Key Insights

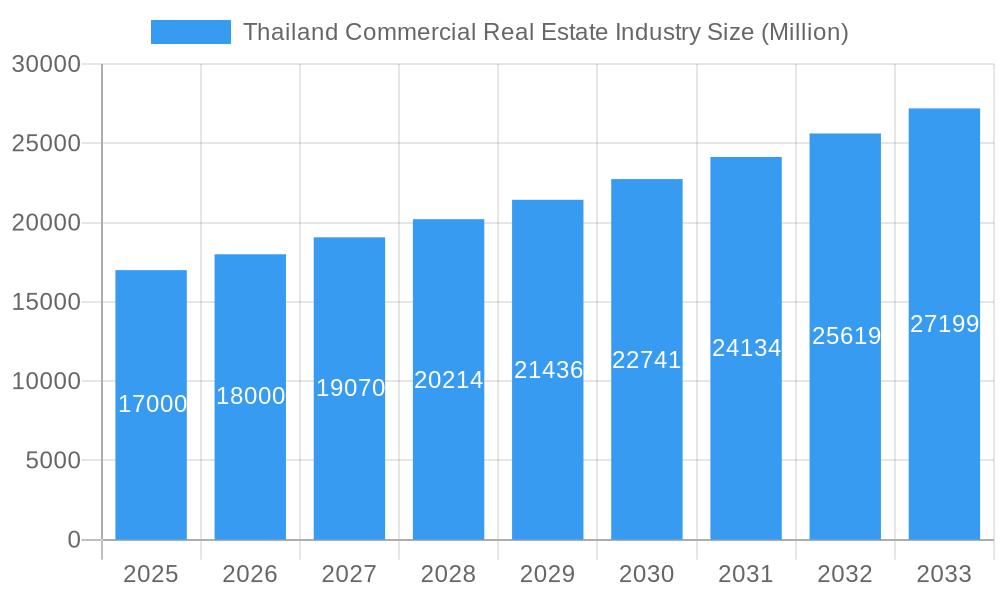

The Thailand commercial real estate market, valued at approximately $17 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.97% from 2025 to 2033. This expansion is driven by several key factors. Strong economic growth, particularly in key sectors like tourism and manufacturing, fuels demand for office, retail, and industrial spaces. The burgeoning logistics sector, fueled by e-commerce expansion and improved infrastructure, is significantly contributing to the growth in industrial and logistics real estate. Furthermore, increasing urbanization and a growing middle class are boosting demand for retail spaces and hospitality properties in major cities like Bangkok, Chiang Mai, and Hua Hin. However, the market faces challenges such as potential interest rate hikes and global economic uncertainty that could impact investment and construction activity. Competition among developers, especially in the prime locations of Bangkok, is also a factor. The diverse segments, including office, retail, industrial and logistics, hospitality, and others, present both opportunities and challenges, with varying growth trajectories depending on location and sector-specific dynamics. The involvement of numerous prominent players, including international firms like CBRE and JLL alongside significant local developers, underscores the market's maturity and potential.

Thailand Commercial Real Estate Industry Market Size (In Billion)

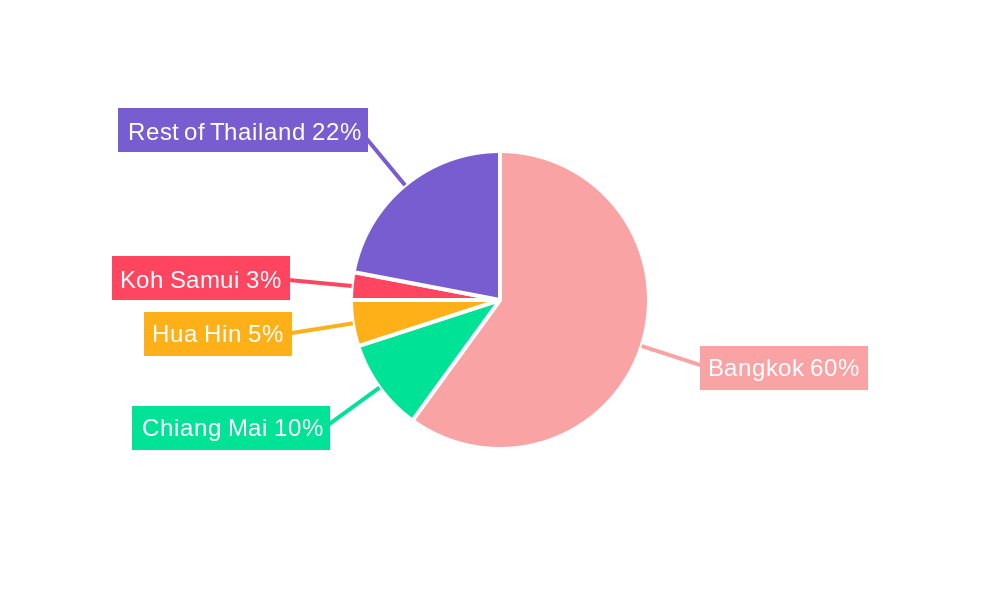

The segmentation of the market by type (office, retail, industrial & logistics, hospitality, others) and by key cities (Bangkok, Chiang Mai, Hua Hin, Koh Samui, Rest of Thailand) allows for a granular analysis of growth patterns. Bangkok, as the economic and commercial hub, will likely dominate the market share, followed by other key cities experiencing significant tourism and economic development. Future growth will hinge on the effective management of infrastructural development, regulatory frameworks that support investment, and the ability of developers to adapt to changing market demands and technological advancements within the commercial real estate sector. Further diversification of the market, particularly in the industrial and logistics sectors, holds significant potential for continued expansion in the coming years. Sustained growth will likely depend on the country's ongoing economic performance and the successful management of potential risks in the global economy.

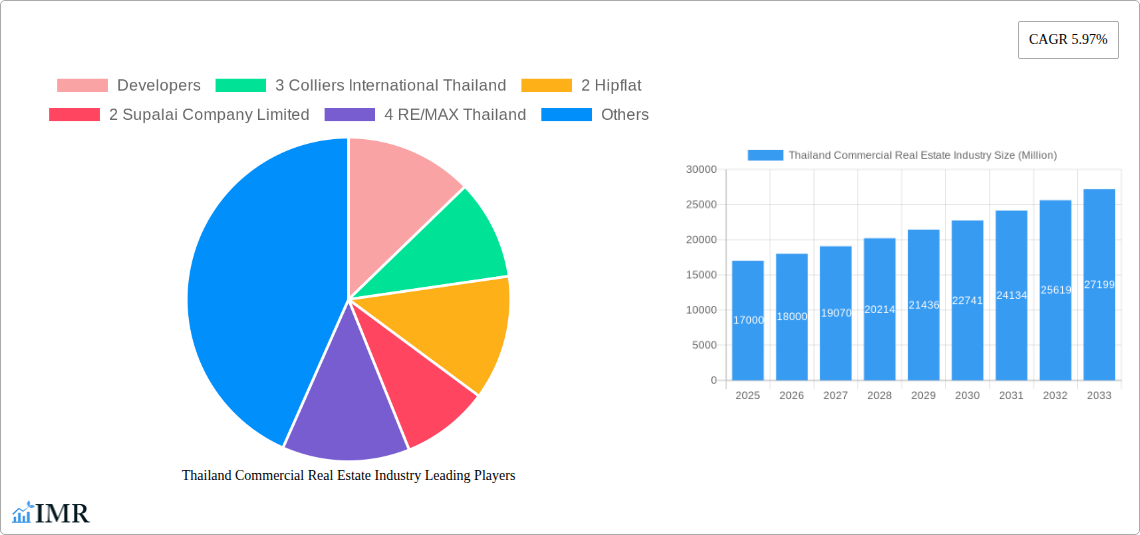

Thailand Commercial Real Estate Industry Company Market Share

Thailand Commercial Real Estate Industry: 2019-2033 Market Report

Unlocking Growth Opportunities in Thailand's Dynamic Real Estate Sector

This comprehensive report provides an in-depth analysis of the Thailand commercial real estate market from 2019 to 2033, offering invaluable insights for investors, developers, and industry professionals. We examine market dynamics, growth trends, key players, and emerging opportunities across various segments and key cities, empowering you to make informed decisions in this thriving market. The report uses 2025 as its base and estimated year, with a forecast period spanning 2025-2033 and a historical period covering 2019-2024. All values are presented in million units.

Thailand Commercial Real Estate Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within Thailand's commercial real estate sector. The market is characterized by a mix of large multinational players and local developers, with varying degrees of market concentration across different segments.

Market Concentration: The office and retail segments exhibit higher concentration, with major players like Colliers International Thailand, Savills, CBRE Thailand, and JLL Thailand holding significant market share. The industrial and logistics segment shows more fragmentation, presenting opportunities for smaller players. We estimate the market share of the top 5 players in the office segment at approximately 60% in 2025.

Technological Innovation: Proptech is significantly impacting the market, with platforms like Hipflat and Dot Property revolutionizing property search and transactions. However, adoption rates vary across segments, with the office sector lagging behind in digital transformation.

Regulatory Framework: Government policies, including tax incentives and infrastructure development plans, significantly influence market growth. Regulatory changes related to foreign ownership and building codes can impact investment decisions.

Competitive Product Substitutes: The rise of co-working spaces is affecting the traditional office market, while e-commerce continues to reshape the retail landscape.

End-User Demographics: The growing middle class and increasing urbanization are driving demand for commercial real estate, particularly in Bangkok.

M&A Trends: The number of M&A deals in the commercial real estate sector has been relatively stable in recent years, with approximately xx deals recorded annually between 2021 and 2024, valued at approximately xxx million USD. Consolidation is expected to continue, with larger players acquiring smaller firms to expand their market reach. This is largely driven by a need to enhance efficiency, expand portfolio and capitalize on market opportunities.

Thailand Commercial Real Estate Industry Growth Trends & Insights

Thailand's commercial real estate market has experienced significant growth over the past five years. Driven by a robust economy, rising foreign investment, and increasing urbanization, the sector is poised for continued expansion. Utilizing advanced analytical techniques, we project a Compound Annual Growth Rate (CAGR) of xx% for the overall market from 2025 to 2033. Bangkok remains the dominant market, but secondary cities like Chiang Mai and Hua Hin are also experiencing substantial growth due to tourism and infrastructure development. The rise of e-commerce and the demand for modern logistics facilities are driving strong growth in the industrial and logistics sector. Consumer behavior is shifting towards experiences and convenience, with retail developers increasingly incorporating technology and entertainment options into their projects. The hospitality sector is also witnessing a recovery post-pandemic, with a focus on sustainable and experiential tourism.

Dominant Regions, Countries, or Segments in Thailand Commercial Real Estate Industry

Bangkok dominates the Thailand commercial real estate market, accounting for approximately xx% of the total market value in 2025. Its strong economy, advanced infrastructure, and concentration of businesses make it the most attractive location for investment.

By Type: The office segment holds the largest market share, followed by retail and industrial and logistics. The hospitality sector is recovering steadily, while the "others" segment, including healthcare and education facilities, is showing promising growth.

By Key Cities:

- Bangkok: Dominated by high-rise office buildings and large-scale retail developments, fueled by strong corporate demand and tourism.

- Chiang Mai: Experiencing growth in hospitality and smaller-scale commercial projects, driven by tourism and a growing expat community.

- Hua Hin: Primarily driven by tourism and residential development, with limited but growing commercial properties.

- Koh Samui: Strong growth in hospitality, with resorts and related commercial activities.

- Rest of Thailand: A mix of various sectors, with growth potential influenced by regional economic activities and infrastructure investments.

Key drivers include government initiatives promoting infrastructure development, tourism, and foreign investment. The robust economy and growing middle class further contribute to market expansion.

Thailand Commercial Real Estate Industry Product Landscape

The commercial real estate market showcases a diverse range of products tailored to meet specific demands. Office spaces span from traditional structures to innovative co-working spaces incorporating technology and community features. Retail developments feature modern designs incorporating technology and entertainment to enhance customer experiences. Industrial and logistics spaces provide state-of-the-art facilities equipped to handle modern supply chain requirements. The hospitality segment offers diversified experiences ranging from luxury resorts to budget-friendly options. These spaces consistently evolve to meet the changing needs and preferences of the target audiences.

Key Drivers, Barriers & Challenges in Thailand Commercial Real Estate Industry

Key Drivers: Strong economic growth, rising foreign investment, government support for infrastructure development, tourism growth, and increasing urbanization are key drivers. Technological advancements and the adoption of sustainable practices further propel market development.

Challenges: Supply chain disruptions, rising construction costs, intense competition, regulatory hurdles concerning foreign ownership, and the potential impact of global economic uncertainties pose significant challenges.

Emerging Opportunities in Thailand Commercial Real Estate Industry

Opportunities abound in sustainable developments, technology integration, specialized niche markets (e.g., healthcare, education), and expansion into secondary cities. Demand for flexible workspaces and experiential retail destinations presents significant growth avenues.

Growth Accelerators in the Thailand Commercial Real Estate Industry

Continued infrastructure development, strategic partnerships between developers and technology companies, and expansion into new markets like medical tourism and smart city initiatives will accelerate long-term growth.

Key Players Shaping the Thailand Commercial Real Estate Industry Market

- Developers: Supalai Company Limited

- Colliers International Thailand

- Hipflat

- RE/MAX Thailand

- Central Pattana PLC

- Savills

- Dot Property

- Knight Frank Thailand

- CBRE Thailand

- Other Companies (Start-ups Associations)

- JLL Thailand

- Pace Development Corporation PLC

- Real Estate Agencies

- Property Perfect

- Blink Design Group

- Raimon Land PCL

- DDProperty

Notable Milestones in Thailand Commercial Real Estate Industry Sector

- December 2023: FitFlop expands its retail presence in Thailand, showcasing a revamped retail design.

- February 2024: Central Retail Corporation allocates THB 22-24 billion (USD 613-669 million) for expansion.

In-Depth Thailand Commercial Real Estate Industry Market Outlook

The Thailand commercial real estate market is projected to maintain robust growth, fueled by long-term economic expansion and continuous infrastructure improvements. Strategic investments in sustainable and technologically advanced developments, along with expansion into emerging sectors, will unlock significant opportunities for market participants.

Thailand Commercial Real Estate Industry Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

- 1.5. Others

-

2. Key Cities

- 2.1. Bangkok

- 2.2. Chiang Mai

- 2.3. Hua Hin

- 2.4. Koh Samui

- 2.5. Rest of Thailand

Thailand Commercial Real Estate Industry Segmentation By Geography

- 1. Thailand

Thailand Commercial Real Estate Industry Regional Market Share

Geographic Coverage of Thailand Commercial Real Estate Industry

Thailand Commercial Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Overall economic growth driving the market; The growth of business and industries driving the market

- 3.3. Market Restrains

- 3.3.1. Fluctuating economic conditions hindering the growth of the market; Difficulty in landownership and leasing rights affecting the market

- 3.4. Market Trends

- 3.4.1. Growing Demand for Retail Spaces in Thailand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Commercial Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Bangkok

- 5.2.2. Chiang Mai

- 5.2.3. Hua Hin

- 5.2.4. Koh Samui

- 5.2.5. Rest of Thailand

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Developers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 3 Colliers International Thailand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 2 Hipflat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Supalai Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 4 RE/MAX Thailand

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 1 Central Pattana PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 2 Savills

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 4 Dot Property**List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 6 Knight Frank Thailand*

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 1 CBRE Thailand

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Other Companies (Start-ups Associations)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 5 JLL Thailand

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 3 Pace Development Corporation PLC

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Real Estate Agencies

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 1 Property Perfect

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 5 Blink Design Group*

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 4 Raimon Land PCL

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 3 DDProperty

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Developers

List of Figures

- Figure 1: Thailand Commercial Real Estate Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Commercial Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Thailand Commercial Real Estate Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Commercial Real Estate Industry?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the Thailand Commercial Real Estate Industry?

Key companies in the market include Developers, 3 Colliers International Thailand, 2 Hipflat, 2 Supalai Company Limited, 4 RE/MAX Thailand, 1 Central Pattana PLC, 2 Savills, 4 Dot Property**List Not Exhaustive, 6 Knight Frank Thailand*, 1 CBRE Thailand, Other Companies (Start-ups Associations), 5 JLL Thailand, 3 Pace Development Corporation PLC, Real Estate Agencies, 1 Property Perfect, 5 Blink Design Group*, 4 Raimon Land PCL, 3 DDProperty.

3. What are the main segments of the Thailand Commercial Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 17 Million as of 2022.

5. What are some drivers contributing to market growth?

Overall economic growth driving the market; The growth of business and industries driving the market.

6. What are the notable trends driving market growth?

Growing Demand for Retail Spaces in Thailand.

7. Are there any restraints impacting market growth?

Fluctuating economic conditions hindering the growth of the market; Difficulty in landownership and leasing rights affecting the market.

8. Can you provide examples of recent developments in the market?

February 2024: Central Retail Corporation, Thailand's leading retailer, set aside THB 22 to 24 billion (USD 613 to USD 669 million) for expansion in 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Commercial Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Commercial Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Commercial Real Estate Industry?

To stay informed about further developments, trends, and reports in the Thailand Commercial Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence