Key Insights

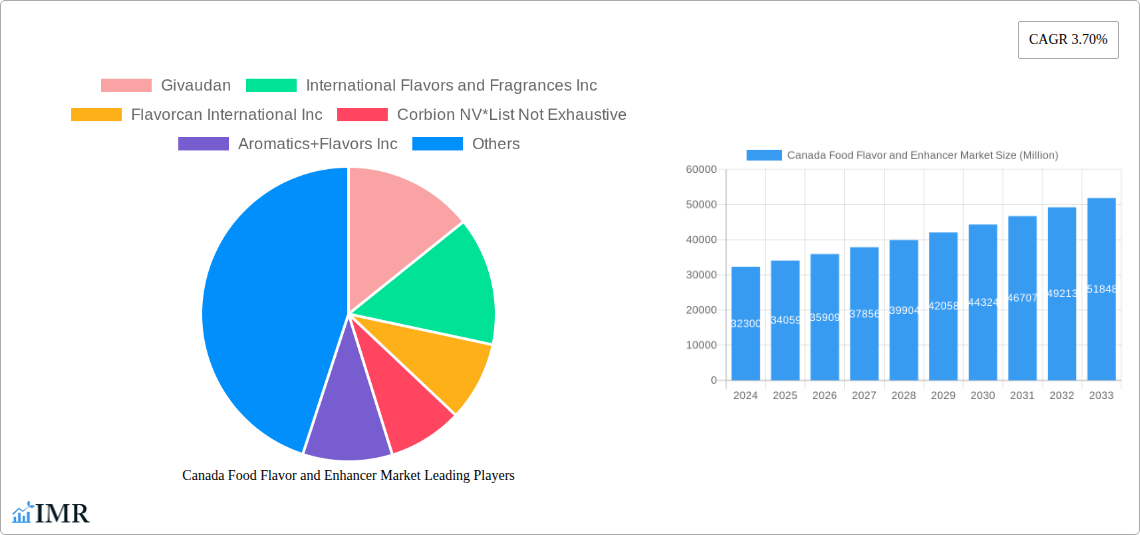

The Canadian Food Flavor and Enhancer Market is poised for robust expansion, with an estimated market size of USD 32.3 billion in 2024. This growth is propelled by a projected Compound Annual Growth Rate (CAGR) of 5.4% throughout the forecast period of 2025-2033. The increasing consumer demand for processed foods, coupled with a growing preference for diverse and authentic taste profiles, serves as a significant market driver. Furthermore, the rising awareness regarding the impact of food ingredients on sensory experience and the expanding application of flavors and enhancers across various food and beverage categories, including bakery, confectionery, dairy, and savory snacks, are contributing to this upward trajectory. The market is also influenced by evolving dietary trends, such as the demand for natural and clean-label ingredients, which is fostering innovation in the development of natural flavors and nature-identical flavor compounds. This creates significant opportunities for market players to cater to a discerning consumer base.

Canada Food Flavor and Enhancer Market Market Size (In Billion)

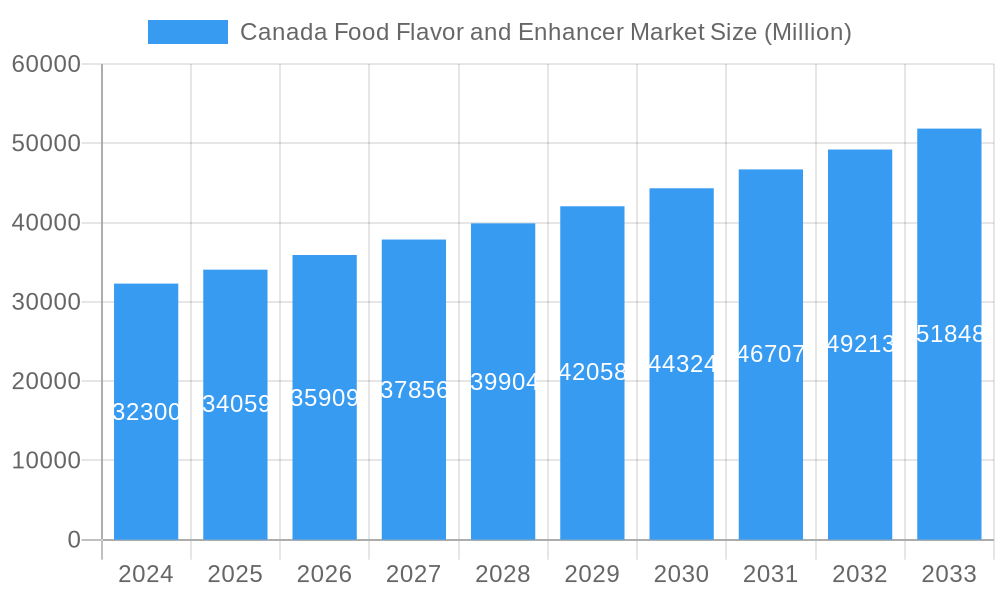

The market's dynamism is further shaped by several key trends. The inclination towards premiumization in food products, where sophisticated flavor profiles command higher value, is a notable trend. Innovations in flavor encapsulation technologies are also gaining traction, enabling better stability, controlled release, and enhanced sensory impact. However, certain factors may present challenges. Stringent regulatory frameworks concerning food additives and flavorings, along with the potential volatility in the prices of raw materials, could pose restraints. Nevertheless, the overall outlook for the Canadian Food Flavor and Enhancer Market remains highly positive, driven by continuous product innovation and the persistent consumer appetite for exciting and high-quality food experiences. The competitive landscape features prominent global players like Givaudan and International Flavors & Fragrances Inc., alongside emerging regional companies, all vying to capture market share through strategic product development and market penetration.

Canada Food Flavor and Enhancer Market Company Market Share

Comprehensive Report: Canada Food Flavor and Enhancer Market (2019–2033)

This in-depth report provides a detailed analysis of the Canada Food Flavor and Enhancer Market, encompassing its current landscape, historical trends, and future projections. Covering a study period from 2019 to 2033, with a base year of 2025, this research offers actionable insights for stakeholders, including manufacturers, suppliers, ingredient providers, and investors. We delve into market dynamics, growth trajectories, regional dominance, product innovation, key drivers, emerging opportunities, and the competitive landscape.

Report Scope:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Market Value: All values presented in USD Billion units.

Key Segments Analyzed:

- Type:

- Flavors (Natural Flavors, Nature-Identical Flavors, Synthetic Flavors)

- Flavor Enhancers

- Application:

- Bakery

- Confectionery

- Dairy Products

- Beverages

- Savory Snacks

- Soups and Sauces

- Others

Canada Food Flavor and Enhancer Market Market Dynamics & Structure

The Canada Food Flavor and Enhancer Market exhibits a moderately consolidated structure, with key players like Givaudan, International Flavors and Fragrances Inc., and Firmenich holding significant market shares. Technological innovation is a primary driver, fueled by advancements in extraction techniques, fermentation, and encapsulation, leading to the development of more sophisticated and authentic flavor profiles. Regulatory frameworks, including those governed by Health Canada, play a crucial role in dictating ingredient safety, labeling standards, and permissible usage levels, influencing product formulation and market entry. Competitive product substitutes, such as ingredient reformulation and the use of whole food ingredients for natural flavoring, present a dynamic challenge to synthetic and nature-identical alternatives. End-user demographics, particularly the growing demand for clean-label products, plant-based alternatives, and reduced sugar/salt formulations, are profoundly shaping product development. Mergers and acquisitions (M&A) trends are active, with larger companies acquiring innovative startups to expand their portfolios and geographical reach. For instance, the acquisition of specialized flavor ingredient companies by multinational corporations has been a notable trend, aiming to enhance R&D capabilities and market penetration.

- Market Concentration: Moderately consolidated.

- Technological Innovation Drivers: Advanced extraction, fermentation, encapsulation, and AI-driven flavor design.

- Regulatory Frameworks: Health Canada approvals, allergen labeling, nutritional claims, and food additive regulations.

- Competitive Product Substitutes: Whole food ingredients, natural extracts, and innovative food science approaches.

- End-User Demographics: Demand for clean labels, plant-based, low-sugar, low-salt, and sustainably sourced products.

- M&A Trends: Strategic acquisitions to gain technological expertise and market access. Approximately 3-5 significant M&A deals are anticipated annually in the Canadian market, indicating active consolidation.

Canada Food Flavor and Enhancer Market Growth Trends & Insights

The Canada Food Flavor and Enhancer Market is on a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. This expansion is underpinned by evolving consumer preferences and increased demand for processed foods and beverages across various applications. The market size, estimated to be around USD 1.2 billion in 2025, is expected to reach USD 1.8 billion by 2033. The adoption rate of natural and nature-identical flavors is significantly increasing, driven by a growing consumer consciousness around health and wellness, leading to a perceptible shift away from purely synthetic ingredients. Technological disruptions, including advancements in biotechnology for flavor production and the application of artificial intelligence in flavor profile development, are creating new avenues for product innovation and market penetration. Consumer behavior shifts, such as a rising interest in international cuisines and diverse taste profiles, are also contributing to market dynamism, encouraging manufacturers to introduce novel and exotic flavor options. The increasing prevalence of convenience foods and ready-to-eat meals further propels the demand for effective flavorings and enhancers to ensure consistent taste and palatability.

- Market Size Evolution: From an estimated USD 1.2 billion in 2025 to an anticipated USD 1.8 billion by 2033.

- CAGR: Approximately 5.5% during the forecast period.

- Adoption Rates: Significant increase in the adoption of natural and nature-identical flavors.

- Technological Disruptions: Innovations in biotech-produced flavors, AI-driven flavor design, and advanced sensory analysis.

- Consumer Behavior Shifts: Growing demand for diverse taste experiences, ethnic flavors, and clean-label ingredients.

- Market Penetration: High penetration in the bakery and beverage sectors, with increasing growth in savory snacks and dairy.

Dominant Regions, Countries, or Segments in Canada Food Flavor and Enhancer Market

Within the Canadian landscape, the Flavors segment, particularly Natural Flavors, is emerging as the dominant force in the Food Flavor and Enhancer Market. This dominance is driven by a confluence of consumer demand for clean-label products and stringent regulatory scrutiny on artificial ingredients. Canada's progressive approach to food labeling and a growing awareness of natural sourcing among consumers have significantly boosted the market share of natural flavorings, which is expected to account for over 60% of the total flavors market by 2028.

Among the various applications, Beverages and Bakery continue to be the largest end-use segments, collectively representing an estimated 45% of the market value in 2025. The beverage industry's constant demand for innovative taste profiles in soft drinks, juices, and functional beverages, coupled with the bakery sector's reliance on flavors to enhance the appeal of bread, cakes, and pastries, solidifies their leading positions. However, the Savory Snacks segment is exhibiting the fastest growth rate, fueled by an increasing preference for convenient, flavorful snack options and the rise of international flavor trends.

On a regional basis, Ontario and Quebec remain the primary economic hubs and thus command the largest share of the food flavor and enhancer market in Canada. These provinces boast a significant concentration of food processing facilities, research and development centers, and a substantial consumer base that drives demand. Economic policies in these regions, focusing on supporting the food manufacturing sector and promoting innovation, further contribute to their market leadership. Infrastructure development, including robust supply chain networks and efficient distribution channels, also plays a pivotal role in facilitating market access and growth. The presence of major food manufacturers and a highly developed retail sector in these provinces ensures consistent demand for a wide array of flavor and enhancer solutions.

- Dominant Segment (Type): Natural Flavors (expected to exceed 60% market share by 2028).

- Key Drivers: Clean-label trend, consumer preference for natural ingredients, regulatory advantages.

- Dominant Segments (Application): Beverages and Bakery (combined ~45% market share in 2025).

- Key Drivers: High demand for processed foods, constant innovation in taste profiles, established product categories.

- Fastest Growing Segment (Application): Savory Snacks.

- Key Drivers: Convenience food trends, demand for diverse international flavors, increasing disposable income.

- Dominant Regions: Ontario and Quebec.

- Key Drivers: Concentration of food processing industry, large consumer base, supportive economic policies, advanced infrastructure.

Canada Food Flavor and Enhancer Market Product Landscape

The Canada Food Flavor and Enhancer Market is characterized by a continuous stream of innovative products designed to meet evolving consumer demands. Key product innovations include the development of enhanced natural flavor extracts that mimic the complexity of authentic ingredients, the introduction of microencapsulated flavors for controlled release and extended shelf life in confectionery and bakery products, and the creation of sophisticated flavor blends for plant-based meat and dairy alternatives. Performance metrics like flavor intensity, stability under processing conditions, and taste profile authenticity are paramount. Unique selling propositions often revolve around natural sourcing, allergen-free formulations, and the ability to deliver specific taste sensations such as umami enhancement or sweetness perception modulation. Technological advancements are enabling the creation of entirely new flavor experiences, pushing the boundaries of sensory perception and offering novel solutions for product developers seeking to differentiate their offerings in a competitive market.

Key Drivers, Barriers & Challenges in Canada Food Flavor and Enhancer Market

Key Drivers:

The Canadian Food Flavor and Enhancer Market is propelled by several significant forces. The escalating consumer demand for clean-label products, natural ingredients, and healthier food options is a primary driver, pushing manufacturers towards natural and nature-identical flavorings. Technological advancements in flavor extraction, fermentation, and synthesis allow for the creation of more authentic, potent, and cost-effective flavor solutions. Furthermore, the growing processed food and beverage industry, coupled with the increasing popularity of convenience foods and the exploration of diverse global cuisines, fuels the demand for a wider variety of flavor profiles. Policy support for the food manufacturing sector and research into food innovation also contribute to market growth.

Barriers & Challenges:

Despite the positive growth outlook, the market faces several barriers and challenges. Stringent regulatory frameworks and evolving labeling requirements can pose hurdles for new ingredient introductions and necessitate costly compliance measures. The volatility of raw material prices, particularly for natural flavor sources, can impact production costs and supply chain stability. Intense competition from established global players and the emergence of smaller, niche ingredient suppliers also present a significant challenge, requiring continuous innovation and competitive pricing strategies. Consumer perception of "artificial" ingredients, even those deemed safe, can act as a restraint, demanding greater transparency and education from manufacturers. Supply chain disruptions, as experienced during global events, can impact the availability and cost of key ingredients.

Emerging Opportunities in Canada Food Flavor and Enhancer Market

Emerging opportunities in the Canada Food Flavor and Enhancer Market lie in the burgeoning plant-based food sector, which requires specialized flavor solutions to mimic traditional meat and dairy tastes. The demand for functional flavors, offering health benefits beyond taste, such as stress reduction or improved digestion, presents another significant avenue for innovation. Untapped markets include the senior nutrition segment, requiring palatability enhancements for specialized diets, and the growing "free-from" product category, necessitating sophisticated allergen-free flavorings. The development of sustainable flavor production methods, utilizing waste streams or precision fermentation, aligns with increasing eco-conscious consumer preferences and offers a competitive advantage. Moreover, the personalization of food experiences, driven by data analytics, could lead to opportunities for custom flavor blends tailored to individual consumer preferences.

Growth Accelerators in the Canada Food Flavor and Enhancer Market Industry

Several catalysts are accelerating long-term growth in the Canada Food Flavor and Enhancer Market. Technological breakthroughs in biotechnology, enabling the cost-effective production of complex natural flavors through fermentation and cell culture, are a significant growth accelerator. Strategic partnerships between flavor houses and food manufacturers foster collaborative innovation, leading to the development of tailored solutions that meet specific product needs and market trends. Market expansion strategies, including increased investment in research and development for novel flavor applications and the exploration of export markets for Canadian-made flavor ingredients, are also crucial growth drivers. The ongoing trend of premiumization in food products, where consumers are willing to pay more for enhanced taste experiences, further fuels investment and innovation in the flavor sector.

Key Players Shaping the Canada Food Flavor and Enhancer Market Market

- Givaudan

- International Flavors and Fragrances Inc.

- Flavorcan International Inc.

- Corbion NV

- Aromatics+Flavors Inc.

- Firmenich

- Archer Daniels Midland Company

- Takasago International Corporation

- Koninklijke DSM N V

- Kerry Group

Notable Milestones in Canada Food Flavor and Enhancer Market Sector

- 2023: Launch of new plant-based flavor lines by major players, responding to increased vegan and vegetarian product development.

- 2022: Increased investment in R&D for natural flavor enhancers, driven by consumer demand for reduced sodium and sugar.

- 2021: Acquisitions of specialized flavor ingredient companies by larger multinational corporations to expand portfolios.

- 2020: Focus on sustainable sourcing and production methods for natural flavors, gaining market traction.

- 2019: Growing adoption of clean-label certifications for flavor ingredients, influencing product formulations.

In-Depth Canada Food Flavor and Enhancer Market Market Outlook

The future outlook for the Canada Food Flavor and Enhancer Market is exceptionally bright, fueled by sustained consumer demand for taste innovation and healthier food choices. Growth accelerators such as advanced biotechnology for natural flavor production, strategic collaborations between ingredient suppliers and food manufacturers, and ongoing market expansion initiatives will continue to shape the industry. The increasing focus on sustainability throughout the value chain presents strategic opportunities for companies adopting eco-friendly production practices. The market's ability to adapt to evolving dietary trends, including the demand for personalized nutrition and functional ingredients, will be key to unlocking its full potential. Stakeholders can anticipate continued growth driven by innovation in flavor creation, a strong emphasis on natural and clean-label solutions, and an expanding array of applications across the food and beverage spectrum.

Canada Food Flavor and Enhancer Market Segmentation

-

1. Type

-

1.1. Flavors

- 1.1.1. Natural Flavors

- 1.1.2. Nature-Identical Flavors

- 1.1.3. Synthetic Flavors

- 1.2. Flavor Enhancers

-

1.1. Flavors

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy Products

- 2.4. Beverages

- 2.5. Savory Snacks

- 2.6. Soups and Sauces

- 2.7. Others

Canada Food Flavor and Enhancer Market Segmentation By Geography

- 1. Canada

Canada Food Flavor and Enhancer Market Regional Market Share

Geographic Coverage of Canada Food Flavor and Enhancer Market

Canada Food Flavor and Enhancer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Clean Label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.1.1. Natural Flavors

- 5.1.1.2. Nature-Identical Flavors

- 5.1.1.3. Synthetic Flavors

- 5.1.2. Flavor Enhancers

- 5.1.1. Flavors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy Products

- 5.2.4. Beverages

- 5.2.5. Savory Snacks

- 5.2.6. Soups and Sauces

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Givaudan

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Flavors and Fragrances Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Flavorcan International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Corbion NV*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aromatics+Flavors Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Firmenich

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takasago International Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Koninklijke DSM N V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Givaudan

List of Figures

- Figure 1: Canada Food Flavor and Enhancer Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Food Flavor and Enhancer Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Canada Food Flavor and Enhancer Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Food Flavor and Enhancer Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Food Flavor and Enhancer Market?

Key companies in the market include Givaudan, International Flavors and Fragrances Inc, Flavorcan International Inc, Corbion NV*List Not Exhaustive, Aromatics+Flavors Inc, Firmenich, Archer Daniels Midland Company, Takasago International Corporation, Koninklijke DSM N V, Kerry Group.

3. What are the main segments of the Canada Food Flavor and Enhancer Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Increase in Demand for Clean Label Ingredients.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Food Flavor and Enhancer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Food Flavor and Enhancer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Food Flavor and Enhancer Market?

To stay informed about further developments, trends, and reports in the Canada Food Flavor and Enhancer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence