Key Insights

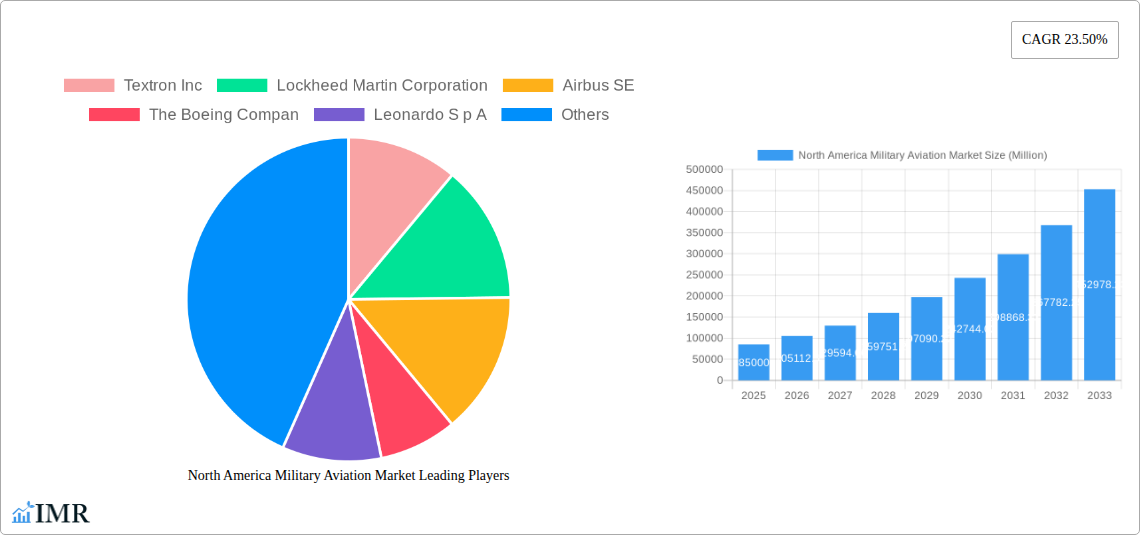

The North America Military Aviation Market is poised for substantial expansion, driven by escalating geopolitical tensions and a persistent need for advanced aerial defense capabilities across the United States, Canada, and Mexico. With an impressive Compound Annual Growth Rate (CAGR) of 23.50%, the market is projected to grow from an estimated USD 85,000 million in 2025 to an even more significant valuation by 2033. This robust growth is fueled by continuous modernization efforts by military forces, aimed at replacing aging fleets and integrating cutting-edge technologies like artificial intelligence, advanced sensors, and stealth capabilities into fixed-wing and rotorcraft platforms. Significant investments are being channeled into multi-role aircraft, training aircraft, and transport aircraft to enhance operational flexibility and troop deployment. Furthermore, the demand for multi-mission helicopters and transport helicopters is escalating to support diverse combat and logistical operations, including special forces deployments and disaster relief missions, underscoring the critical role of these assets in national security strategies.

North America Military Aviation Market Market Size (In Billion)

The market dynamics are further shaped by strategic acquisitions and technological advancements by leading players such as Lockheed Martin Corporation, The Boeing Company, Airbus SE, Textron Inc., Leonardo S.p.A., and Northrop Grumman Corporation. These companies are at the forefront of developing next-generation military aircraft, incorporating enhanced survivability, increased payload capacity, and improved interoperability. However, the sector faces certain restraints, including the exceptionally high cost of research, development, and acquisition of advanced military aviation systems, alongside stringent regulatory frameworks and the long procurement cycles inherent in defense contracts. Despite these challenges, the prevailing security environment and the unwavering commitment to maintaining air superiority and strategic deterrence are expected to sustain the market's upward trajectory, ensuring continued innovation and substantial economic activity throughout the forecast period of 2025-2033.

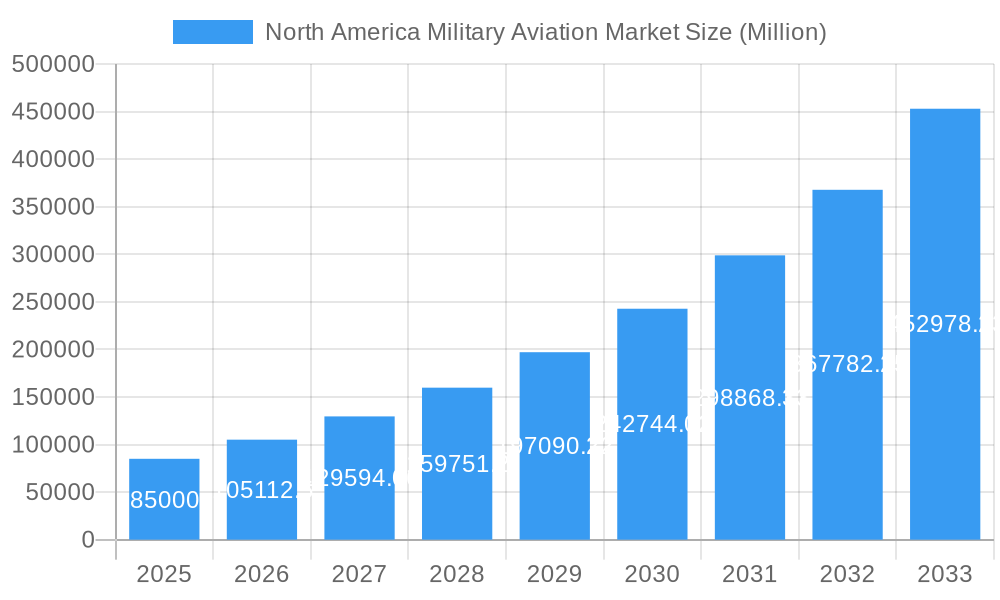

North America Military Aviation Market Company Market Share

North America Military Aviation Market: Comprehensive Report Overview (2019-2033)

This in-depth report offers a panoramic view of the North America Military Aviation Market, encompassing a detailed analysis from 2019 to 2033, with a base and estimated year of 2025, and a forecast period spanning 2025-2033. We meticulously examine the market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and strategic players shaping this vital sector. Values are presented in Million Units.

North America Military Aviation Market Market Dynamics & Structure

The North America Military Aviation Market exhibits a moderately concentrated structure, characterized by the significant presence of established defense conglomerates and a growing number of specialized technology providers. Technological innovation is a primary driver, fueled by the constant demand for advanced capabilities in surveillance, combat, and transport. Regulatory frameworks, primarily driven by national defense strategies and international arms control agreements, significantly influence market entry and product development. Competitive product substitutes, though less prevalent in direct military applications, exist in the form of evolving defense technologies and doctrines. End-user demographics are largely defined by government defense departments and allied nations, with procurement decisions heavily influenced by geopolitical stability, threat assessments, and budgetary allocations. Mergers and Acquisitions (M&A) trends, while not as frequent as in other industries, are strategic, aiming to consolidate capabilities, expand technological portfolios, and secure long-term government contracts. The market is characterized by substantial R&D investments and a long product development lifecycle.

- Market Concentration: Dominated by a few key players, with increasing niche specialization.

- Technological Innovation Drivers: Advanced avionics, AI integration, stealth technology, unmanned systems, and enhanced sensor capabilities.

- Regulatory Frameworks: Strict export controls, defense procurement policies, and international collaboration agreements.

- Competitive Product Substitutes: Evolution in cyber warfare, directed energy weapons, and advanced missile systems indirectly impacting aviation needs.

- End-User Demographics: Primarily US and Canadian federal defense agencies, with significant international FMS (Foreign Military Sales) activity.

- M&A Trends: Strategic acquisitions for technology integration, market expansion, and program sustainment.

North America Military Aviation Market Growth Trends & Insights

The North America Military Aviation Market is poised for robust growth, driven by a confluence of factors including escalating geopolitical tensions, the continuous need for fleet modernization, and the integration of cutting-edge technologies. The market size is projected to expand significantly over the forecast period, with an estimated Compound Annual Growth Rate (CAGR) of XX%, reaching an estimated valuation of [Insert Market Value] Million USD by 2033. Adoption rates for advanced platforms, particularly in the fixed-wing and rotorcraft segments, are accelerating as defense forces prioritize enhanced operational effectiveness and interoperability. Technological disruptions, such as the increasing deployment of unmanned aerial vehicles (UAVs) for reconnaissance and combat, autonomous systems, and advanced electronic warfare capabilities, are reshaping the market landscape. Consumer behavior shifts are evident in the growing demand for multi-role aircraft capable of diverse missions, increased focus on sustainable aviation solutions for military applications, and a greater emphasis on lifecycle support and upgradeability of existing platforms. The ongoing commitment to research and development by major defense contractors and government agencies ensures a sustained influx of innovative solutions. The market penetration of advanced simulation and training technologies also continues to rise, contributing to a more skilled and adaptable military aviation workforce.

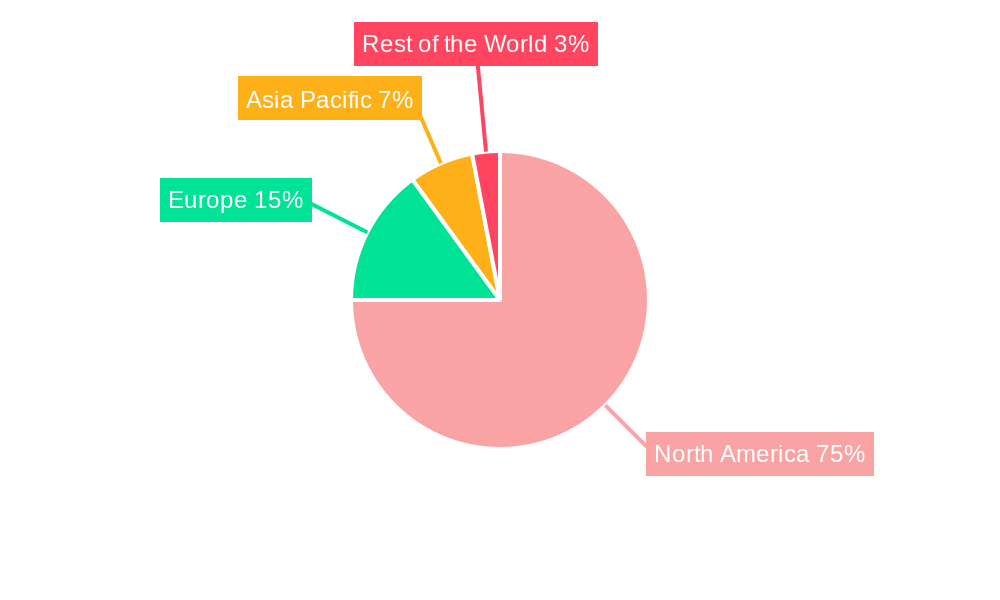

Dominant Regions, Countries, or Segments in North America Military Aviation Market

Within the North America Military Aviation Market, the United States stands as the undisputed dominant country, consistently representing the largest share of global defense spending and military aviation procurement. This dominance is underpinned by extensive research and development initiatives, a vast network of defense contractors, and a proactive approach to modernizing its air and rotorcraft fleets to address evolving global threats. The Fixed-Wing Aircraft segment, in particular, plays a pivotal role in driving market growth. Among the sub-segments, Multi-Role Aircraft are experiencing substantial demand, reflecting the strategic need for versatile platforms capable of performing a wide array of missions, from air-to-air combat and ground attack to intelligence, surveillance, and reconnaissance (ISR). The development and procurement of next-generation fighter jets, bombers, and strategic airlift capabilities are significant contributors to this segment's growth.

- Dominant Country: United States, due to its extensive defense budget and strategic global posture.

- Key Segment Driving Growth: Fixed-Wing Aircraft.

- Multi-Role Aircraft: High demand due to operational versatility and adaptability to diverse mission requirements. This includes platforms designed for air superiority, close air support, and strategic bombing.

- Transport Aircraft: Critical for global logistics, troop deployment, and humanitarian aid, with ongoing upgrades and acquisitions for enhanced payload and range capabilities.

- Training Aircraft: Essential for developing the next generation of pilots and aircrew, with a focus on advanced simulation and integrated training systems.

- Dominance Factors for Fixed-Wing Aircraft:

- Technological Advancement: Continuous innovation in aerodynamics, propulsion, avionics, and stealth technology.

- Strategic Importance: Crucial for power projection, territorial defense, and global reach.

- Government Investment: Substantial and consistent funding allocated for research, development, and procurement by defense ministries.

- Operational Effectiveness: Superior range, speed, and payload capacity compared to rotorcraft for many strategic missions.

The Rotorcraft segment, while following fixed-wing aircraft in overall market share, also exhibits strong growth, particularly within the Multi-Mission Helicopter sub-segment. These versatile platforms are crucial for tactical transport, combat search and rescue, medical evacuation, and special operations, further solidifying the dominance of North America in military aviation.

North America Military Aviation Market Product Landscape

The North America Military Aviation Market product landscape is characterized by a relentless pursuit of technological superiority and operational efficiency. Innovations are focused on enhancing aircraft survivability, intelligence gathering capabilities, and combat effectiveness. Key advancements include the integration of artificial intelligence (AI) for autonomous flight and decision-making, next-generation radar and sensor systems for superior situational awareness, and the development of advanced electronic warfare suites to counter evolving threats. Unique selling propositions often lie in stealth capabilities, reduced radar cross-section, extended loiter times, and the ability to operate in contested environments. Performance metrics are continuously being pushed, with a focus on increased speed, range, payload capacity, and reduced logistical footprint. The development of modular architectures for easier upgrades and maintenance also plays a significant role in the product lifecycle.

Key Drivers, Barriers & Challenges in North America Military Aviation Market

Key Drivers:

- Geopolitical Instability: Rising global tensions and regional conflicts necessitate continuous investment in advanced military aviation capabilities for defense and deterrence.

- Technological Advancement: The relentless drive for superiority fuels demand for cutting-edge platforms, including AI-integrated systems, advanced sensors, and unmanned aerial vehicles.

- Fleet Modernization Programs: Aging military aircraft fleets across North America require substantial upgrades and replacements, creating significant procurement opportunities.

- Strategic Alliances and FMS: Interoperability requirements and foreign military sales to allied nations drive demand for standardized and advanced aviation systems.

Key Barriers & Challenges:

- High Development and Procurement Costs: The research, development, and manufacturing of advanced military aircraft are exceptionally expensive, often straining defense budgets.

- Long Development Cycles: The intricate nature of military aviation development can lead to lengthy timelines, impacting the speed of technology adoption.

- Regulatory Hurdles and Export Controls: Strict national and international regulations can complicate international sales and technology transfers.

- Supply Chain Vulnerabilities: Reliance on global supply chains for critical components can expose the market to disruptions and geopolitical risks.

- Skilled Workforce Shortage: A growing demand for specialized engineers, technicians, and pilots poses a challenge to sustained growth and operational readiness.

Emerging Opportunities in North America Military Aviation Market

Emerging opportunities in the North America Military Aviation Market lie in the rapid expansion of the Unmanned Aerial Systems (UAS) sector, catering to both armed and reconnaissance missions. The increasing demand for Intelligence, Surveillance, and Reconnaissance (ISR) platforms, particularly those with advanced AI-powered data analysis capabilities, presents a significant growth avenue. Furthermore, the development of Hypersonic and Advanced Propulsion Systems for next-generation aircraft, as well as the integration of Cybersecurity Solutions to protect networked aviation assets, represent burgeoning markets. Opportunities also exist in the retrofitting and modernization of existing fleets with new technologies, extending their operational lifespan and enhancing their capabilities. The growing focus on Sustainable Aviation Fuels (SAFs) for military operations also opens new avenues for innovation and market penetration.

Growth Accelerators in the North America Military Aviation Market Industry

Growth in the North America Military Aviation Market is significantly accelerated by breakthroughs in artificial intelligence (AI) and machine learning (ML), enabling autonomous operations and enhanced data processing. Strategic partnerships between prime contractors and specialized technology firms are crucial for integrating novel capabilities into existing and future platforms. The increasing emphasis on network-centric warfare and the development of fifth and sixth-generation aircraft are also major growth catalysts, demanding highly sophisticated and interconnected aviation systems. Furthermore, government initiatives focused on domestic defense industrial base strengthening and interoperability with allied forces are driving sustained investment and program development, fostering long-term market expansion.

Key Players Shaping the North America Military Aviation Market Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- The Boeing Company

- Leonardo S.p.A.

- Northrop Grumman Corporation

Notable Milestones in North America Military Aviation Market Sector

- May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.

- March 2023: Boeing has been awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers. The US government announced USD 1.95 million, indicating that the helicopter will be delivered to the US military and overseas buyers - specifically Australia and Egypt - as a part of the paramilitary process to the Foreign Service (FMS) from the US government. Contract completion is expected by the end of 2027.

- February 2023: Boeing received a contract from the US Air Force for E-7 Airborne Early Warning & Control Aircraft.

In-Depth North America Military Aviation Market Market Outlook

The future market outlook for North America Military Aviation is exceptionally promising, driven by ongoing geopolitical imperatives and continuous technological evolution. Growth accelerators include the pervasive integration of AI and advanced sensor technologies, leading to more intelligent and adaptable aircraft. Strategic collaborations and significant government investments in next-generation defense platforms, particularly in the Fixed-Wing Aircraft and Rotorcraft segments, will continue to fuel market expansion. The increasing adoption of unmanned systems and the focus on enhancing fleet survivability and interoperability present substantial opportunities for innovation and market penetration. The long-term potential is further bolstered by a sustained demand for modernization and upgrades of existing military aviation assets, ensuring a dynamic and evolving market landscape for years to come.

North America Military Aviation Market Segmentation

-

1. Sub Aircraft Type

-

1.1. Fixed-Wing Aircraft

- 1.1.1. Multi-Role Aircraft

- 1.1.2. Training Aircraft

- 1.1.3. Transport Aircraft

- 1.1.4. Others

-

1.2. Rotorcraft

- 1.2.1. Multi-Mission Helicopter

- 1.2.2. Transport Helicopter

-

1.1. Fixed-Wing Aircraft

North America Military Aviation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Military Aviation Market Regional Market Share

Geographic Coverage of North America Military Aviation Market

North America Military Aviation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 23.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Military Aviation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 5.1.1. Fixed-Wing Aircraft

- 5.1.1.1. Multi-Role Aircraft

- 5.1.1.2. Training Aircraft

- 5.1.1.3. Transport Aircraft

- 5.1.1.4. Others

- 5.1.2. Rotorcraft

- 5.1.2.1. Multi-Mission Helicopter

- 5.1.2.2. Transport Helicopter

- 5.1.1. Fixed-Wing Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sub Aircraft Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Boeing Compan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Leonardo S p A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Northrop Grumman Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: North America Military Aviation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Military Aviation Market Share (%) by Company 2025

List of Tables

- Table 1: North America Military Aviation Market Revenue Million Forecast, by Sub Aircraft Type 2020 & 2033

- Table 2: North America Military Aviation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Military Aviation Market Revenue Million Forecast, by Sub Aircraft Type 2020 & 2033

- Table 4: North America Military Aviation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Military Aviation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Military Aviation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Military Aviation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Military Aviation Market?

The projected CAGR is approximately 23.50%.

2. Which companies are prominent players in the North America Military Aviation Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, The Boeing Compan, Leonardo S p A, Northrop Grumman Corporation.

3. What are the main segments of the North America Military Aviation Market?

The market segments include Sub Aircraft Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: The US State Department approved a potential sale of CH-47 Chinook helicopters, engines, and equipment worth USD 8.5 billion to Germany.March 2023: Boeing has been awarded a contract by the US government to manufacture 184 AH-64E Apache attack helicopters for the US military and international customers. The US government announced USD 1.95 million, indicating that the helicopter will be delivered to the US military and overseas buyers - specifically Australia and Egypt - as a part of the paramilitary process to the Foreign Service (FMS) from the US government. Contract completion is expected by the end of 2027.February 2023: Boeing received a contract from the US Air Force for E-7 Airborne Early Warning & Control Aircraft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Military Aviation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Military Aviation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Military Aviation Market?

To stay informed about further developments, trends, and reports in the North America Military Aviation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence