Key Insights

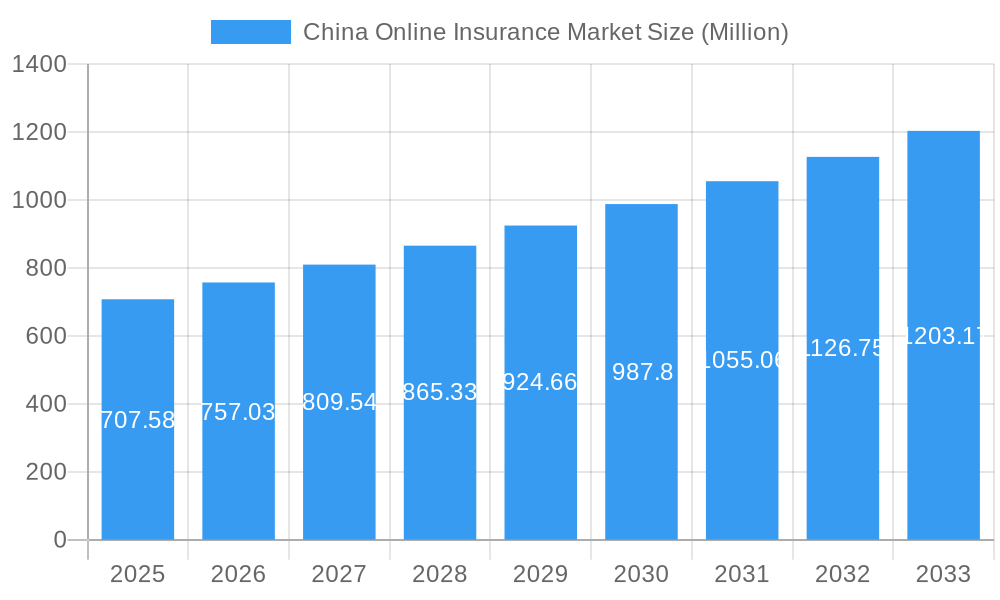

The China Online Insurance Market is poised for substantial growth, projected to reach an estimated market size of USD 707.58 million by 2025, driven by a compelling CAGR of 6.87%. This expansion is fueled by a confluence of factors, including the increasing digital literacy and internet penetration across China, a growing middle class with greater disposable income seeking financial security, and a favorable regulatory environment that encourages innovation in insurtech. The market is witnessing a significant shift towards digital channels for policy purchase, claims processing, and customer service, offering convenience and accessibility that traditional brick-and-mortar models struggle to match. The demand for both Life Insurance and Non-Life Insurance products is escalating online, with consumers actively seeking personalized coverage and transparent product offerings. Key players are leveraging advanced technologies like AI, big data analytics, and blockchain to enhance customer experience, streamline operations, and develop innovative insurance solutions tailored to the evolving needs of the Chinese population. The presence of a vibrant ecosystem of insurance companies, third-party administrators, and brokers, alongside agile insurtech startups, further fuels this dynamic market.

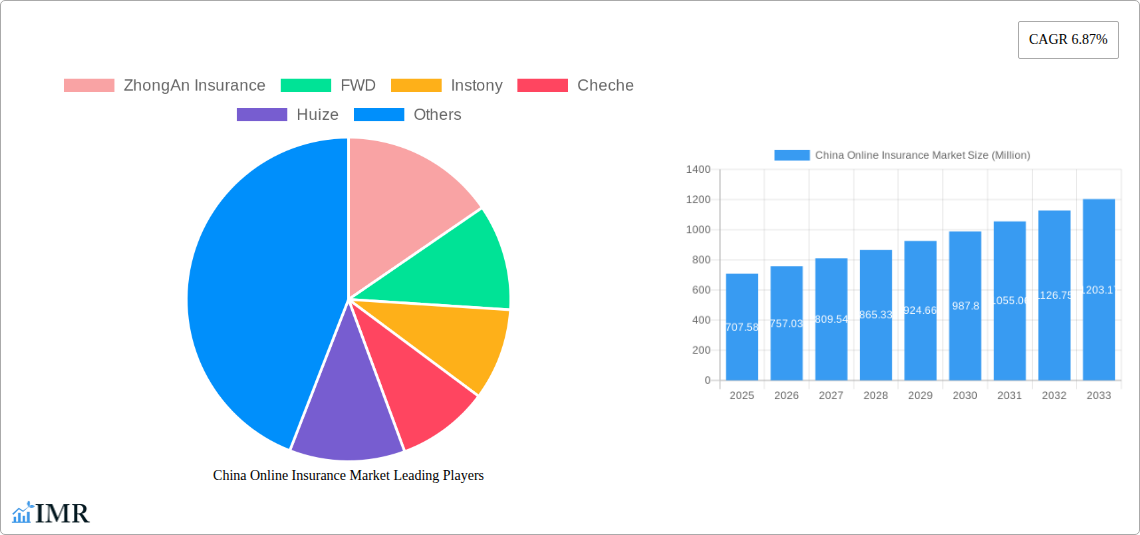

China Online Insurance Market Market Size (In Million)

The growth trajectory of the China Online Insurance Market is further bolstered by emerging trends such as embedded insurance, where insurance products are integrated into other platforms and services, and the rise of usage-based insurance models that offer greater flexibility and cost-effectiveness. While the market is robust, certain restraints, such as evolving data privacy regulations and the need for continued consumer education on digital insurance products, need careful navigation by stakeholders. However, the overarching sentiment is one of optimism, with the market anticipated to maintain its strong growth momentum through the forecast period of 2025-2033. Geographical focus is heavily centered on China, where a vast and digitally-engaged population presents unparalleled opportunities for online insurance providers. The competitive landscape features established players like ZhongAn Insurance and FWD, alongside innovative startups such as Instony and Bowtie, all vying for market share by offering differentiated products and superior digital experiences.

China Online Insurance Market Company Market Share

This in-depth report provides a comprehensive analysis of the China Online Insurance Market, forecasting its trajectory from 2019 to 2033, with a base year of 2025. We delve into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities, offering actionable insights for industry stakeholders. The study meticulously examines both the parent market and crucial child markets, including Life Insurance and Non-Life Insurance, alongside various provider types such as Insurance Companies, Third Party Administrators, and Brokers. All monetary values are presented in Million units.

China Online Insurance Market Market Dynamics & Structure

The China Online Insurance Market is characterized by a dynamic and evolving landscape, driven by rapid technological advancements and shifting consumer preferences. Market concentration is notably influenced by the presence of established insurance giants and agile insurtech startups, creating a competitive yet collaborative environment. Technological innovation is a primary driver, with the integration of Artificial Intelligence (AI), big data analytics, and blockchain technology revolutionizing product development, underwriting, and customer service. Regulatory frameworks, while maturing, continue to play a pivotal role in shaping market access, data privacy, and consumer protection. Competitive product substitutes are emerging from adjacent financial services and even non-traditional tech platforms, compelling online insurers to constantly innovate and differentiate. End-user demographics are increasingly tech-savvy, demanding seamless digital experiences, personalized products, and transparent pricing. Mergers and acquisitions (M&A) trends are indicative of consolidation and strategic partnerships aimed at expanding market reach and enhancing technological capabilities. For instance, historical M&A volumes in the past five years have seen an upward trend, with an estimated XX deals, indicating a strong interest in market consolidation and innovation acquisition. The barrier to entry for new players is moderate, primarily due to stringent regulatory requirements and the need for significant technological investment. However, niche players can find traction by focusing on specific underserved segments or by offering highly specialized products.

- Market Concentration: A mixed landscape with dominant players and emerging startups.

- Technological Innovation: AI, big data, and blockchain are transforming the industry.

- Regulatory Frameworks: Evolving regulations impact market access and consumer protection.

- Competitive Product Substitutes: Growing competition from fintech and other digital platforms.

- End-User Demographics: Tech-savvy consumers demanding digital-first solutions.

- M&A Trends: Increasing consolidation and strategic alliances for growth.

- Innovation Barriers: High initial investment in technology and regulatory compliance.

China Online Insurance Market Growth Trends & Insights

The China Online Insurance Market is poised for substantial growth, driven by a confluence of factors including increasing internet penetration, a burgeoning middle class, and a growing awareness of insurance needs. Market size evolution is projected to witness a significant upward trend throughout the forecast period. The adoption rates of online insurance products have accelerated, fueled by convenience, accessibility, and competitive pricing. Technological disruptions, particularly in the realm of AI and data analytics, are reshaping underwriting processes, claims management, and personalized product offerings. This has led to a surge in adoption of innovative products such as usage-based insurance and micro-insurance. Consumer behavior shifts are a critical determinant of this growth. Younger generations, digital natives, are increasingly comfortable purchasing insurance online, preferring self-service options and digital communication channels. The COVID-19 pandemic further accelerated this trend, normalizing online transactions across all sectors, including insurance. Key metrics such as the Compound Annual Growth Rate (CAGR) are estimated to be in the XX% range for the forecast period. Market penetration, currently at XX%, is expected to climb significantly as more consumers embrace digital channels for their insurance needs. The emphasis on customer-centricity and tailored solutions will further fuel market expansion. The interplay between technological advancements and evolving consumer expectations is creating a fertile ground for sustained growth. Insurtech companies are at the forefront of this transformation, leveraging data to offer more relevant and affordable insurance policies. The digital transformation of traditional insurance companies is also a key contributor, as they invest in online platforms and digital customer engagement strategies. The growing preference for online channels over traditional agent-led sales is a significant long-term trend. The convenience of comparing policies, purchasing coverage, and managing claims entirely online is a powerful draw for consumers. Furthermore, the increasing availability of affordable smartphones and high-speed internet access across China has democratized access to online insurance services. The government's push towards digitalization and financial inclusion also plays a crucial role in fostering the growth of the online insurance market. The pandemic highlighted the resilience and efficiency of online insurance models, solidifying their position in the market.

Dominant Regions, Countries, or Segments in China Online Insurance Market

Within the expansive China Online Insurance Market, certain segments and regions stand out as key drivers of growth and innovation. Life Insurance is a dominant segment, driven by China's vast population and increasing awareness of financial planning and protection needs, especially in areas like health and retirement. The projected market share for Life Insurance within the online segment is estimated to be XX% in 2025 and growing to XX% by 2033. This growth is propelled by economic policies aimed at encouraging domestic consumption and savings, coupled with a rising middle class with greater disposable income. The infrastructure for digital delivery of life insurance products is well-established, supported by robust e-commerce platforms and payment systems.

Insurance Companies represent the leading type of providers in the online insurance market, holding an estimated XX% market share in 2025. These established entities leverage their existing customer base and brand recognition to transition their offerings online. However, Third Party Administrators (TPAs) and Brokers are increasingly playing a crucial role, acting as intermediaries and specialized service providers, particularly in niche markets or for complex product offerings. Their market share is projected to grow from XX% in 2025 to XX% by 2033.

Geographically, Tier 1 and Tier 2 cities in China, such as Beijing, Shanghai, Guangzhou, and Shenzhen, are the epicenters of online insurance adoption and growth. These regions boast higher internet penetration, greater digital literacy, and a concentration of affluent consumers who are early adopters of digital services. Economic policies in these urban centers often prioritize technological innovation and digital infrastructure development, creating a conducive environment for online insurance. The market share from these dominant regions is expected to account for over XX% of the total online insurance market by 2033.

- Key Drivers for Life Insurance Dominance: Growing health and retirement awareness, economic policies, rising middle class.

- Dominant Provider Type: Insurance Companies, with growing influence of TPAs and Brokers.

- Leading Regions: Tier 1 and Tier 2 cities due to digital infrastructure and affluent populations.

- Market Share of Dominant Segments: Life Insurance (XX%), Insurance Companies (XX%).

- Growth Potential: High due to increasing digital adoption and urbanization.

China Online Insurance Market Product Landscape

The China Online Insurance Market's product landscape is characterized by rapid innovation and diversification, moving beyond traditional offerings to cater to evolving consumer needs. Online insurers are leveraging data analytics to create personalized insurance products, including micro-insurance for gig economy workers, on-demand insurance for specific events, and parametric insurance triggered by predefined conditions. Applications range from health and travel insurance to cyber insurance and specialized coverage for emerging technologies like drones and autonomous vehicles. Performance metrics such as faster claims processing, lower premium costs, and improved customer satisfaction are key selling propositions. For example, ZhongAn Insurance has pioneered unique products like flight delay insurance and pet health insurance, demonstrating the potential for niche market penetration. Technological advancements like AI-powered chatbots for customer service and blockchain for secure claims processing are enhancing product delivery and efficiency.

Key Drivers, Barriers & Challenges in China Online Insurance Market

The China Online Insurance Market is propelled by several key drivers, including the pervasive adoption of smartphones and internet connectivity, a growing digitally savvy population eager for convenient financial solutions, and increasing government support for digitalization and financial inclusion. Furthermore, the rise of the sharing economy and gig workforce has created a demand for flexible, on-demand insurance products.

Key Drivers:

- Ubiquitous smartphone and internet penetration.

- Digitally adept consumer base seeking convenience.

- Government initiatives promoting digital finance.

- Growth of the gig economy requiring flexible insurance.

Conversely, the market faces significant barriers and challenges. Regulatory uncertainties and evolving compliance requirements can pose hurdles for new entrants and established players alike. Intense competition from both traditional insurers digitizing their operations and agile insurtech startups can lead to price wars and pressure on margins. Data privacy concerns and cybersecurity threats are also critical challenges that require robust mitigation strategies. Supply chain issues, though less direct in insurance, can manifest in the reliance on third-party technology providers and the need for robust digital infrastructure.

Key Barriers & Challenges:

- Evolving regulatory landscape and compliance complexities.

- Intense competition and price sensitivity.

- Data privacy concerns and cybersecurity threats.

- Dependence on third-party technology infrastructure.

- Building customer trust in digital insurance offerings.

Emerging Opportunities in China Online Insurance Market

Emerging opportunities within the China Online Insurance Market are abundant, fueled by unmet needs and evolving consumer preferences. The rapidly growing elderly population presents a significant opportunity for specialized online health and long-term care insurance products. Furthermore, the increasing adoption of electric vehicles and smart home technologies is creating a demand for new types of cyber and product liability insurance. The vast rural population, increasingly connected, represents an untapped market for affordable and accessible online insurance solutions. Innovative applications of AI for risk assessment and personalized customer journeys will also unlock new avenues for growth and product differentiation.

Growth Accelerators in the China Online Insurance Market Industry

Several catalysts are driving the long-term growth of the China Online Insurance Market. The continuous advancements in Artificial Intelligence and machine learning are enabling more accurate risk assessment, personalized pricing, and efficient claims processing, thereby enhancing customer experience and operational efficiency. Strategic partnerships between insurance companies and technology providers, as well as collaborations with e-commerce giants and fintech platforms, are expanding market reach and distribution channels. Market expansion strategies, including penetration into lower-tier cities and rural areas, driven by mobile-first solutions, are crucial growth accelerators.

Key Players Shaping the China Online Insurance Market Market

- ZhongAn Insurance

- FWD

- Instony

- Cheche

- Huize

- eBaoTech

- Bowtie

- Oliver Wyman

- Taikang Online

- Cathay Insurance

Notable Milestones in China Online Insurance Market Sector

- October 2023: FWD and Club Care partnered to launch the online insurance platform Club Care. Club Care is a new online insurance platform that has a reward-based system for its loyal customers.

- June 2023: ZhongAn Insurance and ZhongAn Technology explored a generative artificial intelligence (AI) technology that is predicted to emerge as an essential strategic asset for online insurance companies in the future.

In-Depth China Online Insurance Market Market Outlook

The future outlook for the China Online Insurance Market is exceptionally promising, driven by sustained technological innovation and expanding market penetration. AI-driven personalization and efficiency gains will continue to redefine customer interactions and product offerings. Strategic alliances and ecosystem collaborations will be pivotal in unlocking new distribution channels and customer segments. The market's ability to adapt to evolving regulatory landscapes and capitalize on the burgeoning demand for specialized insurance products will determine its long-term trajectory. Investments in robust data analytics and cybersecurity infrastructure will be crucial for maintaining competitive advantage and fostering customer trust, ensuring a dynamic and high-growth future for the online insurance sector in China.

China Online Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Life Insurance

- 1.2. Non-Life Insurance

-

2. Type of Providers

- 2.1. Insurance Companies

- 2.2. Third Party Administrators

- 2.3. Brokers

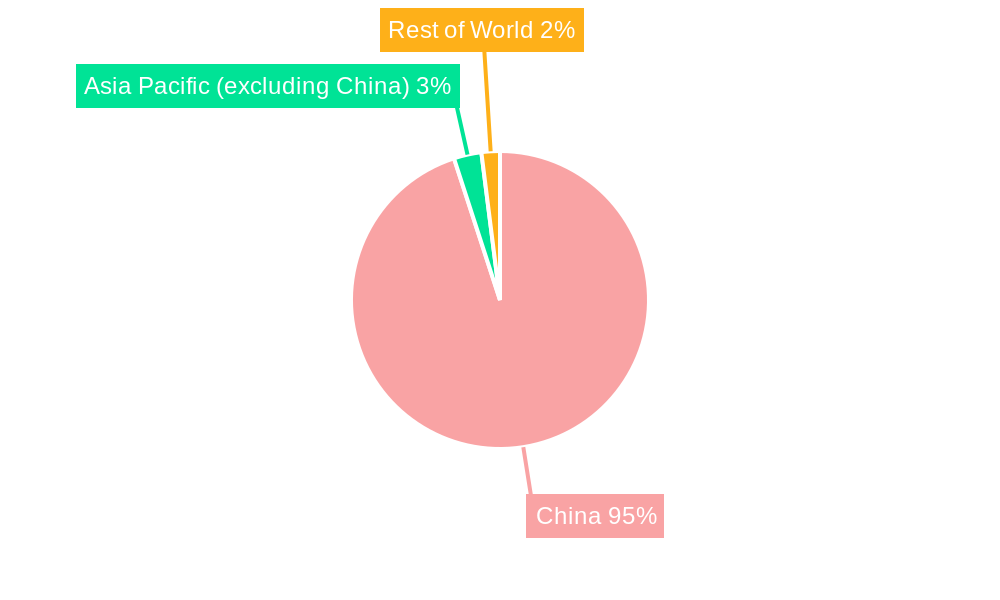

China Online Insurance Market Segmentation By Geography

- 1. China

China Online Insurance Market Regional Market Share

Geographic Coverage of China Online Insurance Market

China Online Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market

- 3.4. Market Trends

- 3.4.1. The Online Health Insurance is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Online Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.2. Non-Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Type of Providers

- 5.2.1. Insurance Companies

- 5.2.2. Third Party Administrators

- 5.2.3. Brokers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ZhongAn Insurance

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FWD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Instony

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cheche

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huize

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 eBaoTech

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bowtie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oliver Wyman

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Taikang Online

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cathay Insurance**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ZhongAn Insurance

List of Figures

- Figure 1: China Online Insurance Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Online Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: China Online Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 2: China Online Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 3: China Online Insurance Market Revenue Million Forecast, by Type of Providers 2020 & 2033

- Table 4: China Online Insurance Market Volume Billion Forecast, by Type of Providers 2020 & 2033

- Table 5: China Online Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Online Insurance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: China Online Insurance Market Revenue Million Forecast, by Insurance Type 2020 & 2033

- Table 8: China Online Insurance Market Volume Billion Forecast, by Insurance Type 2020 & 2033

- Table 9: China Online Insurance Market Revenue Million Forecast, by Type of Providers 2020 & 2033

- Table 10: China Online Insurance Market Volume Billion Forecast, by Type of Providers 2020 & 2033

- Table 11: China Online Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: China Online Insurance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Online Insurance Market?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the China Online Insurance Market?

Key companies in the market include ZhongAn Insurance, FWD, Instony, Cheche, Huize, eBaoTech, Bowtie, Oliver Wyman, Taikang Online, Cathay Insurance**List Not Exhaustive.

3. What are the main segments of the China Online Insurance Market?

The market segments include Insurance Type, Type of Providers.

4. Can you provide details about the market size?

The market size is estimated to be USD 707.58 Million as of 2022.

5. What are some drivers contributing to market growth?

Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market.

6. What are the notable trends driving market growth?

The Online Health Insurance is Driving the Market.

7. Are there any restraints impacting market growth?

Internet Penetration is Driving the Market; Young Age Population Preferring Online Insurance is Driving the Market.

8. Can you provide examples of recent developments in the market?

October 2023: FWD and Club Care partnered to launch the online insurance platform Club Care. Club Care is a new online insurance platform that has a reward-based system for its loyal customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Online Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Online Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Online Insurance Market?

To stay informed about further developments, trends, and reports in the China Online Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence