Key Insights

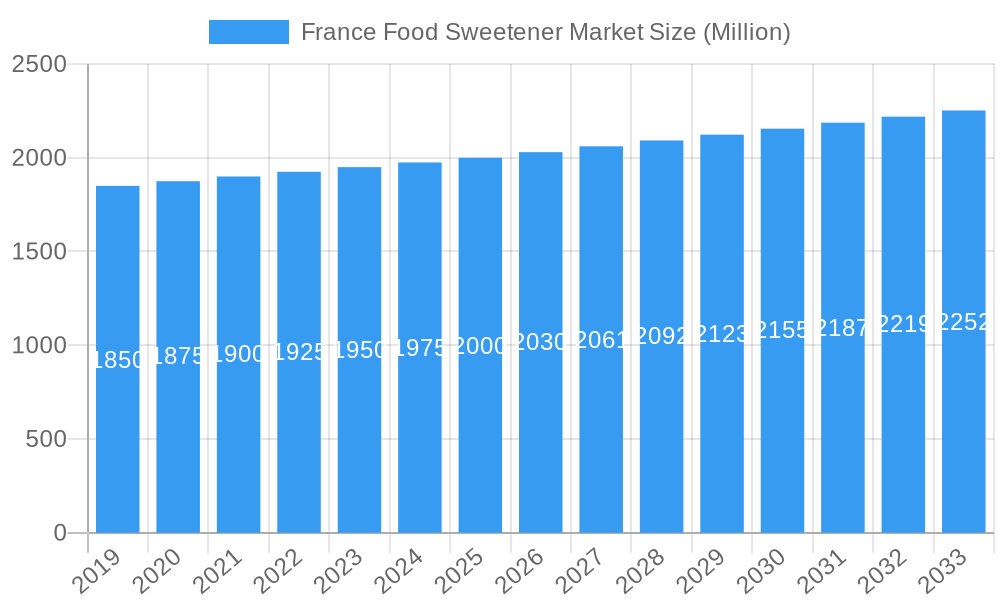

The French food sweetener market is poised for steady growth, projected to reach approximately [Estimate based on market size and CAGR] million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 1.53% from a base year of 2025. This consistent expansion is fueled by evolving consumer preferences towards healthier alternatives and reduced sugar intake, driving demand for a diverse range of sweeteners. Key market drivers include increasing health consciousness, a growing prevalence of lifestyle diseases like diabetes, and the expanding applications of sweeteners across various food and beverage categories. The market is segmented into traditional sweeteners like sucrose, starch sweeteners such as dextrose and high fructose corn syrup (HFCS), and sugar alcohols like sorbitol and xylitol. Simultaneously, high-intensity sweeteners (HIS), including sucralose, aspartame, and natural options like stevia, are gaining significant traction due to their potent sweetness with minimal caloric contribution.

France Food Sweetener Market Market Size (In Billion)

This dynamic landscape presents opportunities and challenges for market players. While sucrose and starch sweeteners maintain a substantial market share, the rapid innovation and consumer acceptance of HIS are reshaping market dynamics. Bakery, confectionery, and beverages represent core application segments, with soups, sauces, and dressings also contributing to demand. However, regulatory scrutiny regarding the safety and labeling of certain artificial sweeteners and fluctuating raw material prices could present restraints. Leading companies such as Cargill Incorporated, Tate & Lyle PLC, and Ingredion Incorporated are actively involved in research and development to introduce novel sweetener solutions and expand their product portfolios to cater to the evolving demands of the French food industry, focusing on both taste and health benefits.

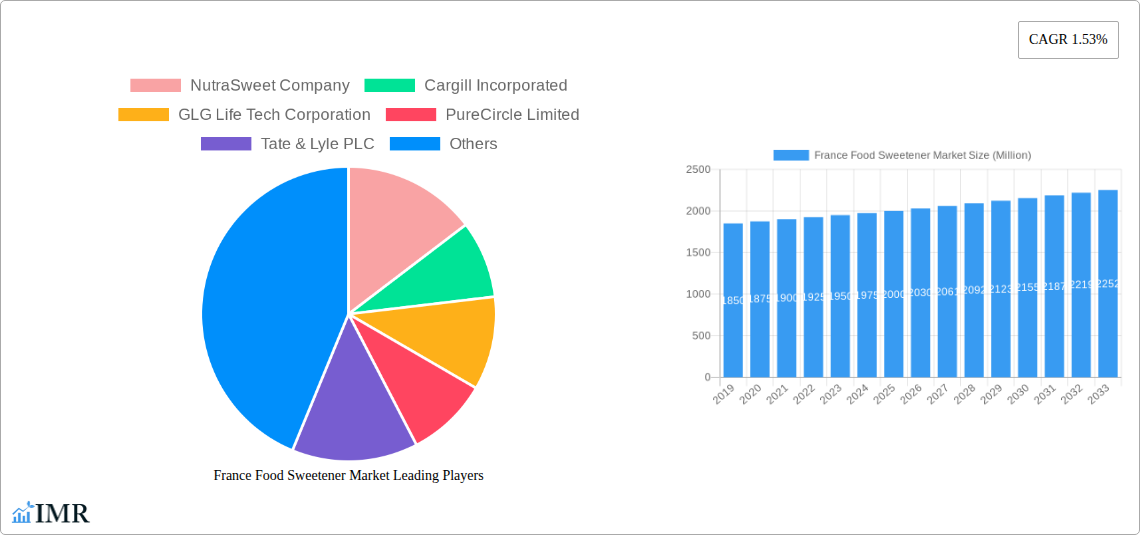

France Food Sweetener Market Company Market Share

France Food Sweetener Market Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the France food sweetener market, offering critical insights into market dynamics, growth trends, product landscape, key players, and future opportunities. Leveraging high-traffic keywords such as food sweeteners France, natural sweeteners market, artificial sweeteners France, sugar substitutes France, sweeteners for bakery, sweeteners for beverages, sucrose market France, starch sweeteners France, high intensity sweeteners France, aspartame France, sucralose market, stevia France, and sugar alcohol market France, this report is optimized for maximum search engine visibility and designed to engage industry professionals. We explore the intricate parent and child market structures, presenting values in Million units for clarity and precision.

France Food Sweetener Market Market Dynamics & Structure

The France food sweetener market is characterized by a dynamic interplay of regulatory frameworks, technological innovation, and evolving consumer preferences. Market concentration is moderate, with a few key players dominating specific segments. Technological innovation is a significant driver, particularly in the development of natural and low-calorie sweeteners, responding to growing health consciousness and demand for healthier food and beverage options. Regulatory frameworks, governed by the European Food Safety Authority (EFSA) and French food safety agencies, dictate permissible sweeteners, labeling requirements, and acceptable daily intake (ADI) levels, influencing product development and market entry.

- Market Concentration: Moderate, with key global players holding significant shares.

- Technological Innovation: Driven by demand for natural, low-calorie, and functional sweeteners.

- Regulatory Frameworks: Strict adherence to EFSA and French food safety standards.

- Competitive Product Substitutes: Increasing availability of natural alternatives to artificial sweeteners.

- End-User Demographics: Growing segment of health-conscious consumers and diabetic populations.

- M&A Trends: Strategic acquisitions and partnerships are observed to expand product portfolios and market reach. For instance, the historical period (2019-2024) saw a consistent pace of consolidations aiming to capture niche markets.

France Food Sweetener Market Growth Trends & Insights

The France food sweetener market has witnessed robust growth, driven by an increasing consumer focus on health and wellness, a rising prevalence of lifestyle diseases like diabetes, and evolving dietary habits. The market's evolution from traditional sucrose to a diverse range of sugar substitutes, including natural, artificial, and blended sweeteners, reflects a significant shift in consumer behavior. Technological advancements have been pivotal, enabling the development of sweeteners with improved taste profiles, enhanced functionality, and greater cost-effectiveness. The adoption rates of low-calorie and natural sweeteners are particularly on an upward trajectory, as consumers actively seek to reduce sugar intake without compromising on taste. This trend is further amplified by the "clean label" movement, pushing manufacturers to incorporate naturally derived sweeteners.

Market size in the base year 2025 is estimated to be XX Million units. The forecast period (2025–2033) is expected to witness a Compound Annual Growth Rate (CAGR) of XX%, fueled by ongoing innovation in sweetener technology, particularly in the realm of plant-based sweeteners like stevia and monk fruit. Disruptions in the market are largely driven by the demand for sugar reduction in processed foods and beverages, leading to a surge in demand for high intensity sweeteners (HIS). Consumer behavior shifts are evident in the preference for products with fewer artificial ingredients and a greater emphasis on nutritional value. The increasing penetration of health-oriented food products, coupled with government initiatives promoting healthier diets, are significant contributors to the sustained growth of the France food sweetener market.

Dominant Regions, Countries, or Segments in France Food Sweetener Market

Within the France food sweetener market, the dominance is distributed across various product types and application segments, each exhibiting unique growth drivers. The Beverages application segment consistently emerges as a leading sector due to the high demand for sugar-free and low-calorie drink options, ranging from carbonated soft drinks to fruit juices and functional beverages. This segment's growth is intrinsically linked to the broader consumer trend towards healthier beverage choices, driven by concerns about obesity and diabetes. The market penetration of diet and zero-sugar beverages has significantly increased the consumption of high intensity sweeteners (HIS) such as aspartame, sucralose, and Ace-K.

- Leading Segment by Application: Beverages, driven by demand for sugar-free and low-calorie options.

- Market Share: Estimated to be over 35% of the total application segment in 2025.

- Growth Potential: Continual innovation in RTD (Ready-to-Drink) beverages and the expansion of functional drink categories will sustain its dominance.

- Dominant Product Type: While Sucrose (Common Sugar) still holds a substantial market share due to its widespread use and cost-effectiveness, High Intensity Sweeteners (HIS) are exhibiting the fastest growth.

- HIS Growth Drivers: Rising health consciousness, demand for sugar reduction, and advancements in taste masking technologies.

- Specific HIS: Sucralose and Stevia are particularly popular due to their natural or nature-identical profiles and zero-calorie attributes.

- Starch Sweeteners and Sugar Alcohols: Dextrose and HFCS remain crucial for bulk and texture in various food products, especially in the bakery and confectionery sectors. However, their growth is tempered by the increasing preference for healthier alternatives. Sorbitol and Xylitol are gaining traction in sugar-free confectionery and oral care products, capitalizing on their dental benefits.

Economic policies supporting the food and beverage industry, coupled with robust distribution networks, ensure widespread availability of these sweeteners. Infrastructure supporting the manufacturing and logistics of food ingredients further bolsters the growth of dominant segments.

France Food Sweetener Market Product Landscape

The France food sweetener market boasts a diverse and innovative product landscape. Beyond traditional sucrose, manufacturers are increasingly offering a wide array of starch sweeteners and sugar alcohols, including dextrose, high fructose corn syrup (HFCS), maltodextrin, sorbitol, and xylitol, catering to specific textural and functional needs in baking and confectionery. The most dynamic evolution is observed in the high intensity sweeteners (HIS) category, featuring sucralose, aspartame, saccharin, cyclamate, Ace-K, neotame, and the rapidly growing stevia. These HIS offer potent sweetness with minimal caloric impact, aligning with consumer demands for sugar reduction. Product innovations focus on improving taste profiles, enhancing solubility, and developing synergistic blends of sweeteners to mimic sucrose's sensory experience. Unique selling propositions include natural origin, zero-calorie claims, and specific health benefits like dental friendliness (e.g., xylitol). Technological advancements in extraction and purification processes are driving the development of purer and more cost-effective HIS.

Key Drivers, Barriers & Challenges in France Food Sweetener Market

The France food sweetener market is propelled by several key drivers. Foremost is the escalating global health and wellness trend, fueling demand for sugar substitutes and reduced-sugar products, particularly in response to concerns about obesity and diabetes. Technological advancements in developing natural and low-calorie sweeteners with improved taste profiles are also significant drivers. Supportive government initiatives promoting healthier food choices and clear labeling regulations further encourage the adoption of innovative sweeteners.

- Key Drivers:

- Growing health and wellness consciousness.

- Increasing prevalence of lifestyle diseases.

- Demand for sugar reduction in food and beverages.

- Technological innovation in natural and low-calorie sweeteners.

- Government initiatives for healthier diets.

Conversely, the market faces several barriers and challenges. Regulatory hurdles, including stringent approval processes and evolving ADI limits for certain sweeteners, can impact market entry and product development. Consumer perception and trust regarding artificial sweeteners remain a significant challenge, leading to a preference for natural alternatives. Price sensitivity and the higher cost of some novel sweeteners compared to sucrose also act as a restraint.

- Key Barriers & Challenges:

- Complex and evolving regulatory frameworks.

- Negative consumer perception of artificial sweeteners.

- Higher cost of some premium sweeteners.

- Supply chain complexities for natural sweetener sourcing.

- Competition from traditional sugar and sugar blends.

Emerging Opportunities in France Food Sweetener Market

Emerging opportunities within the France food sweetener market are largely centered around the growing demand for natural and plant-derived sweeteners. Stevia and monk fruit extract are poised for significant growth as consumers actively seek "clean label" ingredients. The development of innovative blended sweeteners, combining different types of sweeteners to achieve optimal taste and functionality, presents a lucrative avenue for manufacturers. Untapped markets exist in the development of specialized sweeteners for specific dietary needs, such as ketogenic or low-FODMAP diets. Furthermore, the expanding functional food and beverage sector offers opportunities for sweeteners with added health benefits, such as improved gut health or enhanced cognitive function.

Growth Accelerators in the France Food Sweetener Market Industry

Several catalysts are accelerating the long-term growth of the France food sweetener market. Technological breakthroughs in fermentation and bio-engineering are enabling the cost-effective production of novel sweeteners with superior sensory attributes. Strategic partnerships between sweetener manufacturers and food and beverage companies are crucial for product innovation and market penetration, facilitating the integration of new sweeteners into consumer products. Market expansion strategies, including the development of new product applications and the penetration of emerging demographics, are also significant growth accelerators. The increasing consumer awareness and demand for sugar-free and healthier alternatives continue to be a foundational driver for market expansion.

Key Players Shaping the France Food Sweetener Market Market

- NutraSweet Company

- Cargill Incorporated

- GLG Life Tech Corporation

- PureCircle Limited

- Tate & Lyle PLC

- DuPont

- Ingredion Incorporated

- Tereos S A

Notable Milestones in France Food Sweetener Market Sector

- 2019: Launch of new stevia-derived sweetener blends offering improved taste profiles for beverage applications.

- 2020: Increased research and development investment in erythritol and xylitol due to growing demand for sugar alcohols in sugar-free confectionery.

- 2021: Expansion of sucralose production capacity by key manufacturers to meet rising global demand.

- 2022: Introduction of novel natural sweetener formulations to cater to the "clean label" trend in the bakery sector.

- 2023: Mergers and acquisitions focused on acquiring companies with expertise in plant-based sweetener extraction technologies.

- 2024: Regulatory bodies reviewed and updated acceptable daily intake (ADI) levels for certain high-intensity sweeteners, impacting product formulations.

In-Depth France Food Sweetener Market Market Outlook

The future outlook for the France food sweetener market remains exceptionally bright, driven by sustained consumer demand for healthier food and beverage options. Growth accelerators, including ongoing technological innovation in natural sweeteners like stevia and monk fruit, coupled with strategic partnerships, will continue to shape market expansion. The increasing focus on sugar reduction in processed foods and the expanding functional food and beverage sectors present significant untapped potential. Manufacturers are expected to prioritize developing sweeteners that not only reduce sugar content but also enhance nutritional profiles and offer a taste experience indistinguishable from traditional sugar. This forward-looking market is poised for sustained growth, driven by evolving consumer preferences and a dynamic innovation landscape.

France Food Sweetener Market Segmentation

-

1. Product Type

- 1.1. Sucrose (Common Sugar)

-

1.2. Starch Sweeteners and Sugar Alcohols

- 1.2.1. Dextrose

- 1.2.2. High Fructose Corn Syrup (HFCS)

- 1.2.3. Maltodextrin

- 1.2.4. Sorbitol

- 1.2.5. Xylitol

- 1.2.6. Others

-

1.3. High Intensity Sweeteners (HIS)

- 1.3.1. Sucralose

- 1.3.2. Aspartame

- 1.3.3. Saccharin

- 1.3.4. Cyclamate

- 1.3.5. Ace-K

- 1.3.6. Neotame

- 1.3.7. Stevia

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Soups, Sauces and Dressings

- 2.4. Confectionery

- 2.5. Beverages

- 2.6. Others

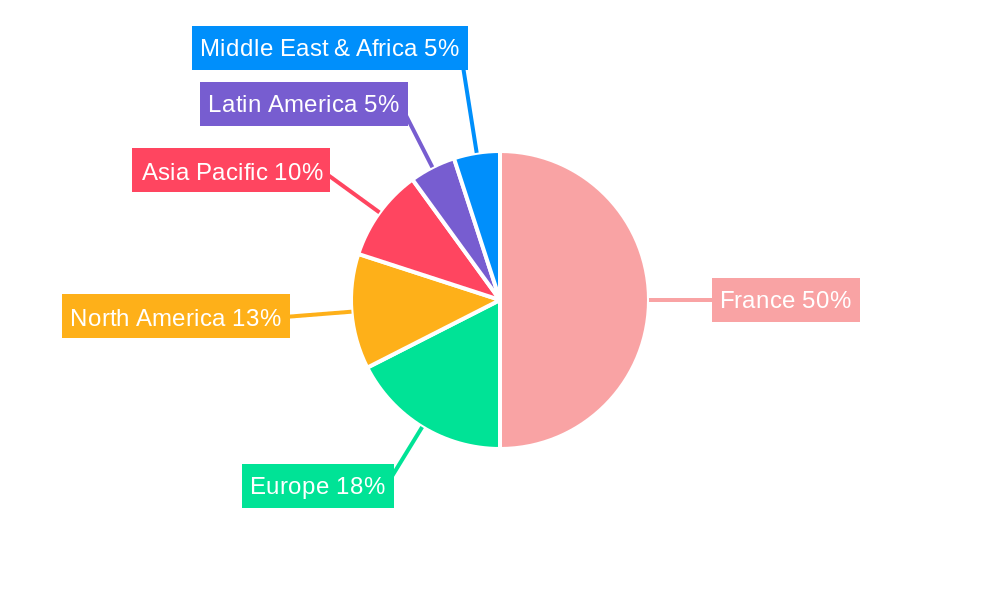

France Food Sweetener Market Segmentation By Geography

- 1. France

France Food Sweetener Market Regional Market Share

Geographic Coverage of France Food Sweetener Market

France Food Sweetener Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products

- 3.3. Market Restrains

- 3.3.1. Stringent government regulations on food product claims

- 3.4. Market Trends

- 3.4.1. Aspartame Is A Major Sweetener In France

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Food Sweetener Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sucrose (Common Sugar)

- 5.1.2. Starch Sweeteners and Sugar Alcohols

- 5.1.2.1. Dextrose

- 5.1.2.2. High Fructose Corn Syrup (HFCS)

- 5.1.2.3. Maltodextrin

- 5.1.2.4. Sorbitol

- 5.1.2.5. Xylitol

- 5.1.2.6. Others

- 5.1.3. High Intensity Sweeteners (HIS)

- 5.1.3.1. Sucralose

- 5.1.3.2. Aspartame

- 5.1.3.3. Saccharin

- 5.1.3.4. Cyclamate

- 5.1.3.5. Ace-K

- 5.1.3.6. Neotame

- 5.1.3.7. Stevia

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Soups, Sauces and Dressings

- 5.2.4. Confectionery

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 NutraSweet Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GLG Life Tech Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PureCircle Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tate & Lyle PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DuPont

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ingredion Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tereos S A *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 NutraSweet Company

List of Figures

- Figure 1: France Food Sweetener Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: France Food Sweetener Market Share (%) by Company 2025

List of Tables

- Table 1: France Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: France Food Sweetener Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: France Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: France Food Sweetener Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: France Food Sweetener Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: France Food Sweetener Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: France Food Sweetener Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 8: France Food Sweetener Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 9: France Food Sweetener Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: France Food Sweetener Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: France Food Sweetener Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: France Food Sweetener Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Food Sweetener Market?

The projected CAGR is approximately 1.53%.

2. Which companies are prominent players in the France Food Sweetener Market?

Key companies in the market include NutraSweet Company, Cargill Incorporated, GLG Life Tech Corporation, PureCircle Limited, Tate & Lyle PLC, DuPont, Ingredion Incorporated, Tereos S A *List Not Exhaustive.

3. What are the main segments of the France Food Sweetener Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Surge in Diabetic Population drives sweetener market; Growing demand for natural sweetener-infused beverage products.

6. What are the notable trends driving market growth?

Aspartame Is A Major Sweetener In France.

7. Are there any restraints impacting market growth?

Stringent government regulations on food product claims.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Food Sweetener Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Food Sweetener Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Food Sweetener Market?

To stay informed about further developments, trends, and reports in the France Food Sweetener Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence