Key Insights

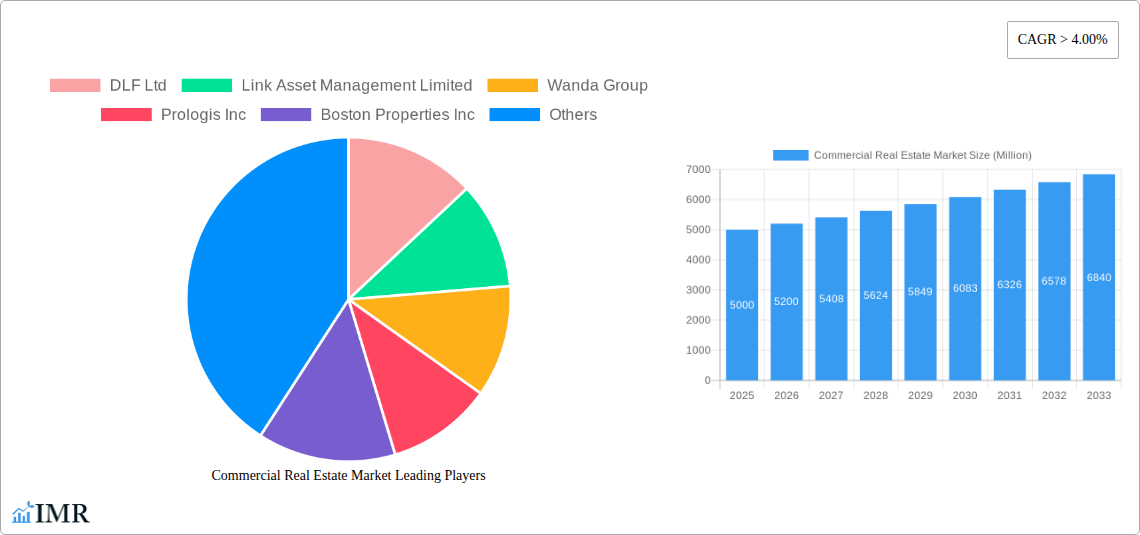

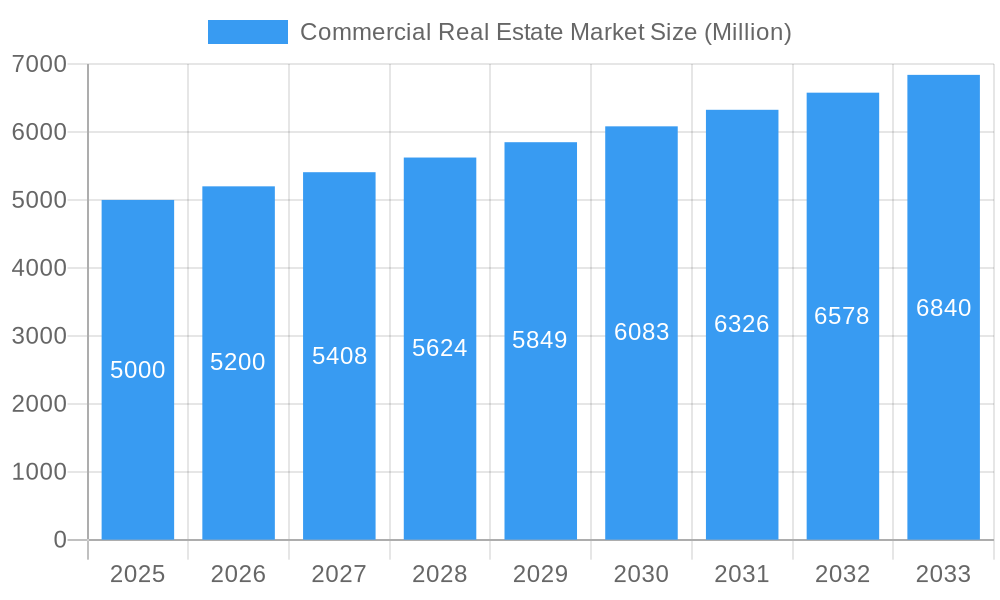

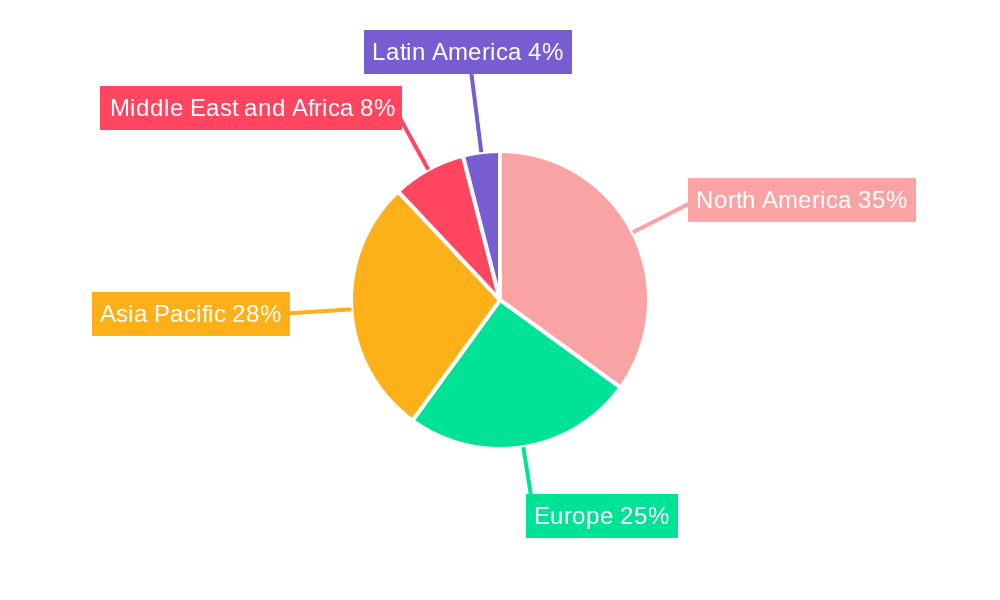

The global Commercial Real Estate (CRE) market is poised for significant expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 3.32% from 2025 to 2033. The estimated market size in 2025 is 742.3 billion. This growth is propelled by key factors including global population increase, urbanization driving demand for diverse property types (office, retail, residential), and the e-commerce boom fueling the industrial and logistics sectors. Advancements in smart building technology and property management systems further enhance market efficiency and investor appeal. However, economic volatility, interest rate fluctuations, and evolving consumer behavior present potential challenges. The market is segmented by property type, with office, retail, industrial/logistics, multi-family, and hospitality sectors showing varied growth. Key industry leaders such as DLF Ltd, Prologis Inc, and Brookfield Asset Management Inc are actively influencing market trends through strategic initiatives. North America and Asia-Pacific are expected to lead market share due to substantial economic activity and infrastructure development.

Commercial Real Estate Market Market Size (In Billion)

The competitive environment features a mix of multinational corporations and regional entities, offering opportunities for both established and emerging businesses. Despite existing challenges, the fundamental growth drivers indicate sustained potential within the CRE sector. The ongoing expansion of metropolitan areas, the need for efficient logistics solutions, and continuous technological innovation in commercial real estate collectively signal a dynamic and expanding market over the next decade. Strategic risk management and adaptability to evolving market conditions are paramount for successful participation in this robust sector.

Commercial Real Estate Market Company Market Share

Commercial Real Estate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global commercial real estate market, encompassing historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). The report delves into market dynamics, growth trends, dominant segments (Offices, Retail, Industrial/Logistics, Multi-family, Hospitality), key players, and emerging opportunities across various regions and countries. This analysis is crucial for investors, developers, and industry professionals seeking to navigate the complexities and capitalize on the growth potential within this dynamic sector. The report also examines parent markets (e.g., global real estate investment) and child markets (e.g., specific sub-sectors within commercial real estate) to provide a granular understanding of market segmentation.

Study Period: 2019–2033; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025–2033; Historical Period: 2019–2024

Commercial Real Estate Market Market Dynamics & Structure

The global commercial real estate market exhibits moderate concentration, with a few major players commanding significant market share, though the precise figures are dependent on the specific segment (e.g., office buildings in New York City vs. industrial warehouses nationally). Technological innovation, particularly in areas like proptech and data analytics, significantly impacts efficiency and investment decisions. Regulatory frameworks, varying by region and property type, influence development and investment activity. The market sees increasing competition from alternative investments and evolving consumer preferences; for example, the rise of remote work impacts office space demand. M&A activity is robust, with deal volumes fluctuating based on economic conditions, driven by consolidation and portfolio diversification.

- Market Concentration: xx% controlled by top 5 players (2025 estimate).

- Technological Innovation: Increased use of AI, big data, and IoT in property management and valuation.

- Regulatory Framework: Varied regional regulations affect development costs and timelines.

- Competitive Substitutes: Alternative investments (e.g., bonds, private equity) compete for capital.

- End-User Demographics: Shifting demographics and working patterns influence demand for different property types.

- M&A Trends: xx Million USD in M&A deals in 2024 (estimated), driven primarily by consolidation and expansion.

Commercial Real Estate Market Growth Trends & Insights

The global commercial real estate market is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million USD by 2033. This growth is influenced by several factors, including urbanization, increasing demand for specialized properties (such as data centers and life-science facilities), and government initiatives promoting infrastructure development. Technological disruptions, such as the rise of remote work and the adoption of smart building technologies, are reshaping the industry. Consumer behavior shifts, reflecting changing preferences for workspaces and retail experiences, will continue to influence market trends. The adoption rate of green building standards is steadily increasing as environmental consciousness becomes more important for investors and tenants alike.

Dominant Regions, Countries, or Segments in Commercial Real Estate Market

The Industrial/Logistics segment currently dominates the commercial real estate market (xx% market share in 2025) fueled by e-commerce growth and supply chain optimization. North America and Asia-Pacific remain leading regions, with significant growth potential in emerging markets.

- Key Drivers:

- E-commerce Boom: Driving demand for warehouse and distribution centers (Industrial/Logistics).

- Urbanization: Increasing population density fuels demand for residential and commercial properties in city centers.

- Infrastructure Development: Government investment in transportation and utilities supports real estate development.

- Dominance Factors:

- Strong Economic Growth: In key regions like the US and China drives investment in commercial real estate.

- Favorable Regulatory Environment: Attractive tax incentives and streamlined permitting processes.

- High Rental Yields: Attracting investors in high-demand locations.

Commercial Real Estate Market Product Landscape

The commercial real estate market offers a diverse product landscape, encompassing offices, retail spaces, industrial/logistics facilities, multi-family residential buildings, and hospitality properties. Recent innovations include smart building technologies improving energy efficiency and tenant experience and sustainable construction methods minimizing environmental impact. These advancements offer enhanced performance metrics, including reduced operating costs and improved asset values. Unique selling propositions focus on location, sustainability features, and technological integration.

Key Drivers, Barriers & Challenges in Commercial Real Estate Market

Key Drivers:

- Robust global economic growth.

- Technological advancements (Proptech).

- Government infrastructure investments.

Challenges & Restraints:

- Geopolitical uncertainty impacts investment decisions.

- Rising interest rates increase financing costs.

- Supply chain disruptions affect construction timelines and costs. (estimated xx% increase in construction costs in 2024).

Emerging Opportunities in Commercial Real Estate Market

- Growing demand for sustainable and energy-efficient buildings.

- Expansion into emerging markets.

- Development of specialized properties (e.g., data centers).

- Integration of Proptech solutions for enhanced efficiency.

Growth Accelerators in the Commercial Real Estate Market Industry

Technological advancements in building automation and property management, strategic partnerships between developers and technology companies, and government initiatives promoting green building standards will fuel long-term growth in the commercial real estate market. Expansion into emerging markets with strong economic growth will present significant opportunities.

Key Players Shaping the Commercial Real Estate Market Market

- DLF Ltd

- Link Asset Management Limited

- Wanda Group

- Prologis Inc

- Boston Properties Inc

- Brookfield Asset Management Inc

- Segro

- Nakheel PJSC

- MaxWell Realty

- Onni Contracting Ltd

- Simon Property Group LP

- Shannon waltchack LLC

- ATC IP LLC

- RAK Properties

- List Not Exhaustive

Notable Milestones in Commercial Real Estate Market Sector

- November 2022: Colliers CAAC acquired a Costa Rican real estate consultancy, expanding its Central American and Caribbean footprint.

- October 2022: M&G Plc's real estate division acquired a prime office building in Yokohama, Japan, for over USD 700 Million.

In-Depth Commercial Real Estate Market Market Outlook

The future of the commercial real estate market is bright, driven by ongoing urbanization, technological innovation, and favorable government policies. Strategic partnerships and a focus on sustainability will be crucial for success. The market presents substantial opportunities for investors, developers, and technology providers who can adapt to changing market dynamics and capitalize on emerging trends. The predicted growth in key segments, such as industrial and logistics, will continue to shape investment strategies and development priorities.

Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial/Logistics

- 1.4. Multi-family

- 1.5. Hospitality

Commercial Real Estate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Russia

- 3.5. Rest of Europe

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Qatar

- 4.4. South Africa

- 4.5. Rest of Middle East and Africa

-

5. Latin America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Argentina

- 5.4. Colombia

- 5.5. Rest of Latin America

Commercial Real Estate Market Regional Market Share

Geographic Coverage of Commercial Real Estate Market

Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market

- 3.4. Market Trends

- 3.4.1. Office Markets to Witness Increased Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial/Logistics

- 5.1.4. Multi-family

- 5.1.5. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. Middle East and Africa

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Offices

- 6.1.2. Retail

- 6.1.3. Industrial/Logistics

- 6.1.4. Multi-family

- 6.1.5. Hospitality

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Offices

- 7.1.2. Retail

- 7.1.3. Industrial/Logistics

- 7.1.4. Multi-family

- 7.1.5. Hospitality

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Offices

- 8.1.2. Retail

- 8.1.3. Industrial/Logistics

- 8.1.4. Multi-family

- 8.1.5. Hospitality

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Offices

- 9.1.2. Retail

- 9.1.3. Industrial/Logistics

- 9.1.4. Multi-family

- 9.1.5. Hospitality

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Commercial Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Offices

- 10.1.2. Retail

- 10.1.3. Industrial/Logistics

- 10.1.4. Multi-family

- 10.1.5. Hospitality

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DLF Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Link Asset Management Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wanda Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Prologis Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Boston Properties Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brookfield Asset Management Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Segro

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nakheel PJSC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MaxWell Realty

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Onni Contracting Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Simon Property Group LP

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shannon waltchack LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ATC IP LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 RAK Properties**List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 DLF Ltd

List of Figures

- Figure 1: Global Commercial Real Estate Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 5: Asia Pacific Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 7: North America Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: North America Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East and Africa Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Middle East and Africa Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East and Africa Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East and Africa Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Latin America Commercial Real Estate Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Latin America Commercial Real Estate Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Latin America Commercial Real Estate Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Latin America Commercial Real Estate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Commercial Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 4: Global Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: India Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Korea Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Canada Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 15: Global Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: Saudi Arabia Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: United Arab Emirates Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Qatar Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Africa Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Middle East and Africa Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Commercial Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 29: Global Commercial Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Brazil Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Mexico Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Colombia Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Commercial Real Estate Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Real Estate Market?

The projected CAGR is approximately 3.32%.

2. Which companies are prominent players in the Commercial Real Estate Market?

Key companies in the market include DLF Ltd, Link Asset Management Limited, Wanda Group, Prologis Inc, Boston Properties Inc, Brookfield Asset Management Inc, Segro, Nakheel PJSC, MaxWell Realty, Onni Contracting Ltd, Simon Property Group LP, Shannon waltchack LLC, ATC IP LLC, RAK Properties**List Not Exhaustive.

3. What are the main segments of the Commercial Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 742.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Aging Population Driving the Market4.; Healthcare and Long-term Care Needs Driving the Market.

6. What are the notable trends driving market growth?

Office Markets to Witness Increased Growth.

7. Are there any restraints impacting market growth?

4.; High Affordability and Cost of Care Affecting the Market4.; Staffing and Workforce Challenges Affecting the Market.

8. Can you provide examples of recent developments in the market?

November 2022 - Colliers CAAC, a regional holding company, currently holding exclusive sublicenses for Central America, the Caribbean, and certain Andean countries from Colliers International announced the acquisition of a Costa Rican real estate consultancy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence