Key Insights

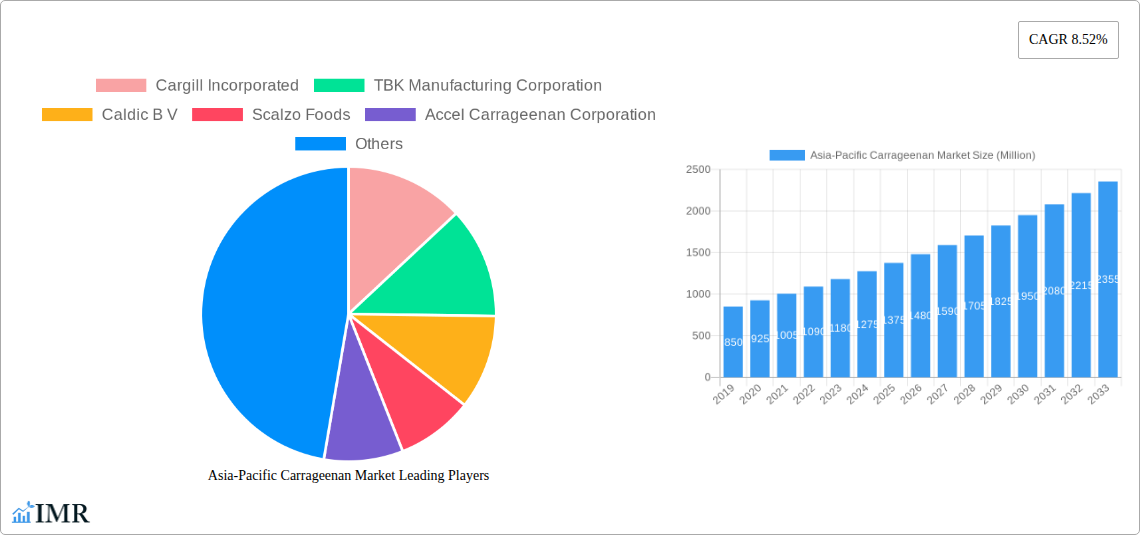

The Asia-Pacific carrageenan market is set for significant expansion, projected to achieve a valuation of approximately $1.25 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.52% through 2033. This growth is primarily driven by the escalating demand for carrageenan as a gelling, stabilizing, and thickening agent across various industries. The food sector, particularly dairy, meat, and beverages, is the largest application segment, fueled by consumer preference for processed and convenience foods. The pharmaceutical industry is another key contributor, leveraging carrageenan's emulsifying and stabilizing properties in drug formulations and excipients. Additionally, the expanding beauty and personal care sector increasingly utilizes carrageenan in products like lotions, creams, and toothpaste for its texturizing and moisturizing benefits.

Asia-Pacific Carrageenan Market Market Size (In Billion)

Key growth catalysts include a rising middle class with enhanced disposable income, leading to increased consumption of processed foods and personal care items. Technological advancements in extraction and processing are also improving carrageenan's quality and utility, positioning it as a preferred natural and functional additive. However, the market faces challenges such as raw material price volatility (seaweed) and the emergence of alternative hydrocolloids. Stringent regional regulations and consumer awareness regarding seaweed processing may also impact market dynamics. Geographically, China and India are anticipated to lead market growth, owing to their large populations, rapidly developing food processing industries, and growing adoption of convenience products. Japan and other Southeast Asian nations are also significant contributors, supported by established food and pharmaceutical sectors and a rising demand for premium ingredients.

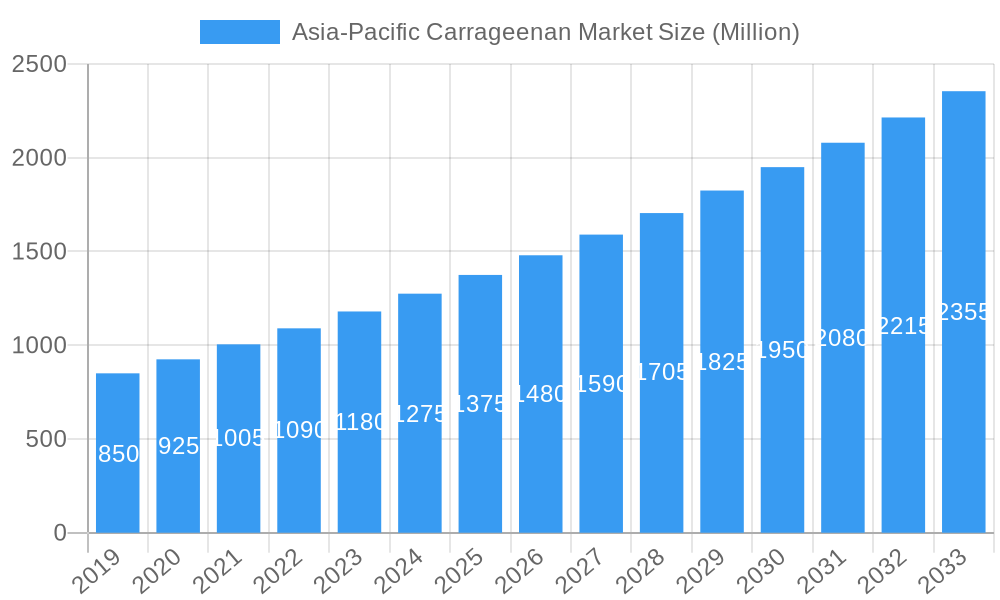

Asia-Pacific Carrageenan Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia-Pacific Carrageenan Market, an essential ingredient in numerous consumer and industrial applications. Explore market dynamics, growth trajectories, regional leadership, product innovations, key drivers, emerging opportunities, and competitive landscapes. With a forecast period extending to 2033, this report provides actionable intelligence for stakeholders aiming to capitalize on the growing carrageenan demand across the region. Our analysis covers food ingredients, hydrocolloids, and carrageenan extract for a holistic market perspective.

Asia-Pacific Carrageenan Market Market Dynamics & Structure

The Asia-Pacific Carrageenan Market is characterized by a moderately concentrated structure, with key players investing strategically to bolster their presence and product offerings. Technological innovation remains a significant driver, focusing on enhancing carrageenan's functional properties, such as gel strength and viscosity, for specialized applications in the food industry. Regulatory frameworks, while evolving, largely support the use of carrageenan as a thickener, stabilizer, and emulsifier, particularly in the dairy product and beverage sectors. Competitive product substitutes, including pectin, agar-agar, and xanthan gum, present a constant challenge, necessitating continuous product differentiation and cost optimization by carrageenan manufacturers. End-user demographics are shifting towards a greater demand for clean-label ingredients and natural additives, influencing R&D efforts. Mergers and acquisitions (M&A) are a notable trend, with companies aiming to expand market reach and diversify product portfolios. For instance, approximately 5-8 M&A deals have been observed within the broader food ingredient sector annually, with carrageenan players participating to consolidate market share and access new technologies. Innovation barriers include the inherent variability in seaweed sourcing and processing, which can impact product quality and cost.

- Market Concentration: Moderately concentrated, with leading global and regional players holding significant market shares.

- Technological Innovation Drivers: Focus on improved gel strength, controlled rheology, and specialized functionalities for niche applications.

- Regulatory Frameworks: Generally favorable for food applications, with ongoing assessments for pharmaceutical and personal care uses.

- Competitive Product Substitutes: Pectin, agar-agar, alginates, and synthetic thickeners pose ongoing competition.

- End-User Demographics: Growing demand for natural, clean-label, and healthier food options.

- M&A Trends: Strategic acquisitions and partnerships aimed at market expansion and portfolio enhancement.

- Innovation Barriers: Supply chain consistency of raw materials (seaweed), processing complexities, and cost competitiveness against substitutes.

Asia-Pacific Carrageenan Market Growth Trends & Insights

The Asia-Pacific Carrageenan Market is poised for robust growth, driven by the expanding food and beverage industry, increasing consumer preference for processed foods, and burgeoning pharmaceutical and beauty & personal care applications. The market size is projected to reach approximately USD 1,200 Million units by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period of 2025–2033. Adoption rates of carrageenan are steadily increasing, particularly in emerging economies like India and the Philippines, fueled by rising disposable incomes and changing dietary habits. Technological disruptions, such as advancements in extraction and purification processes, are enhancing the quality and efficiency of carrageenan production, leading to more diverse applications. Consumer behavior shifts towards convenient and ready-to-eat meals, coupled with a growing awareness of carrageenan's textural and stabilizing properties, are further propelling market expansion. The market penetration of carrageenan in various food applications is already significant, with ongoing opportunities for growth in specialized sectors like confectionery, desserts, and low-fat dairy alternatives. The demand for specific carrageenan types, like Kappa and Iota carrageenan, is expected to see substantial increases due to their distinct gelling and thickening properties, respectively. The pharmaceutical sector's increasing use of carrageenan as an excipient and in drug delivery systems is a key growth accelerator. Similarly, the beauty and personal care industry is exploring carrageenan for its emulsifying and stabilizing capabilities in creams, lotions, and toothpaste. The base year 2025 estimates the market at USD 1,180 Million units, with a projected growth to USD 1,850 Million units by 2033.

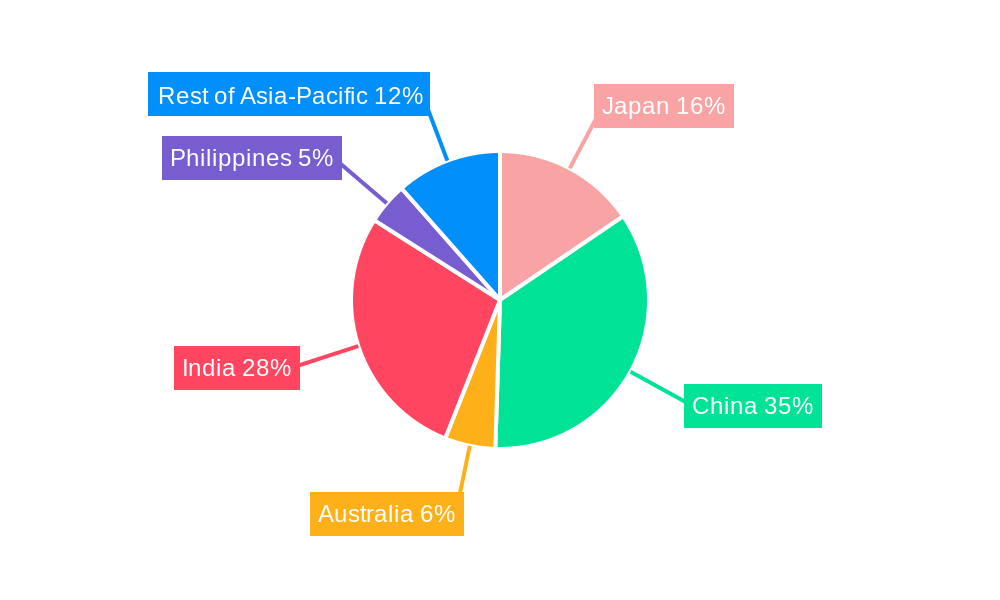

Dominant Regions, Countries, or Segments in Asia-Pacific Carrageenan Market

China stands out as the dominant region within the Asia-Pacific Carrageenan Market, driven by its massive population, rapidly expanding food processing industry, and significant investments in R&D. The country's robust manufacturing capabilities and a growing middle class with increasing purchasing power contribute to a substantial demand for carrageenan in food products, particularly in dairy products and beverages. China's market share in the Asia-Pacific region is estimated to be around 35-40%, reflecting its pivotal role.

Key Drivers of Dominance in China:

- Vast Consumer Base: A large and growing population with increasing consumption of processed foods and beverages.

- Industrial Growth: A highly developed food manufacturing sector that extensively utilizes carrageenan as a functional ingredient.

- Government Support & Investment: Favorable policies and investments in food technology and ingredient innovation.

- Technological Advancements: Local companies are increasingly investing in advanced extraction and purification technologies for carrageenan.

In terms of application segments, the Food category, encompassing Dairy Products, Meat Products, and Beverages, is by far the largest and fastest-growing segment, accounting for approximately 70-75% of the total market revenue. Within the food segment, dairy products, including ice cream, yogurt, and milk-based desserts, represent a significant portion of carrageenan consumption due to its ability to provide desired texture and stability.

Key Drivers for Food Application Dominance:

- Versatility: Carrageenan's ability to act as a thickener, stabilizer, gelling agent, and emulsifier makes it indispensable in a wide range of food products.

- Texture Enhancement: It significantly improves the mouthfeel and texture of dairy products, meat products, and beverages.

- Cost-Effectiveness: Compared to some other hydrocolloids, carrageenan offers a favorable cost-benefit ratio for mass-produced food items.

- Consumer Acceptance: It is widely recognized and accepted by consumers in these product categories.

Among the types of carrageenan, Kappa carrageenan leads the market due to its strong gelling properties, making it ideal for desserts and confectionery. Iota carrageenan follows, valued for its elastic gel formation and use in dairy products requiring heat stability. Lambda carrageenan, primarily used as a thickener without significant gelling, finds applications in sauces and beverages.

Asia-Pacific Carrageenan Market Product Landscape

The Asia-Pacific Carrageenan Market is characterized by a dynamic product landscape focused on delivering enhanced functionalities and catering to evolving consumer demands. Manufacturers are innovating by producing refined carrageenan variants with specific gel strengths, viscosities, and thermal stabilities, crucial for precise applications in dairy products, meat products, and pharmaceutical formulations. Product innovations emphasize improved solubility, reduced syneresis, and the development of cleaner-label carrageenan extracts derived from sustainably sourced seaweed. Performance metrics such as gel strength (measured in grams per square centimeter), viscosity (measured in centipoise), and clarity are key differentiators. For example, advancements in Kappa carrageenan are yielding stronger, more heat-stable gels, while Iota carrageenan innovations are focusing on creating smoother, more melt-in-the-mouth textures for desserts. The application in plant-based alternatives is also a significant area of product development, with carrageenan playing a vital role in mimicking the texture of traditional dairy products.

Key Drivers, Barriers & Challenges in Asia-Pacific Carrageenan Market

Key Drivers:

- Growing Demand for Processed Foods: The burgeoning middle class in Asia-Pacific fuels the demand for convenient, ready-to-eat food products that heavily rely on carrageenan for texture and stability.

- Versatile Applications: Carrageenan's multifaceted functionalities as a thickener, stabilizer, gelling agent, and emulsifier make it indispensable across various industries, especially food.

- Technological Advancements: Continuous improvements in extraction and purification processes enhance carrageenan quality and unlock new applications, particularly in pharmaceuticals and personal care.

- Rising Health Consciousness (Paradoxical): While "clean label" is a trend, carrageenan's perceived natural origin (from seaweed) and its role in low-fat formulations can drive demand.

Barriers & Challenges:

- Supply Chain Volatility: Dependence on natural seaweed resources makes the supply chain susceptible to climate change, environmental factors, and geopolitical issues, impacting raw material availability and price stability.

- Regulatory Scrutiny & Consumer Perception: Although generally approved, certain carrageenan types have faced scrutiny regarding their impact on gut health, leading to negative consumer perceptions and a demand for alternatives.

- Competition from Substitutes: Pectin, agar-agar, modified starches, and other hydrocolloids offer similar functionalities and can pose significant price competition.

- Sustainability Concerns: Sourcing of seaweed and its impact on marine ecosystems can be a growing concern for environmentally conscious consumers and manufacturers.

Emerging Opportunities in Asia-Pacific Carrageenan Market

Emerging opportunities in the Asia-Pacific Carrageenan Market lie in the expanding plant-based food sector, where carrageenan is crucial for replicating the texture and mouthfeel of dairy products. The increasing demand for functional foods and nutraceuticals presents avenues for carrageenan's application as a carrier or stabilizer for active ingredients. Furthermore, advancements in pharmaceutical applications, including its use in drug delivery systems and as a binder in tablets, offer significant growth potential. The beauty and personal care industry's exploration of carrageenan for its moisturizing and texturizing properties in skincare and haircare products also represents an untapped market. The development of carrageenan derivatives with enhanced properties, such as improved heat resistance or specific gelling profiles, will cater to niche and high-value applications.

Growth Accelerators in the Asia-Pacific Carrageenan Market Industry

Several catalysts are propelling the long-term growth of the Asia-Pacific Carrageenan Market. Technological breakthroughs in sustainable seaweed cultivation and advanced extraction techniques are enhancing efficiency and reducing environmental impact. Strategic partnerships between carrageenan manufacturers and food technology companies are fostering innovation and the development of novel applications. The growing trend towards premiumization in food products, particularly in dairy and dessert segments, is driving demand for high-quality carrageenan that delivers superior texture and stability. Market expansion strategies focusing on untapped emerging economies within the region, coupled with a growing understanding of carrageenan's benefits in health-conscious formulations and pharmaceutical applications, are significant growth accelerators.

Key Players Shaping the Asia-Pacific Carrageenan Market Market

- Cargill Incorporated

- TBK Manufacturing Corporation

- Caldic B V

- Scalzo Foods

- Accel Carrageenan Corporation

- MCPI Corporation

- W Hydrocolloids Inc

- Marcel Carrageenan

Notable Milestones in Asia-Pacific Carrageenan Market Sector

- 2022: Several major carrageenan producers announced strategic partnerships aimed at expanding their supply chain resilience and market reach across Southeast Asia.

- 2023: Significant investments were reported in R&D for carrageenan extraction from alternative seaweed species to mitigate reliance on traditional sources and enhance functionality.

- 2024 (Q1): Regulatory approvals were obtained in key Asian markets for new applications of Lambda carrageenan in specialized pharmaceutical formulations, opening up new revenue streams.

- 2024 (Q2): A prominent player in the region completed an acquisition of a smaller competitor, thereby broadening its product portfolio and strengthening its market position.

- 2024 (Q3): Increased R&D funding towards developing carrageenan with enhanced gel-forming properties for plant-based meat alternatives was observed from multiple industry leaders.

- 2025 (Projected): Anticipated regulatory approvals for novel carrageenan-based cosmetic ingredients in major markets like China and Japan are expected to drive innovation in the beauty and personal care sector.

In-Depth Asia-Pacific Carrageenan Market Market Outlook

The future of the Asia-Pacific Carrageenan Market is exceptionally promising, driven by a confluence of factors including escalating demand from the food industry, particularly in dairy and processed foods, and expanding applications in the pharmaceutical and beauty sectors. Growth accelerators such as advancements in sustainable sourcing and processing technologies, coupled with strategic collaborations, are set to unlock new market potential. The rising consumer preference for natural ingredients and the innovative use of carrageenan in plant-based alternatives will further fuel market expansion. Stakeholders can anticipate strategic opportunities in developing specialized carrageenan grades catering to niche applications and in penetrating emerging economies with tailored product offerings. The continuous evolution of regulatory landscapes and an increasing focus on product differentiation will shape the competitive environment, paving the way for sustained growth.

Asia-Pacific Carrageenan Market Segmentation

-

1. Types

- 1.1. Kappa

- 1.2. Lota

- 1.3. Lambda

-

2. Application

-

2.1. Food

- 2.1.1. Dairy Products

- 2.1.2. Meat Products

- 2.1.3. Beverages

- 2.1.4. Others

- 2.2. Pharmaceutical

- 2.3. Beauty & Personal Care

-

2.1. Food

-

3. Geography

- 3.1. Japan

- 3.2. China

- 3.3. Australia

- 3.4. India

- 3.5. Philippines

- 3.6. Rest of Asia-Pacific

Asia-Pacific Carrageenan Market Segmentation By Geography

- 1. Japan

- 2. China

- 3. Australia

- 4. India

- 5. Philippines

- 6. Rest of Asia Pacific

Asia-Pacific Carrageenan Market Regional Market Share

Geographic Coverage of Asia-Pacific Carrageenan Market

Asia-Pacific Carrageenan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Upsurge in the Application in Dairy Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Carrageenan Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Kappa

- 5.1.2. Lota

- 5.1.3. Lambda

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food

- 5.2.1.1. Dairy Products

- 5.2.1.2. Meat Products

- 5.2.1.3. Beverages

- 5.2.1.4. Others

- 5.2.2. Pharmaceutical

- 5.2.3. Beauty & Personal Care

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Japan

- 5.3.2. China

- 5.3.3. Australia

- 5.3.4. India

- 5.3.5. Philippines

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.4.2. China

- 5.4.3. Australia

- 5.4.4. India

- 5.4.5. Philippines

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Japan Asia-Pacific Carrageenan Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Types

- 6.1.1. Kappa

- 6.1.2. Lota

- 6.1.3. Lambda

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food

- 6.2.1.1. Dairy Products

- 6.2.1.2. Meat Products

- 6.2.1.3. Beverages

- 6.2.1.4. Others

- 6.2.2. Pharmaceutical

- 6.2.3. Beauty & Personal Care

- 6.2.1. Food

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Japan

- 6.3.2. China

- 6.3.3. Australia

- 6.3.4. India

- 6.3.5. Philippines

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Types

- 7. China Asia-Pacific Carrageenan Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Types

- 7.1.1. Kappa

- 7.1.2. Lota

- 7.1.3. Lambda

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food

- 7.2.1.1. Dairy Products

- 7.2.1.2. Meat Products

- 7.2.1.3. Beverages

- 7.2.1.4. Others

- 7.2.2. Pharmaceutical

- 7.2.3. Beauty & Personal Care

- 7.2.1. Food

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Japan

- 7.3.2. China

- 7.3.3. Australia

- 7.3.4. India

- 7.3.5. Philippines

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Types

- 8. Australia Asia-Pacific Carrageenan Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Types

- 8.1.1. Kappa

- 8.1.2. Lota

- 8.1.3. Lambda

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food

- 8.2.1.1. Dairy Products

- 8.2.1.2. Meat Products

- 8.2.1.3. Beverages

- 8.2.1.4. Others

- 8.2.2. Pharmaceutical

- 8.2.3. Beauty & Personal Care

- 8.2.1. Food

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Japan

- 8.3.2. China

- 8.3.3. Australia

- 8.3.4. India

- 8.3.5. Philippines

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Types

- 9. India Asia-Pacific Carrageenan Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Types

- 9.1.1. Kappa

- 9.1.2. Lota

- 9.1.3. Lambda

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food

- 9.2.1.1. Dairy Products

- 9.2.1.2. Meat Products

- 9.2.1.3. Beverages

- 9.2.1.4. Others

- 9.2.2. Pharmaceutical

- 9.2.3. Beauty & Personal Care

- 9.2.1. Food

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Japan

- 9.3.2. China

- 9.3.3. Australia

- 9.3.4. India

- 9.3.5. Philippines

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Types

- 10. Philippines Asia-Pacific Carrageenan Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Types

- 10.1.1. Kappa

- 10.1.2. Lota

- 10.1.3. Lambda

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food

- 10.2.1.1. Dairy Products

- 10.2.1.2. Meat Products

- 10.2.1.3. Beverages

- 10.2.1.4. Others

- 10.2.2. Pharmaceutical

- 10.2.3. Beauty & Personal Care

- 10.2.1. Food

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Japan

- 10.3.2. China

- 10.3.3. Australia

- 10.3.4. India

- 10.3.5. Philippines

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Types

- 11. Rest of Asia Pacific Asia-Pacific Carrageenan Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Types

- 11.1.1. Kappa

- 11.1.2. Lota

- 11.1.3. Lambda

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Food

- 11.2.1.1. Dairy Products

- 11.2.1.2. Meat Products

- 11.2.1.3. Beverages

- 11.2.1.4. Others

- 11.2.2. Pharmaceutical

- 11.2.3. Beauty & Personal Care

- 11.2.1. Food

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Japan

- 11.3.2. China

- 11.3.3. Australia

- 11.3.4. India

- 11.3.5. Philippines

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Types

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Cargill Incorporated

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 TBK Manufacturing Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Caldic B V

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Scalzo Foods

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Accel Carrageenan Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 MCPI Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 W Hydrocolloids Inc *List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Marcel Carrageenan

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Cargill Incorporated

List of Figures

- Figure 1: Asia-Pacific Carrageenan Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Carrageenan Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Types 2020 & 2033

- Table 2: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Types 2020 & 2033

- Table 6: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Types 2020 & 2033

- Table 10: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Types 2020 & 2033

- Table 14: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Types 2020 & 2033

- Table 18: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Types 2020 & 2033

- Table 22: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Types 2020 & 2033

- Table 26: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Carrageenan Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Carrageenan Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Asia-Pacific Carrageenan Market?

Key companies in the market include Cargill Incorporated, TBK Manufacturing Corporation, Caldic B V, Scalzo Foods, Accel Carrageenan Corporation, MCPI Corporation, W Hydrocolloids Inc *List Not Exhaustive, Marcel Carrageenan.

3. What are the main segments of the Asia-Pacific Carrageenan Market?

The market segments include Types, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 billion as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Upsurge in the Application in Dairy Sector.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

1. Acquisitions and partnerships to expand market reach and product portfolios. 2. Investments in research and development to enhance carrageenan properties and applications. 3. Regulatory approvals for new applications in pharmaceuticals and personal care.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Carrageenan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Carrageenan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Carrageenan Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Carrageenan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence