Key Insights

The global Automotive Fault Circuit Controller Market is projected to experience significant growth, reaching an estimated market size of USD 2.8 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 5.4%. This expansion is driven by the increasing demand for advanced vehicle safety systems and the rising adoption of electric vehicles (EVs), which necessitate sophisticated fault management solutions. The market is segmented by device type into superconducting and non-superconducting controllers. While non-superconducting devices currently lead due to cost-effectiveness, superconducting devices are anticipated to see rapid adoption in specialized high-performance applications. The voltage segment, comprising high and medium voltage controllers, is critical for managing power distribution, particularly in EVs with their high-power battery systems.

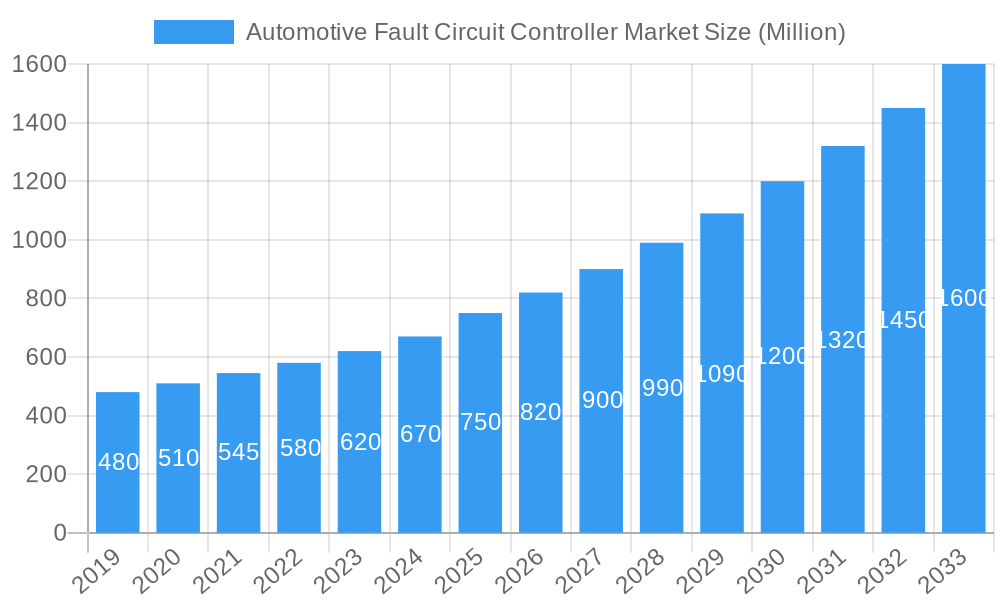

Automotive Fault Circuit Controller Market Market Size (In Billion)

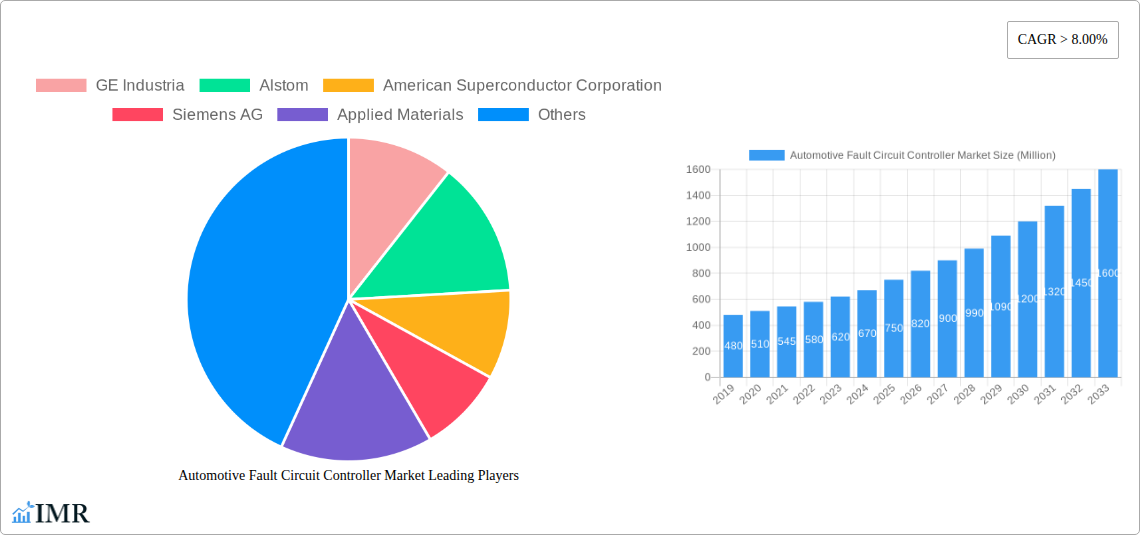

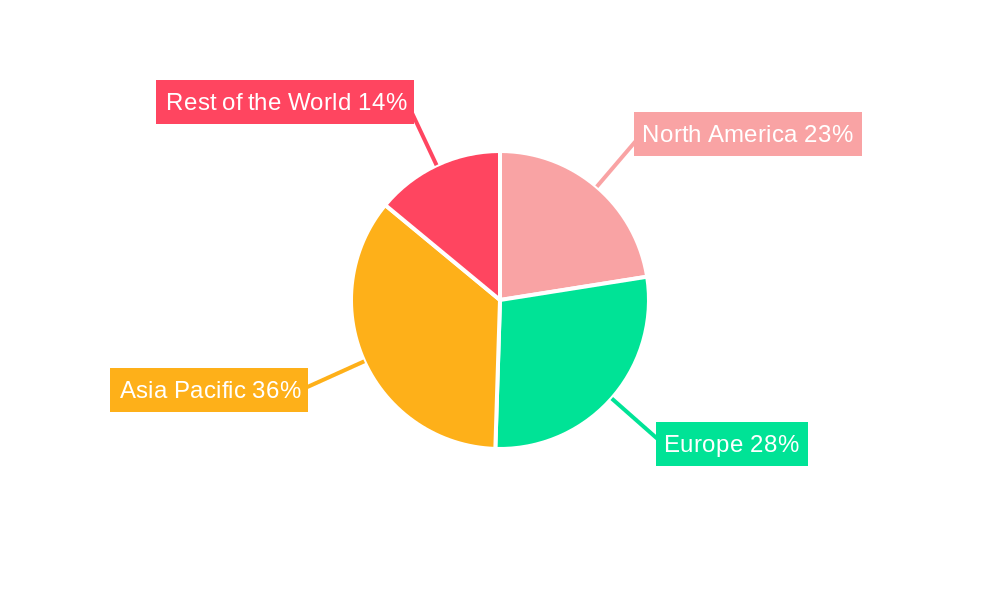

Key market drivers include stringent global automotive safety regulations, the increasing complexity of vehicle electrical systems, and the continuous need for enhanced vehicle reliability and performance. Advances in semiconductor technology and the integration of intelligent fault detection algorithms further contribute to market expansion. However, potential restraints include high development and manufacturing costs for advanced controllers and possible interoperability issues across different vehicle platforms. Geographically, the Asia Pacific region, particularly China and India, is expected to be a major growth driver, supported by substantial automotive production and a burgeoning EV market. North America and Europe are also significant markets, influenced by their focus on technological innovation and strict safety standards. Prominent market players such as GE Industria, Alstom, Siemens AG, and ABB Limited are actively engaged in research and development to introduce innovative fault circuit control solutions.

Automotive Fault Circuit Controller Market Company Market Share

This comprehensive report offers an in-depth analysis of the global Automotive Fault Circuit Controller Market, providing critical insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2024 (base year), with forecasts extending to 2033, this research examines market dynamics, growth trends, regional analysis, product segmentation, and key player strategies. We utilize extensive data to illustrate market evolution, technological advancements, and future opportunities.

Automotive Fault Circuit Controller Market Market Dynamics & Structure

The Automotive Fault Circuit Controller Market is characterized by a moderate to high concentration, driven by significant technological innovation and substantial capital investment requirements. Key drivers include the escalating demand for enhanced vehicle safety, particularly in electric vehicles (EVs), and stringent regulatory mandates concerning electrical protection systems. The market is also influenced by the competitive landscape, where advanced superconducting fault current limiters (SFCLs) and sophisticated non-superconducting devices vie for market share. Substitutes primarily involve traditional circuit breakers and fuses, but their limitations in high-power applications are increasingly evident. End-user demographics are shifting towards technologically adept consumers and fleet operators prioritizing reliability and reduced downtime. Mergers and acquisitions (M&A) are expected to play a crucial role in consolidating the market, with xx reported M&A deals in the historical period 2019-2024, indicating a trend towards strategic partnerships and market expansion. Barriers to innovation include the high cost of research and development for advanced superconducting technologies and the need for extensive testing and certification for automotive applications.

- Market Concentration: Moderate to High, with a few key players dominating advanced technologies.

- Technological Innovation Drivers: EV proliferation, advanced safety features, grid modernization for vehicle charging infrastructure.

- Regulatory Frameworks: Increasing stringency in automotive electrical safety standards.

- Competitive Product Substitutes: Traditional circuit breakers, fuses (limited in high-power scenarios).

- End-User Demographics: Growing demand from EV manufacturers and industrial vehicle operators.

- M&A Trends: Active consolidation expected, with xx major M&A activities in the past five years.

Automotive Fault Circuit Controller Market Growth Trends & Insights

The Automotive Fault Circuit Controller Market is poised for substantial growth, driven by the global transition towards electrified transportation and the increasing complexity of automotive electrical systems. The market size is projected to expand from $XXX million units in the base year 2025 to $XXX million units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This expansion is fueled by the imperative for sophisticated fault current mitigation in electric vehicles, where high-capacity battery systems and intricate power electronics necessitate advanced protection. Adoption rates of fault circuit controllers, particularly superconducting variants, are accelerating as manufacturers recognize their superior performance in terms of speed, efficiency, and reliability compared to conventional protection devices. Technological disruptions, such as advancements in superconducting materials and power semiconductor technologies, are continuously enhancing the capabilities and reducing the cost of fault circuit controllers. Consumer behavior is also a significant factor, with a growing preference for vehicles that offer enhanced safety and operational reliability. The market penetration of advanced fault circuit controllers is expected to rise from xx% in 2025 to an estimated xx% by 2033, underscoring their growing importance in the automotive sector.

Dominant Regions, Countries, or Segments in Automotive Fault Circuit Controller Market

The Electric Vehicle (EV) segment is unequivocally the dominant force driving growth in the Automotive Fault Circuit Controller Market, with an estimated market share of xx% in 2025. This dominance stems from the inherent electrical complexities and high-energy demands of EVs, necessitating advanced fault protection mechanisms. Within the voltage segment, High Voltage applications are experiencing the most rapid expansion, accounting for an estimated xx% of the market share in 2025, driven by the electrification of heavy-duty vehicles and the development of advanced battery architectures.

Dominant Vehicle Type: Electric Vehicle (EV)

- Key Drivers: Escalating EV adoption rates globally, particularly in North America and Europe; inherent need for robust fault protection in high-voltage battery systems; government incentives promoting EV sales.

- Market Share (2025 Estimate): XX%

- Growth Potential: Significant, driven by ongoing electrification trends and technological advancements in battery technology.

Dominant Voltage Segment: High Voltage

- Key Drivers: Integration into electric buses, trucks, and specialized industrial vehicles; requirement for efficient and rapid fault interruption in high-current scenarios; advancements in HV DC architectures.

- Market Share (2025 Estimate): XX%

- Growth Potential: High, as the electrification of commercial and heavy-duty transport continues.

Dominant Type Segment: Superconducting Devices

- Key Drivers: Superior performance in fault current limitation speed and capacity; reduced energy losses; enabling higher power densities in vehicle systems; ongoing R&D improving cost-effectiveness.

- Market Share (2025 Estimate): XX%

- Growth Potential: Strong, as technological maturity reduces initial cost barriers.

Regionally, Asia-Pacific is emerging as a pivotal market due to its leadership in EV manufacturing and significant government support for the automotive industry, contributing an estimated xx% to the global market in 2025.

Automotive Fault Circuit Controller Market Product Landscape

The Automotive Fault Circuit Controller Market is characterized by a landscape of rapidly evolving products. Innovations are centered around enhancing fault detection speed, current limiting capability, and overall system reliability for electric vehicles. Superconducting Fault Current Limiters (SFCLs), for instance, offer near-instantaneous fault interruption, safeguarding sensitive components like battery management systems and power inverters. Non-superconducting devices are witnessing improvements in miniaturization, cost-effectiveness, and integration with advanced control algorithms. Applications extend beyond passenger EVs to electric buses, trucks, and specialized industrial vehicles, where higher power demands and stringent safety regulations necessitate advanced solutions. Performance metrics are increasingly focusing on response times (measured in microseconds), energy dissipation during fault events, and extended operational lifespans.

Key Drivers, Barriers & Challenges in Automotive Fault Circuit Controller Market

The Automotive Fault Circuit Controller Market is propelled by several key drivers, including the relentless surge in electric vehicle production and adoption, stringent automotive safety regulations mandating advanced protection, and the inherent need to manage high fault currents in complex EV powertrains. Technological advancements in superconducting materials and power electronics also play a crucial role.

- Key Drivers:

- EV Penetration: The global shift towards electric mobility.

- Safety Regulations: Evolving and stringent automotive safety standards.

- High Power Management: Necessity for robust fault protection in high-voltage EV systems.

- Technological Advancements: Innovations in superconducting and power electronic technologies.

Conversely, significant barriers and challenges exist. The high initial cost of advanced superconducting fault circuit controllers remains a primary restraint. Supply chain complexities for specialized materials and components, coupled with the need for rigorous testing and certification processes within the automotive industry, present further hurdles. Intense competition from established manufacturers of traditional protective devices also impacts market entry and growth.

- Key Barriers & Challenges:

- High Initial Cost: Particularly for superconducting technologies.

- Supply Chain Issues: Sourcing of specialized materials.

- Regulatory Hurdles: Lengthy certification processes for automotive components.

- Competitive Pressures: From traditional protection device manufacturers.

- Integration Complexity: Ensuring seamless integration with existing vehicle architectures.

Emerging Opportunities in Automotive Fault Circuit Controller Market

Emerging opportunities within the Automotive Fault Circuit Controller Market lie in the development of more cost-effective and scalable superconducting solutions, making them accessible to a broader range of EV manufacturers. The increasing demand for robust electrical protection in autonomous vehicles and advanced driver-assistance systems (ADAS) presents a significant untapped market. Furthermore, the integration of fault circuit controllers with smart grid technologies for optimized charging infrastructure and vehicle-to-grid (V2G) applications opens up new avenues for innovation and market expansion. The growing adoption of electric heavy-duty vehicles, such as long-haul trucks and buses, also signifies a substantial opportunity for high-capacity fault circuit controllers.

Growth Accelerators in the Automotive Fault Circuit Controller Market Industry

Several catalysts are accelerating long-term growth in the Automotive Fault Circuit Controller Market. Foremost among these is the ongoing technological breakthrough in high-temperature superconducting materials, which promises to significantly reduce the cost and improve the performance of superconducting fault circuit controllers. Strategic partnerships between automotive OEMs, Tier-1 suppliers, and technology providers are crucial for fostering collaborative innovation and accelerating product development. Market expansion strategies, including the penetration into emerging automotive markets and the development of standardized, modular fault circuit controller solutions, will also act as significant growth accelerators. The continuous improvement in manufacturing processes for both superconducting and non-superconducting devices will drive down costs and increase production volumes, further fueling market expansion.

Key Players Shaping the Automotive Fault Circuit Controller Market Market

- GE Industria

- Alstom

- American Superconductor Corporation

- Siemens AG

- Applied Materials

- Superpower Inc

- Gridon

- Rongxin Power Electronic Co Ltd

- Nexans

- ABB Limited

- Superconductor Technologies Inc

- AMSC

Notable Milestones in Automotive Fault Circuit Controller Market Sector

- 2021: GE Industria announces breakthrough in cost-effective manufacturing of high-performance superconducting tapes for fault current limiters.

- 2022: Alstom and Siemens AG collaborate on developing integrated fault current protection solutions for electric rail and automotive applications.

- 2023: American Superconductor Corporation (AMSC) secures significant contracts for supplying superconducting wires for next-generation electric vehicle powertrains.

- 2024: Applied Materials introduces advanced deposition techniques to enhance the performance and durability of superconducting components.

- 2025 (Estimated): Superpower Inc. is anticipated to launch a new generation of compact and efficient fault current limiters specifically designed for passenger EVs.

- 2025 (Estimated): Gridon receives regulatory approval for its innovative non-superconducting fault circuit controller, offering a competitive alternative for medium-voltage applications.

- 2026 (Projected): Rongxin Power Electronic Co Ltd plans to expand its manufacturing capacity to meet the growing demand for electric vehicle power components, including fault circuit controllers.

- 2027 (Projected): Nexans announces advancements in cable integration for fault current protection systems, simplifying installation and enhancing reliability.

- 2028 (Projected): ABB Limited showcases a fully integrated electric vehicle charging and protection system featuring advanced fault circuit controllers.

- 2029 (Projected): Superconductor Technologies Inc. demonstrates significant progress in developing room-temperature superconducting materials, potentially revolutionizing the market.

In-Depth Automotive Fault Circuit Controller Market Market Outlook

The future market potential for Automotive Fault Circuit Controllers is exceptionally bright, driven by sustained growth in electric vehicle adoption and the continuous pursuit of enhanced vehicle safety and performance. Growth accelerators will center on technological advancements, particularly in the cost reduction and scalability of superconducting technologies, alongside the ongoing refinement of non-superconducting solutions. Strategic partnerships and market expansion into underserved segments, such as emerging economies and specialized commercial vehicle sectors, will be critical. The industry is on the cusp of a transformation, with fault circuit controllers moving from niche components to integral elements of modern automotive electrical architectures, promising significant future market opportunities and innovation.

Automotive Fault Circuit Controller Market Segmentation

-

1. Type

- 1.1. Superconducting Devices

- 1.2. Non- Superconducting Devices

- 1.3. Others

-

2. Voltage

- 2.1. High Voltage

- 2.2. Medium Voltage

- 2.3. Low Voltage

-

3. Vehicle Type

- 3.1. ICE Vehicle

- 3.2. Electric Vehicle

Automotive Fault Circuit Controller Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. South Africa

- 4.4. Other Countries

Automotive Fault Circuit Controller Market Regional Market Share

Geographic Coverage of Automotive Fault Circuit Controller Market

Automotive Fault Circuit Controller Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Electric Vehicles is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with Electric Vehicles is Anticipated to Restrain the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increasing Electronic Components in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Fault Circuit Controller Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Superconducting Devices

- 5.1.2. Non- Superconducting Devices

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Voltage

- 5.2.1. High Voltage

- 5.2.2. Medium Voltage

- 5.2.3. Low Voltage

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. ICE Vehicle

- 5.3.2. Electric Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Fault Circuit Controller Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Superconducting Devices

- 6.1.2. Non- Superconducting Devices

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Voltage

- 6.2.1. High Voltage

- 6.2.2. Medium Voltage

- 6.2.3. Low Voltage

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. ICE Vehicle

- 6.3.2. Electric Vehicle

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Fault Circuit Controller Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Superconducting Devices

- 7.1.2. Non- Superconducting Devices

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Voltage

- 7.2.1. High Voltage

- 7.2.2. Medium Voltage

- 7.2.3. Low Voltage

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. ICE Vehicle

- 7.3.2. Electric Vehicle

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Fault Circuit Controller Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Superconducting Devices

- 8.1.2. Non- Superconducting Devices

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Voltage

- 8.2.1. High Voltage

- 8.2.2. Medium Voltage

- 8.2.3. Low Voltage

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. ICE Vehicle

- 8.3.2. Electric Vehicle

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Automotive Fault Circuit Controller Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Superconducting Devices

- 9.1.2. Non- Superconducting Devices

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Voltage

- 9.2.1. High Voltage

- 9.2.2. Medium Voltage

- 9.2.3. Low Voltage

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. ICE Vehicle

- 9.3.2. Electric Vehicle

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 GE Industria

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alstom

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 American Superconductor Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Applied Materials

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Superpower Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Gridon

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Rongxin Power Electronic Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nexans

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ABB Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Superconductor Technologies Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 AMSC

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 GE Industria

List of Figures

- Figure 1: Global Automotive Fault Circuit Controller Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Fault Circuit Controller Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Automotive Fault Circuit Controller Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Fault Circuit Controller Market Revenue (billion), by Voltage 2025 & 2033

- Figure 5: North America Automotive Fault Circuit Controller Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 6: North America Automotive Fault Circuit Controller Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Fault Circuit Controller Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Fault Circuit Controller Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive Fault Circuit Controller Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Fault Circuit Controller Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Automotive Fault Circuit Controller Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Automotive Fault Circuit Controller Market Revenue (billion), by Voltage 2025 & 2033

- Figure 13: Europe Automotive Fault Circuit Controller Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 14: Europe Automotive Fault Circuit Controller Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Fault Circuit Controller Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Fault Circuit Controller Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Fault Circuit Controller Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Fault Circuit Controller Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Fault Circuit Controller Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Fault Circuit Controller Market Revenue (billion), by Voltage 2025 & 2033

- Figure 21: Asia Pacific Automotive Fault Circuit Controller Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 22: Asia Pacific Automotive Fault Circuit Controller Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Fault Circuit Controller Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Fault Circuit Controller Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Fault Circuit Controller Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Fault Circuit Controller Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of the World Automotive Fault Circuit Controller Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Automotive Fault Circuit Controller Market Revenue (billion), by Voltage 2025 & 2033

- Figure 29: Rest of the World Automotive Fault Circuit Controller Market Revenue Share (%), by Voltage 2025 & 2033

- Figure 30: Rest of the World Automotive Fault Circuit Controller Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Fault Circuit Controller Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Fault Circuit Controller Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Fault Circuit Controller Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 3: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 7: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 14: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 23: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: India Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Type 2020 & 2033

- Table 31: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Voltage 2020 & 2033

- Table 32: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 33: Global Automotive Fault Circuit Controller Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: Brazil Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Mexico Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: South Africa Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Other Countries Automotive Fault Circuit Controller Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Fault Circuit Controller Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Automotive Fault Circuit Controller Market?

Key companies in the market include GE Industria, Alstom, American Superconductor Corporation, Siemens AG, Applied Materials, Superpower Inc, Gridon, Rongxin Power Electronic Co Ltd, Nexans, ABB Limited, Superconductor Technologies Inc, AMSC.

3. What are the main segments of the Automotive Fault Circuit Controller Market?

The market segments include Type, Voltage, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Electric Vehicles is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

Increasing Electronic Components in Automobiles.

7. Are there any restraints impacting market growth?

High Cost Associated with Electric Vehicles is Anticipated to Restrain the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Fault Circuit Controller Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Fault Circuit Controller Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Fault Circuit Controller Market?

To stay informed about further developments, trends, and reports in the Automotive Fault Circuit Controller Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence