Key Insights

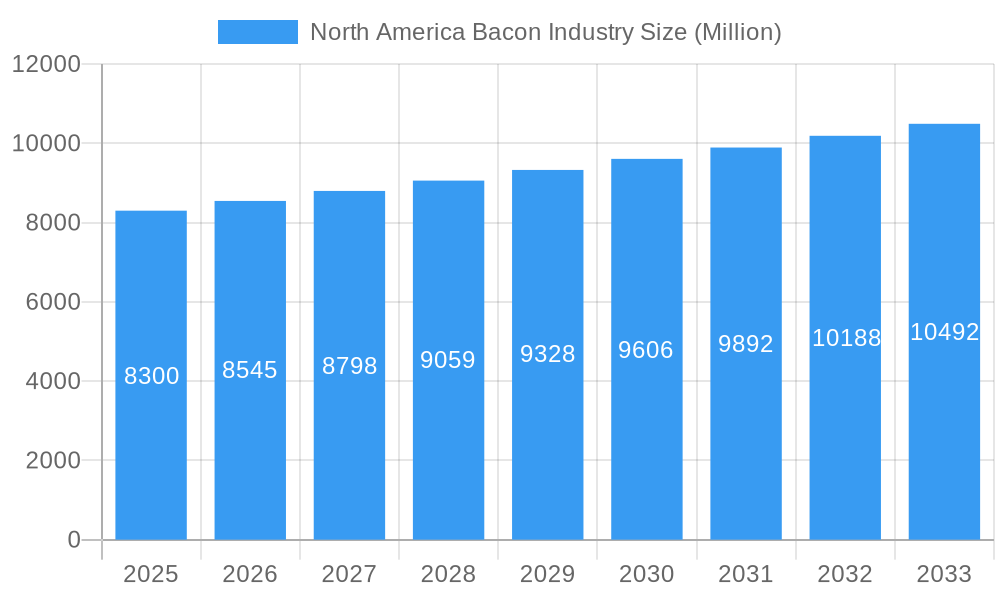

The North America Bacon Industry is poised for steady growth, with a market size estimated at $8.3 billion in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.9% from 2025 to 2033. This expansion is primarily fueled by evolving consumer preferences towards convenient and ready-to-eat food options, alongside a persistent demand for premium and artisanal bacon products. The "ready-to-eat" segment, encompassing microwavable bacon, is a significant growth driver, catering to the fast-paced lifestyles prevalent across the region. Furthermore, the increasing popularity of bacon in various culinary applications, from breakfast staples to gourmet burger toppings and innovative snack formulations, continues to bolster market demand. The foodservice sector, particularly quick-service restaurants (QSRs) and full-service restaurants, remains a dominant distribution channel, leveraging bacon's versatility to enhance menu offerings and attract a broad customer base. The rising disposable incomes and a growing appreciation for high-quality food ingredients are also contributing to the industry's upward trajectory.

North America Bacon Industry Market Size (In Billion)

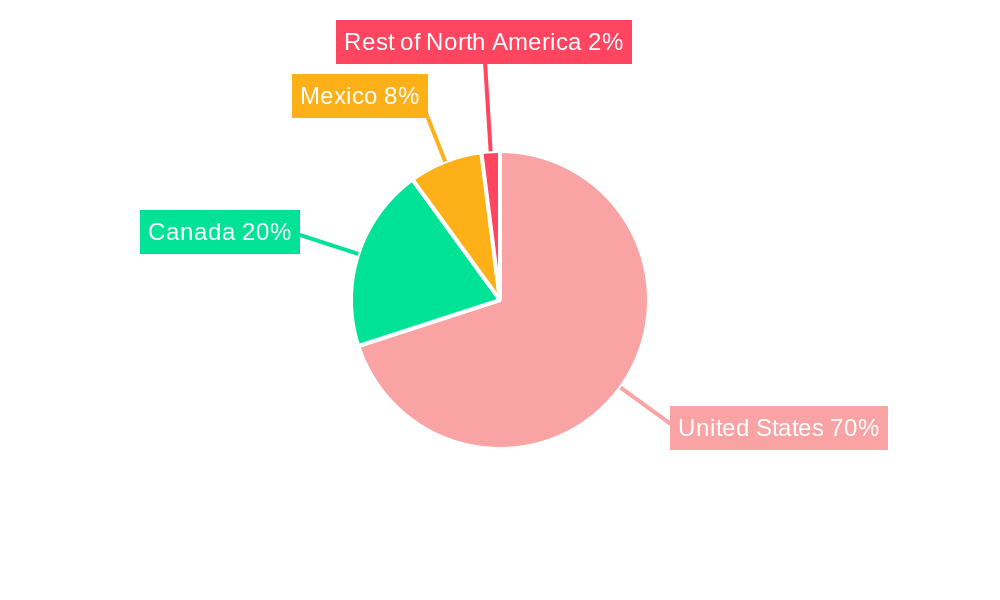

The market's growth is further supported by expanding retail channels, with online stores and specialty food retailers playing an increasingly crucial role in reaching a wider consumer demographic. While the industry benefits from strong consumer appeal, potential restraints include fluctuating raw material costs, particularly for pork, and increasing consumer awareness regarding health implications associated with processed meats, driving a demand for healthier alternatives. However, innovative product development, such as lower-sodium or nitrate-free bacon, is emerging to address these concerns. Geographically, the United States represents the largest market within North America, followed by Canada and Mexico. The "Rest of North America" segment is also expected to see moderate growth as these markets mature and adopt similar consumption patterns. Key players like Hormel Foods Corporation, The Kraft Heinz Company, and JBS SA are actively investing in product innovation, strategic partnerships, and expanded distribution networks to capitalize on these market dynamics and maintain a competitive edge.

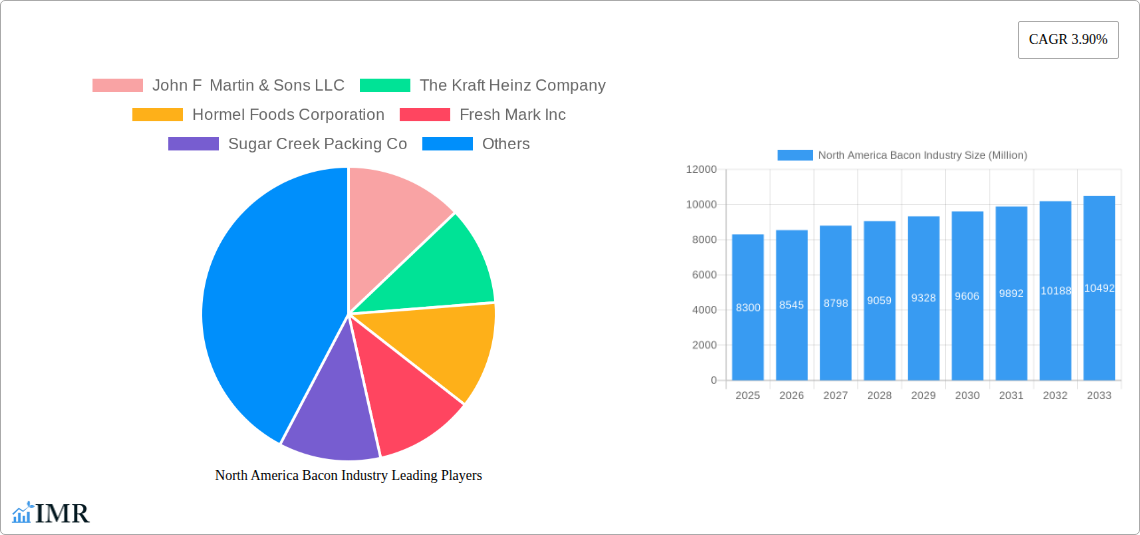

North America Bacon Industry Company Market Share

North America Bacon Industry Market Report: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the North America bacon industry, meticulously examining market dynamics, growth trends, and future outlook. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this comprehensive study leverages extensive data and industry expertise to deliver actionable insights for stakeholders. Our analysis encompasses the parent market of processed meats and the child market of bacon, offering a granular understanding of market segmentation by product type, distribution channel, and geography. We delve into key players, technological innovations, regulatory landscapes, and emerging opportunities, equipping businesses with the strategic intelligence needed to navigate this dynamic sector.

North America Bacon Industry Market Dynamics & Structure

The North America bacon industry is characterized by a moderate to highly concentrated market structure, with a few dominant players controlling a significant share. Technological innovation is a key driver, with advancements in processing, packaging, and product development influencing market competitiveness. Regulatory frameworks, particularly concerning food safety and animal welfare, play a crucial role in shaping operational practices and market entry. Competitive product substitutes, including plant-based alternatives and other breakfast meats, exert pressure on market growth. End-user demographics are shifting, with increasing demand for convenience, premium quality, and healthier options. Mergers and acquisitions (M&A) trends indicate a consolidation drive among larger players seeking to expand their product portfolios and market reach.

- Market Concentration: Dominated by key players like John F Martin & Sons LLC, The Kraft Heinz Company, Hormel Foods Corporation, Tyson Foods, and JBS SA.

- Technological Innovation: Focus on automation in processing, shelf-life extension, and development of novel bacon alternatives.

- Regulatory Frameworks: Stringent food safety standards (e.g., USDA, CFIA) and evolving labeling requirements.

- Competitive Substitutes: Growing presence of plant-based bacon and other protein sources.

- End-User Demographics: Increasing demand from millennials and Gen Z for convenience, ethically sourced products, and artisanal options.

- M&A Trends: Strategic acquisitions by larger corporations to enhance market share and diversify product offerings.

North America Bacon Industry Growth Trends & Insights

The North America bacon industry is poised for sustained growth, driven by evolving consumer preferences and advancements in production. The market size is projected to expand significantly over the forecast period, propelled by increasing consumption of processed meats and a resurgence in at-home cooking. Adoption rates for value-added and ready-to-eat bacon products are on the rise, catering to the demand for convenience. Technological disruptions are evident in the adoption of automation to improve efficiency and reduce costs, alongside innovations in sustainable sourcing and product development. Consumer behavior shifts towards seeking premium, ethically sourced, and healthier bacon options are reshaping product offerings and marketing strategies. The overall Compound Annual Growth Rate (CAGR) is expected to be robust, reflecting a healthy expansion in market penetration across various consumer segments.

Dominant Regions, Countries, or Segments in North America Bacon Industry

The United States stands as the dominant region within the North America bacon industry, consistently leading in market size and consumption. This dominance is fueled by a deeply ingrained culinary culture that features bacon prominently in a wide array of dishes and meal occasions. The robust presence of major food manufacturers and a well-established retail and food service infrastructure further solidify its leading position.

- United States:

- Market Share Dominance: Accounts for the largest share of the North American bacon market due to high per capita consumption and a vast consumer base.

- Key Drivers: Cultural significance of bacon in American cuisine, strong presence of major food companies, and well-developed distribution networks.

- Growth Potential: Continued demand for both traditional and innovative bacon products, including premium and healthier options.

Within product types, Standard Bacon continues to hold the largest market share, reflecting its widespread appeal and versatility. However, Ready-to-Eat Bacon (Includes Microwavable) is witnessing significant growth, driven by the increasing need for convenience and quick meal solutions among busy consumers. This segment benefits from innovations in packaging that ensure freshness and easy preparation.

In terms of distribution channels, the Retail Channel, particularly Supermarkets/Hypermarkets, remains the primary avenue for bacon sales, owing to their extensive reach and accessibility to households. Nevertheless, the Food Service Channel, comprising Quick-Service Restaurants (QSRs) and Full-Service Restaurants, also represents a substantial market, with bacon being a staple ingredient in numerous menu items. Online stores are emerging as a noteworthy segment within retail, indicating a growing preference for e-commerce for grocery purchases.

North America Bacon Industry Product Landscape

The North America bacon industry is characterized by a diverse product landscape, ranging from traditional cured pork bacon to innovative ready-to-eat and plant-based alternatives. Product innovations focus on enhancing flavor profiles, reducing fat content, and improving convenience through microwavable packaging. Companies are also exploring ethically sourced and sustainable production methods to cater to evolving consumer preferences. Performance metrics such as shelf-life, taste, texture, and nutritional content are key differentiators in a competitive market.

Key Drivers, Barriers & Challenges in North America Bacon Industry

Key Drivers:

- Consumer Preference for Protein: Bacon's appeal as a high-protein food continues to drive demand.

- Culinary Versatility: Its adaptability in various dishes across breakfast, lunch, and dinner.

- Convenience Products: Growing demand for ready-to-eat and microwavable bacon formats.

- Technological Advancements: Innovations in processing and packaging enhance quality and shelf-life.

Barriers & Challenges:

- Health Concerns: Negative perceptions related to saturated fat and sodium content.

- Supply Chain Volatility: Fluctuations in pork prices and availability due to disease outbreaks or global events.

- Regulatory Scrutiny: Increasing focus on food safety, animal welfare, and labeling.

- Competition from Alternatives: Rise of plant-based bacon and other protein sources.

- Sustainability Pressures: Demand for more environmentally friendly production methods.

Emerging Opportunities in North America Bacon Industry

Emerging opportunities in the North America bacon industry lie in the growing demand for premium and specialty bacon products, including artisanal, heritage, and smoke-free varieties. The expansion of plant-based bacon alternatives presents a significant untapped market catering to health-conscious and vegetarian/vegan consumers. Furthermore, innovative applications in snack foods and ready-to-eat meals offer new avenues for growth. Companies focusing on transparent sourcing, sustainable practices, and unique flavor profiles are well-positioned to capture these evolving consumer preferences and expand their market reach.

Growth Accelerators in the North America Bacon Industry Industry

Long-term growth in the North America bacon industry will be accelerated by continuous technological breakthroughs in processing and automation, leading to improved efficiency and reduced costs. Strategic partnerships between producers, retailers, and food service providers will streamline supply chains and enhance market penetration. Market expansion strategies, including the development of new product lines and the exploration of international markets, will also be critical. Furthermore, sustained investment in research and development to create healthier and more sustainable bacon products will be a key catalyst for continued growth and consumer engagement.

Key Players Shaping the North America Bacon Industry Market

- John F Martin & Sons LLC

- The Kraft Heinz Company

- Hormel Foods Corporation

- Fresh Mark Inc

- Sugar Creek Packing Co

- Maple Leaf Foods

- JBS SA

- Tyson Foods

- Seaboard Foods

Notable Milestones in North America Bacon Industry Sector

- June 2022: Umaro Foods launched novel seaweed bacon in several renowned United States restaurants, introducing a plant-based protein alternative to Michelin-starred Sorrel Restaurant, New York City's Egg Shop, and Nashville's D'Andrews Bakery and Cafe, with plans for wider expansion.

- March 2022: Seaboard Foods introduced its premium bacon line, "Prairie Fresh USA Prime," expanding its existing pork brand offerings.

- February 2022: Tyson Foods announced a USD 1.3 billion investment in automation over three years to boost manufacturing capacity and efficiency, with their new Kentucky bacon production plant to feature advanced robotics and automated technologies.

In-Depth North America Bacon Industry Market Outlook

The future of the North America bacon industry is characterized by robust growth potential, fueled by a confluence of factors including sustained consumer demand for protein-rich foods, ongoing innovation in product development, and increasing consumer interest in convenience. Strategic partnerships and market expansion initiatives will play a crucial role in capitalizing on untapped markets and evolving consumer preferences for specialty and healthier bacon options. The industry is poised to witness significant advancements in sustainable production and technological integration, driving both efficiency and market competitiveness, thereby solidifying its position as a vital segment of the broader processed meats market.

North America Bacon Industry Segmentation

-

1. Product Type

- 1.1. Standard Bacon

- 1.2. Ready-to-Eat Bacon (Includes Microwavable)

-

2. Distribution Channel

-

2.1. Food Service Channel

- 2.1.1. Full-Service Restaurants

- 2.1.2. Quick-Service Restaurants

- 2.1.3. Cafes and Bars

- 2.1.4. Other Food Service Channels

-

2.2. Retail Channel

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Specialty Stores

- 2.2.3. Online Stores

- 2.2.4. Other Retail Channels

-

2.3. By Geography

- 2.3.1. United States

- 2.3.2. Canada

- 2.3.3. Mexico

- 2.3.4. Rest of North America

-

2.1. Food Service Channel

North America Bacon Industry Segmentation By Geography

-

1. United States

- 1.1. Canada

- 1.2. Mexico

- 1.3. Rest of North America

North America Bacon Industry Regional Market Share

Geographic Coverage of North America Bacon Industry

North America Bacon Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumer Demand for Convenience Foods; Innovation in Bacon Varieties

- 3.3. Market Restrains

- 3.3.1. High fat and sodium content in bacon can lead to health issues impacting consumer preference

- 3.4. Market Trends

- 3.4.1. Increasing Preference for Premium Bacon Products as Breakfast Option

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bacon Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Standard Bacon

- 5.1.2. Ready-to-Eat Bacon (Includes Microwavable)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Food Service Channel

- 5.2.1.1. Full-Service Restaurants

- 5.2.1.2. Quick-Service Restaurants

- 5.2.1.3. Cafes and Bars

- 5.2.1.4. Other Food Service Channels

- 5.2.2. Retail Channel

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Retail Channels

- 5.2.3. By Geography

- 5.2.3.1. United States

- 5.2.3.2. Canada

- 5.2.3.3. Mexico

- 5.2.3.4. Rest of North America

- 5.2.1. Food Service Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 John F Martin & Sons LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Kraft Heinz Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hormel Foods Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fresh Mark Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sugar Creek Packing Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maple Leaf Foods

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JBS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tyson Foods

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Seaboard Foods

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 John F Martin & Sons LLC

List of Figures

- Figure 1: North America Bacon Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Bacon Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Bacon Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Bacon Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America Bacon Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Bacon Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: North America Bacon Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: North America Bacon Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Canada North America Bacon Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Mexico North America Bacon Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America North America Bacon Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bacon Industry?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the North America Bacon Industry?

Key companies in the market include John F Martin & Sons LLC, The Kraft Heinz Company, Hormel Foods Corporation, Fresh Mark Inc, Sugar Creek Packing Co, Maple Leaf Foods, JBS SA, Tyson Foods, Seaboard Foods.

3. What are the main segments of the North America Bacon Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumer Demand for Convenience Foods; Innovation in Bacon Varieties.

6. What are the notable trends driving market growth?

Increasing Preference for Premium Bacon Products as Breakfast Option.

7. Are there any restraints impacting market growth?

High fat and sodium content in bacon can lead to health issues impacting consumer preference.

8. Can you provide examples of recent developments in the market?

June 2022: Umaro Foods' novel seaweed bacon was launched in several renowned United States restaurants. Umaro Foods introduced seaweed-based bacon into three US restaurants for the first time, allowing customers to try the brand's novel protein. UMARO bacon was featured in various specialty dishes at San Francisco's Michelin-starred Sorrel Restaurant, New York City's Egg Shop, and Nashville's D'Andrews Bakery and Cafe. The company intends to expand into more restaurants in the Bay Area, Los Angeles, and elsewhere.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bacon Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bacon Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bacon Industry?

To stay informed about further developments, trends, and reports in the North America Bacon Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence