Key Insights

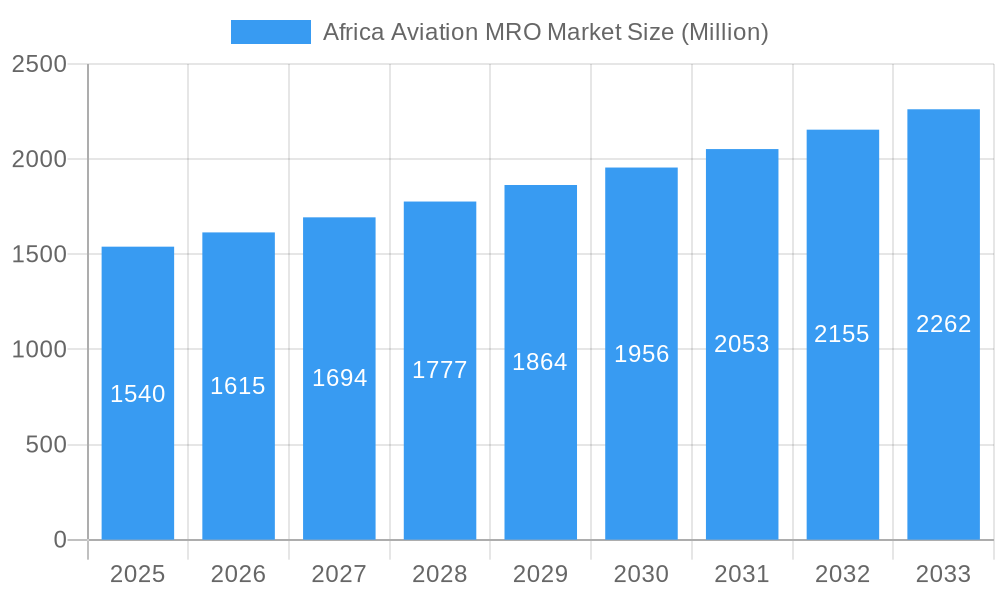

The African Aviation Maintenance, Repair, and Overhaul (MRO) market, valued at $1.54 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.79% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning air travel sector across Africa, spurred by increasing disposable incomes and tourism, necessitates a corresponding rise in MRO services. Furthermore, the modernization of existing fleets and the introduction of newer, more technologically advanced aircraft create significant demand for specialized maintenance and repair capabilities. Government initiatives focused on improving aviation infrastructure and safety standards also contribute positively to market growth. However, challenges persist, including a shortage of skilled technicians, inconsistent regulatory frameworks across different African nations, and the high cost of acquiring advanced MRO technologies. Despite these hurdles, the long-term outlook for the African Aviation MRO market remains optimistic, with substantial opportunities for both domestic and international players. The market is segmented by aircraft type (fixed-wing and rotorcraft), aviation type (commercial, military, and general aviation), and MRO type (engine, components, interior, airframe, and field maintenance). Key players like Ethiopian Airlines, Airbus SE, and Safran SA are strategically positioned to benefit from this growth, focusing on expanding their capabilities and partnerships to meet the escalating demand. The substantial growth potential is particularly evident in regions like South Africa, Kenya, and Nigeria, which represent significant hubs for aviation activity.

Africa Aviation MRO Market Market Size (In Billion)

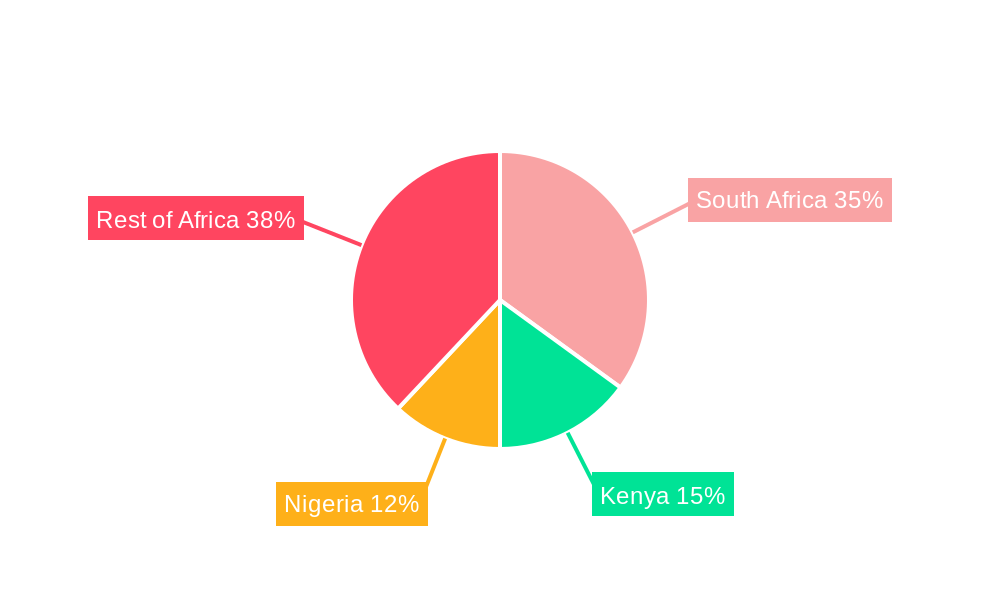

The market segmentation reveals a diverse landscape with engine MRO currently holding the largest share, driven by the complexity and high cost of engine maintenance. However, the components and modifications MRO segment is expected to witness the highest growth rate during the forecast period due to increasing technological advancements in aircraft components and the growing need for customized modifications. The geographic distribution of the market is uneven, with South Africa leading in terms of market share due to its more developed aviation infrastructure and established MRO facilities. However, significant growth potential exists across other African countries, particularly in the East and West African regions, as these regions expand their aviation sectors and attract investment in aviation infrastructure. Continued investment in training and upskilling programs to address the skilled labor shortage will be vital for the sustainable growth of the African Aviation MRO market.

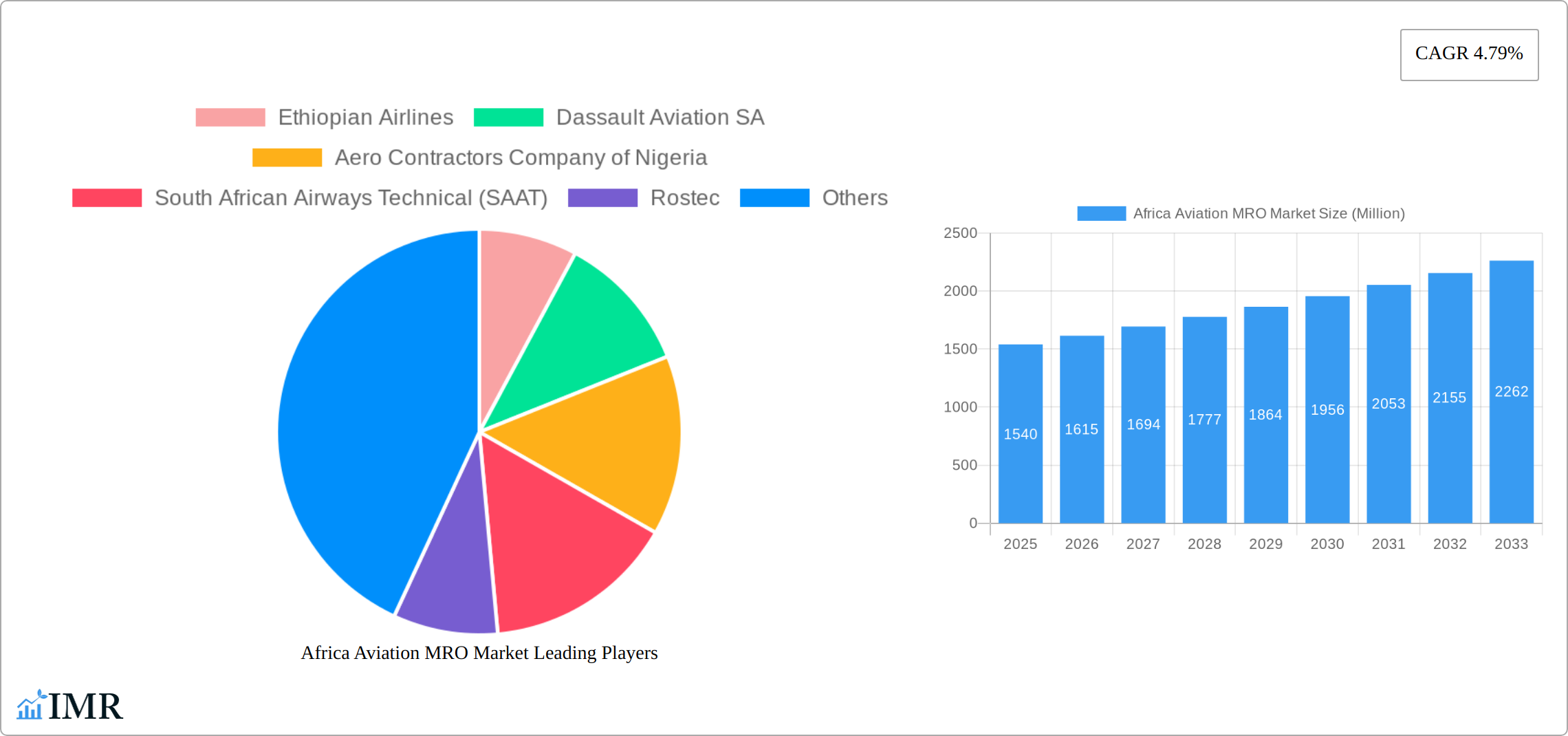

Africa Aviation MRO Market Company Market Share

Africa Aviation MRO Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa Aviation Maintenance, Repair, and Overhaul (MRO) market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The total market size in 2025 is estimated at xx Million.

Africa Aviation MRO Market Dynamics & Structure

The African aviation MRO market is characterized by a fragmented landscape with a mix of large international players and smaller regional operators. Market concentration is relatively low, with no single entity dominating. Technological innovation, particularly in areas like predictive maintenance and digitalization, is a key driver, although challenges exist regarding infrastructure and skilled labor. Regulatory frameworks vary across the continent, creating both opportunities and complexities. The market faces competition from new entrants and substitutes, including outsourced maintenance services. M&A activity remains significant, with strategic partnerships and acquisitions shaping market consolidation.

- Market Concentration: Low, with xx% market share held by the top 5 players in 2025.

- Technological Innovation: Adoption of predictive maintenance and digital technologies is increasing, but slow adoption is hindered by infrastructure limitations and skills gap.

- Regulatory Framework: Varied across African nations, impacting standardization and operational efficiency.

- Competitive Substitutes: Increasing competition from outsourced maintenance services and regional players.

- M&A Activity: Moderate level of mergers and acquisitions, with xx deals recorded between 2019 and 2024.

- End-User Demographics: Predominantly commercial aviation, with growing demand from military and general aviation segments.

Africa Aviation MRO Market Growth Trends & Insights

The African aviation Maintenance, Repair, and Overhaul (MRO) market is experiencing a dynamic and accelerated growth phase. This surge is directly fueled by the continent's burgeoning air travel demand, a significant expansion in airline fleet sizes, and a growing number of aircraft operating within the region. Projections indicate a robust Compound Annual Growth Rate (CAGR) of XX% for the period spanning 2025 to 2033, underscoring the market's substantial expansion potential. Key to this growth are technological advancements, including the widespread adoption of sophisticated diagnostic systems, AI-powered predictive maintenance solutions, and advanced data analytics. These innovations are instrumental in streamlining maintenance workflows, enhancing efficiency, and ultimately reducing operational expenditures for airlines. Moreover, a discernible shift in airline strategies, with a greater inclination towards outsourcing non-core MRO functions, is a significant contributor to this expanding market. Despite this growth, the penetration of specialized MRO services remains relatively nascent, presenting considerable untapped opportunities for future development and market penetration. Specific, in-depth quantitative analysis based on proprietary data from XXX will be detailed in the comprehensive market report.

Dominant Regions, Countries, or Segments in Africa Aviation MRO Market

The North African region, particularly countries like Egypt and Morocco, currently leads the African aviation MRO market due to their established infrastructure and relatively advanced aviation sectors. However, sub-Saharan Africa shows significant growth potential, driven by increasing air travel and investment in aviation infrastructure.

Leading Segments:

- Aircraft Type: Fixed-wing aircraft dominates the market, representing xx% of the total market share in 2025. Growth in the rotorcraft segment is expected to be slower, representing only xx% in 2025.

- Aviation Type: Commercial aviation constitutes the largest segment, followed by military aviation and general aviation. Commercial aviation holds xx% of the market share in 2025, while Military Aviation and General Aviation hold xx% and xx% respectively.

- MRO Type: Engine MRO holds the largest market share (xx%) followed by Airframe MRO (xx%), Component and Modifications MRO (xx%), Interior MRO (xx%) and Field Maintenance (xx%).

Key Drivers:

- Economic Growth: Rising disposable incomes and expanding tourism sectors fuel demand for air travel.

- Government Initiatives: Investments in aviation infrastructure and supportive regulatory frameworks.

- Airline Expansion: Growth of both legacy and low-cost carriers.

Africa Aviation MRO Market Product Landscape

The African aviation MRO market encompasses a comprehensive spectrum of services, ranging from routine airframe checks and minor repairs to highly intricate and specialized engine overhauls and critical component repairs. The landscape is being continually reshaped by technological evolution, driving the integration of cutting-edge diagnostic tools, predictive maintenance technologies, and sophisticated digital solutions. These advancements are pivotal in elevating operational efficiency, minimizing aircraft downtime, and improving overall service quality. Service providers are increasingly differentiating themselves through unique selling propositions that leverage deep regional expertise, offer highly competitive pricing structures, and provide bespoke service packages meticulously designed to meet the diverse and evolving needs of various airline operators across the continent.

Key Drivers, Barriers & Challenges in Africa Aviation MRO Market

Key Drivers:

- Surging Air Travel Demand: The continuous and substantial increase in passenger and cargo traffic across the African continent is a primary catalyst, creating an ever-growing requirement for reliable and efficient MRO services to ensure operational continuity.

- Aging Aircraft Fleets: A significant portion of the existing aircraft fleets in Africa are aging, necessitating more frequent, extensive, and specialized maintenance interventions, thus boosting demand for MRO activities.

- Strategic Investments in Aviation Infrastructure: Ongoing and planned investments in modernizing airport facilities, expanding air traffic control systems, and enhancing related logistical infrastructure are crucial enablers, directly contributing to improved MRO capabilities and service delivery.

Challenges and Restraints:

- Critical Skills Gap: A persistent and significant shortage of highly skilled and certified aviation technicians, engineers, and specialized MRO personnel continues to be a major impediment to the industry's robust growth and expansion.

- Infrastructure Limitations: The presence of inadequate or outdated maintenance facilities, a lack of specialized equipment, and insufficient logistical support infrastructure often constrain operational efficiency and capacity. This constraint is estimated to result in an annual financial loss of approximately XX Million for the industry due to extended turnaround times and missed opportunities.

- Regulatory Complexity and Harmonization: The presence of fragmented and sometimes inconsistent regulatory frameworks across various African nations poses significant challenges for MRO providers and operators, impacting cross-border operations and standardization.

Emerging Opportunities in Africa Aviation MRO Market

- Growth of Low-Cost Carriers: Expansion of low-cost airlines creates demand for cost-effective MRO solutions.

- Specialized MRO Services: Increased demand for specialized services like engine MRO and component repair.

- Digitalization: Adoption of digital technologies and data analytics offers opportunities for optimization and improved efficiency.

Growth Accelerators in the Africa Aviation MRO Market Industry

Technological advancements, strategic partnerships between international and local MRO providers, and government initiatives to improve aviation infrastructure are key growth drivers. These factors, combined with a growing air travel market, are poised to propel the sector's expansion in the coming years.

Key Players Shaping the Africa Aviation MRO Market Market

- Ethiopian Airlines

- Dassault Aviation SA

- Aero Contractors Company of Nigeria

- South African Airways Technical (SAAT)

- Rostec

- Airbus SE

- Egyptair Maintenance & Engineering

- Safran SA

- Denel SOC Ltd

- RTX Corporation

- Pilatus Aircraft Ltd

- Lufthansa Technik AG

- Leonardo S p A

- Saab AB

- Sabena technics S A

Notable Milestones in Africa Aviation MRO Market Sector

- May 2023: ExecuJet MRO Services achieved a significant milestone by being appointed as an Authorized Service Center (ASC) for Embraer business jets, expanding its service reach across the entire African continent.

- January 2023: RwandAir formalized a strategic multi-year contract with Iberia Maintenance, entrusting them with the critical Boeing 737 engine maintenance services, highlighting a growing trend in regional partnerships for specialized MRO.

In-Depth Africa Aviation MRO Market Market Outlook

The African aviation MRO market presents substantial growth opportunities driven by an expanding air travel market, increasing fleet sizes, and advancements in technology. Strategic investments in infrastructure, skills development, and technological adoption will be critical in realizing the market's full potential. The market is expected to attract further foreign investment, leading to increased competition and further consolidation. The long-term outlook remains positive, with a projected market size of xx Million by 2033.

Africa Aviation MRO Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Aviation MRO Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Aviation MRO Market Regional Market Share

Geographic Coverage of Africa Aviation MRO Market

Africa Aviation MRO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries

- 3.3. Market Restrains

- 3.3.1. ; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies

- 3.4. Market Trends

- 3.4.1. Fixed-Wing Aircraft to Witness Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Aviation MRO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ethiopian Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dassault Aviation SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aero Contractors Company of Nigeria

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 South African Airways Technical (SAAT)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rostec

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Airbus SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Egyptair Maintenance & Engineering

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safran SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Denel SOC Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RTX Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Pilatus Aircraft Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Lufthansa Technik AG

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Leonardo S p A

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Saab AB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sabena technics S A

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Ethiopian Airlines

List of Figures

- Figure 1: Africa Aviation MRO Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Aviation MRO Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Aviation MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Aviation MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Africa Aviation MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Africa Aviation MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Africa Aviation MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Africa Aviation MRO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Africa Aviation MRO Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Africa Aviation MRO Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Africa Aviation MRO Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Africa Aviation MRO Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Africa Aviation MRO Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Africa Aviation MRO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: South Africa Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Egypt Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Morocco Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ghana Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Algeria Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Tanzania Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ivory Coast Africa Aviation MRO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Aviation MRO Market?

The projected CAGR is approximately 4.79%.

2. Which companies are prominent players in the Africa Aviation MRO Market?

Key companies in the market include Ethiopian Airlines, Dassault Aviation SA, Aero Contractors Company of Nigeria, South African Airways Technical (SAAT), Rostec, Airbus SE, Egyptair Maintenance & Engineering, Safran SA, Denel SOC Ltd, RTX Corporation, Pilatus Aircraft Ltd, Lufthansa Technik AG, Leonardo S p A, Saab AB, Sabena technics S A.

3. What are the main segments of the Africa Aviation MRO Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.54 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Seaborne Threats And Ambiguous Maritime Security Policies; Increasing Adoption Of Security Technologies In Bric Countries.

6. What are the notable trends driving market growth?

Fixed-Wing Aircraft to Witness Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Risk Rate In Ungoverned Zones; Unstructured Security Standards And Technologies.

8. Can you provide examples of recent developments in the market?

May 2023: ExecuJet MRO Services, the business aviation maintenance, repair, and overhaul (MRO) organization in Africa, was appointed as the authorized service center (ASC) for Embraer business jets across the region. The partnership signifies a significant expansion of Embraer’s service network in the region and reinforces ExecuJet’s position as a trusted and reliable MRO provider.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Aviation MRO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Aviation MRO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Aviation MRO Market?

To stay informed about further developments, trends, and reports in the Africa Aviation MRO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence