Key Insights

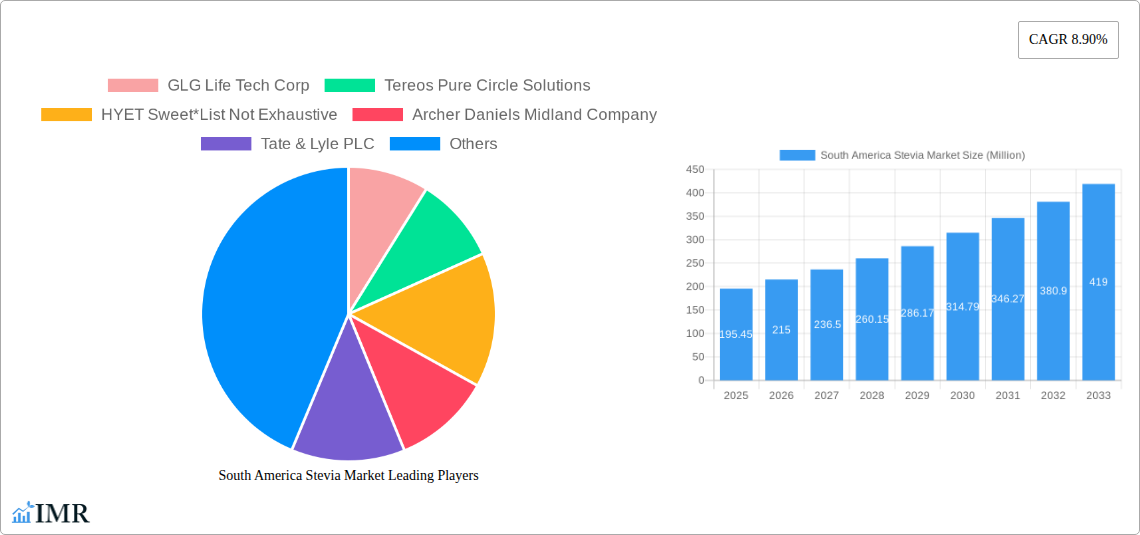

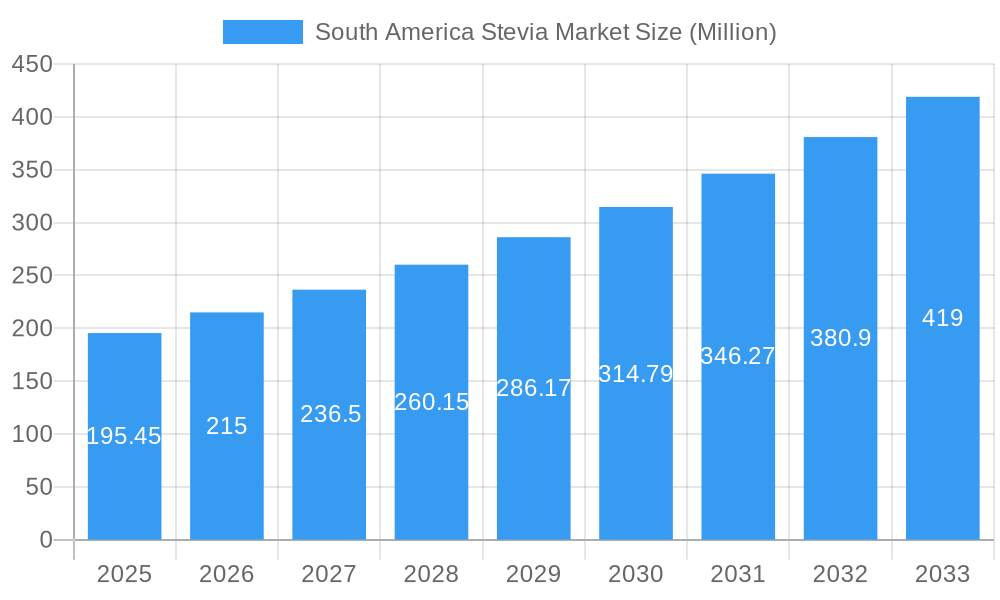

The South America Stevia Market is poised for robust expansion, with an estimated market size of USD 195.45 million in 2025. This growth is propelled by a significant CAGR of 10%, indicating a dynamic and flourishing sector. A primary driver for this surge is the increasing consumer demand for natural and zero-calorie sweeteners, directly aligning with global health and wellness trends. The burgeoning awareness of the health benefits associated with stevia, such as its low glycemic index and suitability for diabetic individuals, further fuels its adoption across various food and beverage categories. The versatility of stevia, available in forms like powder, liquid, and leaf, allows for widespread application in bakery products, dairy items, beverages, confectionery, and dietary supplements. This broad applicability, coupled with a growing preference for clean-label ingredients, positions stevia as a preferred sugar substitute, driving market penetration and value.

South America Stevia Market Market Size (In Million)

The market's trajectory is further shaped by evolving consumer preferences and the food industry's response to health-conscious demands. While the market experiences substantial growth, certain restraints, such as the lingering taste perception challenges for some consumers and the cost-competitiveness against traditional sugars, may present minor headwinds. However, ongoing advancements in extraction and purification technologies are continuously addressing these concerns, leading to improved taste profiles and more cost-effective production. Key players like GLG Life Tech Corp, Tereos Pure Circle Solutions, Archer Daniels Midland Company, Tate & Lyle PLC, Cargill Inc, and Ingredion Incorporated are actively investing in research and development, expanding production capacities, and forging strategic partnerships to capitalize on the burgeoning opportunities. The strategic focus on innovation and market penetration within key geographical segments, including Brazil, Argentina, and the rest of South America, underscores the region's significant potential and its integral role in the global stevia landscape.

South America Stevia Market Company Market Share

Here is a comprehensive, SEO-optimized report description for the South America Stevia Market, designed for maximum visibility and industry engagement:

Gain unparalleled insights into the dynamic South America stevia market, a rapidly expanding sector driven by growing consumer demand for natural sweeteners and a robust shift towards healthier food and beverage options. This in-depth report provides a 360-degree view of the market, encompassing parent market trends and child market segment analysis. We dissect critical growth drivers, present detailed market size forecasts in million units, and identify key opportunities for stakeholders within the South America stevia industry. This report is essential for manufacturers, ingredient suppliers, R&D professionals, and investors seeking to navigate and capitalize on the evolving stevia market South America.

South America Stevia Market Market Dynamics & Structure

The South America stevia market is characterized by moderate concentration, with key players like GLG Life Tech Corp, Tereos Pure Circle Solutions, HYET Sweet, Archer Daniels Midland Company, Tate & Lyle PLC, Cargill Inc, and Ingredion Incorporated actively shaping its trajectory. Technological innovation is a significant driver, focusing on enhancing steviol glycoside extraction efficiency and purity, alongside the development of novel stevia-based blends that mimic sugar's taste profile without the calories. Regulatory frameworks, primarily related to food additive approvals and labeling standards, are evolving across the region, influencing market access and product development. Competitive product substitutes, including artificial sweeteners and other natural high-intensity sweeteners, exert pressure, necessitating continuous innovation and cost-effectiveness from stevia producers. End-user demographics show a strong preference among health-conscious consumers, particularly in urban centers, seeking sugar reduction solutions. Mergers and acquisitions (M&A) trends are moderate, with strategic partnerships being more prevalent, aimed at expanding supply chains and co-developing innovative applications.

- Market Concentration: Moderate, with significant influence from established ingredient manufacturers and agricultural cooperatives.

- Technological Innovation Drivers: Improved extraction and purification techniques, taste modulation, and cost reduction.

- Regulatory Frameworks: Evolving approval processes and labeling requirements across key South American nations.

- Competitive Product Substitutes: Artificial sweeteners, other natural sweeteners, and sugar itself.

- End-User Demographics: Growing segment of health-conscious consumers, millennials, and individuals managing chronic health conditions.

- M&A Trends: Moderate, with a focus on strategic alliances and joint ventures for market expansion and product development.

South America Stevia Market Growth Trends & Insights

The South America stevia market is projected to experience significant expansion from its base year of 2025, with a robust CAGR expected throughout the forecast period of 2025–2033. This growth is fueled by a confluence of factors, including increasing consumer awareness regarding the health risks associated with excessive sugar consumption and a heightened preference for natural, plant-derived ingredients. The market's evolution is marked by a steady rise in adoption rates across various food and beverage categories, driven by manufacturers reformulating products to meet consumer demand for "clean label" and reduced-sugar alternatives. Technological disruptions, such as advancements in steviol glycoside purification and encapsulation technologies, are enhancing the sensory attributes and functional properties of stevia, making it a more versatile and appealing ingredient. Consumer behavior shifts are profoundly impacting the market, with a growing willingness to pay a premium for products perceived as healthier and more natural. This trend is particularly evident in the beverages and bakery segments, where stevia is increasingly being adopted as a sugar replacer. The market penetration of stevia-based products is steadily increasing, indicating a broad acceptance and integration into everyday consumer goods. Historical data from 2019–2024 showcases a consistent upward trend, laying a strong foundation for future growth. The estimated market size for 2025 stands at XX million units, with significant potential for further scaling as more product launches incorporate this natural sweetener. The focus on sustainability and ethical sourcing is also becoming a crucial differentiator, influencing purchasing decisions and brand loyalty within the South America stevia market. The interplay between these trends is creating a fertile ground for innovation and market expansion.

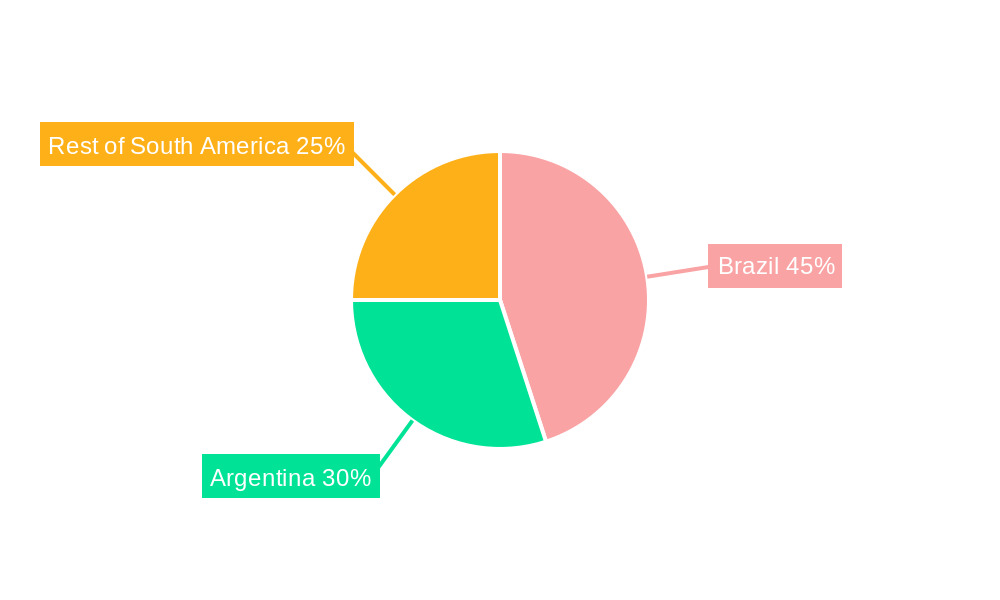

Dominant Regions, Countries, or Segments in South America Stevia Market

The South America stevia market is currently experiencing significant growth, with Brazil standing out as the dominant region. Its vast agricultural capacity for stevia cultivation, coupled with strong government initiatives to promote its cultivation and processing, has solidified its leadership position. Brazil's established infrastructure for agricultural exports and a burgeoning domestic market for health-conscious products further contribute to its dominance. The beverages segment is a major driver of stevia consumption in the region, with soft drinks, juices, and functional beverages increasingly opting for stevia as a natural sweetener to cater to the growing demand for sugar-free and low-calorie options.

- Dominant Region: Brazil, owing to its significant agricultural output and supportive government policies.

- Key Contributing Segments:

- Form: Powder form of stevia extract is widely adopted due to its ease of incorporation into dry mixes and baked goods.

- Application: Beverages remain the largest application segment, followed closely by Bakery and Dairy Products.

- Geography: Brazil leads, with Argentina showing growing adoption and the "Rest of South America" exhibiting promising potential.

The powder form of stevia extract is particularly favored for its convenience in manufacturing processes, especially within the bakery and confectionery industries. The ability to precisely measure and integrate powder forms into dry ingredients makes it a highly versatile option for food manufacturers. Furthermore, the increasing demand for dietary supplements in South America also presents a significant avenue for stevia's application, appealing to consumers seeking natural health enhancers. The economic policies in Brazil, which actively encourage agricultural diversification and value-added processing, have created a favorable environment for stevia producers. Infrastructure development, including improved logistics and processing facilities, further supports the market's growth. The market share of stevia in the sweetener category within Brazil is steadily increasing, reflecting a broader consumer shift away from artificial alternatives and refined sugars. While Argentina is also a notable player with a growing stevia production base, Brazil's scale and market penetration remain unparalleled. The "Rest of South America" segment, encompassing countries like Colombia, Peru, and Chile, represents a rapidly emerging market with significant untapped potential driven by increasing urbanization and rising disposable incomes, leading to a greater demand for healthier food and beverage choices.

South America Stevia Market Product Landscape

The South America stevia market product landscape is characterized by continuous innovation in stevia extract formulations. Manufacturers are focusing on producing high-purity steviol glycosides, such as Rebaudioside A (Reb A) and Rebaudioside M (Reb M), which offer a cleaner taste profile with reduced bitterness and aftertaste. Product innovations include synergistic blends of different steviol glycosides and combinations with other natural sweeteners to achieve optimal sweetness and mouthfeel, closely mimicking the taste of sugar. Performance metrics are improving, with enhanced solubility, heat stability, and compatibility across a wider range of food and beverage applications, from beverages and dairy products to bakery and confectionery.

Key Drivers, Barriers & Challenges in South America Stevia Market

The South America stevia market is propelled by several key drivers. The escalating global health consciousness and the consumer demand for natural, sugar-free, and low-calorie alternatives are primary growth catalysts. Government initiatives promoting stevia cultivation and processing, alongside growing awareness of stevia's natural origin and zero-calorie benefits, are significantly boosting its adoption. Furthermore, partnerships between industry players to develop innovative products and expand market reach are accelerating growth.

However, the market faces several challenges. Price volatility of raw stevia leaves, influenced by weather conditions and cultivation yields, can impact production costs. Regulatory hurdles and varying approval statuses for different steviol glycosides across South American countries can hinder market access. Competition from established artificial sweeteners and other natural sweeteners also presents a restraint. Additionally, supply chain inefficiencies and the need for advanced extraction and purification technologies require significant investment.

Emerging Opportunities in South America Stevia Market

Emerging opportunities in the South America stevia market lie in the untapped potential of niche applications and further product diversification. Expanding the use of stevia in dietary supplements and functional foods, targeting specific health benefits like blood sugar management, presents a significant growth avenue. Developing novel stevia-based formulations for dairy products, such as yogurts and ice creams, is another area with high potential. Furthermore, there is an opportunity to leverage consumer interest in traceability and sustainability by promoting ethically sourced and locally produced stevia, differentiating products in a competitive landscape. The growing middle class in "Rest of South America" countries presents a fertile ground for introducing stevia-sweetened products.

Growth Accelerators in the South America Stevia Market Industry

Long-term growth in the South America stevia market is being accelerated by several factors. Continued technological breakthroughs in steviol glycoside extraction, purification, and taste modulation are making stevia an even more attractive ingredient. Strategic partnerships between stevia producers, food and beverage manufacturers, and research institutions are fostering innovation and accelerating product development cycles. Market expansion strategies, including the penetration of stevia into emerging economies within South America and the development of ready-to-drink beverages and convenience foods featuring stevia, are crucial growth catalysts.

Key Players Shaping the South America Stevia Market Market

- GLG Life Tech Corp

- Tereos Pure Circle Solutions

- HYET Sweet

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Cargill Inc

- Ingredion Incorporated

Notable Milestones in South America Stevia Market Sector

- 2023: Government initiatives to promote stevia cultivation across Brazil, offering subsidies and technical support to farmers.

- 2024 (Q1): Partnerships between industry players to develop innovative stevia-based blends for the bakery sector.

- 2024 (Q2): New product launches with stevia as a key ingredient in the dairy product segment in Argentina.

- 2024 (Q3): Expansion of stevia processing facilities in the Rest of South America to meet growing demand.

In-Depth South America Stevia Market Market Outlook

The South America stevia market is poised for sustained growth, driven by a favorable confluence of consumer demand for natural sweeteners, supportive government policies, and ongoing technological advancements. Growth accelerators such as innovative product development, strategic industry partnerships, and the expansion of stevia into new applications like dietary supplements and functional foods will continue to propel the market forward. The increasing adoption across key segments like beverages, bakery, and dairy products, particularly in dominant regions like Brazil, underscores the market's robust potential. Strategic investments in research and development for enhanced taste profiles and cost-effective production will further solidify stevia's position as a leading natural sweetener, offering significant opportunities for stakeholders to capitalize on this evolving market.

South America Stevia Market Segmentation

-

1. Form

- 1.1. Powder

- 1.2. Liquid

- 1.3. Leaf

-

2. Application

- 2.1. Bakery

- 2.2. Dairy Products

- 2.3. Beverages

- 2.4. Confectionery

- 2.5. Dietary Supplements

- 2.6. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

South America Stevia Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Stevia Market Regional Market Share

Geographic Coverage of South America Stevia Market

South America Stevia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia

- 3.3. Market Restrains

- 3.3.1. Side Effects and Challenges with Stevia

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Inclination Toward Clean Label Stevia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Stevia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powder

- 5.1.2. Liquid

- 5.1.3. Leaf

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Dairy Products

- 5.2.3. Beverages

- 5.2.4. Confectionery

- 5.2.5. Dietary Supplements

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Brazil South America Stevia Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Powder

- 6.1.2. Liquid

- 6.1.3. Leaf

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Dairy Products

- 6.2.3. Beverages

- 6.2.4. Confectionery

- 6.2.5. Dietary Supplements

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Argentina South America Stevia Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Powder

- 7.1.2. Liquid

- 7.1.3. Leaf

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Dairy Products

- 7.2.3. Beverages

- 7.2.4. Confectionery

- 7.2.5. Dietary Supplements

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Rest of South America South America Stevia Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Powder

- 8.1.2. Liquid

- 8.1.3. Leaf

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Dairy Products

- 8.2.3. Beverages

- 8.2.4. Confectionery

- 8.2.5. Dietary Supplements

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GLG Life Tech Corp

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Tereos Pure Circle Solutions

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 HYET Sweet*List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Archer Daniels Midland Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Tate & Lyle PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cargill Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Ingredion Incorporated

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 GLG Life Tech Corp

List of Figures

- Figure 1: South America Stevia Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Stevia Market Share (%) by Company 2025

List of Tables

- Table 1: South America Stevia Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 2: South America Stevia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: South America Stevia Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: South America Stevia Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: South America Stevia Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 6: South America Stevia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: South America Stevia Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: South America Stevia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: South America Stevia Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 10: South America Stevia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: South America Stevia Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: South America Stevia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: South America Stevia Market Revenue undefined Forecast, by Form 2020 & 2033

- Table 14: South America Stevia Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: South America Stevia Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: South America Stevia Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Stevia Market?

The projected CAGR is approximately 10%.

2. Which companies are prominent players in the South America Stevia Market?

Key companies in the market include GLG Life Tech Corp, Tereos Pure Circle Solutions, HYET Sweet*List Not Exhaustive, Archer Daniels Midland Company, Tate & Lyle PLC, Cargill Inc, Ingredion Incorporated.

3. What are the main segments of the South America Stevia Market?

The market segments include Form, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Augmented demand for Natural Sweeteners; Rising Consumer Inclination Toward Clean Label and Organic Stevia.

6. What are the notable trends driving market growth?

Increasing Consumer Inclination Toward Clean Label Stevia.

7. Are there any restraints impacting market growth?

Side Effects and Challenges with Stevia.

8. Can you provide examples of recent developments in the market?

1. Government initiatives to promote stevia cultivation 2. Partnerships between industry players to develop innovative products 3. New product launches with stevia as a key ingredient

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Stevia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Stevia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Stevia Market?

To stay informed about further developments, trends, and reports in the South America Stevia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence