Key Insights

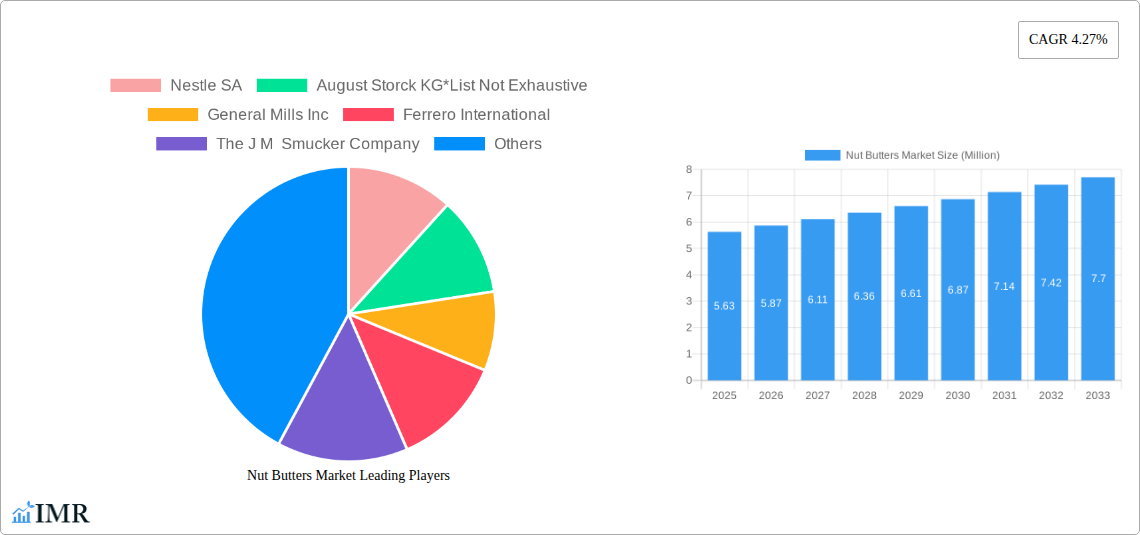

The global Nut Butters Market is projected for robust growth, currently valued at $5.63 billion. This expansion is fueled by a CAGR of 4.27%, indicating a steady and significant increase in market value throughout the forecast period. The primary drivers for this growth are the escalating consumer preference for healthier, protein-rich food options, and the rising awareness of the nutritional benefits of nuts. As dietary habits shift towards plant-based and wellness-oriented choices, nut butters, particularly peanut and almond varieties, are becoming staples in households worldwide. Furthermore, product innovation, including the introduction of flavored nut butters, organic options, and spreads with added functional ingredients, is attracting a wider consumer base and driving sales. The convenience factor associated with nut butters, whether as a spread, ingredient, or snack, also plays a crucial role in their increasing popularity across various demographics.

Nut Butters Market Market Size (In Million)

The market's expansion is also influenced by evolving distribution channels, with online retail showing exceptional growth, providing consumers with easy access to a diverse range of products. Supermarkets and hypermarkets remain dominant, but specialist retailers and convenience stores are also carving out significant market share. Key players like Nestle SA, General Mills Inc., and The Kraft Heinz Company are actively investing in product development, marketing, and expanding their global reach to capitalize on these trends. However, the market also faces certain restraints, including the volatility of raw material prices for nuts, which can impact profit margins for manufacturers and subsequently affect retail pricing. Concerns regarding allergens, particularly for peanut-based products, can also pose a challenge, albeit one that is being addressed through clear labeling and the growing availability of alternative nut spreads. Despite these challenges, the overall outlook for the Nut Butters Market remains highly optimistic, driven by persistent consumer demand for nutritious and versatile food products.

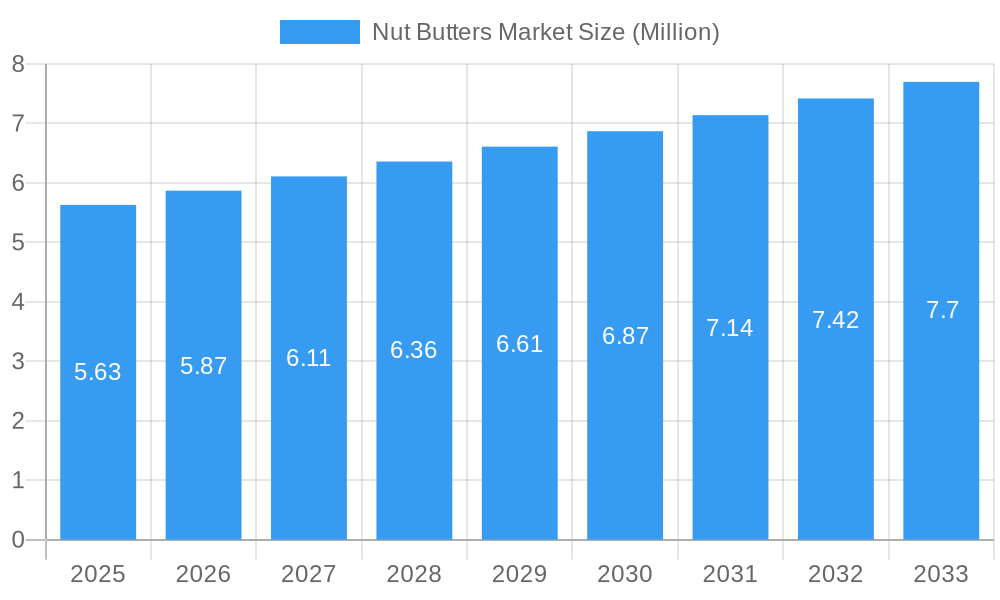

Nut Butters Market Company Market Share

This in-depth report provides a thorough analysis of the global nut butter market, meticulously examining its growth trajectory, key drivers, challenges, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this research offers actionable insights for stakeholders, including manufacturers, suppliers, distributors, and investors. We delve into parent and child market dynamics to uncover comprehensive trends and opportunities within the broader nut spread industry.

Nut Butters Market Market Dynamics & Structure

The nut butter market exhibits a dynamic and evolving structure, characterized by moderate market concentration with key players like Nestle SA, General Mills Inc., The J M Smucker Company, and The Kraft Heinz Company holding significant shares. Technological innovation is a primary driver, focusing on new flavor profiles, functional ingredients (e.g., added protein, reduced sugar), and improved shelf-life technologies for peanut butter, almond butter, and other nut-based spreads. Regulatory frameworks, particularly concerning food safety, labeling, and nutritional claims, play a crucial role in shaping product development and market entry. Competitive product substitutes, including seed butters and dairy-based spreads, present ongoing challenges, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are shifting, with a growing demand for healthy, plant-based, and convenient food options driving the healthy snacks market. Mergers and acquisitions (M&A) trends are evident, with larger food conglomerates acquiring smaller, innovative specialty nut butter brands to expand their portfolio and market reach. For instance, the past year saw an estimated XX M&A deals within the nut-based food industry, signaling consolidation and strategic expansion. Innovation barriers include the high cost of raw materials and the need for significant R&D investment to develop novel products that meet evolving consumer preferences.

Nut Butters Market Growth Trends & Insights

The nut butters market is poised for significant growth, driven by escalating consumer demand for nutritious and convenient food options. The market size is projected to grow from approximately $XX million units in 2025 to over $YY million units by 2033, reflecting a Compound Annual Growth Rate (CAGR) of around XX% during the forecast period. Adoption rates for various nut butter varieties, particularly almond-based spreads and cashew-based spreads, are on an upward trend, fueled by increasing awareness of their health benefits, including their rich protein and healthy fat content. Technological disruptions are emerging, with advancements in processing techniques leading to smoother textures, enhanced flavors, and the development of innovative nut butter formats such as squeeze pouches and ready-to-eat snacks. Consumer behavior shifts are profoundly influencing the market. A growing emphasis on plant-based diets, clean labeling, and functional foods is propelling the demand for organic nut butters, sugar-free nut spreads, and products fortified with vitamins and minerals. The convenience factor is also paramount, with busy lifestyles driving the popularity of single-serve packs and portable nut butter options. Market penetration is expected to deepen, especially in emerging economies as disposable incomes rise and awareness of healthy eating practices increases. The natural nut butter segment is also experiencing robust growth as consumers seek minimally processed ingredients.

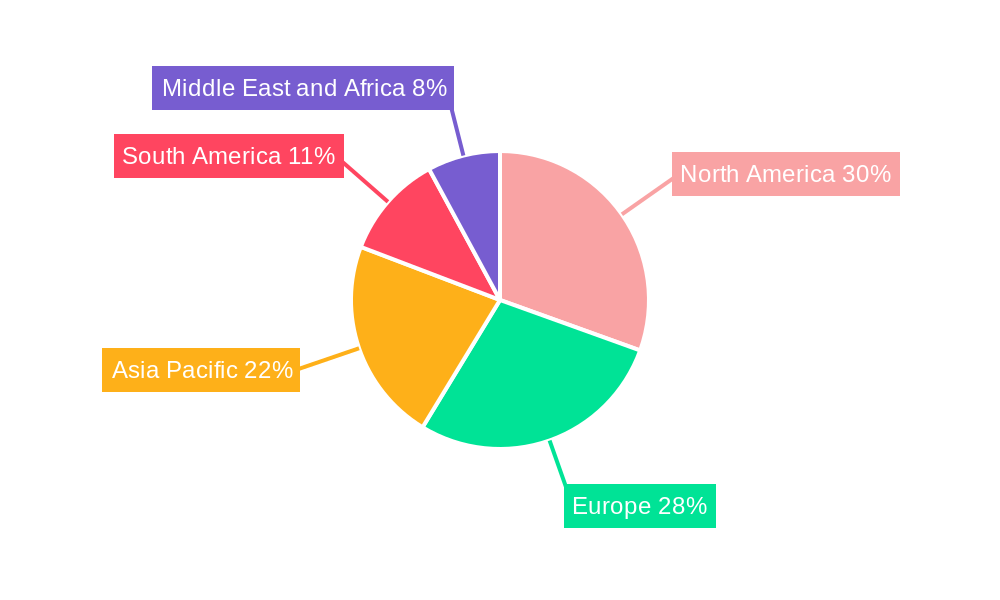

Dominant Regions, Countries, or Segments in Nut Butters Market

North America currently dominates the global nut butters market, driven by a well-established consumer base with a strong preference for peanut butter and an increasing adoption of other nut-based spreads. The United States, in particular, represents a significant market share within this region, owing to high disposable incomes, widespread availability of diverse product offerings, and strong promotional activities by leading brands. The peanut-based spreads segment is the largest contributor to the overall market value in this region, accounting for an estimated XX% of the total market share. This dominance is attributed to the historical popularity and affordability of peanut butter.

However, the Asia Pacific region is emerging as a key growth driver, exhibiting the highest CAGR during the forecast period. This rapid expansion is fueled by a growing middle class, increasing health consciousness, and the rising popularity of Western food trends. Countries like China and India are witnessing a surge in demand for nut butters, particularly almond-based spreads and hazelnut-based spreads, as consumers explore new taste profiles and health-conscious alternatives.

Within the product type segmentation, peanut-based spreads continue to hold the largest market share globally, estimated at XX million units in 2025. However, almond-based spreads are experiencing a substantial growth trajectory, projected to reach XX million units by 2033, driven by their perceived health benefits and a growing demand for nut varieties beyond peanuts.

In terms of distribution channels, Supermarkets/Hypermarkets remain the dominant channel, accounting for approximately XX% of global sales in 2025. This channel offers wide product variety and convenience to consumers. Nevertheless, Online Retail Stores are witnessing the fastest growth rate, driven by e-commerce expansion, convenience, and the availability of niche and specialty nut butter products. This channel is expected to capture a significant market share by 2033.

Nut Butters Market Product Landscape

The nut butters market product landscape is characterized by continuous innovation aimed at enhancing taste, texture, and nutritional profiles. Leading companies are introducing a diverse range of nut-based spreads, including creamy and crunchy varieties, as well as flavored options. Innovations in almond butter, cashew butter, and hazelnut butter are catering to evolving consumer preferences for allergen-friendly and diverse nut options. Performance metrics are evaluated based on product quality, sensory attributes, nutritional value, and shelf-life stability. Unique selling propositions often revolve around the use of natural ingredients, absence of added sugars or artificial additives, and sustainable sourcing practices. Technological advancements in processing, such as micro-grinding and high-pressure processing, are enabling the creation of smoother textures and preserving the natural goodness of nuts.

Key Drivers, Barriers & Challenges in Nut Butters Market

Key Drivers:

- Growing Health and Wellness Trends: Increasing consumer awareness regarding the health benefits of nuts, such as protein content, healthy fats, and essential nutrients, is a primary driver for the nut butter market.

- Demand for Plant-Based and Vegan Products: The global shift towards plant-based diets fuels demand for nut butters as a versatile and nutritious vegan protein source.

- Convenience and Versatility: Nut butters are perceived as convenient, on-the-go snacks and versatile ingredients for various culinary applications, appealing to busy lifestyles.

- Product Innovation and Diversification: Continuous introduction of new flavors, textures, and specialized nut butter formulations (e.g., low-sugar, high-protein) attracts a wider consumer base.

- Rising Disposable Incomes in Emerging Economies: Increased purchasing power in developing regions is leading to greater adoption of premium food products like specialty nut butters.

Key Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of raw nuts, influenced by agricultural yields and global supply chain disruptions, can impact production costs and profit margins. The cost of raw almonds, for example, can increase by up to XX% year-on-year.

- Allergen Concerns: The presence of common allergens, particularly peanuts, necessitates stringent handling protocols and clear labeling, which can be a barrier for consumers with specific dietary restrictions.

- Intense Competition: The market faces intense competition from established brands, private labels, and substitute products like seed butters, requiring significant investment in marketing and product differentiation.

- Supply Chain Disruptions: Global events, such as trade disputes and climate change impacts on agriculture, can disrupt the supply of key raw materials, leading to shortages and price hikes. Estimated impact of such disruptions can lead to a XX% increase in production costs.

- Regulatory Compliance: Navigating diverse international food safety regulations and labeling requirements can be complex and costly for manufacturers.

Emerging Opportunities in Nut Butters Market

Emerging opportunities in the nut butters market lie in catering to specialized dietary needs, such as low-FODMAP nut spreads and allergen-free formulations. The increasing demand for ethically sourced and sustainably produced nut butters presents a significant avenue for brands that can demonstrate transparent supply chains. Furthermore, the expansion of the nut butter market into innovative applications, such as in plant-based dairy alternatives, baked goods, and savory dishes, offers substantial growth potential. Untapped markets in developing regions with growing health consciousness also represent a key opportunity for market penetration.

Growth Accelerators in the Nut Butters Market Industry

Growth in the nut butters market industry is being significantly accelerated by several key factors. Technological breakthroughs in nut processing are leading to improved textures, extended shelf-life, and the development of novel nut butter formats, making them more appealing to a wider consumer base. Strategic partnerships between ingredient suppliers and nut butter manufacturers are fostering innovation in product development, leading to unique flavor combinations and functional benefits. Market expansion strategies, including targeted marketing campaigns emphasizing health benefits and the introduction of affordable product lines, are driving increased consumption in both developed and emerging economies. The growing trend of direct-to-consumer (DTC) sales models is also empowering smaller brands to reach a broader audience and build loyal customer bases.

Key Players Shaping the Nut Butters Market Market

- Nestle SA

- August Storck KG

- General Mills Inc.

- Ferrero International

- The J M Smucker Company

- The Kraft Heinz Company

- Hormel Foods Corporation

- Andros Group

- Conagra Foods Inc

- The Hershey Company

Notable Milestones in Nut Butters Market Sector

- April 2022: Toffife launched its new hazelnut spreads across the United Kingdom, introducing flavors like crunchy roasted hazelnut, caramel cup, smooth hazelnut spread, and rich chocolate. The products were made available in family and unit packing, catering to diverse consumer needs and expanding the hazelnut spread segment.

- March 2022: Hershey India expanded its product portfolio with the launch of two new nut-based spreads: almond and cocoa. This strategic move aimed to capture a larger share of the growing nut butter market in India, with products retailed in supermarkets and convenience stores, enhancing accessibility.

- January 2021: The J. M. Smucker Company unveiled plans to launch Jif Natural Squeeze Creamy Peanut Butter Spread. This product innovation under the iconic Jif brand focused on convenience and accessibility, becoming available on digital platforms and at select retailers, boosting the peanut-based spreads market.

In-Depth Nut Butters Market Market Outlook

The future outlook for the nut butters market is exceptionally promising, driven by sustained consumer demand for healthier, plant-based, and convenient food options. Growth accelerators, including ongoing product innovation, expansion into untapped geographical markets, and increasing consumer awareness of the nutritional benefits of nuts, will continue to fuel market expansion. Strategic opportunities lie in leveraging e-commerce platforms for wider reach, developing specialized nut butter formulations to cater to niche dietary requirements, and focusing on sustainable sourcing and ethical production practices to align with consumer values. The market is expected to witness increased M&A activities as larger players seek to strengthen their portfolios with innovative brands, further consolidating and shaping the future landscape of the nut spread industry.

Nut Butters Market Segmentation

-

1. Product Type

- 1.1. Peanut-based Spreads

- 1.2. Almond-based Spreads

- 1.3. Walnut-based Spreads

- 1.4. Cashew-based Spreads

- 1.5. Hazelnut-based Spreads

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Nut Butters Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Nut Butters Market Regional Market Share

Geographic Coverage of Nut Butters Market

Nut Butters Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Increasing Consumer's Inclination Toward Vegan Culture and Vegan Diets

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nut Butters Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Peanut-based Spreads

- 5.1.2. Almond-based Spreads

- 5.1.3. Walnut-based Spreads

- 5.1.4. Cashew-based Spreads

- 5.1.5. Hazelnut-based Spreads

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Nut Butters Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Peanut-based Spreads

- 6.1.2. Almond-based Spreads

- 6.1.3. Walnut-based Spreads

- 6.1.4. Cashew-based Spreads

- 6.1.5. Hazelnut-based Spreads

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Specialist Retailers

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Nut Butters Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Peanut-based Spreads

- 7.1.2. Almond-based Spreads

- 7.1.3. Walnut-based Spreads

- 7.1.4. Cashew-based Spreads

- 7.1.5. Hazelnut-based Spreads

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Specialist Retailers

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Nut Butters Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Peanut-based Spreads

- 8.1.2. Almond-based Spreads

- 8.1.3. Walnut-based Spreads

- 8.1.4. Cashew-based Spreads

- 8.1.5. Hazelnut-based Spreads

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Specialist Retailers

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Nut Butters Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Peanut-based Spreads

- 9.1.2. Almond-based Spreads

- 9.1.3. Walnut-based Spreads

- 9.1.4. Cashew-based Spreads

- 9.1.5. Hazelnut-based Spreads

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Specialist Retailers

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Nut Butters Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Peanut-based Spreads

- 10.1.2. Almond-based Spreads

- 10.1.3. Walnut-based Spreads

- 10.1.4. Cashew-based Spreads

- 10.1.5. Hazelnut-based Spreads

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Specialist Retailers

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 August Storck KG*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ferrero International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The J M Smucker Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Kraft Heinz Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hormel Foods Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Andros Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Conagra Foods Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Hershey Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Nut Butters Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Nut Butters Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Nut Butters Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Nut Butters Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Nut Butters Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Nut Butters Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Nut Butters Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Nut Butters Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Nut Butters Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Nut Butters Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Nut Butters Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Nut Butters Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Nut Butters Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Nut Butters Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Nut Butters Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Nut Butters Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Nut Butters Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Nut Butters Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Nut Butters Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Nut Butters Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Nut Butters Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Nut Butters Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Nut Butters Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Nut Butters Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Nut Butters Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Nut Butters Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Nut Butters Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Nut Butters Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Nut Butters Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Nut Butters Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Nut Butters Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nut Butters Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Nut Butters Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Nut Butters Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Nut Butters Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Nut Butters Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Nut Butters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Nut Butters Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Nut Butters Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Nut Butters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Nut Butters Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Nut Butters Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Nut Butters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Nut Butters Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Nut Butters Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Nut Butters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Nut Butters Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Nut Butters Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Nut Butters Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Nut Butters Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nut Butters Market?

The projected CAGR is approximately 4.27%.

2. Which companies are prominent players in the Nut Butters Market?

Key companies in the market include Nestle SA, August Storck KG*List Not Exhaustive, General Mills Inc, Ferrero International, The J M Smucker Company, The Kraft Heinz Company, Hormel Foods Corporation, Andros Group, Conagra Foods Inc, The Hershey Company.

3. What are the main segments of the Nut Butters Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Increasing Consumer's Inclination Toward Vegan Culture and Vegan Diets.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

In April 2022, Toffife launched its new hazelnut spreads across the United Kingdom. The flavors include crunchy roasted hazelnut, the delicious caramel cup, smooth hazelnut spread, and a drop of rich chocolate. The products are offered in family packing and in-unit packing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nut Butters Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nut Butters Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nut Butters Market?

To stay informed about further developments, trends, and reports in the Nut Butters Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence