Key Insights

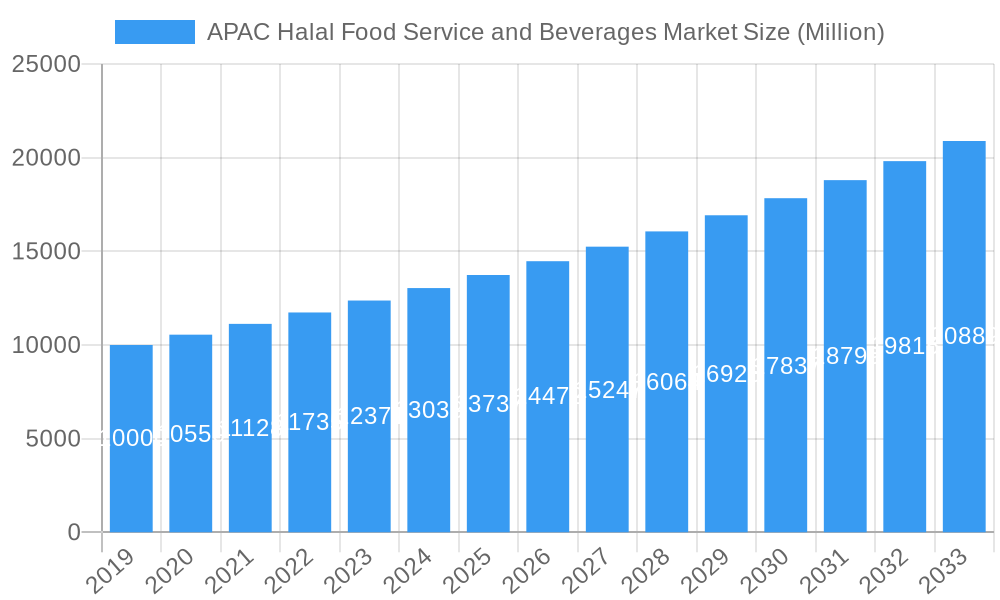

The APAC Halal Food Service and Beverages Market is poised for significant expansion, projected to reach a substantial XX million by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.50% through 2033. This growth is primarily propelled by a confluence of factors, including the increasing awareness and demand for halal products among the burgeoning Muslim population in the region, coupled with a growing non-Muslim consumer base seeking ethically and healthily sourced food options. Rising disposable incomes across key Asia-Pacific economies are further fueling consumer spending on premium and specialized food and beverage categories, including halal certified products. The expanding middle class in countries like China and India, in particular, represents a vast untapped potential for market penetration and sales growth. Furthermore, government initiatives promoting the halal industry and increasing investments in halal certification infrastructure are creating a more conducive environment for market players.

APAC Halal Food Service and Beverages Market Market Size (In Billion)

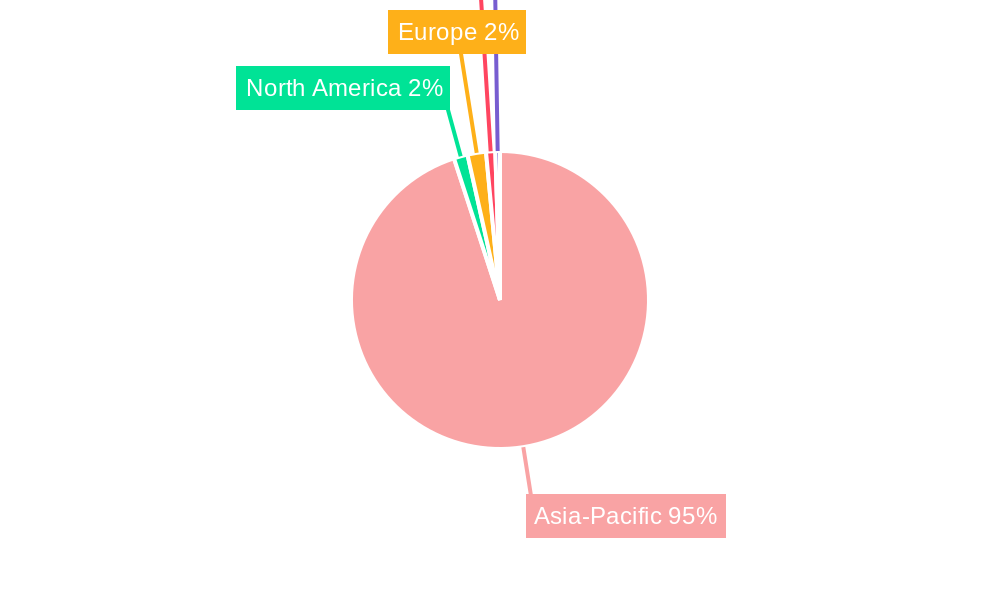

The market segmentation reveals a diverse landscape with Halal Food products, encompassing Meat Products, Bakery Products, Dairy Products, Confectionery, and Other Halal Foods, leading the charge. Halal Beverages and Halal Supplements are also emerging as significant growth segments, catering to evolving consumer lifestyles and health consciousness. Distribution channels are dominated by Supermarkets/Hypermarkets, offering wide accessibility and product variety, followed by Convenience Stores and Specialty Stores catering to niche demands. Geographically, the Asia-Pacific region is a powerhouse, with China, India, Indonesia, and Malaysia expected to be key growth engines, driven by their large Muslim populations and increasing adoption of halal standards. Emerging trends such as the rise of e-commerce for halal product distribution and the increasing demand for innovative halal food products with global appeal are shaping the competitive dynamics. However, challenges such as varying halal certification standards across countries and potential supply chain disruptions could pose restraints, demanding strategic navigation by market participants.

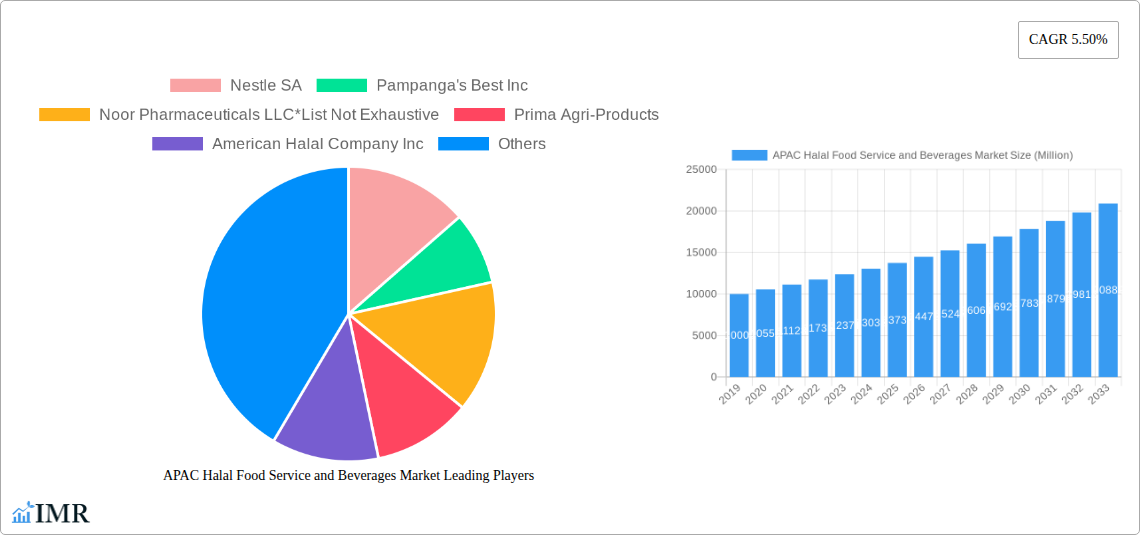

APAC Halal Food Service and Beverages Market Company Market Share

This comprehensive report delves into the dynamic APAC Halal Food Service and Beverages Market, offering a granular analysis of its growth trajectory, key drivers, challenges, and competitive landscape. Examining the period from 2019 to 2033, with a base year of 2025, this study provides invaluable insights for stakeholders seeking to capitalize on the burgeoning demand for Halal-certified products and services across the Asia-Pacific region. Our analysis covers both parent and child markets, segmenting the industry by product type, distribution channel, and geographical presence.

APAC Halal Food Service and Beverages Market Market Dynamics & Structure

The APAC Halal Food Service and Beverages Market is characterized by a moderate market concentration, with a growing number of local and international players vying for market share. Technological innovation is a significant driver, particularly in areas like traceability and certification technologies, enhancing consumer trust and product integrity. Regulatory frameworks, while evolving, are increasingly supportive of Halal standards, creating a more conducive environment for market expansion. Competitive product substitutes exist, primarily from conventional food and beverage options, necessitating clear differentiation and value proposition for Halal offerings. End-user demographics are diverse, with a growing young, affluent, and increasingly health-conscious Muslim population, alongside non-Muslim consumers seeking perceived purity and quality. Mergers and Acquisitions (M&A) trends are on the rise as companies seek to expand their product portfolios, geographical reach, and supply chain capabilities. For instance, a notable M&A deal volume of approximately 15 transactions was observed in the historical period (2019-2024), indicating consolidation and strategic growth. Innovation barriers include the complexity of obtaining and maintaining Halal certification across different regions and the need for significant investment in specialized production facilities.

APAC Halal Food Service and Beverages Market Growth Trends & Insights

The APAC Halal Food Service and Beverages Market is poised for robust expansion, fueled by a confluence of demographic, economic, and socio-cultural factors. The market size is projected to grow from an estimated $XXX Million in 2025 to $YYY Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z.Z% during the forecast period (2025–2033). This growth is underpinned by increasing awareness and adoption rates of Halal products, driven by a growing Muslim population and the rising preference of non-Muslim consumers for ethically sourced and perceived healthier food options. Technological disruptions, such as advancements in food processing, packaging, and digital traceability solutions, are further enhancing the appeal and accessibility of Halal products. Consumer behavior shifts are evident, with a greater demand for transparency in sourcing and production, influencing brand loyalty and purchasing decisions. The market penetration of Halal food and beverages in the general food and beverage sector is estimated to increase from AA% in 2025 to BB% by 2033, signifying a significant shift in consumer preferences. The perceived purity and adherence to strict ethical guidelines associated with Halal certification are increasingly aligning with broader consumer trends towards wellness and conscious consumption.

Dominant Regions, Countries, or Segments in APAC Halal Food Service and Beverages Market

Indonesia stands out as a dominant region within the APAC Halal Food Service and Beverages Market, driven by its substantial Muslim population, robust economic growth, and government initiatives promoting Halal product development and export. The country's market share in the APAC region is estimated at XX% in 2025. Within the product type segmentation, Halal Food is the largest segment, particularly Meat Products, which accounts for an estimated XX% of the Halal Food market in 2025. This dominance is attributed to the staple nature of meat in the diet and the strict Halal requirements for its preparation and processing.

- Key Drivers for Indonesia's Dominance:

- Large Muslim Population: Approximately 237 million Muslims, representing the largest globally, create a consistent and substantial demand.

- Government Support: Policies promoting Halal industry development and export incentives.

- Growing Middle Class: Increased disposable income leads to higher spending on food and beverages.

- Established Halal Certification Body: The Indonesian Ulema Council (MUI) provides a well-recognized and trusted Halal certification.

Among distribution channels, Supermarkets/Hypermarkets lead the market with an estimated XX% market share in 2025, owing to their widespread reach and variety of Halal offerings. Geographically, while Indonesia is a leader, Malaysia is also a significant player, with a strong focus on Halal product innovation and export, holding an estimated YY% market share in 2025. China and India, with their vast populations and growing awareness of Halal products, represent significant growth potential, despite currently holding smaller market shares. The Halal Supplements segment, though nascent, is showing promising growth driven by health-conscious consumers seeking Halal-certified nutritional products.

APAC Halal Food Service and Beverages Market Product Landscape

The product landscape of the APAC Halal Food Service and Beverages Market is evolving rapidly with a focus on innovation and meeting diverse consumer needs. Key developments include the introduction of novel Halal-certified meat alternatives, plant-based options aligning with both Halal and vegan trends, and the fortification of dairy products with essential nutrients while adhering to stringent Halal standards. Bakery products are seeing innovation in gluten-free and specialty Halal options, catering to niche dietary requirements. Confectionery products are experiencing a surge in demand for premium Halal chocolates and snacks. Technological advancements in Halal certification processes, such as blockchain-based traceability, are enhancing product transparency and consumer confidence. The performance metrics of these products are largely driven by their perceived quality, safety, and adherence to Islamic principles, with brand reputation playing a crucial role.

Key Drivers, Barriers & Challenges in APAC Halal Food Service and Beverages Market

Key Drivers: The primary forces propelling the APAC Halal Food Service and Beverages Market include the demographic advantage of a large and growing Muslim population, increasing disposable incomes, and the rising global awareness and acceptance of Halal products beyond the Muslim community. Economic policies that support Halal industry development and export, coupled with growing consumer demand for ethically sourced and perceived healthier food options, further act as significant growth accelerators. Technological advancements in Halal certification and supply chain management enhance trust and efficiency.

Key Barriers & Challenges: Supply chain complexities and the need for stringent adherence to Halal slaughtering and processing methods present significant challenges. Regulatory hurdles in obtaining and maintaining diverse Halal certifications across different countries can be a deterrent. Competitive pressures from both conventional and emerging Halal market players, alongside the cost of Halal certification and production, can impact profitability. Consumer education regarding the nuances of Halal certification and potential misconceptions also pose a challenge.

Emerging Opportunities in APAC Halal Food Service and Beverages Market

Emerging opportunities in the APAC Halal Food Service and Beverages Market lie in untapped geographical markets within Southeast Asia and South Asia, where the Muslim population is significant but Halal product penetration is still developing. The rising demand for Halal-certified ready-to-eat meals and convenience foods presents a substantial avenue for growth. Innovative applications of Halal principles in the functional food and beverage sector, such as Halal-certified probiotics and adaptogens, are gaining traction. Evolving consumer preferences for sustainable and ethically sourced Halal products offer opportunities for brands to differentiate themselves through transparent sourcing and eco-friendly packaging. The expansion of e-commerce platforms dedicated to Halal products also presents a significant distribution opportunity.

Growth Accelerators in the APAC Halal Food Service and Beverages Market Industry

Catalysts driving long-term growth in the APAC Halal Food Service and Beverages Market industry include continuous technological breakthroughs in Halal authentication and supply chain integrity, such as DNA-based testing and AI-powered traceability systems. Strategic partnerships between established food conglomerates and niche Halal producers are fostering innovation and expanding market reach. Aggressive market expansion strategies by key players into emerging economies, coupled with targeted marketing campaigns highlighting the health and ethical benefits of Halal products, are further propelling growth. The increasing focus on Halal tourism and its associated food service requirements also presents a significant growth avenue.

Key Players Shaping the APAC Halal Food Service and Beverages Market Market

- Nestle SA

- Pampanga's Best Inc

- Noor Pharmaceuticals LLC

- Prima Agri-Products

- American Halal Company Inc

- Ecolite Biotech Manufacturing Sdn Bhd

Notable Milestones in APAC Halal Food Service and Beverages Market Sector

- 2023/09: Launch of a new range of Halal-certified plant-based meat alternatives by Nestle SA, catering to growing demand for sustainable and Halal options.

- 2022/11: Pampanga's Best Inc. expands its Halal-certified processed meat product line, targeting increased market share in the Philippines.

- 2021/05: Noor Pharmaceuticals LLC announces significant investment in expanding its Halal-certified pharmaceutical and nutraceutical production capacity in Malaysia.

- 2020/03: Prima Agri-Products secures new Halal certification for its expanded aquaculture operations, enhancing its seafood product offerings.

- 2019/12: American Halal Company Inc. initiates strategic partnerships to broaden its distribution network for Halal ingredients across key Asian markets.

In-Depth APAC Halal Food Service and Beverages Market Market Outlook

The APAC Halal Food Service and Beverages Market is on a robust growth trajectory, driven by a confluence of demographic shifts, increasing consumer awareness, and evolving lifestyle choices. The market is poised to witness sustained expansion, presenting significant strategic opportunities for both established players and new entrants. Growth accelerators such as technological advancements in Halal certification and supply chain transparency, alongside strategic market expansion initiatives and increasing demand for healthy and ethically produced food, will continue to shape the industry. The future outlook indicates a more integrated and sophisticated Halal market, with a stronger emphasis on product innovation, wider accessibility, and greater consumer trust, solidifying its position as a pivotal segment within the global food and beverage landscape.

APAC Halal Food Service and Beverages Market Segmentation

-

1. Product Type

-

1.1. Halal Food

- 1.1.1. Meat Products

- 1.1.2. Bakery Products

- 1.1.3. Dairy Products

- 1.1.4. Confectionery

- 1.1.5. Other Halal Foods

- 1.2. Halal Beverages

- 1.3. Halal Supplements

-

1.1. Halal Food

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. Asia-Pacific

- 3.1.1. China

- 3.1.2. Japan

- 3.1.3. India

- 3.1.4. Australia

- 3.1.5. Indonesia

- 3.1.6. Malaysia

- 3.1.7. Singapore

- 3.1.8. Rest of Asia-Pacific

-

3.1. Asia-Pacific

APAC Halal Food Service and Beverages Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. India

- 1.4. Australia

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Rest of Asia Pacific

APAC Halal Food Service and Beverages Market Regional Market Share

Geographic Coverage of APAC Halal Food Service and Beverages Market

APAC Halal Food Service and Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats

- 3.3. Market Restrains

- 3.3.1. Availability of counterfeit products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Halal Meat Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Halal Food Service and Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Halal Food

- 5.1.1.1. Meat Products

- 5.1.1.2. Bakery Products

- 5.1.1.3. Dairy Products

- 5.1.1.4. Confectionery

- 5.1.1.5. Other Halal Foods

- 5.1.2. Halal Beverages

- 5.1.3. Halal Supplements

- 5.1.1. Halal Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Asia-Pacific

- 5.3.1.1. China

- 5.3.1.2. Japan

- 5.3.1.3. India

- 5.3.1.4. Australia

- 5.3.1.5. Indonesia

- 5.3.1.6. Malaysia

- 5.3.1.7. Singapore

- 5.3.1.8. Rest of Asia-Pacific

- 5.3.1. Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pampanga's Best Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Noor Pharmaceuticals LLC*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Prima Agri-Products

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Halal Company Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ecolite Biotech Manufacturing Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: Global APAC Halal Food Service and Beverages Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific APAC Halal Food Service and Beverages Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Asia Pacific APAC Halal Food Service and Beverages Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific APAC Halal Food Service and Beverages Market Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 5: Asia Pacific APAC Halal Food Service and Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: Asia Pacific APAC Halal Food Service and Beverages Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: Asia Pacific APAC Halal Food Service and Beverages Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Asia Pacific APAC Halal Food Service and Beverages Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Asia Pacific APAC Halal Food Service and Beverages Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Halal Food Service and Beverages Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: India APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Australia APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of Asia Pacific APAC Halal Food Service and Beverages Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Halal Food Service and Beverages Market?

The projected CAGR is approximately 6.56%.

2. Which companies are prominent players in the APAC Halal Food Service and Beverages Market?

Key companies in the market include Nestle SA, Pampanga's Best Inc, Noor Pharmaceuticals LLC*List Not Exhaustive, Prima Agri-Products, American Halal Company Inc, Ecolite Biotech Manufacturing Sdn Bhd.

3. What are the main segments of the APAC Halal Food Service and Beverages Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats.

6. What are the notable trends driving market growth?

Increasing Demand for Halal Meat Products.

7. Are there any restraints impacting market growth?

Availability of counterfeit products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Halal Food Service and Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Halal Food Service and Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Halal Food Service and Beverages Market?

To stay informed about further developments, trends, and reports in the APAC Halal Food Service and Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence