Key Insights

The Asia-Pacific small satellite market is poised for substantial expansion, driven by escalating demand for affordable Earth observation, communication, and navigation services. Key growth drivers include the region's advancing space initiatives, favorable government regulations, and an increasing number of private sector participants. This dynamic landscape is projected to achieve a market size of $3.79 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 31%. Major contributors such as China, Japan, India, and South Korea are spearheading this growth through significant investments in both public and commercial space endeavors. The trend towards miniaturized satellites, which reduces launch expenses and accelerates deployment, is spurring innovation in propulsion systems, with electric propulsion emerging as a preferred choice for its efficiency and cost-effectiveness. Application segments demonstrating strong potential include Earth observation for environmental monitoring, precision agriculture, and disaster management, alongside communication solutions for underserved remote areas and enhanced internet connectivity. The market features a competitive environment with established entities like China Aerospace Science and Technology Corporation (CASC) and agile startups such as MinoSpace Technology and Axelspace Corporation, collectively accelerating technological progress.

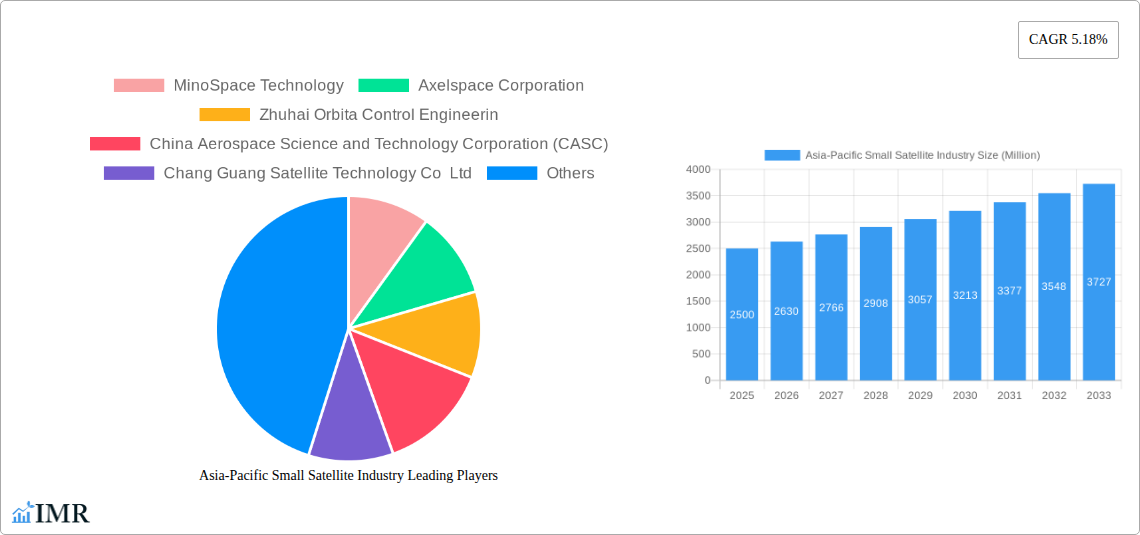

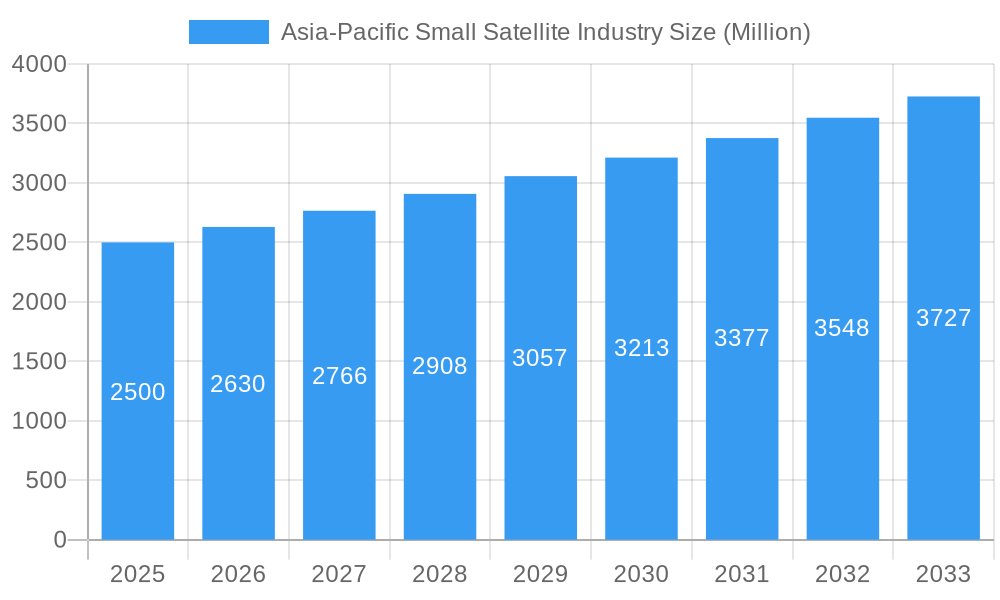

Asia-Pacific Small Satellite Industry Market Size (In Billion)

The future outlook for the Asia-Pacific small satellite sector is exceptionally bright. Ongoing investment in research and development, particularly in electric propulsion and cutting-edge sensor technologies, will facilitate further satellite miniaturization and enhanced operational capabilities. The proliferation of small satellite constellations offering comprehensive global coverage across diverse applications is set to be a significant growth catalyst. Government strategies designed to cultivate a robust space ecosystem, coupled with the region's expanding pool of highly skilled professionals, will further accelerate market expansion. Despite existing challenges, including regulatory hurdles and the need for standardized protocols, the Asia-Pacific small satellite industry is strategically positioned for considerable growth over the next decade.

Asia-Pacific Small Satellite Industry Company Market Share

Asia-Pacific Small Satellite Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Asia-Pacific small satellite industry, covering the period 2019-2033. With a focus on market dynamics, growth trends, key players, and future projections, this report is an essential resource for industry professionals, investors, and policymakers seeking to navigate this rapidly evolving sector. The report leverages extensive data analysis and expert insights to provide a granular view of the parent market (Space Industry) and its child market (Small Satellites). The study includes detailed segmentation by application (Communication, Earth Observation, Navigation, Space Observation, Others), orbit class (GEO, LEO, MEO), end-user (Commercial, Military & Government, Other), and propulsion technology (Electric, Gas-based, Liquid Fuel). The market size is presented in Million units.

Asia-Pacific Small Satellite Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping the Asia-Pacific small satellite industry. We examine market concentration, identifying key players and their market share percentages. We delve into technological innovation drivers, assessing the impact of miniaturization, improved sensors, and advanced propulsion systems. The regulatory frameworks influencing market access and operations are also explored, including licensing requirements and spectrum allocation. Further analysis includes competitive product substitutes, end-user demographics, and M&A trends, providing a comprehensive view of market structure and dynamics.

- Market Concentration: The Asia-Pacific small satellite market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller entrants. The top 5 players collectively hold an estimated xx% market share in 2025.

- Technological Innovation: Miniaturization, advanced sensors (e.g., hyperspectral imaging), and electric propulsion are key innovation drivers. Barriers to innovation include high R&D costs and access to specialized technologies.

- Regulatory Frameworks: Government regulations related to space debris mitigation, spectrum allocation, and launch licensing significantly impact market growth.

- M&A Activity: The number of M&A deals in the Asia-Pacific small satellite sector has seen a xx% increase from 2019 to 2024, reflecting industry consolidation.

Asia-Pacific Small Satellite Industry Growth Trends & Insights

This section details the evolution of the Asia-Pacific small satellite market, analyzing historical data (2019-2024) and providing a forecast for 2025-2033. We examine market size evolution, growth rates (CAGR), and market penetration rates across various segments. The impact of technological disruptions, such as the rise of CubeSats and nanosatellites, is assessed, along with shifts in consumer behavior and emerging applications. Our analysis considers factors such as increasing demand for high-resolution imagery, the expansion of IoT networks, and the growing need for cost-effective satellite solutions. The market size is expected to reach xx Million units by 2033.

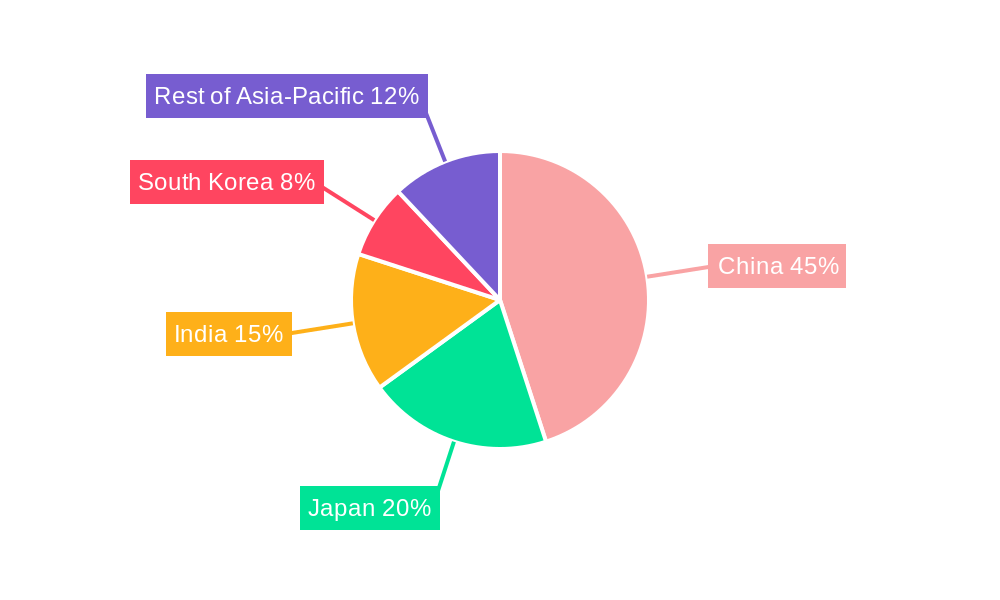

Dominant Regions, Countries, or Segments in Asia-Pacific Small Satellite Industry

This section identifies the leading regions, countries, and segments driving market growth. We analyze market share and growth potential across different applications (Communication, Earth Observation, Navigation, Space Observation, Others), orbit classes (GEO, LEO, MEO), end-users (Commercial, Military & Government, Other), and propulsion technologies (Electric, Gas-based, Liquid Fuel). Key drivers, such as government support for space exploration, robust private sector investment, and the increasing demand for Earth observation data in various sectors, are highlighted.

- Dominant Segment: The LEO segment is expected to dominate the market due to its cost-effectiveness and suitability for various applications.

- Leading Countries: China and Japan are expected to lead the market in terms of both manufacturing and application of small satellites.

- Key Drivers: Strong government support for space programs, growing private investment, demand for high-resolution Earth observation data, and expansion of communication networks fuel market growth.

Asia-Pacific Small Satellite Industry Product Landscape

The Asia-Pacific small satellite industry showcases a diverse range of innovative products, each designed for specific applications. CubeSats and nanosatellites, known for their affordability and ease of deployment, are gaining popularity. Advanced sensor technologies, such as hyperspectral imaging and synthetic aperture radar (SAR), enable high-resolution data acquisition across multiple wavelengths. The focus is on enhancing performance metrics, including improved data transmission rates, extended operational lifespan, and reduced power consumption. Unique selling propositions involve miniaturization, affordability, and specialized payloads tailored to specific market needs.

Key Drivers, Barriers & Challenges in Asia-Pacific Small Satellite Industry

Several factors propel the growth of the Asia-Pacific small satellite industry. These include increasing government funding for space programs, a growing demand for Earth observation data, and technological advancements driving miniaturization and improved performance. Strategic partnerships between government agencies and private companies further accelerate market growth. However, challenges such as the high cost of launch services, regulatory complexities, and the potential for space debris accumulation remain. Supply chain disruptions can also impact production and delivery timelines.

Emerging Opportunities in Asia-Pacific Small Satellite Industry

Emerging opportunities include the expansion of IoT applications requiring widespread connectivity, the increased demand for high-resolution imagery in agriculture and environmental monitoring, and the development of new applications in areas such as disaster management and urban planning. Untapped markets in developing economies offer significant growth potential. Innovation in areas such as propulsion systems and data analytics will create further opportunities.

Growth Accelerators in the Asia-Pacific Small Satellite Industry Industry

Long-term growth will be fueled by continued technological breakthroughs in miniaturization, improved sensor technology, and more efficient propulsion systems. Strategic partnerships between government agencies and private companies will accelerate market expansion. New applications, such as broadband internet access in remote areas and advanced Earth observation services, will drive demand.

Key Players Shaping the Asia-Pacific Small Satellite Industry Market

- MinoSpace Technology

- Axelspace Corporation

- Zhuhai Orbita Control Engineering

- China Aerospace Science and Technology Corporation (CASC)

- Chang Guang Satellite Technology Co Ltd

- Spacety Aerospace Co

- Guodian Gaoke

Notable Milestones in Asia-Pacific Small Satellite Industry Sector

- March 2022: The China Aerospace Science and Technology Corporation successfully launched the Tiankun-2 satellites into a low-Earth polar orbit on the debut launch of the Long March 6A. This launch significantly boosted China's small satellite launch capabilities.

- March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite was launched from the Long March 8 rocket, enhancing commercial data communication capabilities.

- February 2022: A total of 89 Jilin-1 optical imaging satellites, manufactured by CASC, were launched into orbit, significantly increasing the number of Earth observation satellites in operation.

In-Depth Asia-Pacific Small Satellite Industry Market Outlook

The Asia-Pacific small satellite market is poised for significant growth over the forecast period (2025-2033). Continued technological advancements, increasing government and private investment, and expanding applications will drive market expansion. Strategic partnerships, focus on cost-effective solutions, and addressing challenges like space debris will be crucial for long-term success. The market presents substantial opportunities for both established players and new entrants to capitalize on emerging trends and unmet needs.

Asia-Pacific Small Satellite Industry Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Asia-Pacific Small Satellite Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Small Satellite Industry Regional Market Share

Geographic Coverage of Asia-Pacific Small Satellite Industry

Asia-Pacific Small Satellite Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Satellites that are being launched into LEO is driving the market demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MinoSpace Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axelspace Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zhuhai Orbita Control Engineerin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Aerospace Science and Technology Corporation (CASC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chang Guang Satellite Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Spacety Aerospace Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Guodian Gaoke

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 MinoSpace Technology

List of Figures

- Figure 1: Asia-Pacific Small Satellite Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Small Satellite Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Small Satellite Industry?

The projected CAGR is approximately 31%.

2. Which companies are prominent players in the Asia-Pacific Small Satellite Industry?

Key companies in the market include MinoSpace Technology, Axelspace Corporation, Zhuhai Orbita Control Engineerin, China Aerospace Science and Technology Corporation (CASC), Chang Guang Satellite Technology Co Ltd, Spacety Aerospace Co, Guodian Gaoke.

3. What are the main segments of the Asia-Pacific Small Satellite Industry?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Satellites that are being launched into LEO is driving the market demand.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: The China Aerospace Science and Technology Corporation successfully launched the Tiankun-2 satellites into a low-Earth polar orbit on the debut launch of the Long March 6A.March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite was launched from the Long March 8 rocket.February 2022: A total of 89 Jilin-1 optical imaging satellites manufactured by CASC each weighing 30-45 kg were launched into orbit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Small Satellite Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Small Satellite Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Small Satellite Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Small Satellite Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence