Key Insights

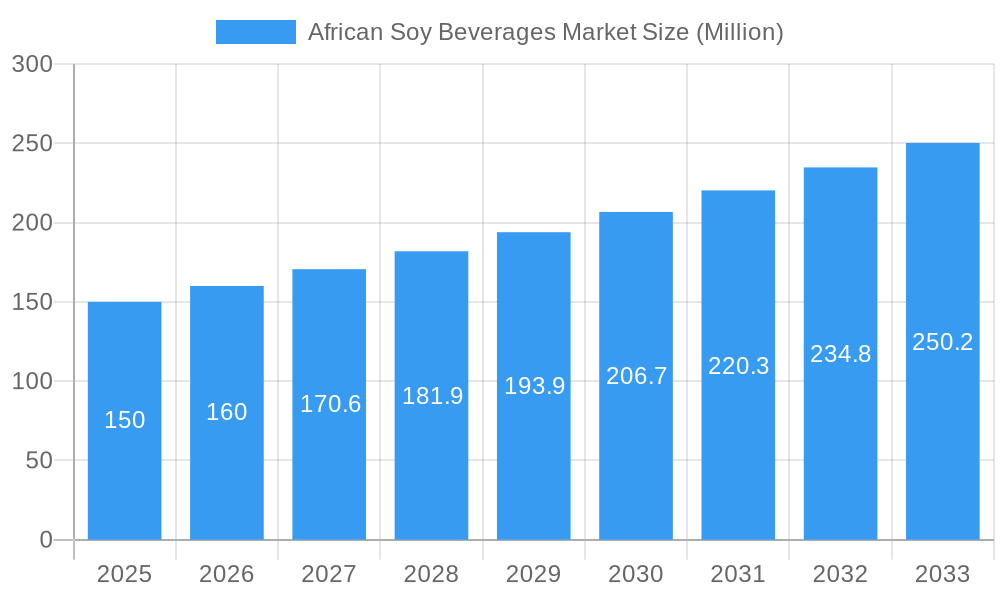

The African soy beverage market, valued at $82.72 million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033. This expansion is driven by increasing consumer health consciousness and a growing preference for plant-based dairy alternatives, especially in urban centers with rising disposable incomes. The inherent versatility of soy beverages, accommodating various dietary needs such as veganism and lactose intolerance, significantly enhances their market appeal. Furthermore, government initiatives focused on promoting nutrition and food security across several African nations positively influence market dynamics. The market is segmented by flavor (flavored and unflavored), distribution channel (supermarkets/hypermarkets, convenience stores, specialist stores, online retail, and others), and type (soy milk and drinkable yogurt). Flavored soy beverages are anticipated to lead, driven by consumer demand for diverse taste profiles. Supermarkets and hypermarkets are expected to remain the dominant distribution channel due to their extensive reach. While soy milk currently holds a larger market share, drinkable yogurt is projected for substantial growth through product innovation and health-focused marketing. Key challenges include regional infrastructure inconsistencies affecting distribution, fluctuating raw material prices, and limited consumer awareness in rural areas.

African Soy Beverages Market Market Size (In Million)

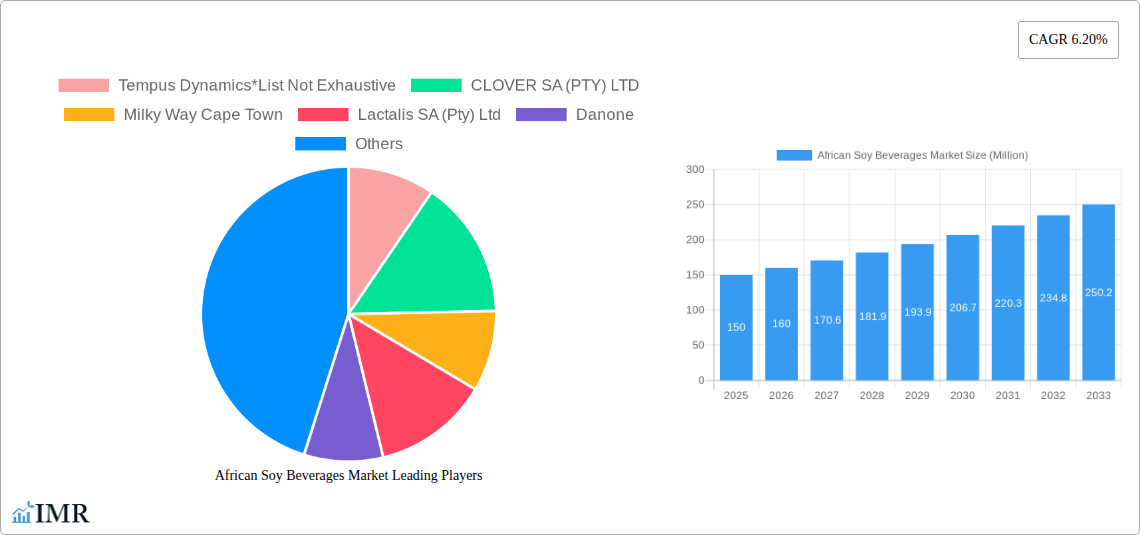

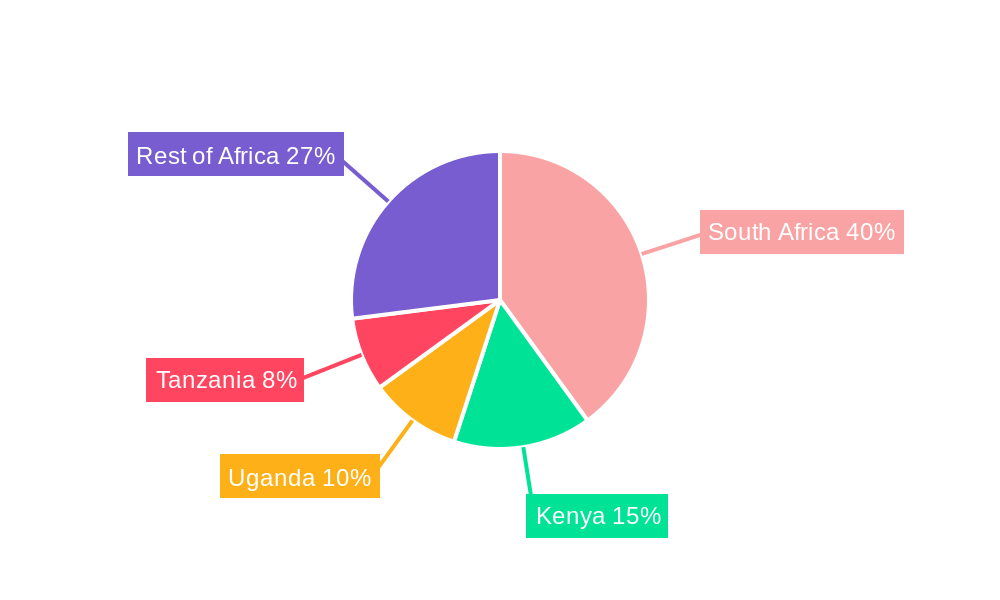

Leading market participants such as Tempus Dynamics, Clover SA (PTY) LTD, Milky Way Cape Town, Lactalis SA (Pty) Ltd, Danone, Vitamilk, Hain Celestial, and Dewfresh (Pty) Ltd compete through pricing strategies, brand establishment, and product differentiation. Geographically, the market is concentrated in South Africa, Kenya, Uganda, and Tanzania, with considerable growth potential in other African countries as infrastructure develops and consumer awareness rises. Future growth will be propelled by innovative product development, such as fortified and functional soy beverages, expansion into e-commerce channels, and targeted marketing campaigns highlighting health benefits. Addressing infrastructure limitations and price volatility will be critical for sustained market expansion. The forecast period indicates significant market growth across diverse segments and regions, positioning the African soy beverage market as a promising investment opportunity.

African Soy Beverages Market Company Market Share

African Soy Beverages Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the African Soy Beverages Market, offering invaluable insights for industry professionals, investors, and stakeholders. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. The market is segmented by flavor (flavored, unflavored), distribution channel (supermarkets/hypermarkets, convenience stores, specialist stores, online retailing, other distribution channels), and type (soy milk, drinkable yogurt). The report offers a granular understanding of market dynamics, growth trends, regional dominance, competitive landscape, and future opportunities. The total market size is projected to reach xx Million units by 2033.

African Soy Beverages Market Market Dynamics & Structure

The African soy beverages market is characterized by a moderately fragmented structure, with several key players competing alongside numerous smaller regional brands. Market concentration is relatively low, with no single dominant player commanding a significant majority share. Technological innovation, particularly in processing and packaging, plays a crucial role, driving efficiency and extending shelf life. Regulatory frameworks concerning food safety and labeling vary across African nations, posing both challenges and opportunities for businesses. The market also faces competition from alternative beverage options, including dairy-based drinks and plant-based alternatives beyond soy. Consumer demographics, particularly the rising middle class and increasing health consciousness, are key factors shaping demand. The M&A activity in the sector has been moderate, with a few significant deals in recent years, totalling approximately xx million units in value over the past five years.

- Market Concentration: Low to moderate, with no dominant player.

- Technological Innovation: Significant driver, impacting processing, packaging, and product differentiation.

- Regulatory Framework: Varies across countries, influencing product development and market access.

- Competitive Substitutes: Dairy milk, other plant-based beverages (almond, oat).

- End-User Demographics: Rising middle class, increasing health awareness fueling growth.

- M&A Activity: Moderate, with xx million units in deal value (2019-2024).

African Soy Beverages Market Growth Trends & Insights

The African soy beverages market has experienced steady growth over the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for healthier beverage options. The market size in 2024 reached approximately xx million units, demonstrating a compound annual growth rate (CAGR) of xx% during this period. Technological advancements have facilitated the introduction of novel soy-based products with enhanced taste, texture, and nutritional value, further stimulating market adoption. Shifts in consumer behavior, reflecting a move towards convenient, on-the-go consumption patterns, have boosted demand for ready-to-drink soy beverages. The market penetration of soy beverages remains relatively low, indicating significant untapped potential for future expansion. We project a CAGR of xx% from 2025 to 2033, driven by sustained consumer preference shifts and technological advancements.

Dominant Regions, Countries, or Segments in African Soy Beverages Market

South Africa currently holds the largest market share within the African soy beverages market, followed by Nigeria and Kenya. The dominance of South Africa is attributed to its more developed infrastructure, higher per capita income, and established retail networks. Nigeria's large population and expanding middle class represent a significant growth opportunity. The flavored segment holds the largest market share in terms of volume, driven by consumer preference for diverse taste profiles. Supermarkets/Hypermarkets dominate distribution channels, due to their extensive reach and established supply chains. Soy milk holds the leading position in the product type segment due to its familiarity and wide acceptance.

- Key Drivers in South Africa: Developed infrastructure, high per capita income, established retail sector.

- Key Drivers in Nigeria: Large population, growing middle class.

- Key Drivers in Flavored Segment: Consumer preference for diverse tastes.

- Key Drivers in Supermarkets/Hypermarkets: Wide reach, established supply chain.

- Key Drivers in Soy Milk Segment: Familiarity, wide acceptance.

African Soy Beverages Market Product Landscape

The African soy beverages market offers a range of products, including traditional soy milk variants and innovative offerings such as fortified soy milk with added vitamins and minerals, flavored soy milk, and soy-based yogurt drinks. Many products emphasize natural ingredients and health benefits, aligning with consumer demand for healthier lifestyles. Technological advancements in processing and packaging have led to longer shelf lives and improved product quality. Unique selling propositions include organic certification, specific health benefits (e.g., high protein content), and appealing flavors catering to local preferences.

Key Drivers, Barriers & Challenges in African Soy Beverages Market

Key Drivers: Increasing health consciousness, rising disposable incomes, urbanization, and the expanding middle class are driving the growth of the soy beverages market in Africa. Government initiatives promoting healthy eating habits further support this trend.

Challenges: Limited awareness about the health benefits of soy beverages in some regions, inconsistent quality control across smaller brands, and logistical challenges in distributing products across vast geographical areas pose significant hurdles. The availability of affordable, high-quality raw soybeans is also crucial for sustainable growth. Competition from cheaper, traditional beverages also presents a significant challenge.

Emerging Opportunities in African Soy Beverages Market

Significant opportunities exist in expanding into less-penetrated regions, launching innovative product variants tailored to local taste preferences, and focusing on value-added products with enhanced health benefits (e.g., fortified soy beverages). Growth in online retail channels presents a significant opportunity, while increased investment in efficient distribution networks could broaden market access. Focusing on organic and sustainably sourced soy can enhance brand appeal.

Growth Accelerators in the African Soy Beverages Market Industry

Strategic partnerships between established players and local producers can facilitate market access and distribution. Technological advancements, especially in processing efficiency and sustainable packaging, are vital for long-term growth. Government policies promoting local food production and health awareness will play a significant role. Investing in research and development to develop new product formats and flavors will help satisfy evolving consumer preferences.

Key Players Shaping the African Soy Beverages Market Market

- Tempus Dynamics *List Not Exhaustive

- CLOVER SA (PTY) LTD

- Milky Way Cape Town

- Lactalis SA (Pty) Ltd

- Danone

- Vitamilk

- Hain Celestial

- Dewfresh (Pty) Ltd

Notable Milestones in African Soy Beverages Market Sector

- 2022 (Q3): Launch of a new range of organic soy milk by Clover SA (Pty) LTD.

- 2021 (Q1): Acquisition of a smaller soy beverage company by Lactalis SA (Pty) Ltd.

- 2020 (Q4): Introduction of a new fortified soy milk product by Danone. (Further milestones require specific data).

In-Depth African Soy Beverages Market Market Outlook

The African soy beverages market presents significant long-term growth potential, driven by sustained economic growth, rising health awareness, and evolving consumer preferences. Strategic investments in innovation, efficient distribution, and brand building are crucial for capturing this potential. The market’s future success hinges on adapting to local tastes, addressing logistical challenges, and capitalizing on the growth of the middle class across the continent. This is reflected in our projection of the market to reach xx million units by 2033.

African Soy Beverages Market Segmentation

-

1. Type

- 1.1. Soy Milk

- 1.2. Drinkable Yogurt

-

2. Flavor

- 2.1. Flavored

- 2.2. Unflavored

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Specialist Stores

- 3.4. Online Retailing

- 3.5. Other Distribution Channels

-

4. Geography

- 4.1. South Africa

- 4.2. Nigeria

- 4.3. Kenya

- 4.4. Rest of Africa

African Soy Beverages Market Segmentation By Geography

- 1. South Africa

- 2. Nigeria

- 3. Kenya

- 4. Rest of Africa

African Soy Beverages Market Regional Market Share

Geographic Coverage of African Soy Beverages Market

African Soy Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Rising Prevalence of Lactose-intolerance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. African Soy Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Soy Milk

- 5.1.2. Drinkable Yogurt

- 5.2. Market Analysis, Insights and Forecast - by Flavor

- 5.2.1. Flavored

- 5.2.2. Unflavored

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Specialist Stores

- 5.3.4. Online Retailing

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. Nigeria

- 5.4.3. Kenya

- 5.4.4. Rest of Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. Nigeria

- 5.5.3. Kenya

- 5.5.4. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa African Soy Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Soy Milk

- 6.1.2. Drinkable Yogurt

- 6.2. Market Analysis, Insights and Forecast - by Flavor

- 6.2.1. Flavored

- 6.2.2. Unflavored

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Specialist Stores

- 6.3.4. Online Retailing

- 6.3.5. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. Nigeria

- 6.4.3. Kenya

- 6.4.4. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Nigeria African Soy Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Soy Milk

- 7.1.2. Drinkable Yogurt

- 7.2. Market Analysis, Insights and Forecast - by Flavor

- 7.2.1. Flavored

- 7.2.2. Unflavored

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Specialist Stores

- 7.3.4. Online Retailing

- 7.3.5. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. Nigeria

- 7.4.3. Kenya

- 7.4.4. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Kenya African Soy Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Soy Milk

- 8.1.2. Drinkable Yogurt

- 8.2. Market Analysis, Insights and Forecast - by Flavor

- 8.2.1. Flavored

- 8.2.2. Unflavored

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Specialist Stores

- 8.3.4. Online Retailing

- 8.3.5. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. Nigeria

- 8.4.3. Kenya

- 8.4.4. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Africa African Soy Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Soy Milk

- 9.1.2. Drinkable Yogurt

- 9.2. Market Analysis, Insights and Forecast - by Flavor

- 9.2.1. Flavored

- 9.2.2. Unflavored

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Specialist Stores

- 9.3.4. Online Retailing

- 9.3.5. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. South Africa

- 9.4.2. Nigeria

- 9.4.3. Kenya

- 9.4.4. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Tempus Dynamics*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CLOVER SA (PTY) LTD

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Milky Way Cape Town

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lactalis SA (Pty) Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Danone

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vitamilk

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hain Celestial

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dewfresh (Pty) Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Tempus Dynamics*List Not Exhaustive

List of Figures

- Figure 1: African Soy Beverages Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: African Soy Beverages Market Share (%) by Company 2025

List of Tables

- Table 1: African Soy Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: African Soy Beverages Market Revenue million Forecast, by Flavor 2020 & 2033

- Table 3: African Soy Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: African Soy Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 5: African Soy Beverages Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: African Soy Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 7: African Soy Beverages Market Revenue million Forecast, by Flavor 2020 & 2033

- Table 8: African Soy Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 9: African Soy Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 10: African Soy Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: African Soy Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 12: African Soy Beverages Market Revenue million Forecast, by Flavor 2020 & 2033

- Table 13: African Soy Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: African Soy Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 15: African Soy Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: African Soy Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 17: African Soy Beverages Market Revenue million Forecast, by Flavor 2020 & 2033

- Table 18: African Soy Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 19: African Soy Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 20: African Soy Beverages Market Revenue million Forecast, by Country 2020 & 2033

- Table 21: African Soy Beverages Market Revenue million Forecast, by Type 2020 & 2033

- Table 22: African Soy Beverages Market Revenue million Forecast, by Flavor 2020 & 2033

- Table 23: African Soy Beverages Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 24: African Soy Beverages Market Revenue million Forecast, by Geography 2020 & 2033

- Table 25: African Soy Beverages Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the African Soy Beverages Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the African Soy Beverages Market?

Key companies in the market include Tempus Dynamics*List Not Exhaustive, CLOVER SA (PTY) LTD, Milky Way Cape Town, Lactalis SA (Pty) Ltd, Danone, Vitamilk, Hain Celestial, Dewfresh (Pty) Ltd.

3. What are the main segments of the African Soy Beverages Market?

The market segments include Type, Flavor, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.72 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Rising Prevalence of Lactose-intolerance.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "African Soy Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the African Soy Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the African Soy Beverages Market?

To stay informed about further developments, trends, and reports in the African Soy Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence