Key Insights

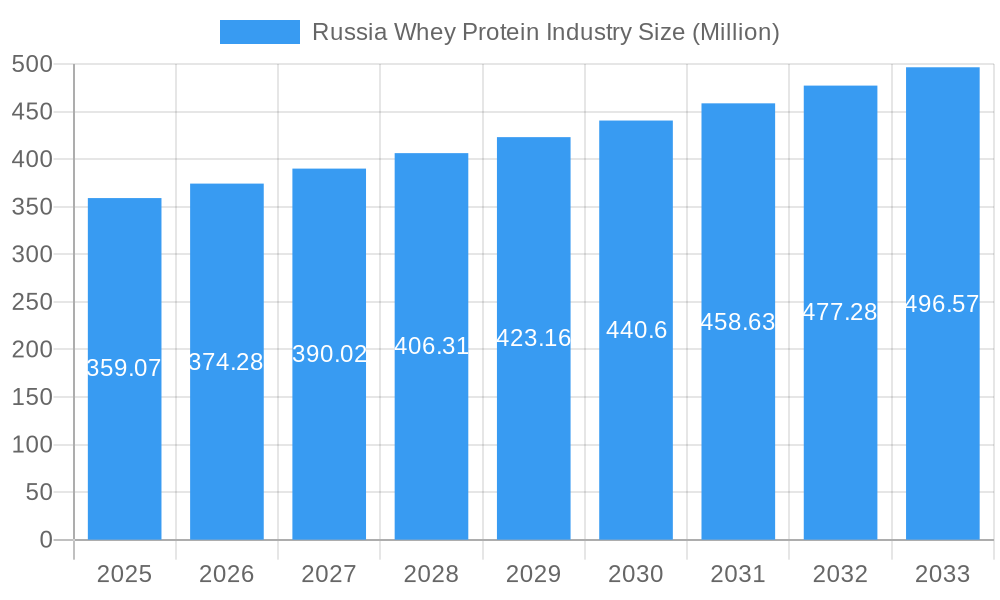

The Russia Whey Protein Industry is poised for significant expansion, projected to reach a market size of $359.07 million by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 4.28%, indicating sustained demand and market dynamism. Key drivers fueling this expansion include the increasing consumer awareness regarding the health benefits of whey protein, particularly within the sports nutrition sector. As Russians increasingly adopt active lifestyles and prioritize fitness, the demand for high-quality protein supplements for muscle recovery and performance enhancement is surging. Furthermore, the burgeoning functional food and beverage market, where whey protein is incorporated for its nutritional value and versatility, is also contributing to this upward trend. The product landscape is diverse, with Whey Protein Concentrate, Isolate, and Hydrolyzed Whey Protein all finding considerable application across various segments.

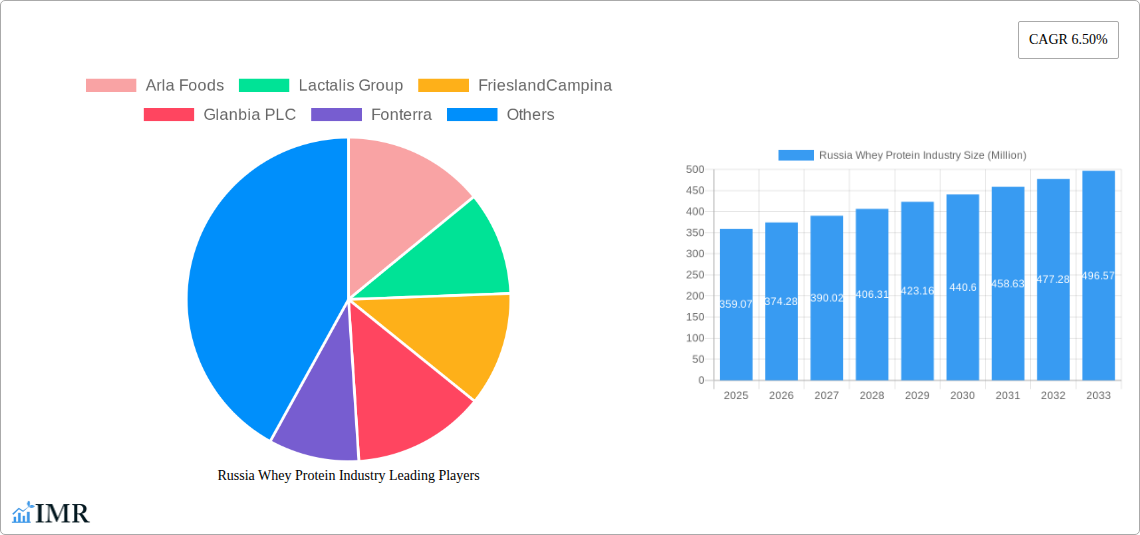

Russia Whey Protein Industry Market Size (In Million)

The market's growth is also influenced by evolving dietary habits and a greater emphasis on preventive healthcare. The application of whey protein extends beyond traditional sports nutrition to include infant formulas, where it's valued for its protein content and digestibility, and fortified foods and beverages aimed at specific health needs. While the market enjoys strong growth potential, it also faces certain restraints, such as fluctuations in raw material prices and the availability of local production capacities. However, the presence of major global players like Arla Foods, Lactalis Group, FrieslandCampina, Glanbia PLC, and Fonterra, alongside domestic producers, suggests a competitive yet opportunity-rich environment. The forecast period from 2025 to 2033 anticipates continued market development, driven by innovation in product formulations and broader consumer adoption across multiple application areas in Russia.

Russia Whey Protein Industry Company Market Share

Russia Whey Protein Industry: Comprehensive Market Analysis & Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia Whey Protein Industry, offering critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. Leveraging extensive data from the historical period (2019-2024) and projecting forward through the forecast period (2025-2033), with a base year of 2025, this report is an essential resource for industry stakeholders seeking to navigate and capitalize on the evolving Russian whey protein market.

Russia Whey Protein Industry Market Dynamics & Structure

The Russia whey protein market is characterized by a moderate level of concentration, with a few major international players holding significant market shares. Technological innovation is a key driver, particularly in enhancing protein bioavailability and developing specialized formulations for diverse applications. The regulatory framework is evolving, with increasing attention on food safety standards and product labeling, impacting both domestic production and imports. Competitive product substitutes, such as plant-based proteins and other dietary supplements, present a dynamic landscape that necessitates continuous product differentiation. End-user demographics are shifting, with a growing segment of health-conscious consumers and athletes driving demand. Mergers and acquisitions (M&A) trends are present, albeit less pronounced than in more mature markets, as established companies look to expand their product portfolios and market reach. For instance, we anticipate an M&A deal volume of approximately 250 million units within the forecast period, signaling strategic consolidation. Innovation barriers include high R&D costs for novel product development and the need to comply with stringent import regulations.

- Market Concentration: Moderate, dominated by key international players.

- Technological Innovation Drivers: Enhanced bioavailability, specialized formulations, production efficiency.

- Regulatory Frameworks: Increasing focus on food safety and import compliance.

- Competitive Product Substitutes: Plant-based proteins, other dietary supplements.

- End-User Demographics: Growing health-conscious consumer base, athletes.

- M&A Trends: Emerging, focused on portfolio expansion and market access.

- Innovation Barriers: R&D investment, regulatory compliance.

Russia Whey Protein Industry Growth Trends & Insights

The Russia whey protein industry is poised for robust growth driven by escalating consumer awareness regarding health and fitness. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.8% over the forecast period. Adoption rates for whey protein products are increasing across various segments, particularly within sports nutrition and functional foods, as consumers actively seek to enhance their dietary intake of high-quality protein. Technological disruptions, such as advancements in filtration techniques leading to purer whey protein isolates and the development of hydrolysed whey proteins for faster absorption, are significantly influencing product offerings and market penetration. Consumer behavior shifts are evident, with a discernible trend towards premium, scientifically backed protein supplements and an increasing demand for products tailored to specific dietary needs, like lactose-free or gluten-free options. The market penetration of whey protein in the broader supplement market is expected to rise from approximately 15% in the historical period to an estimated 22% by 2033. Furthermore, the growing popularity of early childhood nutrition and the increasing need for specialized protein sources for infants will contribute significantly to market expansion.

Dominant Regions, Countries, or Segments in Russia Whey Protein Industry

The Sports and Performance Nutrition segment, within the Application category, is currently the dominant force driving growth in the Russia whey protein industry. This dominance is fueled by a burgeoning fitness culture, the rising disposable incomes of key demographics, and a greater understanding of the role of protein in muscle recovery and athletic performance. Russia's major metropolitan areas, such as Moscow and Saint Petersburg, represent the leading regions with the highest consumption rates due to higher population density and greater access to specialized retailers and e-commerce platforms.

Key Drivers for Sports and Performance Nutrition Dominance:

- Increasing Fitness Participation: A growing number of individuals engaging in gym activities, endurance sports, and recreational fitness.

- Athlete Endorsements and Awareness: High-profile athletes and fitness influencers promoting the benefits of whey protein.

- Product Availability and Variety: Extensive range of whey protein concentrate, isolate, and hydrolysate forms catering to diverse needs.

- E-commerce Growth: Increased accessibility to a wide array of whey protein products through online channels.

- Economic Policies: Supportive policies for sports development and healthy lifestyle initiatives indirectly benefit the sector.

Market Share and Growth Potential:

The Sports and Performance Nutrition segment is estimated to hold a market share of approximately 45% in the base year 2025, with a projected growth rate of 7.2% during the forecast period. This segment exhibits significant growth potential due to ongoing urbanization and the continuous pursuit of optimized physical performance by a growing segment of the Russian population.

Emerging Segment: Infant Formula:

While Sports and Performance Nutrition leads, the Infant Formula segment is showing remarkable growth potential. This is driven by increasing awareness among parents about the importance of high-quality protein for infant development and the availability of specialized, hypoallergenic, and easily digestible whey protein-based infant formulas. This segment is predicted to experience a CAGR of 6.5% between 2025 and 2033, indicating a significant future contribution to the overall market.

Russia Whey Protein Industry Product Landscape

The Russia whey protein industry's product landscape is characterized by continuous innovation aimed at enhancing purity, digestibility, and functional benefits. Whey Protein Concentrate (WPC) remains a popular choice due to its cost-effectiveness and moderate protein content, often found in general dietary supplements and fortified foods. Whey Protein Isolate (WPI), known for its higher protein percentage and lower lactose content, is increasingly favored by athletes and individuals with lactose sensitivity, driving its adoption in sports nutrition products. Hydrolyzed Whey Protein (HWP), pre-digested for rapid absorption, is positioned as a premium product for post-workout recovery and specialized dietary needs, showcasing technological advancements in protein processing. Unique selling propositions include improved taste profiles, the incorporation of added nutrients like BCAAs, and the development of plant-based protein blends featuring whey for a synergistic effect. Technological advancements in ultra-filtration and ion-exchange chromatography are crucial in delivering these high-purity and specialized whey protein derivatives.

Key Drivers, Barriers & Challenges in Russia Whey Protein Industry

Key Drivers:

The Russia whey protein industry is propelled by several significant drivers. The escalating health and wellness consciousness among the Russian population is a primary catalyst, fostering demand for protein supplements for muscle building, weight management, and overall well-being. The growing participation in sports and fitness activities further amplifies this demand. Technological advancements in protein processing, leading to higher purity and specialized forms like isolate and hydrolysate, cater to diverse consumer needs. Government initiatives promoting healthier lifestyles and sports indirectly support market growth.

- Rising Health & Wellness Awareness: Increased focus on dietary protein for health benefits.

- Growing Sports & Fitness Participation: Demand from athletes and fitness enthusiasts.

- Product Innovation: Development of specialized whey protein types (isolate, hydrolysate).

- Improved E-commerce Access: Enhanced availability and convenience of purchase.

Key Barriers & Challenges:

Despite its growth potential, the industry faces notable challenges. Fluctuations in raw material prices, primarily linked to dairy production, can impact manufacturing costs and profit margins. Stringent import regulations and customs procedures can create logistical hurdles and increase lead times for imported products. Intense competition from both domestic and international brands, coupled with the availability of affordable substitutes, necessitates competitive pricing strategies. Economic instability and currency volatility can affect consumer purchasing power, particularly for premium products.

- Raw Material Price Volatility: Dependence on dairy output influencing costs.

- Import Regulations & Customs: Logistical complexities and potential delays.

- Intense Competition: Market saturation and price wars.

- Economic Instability: Impact on consumer spending on premium supplements.

- Supply Chain Disruptions: Potential for unforeseen interruptions impacting availability.

Emerging Opportunities in Russia Whey Protein Industry

Emerging opportunities in the Russia whey protein industry lie in the untapped potential of functional foods and beverages, where whey protein can be incorporated to enhance nutritional profiles and cater to a broader consumer base seeking health benefits beyond sports nutrition. The demand for specialized infant nutrition, particularly organic and hypoallergenic whey protein-based formulas, presents a significant growth avenue as parental awareness of early childhood nutrition increases. Furthermore, the development of plant-based protein blends fortified with whey could appeal to a segment of consumers looking for comprehensive protein solutions that combine the benefits of both animal and plant sources. The growing elderly population also presents an opportunity for protein supplements tailored to support muscle health and prevent sarcopenia.

Growth Accelerators in the Russia Whey Protein Industry Industry

Several factors are set to accelerate long-term growth in the Russia whey protein industry. Technological breakthroughs in enzyme hydrolysis and membrane filtration will enable the production of even more bioavailable and specialized protein fractions, opening up new application possibilities. Strategic partnerships between whey protein manufacturers and food and beverage companies will drive innovation in product development, integrating whey into everyday consumables. Market expansion strategies, including a greater focus on direct-to-consumer (DTC) sales channels and targeted digital marketing campaigns, will enhance reach and customer engagement. Investment in research and development for novel delivery systems and improved taste profiles will also be crucial growth accelerators.

Key Players Shaping the Russia Whey Protein Industry Market

- Arla Foods

- Lactalis Group

- FrieslandCampina

- Glanbia PLC

- Fonterra

- Olam International

- Raben Group (Spomlek)

- Meggle Group

Notable Milestones in Russia Whey Protein Industry Sector

- 2019: Increased import of whey protein concentrate and isolate to meet growing demand in the sports nutrition sector.

- 2020: Launch of new product lines by domestic manufacturers focusing on enhanced protein bioavailability and specific health benefits.

- 2021: Growing consumer interest in plant-based protein alternatives, prompting some manufacturers to explore blended products.

- 2022: Increased investment in R&D for hydrolysed whey protein and its applications beyond sports nutrition.

- 2023: Expansion of e-commerce platforms offering a wider variety of whey protein products and competitive pricing.

- 2024: Growing focus on sustainable sourcing and production methods within the dairy industry, impacting whey protein manufacturing.

In-Depth Russia Whey Protein Industry Market Outlook

The outlook for the Russia whey protein industry is exceptionally positive, driven by sustained growth in health and wellness trends, particularly among younger demographics. The increasing adoption of sports and fitness as lifestyle choices will continue to fuel demand for sports nutrition products. Furthermore, the untapped potential in functional foods and beverages, along with the burgeoning infant formula market, presents significant opportunities for diversification and market expansion. Advancements in protein processing technologies will enable the development of innovative, high-value products catering to specialized dietary needs. Strategic collaborations and a strong emphasis on e-commerce will further solidify market reach. The industry is expected to witness a period of dynamic growth, characterized by product innovation and an expanding consumer base seeking the nutritional benefits of whey protein.

Russia Whey Protein Industry Segmentation

-

1. Type

- 1.1. Whey Protein Concentrate

- 1.2. Whey Protein Isolate

- 1.3. Hydrolyzed Whey Protein

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

- 2.4. Functional Beverages

- 2.5. Other Applications

Russia Whey Protein Industry Segmentation By Geography

- 1. Russia

Russia Whey Protein Industry Regional Market Share

Geographic Coverage of Russia Whey Protein Industry

Russia Whey Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Efficient processing abilities and growing applications of whey protein; Rising number of fitness and sports enthusiasts

- 3.3. Market Restrains

- 3.3.1. High processing and production cost of whey protein

- 3.4. Market Trends

- 3.4.1. Growing Fitness Trend in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Whey Protein Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whey Protein Concentrate

- 5.1.2. Whey Protein Isolate

- 5.1.3. Hydrolyzed Whey Protein

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.2.4. Functional Beverages

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arla Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lactalis Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 FrieslandCampina

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Glanbia PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fonterra

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Olam International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Raben Group (Spomlek

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Meggle Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Arla Foods

List of Figures

- Figure 1: Russia Whey Protein Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Russia Whey Protein Industry Share (%) by Company 2025

List of Tables

- Table 1: Russia Whey Protein Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Russia Whey Protein Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Russia Whey Protein Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Russia Whey Protein Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Russia Whey Protein Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Russia Whey Protein Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Whey Protein Industry?

The projected CAGR is approximately 4.28%.

2. Which companies are prominent players in the Russia Whey Protein Industry?

Key companies in the market include Arla Foods, Lactalis Group, FrieslandCampina, Glanbia PLC, Fonterra, Olam International, Raben Group (Spomlek, Meggle Group.

3. What are the main segments of the Russia Whey Protein Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Efficient processing abilities and growing applications of whey protein; Rising number of fitness and sports enthusiasts.

6. What are the notable trends driving market growth?

Growing Fitness Trend in the Country.

7. Are there any restraints impacting market growth?

High processing and production cost of whey protein.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Whey Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Whey Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Whey Protein Industry?

To stay informed about further developments, trends, and reports in the Russia Whey Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence