments. Evolving consumer preferences are tilting towards premium, high-performance tires offering superior grip, longevity, and safety features, especially within the motorcycle tire segment. Technological disruptions, such as the development of smart tires equipped with sensors for real-time performance monitoring and predictive maintenance, are also shaping market dynamics and creating new avenues for growth.

The historical period (2019–2024) witnessed steady growth, with the replacement tire market consistently outperforming the OEM segment due to the natural lifecycle of tires and an increasing average age of the 2-wheeler fleet. The shift towards electric mobility has introduced a new dimension, with the electric scooter tire and electric motorcycle tire segments demonstrating exponential growth potential, demanding specialized compounds and tread designs to accommodate higher torque and weight. Consumer behavior is increasingly influenced by factors beyond mere price, with brand reputation, perceived safety, and sustainable manufacturing practices playing a crucial role in purchasing decisions. The penetration of the replacement tire market is expected to deepen as the installed base of 2-wheelers continues to expand, particularly in countries with well-established 2-wheeler cultures and robust infrastructure supporting their use. The study's forecast period anticipates continued upward trajectory, underpinned by ongoing urbanization, a persistent focus on sustainable mobility solutions, and continuous innovation in tire technology by leading manufacturers like Apollo Tires Ltd, Michelin, BFGoodrich, Firestone, Cooper, Goodyear, Dunlop, Yokohama, and General.

Dominant Regions, Countries, or Segments in Europe 2-Wheeler Replacement Tire Market

The Europe 2-Wheeler Replacement Tire Market is currently dominated by Western European nations, with Germany, France, Italy, and the United Kingdom leading the charge. This dominance is attributable to a confluence of factors, including a mature 2-wheeler culture, robust economic policies supporting personal mobility, and well-developed urban infrastructure facilitating the widespread use of motorcycles, scooters, and mopeds. The motorcycle tire segment in these countries is driven by a passionate enthusiast base and a growing trend towards leisure riding and touring, demanding high-performance and specialized tires.

- Leading Region: Western Europe, accounting for a significant share of the total market volume.

- Key Countries: Germany, France, Italy, and the United Kingdom, characterized by high 2-wheeler ownership and robust replacement markets.

- Dominant Vehicle Type: The scooter/moped segment continues to hold a substantial market share due to its affordability, maneuverability in urban environments, and cost-effectiveness for daily commuting. However, the motorcycle segment is experiencing steady growth driven by performance and leisure activities.

- Fuel Type Dominance: The petrol fuel type currently dominates the market, reflecting the existing fleet. However, the electric fuel type segment is experiencing rapid growth, driven by government initiatives and increasing consumer preference for sustainable mobility.

- Demand Category Leadership: The replacement demand category is the primary growth engine for the Europe 2-Wheeler Replacement Tire Market. This is due to the inherent lifecycle of tires requiring periodic replacement, coupled with an expanding base of aging 2-wheelers. While the OEM market contributes, it is significantly smaller in volume compared to the aftermarket.

Further analysis reveals that economic policies promoting eco-friendly transportation, such as subsidies for electric 2-wheelers and favorable tax regimes, are accelerating the growth of the electric scooter tire and electric motorcycle tire markets within these leading countries. Infrastructure development, including dedicated lanes and charging facilities, further encourages the adoption of 2-wheelers, thereby boosting the demand for replacement tires. The growth potential in Eastern European countries is also substantial, as their economies develop and urbanization increases, presenting a significant opportunity for market expansion.

Europe 2-Wheeler Replacement Tire Market Product Landscape

The Europe 2-Wheeler Replacement Tire Market product landscape is characterized by continuous innovation aimed at enhancing safety, performance, and sustainability. Manufacturers are developing advanced compounds that offer improved grip in wet conditions, extended tread life, and reduced rolling resistance for better fuel efficiency. The increasing prevalence of electric 2-wheelers has spurred the development of specialized electric scooter tires and electric motorcycle tires engineered to handle higher torque, greater weight, and specific heat dissipation requirements. Product innovations include tread designs optimized for urban environments, offering a balance of grip, comfort, and durability, as well as performance-oriented tires for motorcycles focusing on superior cornering stability and braking performance. Unique selling propositions often revolve around proprietary rubber compounds, advanced construction techniques, and Michelin's commitment to sustainability.

Key Drivers, Barriers & Challenges in Europe 2-Wheeler Replacement Tire Market

Key Drivers:

- Growing Urbanization: Increasing population density in cities drives demand for agile and efficient 2-wheelers for commuting.

- Rise of Electric 2-Wheelers: Favorable government incentives and environmental concerns accelerate the adoption of electric scooters and motorcycles.

- Aging 2-Wheeler Fleet: A larger base of existing vehicles necessitates regular tire replacements.

- Technological Advancements: Development of tires with enhanced safety, durability, and fuel efficiency.

- Leisure and Tourism: Increased popularity of motorcycle touring and recreational riding.

Barriers & Challenges:

- Economic Downturns: Recessions can reduce discretionary spending on vehicle maintenance and upgrades.

- Supply Chain Disruptions: Geopolitical events and raw material availability can impact production and pricing.

- Counterfeit Products: The presence of sub-standard and counterfeit tires can erode market trust and safety.

- Intense Competition: A crowded market with numerous players can lead to price wars and squeezed margins.

- Infrastructure Limitations: In some regions, inadequate road infrastructure can limit the appeal and lifespan of 2-wheelers and their tires.

Emerging Opportunities in Europe 2-Wheeler Replacement Tire Market

Emerging opportunities within the Europe 2-Wheeler Replacement Tire Market lie in the rapidly expanding electric 2-wheeler segment. This includes the development of specialized tires optimized for the unique demands of electric scooters and motorcycles, focusing on efficiency, longevity, and performance. The increasing trend of last-mile delivery services presents a significant opportunity for durable and cost-effective scooter tires. Furthermore, the growing consumer awareness and demand for sustainable products are opening avenues for manufacturers utilizing recycled materials and eco-friendly production processes. The integration of smart tire technology, offering predictive maintenance and enhanced safety features, is another burgeoning area. Untapped markets in Eastern and Southern Europe also present substantial growth potential as their economies and urban mobility needs evolve.

Growth Accelerators in the Europe 2-Wheeler Replacement Tire Market Industry

Several catalysts are accelerating the growth within the Europe 2-Wheeler Replacement Tire Market. The relentless push towards electrification of personal transport, supported by government subsidies and charging infrastructure development, is a primary accelerator, boosting demand for electric scooter tires and electric motorcycle tires. Strategic partnerships between tire manufacturers and electric 2-wheeler OEMs are crucial for co-developing specialized tire solutions and gaining market access. Market expansion strategies, including the penetration of underserved Eastern European markets and the development of innovative distribution channels, are also key growth drivers. Continuous technological breakthroughs, such as the creation of self-healing tire materials and tires with significantly extended lifespans, will further propel the industry forward.

Key Players Shaping the Europe 2-Wheeler Replacement Tire Market Market

- Apollo Tires Ltd

- Michelin

- BFGoodrich

- Firestone

- Cooper

- Goodyear

- Dunlop

- Yokohama

- General

Notable Milestones in Europe 2-Wheeler Replacement Tire Market Sector

- 2019/08: Michelin launches a new range of eco-friendly scooter tires with improved fuel efficiency.

- 2020/03: Goodyear expands its motorcycle tire offering with a focus on enhanced wet grip and durability.

- 2021/11: Apollo Tires Ltd announces strategic investment in electric vehicle tire technology.

- 2022/06: Dunlop introduces a novel tread pattern for improved stability and longevity in urban environments.

- 2023/01: Yokohama Tire Corporation reveals plans for increased production of lightweight electric scooter tires.

- 2023/09: Firestone partners with a leading electric scooter manufacturer to supply OEM tires.

In-Depth Europe 2-Wheeler Replacement Tire Market Market Outlook

The outlook for the Europe 2-Wheeler Replacement Tire Market is exceptionally positive, driven by the overarching trends of urbanization, electrification, and a continuous pursuit of enhanced mobility solutions. Growth accelerators such as government support for sustainable transport, coupled with the inherent demand for tire replacements from an ever-growing fleet, will solidify market expansion. Strategic opportunities reside in catering to the specific needs of the burgeoning electric 2-wheeler segment and in penetrating emerging markets. The market's future trajectory will be shaped by ongoing innovation in tire technology, focusing on sustainability, performance, and rider safety, ensuring continued robust growth and value creation for stakeholders in this dynamic sector.

Europe 2-Wheeler Replacement Tire Market Segmentation

-

1. Vehicle Type

- 1.1. Motorcycle

- 1.2. Scooter/Moped

-

2. Fuel type

- 2.1. Petrol

- 2.2. Electric

-

3. Demand Category

- 3.1. OEM

- 3.2. Replacement

Europe 2-Wheeler Replacement Tire Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. Italy

- 1.4. France

- 1.5. Rest of Europe

Europe 2-Wheeler Replacement Tire Market Regional Market Share

Geographic Coverage of Europe 2-Wheeler Replacement Tire Market

Europe 2-Wheeler Replacement Tire Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness

- 3.3. Market Restrains

- 3.3.1. Competitiveness Of Alternative Materials

- 3.4. Market Trends

- 3.4.1. Retreading of The Tire Will Push The 2-Wheeler Market for Replacement Tire Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe 2-Wheeler Replacement Tire Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Motorcycle

- 5.1.2. Scooter/Moped

- 5.2. Market Analysis, Insights and Forecast - by Fuel type

- 5.2.1. Petrol

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Demand Category

- 5.3.1. OEM

- 5.3.2. Replacement

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Apollo Tires Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Michelin

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BFGoodrich

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Firestone

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cooper

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Goodyear

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dunlop

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yokoham

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 General

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Apollo Tires Ltd

List of Figures

- Figure 1: Europe 2-Wheeler Replacement Tire Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe 2-Wheeler Replacement Tire Market Share (%) by Company 2025

List of Tables

- Table 1: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Fuel type 2020 & 2033

- Table 3: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Demand Category 2020 & 2033

- Table 4: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Fuel type 2020 & 2033

- Table 7: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Demand Category 2020 & 2033

- Table 8: Europe 2-Wheeler Replacement Tire Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe 2-Wheeler Replacement Tire Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe 2-Wheeler Replacement Tire Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Italy Europe 2-Wheeler Replacement Tire Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: France Europe 2-Wheeler Replacement Tire Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe 2-Wheeler Replacement Tire Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe 2-Wheeler Replacement Tire Market?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Europe 2-Wheeler Replacement Tire Market?

Key companies in the market include Apollo Tires Ltd, Michelin, BFGoodrich, Firestone, Cooper, Goodyear, Dunlop, Yokoham, General.

3. What are the main segments of the Europe 2-Wheeler Replacement Tire Market?

The market segments include Vehicle Type, Fuel type, Demand Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 460.76 million as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness.

6. What are the notable trends driving market growth?

Retreading of The Tire Will Push The 2-Wheeler Market for Replacement Tire Segment.

7. Are there any restraints impacting market growth?

Competitiveness Of Alternative Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe 2-Wheeler Replacement Tire Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe 2-Wheeler Replacement Tire Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe 2-Wheeler Replacement Tire Market?

To stay informed about further developments, trends, and reports in the Europe 2-Wheeler Replacement Tire Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence