Key Insights

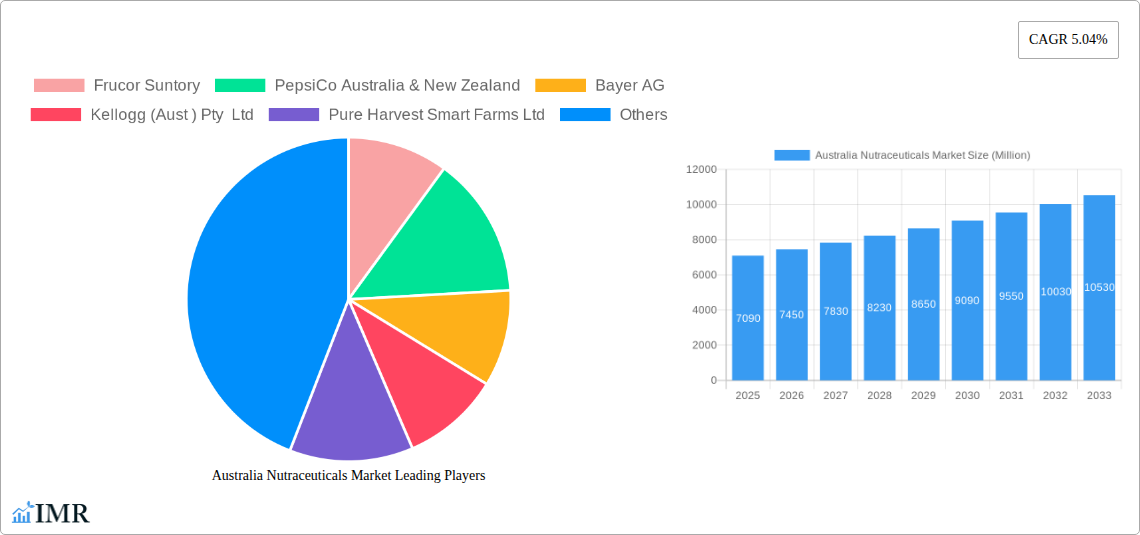

The Australian nutraceuticals market, valued at $7.09 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.04% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a rising health-conscious population, increasingly aware of preventative healthcare and the benefits of dietary supplements, fuels demand for functional foods, beverages, and dietary supplements. Secondly, the increasing prevalence of chronic diseases like heart disease and diabetes is prompting consumers to actively seek out nutraceutical products to support their well-being. The growing popularity of online retail channels provides convenient access to a wider range of products, further boosting market growth. The market is segmented by distribution channel (specialty stores, supermarkets/hypermarkets, convenience stores, drug stores/pharmacies, online retail stores) and product type (functional foods, functional beverages, dietary supplements). Major players like Frucor Suntory, PepsiCo, and Blackmores (implied by presence of other players in this niche) are actively shaping market dynamics through innovation and strategic expansion. The Asia-Pacific region, particularly Australia, benefits from a strong regulatory environment and consumer confidence in nutraceutical products, contributing to the market's overall positive trajectory.

Australia Nutraceuticals Market Market Size (In Billion)

While the market enjoys considerable growth potential, certain restraints exist. These include fluctuating raw material prices, stringent regulatory approvals for new product launches, and the potential for consumer skepticism regarding product efficacy. Despite these challenges, the long-term outlook for the Australian nutraceuticals market remains positive, fueled by sustained consumer interest in health and wellness, innovative product development, and expansion of distribution channels. The market is expected to see continued penetration of functional foods and beverages, driven by increasing consumer demand for convenient and healthy options, with the dietary supplements segment also maintaining consistent growth, propelled by its efficacy in addressing specific health concerns. The continued focus on product innovation and expanding consumer education regarding nutraceutical benefits will further fuel this growth.

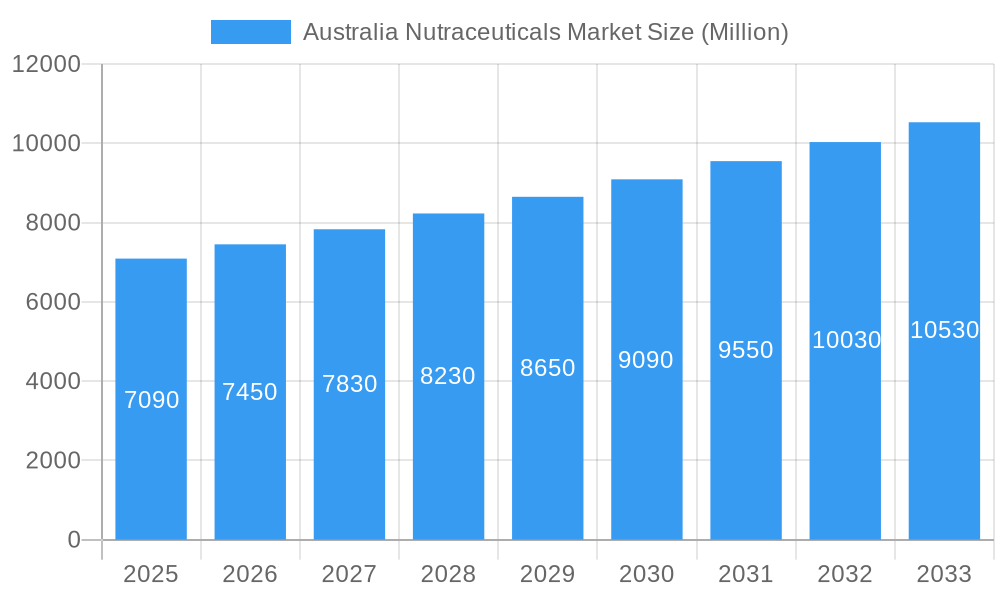

Australia Nutraceuticals Market Company Market Share

Australia Nutraceuticals Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia nutraceuticals market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on the opportunities within this dynamic sector. The market is segmented by distribution channel (Specialty Stores, Supermarkets/Hypermarkets, Convenience Stores, Drug Stores/Pharmacies, Online Retail Stores) and product type (Functional Food, Functional Beverage, Dietary Supplements).

Australia Nutraceuticals Market Dynamics & Structure

The Australian nutraceuticals market is characterized by a moderately concentrated landscape with key players such as Frucor Suntory, PepsiCo Australia & New Zealand, Bayer AG, and Nestle Australia Ltd. holding significant market share. Technological innovation, particularly in product formulation and delivery systems, is a major driver. The regulatory framework, including labeling requirements and food safety standards, plays a crucial role in shaping market dynamics. The market faces competition from alternative health and wellness products, influencing consumer choices. Demographic shifts towards an aging population and increasing health consciousness are boosting demand. M&A activity, while not excessively frequent, has been observed in the past 5 years, with xx deals recorded, contributing to market consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2024).

- Technological Innovation: Focus on personalized nutrition, advanced delivery systems (e.g., liposomal encapsulation), and natural ingredients.

- Regulatory Framework: Stringent food safety and labeling regulations impacting product development and marketing.

- Competitive Substitutes: Traditional pharmaceuticals, herbal remedies, and other wellness products.

- End-User Demographics: Aging population and growing health-conscious millennials driving demand for specific nutraceuticals.

- M&A Trends: xx M&A deals recorded from 2019-2024, primarily focused on expanding product portfolios and market reach.

Australia Nutraceuticals Market Growth Trends & Insights

The Australian nutraceuticals market exhibited robust growth during the historical period (2019-2024), registering a CAGR of xx%. This growth is attributed to several factors, including increased consumer awareness of the health benefits of nutraceuticals, rising disposable incomes, and the expanding availability of diverse products across various retail channels. Market penetration for key product categories like dietary supplements has reached xx% in 2024, signifying considerable market maturity. Technological advancements are driving innovation, introducing personalized nutrition solutions and enhancing product efficacy. Consumer preferences are shifting towards natural and organic ingredients, prompting manufacturers to reformulate products accordingly. The projected CAGR for the forecast period (2025-2033) is xx%, indicating sustained market expansion driven by the factors mentioned above.

Dominant Regions, Countries, or Segments in Australia Nutraceuticals Market

The Australian nutraceuticals market is experiencing robust growth across key segments and geographical areas, driven by a confluence of economic prosperity, supportive government initiatives for the health and wellness sector, and well-established manufacturing and distribution infrastructure. Consumer demand for health-promoting products continues to surge, making this sector a significant contributor to the Australian economy.

- Leading Distribution Channel: Supermarkets/Hypermarkets continue to dominate, capturing an estimated xx% of the market share in 2024. Their extensive reach, accessibility, and the convenience they offer to consumers seeking everyday health solutions are key contributing factors.

- Leading Product Type: Functional Foods remain the vanguard of the market, projected to hold approximately xx% of the market share in 2024. This dominance is fueled by a growing consumer preference for foods that offer more than just basic nutrition, actively contributing to overall well-being.

- Regional Dominance: Major urban centers like Sydney and Melbourne are at the forefront of nutraceutical consumption. This concentration is attributed to higher disposable incomes, greater awareness of health and wellness trends, and a generally more health-conscious populace.

- Growth Drivers: The market's expansion is significantly propelled by sustained economic growth, progressive government policies that actively encourage the health and wellness industry, and a sophisticated distribution network that ensures efficient product availability across the nation.

Australia Nutraceuticals Market Product Landscape

The Australian nutraceuticals market is characterized by a vibrant and expanding product portfolio designed to meet diverse health needs. This includes an extensive array of functional foods and beverages fortified with essential vitamins, minerals, probiotics for gut health, and various other health-enhancing components. Alongside these, dietary supplements in various forms such as capsules, tablets, and powders represent another substantial segment. Emerging trends are highlighting the development of personalized nutrition products that leverage individual genetic data and lifestyle choices to offer tailored health solutions. Technological advancements are a crucial focus, with significant R&D efforts directed towards improving the bioavailability of active ingredients through sophisticated delivery systems, as well as enhancing the stability and shelf-life of sensitive nutrients. Key selling propositions that resonate with consumers include products that emphasize natural sourcing, demonstrable efficacy, and superior absorption rates.

Key Drivers, Barriers & Challenges in Australia Nutraceuticals Market

Key Drivers: Increasing health awareness amongst consumers, rising disposable incomes, government initiatives promoting healthy lifestyles, and technological advancements enabling product innovation.

Challenges & Restraints: Stringent regulatory requirements for product approvals and labeling, fluctuations in raw material prices, and intense competition from both domestic and international brands. Supply chain disruptions stemming from global events have also contributed to increased production costs. These factors combined could negatively impact profitability for some players by up to xx% in specific cases.

Emerging Opportunities in Australia Nutraceuticals Market

Emerging opportunities lie in personalized nutrition, leveraging advanced technologies like genomics and microbiome analysis to tailor products. The demand for natural and organic products is increasing. Growing interest in functional foods and beverages with specific health benefits, such as enhanced immunity and cognitive function, creates new avenues for product development.

Growth Accelerators in the Australia Nutraceuticals Market Industry

Strategic partnerships between nutraceutical companies and healthcare providers, as well as investment in research and development, are key growth accelerators. Technological breakthroughs such as the development of new delivery systems and improved production efficiency can boost market expansion. Expansion into new market segments, such as sports nutrition and functional beauty, are additional drivers of growth.

Key Players Shaping the Australia Nutraceuticals Market Market

- Frucor Suntory

- PepsiCo Australia & New Zealand

- Bayer AG

- Kellogg (Aust ) Pty Ltd

- Pure Harvest Smart Farms Ltd

- Pharmacare Laboratories Pty Ltd

- Remedy Drinks

- General Mills Australia Pty Ltd

- GlaxoSmithKline Plc

- Health & Happiness (H&H) International Holdings Ltd

- Herbalife Australia

- Nestle Australia Ltd

Notable Milestones in Australia Nutraceuticals Market Sector

- October 2022: Remedy Drinks bolstered its presence in the functional beverage sector with the introduction of Remedy K! CK, a clean energy drink targeting health-conscious consumers.

- July 2022: PureHarvest expanded its plant-based offerings by launching four new varieties of plant-based milk, directly addressing the escalating consumer demand for dairy alternatives.

- June 2021: V Energy successfully amplified its brand recognition and consumer interaction through its impactful "Can You Feel It" marketing campaign, highlighting the energy and lifestyle benefits of their products.

In-Depth Australia Nutraceuticals Market Market Outlook

The Australian nutraceuticals market is poised for continued and significant expansion, underpinned by a growing societal emphasis on health and well-being, rapid technological innovation in product development, and a supportive regulatory framework. Strategic alliances and substantial investments in research and development are identified as critical components for maintaining this upward trajectory. Companies that demonstrate agility in adapting to evolving consumer demands for natural, organic, and personalized health solutions are exceptionally well-positioned to capture substantial market share. The market is forecasted to maintain its robust growth throughout the upcoming period, presenting abundant and lucrative opportunities for both established industry leaders and emerging enterprises.

Australia Nutraceuticals Market Segmentation

-

1. Product Type

-

1.1. Functional Food

- 1.1.1. Cereals

- 1.1.2. Bakery and Confectionery

- 1.1.3. Dairy

- 1.1.4. Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverage

- 1.2.1. Energy Drinks

- 1.2.2. Sports Drinks

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverages

- 1.2.5. Other Functional Beverages

-

1.3. Dietary Supplements

- 1.3.1. Vitamins

- 1.3.2. Minerals

- 1.3.3. Botanicals

- 1.3.4. Enzymes

- 1.3.5. Fatty Acids

- 1.3.6. Proteins

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

Australia Nutraceuticals Market Segmentation By Geography

- 1. Australia

Australia Nutraceuticals Market Regional Market Share

Geographic Coverage of Australia Nutraceuticals Market

Australia Nutraceuticals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Food Safety Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Elderly Population boosting Nutraceuticals Market in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Nutraceuticals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.1.1. Cereals

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Dairy

- 5.1.1.4. Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverage

- 5.1.2.1. Energy Drinks

- 5.1.2.2. Sports Drinks

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverages

- 5.1.2.5. Other Functional Beverages

- 5.1.3. Dietary Supplements

- 5.1.3.1. Vitamins

- 5.1.3.2. Minerals

- 5.1.3.3. Botanicals

- 5.1.3.4. Enzymes

- 5.1.3.5. Fatty Acids

- 5.1.3.6. Proteins

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Frucor Suntory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PepsiCo Australia & New Zealand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kellogg (Aust ) Pty Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pure Harvest Smart Farms Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pharmacare Laboratories Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Remedy Drinks

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills Australia Pty Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 GlaxoSmithKline Plc*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Health & Happiness (H&H) International Holdings Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Herbalife Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nestle Australia Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Frucor Suntory

List of Figures

- Figure 1: Australia Nutraceuticals Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Nutraceuticals Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Australia Nutraceuticals Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Nutraceuticals Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Australia Nutraceuticals Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Australia Nutraceuticals Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Nutraceuticals Market?

The projected CAGR is approximately 5.04%.

2. Which companies are prominent players in the Australia Nutraceuticals Market?

Key companies in the market include Frucor Suntory, PepsiCo Australia & New Zealand, Bayer AG, Kellogg (Aust ) Pty Ltd, Pure Harvest Smart Farms Ltd, Pharmacare Laboratories Pty Ltd, Remedy Drinks, General Mills Australia Pty Ltd, GlaxoSmithKline Plc*List Not Exhaustive, Health & Happiness (H&H) International Holdings Ltd, Herbalife Australia, Nestle Australia Ltd.

3. What are the main segments of the Australia Nutraceuticals Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Organic Ingredients in the Food Industry; Increasing Popularity of "Super Fruit" Ingredients in Functional Foods and Beverages.

6. What are the notable trends driving market growth?

Increasing Elderly Population boosting Nutraceuticals Market in the Country.

7. Are there any restraints impacting market growth?

Stringent Food Safety Regulations.

8. Can you provide examples of recent developments in the market?

In October 2022, Remedy Drinks introduced Remedy K! CK, an all-natural clean energy drink available at 7-Eleven stores across Australia. Remedy K! CK is available in three fruity flavors - Blackberry, Lemon Lime, and Mango Pineapple.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Nutraceuticals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Nutraceuticals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Nutraceuticals Market?

To stay informed about further developments, trends, and reports in the Australia Nutraceuticals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence