Key Insights

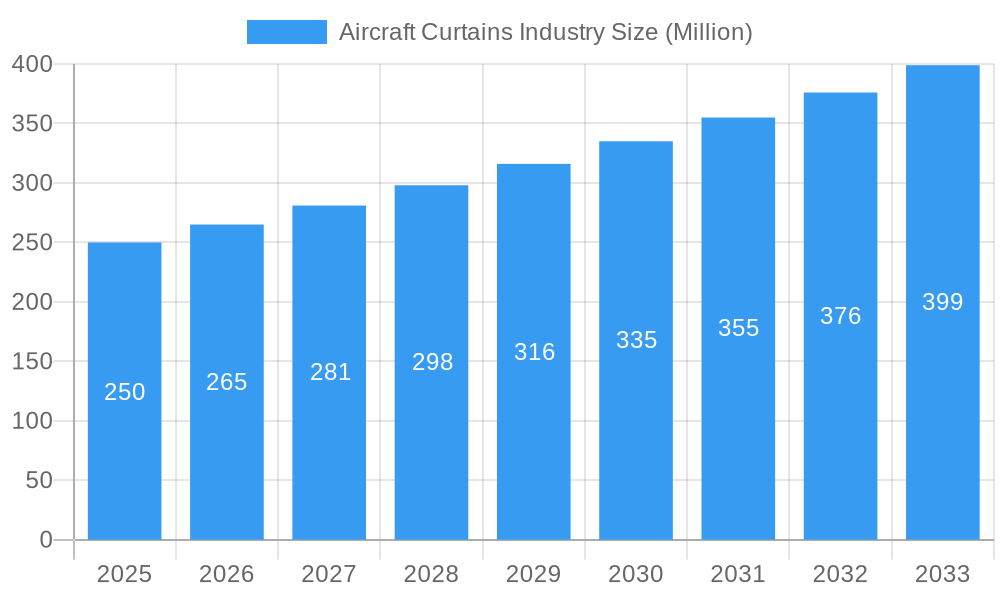

The global Aircraft Curtains Industry is poised for robust growth, projected to reach a market size of approximately $250 million by 2025, with a significant Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This expansion is primarily fueled by the escalating demand for enhanced passenger comfort and cabin aesthetics, particularly within the commercial aviation sector. The increasing global air traffic and the subsequent need for fleet modernization and cabin refurbishment are key drivers. Furthermore, the growing emphasis on lightweight and flame-retardant materials in aircraft interiors contributes to the adoption of advanced curtain solutions. Emerging economies, with their rapidly expanding aviation infrastructure, are also presenting substantial opportunities for market players.

Aircraft Curtains Industry Market Size (In Million)

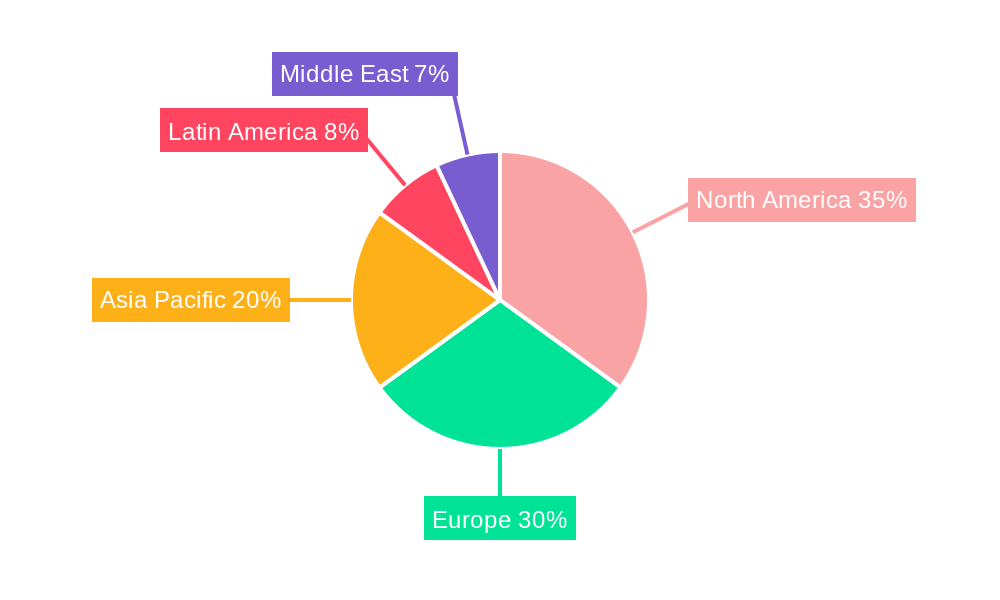

The industry is experiencing a dynamic shift with a growing preference for advanced, sustainable, and aesthetically pleasing cabin designs. Key trends include the integration of smart technologies, such as automated curtain controls and enhanced light-filtering capabilities, to improve the passenger experience. The development of novel, durable, and aesthetically versatile fabrics is also a significant trend. However, the market faces certain restraints, including stringent aviation regulations and the high cost of specialized materials and manufacturing processes. Despite these challenges, the continuous innovation in material science and the increasing focus on passenger satisfaction are expected to propel the aircraft curtains market forward, with North America and Europe leading in market share due to their well-established aviation sectors, while the Asia Pacific region presents significant growth potential.

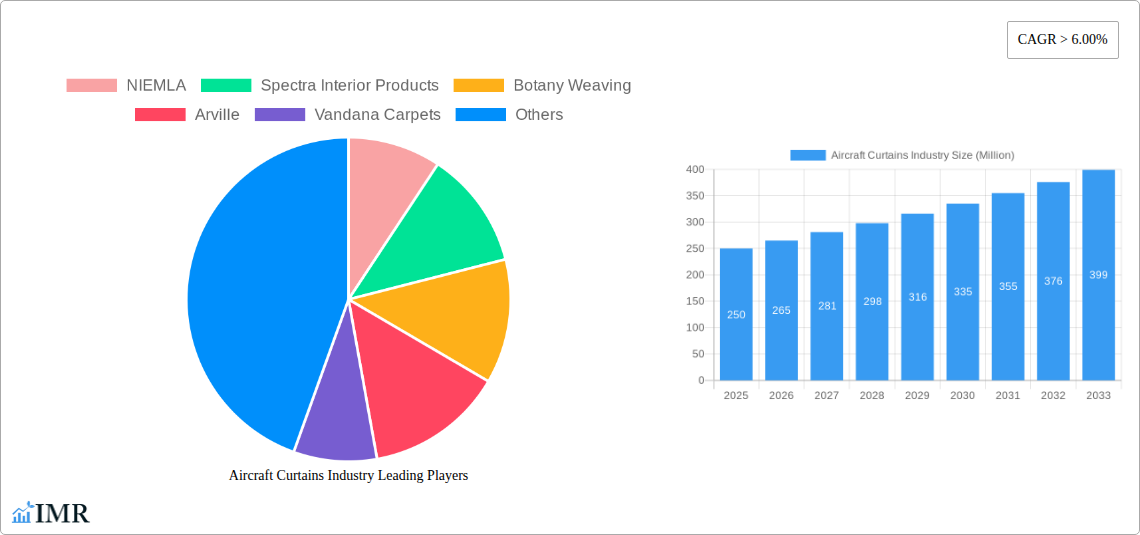

Aircraft Curtains Industry Company Market Share

Here's a compelling, SEO-optimized report description for the Aircraft Curtains Industry, designed for maximum visibility and engagement:

Aircraft Curtains Industry Report: Market Size, Trends, and Forecast 2019–2033

Gain unparalleled insights into the global Aircraft Curtains Industry with this comprehensive market research report. Covering a detailed study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report delves into critical market dynamics, growth trends, competitive landscape, and future opportunities. Essential for industry professionals, manufacturers, suppliers, and investors seeking to understand the evolving aircraft interior market, aerospace textiles, and passenger experience solutions.

This report provides a granular analysis of both the parent market (overall aircraft interiors) and child markets (specific aircraft curtain segments), offering a holistic view. With all values presented in Million units, this research delivers actionable data for strategic decision-making in the aviation industry.

Key Segments Analyzed:

Key Companies Featured: NIEMLA, Spectra Interior Products, Botany Weaving, Arville, Vandana Carpets, Lantal, EPSILON AEROSPAC, ABC International, Fu-Chi Innovation Technology Co Ltd, FELLFAB, Industrial Neotex SA, ACM Aircraft Cabin Modification GmbH, Belgraver aircraft interiors.

- End User: Commercial Aircraft, Military Aircraft, General Aviation

- Type: Cabin Curtains, Window Curtains

Aircraft Curtains Industry Market Dynamics & Structure

The Aircraft Curtains Industry is characterized by a moderately consolidated market structure, with a few key players holding significant market share, driven by technological innovation in flame-retardant, lightweight, and aesthetically pleasing materials. Regulatory frameworks, such as FAA and EASA certifications for aviation materials, play a crucial role in market entry and product development. Competitive product substitutes include advanced composite materials and engineered textiles, though the specialized nature of aircraft curtains limits direct replacement. End-user demographics, primarily airlines and aircraft manufacturers, dictate demand, influenced by fleet expansion, cabin retrofitting projects, and evolving passenger preferences for enhanced cabin ambiance. Mergers and acquisitions (M&A) activity is present, driven by strategic partnerships aimed at expanding product portfolios and global reach.

- Market Concentration: Dominated by a blend of established aviation interior specialists and niche textile manufacturers.

- Technological Innovation: Focus on fire safety (e.g., FAR 25.853 compliance), weight reduction, acoustic dampening, and UV protection.

- Regulatory Frameworks: Stringent certification processes for material safety, flammability, and performance standards.

- Competitive Substitutes: Limited direct substitutes due to specialized requirements, but advancements in alternative cabin materials present indirect competition.

- End-User Demographics: Airlines (for new builds and retrofits), Aircraft Manufacturers (OEMs), and MRO providers.

- M&A Trends: Strategic acquisitions to gain market access, technological capabilities, or expand product offerings.

Aircraft Curtains Industry Growth Trends & Insights

The Aircraft Curtains Industry is poised for significant growth, driven by the projected expansion of the global commercial aircraft fleet and an increasing emphasis on passenger comfort and cabin aesthetics. The market size is expected to evolve from approximately $350 million in 2019 to an estimated $780 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period. Adoption rates for advanced, high-performance aircraft curtains are steadily increasing as airlines seek to differentiate their passenger experience and comply with evolving regulations. Technological disruptions, such as the integration of smart fabrics for light control and enhanced insulation, are beginning to influence product development. Consumer behavior shifts, particularly the demand for premium cabin environments and personalized travel experiences, are compelling manufacturers to invest in innovative, aesthetically superior, and functional curtain solutions. The resurgence in air travel post-pandemic is a major catalyst for growth, with airlines prioritizing cabin upgrades and new aircraft deliveries. Furthermore, the military aviation sector's ongoing modernization programs contribute to sustained demand for durable and specialized aircraft curtains.

Dominant Regions, Countries, or Segments in Aircraft Curtains Industry

The Commercial Aircraft segment, particularly within the cabin curtains category, is the dominant driver of growth in the global Aircraft Curtains Industry. This dominance is underpinned by the sheer volume of commercial passenger flights and the continuous need for airlines to refresh their cabin interiors to maintain a competitive edge and enhance passenger satisfaction. Leading regions such as North America and Europe command significant market share due to the presence of major aircraft manufacturers (Boeing and Airbus) and a high concentration of established airlines with substantial fleet sizes undertaking regular cabin retrofits. Asia-Pacific is emerging as a rapid growth region, fueled by the expansion of low-cost carriers and a burgeoning middle class driving air travel demand. The demand for window curtains also remains robust, essential for passenger comfort, privacy, and light management. Key drivers include economic policies supporting aviation infrastructure, increasing disposable incomes, and favorable tourism trends that directly impact airline profitability and investment in cabin upgrades. The continuous evolution of aircraft cabin design, driven by passenger expectations and operational efficiency goals, further solidifies the commercial aircraft segment's leadership.

- Dominant Segment: Commercial Aircraft, specifically Cabin Curtains.

- Key Regional Markets: North America, Europe, and Asia-Pacific.

- Driving Factors: Fleet expansion, cabin retrofitting, passenger experience enhancement, regulatory compliance, economic growth, and tourism.

- Growth Potential: High in Asia-Pacific due to rapid air travel expansion.

- Type Dominance: Cabin Curtains lead, with Window Curtains as a significant sub-segment.

Aircraft Curtains Industry Product Landscape

Innovations in the aircraft curtains sector are increasingly focused on enhanced functionality and sustainability. Products are being developed with advanced flame-retardant properties exceeding regulatory requirements, superior sound insulation capabilities to improve cabin acoustics, and optimized light-blocking features for better passenger rest. The use of lightweight, yet durable, specialized textiles contributes to fuel efficiency goals. Unique selling propositions include customizability in terms of color, pattern, and texture to align with diverse airline branding strategies. Technological advancements are also exploring integrated features like adjustable opacity and antimicrobial coatings for improved hygiene.

Key Drivers, Barriers & Challenges in Aircraft Curtains Industry

Key Drivers:

- Fleet Expansion: Growing global aircraft orders necessitate more cabin interior components.

- Retrofitting & Refurbishment: Airlines continuously upgrade older fleets for passenger appeal and regulatory compliance.

- Passenger Experience Demand: Increasing passenger expectations for comfort, privacy, and aesthetics drive demand for premium curtains.

- Technological Advancements: Development of lightweight, fire-retardant, and functional materials.

Barriers & Challenges:

- Stringent Regulations: Navigating complex and evolving aviation material certifications (FAA, EASA) poses a significant hurdle.

- Supply Chain Volatility: Reliance on specialized raw materials and potential disruptions can impact production and costs.

- High Development Costs: R&D for new materials and certifications requires substantial investment.

- Price Sensitivity: Airlines often seek cost-effective solutions, creating pricing pressures for manufacturers.

- Long Product Lifecycles: Aircraft interiors have long lifespans, leading to extended procurement cycles.

Emerging Opportunities in Aircraft Curtains Industry

Emerging opportunities lie in the development of "smart" aircraft curtains that integrate technology for customizable light filtering, privacy settings, and potentially even embedded sensors for cabin monitoring. The growing focus on sustainability presents a significant opportunity for manufacturers offering curtains made from recycled or biodegradable materials without compromising on performance or safety standards. Untapped markets in the business and general aviation sectors, which are increasingly prioritizing cabin luxury, also offer niche growth avenues. Furthermore, the demand for enhanced hygiene solutions in post-pandemic air travel opens doors for antimicrobial-treated curtains.

Growth Accelerators in the Aircraft Curtains Industry Industry

Long-term growth in the Aircraft Curtains Industry will be accelerated by continued technological breakthroughs in material science, leading to lighter, stronger, and more eco-friendly fabrics that meet stringent aviation safety standards. Strategic partnerships between textile manufacturers, aircraft OEMs, and airlines will foster innovation and streamline product development cycles. Market expansion strategies, particularly focusing on emerging aviation hubs in Asia-Pacific and the Middle East, will be crucial. The increasing adoption of digitalization in aircraft manufacturing and maintenance will also create opportunities for more efficient procurement and integration of cabin components.

Key Players Shaping the Aircraft Curtains Industry Market

- NIEMLA

- Spectra Interior Products

- Botany Weaving

- Arville

- Vandana Carpets

- Lantal

- EPSILON AEROSPAC

- ABC International

- Fu-Chi Innovation Technology Co Ltd

- FELLFAB

- Industrial Neotex SA

- ACM Aircraft Cabin Modification GmbH

- Belgraver aircraft interiors

Notable Milestones in Aircraft Curtains Industry Sector

- 2020: Introduction of advanced flame-retardant treatments meeting enhanced regulatory standards for cabin materials.

- 2021: Increased focus on sustainable material sourcing and production processes by leading manufacturers.

- 2022: Launch of lightweight, sound-dampening curtain solutions to improve passenger comfort.

- 2023: Development of customizable digital printing technologies for unique airline branding on curtains.

- 2024: Growing adoption of bio-based and recycled textiles in aircraft curtain production.

In-Depth Aircraft Curtains Industry Market Outlook

The Aircraft Curtains Industry outlook is exceptionally positive, driven by sustained demand from commercial aviation's recovery and growth trajectory. Key growth accelerators include continuous innovation in lightweight, fire-retardant, and aesthetically superior materials, alongside the rising importance of passenger comfort and cabin customization. Strategic collaborations among industry stakeholders will further fuel advancements and market penetration. The industry is well-positioned to capitalize on the ongoing fleet modernization programs globally and the increasing passenger preference for enhanced travel experiences, ensuring a robust market for advanced aircraft curtain solutions.

Aircraft Curtains Industry Segmentation

-

1. End User

- 1.1. Commercial Aircraft

- 1.2. Military Aircraft

- 1.3. General Aviation

-

2. Type

- 2.1. Cabin Curtains

- 2.2. Window Curtains

Aircraft Curtains Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Egypt

- 6.3. Rest of Middle East

Aircraft Curtains Industry Regional Market Share

Geographic Coverage of Aircraft Curtains Industry

Aircraft Curtains Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment Is Anticipated to Grow with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Commercial Aircraft

- 5.1.2. Military Aircraft

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cabin Curtains

- 5.2.2. Window Curtains

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Commercial Aircraft

- 6.1.2. Military Aircraft

- 6.1.3. General Aviation

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cabin Curtains

- 6.2.2. Window Curtains

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Commercial Aircraft

- 7.1.2. Military Aircraft

- 7.1.3. General Aviation

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cabin Curtains

- 7.2.2. Window Curtains

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Commercial Aircraft

- 8.1.2. Military Aircraft

- 8.1.3. General Aviation

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cabin Curtains

- 8.2.2. Window Curtains

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Commercial Aircraft

- 9.1.2. Military Aircraft

- 9.1.3. General Aviation

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cabin Curtains

- 9.2.2. Window Curtains

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Commercial Aircraft

- 10.1.2. Military Aircraft

- 10.1.3. General Aviation

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cabin Curtains

- 10.2.2. Window Curtains

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. United Arab Emirates Aircraft Curtains Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by End User

- 11.1.1. Commercial Aircraft

- 11.1.2. Military Aircraft

- 11.1.3. General Aviation

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Cabin Curtains

- 11.2.2. Window Curtains

- 11.1. Market Analysis, Insights and Forecast - by End User

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 NIEMLA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Spectra Interior Products

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Botany Weaving

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Arville

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Vandana Carpets

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Lantal

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 EPSILON AEROSPAC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ABC International

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fu-Chi Innovation Technology Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 FELLFAB

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Industrial Neotex SA

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 ACM Aircraft Cabin Modification GmbH

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Belgraver aircraft interiors

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 NIEMLA

List of Figures

- Figure 1: Global Aircraft Curtains Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 3: North America Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 9: Europe Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: Europe Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: Europe Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: Asia Pacific Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Asia Pacific Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 17: Asia Pacific Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Asia Pacific Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 21: Latin America Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Latin America Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 23: Latin America Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 24: Latin America Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Latin America Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 27: Middle East Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 28: Middle East Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 29: Middle East Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates Aircraft Curtains Industry Revenue (undefined), by End User 2025 & 2033

- Figure 33: United Arab Emirates Aircraft Curtains Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: United Arab Emirates Aircraft Curtains Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: United Arab Emirates Aircraft Curtains Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: United Arab Emirates Aircraft Curtains Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: United Arab Emirates Aircraft Curtains Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 2: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Aircraft Curtains Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 5: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Germany Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: France Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 17: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: China Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 27: Brazil Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Mexico Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Rest of Latin America Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 31: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Global Aircraft Curtains Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Aircraft Curtains Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Aircraft Curtains Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Saudi Arabia Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Egypt Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East Aircraft Curtains Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Curtains Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Aircraft Curtains Industry?

Key companies in the market include NIEMLA, Spectra Interior Products, Botany Weaving, Arville, Vandana Carpets, Lantal, EPSILON AEROSPAC, ABC International, Fu-Chi Innovation Technology Co Ltd, FELLFAB, Industrial Neotex SA, ACM Aircraft Cabin Modification GmbH, Belgraver aircraft interiors.

3. What are the main segments of the Aircraft Curtains Industry?

The market segments include End User, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment Is Anticipated to Grow with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Curtains Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Curtains Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Curtains Industry?

To stay informed about further developments, trends, and reports in the Aircraft Curtains Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence