Key Insights

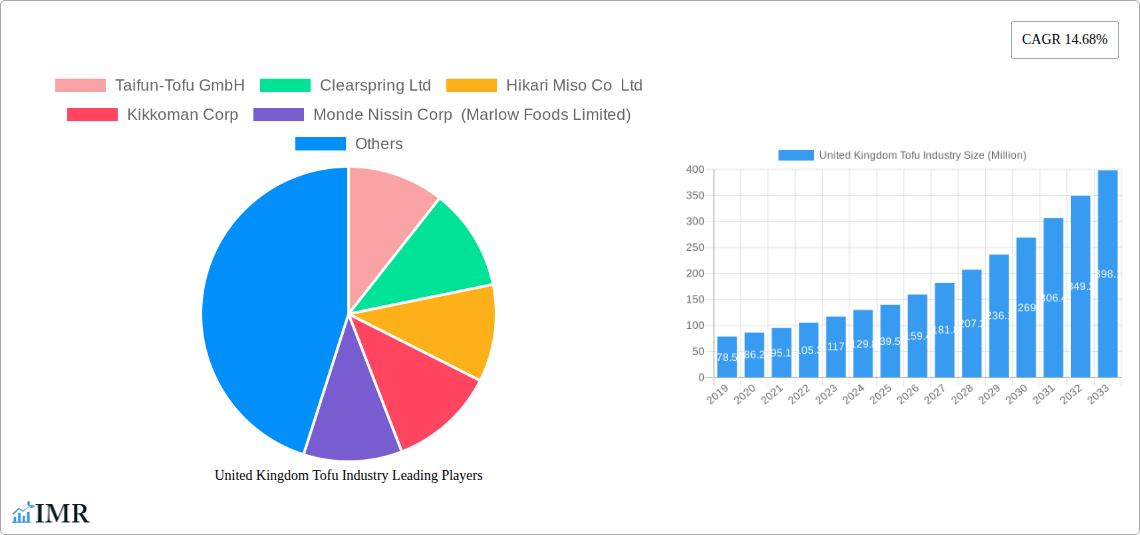

The United Kingdom tofu market is poised for significant expansion, with a projected market size of £139.54 million in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 14.68%. This impressive growth trajectory, estimated to continue through to 2033, is fueled by a confluence of evolving consumer preferences, a burgeoning health and wellness consciousness, and increasing environmental awareness. Consumers are increasingly seeking plant-based protein alternatives to traditional animal products, positioning tofu as a versatile and healthy staple. The market's expansion is further supported by a widening distribution network, encompassing traditional supermarkets and grocery stores, as well as a rapidly growing online retail sector that offers convenience and accessibility to a broader consumer base. Key market players are investing in product innovation, expanding their portfolios with diverse tofu varieties and ready-to-eat meals, catering to the demand for both convenience and novel culinary experiences.

United Kingdom Tofu Industry Market Size (In Million)

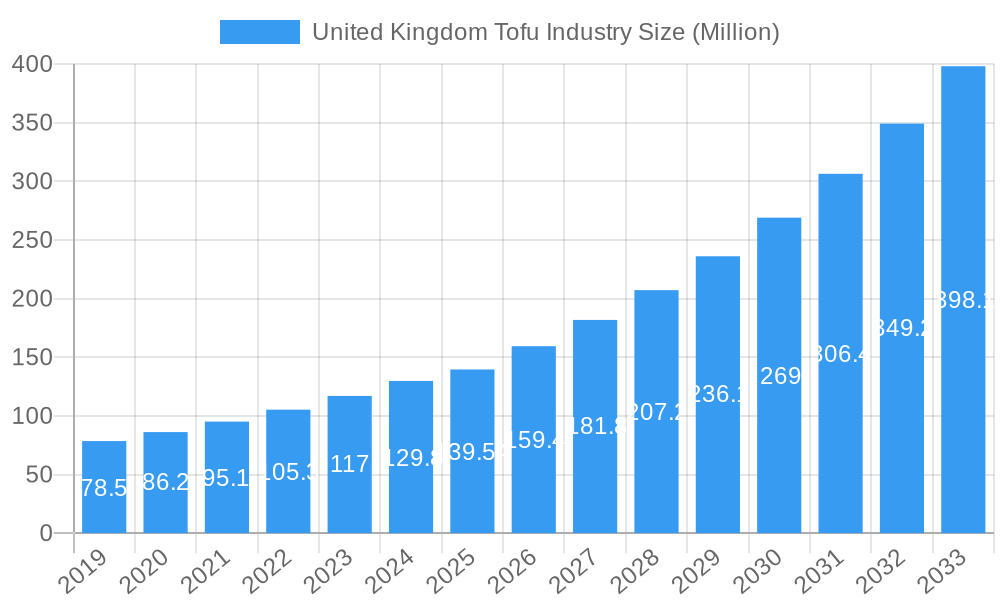

The growth within the UK tofu sector is also significantly influenced by prevailing lifestyle trends, including flexitarianism and veganism, which are gaining widespread adoption. This shift in dietary habits creates a sustained demand for plant-based proteins like tofu. Furthermore, increasing disposable incomes and a greater willingness among consumers to experiment with international cuisines contribute to the market's dynamism. While the market enjoys strong growth drivers, potential restraints could emerge from fluctuating raw material prices, particularly for soybeans, and the need for continued consumer education regarding the versatility and health benefits of tofu. However, the established presence of key companies like Taifun-Tofu GmbH, Clearspring Ltd, and Kikkoman Corp, alongside emerging players, indicates a competitive landscape that will likely drive further innovation and market penetration, solidifying tofu's position as a mainstream food product in the UK.

United Kingdom Tofu Industry Company Market Share

Unlock deep insights into the burgeoning United Kingdom tofu market with this exhaustive report. Covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033), this analysis provides a granular view of market dynamics, growth trends, and competitive landscapes. Delve into the strategic moves of key players, understand evolving consumer preferences, and identify untapped opportunities within this rapidly expanding sector. This report is essential for manufacturers, distributors, investors, and stakeholders seeking to navigate and capitalize on the future of plant-based protein in the UK.

United Kingdom Tofu Industry Market Dynamics & Structure

The United Kingdom tofu market is characterized by increasing fragmentation and dynamic competition, driven by evolving consumer health consciousness and a growing demand for plant-based alternatives. Market concentration is moderate, with several key players vying for market share, alongside a growing number of smaller, artisanal producers. Technological innovation plays a pivotal role, with advancements in processing, flavoring, and packaging significantly influencing product development and consumer appeal. Regulatory frameworks, particularly concerning food safety and labeling, are well-established and are adapting to accommodate the growth of the plant-based sector. Competitive product substitutes, including other plant-based proteins like tempeh and seitan, as well as traditional meat and dairy products, exert pressure, but tofu's versatility and perceived health benefits offer a distinct advantage. End-user demographics are broadening, encompassing not only vegetarians and vegans but also flexitarians and health-conscious consumers seeking to reduce their meat consumption. Mergers and acquisitions (M&A) trends are emerging as larger food conglomerates look to expand their plant-based portfolios, offering opportunities for strategic consolidation.

- Market Concentration: Moderate, with a blend of established brands and emerging niche players.

- Technological Innovation Drivers: Improved processing techniques for texture enhancement, a wider range of flavor profiles, and sustainable packaging solutions.

- Regulatory Frameworks: Stringent food safety standards and evolving labeling regulations for plant-based products.

- Competitive Product Substitutes: Tempeh, seitan, plant-based meat alternatives, and traditional protein sources.

- End-User Demographics: Vegetarians, vegans, flexitarians, health-conscious individuals, and environmentally aware consumers.

- M&A Trends: Increasing interest from larger food corporations seeking to acquire innovative plant-based brands.

United Kingdom Tofu Industry Growth Trends & Insights

The United Kingdom tofu market is poised for substantial growth, driven by a confluence of powerful market trends and evolving consumer behaviors. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) throughout the forecast period, fueled by increasing adoption rates of plant-based diets across all age groups. This expansion is not merely a niche phenomenon; it represents a significant shift in mainstream dietary patterns. Technological disruptions, such as advanced fermentation techniques and novel ingredient applications, are further enhancing the appeal and functionality of tofu-based products. Consumer behavior is undergoing a rapid transformation, with a heightened focus on health, sustainability, and ethical sourcing influencing purchasing decisions. This shift is evident in the growing demand for organic, non-GMO, and sustainably produced tofu. The market penetration of tofu is expected to deepen significantly as accessibility increases through broader distribution channels and a wider variety of product offerings. Innovations in flavor and texture are key to overcoming historical barriers to adoption, making tofu a more appealing and versatile ingredient for a wider consumer base. The perception of tofu is moving beyond its traditional association with specific diets to being recognized as a healthy, delicious, and adaptable food source. This evolving perception, coupled with growing environmental concerns regarding traditional animal agriculture, acts as a significant tailwind for market expansion. The increasing availability of convenient and ready-to-cook tofu options also caters to busy modern lifestyles, further accelerating adoption.

Dominant Regions, Countries, or Segments in United Kingdom Tofu Industry

Within the United Kingdom tofu industry, the Supermarkets/Hypermarkets distribution channel is demonstrably the dominant force driving market growth. This segment's expansive reach, coupled with its ability to cater to a broad consumer base seeking convenience and variety, positions it as the primary gateway for tofu products. The sheer volume of foot traffic and purchasing power concentrated within supermarket chains allows for significant market penetration and brand visibility. Economic policies that support the growth of the plant-based food sector, alongside the retail infrastructure that facilitates widespread availability, contribute to this dominance.

Supermarkets/Hypermarkets:

- Market Share: Holds the largest market share due to extensive product placement and consumer accessibility.

- Growth Potential: Continues to be a key channel for reaching mainstream consumers and driving volume sales.

- Key Drivers: Wide product variety, competitive pricing, promotional activities, and strategic shelf placement.

- Consumer Behavior: Facilitates impulse purchases and accommodates the growing trend of incorporating plant-based options into regular grocery shopping.

Online Retail Stores:

- Market Share: Experiencing rapid growth, offering convenience and specialized product selections.

- Growth Potential: High, driven by e-commerce adoption and demand for direct-to-consumer options.

- Key Drivers: Convenience, wider product selection beyond physical store limitations, subscription services, and targeted marketing.

Convenience/Grocery Stores:

- Market Share: Important for smaller, more localized purchases and impulse buys.

- Growth Potential: Steady, serving consumers seeking quick and accessible plant-based options.

- Key Drivers: Localized availability, impulse purchasing, and catering to immediate needs.

Other Distribution Channels:

- Market Share: Includes food service, independent health food stores, and specialist ethnic food retailers.

- Growth Potential: Niche but significant, particularly in the food service sector catering to vegetarian and vegan menus.

- Key Drivers: Catering to specific dietary needs, specialized culinary applications, and unique product offerings.

United Kingdom Tofu Industry Product Landscape

The United Kingdom tofu market is witnessing an exciting wave of product innovation, moving beyond basic blocks to encompass a diverse and appealing range of formats and flavors. Product innovations are heavily focused on enhancing texture, mimicking traditional meat-like mouthfeels, and introducing a variety of culinary applications. Performance metrics are increasingly evaluated by consumer acceptance, taste profiles, and nutritional value. Unique selling propositions often revolve around natural ingredients, organic sourcing, and innovative flavoring techniques that cater to evolving palates. Technological advancements in processing allow for the creation of firmer textures, pre-marinated options, and even tofu-based meat alternatives that rival traditional meat in terms of taste and texture.

Key Drivers, Barriers & Challenges in United Kingdom Tofu Industry

Key Drivers:

- Growing Health Consciousness: Increased consumer awareness of the health benefits associated with plant-based protein.

- Environmental Concerns: Rising demand for sustainable food choices and reduced environmental impact from animal agriculture.

- Flexitarianism and Veganism Trends: A significant and growing segment of the population actively reducing or eliminating meat consumption.

- Product Innovation: Development of more appealing textures, flavors, and convenient formats.

Barriers & Challenges:

- Perceived Blandness and Texture Issues: Historical consumer perceptions that need to be overcome through better product development.

- Supply Chain Volatility: Reliance on global soy supply chains can lead to price fluctuations and availability concerns.

- Competition from Other Plant-Based Proteins: A crowded market with numerous alternative protein sources.

- Cost Competitiveness: Tofu can sometimes be perceived as more expensive than conventional protein sources.

- Regulatory Hurdles: Navigating evolving food labeling and marketing regulations for plant-based products.

Emerging Opportunities in United Kingdom Tofu Industry

Emerging opportunities in the United Kingdom tofu industry lie in catering to a growing demand for highly convenient and ready-to-eat tofu products, particularly those designed for specific meal occasions like lunches and quick dinners. Untapped markets exist within the foodservice sector, with an increasing number of restaurants and cafes looking to incorporate more diverse and innovative plant-based options on their menus. Innovative applications in product development, such as tofu-based snacks, desserts, and even dairy alternatives, present significant growth potential. Evolving consumer preferences for ethically sourced and locally produced ingredients also create a niche for artisanal and traceable tofu brands. Furthermore, the development of functional tofu products, enriched with additional nutrients or prebiotics, could appeal to health-conscious consumers seeking more than just basic protein.

Growth Accelerators in the United Kingdom Tofu Industry Industry

Several key catalysts are driving long-term growth in the United Kingdom tofu industry. Technological breakthroughs in plant-based protein processing are continuously improving the taste, texture, and versatility of tofu, making it more appealing to a wider consumer base. Strategic partnerships between tofu manufacturers and retailers are crucial for enhancing distribution and market penetration, ensuring wider availability and better shelf placement. Market expansion strategies, including targeting new demographic segments and geographical areas within the UK, are also vital. Furthermore, the increasing investment from venture capital and established food corporations into the plant-based sector is fueling innovation and scaling production capabilities, further accelerating growth.

Key Players Shaping the United Kingdom Tofu Industry Market

- Taifun-Tofu GmbH

- Clearspring Ltd

- Hikari Miso Co Ltd

- Kikkoman Corp

- Monde Nissin Corp (Marlow Foods Limited)

- House Foods Group Inc

- Associated British Foods (AB World Foods Limited)

- The Tofoo Co Ltd

- Morinaga Milk Industry Co Ltd

- Wilson International Frozen Foods (H K ) Limited (Tazaki Foods)

Notable Milestones in United Kingdom Tofu Industry Sector

- April 2022: Cauldron Foods, a division of Marlow Foods Ltd, expanded its famous range with the addition of two new tofu products, namely Quick & Tasty Smoky BBQ Block and Hoisin Tofu. The new SKUs are created from sustainable soy and come in 100% recyclable packaging.

- December 2021: The Tofoo Co., a UK tofu brand, expanded its portfolio with a new line of frozen tofu products called Straight to Wok. Straight to Wok is prepared with tofu cubes coated in cornflour. The new line comes in two flavors, such as Naked and Ginger & Chilli.

- February 2021: The Tofoo Co., a British company, launched the country's first frozen tofu product, Tofoo Chunkies, which is intended to make tofu more accessible.

In-Depth United Kingdom Tofu Industry Market Outlook

The United Kingdom tofu industry is set for sustained and significant growth, propelled by ongoing shifts in consumer dietary habits towards plant-based options and an increasing appreciation for the health and environmental benefits of tofu. Strategic collaborations between ingredient suppliers, manufacturers, and retailers will be pivotal in optimizing supply chains and expanding market reach. The ongoing commitment to innovation, particularly in developing convenient, versatile, and appealing tofu products, will continue to attract a broader consumer base. Future market potential is immense, with opportunities to further penetrate the foodservice sector and develop novel product categories that cater to evolving lifestyle needs and health aspirations, solidifying tofu's position as a mainstream protein choice.

United Kingdom Tofu Industry Segmentation

-

1. Distribution Channel

- 1.1. Supermarkets/Hypermarkets

- 1.2. Convenience/Grocery Stores

- 1.3. Online Retail Stores

- 1.4. Other Distribution Channels

United Kingdom Tofu Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Tofu Industry Regional Market Share

Geographic Coverage of United Kingdom Tofu Industry

United Kingdom Tofu Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing consumer awareness about the health benefits of tofu

- 3.3. Market Restrains

- 3.3.1. Processing and Shelf Life Issues

- 3.4. Market Trends

- 3.4.1. Increased demand for organic and non-GMO tofu products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Tofu Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Supermarkets/Hypermarkets

- 5.1.2. Convenience/Grocery Stores

- 5.1.3. Online Retail Stores

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Taifun-Tofu GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Clearspring Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hikari Miso Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kikkoman Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Monde Nissin Corp (Marlow Foods Limited)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 House Foods Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Associated British Foods (AB World Foods Limited)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Tofoo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Morinaga Milk Industry Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wilson International Frozen Foods (H K ) Limited (Tazaki Foods)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Taifun-Tofu GmbH

List of Figures

- Figure 1: United Kingdom Tofu Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Tofu Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Tofu Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 2: United Kingdom Tofu Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 3: United Kingdom Tofu Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Tofu Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Tofu Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: United Kingdom Tofu Industry Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 7: United Kingdom Tofu Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 8: United Kingdom Tofu Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Tofu Industry?

The projected CAGR is approximately 14.68%.

2. Which companies are prominent players in the United Kingdom Tofu Industry?

Key companies in the market include Taifun-Tofu GmbH, Clearspring Ltd, Hikari Miso Co Ltd, Kikkoman Corp, Monde Nissin Corp (Marlow Foods Limited), House Foods Group Inc, Associated British Foods (AB World Foods Limited)*List Not Exhaustive, The Tofoo Co Ltd, Morinaga Milk Industry Co Ltd, Wilson International Frozen Foods (H K ) Limited (Tazaki Foods).

3. What are the main segments of the United Kingdom Tofu Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 139.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing consumer awareness about the health benefits of tofu.

6. What are the notable trends driving market growth?

Increased demand for organic and non-GMO tofu products.

7. Are there any restraints impacting market growth?

Processing and Shelf Life Issues.

8. Can you provide examples of recent developments in the market?

April 2022: Cauldron Foods, a division of Marlow Foods Ltd, expanded its famous range with the addition of two new tofu products, namely Quick & Tasty Smoky BBQ Block and Hoisin Tofu. The new SKUs are created from sustainable soy and come in 100% recyclable packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Tofu Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Tofu Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Tofu Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Tofu Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence