Key Insights

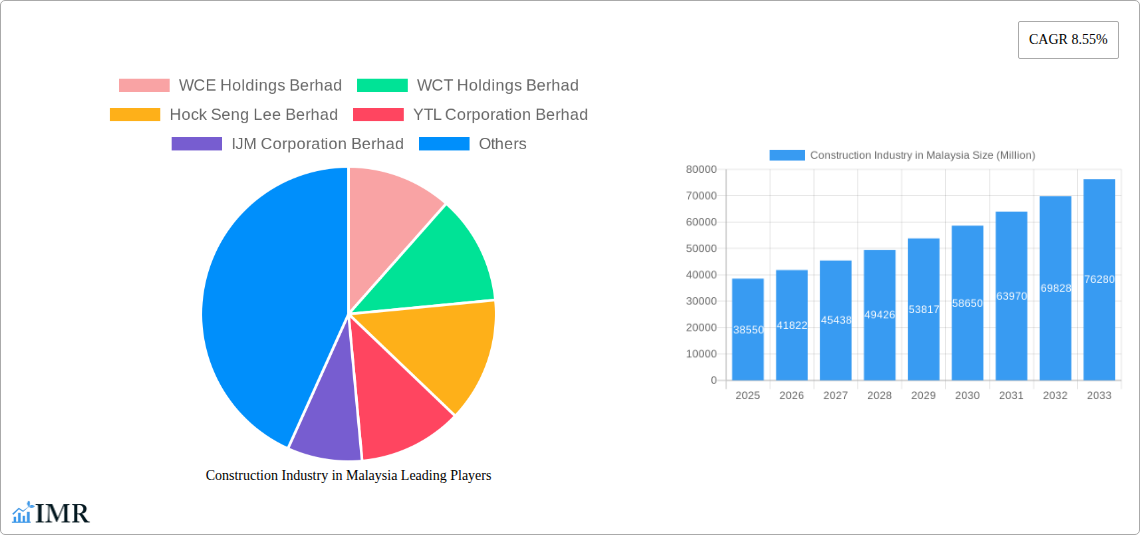

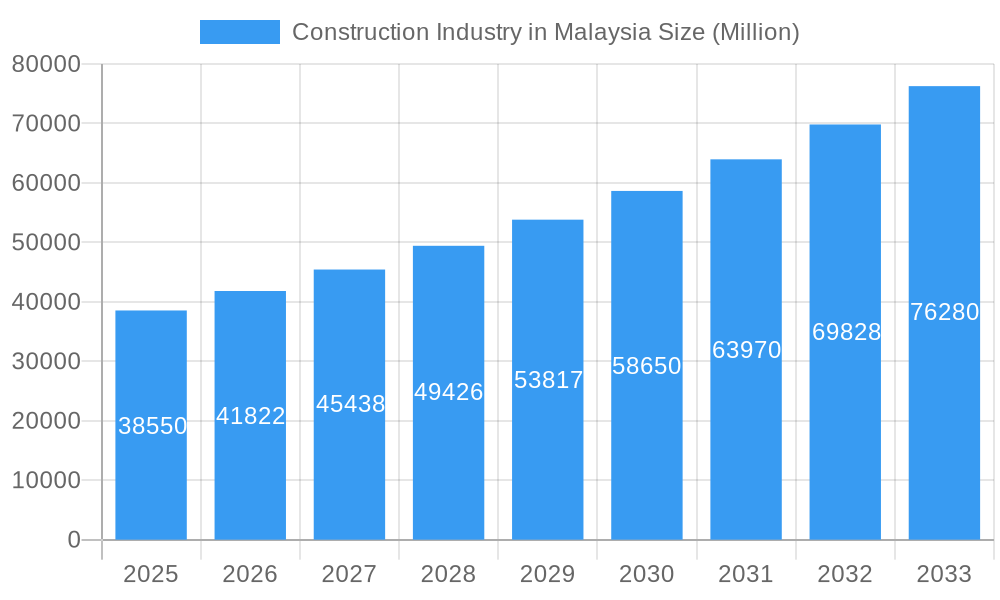

The Malaysian construction industry, valued at RM 38.55 billion in 2025, is projected to experience robust growth, driven by sustained government investment in infrastructure development, particularly in transportation and energy projects. The ongoing expansion of urban areas, coupled with rising demand for residential and commercial spaces, fuels this growth. Key segments like infrastructure construction, encompassing road networks, railways, and airports, are expected to be major contributors to the market's expansion. The residential sector will also see significant activity, fueled by a growing population and increasing urbanization, especially in major cities like Kuala Lumpur and Johor Bahru. While the industry faces challenges such as material cost fluctuations and skilled labor shortages, the overall positive economic outlook for Malaysia suggests continued growth throughout the forecast period. The government's focus on sustainable development initiatives will also influence the sector, driving adoption of green building technologies and practices. The construction type segment is diversified, with a balanced contribution from new construction, additions, and demolition projects reflecting a dynamic and adaptable market.

Construction Industry in Malaysia Market Size (In Billion)

This positive trajectory is anticipated to continue, with a compound annual growth rate (CAGR) of 8.55% from 2025 to 2033. Major players like WCE Holdings Berhad, WCT Holdings Berhad, and Gamuda Berhad are well-positioned to benefit from this expansion, leveraging their expertise and experience in various construction sectors. However, success will depend on their ability to navigate the challenges effectively, including managing cost pressures, attracting and retaining skilled workers, and adapting to evolving technological advancements and sustainable development priorities. The market will see increasing competition, potentially leading to strategic mergers and acquisitions as companies seek to expand their market share and capabilities.

Construction Industry in Malaysia Company Market Share

Construction Industry in Malaysia: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Malaysian construction industry, encompassing market dynamics, growth trends, key players, and future outlook. Covering the period from 2019 to 2033, with a focus on 2025, this report is an invaluable resource for industry professionals, investors, and strategic planners seeking to navigate this dynamic sector. The report segments the market by sector (Commercial, Residential, Industrial, Infrastructure, Energy & Utilities) and construction type (Additions, Demolition, New Construction).

Construction Industry in Malaysia Market Dynamics & Structure

This section analyzes the Malaysian construction market's competitive landscape, identifying key trends and factors influencing its evolution. The market is characterized by a mix of large multinational players and local contractors, resulting in a moderately concentrated market. The exact market concentration (Herfindahl-Hirschman Index, for example) requires further dedicated research and is therefore not presented here. We will however examine the leading players within their respective segments.

Market Concentration:

- Top 5 players hold an estimated xx% market share in 2025.

- Increased consolidation through mergers and acquisitions (M&A) is expected, potentially leading to further market concentration.

Technological Innovation:

- Adoption of Building Information Modeling (BIM) and other digital technologies is gradually increasing, though penetration remains relatively low compared to developed markets.

- Barriers to wider adoption include cost, skill gaps, and a lack of standardized procedures.

Regulatory Framework:

- Stringent building codes and environmental regulations influence project timelines and costs.

- Government initiatives promoting sustainable construction practices are driving demand for green building materials and technologies.

Competitive Product Substitutes:

- The primary substitute is prefabricated construction which has seen increased adoption recently. However, its usage remains niche at present.

End-User Demographics:

- Demand is driven by a growing population, urbanization, and government infrastructure development projects.

- The residential segment shows significant growth based on middle and upper-class income increase.

M&A Trends:

- The number of M&A deals in the industry has been xx in the last 5 years, and xx deals expected between 2025 and 2033.

- Driving factors include expansion strategies, access to new technologies, and enhanced project execution capabilities.

Construction Industry in Malaysia Growth Trends & Insights

The Malaysian construction industry has experienced fluctuating growth over the historical period (2019-2024), influenced by economic cycles and government policies. The base year (2025) is expected to show a market size of RM xx billion, and the forecast period (2025-2033) projects a Compound Annual Growth Rate (CAGR) of xx%. This growth is driven by several factors, including:

- Government infrastructure projects: Large-scale initiatives such as the East Coast Rail Link (ECRL) and the development of new cities are stimulating substantial construction activity.

- Private sector investments: The private sector plays a significant role in residential and commercial construction, and its level of investment is an influential factor in overall industry growth.

- Tourism development: The tourism sector’s expansion fuels demand for new hotels, resorts, and related infrastructure.

Technological disruptions, such as BIM and prefabricated construction, are increasing efficiency but face hurdles in adoption. Shifting consumer preferences, including a growing preference for sustainable and eco-friendly buildings, present opportunities for firms that embrace these trends. Market penetration of green technologies is currently at xx% and expected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in Construction Industry in Malaysia

While data on precise regional dominance requires further study, the Klang Valley (including Kuala Lumpur and Selangor) remains the most significant market due to its concentration of economic activity, population density, and ongoing development projects. The growth of other regions in Malaysia is highly dependent on government policies and initiatives.

By Sector:

- Infrastructure (Transportation) Construction: This segment is likely the largest and fastest-growing due to major government investments in transportation networks.

- Residential Construction: This sector is showing strong growth, fueled by urbanization and rising middle-class income levels.

- Commercial Construction: This segment is showing moderate growth depending on economic conditions and business confidence.

By Construction Type:

- New Construction: This dominates the market, reflecting overall construction sector expansion.

- Additions & Renovations: This segment shows moderate growth, driven by existing building upgrades and expansions.

Key Drivers:

- Robust government spending on infrastructure projects.

- Continued urbanization and population growth.

- Increased foreign direct investment (FDI) in the country.

- Government initiatives to promote sustainable construction.

Construction Industry in Malaysia Product Landscape

The Malaysian construction industry's product landscape is marked by a diversification of materials and methodologies. While traditional materials (cement, steel, concrete) still dominate, there's a rise in the adoption of prefabricated building components and sustainable materials (e.g., bamboo, recycled materials). Technological advancements encompass BIM, 3D printing, and drone surveying, boosting efficiency and project precision. The unique selling propositions (USPs) increasingly focus on speed, cost-effectiveness, and sustainable features.

Key Drivers, Barriers & Challenges in Construction Industry in Malaysia

Key Drivers:

- Government investment in large-scale infrastructure projects is a major driver.

- Increased private sector investment in residential and commercial real estate.

- Population growth and urbanization fueling demand for new housing and infrastructure.

Key Challenges & Restraints:

- Supply Chain Issues: Fluctuations in material prices and availability cause project cost overruns.

- Regulatory Hurdles: Obtaining permits and approvals can be time-consuming and complex.

- Skilled Labor Shortages: A lack of skilled workers impacts project completion timelines and quality. The industry is actively looking into means to address this issue.

- Competitive Pressure: Intense competition among contractors can lead to price wars and reduced profit margins. Approximately xx% of projects experience delays due to unforeseen circumstances.

Emerging Opportunities in Construction Industry in Malaysia

- Green Building: Growing demand for sustainable buildings creates significant opportunities.

- Prefabrication: Increased adoption of prefabricated components improves efficiency and reduces construction time.

- Smart City Development: Investments in smart city initiatives will fuel demand for advanced building technologies and infrastructure.

- Infrastructure Development in Less Developed Regions: This offers opportunities for regional expansion.

Growth Accelerators in the Construction Industry in Malaysia Industry

Technological advancements (BIM, prefabrication) and strategic partnerships are driving long-term growth. Government initiatives supporting sustainable construction and infrastructure development create further momentum. Expanding into less developed regions and focusing on high-value projects are key expansion strategies.

Key Players Shaping the Construction Industry in Malaysia Market

- WCE Holdings Berhad

- WCT Holdings Berhad

- Hock Seng Lee Berhad

- YTL Corporation Berhad

- IJM Corporation Berhad

- Muhibbah Engineering (M) Bhd

- Malaysian Resources Corporation Berhad

- Gamuda Berhad

- Mudajaya Group Berhad

- UEM Group Berhad

Notable Milestones in Construction Industry in Malaysia Sector

- October 2023: Gamuda Bhd's joint venture secures a MYR 4 billion hydroelectric power plant project in Sabah, significantly impacting the energy and utilities construction segment.

- July 2023: IJM Corporation's foray into industrial property development in the Klang Valley expands its market reach and diversifies its portfolio.

In-Depth Construction Industry in Malaysia Market Outlook

The Malaysian construction industry's future is promising, driven by sustained government infrastructure spending, private sector investments, and technological advancements. Opportunities lie in sustainable construction, prefabrication, and smart city development. Strategic partnerships and expansion into new regions will be crucial for success. The market is predicted to witness substantial growth in the coming years with increasing focus on resilient and eco-friendly building practices.

Construction Industry in Malaysia Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition and New Construction

Construction Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Malaysia Regional Market Share

Geographic Coverage of Construction Industry in Malaysia

Construction Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects

- 3.3. Market Restrains

- 3.3.1. 4.; Increase in Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Residential Construction Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition and New Construction

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.2. Market Analysis, Insights and Forecast - by Construction Type

- 6.2.1. Additions

- 6.2.2. Demolition and New Construction

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.2. Market Analysis, Insights and Forecast - by Construction Type

- 7.2.1. Additions

- 7.2.2. Demolition and New Construction

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.2. Market Analysis, Insights and Forecast - by Construction Type

- 8.2.1. Additions

- 8.2.2. Demolition and New Construction

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.2. Market Analysis, Insights and Forecast - by Construction Type

- 9.2.1. Additions

- 9.2.2. Demolition and New Construction

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Malaysia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.2. Market Analysis, Insights and Forecast - by Construction Type

- 10.2.1. Additions

- 10.2.2. Demolition and New Construction

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WCE Holdings Berhad

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 WCT Holdings Berhad

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hock Seng Lee Berhad

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 YTL Corporation Berhad

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 IJM Corporation Berhad

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Muhibbah Engineering (M) Bhd**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Malaysian Resources Corporation Berhad

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gamuda Berhad

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Mudajaya Group Berhad

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UEM Group Berhad

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 WCE Holdings Berhad

List of Figures

- Figure 1: Global Construction Industry in Malaysia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Industry in Malaysia Revenue (Million), by Sector 2025 & 2033

- Figure 3: North America Construction Industry in Malaysia Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Construction Industry in Malaysia Revenue (Million), by Construction Type 2025 & 2033

- Figure 5: North America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2025 & 2033

- Figure 6: North America Construction Industry in Malaysia Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Construction Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Construction Industry in Malaysia Revenue (Million), by Sector 2025 & 2033

- Figure 9: South America Construction Industry in Malaysia Revenue Share (%), by Sector 2025 & 2033

- Figure 10: South America Construction Industry in Malaysia Revenue (Million), by Construction Type 2025 & 2033

- Figure 11: South America Construction Industry in Malaysia Revenue Share (%), by Construction Type 2025 & 2033

- Figure 12: South America Construction Industry in Malaysia Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Construction Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Construction Industry in Malaysia Revenue (Million), by Sector 2025 & 2033

- Figure 15: Europe Construction Industry in Malaysia Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Europe Construction Industry in Malaysia Revenue (Million), by Construction Type 2025 & 2033

- Figure 17: Europe Construction Industry in Malaysia Revenue Share (%), by Construction Type 2025 & 2033

- Figure 18: Europe Construction Industry in Malaysia Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Construction Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Sector 2025 & 2033

- Figure 21: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Sector 2025 & 2033

- Figure 22: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Construction Type 2025 & 2033

- Figure 23: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Construction Type 2025 & 2033

- Figure 24: Middle East & Africa Construction Industry in Malaysia Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Construction Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Sector 2025 & 2033

- Figure 27: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Sector 2025 & 2033

- Figure 28: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Construction Type 2025 & 2033

- Figure 29: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Construction Type 2025 & 2033

- Figure 30: Asia Pacific Construction Industry in Malaysia Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Construction Industry in Malaysia Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 3: Global Construction Industry in Malaysia Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2020 & 2033

- Table 5: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 6: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2020 & 2033

- Table 11: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 12: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2020 & 2033

- Table 17: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 18: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2020 & 2033

- Table 29: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 30: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Construction Industry in Malaysia Revenue Million Forecast, by Sector 2020 & 2033

- Table 38: Global Construction Industry in Malaysia Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Global Construction Industry in Malaysia Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Construction Industry in Malaysia Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Malaysia?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the Construction Industry in Malaysia?

Key companies in the market include WCE Holdings Berhad, WCT Holdings Berhad, Hock Seng Lee Berhad, YTL Corporation Berhad, IJM Corporation Berhad, Muhibbah Engineering (M) Bhd**List Not Exhaustive, Malaysian Resources Corporation Berhad, Gamuda Berhad, Mudajaya Group Berhad, UEM Group Berhad.

3. What are the main segments of the Construction Industry in Malaysia?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.55 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rise in Demand for Residential Property4.; Increase in Infrastructure Projects.

6. What are the notable trends driving market growth?

Residential Construction Driving the Market.

7. Are there any restraints impacting market growth?

4.; Increase in Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

October 2023: Gamuda Bhd entered into a joint-venture agreement with Sabah Energy Corp Sdn Bhd (SEC) and Kerjaya Kagum Hitech JV Sdn Bhd (KKHJV) to undertake a private finance initiative for the development of the MYR 4 billion (USD 0.86 billion) 187.5 MW hydroelectric power plant in Tenom, Sabah.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Malaysia?

To stay informed about further developments, trends, and reports in the Construction Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence