Key Insights

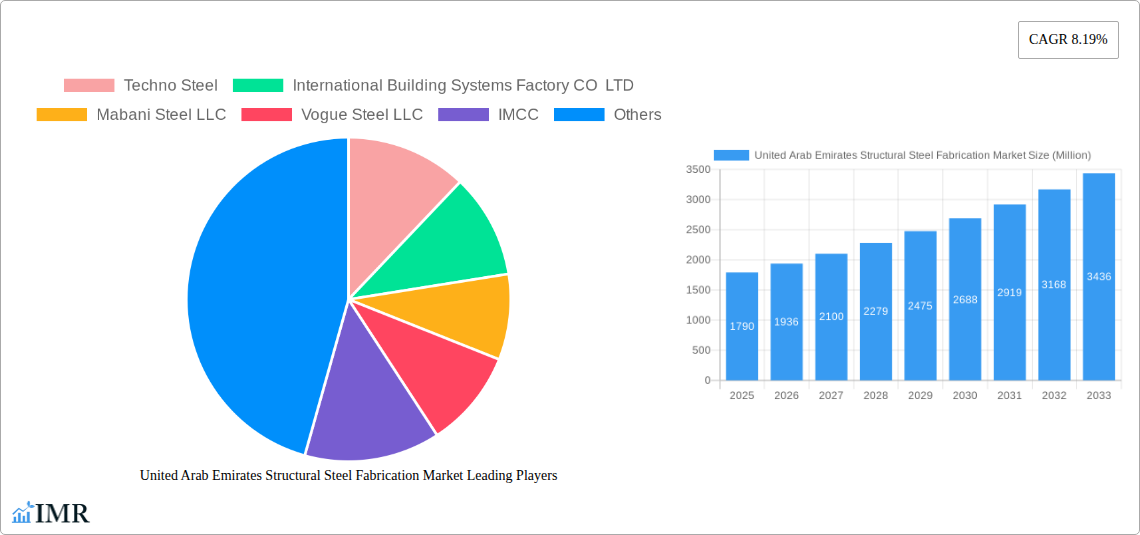

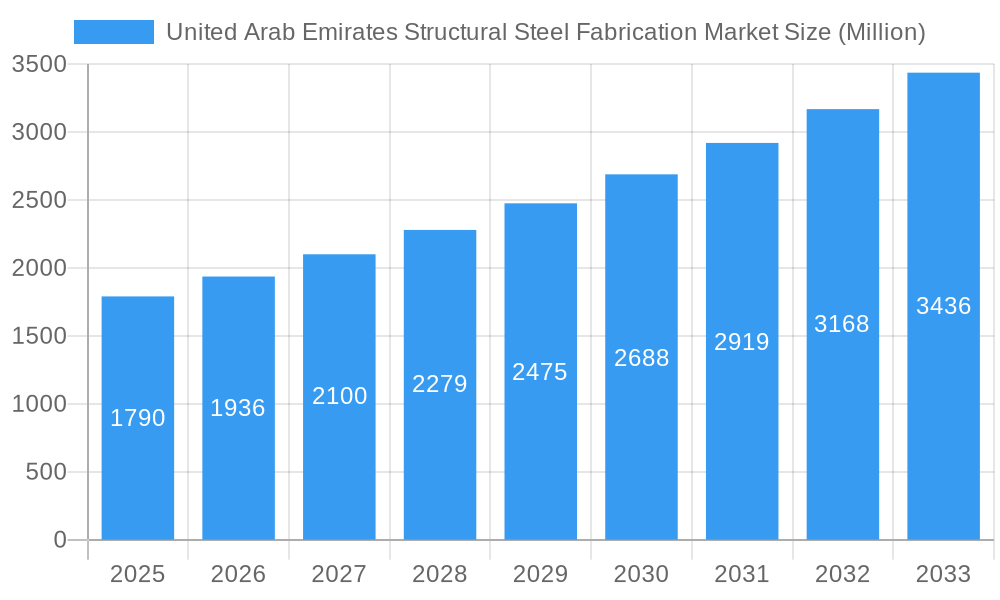

The United Arab Emirates (UAE) structural steel fabrication market, valued at $1.79 billion in 2025, is projected to experience robust growth, driven by the nation's ambitious infrastructure development plans. The ongoing expansion of construction, particularly in sectors like residential, commercial, and industrial buildings, along with large-scale energy and power projects, fuels significant demand for steel fabrication services. The market is segmented by end-user industry (manufacturing, power & energy, construction, oil & gas, and others) and product type (heavy sectional steel, light sectional steel, and others). The construction sector is expected to be the largest consumer of structural steel, fueled by government initiatives promoting sustainable urban development and tourism. The growth in the power and energy sector, driven by renewable energy projects and expansions in the oil and gas industry, further contributes to the market's expansion. While potential restraints such as fluctuating steel prices and global economic uncertainties exist, the UAE's long-term economic vision and consistent investment in infrastructure projects are expected to mitigate these challenges, ensuring sustained market growth through 2033. Key players like Techno Steel, International Building Systems Factory, and Mabani Steel LLC are expected to remain competitive due to their established market presence and experience. The anticipated CAGR of 8.19% indicates a significant expansion of this market over the forecast period (2025-2033), offering promising prospects for both established and emerging players.

United Arab Emirates Structural Steel Fabrication Market Market Size (In Billion)

The market's growth is further propelled by advancements in steel fabrication technologies, leading to increased efficiency and precision in construction. This innovation trend is also driving the demand for specialized, high-strength steel products, particularly within the heavy sectional steel segment. The consistent inflow of foreign direct investment (FDI) and the UAE's strategic location as a regional trade hub also contribute to the market’s positive outlook. While competition among various fabrication companies will intensify, the overall market expansion allows for the entry and success of new businesses, creating a dynamic and evolving landscape. The focus on sustainable construction practices, including the use of recycled steel, is also emerging as a significant factor influencing market growth, offering opportunities for companies that prioritize environmentally friendly solutions.

United Arab Emirates Structural Steel Fabrication Market Company Market Share

United Arab Emirates Structural Steel Fabrication Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Arab Emirates (UAE) structural steel fabrication market, covering market dynamics, growth trends, dominant segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

United Arab Emirates Structural Steel Fabrication Market Dynamics & Structure

The UAE structural steel fabrication market is characterized by a moderately concentrated landscape, with several large players and numerous smaller firms competing. Technological innovation, driven by the need for higher strength, lighter weight, and sustainable materials, is a key driver. Stringent regulatory frameworks, particularly concerning safety and quality standards, influence market practices. Competitive product substitutes, such as composite materials, are emerging but haven't significantly impacted market share yet. End-user demographics are skewed towards large-scale construction and infrastructure projects, along with the burgeoning oil and gas sector. M&A activity remains moderate, with a few notable transactions in recent years.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Focus on high-strength low-alloy (HSLA) steels, advanced welding techniques, and prefabricated modular components.

- Regulatory Framework: Strict adherence to international safety and quality standards (e.g., ISO 9001, ISO 3834).

- Competitive Substitutes: Limited impact from composite materials currently; potential for future disruption.

- M&A Activity: xx deals recorded between 2019 and 2024, primarily focused on consolidation and expansion.

United Arab Emirates Structural Steel Fabrication Market Growth Trends & Insights

The UAE structural steel fabrication market has witnessed significant growth fueled by robust infrastructure development, particularly in construction and energy sectors. Adoption rates for advanced steel fabrication techniques are increasing, driven by the need for efficient and cost-effective solutions. Technological disruptions, such as automation and digitalization in manufacturing processes, are enhancing productivity and precision. Consumer behavior is shifting towards sustainable and environmentally friendly steel products, leading to increased demand for recycled and low-carbon steel.

The market size expanded from xx Million in 2019 to xx Million in 2024, demonstrating consistent growth. The forecast period (2025-2033) anticipates sustained expansion, driven by government initiatives, large-scale infrastructure projects, and the growing energy sector. This growth is expected to result in a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Market penetration of advanced steel fabrication technologies is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in United Arab Emirates Structural Steel Fabrication Market

The construction sector is the dominant end-user industry, accounting for the largest market share (xx%), followed by the oil & gas sector (xx%). Within product types, Heavy Sectional Steel holds the largest share (xx%), due to its use in large infrastructure projects. Abu Dhabi and Dubai are the leading regions, due to their concentrated infrastructure development and energy projects.

Key Drivers:

- Robust government spending on infrastructure development.

- Growth in the oil & gas and energy sectors.

- Increasing urbanization and population growth.

- Government initiatives promoting local manufacturing and industrial diversification.

Dominance Factors:

- High concentration of major construction and infrastructure projects in Abu Dhabi and Dubai.

- Strong presence of major steel fabrication companies in these regions.

- Favorable government policies supporting industrial growth.

United Arab Emirates Structural Steel Fabrication Market Product Landscape

The market offers a range of products, including heavy and light sectional steel, along with specialized steel components designed for specific applications. Recent innovations include high-strength, lightweight steel alloys and prefabricated modular steel structures. These innovations offer increased strength, durability, and reduced construction time. Key selling propositions include superior performance, cost-effectiveness, and sustainability.

Key Drivers, Barriers & Challenges in United Arab Emirates Structural Steel Fabrication Market

Key Drivers: Government initiatives promoting local manufacturing, robust infrastructure projects, growth in the oil and gas sector, and increasing demand for sustainable building materials.

Key Challenges: Fluctuations in global steel prices, competition from imports, skilled labor shortages, and the need to meet stringent environmental regulations. Supply chain disruptions, particularly related to raw material sourcing, can impact production and delivery timelines. The regulatory landscape demands adherence to strict safety and quality standards, representing a significant cost factor.

Emerging Opportunities in United Arab Emirates Structural Steel Fabrication Market

Untapped opportunities exist in the growing renewable energy sector, particularly solar and wind power projects. The demand for lightweight and sustainable steel solutions is also creating opportunities for innovative product development and market penetration. Further opportunities lie in exploring new applications of steel fabrication in advanced infrastructure, such as smart cities and sustainable transportation systems.

Growth Accelerators in the United Arab Emirates Structural Steel Fabrication Market Industry

Strategic partnerships between local and international companies can accelerate technological advancements and market expansion. Government initiatives focused on promoting sustainable manufacturing and industrial diversification will continue to drive growth. Technological breakthroughs in steel production and fabrication, such as additive manufacturing and robotics, will offer significant cost and efficiency gains.

Key Players Shaping the United Arab Emirates Structural Steel Fabrication Market Market

- Techno Steel

- International Building Systems Factory CO LTD

- Mabani Steel LLC

- Vogue Steel LLC

- IMCC

- Arabian International Company Ras Al Khaimah

- Aarya Engineering

- Standard Steel Fabrication Co LLC

- A S Husseini & Partner Contracting Company Ltd

- 63 Other Companies

- Atteih Steel

- Age Steel

Notable Milestones in United Arab Emirates Structural Steel Fabrication Market Sector

- September 2023: Abu Dhabi-based EPC company Target partnered with Adnoc, securing USD 19 billion in steel fabrication contracts by 2027. This significantly boosts the local steel fabrication industry.

- September 2023: A consortium of Emirati steel companies announced plans to establish four new steel plants in Umm Al Quwain, increasing production capacity and boosting local supply.

In-Depth United Arab Emirates Structural Steel Fabrication Market Market Outlook

The UAE structural steel fabrication market is poised for sustained growth, driven by ongoing infrastructure development, government support, and the increasing demand for sustainable construction materials. Strategic partnerships, technological advancements, and market diversification into emerging sectors, like renewable energy, present significant opportunities for players to expand their market share and profitability. The long-term outlook remains positive, with potential for significant market expansion over the next decade.

United Arab Emirates Structural Steel Fabrication Market Segmentation

-

1. End-User Industry

- 1.1. Manufacturing

- 1.2. Power & Energy

- 1.3. Construction

- 1.4. Oil & Gas

- 1.5. Other End-User Industries

-

2. Product Type

- 2.1. Heavy Sectional Steel

- 2.2. Light Sectional Steel

- 2.3. Other Product Types

United Arab Emirates Structural Steel Fabrication Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Structural Steel Fabrication Market Regional Market Share

Geographic Coverage of United Arab Emirates Structural Steel Fabrication Market

United Arab Emirates Structural Steel Fabrication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Infrastructure; Vision; Increasing Tourism

- 3.3. Market Restrains

- 3.3.1. Increasing Price of Steel; Lack of Skilled Worker

- 3.4. Market Trends

- 3.4.1. Infrastructure Development Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Structural Steel Fabrication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Manufacturing

- 5.1.2. Power & Energy

- 5.1.3. Construction

- 5.1.4. Oil & Gas

- 5.1.5. Other End-User Industries

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Heavy Sectional Steel

- 5.2.2. Light Sectional Steel

- 5.2.3. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Techno Steel

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Building Systems Factory CO LTD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mabani Steel LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Vogue Steel LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IMCC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arabian International Company Ras Al Khaimah

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Aarya Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Standard Steel Fabrication Co LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A S Husseini & Partner Contracting Company Ltd**List Not Exhaustive 6 3 Other Companie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atteih Steel

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Age Steel

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Techno Steel

List of Figures

- Figure 1: United Arab Emirates Structural Steel Fabrication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Structural Steel Fabrication Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 5: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United Arab Emirates Structural Steel Fabrication Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Structural Steel Fabrication Market?

The projected CAGR is approximately 8.19%.

2. Which companies are prominent players in the United Arab Emirates Structural Steel Fabrication Market?

Key companies in the market include Techno Steel, International Building Systems Factory CO LTD, Mabani Steel LLC, Vogue Steel LLC, IMCC, Arabian International Company Ras Al Khaimah, Aarya Engineering, Standard Steel Fabrication Co LLC, A S Husseini & Partner Contracting Company Ltd**List Not Exhaustive 6 3 Other Companie, Atteih Steel, Age Steel.

3. What are the main segments of the United Arab Emirates Structural Steel Fabrication Market?

The market segments include End-User Industry, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Infrastructure; Vision; Increasing Tourism.

6. What are the notable trends driving market growth?

Infrastructure Development Driving The Market.

7. Are there any restraints impacting market growth?

Increasing Price of Steel; Lack of Skilled Worker.

8. Can you provide examples of recent developments in the market?

September 2023: Abu Dhabi-based EPC company Target forged a strategic alliance with the Abu Dhabi National Oil Company (Adnoc) as part of a broader initiative involving 25 local manufacturers signing a Strategic Collaboration Agreement (SCA). This collaborative venture is in line with Adnoc's ambitious vision to procure USD 19 billion worth of industrial products from UAE-based manufacturers by 2027. Under this agreement, Target will serve as the designated steel fabricator tasked with producing a diverse range of steel structural products crucial for various Adnoc EPC projects. Adnoc has committed to sourcing all its steel fabrication needs exclusively from local manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Structural Steel Fabrication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Structural Steel Fabrication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Structural Steel Fabrication Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Structural Steel Fabrication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence