Key Insights

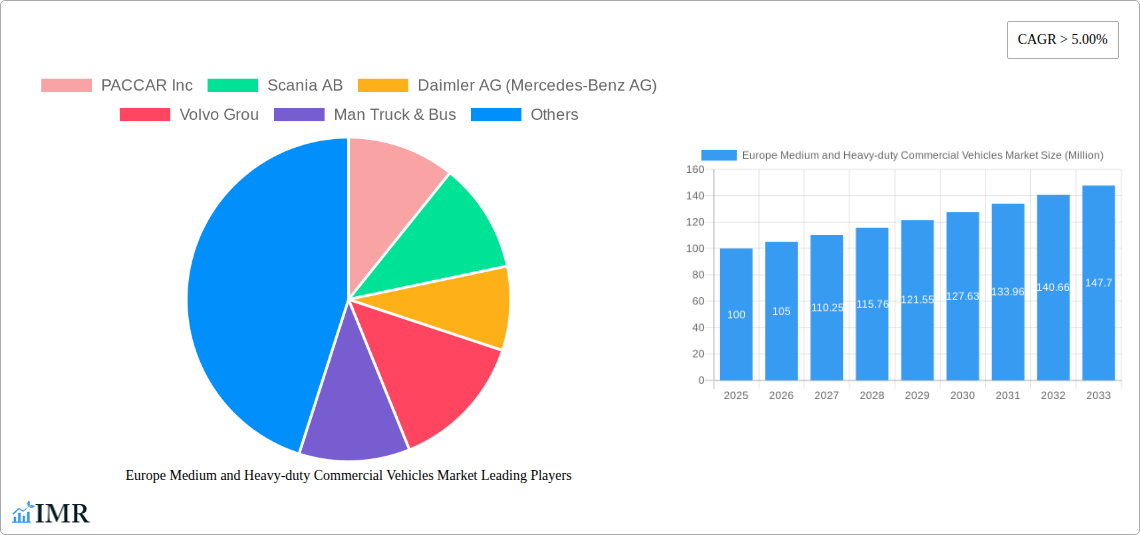

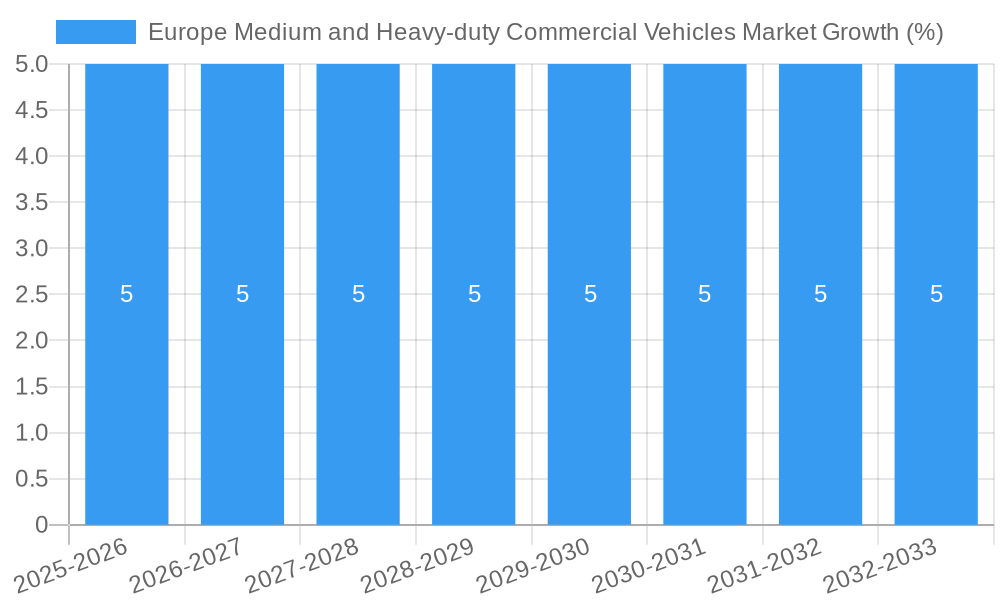

The European medium and heavy-duty commercial vehicle market is experiencing robust growth, driven by increasing e-commerce logistics, infrastructure development, and a shift towards sustainable transportation solutions. The market, valued at approximately €[Estimate based on market size XX and value unit Million. For example, if XX = 100, then €100 million in 2025], is projected to expand at a CAGR exceeding 5% from 2025 to 2033. Key growth drivers include stringent emission regulations compelling the adoption of hybrid and electric vehicles (HEVs, EVs, FCEVs, PHEVs), expanding cross-border trade within the EU, and a flourishing construction and manufacturing sector. The market is segmented by vehicle type (commercial vehicles), propulsion type (hybrid and electric), fuel category (BEV, FCEV, HEV, PHEV, ICE, CNG, Diesel, Gasoline, LPG), and country (spanning major European nations including Germany, France, UK, Italy, and others). Leading manufacturers like PACCAR Inc, Scania AB, Daimler AG, Volvo Group, and MAN Truck & Bus are actively competing, fueling innovation and product diversification.

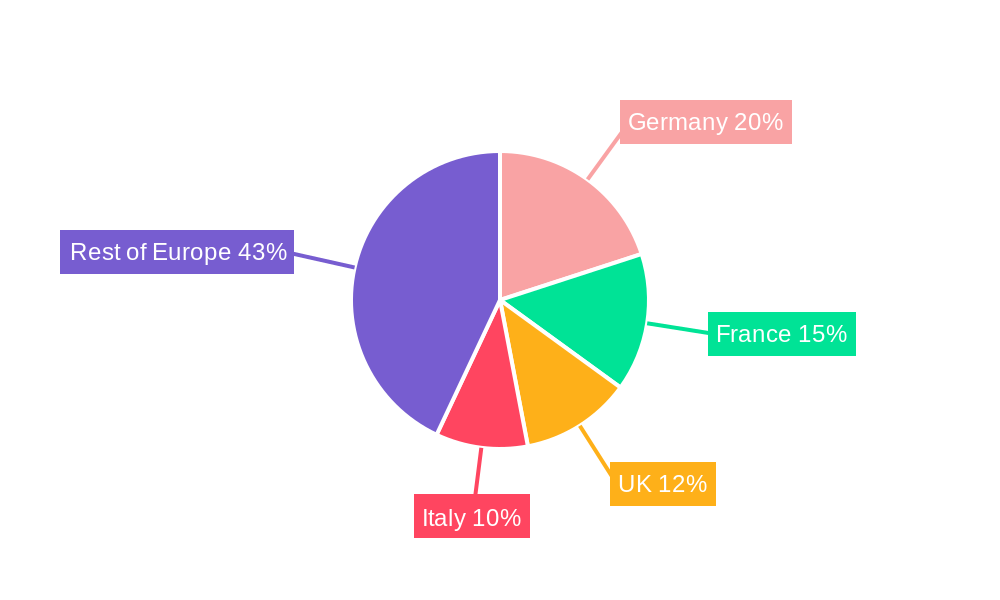

Despite the positive outlook, the market faces certain restraints. Fluctuations in fuel prices, supply chain disruptions impacting component availability, and the high initial investment costs associated with electric and alternative fuel vehicles pose challenges. Nevertheless, government incentives promoting green technologies, coupled with ongoing advancements in battery technology and charging infrastructure, are expected to mitigate these constraints. The increasing adoption of connected vehicle technologies and autonomous driving features will further shape market dynamics in the coming years. Germany, France, and the UK are anticipated to dominate the market owing to their advanced transportation networks and robust economies. The sustained growth trajectory underscores the significance of the European medium and heavy-duty commercial vehicle market as a key player in the global automotive landscape.

Europe Medium and Heavy-duty Commercial Vehicles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe medium and heavy-duty commercial vehicles market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, regional variations, and key players, offering valuable insights for industry professionals, investors, and strategists. The report segments the market by vehicle type, propulsion type, fuel category, and country, providing granular data and forecasts. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period covers 2019-2024. The report covers major players including PACCAR Inc, Scania AB, Daimler AG (Mercedes-Benz AG), Volvo Group, and MAN Truck & Bus.

Europe Medium and Heavy-duty Commercial Vehicles Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory influences, and market trends. We examine market concentration, exploring the market share held by key players and identifying emerging competitors. Technological innovation, including the shift towards electrification and automation, is assessed, along with the impact of regulatory frameworks like emission standards on market evolution. The analysis includes an evaluation of substitute products and their impact on market dynamics, as well as an examination of end-user demographics and their evolving needs. Finally, the report details significant mergers and acquisitions (M&A) activity within the sector.

- Market Concentration: The European medium and heavy-duty commercial vehicle market exhibits a moderately concentrated structure, with the top 5 players holding an estimated xx% market share in 2025.

- Technological Innovation: The increasing adoption of hybrid and electric vehicles (HEV, BEV, FCEV, PHEV) is a major driver, alongside advancements in autonomous driving technologies and connected vehicle solutions.

- Regulatory Framework: Stringent emission regulations (e.g., Euro VI and beyond) are accelerating the shift towards cleaner propulsion technologies.

- Competitive Substitutes: Alternative transportation modes, such as rail and inland waterways, pose some level of competition, particularly for long-haul freight.

- End-User Demographics: The growing e-commerce sector and the need for efficient last-mile delivery are driving demand for specific vehicle types.

- M&A Activity: The number of M&A deals in the sector averaged xx per year during the historical period (2019-2024), with a focus on consolidating market share and gaining access to new technologies.

Europe Medium and Heavy-duty Commercial Vehicles Market Growth Trends & Insights

This section provides a detailed analysis of the market's growth trajectory, focusing on market size evolution (in Million units), adoption rates of new technologies, technological disruptions, and shifts in consumer behavior. We utilize a combination of quantitative data (e.g., CAGR, market penetration rates) and qualitative insights to offer a comprehensive understanding of market trends. The analysis considers various factors impacting market growth, including economic conditions, infrastructure development, and government policies. The long-term growth potential is projected based on expected market dynamics.

(The XXX data point needs to be replaced with specific data and analysis for this section to meet the 600-word requirement. The following is a framework; actual data needs to be inserted.)

*Market size (Million units): XX in 2019, XX in 2024, XX (estimated) in 2025, and projected to reach XX by 2033. *CAGR (2025-2033): XX% *Market penetration of HEVs/EVs: XX% in 2025, projected to reach XX% by 2033. *Key growth drivers: Stringent emission regulations, increasing demand for efficient logistics, infrastructure investments. *Challenges: High initial investment costs for EVs, limited charging infrastructure, range anxiety.

Dominant Regions, Countries, or Segments in Europe Medium and Heavy-duty Commercial Vehicles Market

This section identifies the leading regions, countries, and segments within the European medium and heavy-duty commercial vehicle market based on market size, growth rate, and key contributing factors. We analyze market share and growth potential for each region (Austria, Belgium, Czech Republic, Denmark, Estonia, France, Germany, Ireland, Italy, Norway, Poland, Russia, Spain, Sweden, UK, Rest-of-Europe) and segment (Vehicle Type: Commercial Vehicles; Propulsion Type: Hybrid and Electric Vehicles (HEV, BEV, FCEV, PHEV); Fuel Category: BEV, FCEV, HEV, PHEV, ICE, CNG, Diesel, Gasoline, LPG). The dominance of specific regions or segments is explained by examining economic conditions, infrastructure development, government policies, and consumer preferences.

- Germany: Expected to remain the largest market due to its strong automotive industry and robust logistics sector. (Specific data on market share and growth projection needed here).

- France: Significant growth anticipated, driven by government incentives for electric vehicle adoption and investments in infrastructure. (Specific data on market share and growth projection needed here).

- UK: Market size and growth projections affected by Brexit and evolving domestic policies. (Specific data on market share and growth projection needed here).

- Scandinavia (Norway, Sweden): Leading adoption of electric commercial vehicles, due to strong environmental policies and government support. (Specific data on market share and growth projection needed here).

- Diesel remains the dominant fuel category, but BEV and other alternative fuels are rapidly gaining traction. (Specific data on market share and growth projection needed here).

(This section requires detailed data and analysis for each country and segment to reach the 600-word requirement. The above is a framework.)

Europe Medium and Heavy-duty Commercial Vehicles Market Product Landscape

The European medium and heavy-duty commercial vehicle market showcases a diverse range of products, encompassing various vehicle types (e.g., trucks, buses, vans), propulsion systems (ICE, hybrid, electric), and fuel types (diesel, gasoline, CNG, LPG, electricity). Innovation is driven by the need for increased fuel efficiency, reduced emissions, and enhanced safety features. Key advancements include the development of advanced driver-assistance systems (ADAS), telematics solutions, and lightweight materials to improve overall performance and reduce operational costs. Unique selling propositions include fuel efficiency, payload capacity, safety features, and connectivity features, differentiating products in a competitive landscape.

Key Drivers, Barriers & Challenges in Europe Medium and Heavy-duty Commercial Vehicles Market

Key Drivers: Stringent emission regulations driving electrification; growing e-commerce requiring efficient delivery; investments in infrastructure supporting EV adoption; advancements in battery technology reducing range anxiety.

Challenges: High upfront costs of electric vehicles; limited charging infrastructure availability in certain regions; supply chain disruptions impacting production and component availability; consumer hesitancy towards adopting new technologies; competition from established players and new entrants.

Emerging Opportunities in Europe Medium and Heavy-duty Commercial Vehicles Market

Emerging opportunities lie in the growing demand for electric and autonomous vehicles, the expansion of last-mile delivery services, and the adoption of innovative fleet management solutions. Untapped markets in Eastern Europe offer potential for growth, and development of specialized vehicles for niche applications presents further opportunities. Growing focus on sustainability and reducing carbon footprints opens avenues for businesses offering eco-friendly solutions.

Growth Accelerators in the Europe Medium and Heavy-duty Commercial Vehicles Market Industry

Long-term growth is propelled by continued technological innovation, strategic partnerships between OEMs and technology providers, and expansion into new markets. Government incentives for electric vehicle adoption, investments in charging infrastructure, and the development of robust charging networks will contribute to sustainable long-term growth.

Key Players Shaping the Europe Medium and Heavy-duty Commercial Vehicles Market Market

- PACCAR Inc

- Scania AB

- Daimler AG (Mercedes-Benz AG)

- Volvo Group

- MAN Truck & Bus

Notable Milestones in Europe Medium and Heavy-duty Commercial Vehicles Market Sector

(This section requires specific dates and details of milestones. Example below)

- October 2022: Volvo Group announces significant investment in electric vehicle production.

- March 2023: New emission standards implemented across the EU.

- June 2024: Major partnership formed between an OEM and a battery technology provider.

In-Depth Europe Medium and Heavy-duty Commercial Vehicles Market Market Outlook

The European medium and heavy-duty commercial vehicle market is poised for substantial growth in the coming years, driven by technological advancements, favorable government policies, and increasing demand for efficient and sustainable transportation solutions. Opportunities exist for players who can successfully navigate the challenges associated with electrification, supply chain complexities, and the transition to a low-carbon economy. Strategic partnerships and investments in R&D will be crucial for securing a strong market position in this evolving landscape.

Europe Medium and Heavy-duty Commercial Vehicles Market Segmentation

-

1. Vehicle Type

- 1.1. Commercial Vehicles

-

2. Propulsion Type

-

2.1. Hybrid and Electric Vehicles

-

2.1.1. By Fuel Category

- 2.1.1.1. BEV

- 2.1.1.2. FCEV

- 2.1.1.3. HEV

- 2.1.1.4. PHEV

-

2.1.1. By Fuel Category

-

2.2. ICE

- 2.2.1. CNG

- 2.2.2. Diesel

- 2.2.3. Gasoline

- 2.2.4. LPG

-

2.1. Hybrid and Electric Vehicles

Europe Medium and Heavy-duty Commercial Vehicles Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Medium and Heavy-duty Commercial Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Hybrid and Electric Vehicles

- 5.2.1.1. By Fuel Category

- 5.2.1.1.1. BEV

- 5.2.1.1.2. FCEV

- 5.2.1.1.3. HEV

- 5.2.1.1.4. PHEV

- 5.2.1.1. By Fuel Category

- 5.2.2. ICE

- 5.2.2.1. CNG

- 5.2.2.2. Diesel

- 5.2.2.3. Gasoline

- 5.2.2.4. LPG

- 5.2.1. Hybrid and Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Germany Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Medium and Heavy-duty Commercial Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 PACCAR Inc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Scania AB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Daimler AG (Mercedes-Benz AG)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Volvo Grou

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Man Truck & Bus

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.1 PACCAR Inc

List of Figures

- Figure 1: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Medium and Heavy-duty Commercial Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 14: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 15: Europe Medium and Heavy-duty Commercial Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Medium and Heavy-duty Commercial Vehicles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Medium and Heavy-duty Commercial Vehicles Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Medium and Heavy-duty Commercial Vehicles Market?

Key companies in the market include PACCAR Inc, Scania AB, Daimler AG (Mercedes-Benz AG), Volvo Grou, Man Truck & Bus.

3. What are the main segments of the Europe Medium and Heavy-duty Commercial Vehicles Market?

The market segments include Vehicle Type, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Medium and Heavy-duty Commercial Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Medium and Heavy-duty Commercial Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Medium and Heavy-duty Commercial Vehicles Market?

To stay informed about further developments, trends, and reports in the Europe Medium and Heavy-duty Commercial Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence