Key Insights

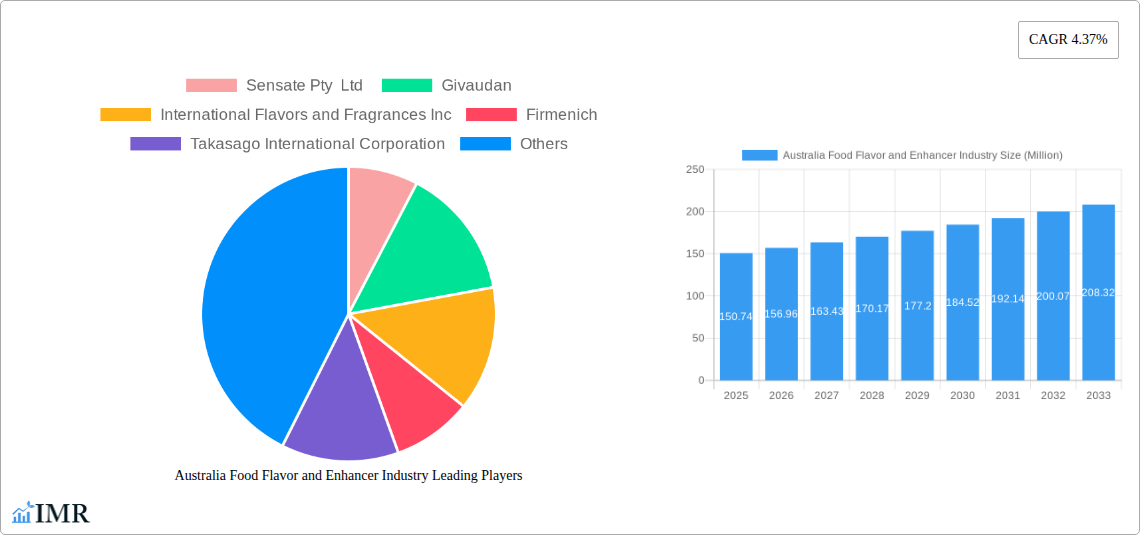

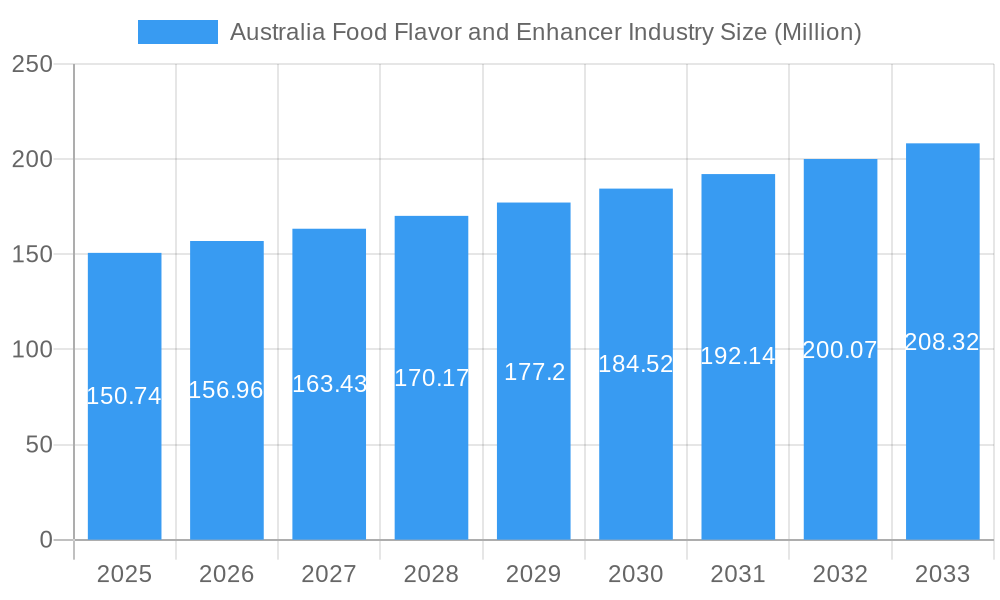

The Australian food flavor and enhancer market is poised for steady expansion, projected to reach AUD 150.74 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 4.1% over the forecast period of 2025-2033. This growth is primarily fueled by evolving consumer preferences for diverse and innovative taste experiences, alongside a growing demand for cleaner labels and natural ingredients. The "natural flavors" segment is anticipated to lead the market, driven by consumer awareness and a willingness to pay a premium for products perceived as healthier and more authentic. Furthermore, the burgeoning processed food industry, particularly in sectors like bakery, confectionery, and beverages, necessitates a continuous supply of high-quality flavors and enhancers to meet production demands and product differentiation strategies.

Australia Food Flavor and Enhancer Industry Market Size (In Million)

Key trends shaping the Australian market include the increasing adoption of flavor enhancers to improve the taste profile of healthier, low-sugar, and low-sodium food products, as regulatory pressures and health consciousness continue to rise. The demand for plant-based and functional food ingredients is also creating new avenues for flavor innovation. However, the market faces restraints such as stringent regulatory frameworks regarding food additives and the rising cost of raw materials, which can impact profit margins for manufacturers. Geographically, while the provided data only specifies Australia, the global trends suggest that the Asia-Pacific region, including Australia, represents a significant growth opportunity due to its dynamic food and beverage industry and a growing middle class with increasing disposable incomes. Companies like Givaudan, International Flavors & Fragrances Inc., and Firmenich are expected to play a pivotal role in driving innovation and catering to the evolving demands of the Australian food and beverage sector.

Australia Food Flavor and Enhancer Industry Company Market Share

Australia Food Flavor and Enhancer Industry Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock critical insights into Australia's burgeoning food flavor and enhancer market. This comprehensive report details market dynamics, growth trajectories, dominant segments, product innovation, key players, and future opportunities, providing a strategic roadmap for industry stakeholders. All monetary values are presented in million AUD.

Australia Food Flavor and Enhancer Industry Market Dynamics & Structure

The Australian food flavor and enhancer industry exhibits a moderately concentrated market structure, with a few global giants and several specialized domestic players vying for market share. Technological innovation is primarily driven by advancements in natural extraction techniques, fermentation processes, and the development of clean-label ingredients, responding to escalating consumer demand for transparency and healthier options. The regulatory framework, governed by Food Standards Australia New Zealand (FSANZ), plays a pivotal role in shaping product development and market entry, with stringent guidelines on ingredient safety and labeling. Competitive product substitutes are increasingly evolving, with a growing emphasis on whole-food ingredients and plant-based alternatives that offer inherent flavor profiles. End-user demographics are shifting towards a health-conscious and discerning consumer base, prioritizing natural, low-sugar, and low-salt options. Mergers and acquisitions (M&A) trends indicate strategic consolidation among larger players to expand their portfolios, acquire innovative technologies, and enhance their market reach.

- Market Concentration: Dominated by global players like Givaudan, International Flavors and Fragrances Inc., Firmenich, and Symrise AG, alongside significant contributions from Sensate Pty Ltd and Kerry Group.

- Technological Innovation Drivers: Focus on natural flavors, biotechnology for ingredient synthesis, and encapsulation technologies for extended shelf-life and controlled release.

- Regulatory Framework: Adherence to FSANZ regulations regarding food additive approval, labeling, and safety standards.

- Competitive Product Substitutes: Rise of natural sweeteners, spice blends, and functional ingredients as alternatives to synthetic flavorings.

- End-User Demographics: Growing demand from health-conscious millennials and Gen Z consumers seeking natural, sustainable, and allergen-free ingredients.

- M&A Trends: Acquisitions targeting innovative flavor houses and ingredient technology companies to diversify product offerings and secure market leadership.

Australia Food Flavor and Enhancer Industry Growth Trends & Insights

The Australian food flavor and enhancer industry is poised for robust expansion, driven by evolving consumer preferences and dynamic food manufacturing practices. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period (2025-2033). This growth is underpinned by a significant rise in the adoption rates of both natural and nature-identical flavors, as manufacturers strive to meet consumer demand for clean-label products. Technological disruptions, such as the application of artificial intelligence in flavor profiling and the development of novel fermentation techniques, are further accelerating innovation and efficiency within the industry. Consumer behavior shifts are paramount, with a discernible trend towards healthier food options, leading to increased demand for flavors that mask undesirable tastes in low-sugar or low-fat products, and enhancers that amplify natural savory notes. The growing awareness of the link between diet and well-being is also fueling the demand for functional ingredients that offer health benefits alongside desirable taste profiles. The penetration of flavored beverages, particularly those catering to specific dietary needs like low-calorie or plant-based options, continues to expand, presenting substantial growth avenues. Similarly, the confectionery and bakery sectors are witnessing innovation in flavor profiles and ingredient sourcing to cater to premiumization trends and indulgent experiences. The savory snacks segment, a consistent performer, is expected to see sustained growth with the introduction of more complex and globally inspired flavor combinations.

Dominant Regions, Countries, or Segments in Australia Food Flavor and Enhancer Industry

Within the Australian food flavor and enhancer industry, the Flavors segment, particularly Natural Flavors, is the dominant force, driving substantial market growth. This dominance is propelled by a confluence of factors including escalating consumer demand for natural and perceived healthier food options, coupled with increasing regulatory scrutiny on synthetic ingredients. The market share for Natural Flavors is estimated to represent over 55% of the total flavor and enhancer market in Australia.

Key Drivers for Natural Flavors Dominance:

- Consumer Preference: A significant and growing segment of Australian consumers actively seeks out products with natural ingredients, driven by health and wellness trends, and a desire for transparent ingredient lists. This preference is particularly pronounced in the Beverages and Dairy application segments.

- Clean Labeling Initiatives: Food manufacturers are increasingly reformulating products to achieve "clean label" status, necessitating the replacement of artificial additives with natural flavorings. This trend significantly impacts the Bakery and Confectionery sectors.

- Technological Advancements: Innovations in extraction and processing technologies have made natural flavors more accessible, cost-effective, and consistent in quality, expanding their applicability across various food categories.

- Premiumization: The premiumization of food products often hinges on the use of high-quality, natural flavor profiles, enhancing the perceived value and sensory experience for consumers in segments like Soups and Sauces and specialized Savory Snacks.

- Regulatory Support: While regulations are stringent for all food ingredients, a supportive environment for the approval and use of naturally derived flavor compounds further bolsters their adoption.

The Beverages application segment emerges as a key growth driver within the broader flavor and enhancer market. The Australian beverage industry, encompassing carbonated soft drinks, juices, dairy beverages, and alcoholic drinks, has a high propensity for flavor innovation. The increasing demand for functional beverages, plant-based milk alternatives, and ready-to-drink (RTD) options creates a fertile ground for sophisticated flavor solutions and enhancers that improve palatability and shelf stability. The Bakery and Confectionery segments also represent significant markets, driven by consumer demand for indulgent and novel taste experiences, with natural flavors playing a crucial role in delivering authentic and appealing profiles.

Australia Food Flavor and Enhancer Industry Product Landscape

The Australian food flavor and enhancer industry is characterized by a dynamic product landscape, increasingly focused on innovation driven by consumer trends and technological advancements. The development of highly concentrated natural flavor extracts, utilizing advanced extraction techniques such as supercritical fluid extraction, is a prominent innovation. These extracts offer superior flavor profiles and cost-effectiveness. Furthermore, the industry is witnessing a surge in encapsulated flavors, which provide controlled release and enhanced stability, particularly crucial for processed foods like savory snacks and baked goods. Flavor enhancers that leverage natural compounds like yeast extracts and fermentation by-products are gaining traction for their ability to boost umami and savory notes without relying on synthetic additives. The performance metrics of these products are measured by their flavor intensity, stability under processing conditions, cost-effectiveness, and sensory appeal. Unique selling propositions often revolve around sourcing from sustainable origins, allergen-free formulations, and the ability to replicate complex, authentic taste experiences.

Key Drivers, Barriers & Challenges in Australia Food Flavor and Enhancer Industry

Key Drivers:

The Australian food flavor and enhancer industry is propelled by several key drivers. Increasing consumer demand for natural and clean-label products stands as a primary catalyst, influencing product development towards plant-derived and minimally processed ingredients. Technological advancements in flavor extraction, synthesis, and encapsulation are enabling the creation of more sophisticated, stable, and cost-effective flavor solutions. The growing processed food market, particularly in categories like beverages, bakery, and savory snacks, necessitates innovative flavorings and enhancers to meet evolving consumer palates. Health and wellness trends, leading to demand for low-sugar, low-salt, and fortified products, also drive the need for effective flavor masking and enhancement solutions. Government initiatives promoting local food production and innovation can also act as a significant growth accelerator.

Barriers & Challenges:

Despite its growth potential, the industry faces several barriers and challenges. Stringent regulatory frameworks and approval processes for new flavor ingredients can be time-consuming and costly, potentially slowing down market entry for innovators. The fluctuating cost and availability of natural raw materials, subject to agricultural yields and global supply chain disruptions, pose a significant challenge to price stability and consistent supply. Intense competition from global players with established R&D capabilities and vast distribution networks creates pressure on smaller domestic companies. Consumer perception and education regarding the safety and benefits of certain flavor enhancers remain a challenge, with some consumers exhibiting a preference for "recognizable" ingredients. Supply chain vulnerabilities, exacerbated by global events, can lead to raw material shortages and increased logistics costs, impacting overall profitability.

Emerging Opportunities in Australia Food Flavor and Enhancer Industry

Emerging opportunities in the Australian food flavor and enhancer industry lie in the expanding demand for plant-based and vegan flavor profiles, catering to the growing vegan and flexitarian consumer base. Innovations in fermentation-derived flavors offer a sustainable and authentic route to complex taste profiles. The functional food and beverage sector presents a significant untapped market, with opportunities for flavors that complement health-promoting ingredients or mask the taste of beneficial but less palatable compounds. Furthermore, the development of personalized flavor experiences through advanced sensory science and AI-driven profiling could unlock niche markets. There is also a growing opportunity in the "free-from" category, creating flavors that are free from common allergens like gluten, dairy, and nuts, meeting the needs of a significant consumer segment.

Growth Accelerators in the Australia Food Flavor and Enhancer Industry Industry

Several catalysts are accelerating the long-term growth of the Australia Food Flavor and Enhancer Industry. Continued investment in research and development by major players focusing on novel natural flavor extraction, biotechnology, and the creation of sustainable ingredient solutions will be crucial. Strategic partnerships and collaborations between flavor houses, food manufacturers, and research institutions can foster innovation and accelerate product development cycles. Market expansion strategies, including entry into emerging application areas like ready-to-eat meals and infant nutrition, will tap into new consumer bases. The increasing adoption of digital technologies for supply chain management and consumer insights will also optimize operations and drive targeted product development, further fueling growth. The focus on "farm-to-fork" transparency and traceable ingredients will continue to be a significant growth accelerator.

Key Players Shaping the Australia Food Flavor and Enhancer Industry Market

- Sensate Pty Ltd

- Givaudan

- International Flavors and Fragrances Inc.

- Firmenich

- Takasago International Corporation

- Symrise AG

- Kerry Group

- Sensient Technologies Corporation

Notable Milestones in Australia Food Flavor and Enhancer Industry Sector

- 2022/05: Givaudan announces expansion of its innovation center in Australia, focusing on natural flavor solutions.

- 2021/11: Kerry Group acquires a leading Australian natural ingredient supplier, strengthening its clean-label portfolio.

- 2020/08: Sensient Technologies Corporation launches a new range of plant-based flavors in the Australian market.

- 2019/03: Firmenich invests in a new R&D facility in Sydney, emphasizing sustainable flavor innovation.

- 2023/07: International Flavors and Fragrances Inc. collaborates with a local university to research novel flavor encapsulation technologies.

- 2024/01: Symrise AG expands its distribution network in Australia, enhancing market penetration for its flavor and nutrition solutions.

In-Depth Australia Food Flavor and Enhancer Industry Market Outlook

The future outlook for the Australia Food Flavor and Enhancer Industry is exceptionally bright, driven by sustained consumer preference for natural and healthier food options. Growth accelerators will include the continued innovation in plant-based and fermentation-derived flavors, alongside the increasing demand for functional ingredients that enhance both taste and well-being. Strategic partnerships and technological advancements in AI-driven flavor design and sustainable sourcing will further propel the market forward. The industry is well-positioned to capitalize on the growing health-conscious consumer base and the evolving landscape of food manufacturing, promising significant opportunities for both established players and emerging innovators.

Australia Food Flavor and Enhancer Industry Segmentation

-

1. Type

-

1.1. Flavors

- 1.1.1. Natural Flavors

- 1.1.2. Nature-Identical Flavors

- 1.1.3. Synthetic Flavors

- 1.2. Flavor Enhancers

-

1.1. Flavors

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy

- 2.4. Beverages

- 2.5. Savory Snacks

- 2.6. Soups and Sauces

- 2.7. Others

Australia Food Flavor and Enhancer Industry Segmentation By Geography

- 1. Australia

Australia Food Flavor and Enhancer Industry Regional Market Share

Geographic Coverage of Australia Food Flavor and Enhancer Industry

Australia Food Flavor and Enhancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Increasing Inclination Towards Clean-Label Claim

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.1.1. Natural Flavors

- 5.1.1.2. Nature-Identical Flavors

- 5.1.1.3. Synthetic Flavors

- 5.1.2. Flavor Enhancers

- 5.1.1. Flavors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy

- 5.2.4. Beverages

- 5.2.5. Savory Snacks

- 5.2.6. Soups and Sauces

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sensate Pty Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Givaudan

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 International Flavors and Fragrances Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Firmenich

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Takasago International Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Symsrise AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sensient Technologies Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sensate Pty Ltd

List of Figures

- Figure 1: Australia Food Flavor and Enhancer Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Food Flavor and Enhancer Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Food Flavor and Enhancer Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Australia Food Flavor and Enhancer Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Australia Food Flavor and Enhancer Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Australia Food Flavor and Enhancer Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Australia Food Flavor and Enhancer Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Australia Food Flavor and Enhancer Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Food Flavor and Enhancer Industry?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Australia Food Flavor and Enhancer Industry?

Key companies in the market include Sensate Pty Ltd , Givaudan, International Flavors and Fragrances Inc, Firmenich, Takasago International Corporation, Symsrise AG, Kerry Group, Sensient Technologies Corporation.

3. What are the main segments of the Australia Food Flavor and Enhancer Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Increasing Inclination Towards Clean-Label Claim.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Food Flavor and Enhancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Food Flavor and Enhancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Food Flavor and Enhancer Industry?

To stay informed about further developments, trends, and reports in the Australia Food Flavor and Enhancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence