Key Insights

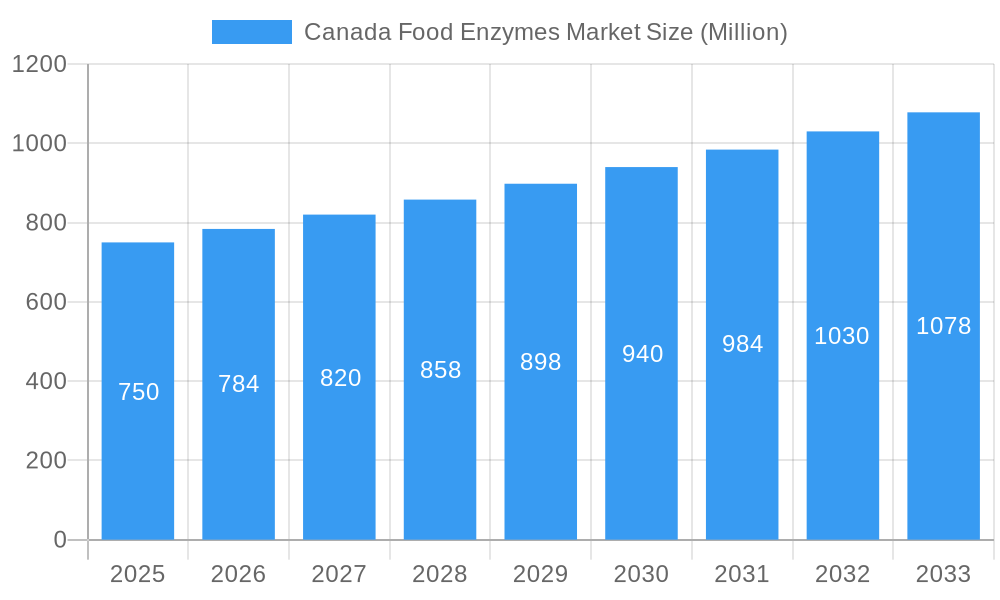

The Canadian food enzymes market is poised for robust growth, projected to reach an estimated value of $XXX million in 2025, with a Compound Annual Growth Rate (CAGR) of 4.61% expected to drive it through 2033. This expansion is fueled by a confluence of evolving consumer preferences and increasing demand for healthier, more sustainable food products. Key drivers include the growing consumer inclination towards clean-label ingredients, a rising awareness of the functional benefits of enzymes in food processing such as improved texture, flavor, and shelf-life, and the continuous innovation in enzyme technology leading to more efficient and specialized solutions. The demand for enzymes in the bakery sector, driven by the desire for improved dough stability and enhanced product quality, and in the dairy and frozen desserts segment, for better texture and yield, are significant contributors. Furthermore, the expanding processed food industry in Canada, coupled with stringent regulatory support for the use of food-grade enzymes, is creating a favorable environment for market players.

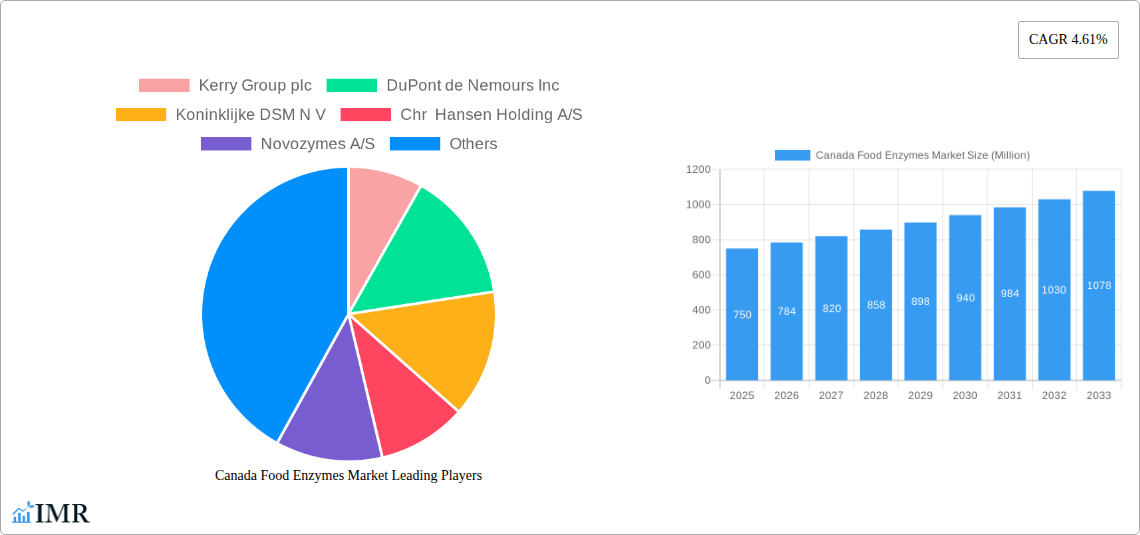

Canada Food Enzymes Market Market Size (In Million)

The market is segmented into various enzyme types, with Carbohydrase and Protease holding prominent positions due to their widespread applications in baking, brewing, and meat processing. The increasing adoption of these enzymes in various food applications, from confectionery to meat and seafood products, underscores their versatility. Restraints, such as the high cost of research and development for novel enzymes and the potential for stringent regulatory approvals for new enzyme formulations, are present. However, strategic collaborations between enzyme manufacturers and food producers, alongside a focus on developing cost-effective and sustainable enzyme solutions, are expected to mitigate these challenges. The competitive landscape features established global players like Kerry Group plc, DuPont de Nemours Inc., and Novozymes A/S, who are actively investing in R&D and expanding their product portfolios to cater to the dynamic Canadian market. The market's trajectory indicates a sustained demand for innovative enzyme solutions that address the evolving needs of the Canadian food industry and its consumers.

Canada Food Enzymes Market Company Market Share

Here is a comprehensive and SEO-optimized report description for the Canada Food Enzymes Market, designed to attract industry professionals and maximize search engine visibility:

This in-depth report provides a detailed analysis of the Canada Food Enzymes Market, offering critical insights into its dynamics, growth trajectory, and future potential. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into the evolving landscape of enzyme applications in Canada's food and beverage industry. We meticulously examine key market segments, technological advancements, and the competitive environment, making it an indispensable resource for stakeholders seeking to capitalize on market opportunities. This analysis integrates high-traffic keywords such as "Canada food enzymes," "enzyme market Canada," "food processing enzymes," "bakery enzymes," "dairy enzymes," and "protease market Canada" to ensure maximum search engine visibility and reach.

Canada Food Enzymes Market Market Dynamics & Structure

The Canada Food Enzymes Market is characterized by a moderate level of market concentration, with a few key players dominating the landscape. Technological innovation is a significant driver, fueled by the continuous development of novel enzyme formulations and production methods to enhance food quality, efficiency, and sustainability. Robust regulatory frameworks, primarily overseen by Health Canada, ensure the safety and efficacy of enzymes used in food production, although navigating these can present certain barriers. Competitive product substitutes, such as synthetic additives, exist but are increasingly being outpaced by the demand for natural and functional enzyme solutions. End-user demographics are shifting towards health-conscious consumers who favor processed foods with cleaner labels and improved nutritional profiles, thereby boosting the demand for specialized food enzymes. Mergers and acquisitions (M&A) are active, indicating strategic consolidation and expansion efforts. For instance, a recent M&A trend has seen larger players acquiring specialized enzyme producers to broaden their portfolios and market reach, with an estimated XX number of deals recorded in the historical period. The market faces innovation barriers primarily related to R&D costs and the time required for regulatory approvals for novel enzyme applications.

Canada Food Enzymes Market Growth Trends & Insights

The Canada Food Enzymes Market is projected to witness substantial growth driven by increasing consumer demand for healthier, more sustainable, and processed food products. Leveraging a predicted CAGR of XX% from 2025 to 2033, the market size is expected to expand from an estimated $XXX Million in 2025 to $XXX Million by 2033. Adoption rates of enzymatic solutions are on an upward trajectory, as food manufacturers recognize their benefits in improving product quality, shelf-life, and production efficiency. Technological disruptions, such as the development of more stable and highly specific enzymes through genetic engineering and fermentation, are revolutionizing applications across various food sectors. Consumer behavior shifts, including a preference for naturally derived ingredients and a reduced reliance on artificial additives, are directly fueling the demand for food enzymes. For example, the growing "clean label" movement has significantly impacted the bakery enzymes and dairy enzymes segments, as manufacturers seek enzyme-based solutions to replace artificial improvers and stabilizers. Market penetration of specific enzyme types, like proteases and carbohydrases, is deepening, with an estimated XX% increase in their application across different food categories in the forecast period. This evolution underscores a fundamental change in food manufacturing practices, prioritizing innovation and consumer wellness.

Dominant Regions, Countries, or Segments in Canada Food Enzymes Market

Within the Canada Food Enzymes Market, the Bakery application segment stands out as a dominant force, consistently driving market growth. The bakery sector's robust demand for enzymes, particularly carbohydrases and proteases, to improve dough handling, crumb structure, volume, and shelf-life of baked goods, positions it at the forefront. Canada's well-established and innovative baking industry, coupled with a growing consumer preference for artisanal and convenience baked products, creates a fertile ground for enzyme adoption. Key drivers include favorable economic policies supporting the food processing sector and the continuous expansion of supermarket chains and retail bakeries across the country. Market share within the bakery segment is estimated at XX% of the total food enzymes market in 2025. The carbohydrase segment, crucial for starch conversion and sugar release in baking, holds a significant portion of the enzyme type market. Growth potential is further amplified by the increasing use of enzyme blends for specific functionalities, catering to diverse product needs from bread to pastries and cakes. The adoption of advanced processing techniques in Canadian bakeries, alongside a strong emphasis on product innovation, ensures the sustained dominance of this segment and its associated enzyme types.

Canada Food Enzymes Market Product Landscape

The Canada Food Enzymes Market product landscape is dynamic, showcasing significant innovation in enzyme technology. Manufacturers are continuously developing novel enzymes with enhanced specificity, stability, and activity under challenging processing conditions. For instance, advancements in directed evolution and recombinant DNA technology have led to the creation of highly efficient proteases for meat tenderization and lipases for fat modification in dairy products. Unique selling propositions often lie in customized enzyme formulations tailored to specific food applications, such as improved enzymatic browning in confectionery or enhanced texture in dairy and frozen desserts. Technological advancements are also focusing on enzymes that contribute to nutritional enhancement and the reduction of allergens in food products, aligning with evolving consumer preferences.

Key Drivers, Barriers & Challenges in Canada Food Enzymes Market

Key Drivers:

- Growing Demand for Natural and Clean Label Products: Consumers are increasingly seeking food products with fewer artificial ingredients, boosting the appeal of naturally derived enzymes.

- Technological Advancements in Enzyme Production: Innovations in biotechnology and fermentation are leading to more efficient, cost-effective, and specialized enzymes.

- Increased Focus on Food Processing Efficiency and Quality: Enzymes offer significant benefits in improving texture, flavor, shelf-life, and reducing production costs for food manufacturers.

- Rising Health and Wellness Trends: Enzymes contribute to enhanced nutritional profiles and digestibility of food products.

Barriers & Challenges:

- High Research and Development Costs: Developing novel enzymes and securing regulatory approvals can be expensive and time-consuming.

- Stringent Regulatory Frameworks: Compliance with food safety regulations for enzyme usage can pose a challenge for new entrants.

- Price Volatility of Raw Materials: Fluctuations in the cost of raw materials used in enzyme production can impact profitability.

- Limited Consumer Awareness: In some segments, there might be a lack of widespread understanding regarding the benefits and safety of food enzymes, potentially hindering adoption.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and cost of enzyme products. The estimated impact of supply chain disruptions on market growth is XX%.

Emerging Opportunities in Canada Food Enzymes Market

Emerging opportunities in the Canada Food Enzymes Market lie in the growing demand for plant-based food alternatives, where enzymes can play a crucial role in improving texture and flavor profiles. The expansion of the functional food and beverage sector presents another significant avenue, with enzymes being utilized for enhanced nutrient bioavailability and the creation of specialized health-promoting products. Furthermore, the development of novel enzymes for sustainable food waste reduction and valorization, transforming by-products into valuable ingredients, offers a substantial untapped market. The increasing focus on personalized nutrition also opens doors for enzyme applications in customized food formulations.

Growth Accelerators in the Canada Food Enzymes Market Industry

Several catalysts are accelerating long-term growth in the Canada Food Enzymes Market. Continued technological breakthroughs in enzyme engineering and biocatalysis are leading to the development of enzymes with superior performance characteristics, driving wider adoption. Strategic partnerships between enzyme manufacturers and food processing companies are fostering innovation and market penetration, allowing for the co-creation of tailored enzymatic solutions. Market expansion strategies, including penetration into emerging food categories and regions, are also contributing significantly. The increasing investment in R&D by key players, aimed at discovering and commercializing next-generation enzymes, is a critical growth accelerator.

Key Players Shaping the Canada Food Enzymes Market Market

- Kerry Group plc

- DuPont de Nemours Inc

- Koninklijke DSM N V

- Chr Hansen Holding A/S

- Novozymes A/S

- ABF Ingredients

- Codexis Inc

- Puratos Group

Notable Milestones in Canada Food Enzymes Market Sector

- 2023/XX: Launch of novel protease formulations by DuPont de Nemours Inc. for improved meat processing efficiency, leading to an estimated XX% increase in market adoption within the meat segment.

- 2022/XX: Kerry Group plc acquires a specialized enzyme technology company, expanding its portfolio in the bakery and confectionery sectors. This M&A activity is projected to boost market share by XX%.

- 2021/XX: Novozymes A/S introduces a new generation of carbohydrases designed for enhanced starch conversion in the brewing industry, impacting beverage enzyme applications.

- 2020/XX: Chr Hansen Holding A/S patents an innovative lipase enzyme for dairy applications, aiming to improve flavor and texture in cheese production.

- 2019/XX: Health Canada revises guidelines for enzyme usage in food, potentially streamlining approvals for new innovative products.

In-Depth Canada Food Enzymes Market Market Outlook

The future outlook for the Canada Food Enzymes Market is exceptionally promising, driven by a confluence of sustained demand for functional and natural food ingredients, coupled with ongoing technological innovation. Growth accelerators, such as advancements in enzyme immobilization techniques for enhanced stability and reusability, and the exploration of enzymes in novel food preservation methods, will significantly shape market expansion. Strategic partnerships and increasing R&D investments by leading companies will continue to drive product development and market penetration. The market is poised for significant growth, with opportunities in expanding into niche applications and catering to evolving consumer preferences for healthier, more sustainable, and ethically produced food products.

Canada Food Enzymes Market Segmentation

-

1. Type

- 1.1. Carbohydrase

- 1.2. Protease

- 1.3. Lipase

- 1.4. Others

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy and Frozen Desserts

- 2.4. Meat Poultry and Sea Food Products

- 2.5. Beverages

- 2.6. Others

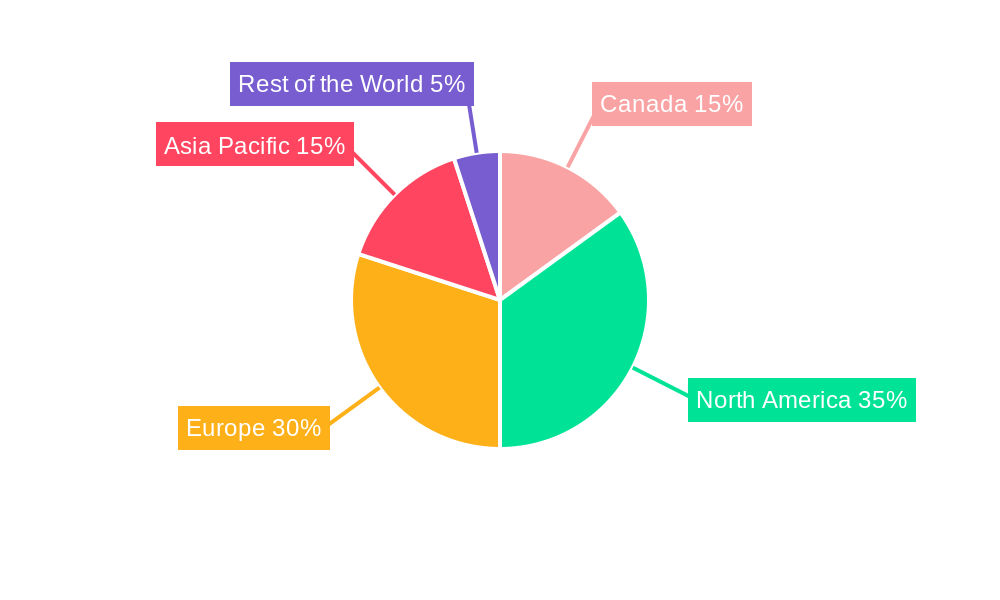

Canada Food Enzymes Market Segmentation By Geography

- 1. Canada

Canada Food Enzymes Market Regional Market Share

Geographic Coverage of Canada Food Enzymes Market

Canada Food Enzymes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Bakery Enzymes Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Food Enzymes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbohydrase

- 5.1.2. Protease

- 5.1.3. Lipase

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy and Frozen Desserts

- 5.2.4. Meat Poultry and Sea Food Products

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kerry Group plc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DuPont de Nemours Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke DSM N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chr Hansen Holding A/S

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Novozymes A/S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ABF Ingredients

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Codexis Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Puratos Group*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kerry Group plc

List of Figures

- Figure 1: Canada Food Enzymes Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Food Enzymes Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Food Enzymes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Food Enzymes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Canada Food Enzymes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Food Enzymes Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Food Enzymes Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Canada Food Enzymes Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Food Enzymes Market?

The projected CAGR is approximately 4.61%.

2. Which companies are prominent players in the Canada Food Enzymes Market?

Key companies in the market include Kerry Group plc, DuPont de Nemours Inc, Koninklijke DSM N V, Chr Hansen Holding A/S, Novozymes A/S, ABF Ingredients, Codexis Inc, Puratos Group*List Not Exhaustive.

3. What are the main segments of the Canada Food Enzymes Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Bakery Enzymes Drive the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Food Enzymes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Food Enzymes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Food Enzymes Market?

To stay informed about further developments, trends, and reports in the Canada Food Enzymes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence