Key Insights

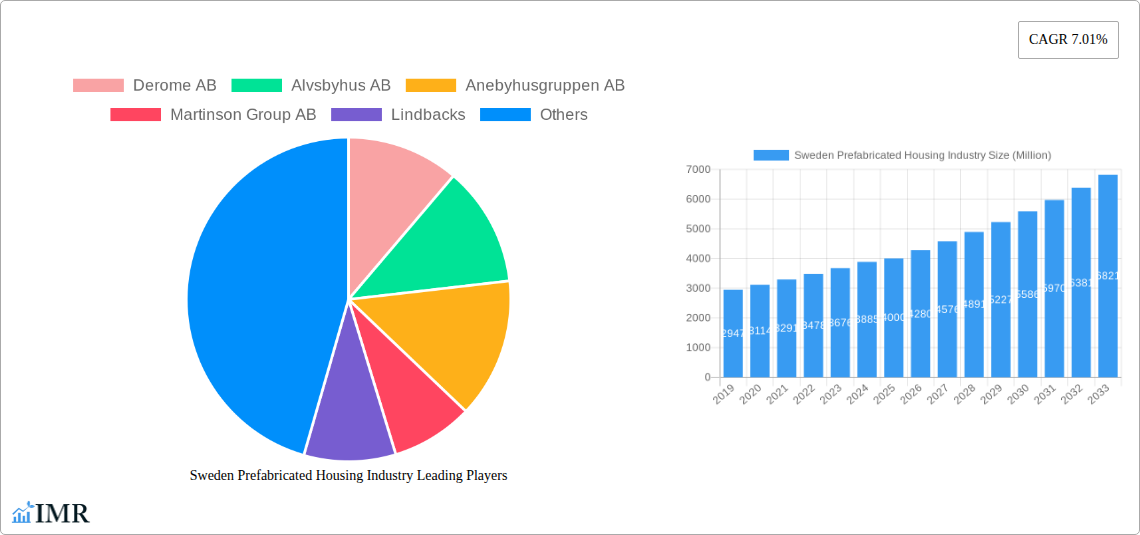

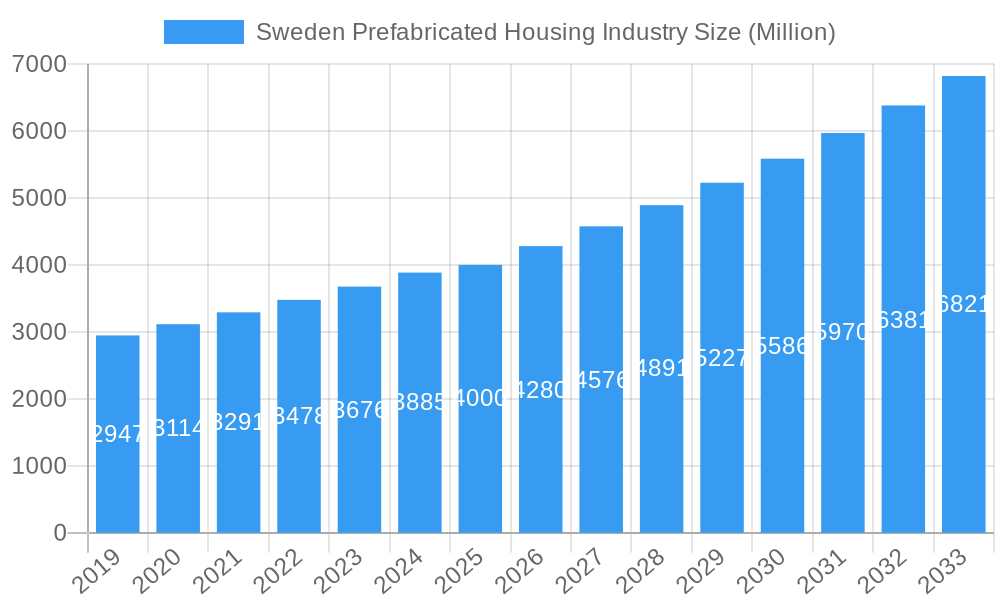

The Swedish prefabricated housing market is poised for significant expansion, driven by robust demand for sustainable and cost-effective construction solutions. With a current market size estimated at approximately $4,000 million in 2025, the industry is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.01% through 2033. This impressive growth is fueled by several key factors, including increasing urbanization, a persistent housing shortage, and a strong government emphasis on eco-friendly building practices. Prefabricated construction offers faster build times, reduced waste, and enhanced quality control, aligning perfectly with Sweden's commitment to sustainability. The market is segmented across various material types, with concrete, glass, and timber likely to dominate due to their durability, aesthetic appeal, and environmental credentials. Application-wise, residential construction is expected to be the largest segment, given the ongoing need for new housing units. However, the commercial sector is also anticipated to witness substantial growth as businesses increasingly adopt modular solutions for offices, retail spaces, and other facilities.

Sweden Prefabricated Housing Industry Market Size (In Billion)

The competitive landscape features established players such as Derome AB, Alvsbyhus AB, Anebyhusgruppen AB, and Peab AB, alongside emerging companies focused on innovative designs and sustainable materials. These companies are actively investing in research and development to enhance the efficiency and customization options of prefabricated homes. Trends indicate a growing preference for energy-efficient designs, smart home integration, and the use of recycled or low-impact materials. However, the market also faces certain restraints, including potential perceptions of limited design flexibility compared to traditional construction, although this is rapidly changing. Supply chain disruptions and the availability of skilled labor for specialized prefabricated assembly could also present challenges. Despite these hurdles, the strong underlying demand, coupled with continuous technological advancements and a favorable regulatory environment in Sweden, positions the prefabricated housing sector for sustained and dynamic growth over the forecast period.

Sweden Prefabricated Housing Industry Company Market Share

Here's a comprehensive, SEO-optimized report description for the Sweden Prefabricated Housing Industry, incorporating high-traffic keywords and adhering to all your specifications.

This in-depth report provides a comprehensive analysis of the Sweden prefabricated housing industry, examining market dynamics, growth trends, and future projections from 2019 to 2033. Leveraging extensive data and expert insights, we delve into the modular construction market in Sweden, analyzing its structure, key players, and influential drivers. Explore the offsite construction Sweden landscape, including timber frame housing Sweden and concrete modular homes Sweden, to understand market penetration and adoption rates. This report is essential for stakeholders seeking to capitalize on the burgeoning demand for sustainable and efficient housing solutions, offering a granular view of the Sweden building market and its prefabricated segment. We cover parent and child market dynamics, providing a holistic understanding of market evolution and investment opportunities within the Swedish construction sector.

Sweden Prefabricated Housing Industry Market Dynamics & Structure

The Sweden prefabricated housing market is characterized by a moderate to high level of concentration, with a few key players holding significant market share. Technological innovation is a primary driver, particularly advancements in sustainable building materials and digital design tools that enhance efficiency and reduce construction timelines. Regulatory frameworks, including stringent building codes and governmental incentives for green construction, also play a crucial role in shaping market growth. Competitive product substitutes, such as traditional on-site construction methods, are being increasingly challenged by the cost-effectiveness and speed of prefabricated solutions. End-user demographics are shifting towards a greater appreciation for sustainable living and smart home technologies, directly influencing product demand. Mergers and acquisitions (M&A) are evident as larger companies seek to consolidate their market position and expand their product portfolios.

- Market Concentration: Dominated by established manufacturers, with ongoing consolidation trends.

- Technological Innovation: Driven by advanced manufacturing, digital design (BIM), and sustainable material research.

- Regulatory Frameworks: Supportive policies promoting energy efficiency and modular construction.

- Competitive Substitutes: Traditional building methods face increasing competition from off-site solutions.

- End-User Demographics: Growing demand for energy-efficient, modern, and customizable homes.

- M&A Trends: Strategic acquisitions to enhance capabilities and market reach.

Sweden Prefabricated Housing Industry Growth Trends & Insights

The Swedish modular housing market is poised for significant expansion, driven by a confluence of factors including an ongoing housing shortage, a strong emphasis on sustainability, and rapid technological advancements in construction. Our analysis, based on extensive market intelligence, projects a robust Compound Annual Growth Rate (CAGR) for the prefabricated building Sweden sector. Market penetration is steadily increasing as consumers and developers recognize the benefits of off-site construction, such as faster build times, reduced waste, and predictable costs. Technological disruptions, including the integration of AI in design and manufacturing, along with the increasing use of advanced materials like CLT (Cross-Laminated Timber), are reshaping the industry. Consumer behavior is evolving, with a growing preference for energy-efficient homes, smart home integration, and personalized design options that are readily achievable with prefabricated construction. The construction technology Sweden landscape is rapidly adopting these innovative approaches, further accelerating market growth. We foresee substantial market size evolution as more projects, from residential developments to commercial structures, embrace the efficiency and sustainability of prefabricated solutions. This trend is supported by government initiatives aimed at increasing housing supply and promoting eco-friendly building practices, making offsite construction Sweden a key pillar of the nation's development strategy.

Dominant Regions, Countries, or Segments in Sweden Prefabricated Housing Industry

Within the Sweden prefabricated housing industry, Timber material type currently dominates the market, reflecting Sweden's rich forest resources and its long-standing tradition of timber construction. This segment benefits from inherent sustainability, excellent insulation properties, and the aesthetic appeal of wood, making it a preferred choice for both Residential and increasingly, Commercial applications. The Residential segment itself is the largest application within the prefabricated housing market, driven by high demand for new homes, including affordable housing and multi-family dwellings. Key drivers for Timber's dominance and the Residential segment's growth include:

- Economic Policies: Government support for the forestry sector and green building initiatives directly benefit timber-based prefabricated housing.

- Infrastructure Development: Urban expansion and the need for rapid housing solutions in growing cities boost demand for prefabricated units.

- Consumer Preferences: A strong cultural affinity for natural materials and a growing awareness of the environmental benefits of timber construction.

- Technological Advancements: Innovations in timber engineering, such as Glulam and CLT, enable larger and more complex prefabricated timber structures.

- Sustainability Mandates: Increasing pressure for low-carbon footprint construction aligns perfectly with the properties of timber.

The Commercial segment is also showing robust growth, with prefabricated timber structures being utilized for office buildings, retail spaces, and educational facilities, offering cost savings and faster project completion. While Concrete and Metal also hold significant market share, particularly for larger infrastructure projects and specific commercial applications, Timber's widespread adoption across diverse residential and commercial projects solidifies its leading position.

Sweden Prefabricated Housing Industry Product Landscape

The Sweden prefabricated housing industry showcases a diverse and innovative product landscape. Key innovations revolve around enhanced energy efficiency, modular design for flexible configurations, and the integration of smart home technologies. Products range from single-family homes and apartment modules to specialized commercial units. Performance metrics are continually improving, with a focus on thermal insulation, acoustic performance, and structural integrity. Companies are increasingly offering customizable design options, allowing clients to personalize their prefabricated homes. Unique selling propositions include rapid deployment, reduced construction waste, and a lower environmental impact, particularly with the prevalence of timber prefabricated homes Sweden. Technological advancements are evident in the use of advanced manufacturing techniques and higher-quality, sustainable materials.

Key Drivers, Barriers & Challenges in Sweden Prefabricated Housing Industry

Key Drivers:

- Housing Demand: Persistent housing shortages and urbanization fuel the need for efficient construction solutions.

- Sustainability Focus: Government policies and consumer demand for eco-friendly buildings strongly favor prefabricated methods.

- Technological Advancement: Innovations in modular design, automation, and materials enhance efficiency and quality.

- Cost-Effectiveness: Reduced labor costs and faster build times offer economic advantages.

- Skilled Labor Shortage: Prefabrication can alleviate reliance on on-site skilled labor.

Barriers & Challenges:

- Perception: Overcoming outdated perceptions of prefabricated homes being lower in quality or design.

- Transportation Limitations: The size and weight of modules can present logistical challenges.

- Initial Investment: Higher upfront costs for factory setup and advanced machinery.

- Regulatory Hurdles: Adapting local building regulations to accommodate off-site construction.

- Supply Chain Volatility: Potential disruptions in the supply of raw materials, particularly timber.

Emerging Opportunities in Sweden Prefabricated Housing Industry

Emerging opportunities within the Sweden prefabricated housing market are diverse and promising. There is a significant untapped potential in the development of student housing Sweden and elderly care facilities utilizing modular construction, driven by demographic shifts and societal needs. Innovative applications in the commercial building Sweden sector, such as pop-up retail spaces and modular office expansions, are gaining traction. Evolving consumer preferences for sustainable living and smart home integration present a fertile ground for product development and customization. Furthermore, the growing interest in sustainable tourism is creating opportunities for prefabricated eco-lodges and resort accommodations. The increasing focus on circular economy principles also opens avenues for the development of reusable and recyclable modular components.

Growth Accelerators in the Sweden Prefabricated Housing Industry Industry

Several key growth accelerators are propelling the Sweden prefabricated housing industry. Technological breakthroughs in robotics and automation within manufacturing facilities are significantly boosting production efficiency and reducing costs. Strategic partnerships between prefabricated manufacturers and developers, as well as between tech companies and construction firms, are fostering innovation and expanding market reach. Market expansion strategies, including the development of new product lines tailored to specific market needs and international collaborations, are also critical growth drivers. The increasing government investment in affordable housing projects and sustainable urban development further acts as a significant catalyst for the sector's long-term expansion.

Key Players Shaping the Sweden Prefabricated Housing Industry Market

- Derome AB

- Alvsbyhus AB

- Anebyhusgruppen AB

- Martinson Group AB

- Lindbacks

- Vida AB

- Peab AB

- Eksjohus AB

- Trivselhus AB

- Gotenehus AB

Notable Milestones in Sweden Prefabricated Housing Industry Sector

- November 2023: Algeco secured a substantial order for state-of-the-art GRIDSERVE Electrical Forecourts®, highlighting the growing demand for modular buildings in infrastructure projects.

- September 2023: Forta PRO delivered 269 modules (9,671.9 m2) for Unity Malmö, a new student housing project featuring 450 micro-living apartments, demonstrating the capacity of prefabricated solutions for large-scale residential initiatives.

In-Depth Sweden Prefabricated Housing Industry Market Outlook

The outlook for the Sweden prefabricated housing industry is exceptionally positive, driven by sustained demand and a conducive market environment. Growth accelerators such as technological advancements in manufacturing and sustainable material innovation will continue to enhance the sector's competitiveness. Strategic partnerships and market expansion initiatives will broaden the accessibility and application of prefabricated solutions across various building types. The ongoing commitment to sustainable development and the persistent need for efficient housing solutions position the Swedish modular construction market for continued significant growth and investment, making it a key sector for future development in Sweden.

Sweden Prefabricated Housing Industry Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

Sweden Prefabricated Housing Industry Segmentation By Geography

- 1. Sweden

Sweden Prefabricated Housing Industry Regional Market Share

Geographic Coverage of Sweden Prefabricated Housing Industry

Sweden Prefabricated Housing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy efficiency in construction; Flexibility and customization options

- 3.3. Market Restrains

- 3.3.1. Limited availability of suitable land for construction; Lower quality compared to traditional construction

- 3.4. Market Trends

- 3.4.1. The Demand for Prefabricated Houses is Increasing in Sweden

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sweden Prefabricated Housing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Sweden

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Derome AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alvsbyhus AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Anebyhusgruppen AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Martinson Group AB

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lindbacks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vida AB*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Peab AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Eksjohus AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Trivselhus AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gotenehus AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Derome AB

List of Figures

- Figure 1: Sweden Prefabricated Housing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sweden Prefabricated Housing Industry Share (%) by Company 2025

List of Tables

- Table 1: Sweden Prefabricated Housing Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Sweden Prefabricated Housing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Sweden Prefabricated Housing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Sweden Prefabricated Housing Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Sweden Prefabricated Housing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Sweden Prefabricated Housing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sweden Prefabricated Housing Industry?

The projected CAGR is approximately 7.01%.

2. Which companies are prominent players in the Sweden Prefabricated Housing Industry?

Key companies in the market include Derome AB, Alvsbyhus AB, Anebyhusgruppen AB, Martinson Group AB, Lindbacks, Vida AB*List Not Exhaustive, Peab AB, Eksjohus AB, Trivselhus AB, Gotenehus AB.

3. What are the main segments of the Sweden Prefabricated Housing Industry?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4 Million as of 2022.

5. What are some drivers contributing to market growth?

Energy efficiency in construction; Flexibility and customization options.

6. What are the notable trends driving market growth?

The Demand for Prefabricated Houses is Increasing in Sweden.

7. Are there any restraints impacting market growth?

Limited availability of suitable land for construction; Lower quality compared to traditional construction.

8. Can you provide examples of recent developments in the market?

November 2023: Algeco, Europe's foremost brand in modular and off-site building solutions, successfully secured a substantial order for state-of-the-art GRIDSERVE Electrical Forecourts®. The latest generation of Algeco modular buildings is playing a vital role in meeting the growing demand for GrisEnergy Electric Forecourts® across the nation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sweden Prefabricated Housing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sweden Prefabricated Housing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sweden Prefabricated Housing Industry?

To stay informed about further developments, trends, and reports in the Sweden Prefabricated Housing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence