Key Insights

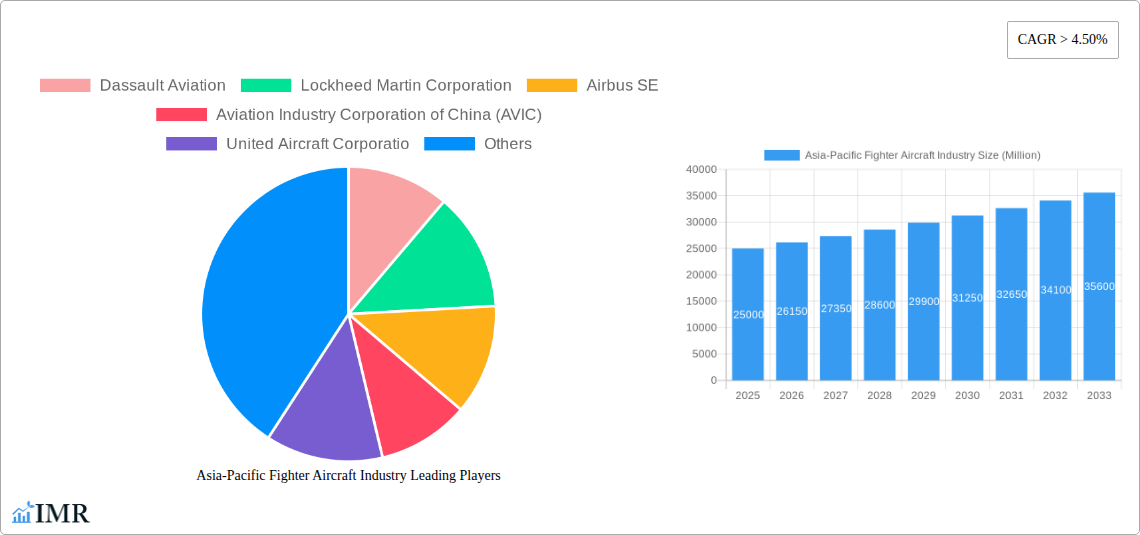

The Asia-Pacific Fighter Aircraft Industry is poised for robust expansion, driven by escalating geopolitical tensions, increasing defense budgets, and the continuous modernization efforts of air forces across the region. With an estimated market size of approximately $XX billion in 2025 and a projected Compound Annual Growth Rate (CAGR) exceeding 4.50%, the industry is set to witness substantial value appreciation throughout the forecast period of 2025-2033. Key market drivers include the urgent need to replace aging fleets with advanced platforms, the growing emphasis on indigenous defense manufacturing capabilities, and the strategic importance of air superiority in maintaining regional stability. Countries like China, India, and South Korea are leading this surge, investing heavily in both domestic production and the acquisition of cutting-edge fighter jets to enhance their operational readiness and technological prowess. This sustained demand, coupled with advancements in stealth technology, avionics, and weapon systems, will further fuel market growth, creating significant opportunities for both established global players and emerging regional manufacturers.

Asia-Pacific Fighter Aircraft Industry Market Size (In Billion)

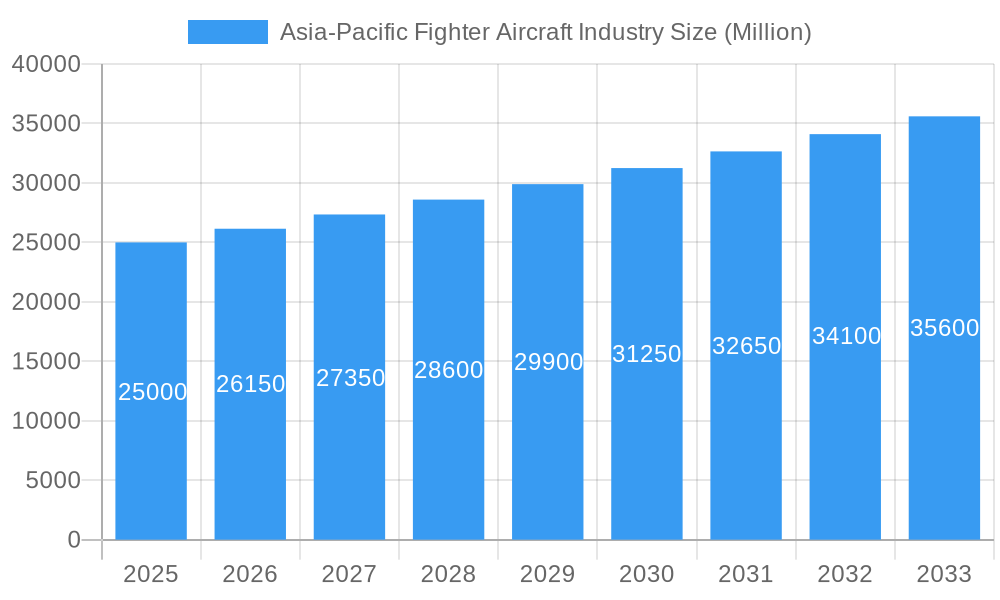

The competitive landscape is characterized by the presence of major global aerospace corporations alongside strong national defense enterprises. Companies such as Lockheed Martin, Boeing, Airbus, and Dassault Aviation are actively vying for lucrative contracts, offering a spectrum of advanced fighter aircraft solutions. Simultaneously, the rise of domestic manufacturers like the Aviation Industry Corporation of China (AVIC) and Hindustan Aeronautics Limited (HAL) signifies a shift towards greater self-reliance and a desire to capture a larger share of the regional market. Emerging trends include the development of fifth-generation fighter jets, unmanned combat aerial vehicles (UCAVs), and enhanced electronic warfare capabilities, all aimed at addressing evolving aerial combat doctrines. However, significant market restraints such as high development costs, stringent export regulations, and the potential for budget constraints in some economies could temper the pace of growth. Despite these challenges, the overarching strategic imperative for enhanced air defense will continue to propel the Asia-Pacific fighter aircraft market forward.

Asia-Pacific Fighter Aircraft Industry Company Market Share

Asia-Pacific Fighter Aircraft Industry Market Dynamics & Structure

The Asia-Pacific fighter aircraft industry is characterized by a complex interplay of geopolitical influences, technological advancements, and evolving defense spending priorities. Market concentration is moderately high, with a few key global players dominating advanced fighter jet manufacturing and a growing number of regional contenders emerging. Technological innovation is a primary driver, fueled by the pursuit of air superiority, stealth capabilities, and advanced electronic warfare systems. Regulatory frameworks, including national defense policies and international arms control agreements, significantly shape market access and product development. Competitive product substitutes are evolving, with the rise of unmanned combat aerial vehicles (UCAVs) presenting a potential long-term alternative to traditional manned fighter aircraft. End-user demographics primarily consist of national defense ministries and air forces, with their procurement decisions heavily influenced by strategic threats and national security objectives. Mergers and acquisitions (M&A) trends are present, though less frequent than in more consumer-driven industries, often focused on strategic alliances for joint development or market access.

- Market Concentration: Dominated by major global defense contractors alongside a growing indigenous manufacturing base in countries like China and India.

- Technological Innovation Drivers: Focus on stealth technology, advanced avionics, network-centric warfare, and multi-role capabilities.

- Regulatory Frameworks: National defense budgets, export controls, and international defense treaties significantly impact market dynamics.

- Competitive Product Substitutes: Increasing development and integration of Unmanned Combat Aerial Vehicles (UCAVs) as potential alternatives.

- End-User Demographics: Primarily national air forces and defense ministries, with procurement driven by national security strategies.

- M&A Trends: Strategic partnerships for joint ventures in R&D and production, rather than large-scale outright acquisitions.

Asia-Pacific Fighter Aircraft Industry Growth Trends & Insights

The Asia-Pacific fighter aircraft industry is poised for robust growth, driven by escalating geopolitical tensions, modernization imperatives of regional air forces, and a significant increase in defense budgets across key nations. This market is experiencing a dynamic evolution, marked by sustained demand for advanced combat platforms capable of meeting diverse operational requirements, from air-to-air superiority to ground attack and reconnaissance missions. The adoption rates for next-generation fighter jets, including 4.5 and 5th generation aircraft, are accelerating as countries strive to maintain a technological edge in a rapidly evolving security landscape. Technological disruptions, such as the integration of artificial intelligence (AI) in avionics, advanced sensor fusion, and enhanced electronic warfare capabilities, are not only shaping current procurement decisions but also dictating future development pathways. Consumer behavior shifts within this sector are less about direct consumer preference and more about the strategic posture and perceived threats that influence governmental defense planning. Countries are increasingly looking for multi-role platforms that offer greater operational flexibility and cost-effectiveness. The market size is projected to expand significantly, with compound annual growth rates (CAGR) reflecting the substantial investment in air power modernization. Market penetration of indigenous fighter programs is also on the rise, supported by government initiatives and technological transfer agreements.

The historical period (2019-2024) saw a steady demand, with notable fleet modernization programs initiated by several major Asia-Pacific nations. The base year (2025) sets a crucial benchmark for understanding current market conditions, with estimated figures providing a snapshot of immediate market health. The forecast period (2025-2033) anticipates a surge in demand, particularly for advanced fighters incorporating stealth, superior sensor capabilities, and network-centric warfare integration. This surge is fueled by an increasing reliance on air power for deterrence and power projection. The analysis of consumption patterns reveals a bifurcated market: a strong demand for advanced multi-role fighters and a continued need for upgrades or replacements of older generation aircraft. Technological disruptions are not merely incremental upgrades but transformative shifts. The introduction of AI-powered decision support systems, advanced cyber warfare capabilities, and the potential for hypersonic weapons integration are key disrupters. Furthermore, the increasing emphasis on unmanned systems operating in conjunction with manned platforms (manned-unmanned teaming) is a significant trend that will shape future procurement and operational doctrines. Economic factors, such as sustained GDP growth in many Asia-Pacific economies, directly correlate with increased defense spending capacity, thereby fueling the fighter aircraft market. The competitive landscape is intensifying, with both established global players and emerging regional manufacturers vying for significant contracts. This competitive environment spurs innovation and drives down prices for certain classes of aircraft, while premium pricing for cutting-edge technology persists. The strategic alliances and partnerships formed between nations and defense corporations are crucial for sharing development costs and ensuring access to advanced technologies, further shaping market dynamics and growth trajectories.

Dominant Regions, Countries, or Segments in Asia-Pacific Fighter Aircraft Industry

The Asia-Pacific fighter aircraft industry is a multifaceted landscape where several regions, countries, and specific segments vie for dominance, driven by a confluence of strategic imperatives, economic capabilities, and technological aspirations. Examining the Production Analysis: reveals that East Asia, particularly China, is emerging as a formidable production hub. This dominance is underpinned by substantial government investment in indigenous defense manufacturing capabilities, a rapidly growing industrial base, and ambitious programs aimed at achieving self-sufficiency in advanced defense technologies. China's Aviation Industry Corporation of China (AVIC) is a key player, spearheading the development and production of advanced fighter jets like the J-20, challenging established global manufacturers. This segment is driven by national security mandates to build a robust air force capable of projecting power and defending territorial claims.

In terms of Consumption Analysis:, Southeast Asia stands out due to a diverse range of countries actively modernizing their air fleets. Nations like India, South Korea, and Japan, while also having significant production capabilities, are substantial consumers. India's Hindustan Aeronautics Limited (HAL) is at the forefront of developing and producing advanced fighters like the LCA Tejas, catering to both domestic needs and export potential. South Korea's KF-21 Boramae program, a collaboration between Korea Aerospace Industries (KAI) and Indonesia, exemplifies a strategic approach to domestic production and regional cooperation. Japan's Mitsubishi F-2 and its future development plans also contribute to this segment's importance. The consumption here is driven by a combination of perceived regional threats, the need for advanced air-to-air and air-to-ground capabilities, and a desire for technological self-reliance.

The Import Market Analysis (Value & Volume): is significantly influenced by countries seeking to rapidly acquire advanced capabilities that may not be fully developed indigenously or where immediate operational needs outweigh domestic production timelines. Southeast Asian nations, including but not limited to Singapore, Thailand, and Indonesia, are key importers. They often procure advanced 4.5 and 5th generation fighters from established global players like Lockheed Martin Corporation (F-35, F-16), Dassault Aviation (Rafale), and Saab AB (Gripen). The value of these imports is substantial, reflecting the high cost of cutting-edge military hardware. Economic policies that prioritize defense modernization and strategic alliances play a crucial role in driving these import volumes.

Conversely, the Export Market Analysis (Value & Volume): is currently dominated by established manufacturers from North America and Europe, though regional players are beginning to make inroads. The United States, through companies like Lockheed Martin Corporation and The Boeing Company, holds a significant share in exporting advanced fighter aircraft to various Asia-Pacific nations. Similarly, France's Dassault Aviation has seen success with its Rafale exports. While the volume of exports from regional players is growing, particularly from China and potentially India in the future, the established track record and technological sophistication of Western manufacturers continue to command a larger export market share. The growth potential in this segment for emerging exporters lies in offering more cost-effective solutions or catering to specific niche requirements.

The Price Trend Analysis: in the Asia-Pacific fighter aircraft industry is complex, with prices heavily dependent on the generation, technological sophistication, and customization of the aircraft. Fifth-generation stealth fighters command premium prices, reflecting their advanced capabilities and extensive research and development costs. 4.5-generation multi-role fighters offer a more balanced price-point, appealing to a wider range of air forces. The entry of new indigenous programs is expected to introduce more competitive pricing, especially for mid-tier capabilities. Industry Developments:, such as advancements in manufacturing processes and the adoption of modular designs, can lead to cost reductions in the long term.

Asia-Pacific Fighter Aircraft Industry Product Landscape

The Asia-Pacific fighter aircraft industry is witnessing a dynamic evolution in its product landscape, driven by a relentless pursuit of technological superiority and operational versatility. Product innovations are centered on enhancing combat effectiveness through advanced avionics, stealth technologies, and superior sensor integration. The focus is increasingly on multi-role capabilities, enabling aircraft to perform a wide array of missions, from air-to-air combat to ground attack and electronic warfare. Key performance metrics being optimized include speed, agility, range, payload capacity, and survivability. Unique selling propositions often lie in the integration of cutting-edge radar systems, directed energy weapons, and sophisticated electronic countermeasures. Technological advancements are pushing the boundaries of manned-unmanned teaming, allowing fighter aircraft to operate seamlessly with drones, thereby extending their operational reach and survivability.

Key Drivers, Barriers & Challenges in Asia-Pacific Fighter Aircraft Industry

Key Drivers:

- Geopolitical Tensions & Regional Security Concerns: Rising assertiveness and territorial disputes in the Asia-Pacific region are compelling nations to bolster their air defense capabilities.

- Modernization Mandates: Existing air fleets are aging, necessitating upgrades and replacements with advanced, next-generation fighter aircraft.

- Technological Advancements: The continuous innovation in stealth, avionics, and weapon systems drives demand for cutting-edge platforms.

- Economic Growth & Increased Defense Budgets: Several Asia-Pacific economies are experiencing sustained growth, enabling higher defense spending.

Key Barriers & Challenges:

- High Acquisition & Maintenance Costs: Advanced fighter aircraft represent a significant financial burden for many nations, impacting procurement decisions.

- Technological Expertise & Infrastructure: Developing and maintaining sophisticated fighter aircraft requires substantial technical expertise and specialized infrastructure, which can be a barrier for emerging defense industries.

- Global Supply Chain Dependencies: Reliance on international suppliers for critical components can lead to vulnerabilities and delays.

- Regulatory & Export Controls: International regulations and export restrictions can hinder technology transfer and market access.

- Political & Social Acceptance: Public perception and political will are crucial for allocating large defense budgets.

Emerging Opportunities in Asia-Pacific Fighter Aircraft Industry

Emerging opportunities in the Asia-Pacific fighter aircraft industry are primarily centered on the growing demand for cost-effective yet capable platforms, the integration of artificial intelligence and advanced networking capabilities, and the potential for collaborative development projects. Countries seeking to enhance their air power without the immense cost of acquiring top-tier 5th-generation fighters are creating a market for advanced 4.5-generation aircraft and modernized versions of existing fleets. The increasing emphasis on networked warfare and the development of manned-unmanned teaming present opportunities for companies offering compatible systems and software solutions. Furthermore, collaborative defense initiatives between regional nations could foster joint development and production of fighter aircraft, reducing individual investment burdens and promoting interoperability. The aftermarket services, including maintenance, repair, and overhaul (MRO), also present a significant and growing opportunity as fleets age.

Growth Accelerators in the Asia-Pacific Fighter Aircraft Industry Industry

The Asia-Pacific fighter aircraft industry is propelled by several key growth accelerators. Technological breakthroughs, particularly in areas like artificial intelligence for enhanced situational awareness and autonomous capabilities, and advanced materials for lighter, stronger airframes, are driving innovation and demand for cutting-edge platforms. Strategic partnerships between major defense contractors and regional players, including joint ventures for co-development and co-production, are crucial for sharing R&D costs, facilitating technology transfer, and accessing new markets. Market expansion strategies, such as catering to the specific needs of emerging economies and offering flexible financing options, are also vital. Furthermore, the increasing adoption of modular design principles in fighter aircraft development allows for easier upgrades and customization, extending the lifespan and relevance of platforms, thereby contributing to sustained market growth.

Key Players Shaping the Asia-Pacific Fighter Aircraft Industry Market

- Dassault Aviation

- Lockheed Martin Corporation

- Airbus SE

- Aviation Industry Corporation of China (AVIC)

- United Aircraft Corporation

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Hindustan Aeronautics Limited

- Saab AB

- The Boeing Company

Notable Milestones in Asia-Pacific Fighter Aircraft Industry Sector

- 2019: India formally inducts the Rafale fighter jet into its Air Force, enhancing its combat capabilities.

- 2020: China's Aviation Industry Corporation of China (AVIC) continues its testing and development of the J-20 stealth fighter, signaling advancements in its indigenous aerospace capabilities.

- 2021: South Korea and Indonesia officially launch the KF-21 Boramae fighter jet program, a significant regional collaboration in advanced aircraft development.

- 2022: Lockheed Martin Corporation secures significant orders for F-35 fighter jets from multiple Asia-Pacific nations, underscoring the global demand for 5th-generation stealth technology.

- 2023: Dassault Aviation announces further export success for its Rafale fighter jet in the Asia-Pacific region, solidifying its market presence.

- 2024: Hindustan Aeronautics Limited (HAL) progresses with the development and production of the Tejas LCA, showcasing India's growing self-reliance in fighter aircraft manufacturing.

- 2025 (Estimated): Expected advancements in the development of next-generation fighter concepts incorporating AI and advanced unmanned capabilities by key players.

In-Depth Asia-Pacific Fighter Aircraft Industry Market Outlook

The Asia-Pacific fighter aircraft industry is set for a dynamic and expansive future. Growth accelerators such as breakthroughs in AI-driven combat systems, advanced materials for enhanced performance, and the strategic imperative for regional powers to maintain air superiority will continue to fuel demand. Collaborative development initiatives and strategic partnerships are poised to reduce financial burdens and foster technological exchange, enabling a broader range of countries to access advanced capabilities. The market's trajectory indicates a sustained demand for multi-role platforms, with a growing emphasis on networked warfare and manned-unmanned teaming. Companies that can offer innovative, cost-effective solutions and demonstrate adaptability to evolving geopolitical landscapes will be best positioned to capitalize on the immense growth potential in this critical sector.

Asia-Pacific Fighter Aircraft Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Fighter Aircraft Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Fighter Aircraft Industry Regional Market Share

Geographic Coverage of Asia-Pacific Fighter Aircraft Industry

Asia-Pacific Fighter Aircraft Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Conventional Take-off and Landing is Projected to Grow with the Highest CAGR During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Fighter Aircraft Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dassault Aviation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aviation Industry Corporation of China (AVIC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 United Aircraft Corporatio

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BAE Systems plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kawasaki Heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hindustan Aeronautics Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saab AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Dassault Aviation

List of Figures

- Figure 1: Asia-Pacific Fighter Aircraft Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Fighter Aircraft Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Fighter Aircraft Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: China Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia-Pacific Fighter Aircraft Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Fighter Aircraft Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the Asia-Pacific Fighter Aircraft Industry?

Key companies in the market include Dassault Aviation, Lockheed Martin Corporation, Airbus SE, Aviation Industry Corporation of China (AVIC), United Aircraft Corporatio, BAE Systems plc, Kawasaki Heavy Industries Ltd, Hindustan Aeronautics Limited, Saab AB, The Boeing Company.

3. What are the main segments of the Asia-Pacific Fighter Aircraft Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Conventional Take-off and Landing is Projected to Grow with the Highest CAGR During Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Fighter Aircraft Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Fighter Aircraft Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Fighter Aircraft Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Fighter Aircraft Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence