Key Insights

The Europe Adaptive Steering Market is projected to reach $17.7 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.5% during the 2025-2033 forecast period. Key growth drivers include the escalating demand for enhanced driving comfort and safety, the widespread adoption of Advanced Driver-Assistance Systems (ADAS), and the continuous pursuit of improved fuel efficiency. Automakers are integrating adaptive steering to deliver a more dynamic and responsive driving experience, aligning with evolving consumer preferences. Stringent safety regulations and government support for automotive innovation further bolster market development. Europe, with its robust automotive manufacturing base and discerning consumer market, is a key region driving this technological evolution.

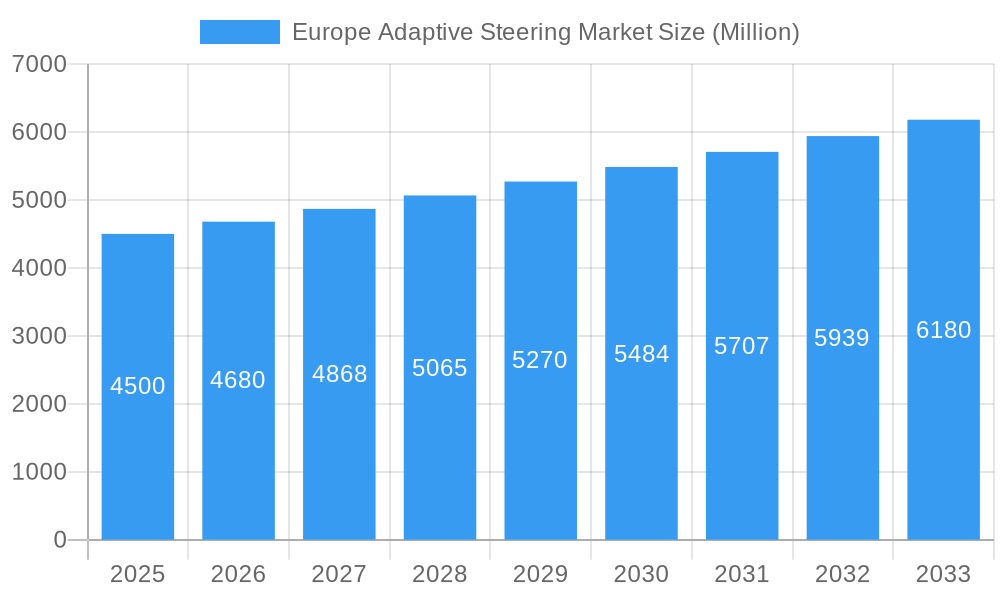

Europe Adaptive Steering Market Market Size (In Billion)

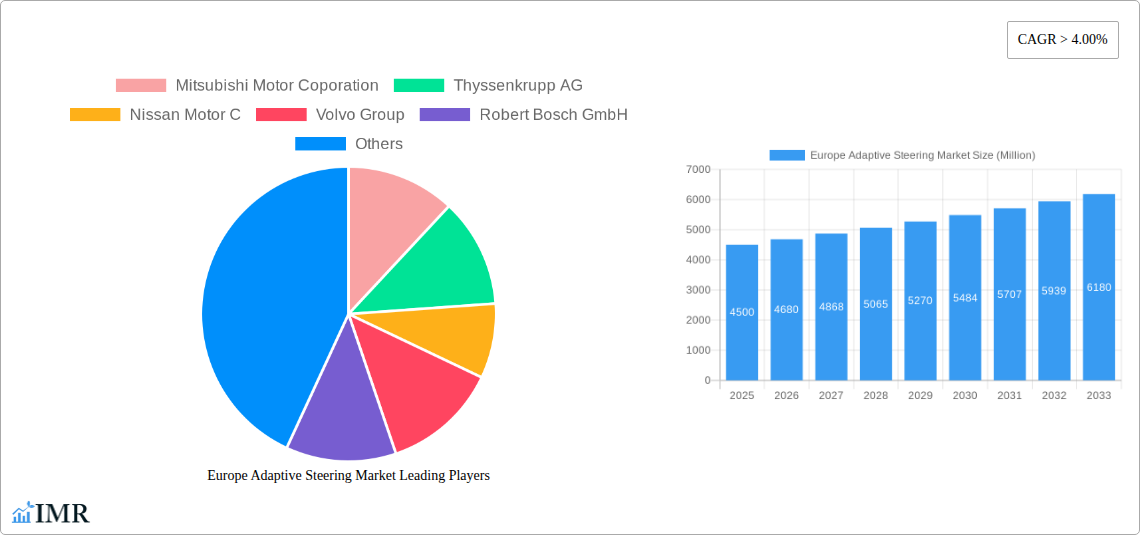

The adaptive steering market spans both Passenger Cars and Commercial Vehicles, showcasing its broad applicability. Leading industry players, including Robert Bosch GmbH, ZF Friedrichshafen AG, and Thyssenkrupp AG, are spearheading innovation through substantial investments in research and development. While initial implementation costs and standardization challenges exist, technological advancements and economies of scale are expected to mitigate these restraints. Germany, the United Kingdom, and France are anticipated to lead the European market due to their established automotive sectors and high adoption rates of advanced automotive technologies.

Europe Adaptive Steering Market Company Market Share

Europe Adaptive Steering Market: Revolutionizing Driving Dynamics for Enhanced Safety and Performance

This comprehensive report delves into the burgeoning Europe Adaptive Steering Market, a sector poised for significant expansion driven by advancements in automotive technology, stringent safety regulations, and evolving consumer demands for enhanced driving experiences. The market encompasses a sophisticated array of systems designed to dynamically adjust steering ratios and responses based on vehicle speed, road conditions, and driver input, offering unparalleled agility and stability. We analyze the intricate market dynamics, identify growth catalysts, explore product innovations, and pinpoint key players shaping this transformative industry. The report provides an in-depth outlook, projecting the market's trajectory from the historical period of 2019–2024 through to an estimated value in 2025 and a forecast period of 2025–2033, with a base year of 2025. All quantitative data is presented in Million units.

Europe Adaptive Steering Market Market Dynamics & Structure

The Europe Adaptive Steering Market is characterized by a moderately concentrated structure, with a few leading global automotive suppliers holding significant sway. Technological innovation remains a primary driver, with ongoing research and development focused on refining sensor accuracy, improving actuator responsiveness, and integrating adaptive steering with advanced driver-assistance systems (ADAS) and autonomous driving technologies. Regulatory frameworks, particularly those emphasizing vehicle safety and emissions reduction, indirectly promote the adoption of adaptive steering systems as they contribute to more efficient and controlled vehicle operation. Competitive product substitutes, such as traditional hydraulic and electric power steering systems, are gradually being phased out as the superior benefits of adaptive steering become more apparent. End-user demographics are shifting, with increasing demand from younger, tech-savvy consumers and a growing emphasis on comfort and convenience across all age groups. Mergers and acquisitions (M&A) trends are observed, particularly involving Tier-1 suppliers acquiring specialized technology firms to bolster their adaptive steering portfolios. For instance, the last five years have seen an estimated volume of 3-5 significant M&A deals focused on integrating AI and advanced control algorithms into steering systems, with deal values ranging from €50 million to €200 million. Innovation barriers include the high initial cost of development and integration, as well as the need for extensive validation and testing to ensure reliability and safety.

- Market Concentration: Moderately concentrated with key players like Robert Bosch GmbH, ZF Friedrichshafen AG, and Thyssenkrupp AG holding substantial market share.

- Technological Innovation Drivers: Advancements in AI for predictive steering, integration with ADAS for enhanced safety, and miniaturization of components for wider vehicle integration.

- Regulatory Frameworks: EU safety directives (e.g., ECE R130 on lane-keeping support) and emissions standards indirectly favor systems that optimize vehicle control and efficiency.

- Competitive Product Substitutes: Traditional power steering systems (hydraulic, electric) are being supplanted by the superior performance and safety offered by adaptive steering.

- End-User Demographics: Growing demand from younger demographics for enhanced driving experiences and from older demographics for improved comfort and reduced driving fatigue.

- M&A Trends: Strategic acquisitions of specialized software and sensor companies by major automotive suppliers to enhance their adaptive steering capabilities. Estimated M&A deal volume: 3-5 significant deals in the last 5 years.

Europe Adaptive Steering Market Growth Trends & Insights

The Europe Adaptive Steering Market is witnessing robust growth, fueled by a confluence of technological advancements, evolving automotive architectures, and an increasing prioritization of driver safety and comfort. The market size is projected to expand significantly, driven by escalating adoption rates of these sophisticated systems across a wider spectrum of vehicle types, from premium passenger cars to commercial vehicles. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) algorithms, are enabling adaptive steering systems to anticipate driver intentions and road conditions with unprecedented accuracy, leading to more intuitive and responsive handling. Furthermore, the widespread integration of these systems with advanced driver-assistance systems (ADAS) and the nascent stages of autonomous driving are creating a powerful synergistic effect, enhancing overall vehicle safety and performance. Consumer behavior shifts are also playing a pivotal role; drivers are increasingly seeking vehicles that offer a more engaging and less fatiguing driving experience, particularly for long commutes and diverse road conditions prevalent in Europe. The market penetration of adaptive steering, while currently concentrated in higher-end segments, is expected to broaden as production costs decrease and its benefits become more widely recognized and demanded. The compound annual growth rate (CAGR) for the Europe Adaptive Steering Market is estimated to be approximately 12.5% during the forecast period of 2025–2033, indicating a strong upward trajectory. By 2025, the market size is estimated to reach xx Million units, with projections indicating substantial growth in subsequent years. The increasing complexity of vehicle platforms, with a greater emphasis on software-defined functionalities, further necessitates the advanced control capabilities offered by adaptive steering. The transition towards electric vehicles (EVs) also presents an opportunity, as the inherent design flexibility of EVs can be further optimized with adaptive steering for enhanced maneuverability and regenerative braking integration.

Dominant Regions, Countries, or Segments in Europe Adaptive Steering Market

Within the Europe Adaptive Steering Market, Passenger Cars are currently the dominant vehicle type segment driving market growth, owing to a confluence of economic policies, consumer preferences, and technological adoption patterns. The sheer volume of passenger car production and sales across Europe, particularly in major automotive hubs like Germany, France, and the UK, naturally translates into a higher demand for advanced automotive technologies. Economic policies, such as incentives for adopting greener and safer vehicles, indirectly favor the integration of adaptive steering systems as they contribute to improved fuel efficiency and enhanced safety features. Consumer demand for premium features, sophisticated driving dynamics, and a more comfortable and engaging driving experience is particularly strong in the passenger car segment, especially among affluent demographics and tech-savvy individuals. The higher profit margins associated with luxury and premium passenger vehicles also allow manufacturers to incorporate more advanced and costly technologies like adaptive steering.

- Passenger Cars Leading Dominance:

- Market Share: Estimated to hold over 75% of the Europe Adaptive Steering Market share in 2025.

- Key Drivers: High disposable income, consumer preference for advanced technology, and stringent safety regulations for passenger vehicles.

- Economic Policies: Government incentives for adopting vehicles with advanced safety features.

- Infrastructure: Well-developed road networks supporting advanced driving capabilities.

- Technological Adoption: Early and widespread adoption of ADAS in passenger cars, where adaptive steering plays a crucial role.

- Examples: BMW Group, Audi AG, and Mercedes-Benz have been at the forefront of integrating adaptive steering in their premium passenger car models, setting benchmarks for the industry.

While Commercial Vehicles represent a smaller but rapidly growing segment, their potential for significant future expansion cannot be overlooked. Factors such as increasing fleet modernization, the drive for operational efficiency, and the demand for enhanced safety in professional driving environments are contributing to the adoption of adaptive steering in trucks, vans, and buses. The integration of adaptive steering in commercial vehicles can lead to reduced driver fatigue on long hauls, improved maneuverability in urban environments, and a decrease in accidents, translating to significant cost savings for fleet operators. Countries with robust logistics and transportation sectors, such as Germany and the Netherlands, are expected to lead the adoption of adaptive steering in commercial vehicles.

Europe Adaptive Steering Market Product Landscape

The Europe Adaptive Steering Market is characterized by continuous product innovation, focusing on enhancing performance, safety, and integration capabilities. Key product advancements include the development of variable ratio steering systems that offer an infinitely adjustable steering feel, adapting seamlessly from agile city driving to stable highway cruising. Actuator technology is also evolving, with a shift towards more compact, efficient, and reliable electric motors that reduce energy consumption and noise levels. Integration with advanced sensor suites, including cameras, radar, and lidar, allows adaptive steering systems to proactively adjust steering inputs based on real-time road and traffic conditions, significantly improving vehicle stability and driver assistance. Unique selling propositions revolve around improved vehicle handling, reduced driver effort, and enhanced safety through features like lane-keeping assist and active park assist. Technological advancements are pushing the boundaries towards steer-by-wire systems, promising even greater flexibility and integration with future autonomous driving architectures.

Key Drivers, Barriers & Challenges in Europe Adaptive Steering Market

Key Drivers:

- Enhanced Driving Experience: Adaptive steering offers improved agility, responsiveness, and comfort, catering to consumer demand for a more engaging drive.

- Advanced Safety Features: Crucial for integrating with ADAS, improving vehicle stability, and reducing accident risks.

- Regulatory Push for Safety: Stringent EU safety standards incentivize the adoption of technologies that enhance vehicle control.

- Technological Advancements: Continuous innovation in sensors, actuators, and control algorithms drives performance improvements and cost reductions.

- Electrification of Vehicles: The flexible architecture of EVs is well-suited for integration with adaptive steering systems.

Key Barriers & Challenges:

- High Initial Cost: The complexity and integration of adaptive steering systems lead to higher vehicle costs, limiting initial adoption.

- System Complexity and Reliability: Ensuring the long-term reliability and fail-safe operation of these sophisticated systems is paramount, requiring extensive validation.

- Supply Chain Constraints: Potential disruptions in the supply of specialized electronic components and microcontrollers can impact production volumes.

- Regulatory Hurdles for Future Systems: Evolving regulations for steer-by-wire and fully autonomous driving may introduce new validation and certification requirements.

- Consumer Awareness and Education: A need to educate consumers on the tangible benefits of adaptive steering beyond traditional steering feel.

Emerging Opportunities in Europe Adaptive Steering Market

Emerging opportunities in the Europe Adaptive Steering Market lie in the increasing integration with advanced autonomous driving technologies. As the automotive industry moves towards higher levels of autonomy, adaptive steering systems will become indispensable for precise vehicle control and maneuverability. The expansion of adaptive steering into the commercial vehicle segment, particularly for long-haul trucking and last-mile delivery vehicles, presents a significant untapped market. Innovations in software-defined steering, allowing for over-the-air updates and customizable driving profiles, will cater to evolving consumer preferences for personalized experiences. Furthermore, the development of more cost-effective and modular adaptive steering solutions could accelerate adoption in mid-range and compact vehicle segments.

Growth Accelerators in the Europe Adaptive Steering Market Industry

Growth accelerators for the Europe Adaptive Steering Market include significant investments in research and development by leading automotive suppliers, focusing on miniaturization, energy efficiency, and enhanced AI-driven control systems. Strategic partnerships between automotive OEMs and technology providers are crucial for accelerating the integration and validation of adaptive steering solutions. Market expansion strategies targeting emerging economies within Europe and the growing demand for advanced safety features in developing markets will also act as catalysts. Furthermore, the increasing trend towards vehicle electrification provides a fertile ground for adaptive steering integration, as it complements the unique characteristics of electric powertrains and offers opportunities for improved regenerative braking and torque vectoring.

Key Players Shaping the Europe Adaptive Steering Market Market

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Thyssenkrupp AG

- Nissan Motor Co., Ltd.

- Volvo Group

- Ford Motor Company

- BMW Group

- Audi AG

- Knorr-Bremse AG

- Mitsubishi Motor Corporation

Notable Milestones in Europe Adaptive Steering Market Sector

- 2019: ZF Friedrichshafen AG launches its advanced ProAI system, enhancing the integration capabilities of its steering technologies with ADAS.

- 2020: BMW Group introduces its latest generation of adaptive steering, offering enhanced comfort and sportiness across its model range.

- 2021: Robert Bosch GmbH announces significant investments in AI-powered steering control systems for future autonomous vehicles.

- 2022: Audi AG showcases its latest adaptive steering innovations, focusing on improved handling and driver assistance in urban environments.

- 2023: Thyssenkrupp AG partners with a leading EV manufacturer to develop customized adaptive steering solutions for electric platforms.

- 2024: Knorr-Bremse AG expands its portfolio of steering technologies to cater to the growing demands of the commercial vehicle sector.

In-Depth Europe Adaptive Steering Market Market Outlook

The Europe Adaptive Steering Market is on a robust growth trajectory, propelled by the relentless pursuit of enhanced vehicle safety, superior driving dynamics, and the transformative impact of autonomous driving technologies. Growth accelerators such as substantial R&D investments, strategic collaborations, and the expanding EV market will continue to fuel expansion. The increasing regulatory focus on vehicle safety and the evolving consumer preference for sophisticated and comfortable driving experiences create a favorable market environment. The outlook suggests a significant increase in market penetration across both passenger and commercial vehicle segments, with technological innovations paving the way for even more integrated and intelligent steering solutions in the coming years, positioning Europe as a leader in this advanced automotive technology sector.

Europe Adaptive Steering Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

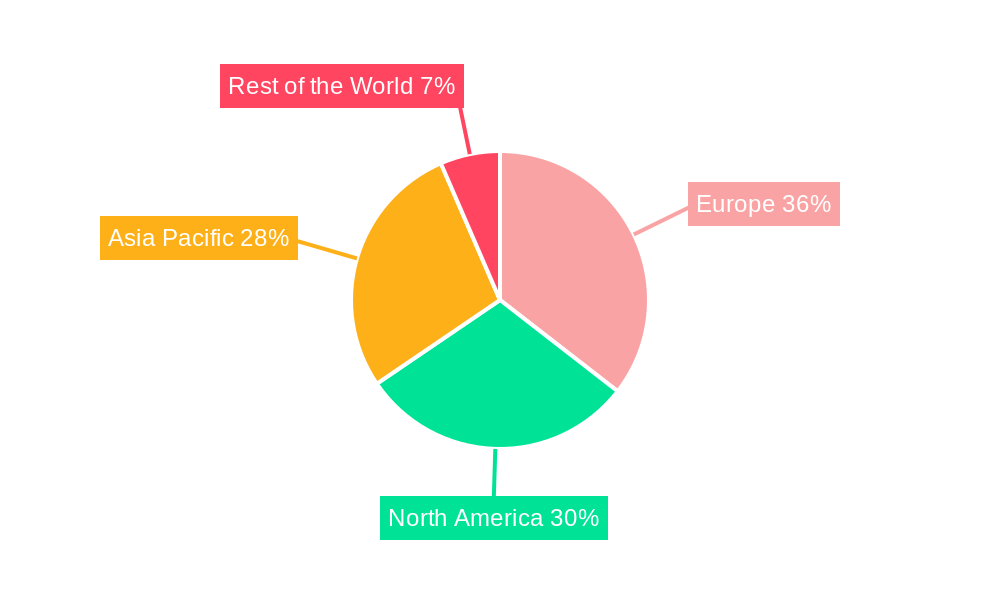

Europe Adaptive Steering Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. Italy

- 1.4. France

- 1.5. Rest of Europe

Europe Adaptive Steering Market Regional Market Share

Geographic Coverage of Europe Adaptive Steering Market

Europe Adaptive Steering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Luxury Vehicles to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rising Adoption of Electric Vehicles Deter Market Growth

- 3.4. Market Trends

- 3.4.1. Sale of Passenger Cars Poised to Fuel Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Adaptive Steering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Motor Coporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thyssenkrupp AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nissan Motor C

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Volvo Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Robert Bosch GmbH

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BMW Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Audi AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Knorr-Bremse AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ford Motor Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZF Friedrichshafen AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Motor Coporation

List of Figures

- Figure 1: Europe Adaptive Steering Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Adaptive Steering Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Adaptive Steering Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Adaptive Steering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Adaptive Steering Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Adaptive Steering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Germany Europe Adaptive Steering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: United Kingdom Europe Adaptive Steering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Italy Europe Adaptive Steering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: France Europe Adaptive Steering Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of Europe Europe Adaptive Steering Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Adaptive Steering Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the Europe Adaptive Steering Market?

Key companies in the market include Mitsubishi Motor Coporation, Thyssenkrupp AG, Nissan Motor C, Volvo Group, Robert Bosch GmbH, BMW Group, Audi AG, Knorr-Bremse AG, Ford Motor Company, ZF Friedrichshafen AG.

3. What are the main segments of the Europe Adaptive Steering Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Luxury Vehicles to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Sale of Passenger Cars Poised to Fuel Demand.

7. Are there any restraints impacting market growth?

Rising Adoption of Electric Vehicles Deter Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Adaptive Steering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Adaptive Steering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Adaptive Steering Market?

To stay informed about further developments, trends, and reports in the Europe Adaptive Steering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence