Key Insights

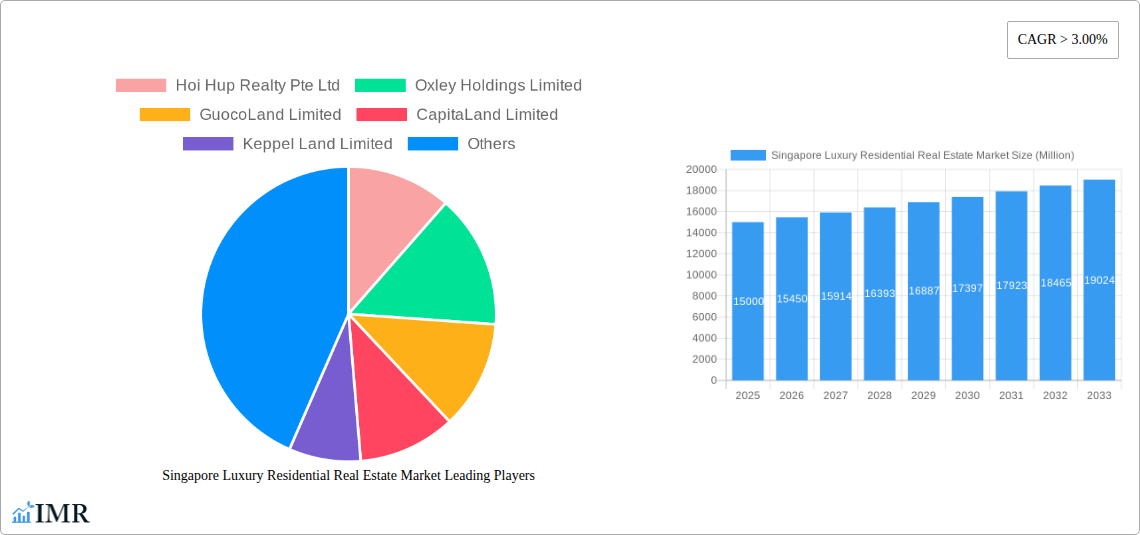

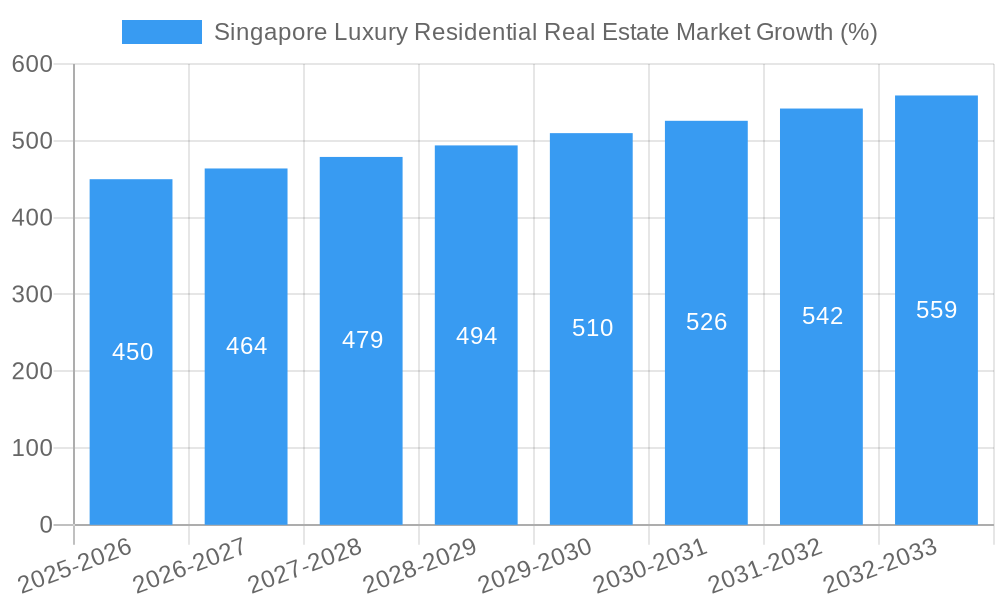

The Singapore luxury residential real estate market, valued at approximately $15 billion in 2025, exhibits robust growth potential, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. This expansion is fueled by several key drivers. Firstly, Singapore's strong economic fundamentals and its position as a global financial hub attract high-net-worth individuals seeking prestigious properties. Secondly, limited land availability and stringent development regulations contribute to the scarcity of luxury residences, further driving up prices. The increasing demand for high-end amenities, sustainable designs, and prime locations also influences market growth. The market is segmented by property type, with apartments and condominiums dominating the landscape, followed by villas and landed houses catering to a more discerning clientele. Prominent developers like CapitaLand, Keppel Land, and City Developments play a significant role in shaping the market's trajectory.

However, the market isn't without its challenges. Government regulations aimed at cooling the property market, including additional buyer's stamp duties and loan-to-value restrictions, act as a restraint on growth. Global economic uncertainties and fluctuations in the international property market also pose potential risks. Furthermore, shifting preferences among high-net-worth individuals might influence demand for specific property types or locations. Despite these challenges, the long-term outlook for the Singapore luxury residential real estate market remains positive, driven by enduring demand from affluent individuals and ongoing investments in infrastructure and luxury developments. The market is expected to continue expanding, albeit at a moderated pace, throughout the forecast period.

Singapore Luxury Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Singapore luxury residential real estate market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals, investors, and stakeholders. The report utilizes data from 2019-2024 as a historical period, with 2025 serving as the base and estimated year, and projecting the market's trajectory until 2033. Parent market: Singapore Real Estate; Child Market: Luxury Residential.

Singapore Luxury Residential Real Estate Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological influences shaping the luxury residential real estate market in Singapore. We examine market concentration, revealing the market share held by key players like CapitaLand Limited, City Developments Limited, and others. The analysis explores M&A activity, with estimated deal volumes reaching xx Million in 2024, driven by strategic expansion and portfolio diversification. Technological innovations, such as smart home integrations and virtual property tours, are assessed for their impact on market growth. Regulatory frameworks, including government policies on foreign ownership and land use, are detailed. The section also incorporates end-user demographic trends (e.g., high-net-worth individuals, expatriates), and explores the impact of substitute products (e.g., luxury condominiums vs. landed properties).

- Market Concentration: CapitaLand Limited holds an estimated xx% market share, followed by City Developments Limited at xx%, with the remaining share dispersed among other players.

- M&A Activity (2019-2024): Estimated volume: xx Million. Key drivers include strategic consolidation and expansion into prime locations.

- Technological Innovation: Smart home technology adoption is growing, with xx% of new luxury properties incorporating such features.

- Regulatory Influence: Government policies on foreign ownership and development restrictions significantly impact land prices and project feasibility.

Singapore Luxury Residential Real Estate Market Growth Trends & Insights

This section provides a detailed analysis of the market size evolution, from 2019 to 2033. Utilizing advanced forecasting methodologies, we project a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). The analysis accounts for factors such as economic growth, changes in consumer preferences towards luxury living, and the impact of technological disruptions on the industry. Market penetration of smart home features and virtual property tours are quantified, reflecting the evolving consumer expectations in this segment. The impact of economic fluctuations and government policies on market growth is also addressed.

- Market Size (2024): Estimated at xx Million.

- Projected Market Size (2033): Estimated at xx Million.

- CAGR (2025-2033): xx%

- Market Penetration of Smart Home Features (2025): xx%

Dominant Regions, Countries, or Segments in Singapore Luxury Residential Real Estate Market

This section identifies the leading segments within the Singapore luxury residential real estate market, focusing on “Apartments and Condominiums” and “Villas and Landed Houses.” While both segments contribute significantly, the analysis indicates that the “Apartments and Condominiums” segment is currently the dominant driver of market growth, attributable to factors like higher demand, and relatively higher transaction volumes. We examine the key drivers within each segment, including economic policies, infrastructural developments, and evolving consumer preferences. Market share and growth potential for each segment are thoroughly evaluated.

- Dominant Segment: Apartments and Condominiums

- Key Drivers (Apartments & Condominiums): High demand from high-net-worth individuals and expatriates, convenient location, and modern amenities.

- Key Drivers (Villas & Landed Houses): Preference for spaciousness and privacy, strong investment value in prime locations.

- Market Share (Apartments & Condominiums, 2024): xx%

- Market Share (Villas & Landed Houses, 2024): xx%

Singapore Luxury Residential Real Estate Market Product Landscape

The luxury residential real estate market in Singapore showcases continuous product innovation. Developers are incorporating smart home technology, sustainable design features, and enhanced security systems to cater to the discerning tastes of affluent buyers. Unique selling propositions (USPs) include premium finishes, bespoke design options, and exclusive access to amenities and concierge services. Technological advancements, like virtual reality property tours and digital twin technology, are enhancing the buyer experience and streamlining the purchasing process.

Key Drivers, Barriers & Challenges in Singapore Luxury Residential Real Estate Market

Key Drivers: Strong economic growth, increasing high-net-worth individuals, government initiatives promoting luxury developments, and technological advancements improving buyer experience.

Key Challenges: Stringent regulatory approvals, limited land availability, fluctuating economic conditions, and intense competition among developers. Supply chain disruptions due to global events can impact construction timelines and costs, potentially affecting project profitability by xx%.

Emerging Opportunities in Singapore Luxury Residential Real Estate Market

Emerging opportunities include the rising demand for sustainable luxury properties, growth in the rental market for luxury apartments, and increasing popularity of co-living spaces catering to high-net-worth individuals. Exploring untapped markets, such as developing luxury integrated resorts and wellness retreats, presents further growth potential. The adoption of metaverse technology offers new avenues for marketing and sales.

Growth Accelerators in the Singapore Luxury Residential Real Estate Market Industry

Strategic partnerships between developers and luxury brands, investments in technological innovation to enhance the customer journey, and expansion into new luxury niche markets will accelerate market growth. Government incentives promoting sustainable development and luxury tourism will further bolster the sector's expansion.

Key Players Shaping the Singapore Luxury Residential Real Estate Market Market

- Hoi Hup Realty Pte Ltd

- Oxley Holdings Limited

- GuocoLand Limited

- CapitaLand Limited

- Keppel Land Limited

- MCC Land Limited

- Bukit Sembawang Estates Limited

- City Developments Limited

- MCL Land

- Allgreen Properties Limited

Notable Milestones in Singapore Luxury Residential Real Estate Market Sector

- 2020-Q4: Launch of [Project Name], a luxury condominium project incorporating smart home technology.

- 2021-Q2: Merger between [Company A] and [Company B], creating a larger player in the luxury residential market.

- 2022-Q3: Government announces new incentives for sustainable luxury developments.

In-Depth Singapore Luxury Residential Real Estate Market Market Outlook

The Singapore luxury residential real estate market is poised for sustained growth over the next decade, driven by strong economic fundamentals, increasing high-net-worth individuals, and ongoing infrastructural development. Strategic partnerships and technological advancements will play a key role in shaping the industry's future. Opportunities exist for developers to focus on sustainability, bespoke design, and innovative marketing strategies to cater to the evolving preferences of affluent buyers.

Singapore Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

Singapore Luxury Residential Real Estate Market Segmentation By Geography

- 1. Singapore

Singapore Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid urbanization; Government initiatives

- 3.3. Market Restrains

- 3.3.1. High property prices; Regulatory challenges

- 3.4. Market Trends

- 3.4.1. UHNWI in Asia Driving the Demand for Luxury Properties

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Singapore Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hoi Hup Realty Pte Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oxley Holdings Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GuocoLand Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CapitaLand Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Keppel Land Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 MCC Land Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bukit Sembawang Estates Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 City Developments Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MCL Land

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Allgreen Properties Limited**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hoi Hup Realty Pte Ltd

List of Figures

- Figure 1: Singapore Luxury Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Singapore Luxury Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Singapore Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Singapore Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Singapore Luxury Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Singapore Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Singapore Luxury Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Singapore Luxury Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Singapore Luxury Residential Real Estate Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Singapore Luxury Residential Real Estate Market?

Key companies in the market include Hoi Hup Realty Pte Ltd, Oxley Holdings Limited, GuocoLand Limited, CapitaLand Limited, Keppel Land Limited, MCC Land Limited, Bukit Sembawang Estates Limited, City Developments Limited, MCL Land, Allgreen Properties Limited**List Not Exhaustive.

3. What are the main segments of the Singapore Luxury Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid urbanization; Government initiatives.

6. What are the notable trends driving market growth?

UHNWI in Asia Driving the Demand for Luxury Properties.

7. Are there any restraints impacting market growth?

High property prices; Regulatory challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Singapore Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Singapore Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Singapore Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Singapore Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence