Key Insights

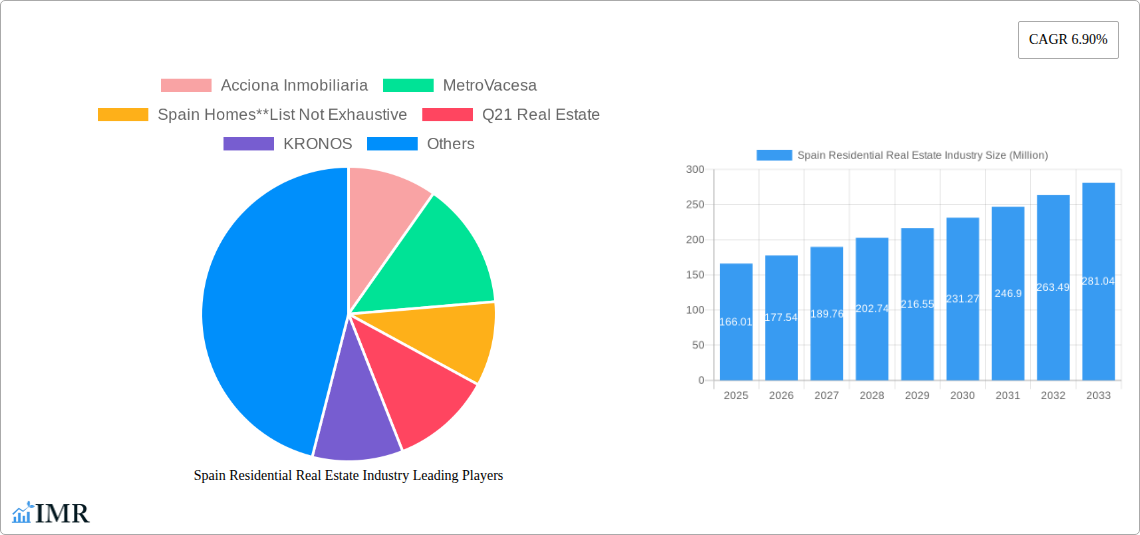

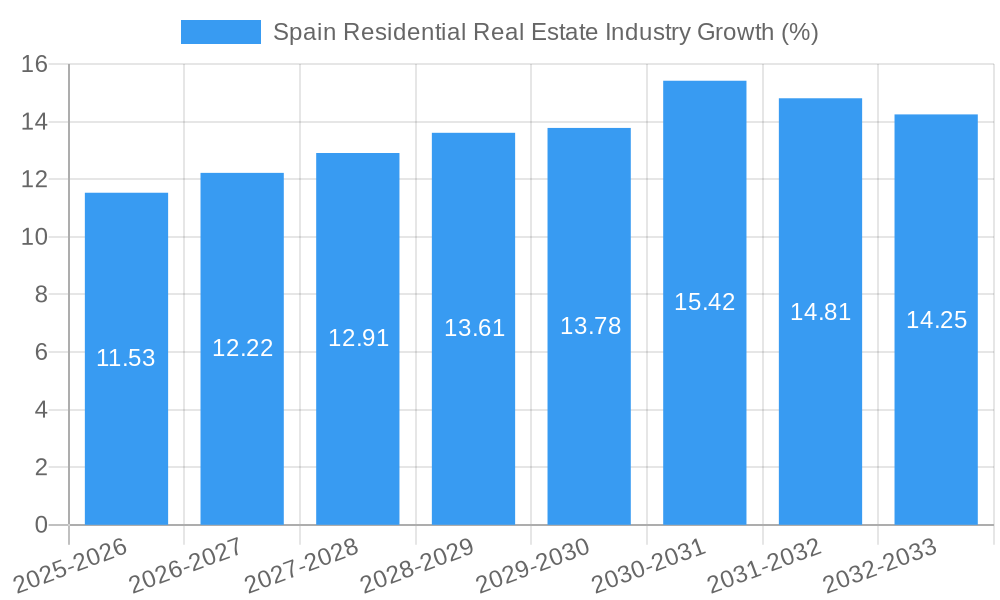

The Spain residential real estate market, valued at €166.01 million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.90% from 2025 to 2033. This positive trajectory is driven by several key factors. Increasing urbanization, particularly in major cities like Madrid and Barcelona, fuels demand for housing. A growing tourism sector necessitates additional accommodation, contributing to the market's expansion. Furthermore, government initiatives aimed at stimulating the housing market, such as tax incentives for homebuyers or investment in infrastructure, can positively influence market growth. Competition within the sector is intense, with major players like Acciona Inmobiliaria, Metrovacesa, and Neinor Homes vying for market share. However, challenges remain, including potential fluctuations in the national and global economies, which could impact buyer confidence and investment levels. The market is segmented by property type (apartments/condominiums, villas/landed houses) and key cities, with Madrid, Barcelona, Valencia, and Malaga representing significant segments. The relatively high cost of housing in prime locations may constrain accessibility for certain income groups, presenting an ongoing challenge for the market.

The forecast period (2025-2033) anticipates continued growth, although the rate may experience minor fluctuations depending on macroeconomic factors. The diverse range of property types caters to various buyer preferences and budgets. However, strategic planning is crucial for developers to address the varying needs and priorities across different segments, ensuring long-term market viability. Sustainable development practices and environmentally conscious designs will likely gain increasing prominence as consumer preferences evolve and environmental regulations tighten. The existing player base comprises a mix of established and emerging firms, suggesting a competitive landscape characterized by both innovation and established expertise. Successful navigation of this market necessitates careful consideration of these dynamic factors.

Spain Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report delivers an in-depth analysis of the Spain residential real estate industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for investors, developers, real estate professionals, and anyone seeking to understand this dynamic market. The report segments the market by type (Apartments & Condominiums, Villas & Landed Houses) and key cities (Madrid, Catalonia, Valencia, Barcelona, Malaga, Others).

Spain Residential Real Estate Industry Market Dynamics & Structure

This section analyzes the Spanish residential real estate market's competitive landscape, regulatory environment, and technological influences. The market is characterized by a mix of large national players and smaller regional firms. Market concentration is moderate, with a few dominant players holding significant shares, although fragmentation is also evident, particularly in the smaller cities and towns.

- Market Concentration: xx% held by top 5 players (Acciona Inmobiliaria, MetroVacesa, Via Celere, Neinor Homes, AEDAS Homes - List Not Exhaustive). Remaining share distributed among numerous smaller firms and individual developers.

- Technological Innovation: Increasing adoption of PropTech solutions, including virtual tours, online property portals, and data analytics. However, barriers to entry include the cost of technology implementation and resistance to change in traditional operations.

- Regulatory Framework: Government regulations concerning construction permits, environmental standards, and property taxation significantly influence market activity. Recent policy changes may have had xx Million units impact on housing supply.

- Competitive Product Substitutes: Rental properties and alternative accommodation forms, such as Airbnb, exert competitive pressure on the traditional homeownership market.

- End-User Demographics: Population growth, urbanization, and changing household structures drive demand. The report will offer detailed analysis on the age, income, and family size of the average buyer.

- M&A Trends: Moderate M&A activity observed, with xx number of deals recorded between 2019 and 2024, primarily involving consolidation among smaller players and expansions by major firms.

Spain Residential Real Estate Industry Growth Trends & Insights

This section provides a detailed analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts within the Spanish residential real estate sector from 2019 to 2033. Leveraging extensive data and analysis, we project a Compound Annual Growth Rate (CAGR) of xx% for the market during the forecast period (2025-2033). This growth is attributed to various factors, including increasing urbanization, a growing population, and improving economic conditions. Market penetration of sustainable building practices and smart home technologies is expected to increase at xx% CAGR. Consumer behavior is shifting towards a preference for modern, energy-efficient homes in strategic locations with convenient amenities. The report thoroughly examines the impact of these trends on market dynamics.

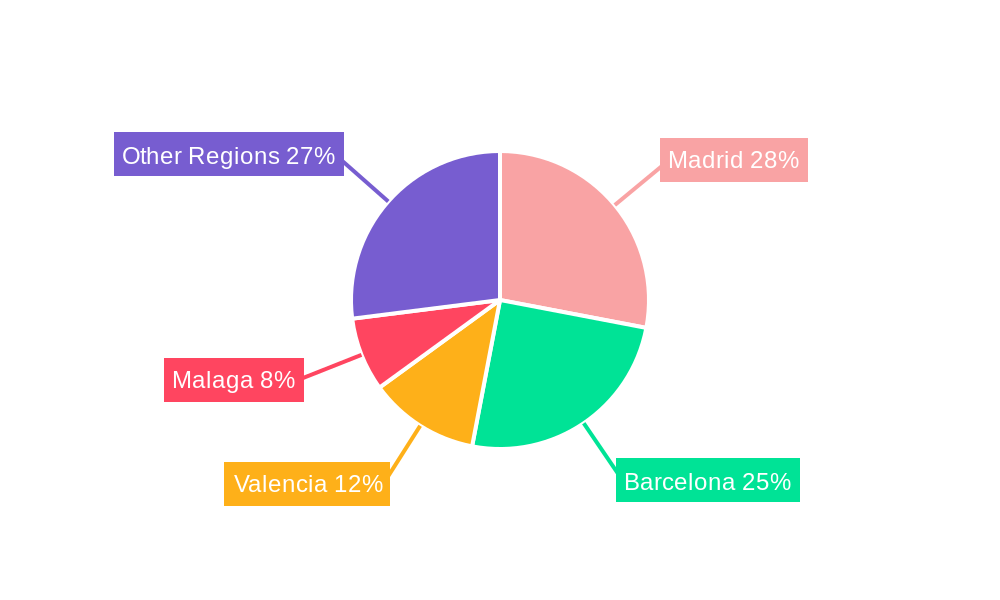

Dominant Regions, Countries, or Segments in Spain Residential Real Estate Industry

Madrid, Barcelona, and Catalonia consistently dominate the Spanish residential real estate market due to strong economic activity, high population density, and robust infrastructure. Valencia and Malaga also show significant growth potential.

- Apartments and Condominiums: This segment constitutes the largest share (xx Million units) of the market due to high demand from young professionals and families.

- Villas and Landed Houses: This segment (xx Million units) is driven by high-net-worth individuals and families seeking larger properties in suburban or rural areas.

- Key Cities:

- Madrid: Strong economic activity, high population density, and government investment in infrastructure have solidified Madrid's position as the leading market.

- Catalonia (including Barcelona): A thriving tourism sector, significant foreign investment, and a diverse population contribute to high demand in Catalonia.

- Valencia: A growing economy, affordable prices, and attractive lifestyle contribute to the increasing popularity of Valencia.

- Barcelona: Barcelona's global appeal and strong tourism industry continue to attract investors and buyers.

- Malaga: Its coastal location, favorable climate, and increasing popularity as a retirement destination boost demand.

- Others: The remainder of the market displays diverse growth patterns reflecting regional economic conditions and demographics.

Spain Residential Real Estate Industry Product Landscape

The Spanish residential real estate market offers a diverse range of properties, from luxury apartments and villas to affordable housing units. Increasingly, developers are incorporating smart home technology, energy-efficient design, and sustainable materials to appeal to environmentally conscious buyers. Unique selling propositions focus on location, amenities, and architectural design, reflecting the diverse preferences of the target market. The application of new technologies is leading to improved construction processes and more efficient property management.

Key Drivers, Barriers & Challenges in Spain Residential Real Estate Industry

Key Drivers:

- Strong economic growth in Spain.

- Increasing urbanization and population growth.

- Government initiatives to promote affordable housing.

- Growing demand for sustainable and energy-efficient homes.

Challenges:

- Bureaucratic hurdles and lengthy permitting processes can delay projects.

- High construction costs and scarcity of skilled labor can limit supply.

- Fluctuations in the economy and interest rates affect buyer affordability.

- Increasing competition from alternative accommodation options, such as Airbnb.

Emerging Opportunities in Spain Residential Real Estate Industry

- Growing demand for eco-friendly housing incorporating sustainable materials and energy-efficient technology.

- Expansion into niche markets, such as senior living facilities.

- Increased adoption of PropTech solutions to improve efficiency and streamline transactions.

- Development of rental housing, particularly build-to-rent (BTR) projects.

Growth Accelerators in the Spain Residential Real Estate Industry

Technological advancements, strategic partnerships, and expansion into untapped markets, such as rural areas with high tourism potential, will accelerate future market growth. The increasing adoption of data-driven decision-making tools will enable companies to optimize investment strategies and maximize returns.

Key Players Shaping the Spain Residential Real Estate Industry Market

- Acciona Inmobiliaria

- MetroVacesa

- Spain Homes

- Q21 Real Estate

- KRONOS

- Via Celere

- AELCA

- Neinor Homes

- Pryconsa

- AEDAS homes

Notable Milestones in Spain Residential Real Estate Industry Sector

- October 2022: Layetana Living and Aviva Investors' EUR 500 million (USD 531.20 Million) BTR portfolio launch signals a significant investment in the Spanish rental market. The purchase of a 71-unit building in Barcelona highlights the growing interest in BTR developments.

- September 2022: Berkshire Hathaway HomeServices expansion into the Valencian Community indicates increasing foreign investment and confidence in the Spanish residential market.

In-Depth Spain Residential Real Estate Industry Market Outlook

The Spanish residential real estate market is poised for continued growth, driven by robust economic fundamentals, population dynamics, and government initiatives. Strategic partnerships, technological innovation, and investment in sustainable development practices will shape the sector's future trajectory. The market presents significant opportunities for investors and developers who can adapt to evolving consumer preferences and effectively navigate the regulatory landscape.

Spain Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. Key Cities

- 2.1. Madrid

- 2.2. Catalonia

- 2.3. Valencia

- 2.4. Barcelona

- 2.5. Malaga

- 2.6. Others

Spain Residential Real Estate Industry Segmentation By Geography

- 1. Spain

Spain Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of High Net-Worth Individuals (HNWIs)

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Rise in International Property Buyers in Spain

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Madrid

- 5.2.2. Catalonia

- 5.2.3. Valencia

- 5.2.4. Barcelona

- 5.2.5. Malaga

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Acciona Inmobiliaria

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MetroVacesa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Spain Homes**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Q21 Real Estate

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KRONOS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Via Celere

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 AELCA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Neinor Homes

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pryconsa

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 AEDAS homes

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Acciona Inmobiliaria

List of Figures

- Figure 1: Spain Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Spain Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Spain Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Spain Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spain Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Spain Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Spain Residential Real Estate Industry Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Spain Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Residential Real Estate Industry?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Spain Residential Real Estate Industry?

Key companies in the market include Acciona Inmobiliaria, MetroVacesa, Spain Homes**List Not Exhaustive, Q21 Real Estate, KRONOS, Via Celere, AELCA, Neinor Homes, Pryconsa, AEDAS homes.

3. What are the main segments of the Spain Residential Real Estate Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 166.01 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of High Net-Worth Individuals (HNWIs).

6. What are the notable trends driving market growth?

Rise in International Property Buyers in Spain.

7. Are there any restraints impacting market growth?

4.; Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

October 2022: A build-to-rent (BTR) cooperation between Layetana Living and Aviva Investors was established in Spain. According to the statement, the collaboration between Aviva and the Spanish developer Layetana will construct a more than EUR 500 million (USD 531.20 Million) residential portfolio, already securing its first development project. Based on the recommendation of international real estate consultancy Knight Frank, the partnership purchased a 71-unit residential building in Barcelona's Sants neighborhood. Construction is scheduled to begin at the end of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Spain Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence