Key Insights

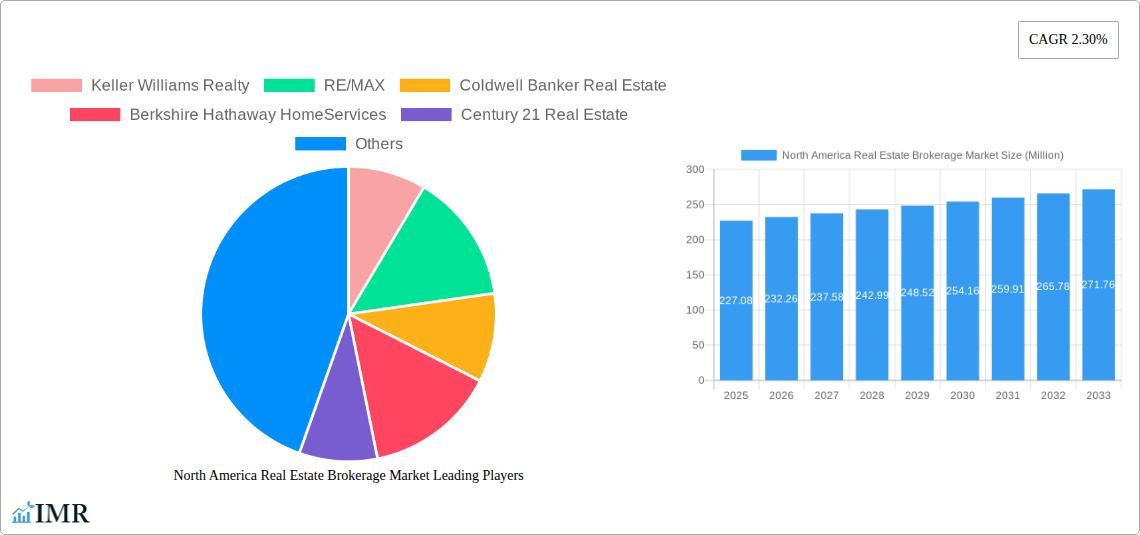

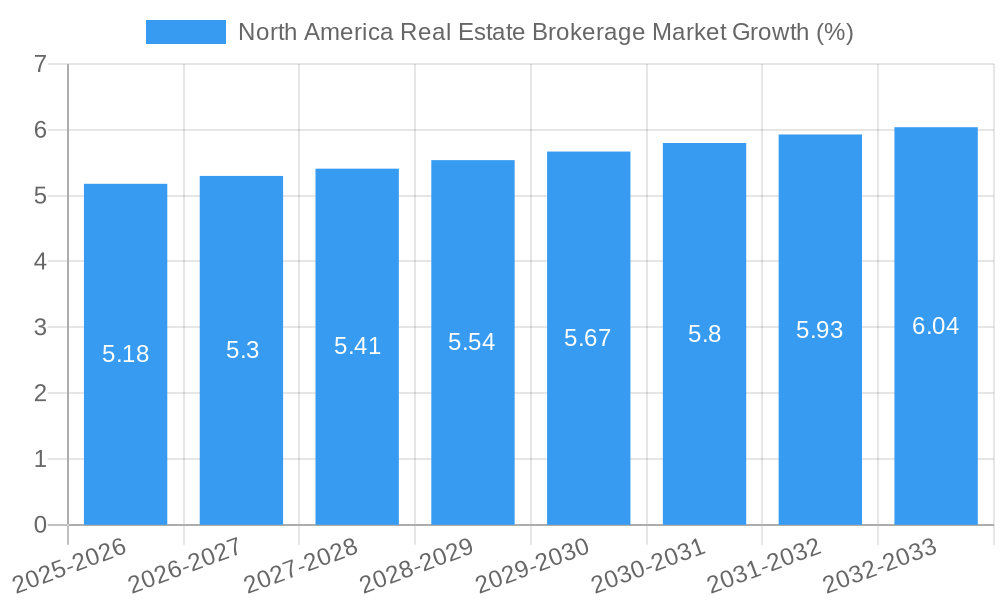

The North American real estate brokerage market, valued at $227.08 million in 2025, is projected to experience steady growth, driven by several key factors. The increasing population and urbanization in major North American cities fuel demand for residential and commercial properties, creating a robust market for brokerage services. Technological advancements, such as sophisticated online property listings and virtual tours, are enhancing efficiency and expanding reach for brokerage firms. Moreover, a growing preference for personalized service and expert market knowledge contributes to the ongoing reliance on real estate brokers. While fluctuating interest rates and economic uncertainties could potentially act as restraints, the market is expected to remain resilient due to the fundamental need for professional guidance in real estate transactions. The consistent demand, coupled with technological innovation and the enduring value of expert advice, positions the North American real estate brokerage market for continued expansion in the coming years.

This market is highly competitive, with established players like Keller Williams Realty, RE/MAX, Coldwell Banker, Berkshire Hathaway HomeServices, and Century 21 dominating the landscape. However, the rise of innovative tech-focused brokerages and boutique firms specializing in niche markets presents both challenges and opportunities. The market's segmentation is likely diverse, encompassing residential, commercial, and luxury properties, each with its own growth trajectory. Geographic variations in market dynamics also exist, with larger metropolitan areas exhibiting potentially higher growth rates than smaller towns. The consistent 2.30% CAGR suggests sustainable, albeit moderate, expansion, indicating a stable and predictable market trajectory for investors and stakeholders. Further analysis of regional data and specific market segments would provide a more granular understanding of growth opportunities within this dynamic market.

North America Real Estate Brokerage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North American real estate brokerage market, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is an invaluable resource for industry professionals, investors, and anyone seeking to understand the complexities and opportunities within this dynamic sector. The report meticulously dissects the parent market (Real Estate Brokerage) and its child market segments (Residential, Commercial, etc.), offering granular insights for strategic decision-making.

North America Real Estate Brokerage Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the North American real estate brokerage market. The market is characterized by a relatively concentrated structure with a few dominant players and many smaller firms. The report explores the impact of technological innovation, such as iBuyers and PropTech solutions, on market dynamics, alongside the role of evolving regulatory frameworks and the increasing adoption of innovative digital tools.

- Market Concentration: The top 10 players (including Keller Williams Realty, RE/MAX, Coldwell Banker Real Estate, Berkshire Hathaway HomeServices, Century 21 Real Estate, Sotheby's International Realty, ERA Real Estate, Corcoran Group, Compass, and Douglas Elliman Real Estate, plus 63 other companies) control approximately xx% of the market.

- Technological Innovation: The adoption of CRM systems, virtual tours, and online property listings is rapidly transforming the industry, creating both opportunities and challenges.

- Regulatory Landscape: Federal, state, and local regulations significantly influence brokerage operations, including licensing, fair housing laws, and data privacy concerns.

- Mergers & Acquisitions (M&A): The market has witnessed a surge in M&A activity, with larger firms acquiring smaller players to expand their reach and market share. The projected M&A deal volume for 2025 is estimated at xx Million deals.

- Competitive Substitutes: The rise of iBuyers and direct-to-consumer platforms presents growing competitive pressure on traditional brokerages.

- End-User Demographics: The report segments the market based on demographic factors, including age, income, location, and homeownership status.

North America Real Estate Brokerage Market Growth Trends & Insights

This section delves into the historical and projected growth trajectory of the North American real estate brokerage market. Utilizing various analytical methods, the report reveals the market size evolution from 2019 to 2024 and projects its expansion to 2033. The analysis will include factors influencing adoption rates, technological disruptions, and evolving consumer behavior. Key growth metrics, such as the Compound Annual Growth Rate (CAGR) and market penetration rate, will be provided. The total market value for 2024 is estimated at xx Million, with a projected value of xx Million for 2025 and xx Million for 2033.

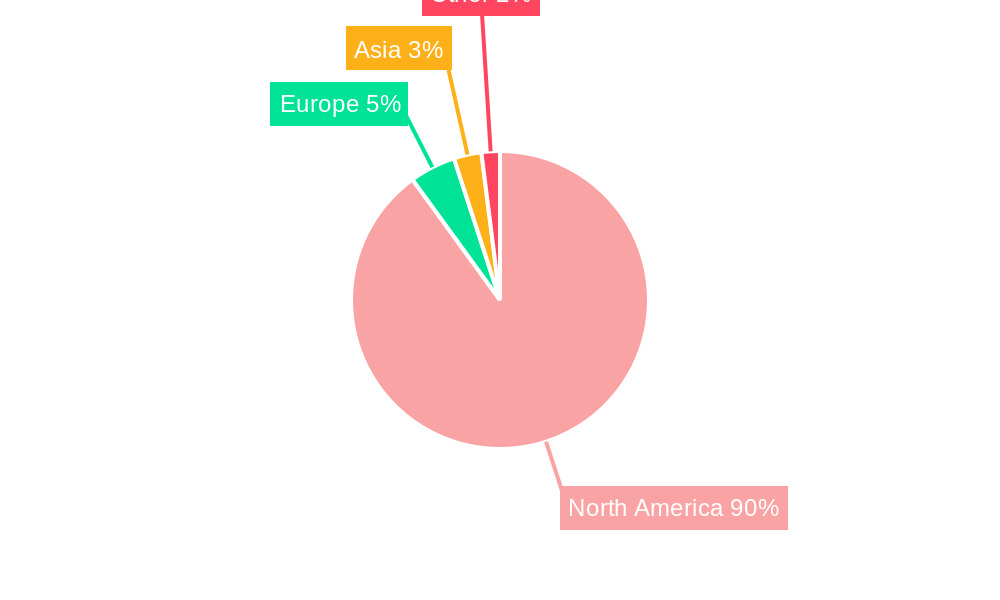

Dominant Regions, Countries, or Segments in North America Real Estate Brokerage Market

This section pinpoints the leading geographical regions and market segments driving growth within the North American real estate brokerage market. Detailed analysis will identify the dominant players and factors contributing to their success. The report quantifies market share by region and segment, highlighting growth potential and key economic indicators.

- Key Drivers: Strong economic growth, favorable government policies, and infrastructure development significantly influence market expansion in specific regions.

- Dominant Regions: The report identifies California, Texas, Florida, and New York as dominant regions. California’s strong economic performance and high population density contribute to significant market share.

- Growth Potential: Regions with high population growth, increasing disposable income, and favorable regulatory environments offer significant untapped potential.

North America Real Estate Brokerage Market Product Landscape

This section offers a concise overview of the product offerings within the North American real estate brokerage market. It covers a range of services, highlighting innovative features and the use of technology to enhance efficiency and client experience. The report discusses the unique selling propositions (USPs) of different players, focusing on their competitive advantages and technological advancements.

Key Drivers, Barriers & Challenges in North America Real Estate Brokerage Market

This section examines the key factors driving market growth and the challenges hindering expansion. Opportunities are examined alongside barriers to entry and competitive pressures.

Key Drivers:

- Increased housing demand driven by population growth and economic prosperity.

- Technological advancements enhancing efficiency and client experience.

- Favorable government policies stimulating homeownership.

Key Challenges and Restraints:

- High operating costs and commission structures.

- Increasing competition from iBuyers and online platforms.

- Regulatory hurdles and compliance requirements. The impact is estimated at a loss of xx Million in revenue annually.

- Supply chain disruptions affecting property development.

Emerging Opportunities in North America Real Estate Brokerage Market

This section identifies emerging trends and opportunities that could shape the future of the North American real estate brokerage market. It focuses on previously untapped market segments, innovative applications of technology, and changing consumer expectations.

Growth Accelerators in the North America Real Estate Brokerage Market Industry

This section highlights the key catalysts anticipated to drive long-term growth within the North American real estate brokerage market. It focuses on the potential for technological advancements, strategic partnerships, and market expansion initiatives to propel growth and market share.

Key Players Shaping the North America Real Estate Brokerage Market Market

- Keller Williams Realty

- RE/MAX

- Coldwell Banker Real Estate

- Berkshire Hathaway HomeServices

- Century 21 Real Estate

- Sotheby's International Realty

- ERA Real Estate

- Corcoran Group

- Compass

- Douglas Elliman Real Estate

- 63 Other Companies

Notable Milestones in North America Real Estate Brokerage Market Sector

- June 2024: Real Brokerage Inc. surpasses 19,000 agents, signifying rapid expansion in the market.

- April 2024: Compass acquires Latter & Blum, increasing its market share to an estimated 15% in New Orleans.

In-Depth North America Real Estate Brokerage Market Market Outlook

The North American real estate brokerage market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and favorable economic conditions. Strategic partnerships and expansion into underserved markets will play a crucial role in shaping the future landscape. The projected CAGR for the forecast period (2025-2033) is xx%, indicating substantial growth potential. Opportunities exist for firms that effectively leverage technology, cater to evolving consumer needs, and navigate regulatory complexities.

North America Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-Residential

-

2. Service

- 2.1. Sales

- 2.2. Rental

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Real Estate Brokerage Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market

- 3.4. Market Trends

- 3.4.1. Industrial Rental Growth Faces Challenges Amidst Changing Dynamics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-Residential

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Residential

- 6.1.2. Non-Residential

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Sales

- 6.2.2. Rental

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Residential

- 7.1.2. Non-Residential

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Sales

- 7.2.2. Rental

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Real Estate Brokerage Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Residential

- 8.1.2. Non-Residential

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Sales

- 8.2.2. Rental

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Keller Williams Realty

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 RE/MAX

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Coldwell Banker Real Estate

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Berkshire Hathaway HomeServices

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Century 21 Real Estate

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Sotheby's International Realty

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 ERA Real Estate

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Corcoran Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Compass

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Douglas Elliman Real Estate**List Not Exhaustive 6 3 Other Companie

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Keller Williams Realty

List of Figures

- Figure 1: Global North America Real Estate Brokerage Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global North America Real Estate Brokerage Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: United States North America Real Estate Brokerage Market Revenue (Million), by Type 2024 & 2032

- Figure 4: United States North America Real Estate Brokerage Market Volume (Billion), by Type 2024 & 2032

- Figure 5: United States North America Real Estate Brokerage Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: United States North America Real Estate Brokerage Market Volume Share (%), by Type 2024 & 2032

- Figure 7: United States North America Real Estate Brokerage Market Revenue (Million), by Service 2024 & 2032

- Figure 8: United States North America Real Estate Brokerage Market Volume (Billion), by Service 2024 & 2032

- Figure 9: United States North America Real Estate Brokerage Market Revenue Share (%), by Service 2024 & 2032

- Figure 10: United States North America Real Estate Brokerage Market Volume Share (%), by Service 2024 & 2032

- Figure 11: United States North America Real Estate Brokerage Market Revenue (Million), by Geography 2024 & 2032

- Figure 12: United States North America Real Estate Brokerage Market Volume (Billion), by Geography 2024 & 2032

- Figure 13: United States North America Real Estate Brokerage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 14: United States North America Real Estate Brokerage Market Volume Share (%), by Geography 2024 & 2032

- Figure 15: United States North America Real Estate Brokerage Market Revenue (Million), by Country 2024 & 2032

- Figure 16: United States North America Real Estate Brokerage Market Volume (Billion), by Country 2024 & 2032

- Figure 17: United States North America Real Estate Brokerage Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: United States North America Real Estate Brokerage Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Canada North America Real Estate Brokerage Market Revenue (Million), by Type 2024 & 2032

- Figure 20: Canada North America Real Estate Brokerage Market Volume (Billion), by Type 2024 & 2032

- Figure 21: Canada North America Real Estate Brokerage Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Canada North America Real Estate Brokerage Market Volume Share (%), by Type 2024 & 2032

- Figure 23: Canada North America Real Estate Brokerage Market Revenue (Million), by Service 2024 & 2032

- Figure 24: Canada North America Real Estate Brokerage Market Volume (Billion), by Service 2024 & 2032

- Figure 25: Canada North America Real Estate Brokerage Market Revenue Share (%), by Service 2024 & 2032

- Figure 26: Canada North America Real Estate Brokerage Market Volume Share (%), by Service 2024 & 2032

- Figure 27: Canada North America Real Estate Brokerage Market Revenue (Million), by Geography 2024 & 2032

- Figure 28: Canada North America Real Estate Brokerage Market Volume (Billion), by Geography 2024 & 2032

- Figure 29: Canada North America Real Estate Brokerage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 30: Canada North America Real Estate Brokerage Market Volume Share (%), by Geography 2024 & 2032

- Figure 31: Canada North America Real Estate Brokerage Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Canada North America Real Estate Brokerage Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Canada North America Real Estate Brokerage Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Canada North America Real Estate Brokerage Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Mexico North America Real Estate Brokerage Market Revenue (Million), by Type 2024 & 2032

- Figure 36: Mexico North America Real Estate Brokerage Market Volume (Billion), by Type 2024 & 2032

- Figure 37: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Mexico North America Real Estate Brokerage Market Volume Share (%), by Type 2024 & 2032

- Figure 39: Mexico North America Real Estate Brokerage Market Revenue (Million), by Service 2024 & 2032

- Figure 40: Mexico North America Real Estate Brokerage Market Volume (Billion), by Service 2024 & 2032

- Figure 41: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Service 2024 & 2032

- Figure 42: Mexico North America Real Estate Brokerage Market Volume Share (%), by Service 2024 & 2032

- Figure 43: Mexico North America Real Estate Brokerage Market Revenue (Million), by Geography 2024 & 2032

- Figure 44: Mexico North America Real Estate Brokerage Market Volume (Billion), by Geography 2024 & 2032

- Figure 45: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Geography 2024 & 2032

- Figure 46: Mexico North America Real Estate Brokerage Market Volume Share (%), by Geography 2024 & 2032

- Figure 47: Mexico North America Real Estate Brokerage Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Mexico North America Real Estate Brokerage Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Mexico North America Real Estate Brokerage Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Mexico North America Real Estate Brokerage Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 6: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 7: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 9: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 14: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 15: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 17: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 22: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 23: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 25: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Type 2019 & 2032

- Table 29: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Service 2019 & 2032

- Table 30: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Service 2019 & 2032

- Table 31: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Geography 2019 & 2032

- Table 33: Global North America Real Estate Brokerage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global North America Real Estate Brokerage Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Real Estate Brokerage Market?

The projected CAGR is approximately 2.30%.

2. Which companies are prominent players in the North America Real Estate Brokerage Market?

Key companies in the market include Keller Williams Realty, RE/MAX, Coldwell Banker Real Estate, Berkshire Hathaway HomeServices, Century 21 Real Estate, Sotheby's International Realty, ERA Real Estate, Corcoran Group, Compass, Douglas Elliman Real Estate**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the North America Real Estate Brokerage Market?

The market segments include Type, Service, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 227.08 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

6. What are the notable trends driving market growth?

Industrial Rental Growth Faces Challenges Amidst Changing Dynamics.

7. Are there any restraints impacting market growth?

4.; Increasing Urbanization Driving the Market4.; Regulatory Environment Driving the Market.

8. Can you provide examples of recent developments in the market?

June 2024: Real Brokerage Inc., North America's fastest-growing publicly traded real estate brokerage, reported a significant expansion, surpassing 19,000 agents after a robust month of recruitment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the North America Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence