Key Insights

The United States senior living market is poised for substantial growth, projected to reach an estimated $112.93 million by 2025. This expansion is driven by a confluence of powerful demographic and societal factors, most notably the aging of the Baby Boomer generation. As this significant cohort enters its later years, the demand for specialized senior living solutions, including assisted living, independent living, memory care, and nursing care, is intensifying. Key states such as New York, Illinois, California, North Carolina, and Washington are expected to lead this growth due to their larger senior populations and higher adoption rates of senior living services. Furthermore, evolving lifestyle preferences among seniors, who increasingly seek vibrant communities offering social engagement, wellness programs, and convenient amenities, are shaping the market landscape. The industry is witnessing a trend towards more personalized care models and technologically integrated living environments that enhance safety and quality of life, further fueling market expansion.

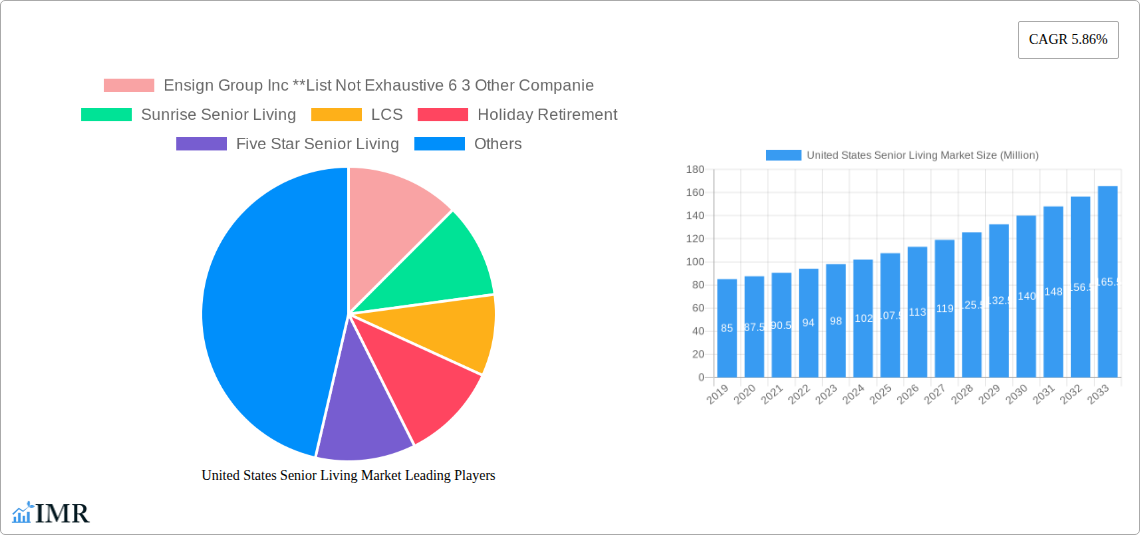

United States Senior Living Market Market Size (In Million)

However, the market is not without its challenges. While the CAGR of 5.86% indicates robust future growth, potential restraints such as the high cost of senior living services, workforce shortages in the care sector, and varying regulatory frameworks across states could impact the pace of expansion. Despite these headwinds, the overarching demand, coupled with ongoing innovation and investment from key players like Ensign Group Inc., Sunrise Senior Living, LCS, and Brookdale Senior Living Inc., suggests a resilient and upward trajectory for the United States senior living market. The industry is adapting by offering a wider spectrum of care options and focusing on creating attractive, supportive environments that cater to the diverse needs and desires of the aging population.

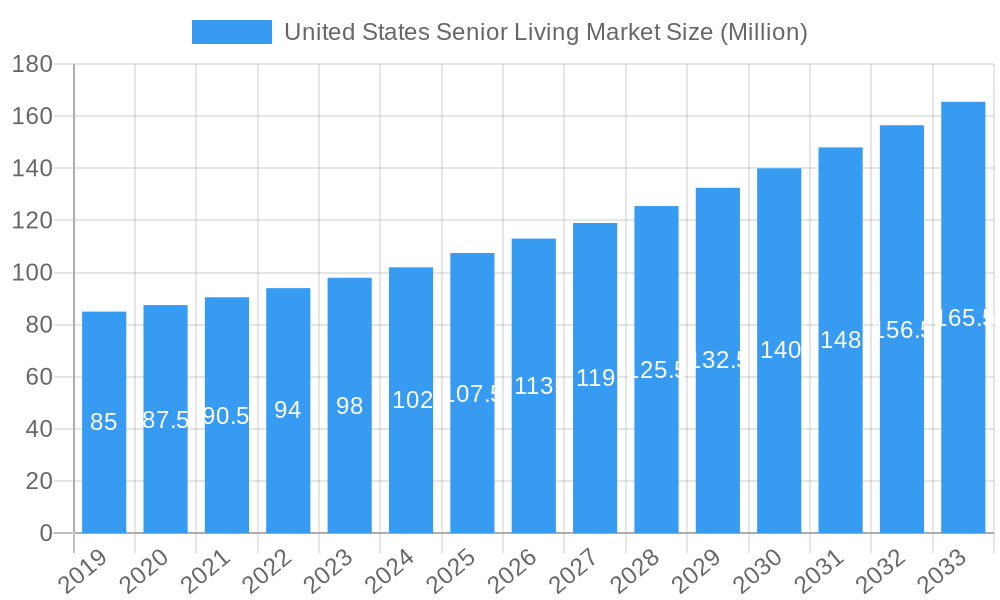

United States Senior Living Market Company Market Share

Here is a compelling, SEO-optimized report description for the United States Senior Living Market, designed for maximum visibility and engagement with industry professionals, without the need for further modification.

United States Senior Living Market Report: Growth, Trends, and Future Outlook (2019–2033)

This comprehensive report offers an in-depth analysis of the United States Senior Living Market, a vital and rapidly evolving sector of the healthcare and real estate industries. Covering the period from 2019 to 2033, with a base year of 2025, this study provides critical insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the strategic positioning of major players. Essential for investors, operators, developers, and policymakers, this report equips stakeholders with the data and analysis needed to navigate and capitalize on the burgeoning senior living market. We delve into parent and child market segments, offering a holistic view of the industry's complex structure and future potential.

United States Senior Living Market Market Dynamics & Structure

The United States Senior Living Market is characterized by a growing concentration of operators, driven by ongoing consolidation and strategic acquisitions. Technological innovation is a significant driver, with advancements in AI for resident care, smart home technologies, and telehealth solutions revolutionizing service delivery. Regulatory frameworks, though varying by state, aim to ensure resident safety and quality of care, influencing operational standards and development approvals. Competitive product substitutes include home healthcare services, multi-generational housing arrangements, and traditional nursing homes, each offering distinct value propositions. End-user demographics are shifting, with an increasing demand for specialized care options such as memory care and assisted living, fueled by an aging population and rising life expectancies. Mergers and acquisitions (M&A) trends highlight a dynamic competitive landscape, with notable deal volumes indicating a robust appetite for market expansion and operational efficiency. For instance, the market is seeing an average of 35-45 M&A deals annually, with a substantial increase in transactions focused on specialized care segments. Innovation barriers include high capital investment requirements for new facilities and technology integration challenges.

United States Senior Living Market Growth Trends & Insights

The United States Senior Living Market is projected for substantial growth, with an estimated compound annual growth rate (CAGR) of 5.2% between 2025 and 2033. This robust expansion is underpinned by a confluence of demographic shifts and evolving consumer preferences. The rapidly aging Baby Boomer generation, numbering over 70 million individuals, is a primary driver, increasingly seeking comfortable, supportive, and amenity-rich living environments. Market penetration for various senior living segments, particularly assisted living and memory care, is expected to rise as awareness of the benefits of specialized care increases. Technological disruptions, such as the integration of AI-powered resident monitoring systems and advanced telehealth platforms, are enhancing the quality and efficiency of care, contributing to higher adoption rates. Consumer behavior is shifting towards a demand for personalized services, greater independence, and engaging community activities, pushing operators to innovate their offerings. The overall market size is anticipated to reach approximately $150 billion by 2030, a significant increase from its current valuation. This growth trajectory is further supported by favorable economic conditions and increasing disposable incomes among the senior demographic.

Dominant Regions, Countries, or Segments in United States Senior Living Market

Within the United States Senior Living Market, California emerges as the dominant region, driven by its large and affluent senior population, robust economic policies, and significant investment in healthcare infrastructure. The state's high concentration of retirement-aged individuals, coupled with strong demand for high-quality senior living options, positions it as a key growth engine. Assisted Living represents the largest segment by revenue, accounting for approximately 40% of the total market share, due to its broad appeal to seniors requiring assistance with daily activities. However, Memory Care is experiencing the fastest growth, with a projected CAGR of 7.5% over the forecast period, reflecting the increasing prevalence of Alzheimer's and dementia.

Key States Driving Growth:

- California: Boasts the largest senior population and significant investment in senior living facilities.

- New York: High population density and strong demand for independent and assisted living.

- Illinois: Growing senior population and increasing development of specialized care facilities.

- North Carolina: Favorable cost of living and active development in retirement communities.

- Washington: Strong economic growth and a significant influx of retirees.

Dominance Factors:

- Demographics: The sheer number of seniors and their life expectancy significantly influence demand.

- Economic Policies: State-level incentives for development and operational tax credits play a crucial role.

- Infrastructure: Availability of well-developed healthcare networks and transportation systems enhances market appeal.

- Consumer Preferences: The demand for specific property types, like independent living with integrated care options, shapes regional dominance.

United States Senior Living Market Product Landscape

The product landscape of the United States Senior Living Market is characterized by a diverse range of offerings designed to meet the varied needs of seniors. Key property types include Independent Living, offering a maintenance-free lifestyle with access to amenities; Assisted Living, providing support with daily activities and personal care; Memory Care, specializing in dementia and Alzheimer's support; and Nursing Care, for individuals requiring intensive medical attention. Innovations focus on creating more homelike environments, incorporating smart home technologies for safety and convenience, and offering flexible care models. The unique selling proposition for many operators lies in their ability to provide a continuum of care, allowing residents to transition between living options as their needs evolve. Technological advancements are enhancing resident engagement through virtual reality experiences and personalized digital platforms.

Key Drivers, Barriers & Challenges in United States Senior Living Market

Key Drivers:

- Aging Population: The substantial growth in the senior demographic is the primary market driver, creating sustained demand.

- Technological Advancements: Innovations in healthcare technology, AI, and smart home systems improve care quality and operational efficiency.

- Increased Life Expectancy: Longer lifespans necessitate longer-term senior living solutions.

- Demand for Specialized Care: Growing awareness and need for memory care and assisted living services fuel market growth.

- Lifestyle Preferences: Seniors increasingly seek active, social, and maintenance-free living environments.

Barriers & Challenges:

- High Capital Investment: Building and maintaining senior living facilities requires substantial upfront capital, posing a barrier for new entrants.

- Regulatory Hurdles: Navigating complex and varying state and federal regulations can be time-consuming and costly.

- Workforce Shortages: A persistent shortage of qualified caregivers and healthcare professionals impacts operational capacity and service quality.

- Rising Operating Costs: Increasing labor, healthcare, and utility costs can squeeze profit margins.

- Public Perception: Some segments of the population may still hold negative perceptions about senior living facilities, requiring proactive marketing and education.

- Supply Chain Disruptions: Fluctuations in the availability and cost of construction materials and medical supplies can impact development and operations.

Emerging Opportunities in United States Senior Living Market

Emerging opportunities in the United States Senior Living Market are predominantly centered around innovation and unmet consumer needs. The growing demand for memory care services presents a significant opportunity, with operators focusing on specialized, therapeutic environments. Technology integration, particularly AI-driven resident monitoring and telehealth solutions, offers avenues to enhance care quality and operational efficiency, creating a competitive edge. Furthermore, the development of affordable senior living options and innovative financing models can tap into a broader market segment. The trend towards intergenerational living and community-based care models also presents untapped potential for operators looking to differentiate their services.

Growth Accelerators in the United States Senior Living Market Industry

Several catalysts are accelerating long-term growth in the United States Senior Living Market. Technological breakthroughs, such as advanced AI for personalized care plans and remote patient monitoring, are enhancing resident well-being and operator efficiency. Strategic partnerships between senior living providers and healthcare systems are creating integrated care models, offering a seamless experience for residents. Market expansion strategies, including the development of new facilities in underserved regions and the acquisition of existing properties, are crucial for increasing market share. Furthermore, government initiatives and favorable policies that support senior housing development and healthcare access are also playing a vital role in accelerating industry growth.

Key Players Shaping the United States Senior Living Market Market

The United States Senior Living Market is shaped by a diverse array of key players, including large national operators, regional providers, and specialized niche companies. These entities are continuously innovating and expanding their footprints to meet the evolving demands of the senior population. The competitive landscape is dynamic, with strategic alliances, mergers, and acquisitions frequently altering market dynamics.

- Ensign Group Inc

- Sunrise Senior Living

- LCS

- Holiday Retirement

- Five Star Senior Living

- Brookdale Senior Living Inc

- Erickson Senior Living

- Kisco Senior Living Company

- Sonida Senior Living

- Atria Senior Living Inc

- Watermark Retirement Communities

- Ventas

- Senior Lifestyle

- 6 3 Other Companies

Notable Milestones in United States Senior Living Market Sector

The United States Senior Living Market has witnessed significant developments reflecting its growth and adaptation to changing needs.

- July 2023: Spring Cypress senior living site expansion announced, set to open late 2024 with three phases: 19 independent-living cottages, 24 townhomes, and 95 apartments, culminating in a resort with luxury amenities, signaling expansion in multi-unit offerings.

- April 2023: Avista Senior Living announced a strategic shift away from its SafelyYou partnership, transitioning to empower safer, more personalized dementia care through real-time AI video and 24/7 remote clinical experts, highlighting an emphasis on advanced technology for specialized care.

In-Depth United States Senior Living Market Market Outlook

The United States Senior Living Market is poised for continued robust expansion, driven by powerful demographic tailwinds and evolving consumer expectations. Growth accelerators, including the increasing demand for assisted living and memory care services, coupled with technological integrations for enhanced resident safety and personalized care, will shape the market's trajectory. Strategic opportunities lie in developing integrated care models, expanding into underserved geographical areas, and leveraging innovative financing solutions to cater to a broader spectrum of the senior population. The market's future outlook is bright, promising significant opportunities for stakeholders who can adapt to these trends and deliver high-quality, person-centered care solutions.

United States Senior Living Market Segmentation

-

1. Property Type

- 1.1. Assisted Living

- 1.2. Independent Living

- 1.3. Memory Care

- 1.4. Nursing Care

- 1.5. Other Property Types

-

2. Key States

- 2.1. New York

- 2.2. Illinois

- 2.3. California

- 2.4. North Carolina

- 2.5. Washington

- 2.6. Rest of United States

United States Senior Living Market Segmentation By Geography

- 1. United States

United States Senior Living Market Regional Market Share

Geographic Coverage of United States Senior Living Market

United States Senior Living Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market

- 3.4. Market Trends

- 3.4.1. Senior Housing Witnessing Increased Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Senior Living Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 5.1.1. Assisted Living

- 5.1.2. Independent Living

- 5.1.3. Memory Care

- 5.1.4. Nursing Care

- 5.1.5. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Key States

- 5.2.1. New York

- 5.2.2. Illinois

- 5.2.3. California

- 5.2.4. North Carolina

- 5.2.5. Washington

- 5.2.6. Rest of United States

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Property Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ensign Group Inc **List Not Exhaustive 6 3 Other Companie

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sunrise Senior Living

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LCS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Holiday Retirement

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Five Star Senior Living

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brookdale Senior Living Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Erickson Senior Living

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kisco Senior Living Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sonida Senior Living

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atria Senior Living Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Watermark Retirement Communities

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ventas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Senior Lifestyle

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Ensign Group Inc **List Not Exhaustive 6 3 Other Companie

List of Figures

- Figure 1: United States Senior Living Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Senior Living Market Share (%) by Company 2025

List of Tables

- Table 1: United States Senior Living Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 2: United States Senior Living Market Revenue Million Forecast, by Key States 2020 & 2033

- Table 3: United States Senior Living Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: United States Senior Living Market Revenue Million Forecast, by Property Type 2020 & 2033

- Table 5: United States Senior Living Market Revenue Million Forecast, by Key States 2020 & 2033

- Table 6: United States Senior Living Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Senior Living Market?

The projected CAGR is approximately 5.86%.

2. Which companies are prominent players in the United States Senior Living Market?

Key companies in the market include Ensign Group Inc **List Not Exhaustive 6 3 Other Companie, Sunrise Senior Living, LCS, Holiday Retirement, Five Star Senior Living, Brookdale Senior Living Inc, Erickson Senior Living, Kisco Senior Living Company, Sonida Senior Living, Atria Senior Living Inc, Watermark Retirement Communities, Ventas, Senior Lifestyle.

3. What are the main segments of the United States Senior Living Market?

The market segments include Property Type, Key States.

4. Can you provide details about the market size?

The market size is estimated to be USD 112.93 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market.

6. What are the notable trends driving market growth?

Senior Housing Witnessing Increased Demand.

7. Are there any restraints impacting market growth?

4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market.

8. Can you provide examples of recent developments in the market?

July 2023: Spring Cypress senior living site expansion is set to open at the end of 2024 and will consist of three phases. The first phase of the expansion will include 19 independent-living, two-bedroom cottages. The second phase will include 24 townhomes. The third phase will feature 95 apartments. The final phase will feature a resort with several luxury amenities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Senior Living Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Senior Living Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Senior Living Market?

To stay informed about further developments, trends, and reports in the United States Senior Living Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence